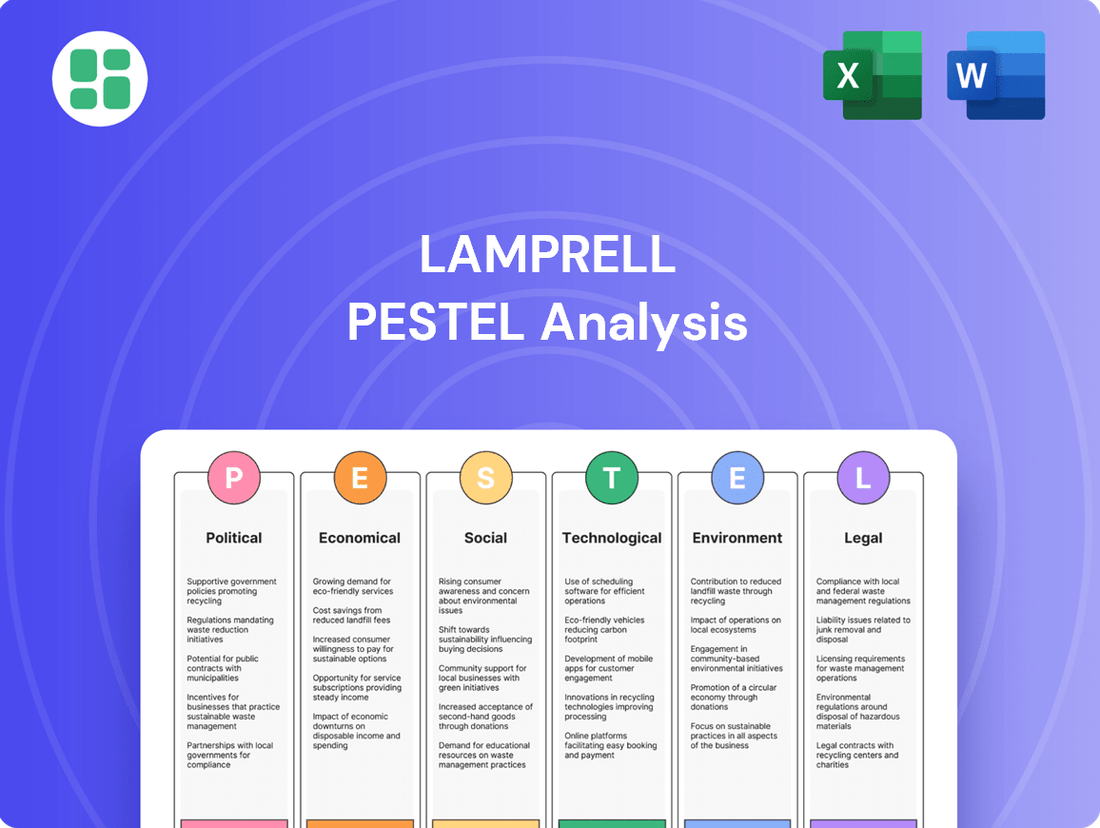

Lamprell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lamprell Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Lamprell's future. Our expertly crafted PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and identify opportunities. Don't be left in the dark; download the full version now for actionable insights.

Political factors

Government energy policies are a major driver for Lamprell, shaping the competitive landscape between traditional oil and gas and the burgeoning renewable energy sector. As the world pushes towards decarbonization, expect to see more government incentives and subsidies directed towards offshore wind projects, potentially impacting Lamprell's project pipeline.

Conversely, oil and gas exploration and production activities might face increasingly stringent regulations and potentially reduced financial support from governments globally. For instance, the International Energy Agency reported in 2024 that global investment in clean energy technologies reached a record $2 trillion, highlighting a clear policy shift.

Lamprell's strategic advantage will hinge on its agility in navigating these evolving policy environments, capitalizing on the growth in renewables while managing the potential downturn in traditional energy markets. This adaptability is crucial for securing future contracts and maintaining profitability.

Lamprell's significant operational footprint in the Middle East, particularly in the UAE and Saudi Arabia, makes it highly susceptible to geopolitical stability and the energy strategies of these key nations. Political stability directly influences the flow of investment into new oil and gas projects and the reliable execution of ongoing contracts. For instance, Lamprell secured a significant contract with Saudi Aramco in late 2023 for fabrication work, underscoring the direct link between regional political stability and major contract awards.

International climate commitments, such as those agreed upon at COP28 in late 2023, are increasingly driving national policies to reduce carbon emissions. This global push directly impacts the long-term demand for fossil fuels, while simultaneously accelerating the transition towards renewable energy sources. For companies like Lamprell, which operates in both oil and gas and renewable energy sectors, these shifts present both opportunities and challenges, potentially reshaping client project pipelines and investment strategies.

The Middle East, a key region for Lamprell's operations, is actively engaged in decarbonization efforts, mirroring global climate agendas. For instance, Saudi Arabia's Vision 2030 includes ambitious targets for renewable energy deployment, aiming for significant solar and wind capacity by 2030. This regional alignment with international climate commitments suggests a growing market for renewable energy infrastructure, an area where Lamprell is strategically positioned.

Regulatory Frameworks for Offshore Operations

The regulatory landscape for offshore energy projects significantly impacts Lamprell's operational costs and project timelines. Stringent safety, environmental, and operational standards are paramount, dictating compliance measures and potential project delays or additional expenses. For instance, evolving regulations in the offshore wind sector, such as the US Renewable Energy Modernization Rule introduced in late 2023, aim to simplify permitting and reduce development costs, potentially creating more favorable conditions for Lamprell's participation in these growing markets.

Lamprell's ability to navigate and adapt to these dynamic regulatory frameworks is critical for maintaining operational efficiency and mitigating risks. Staying abreast of changes, such as the International Maritime Organization's (IMO) updated greenhouse gas (GHG) emission reduction targets for shipping, which came into effect in January 2024, influences the design and operational requirements for offshore vessels and platforms, areas where Lamprell provides services.

- Regulatory Impact: Safety, environmental, and operational standards directly influence Lamprell's cost structures and project execution timelines.

- US Offshore Wind: The US Renewable Energy Modernization Rule, effective from late 2023, seeks to streamline offshore wind development, potentially benefiting Lamprell's project pipeline.

- GHG Emissions: IMO's 2024 GHG reduction targets necessitate adjustments in vessel and platform design, impacting Lamprell's engineering and fabrication services.

- Compliance Necessity: Adherence to these evolving regulations is essential for Lamprell's operational continuity and effective risk management.

Trade Policies and Supply Chain Resilience

Global trade policies significantly influence Lamprell's operational landscape. Tariffs and trade disputes can directly affect the cost and timely delivery of essential materials and specialized equipment, impacting project budgets and timelines. For instance, the ongoing geopolitical shifts and trade tensions in late 2023 and early 2024 have highlighted the vulnerability of extended supply chains, a critical concern for energy infrastructure projects.

The potential for supply chain disruptions, exacerbated by political instability or protectionist measures, necessitates proactive strategies. Lamprell's reliance on international suppliers means that regional trade agreements or sudden policy changes can lead to increased operational costs or project delays. The offshore wind sector, a key market for Lamprell, has particularly experienced significant supply chain constraints, with some projects facing delays due to shortages of key components and shipping capacity in 2023.

- Trade Policy Impact: Changes in trade policies, such as tariffs on steel or specialized components, can directly increase the cost of raw materials and equipment for Lamprell's fabrication projects.

- Supply Chain Vulnerability: The energy sector, including offshore wind, has grappled with supply chain disruptions, with lead times for critical components extending significantly in 2023 and early 2024.

- Geopolitical Risks: Political tensions and protectionist trends can lead to unpredictable market conditions, potentially impacting international sourcing strategies and increasing operational expenses.

Government policies are a significant influence, with a global push towards decarbonization favoring renewable energy projects, like offshore wind, which saw record global investment in clean energy technologies reaching $2 trillion in 2024. Conversely, traditional oil and gas sectors may face stricter regulations and reduced government support, impacting Lamprell's project pipeline and profitability.

Geopolitical stability in regions like the Middle East, where Lamprell has a strong operational presence, directly affects investment in energy projects. For example, Lamprell secured a substantial contract with Saudi Aramco in late 2023, highlighting the link between regional political stability and contract awards.

International climate agreements, such as those from COP28 in late 2023, are driving national policies for emission reductions, influencing long-term demand for fossil fuels and accelerating the transition to renewables. This shift creates both opportunities and challenges for Lamprell's diverse project portfolio.

Regulatory frameworks, including safety and environmental standards, impact Lamprell's operational costs and timelines. For instance, the US Renewable Energy Modernization Rule, effective late 2023, aims to simplify offshore wind development, potentially benefiting Lamprell, while IMO's 2024 GHG reduction targets affect vessel design.

What is included in the product

Lamprell's PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operational landscape, offering a comprehensive view of external influences.

This analysis provides actionable insights for strategic decision-making, identifying key external factors that present both challenges and strategic advantages for Lamprell.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Lamprell's external environment to inform strategic decisions.

Helps support discussions on external risk and market positioning during planning sessions by presenting a structured analysis of political, economic, social, technological, environmental, and legal factors impacting Lamprell.

Economic factors

Fluctuations in global oil and gas prices significantly shape investment in Lamprell's core upstream and midstream sectors. For instance, Brent crude oil averaged around $82 per barrel in the first half of 2024, providing a relatively stable environment that encourages project development and refurbishment.

Conversely, sharp price swings, such as the volatility experienced in late 2023, can cause hesitation, leading to postponed or scrapped projects. This directly affects demand for Lamprell's fabrication and engineering services.

Global investment in renewable energy is surging, with the energy transition attracting an estimated $2.1 trillion in 2024. This massive influx of capital, particularly into offshore wind, directly benefits companies like Lamprell as they expand their capabilities in this sector.

Projections indicate this substantial growth in clean technologies will continue through 2025 and beyond, underscoring the long-term viability of Lamprell's strategic shift. This trend provides a strong tailwind for Lamprell's efforts to capitalize on the burgeoning offshore wind market.

High inflation and increasing interest rates significantly impact Lamprell's operational costs and the financial feasibility of its large-scale energy projects. For instance, the persistent inflation seen through 2024 has driven up the prices of raw materials and components essential for offshore wind farm construction. This, coupled with rising interest rates, makes financing these capital-intensive projects more expensive for both Lamprell and its clients, potentially delaying or scaling back investments.

The offshore wind sector, a key market for Lamprell, experienced considerable headwinds in 2024 due to these economic conditions. Many developers faced challenges in securing favorable financing and managing project budgets. However, forward-looking economic forecasts suggest a potential easing of these pressures. Projections indicate a gradual decrease in interest rates starting in 2025, which could offer some relief by lowering the cost of capital and improving project economics for future endeavors.

Global Economic Growth and Energy Demand

Global economic growth is a significant driver of energy demand. As economies expand, so does the need for power across industries, transportation, and households, impacting fossil fuel consumption and the speed of the shift to renewables. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that directly influences the overall energy market dynamics.

A healthy global economy translates into greater investment capacity for energy infrastructure. This is crucial for companies like Lamprell, which provides services across both traditional oil and gas and the burgeoning renewable energy sectors. Increased capital spending in areas like offshore wind farms or new oil and gas exploration directly benefits their order books.

- Global economic growth forecast for 2024: 3.2% (IMF).

- Energy demand's direct correlation with GDP growth.

- Impact on investment in both fossil fuels and renewables.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant economic factor for Lamprell, an international entity dealing with multiple currencies. These shifts can directly affect the company's reported revenue, operational costs, and overall profitability. For instance, a strengthening of the US Dollar against currencies where Lamprell incurs significant expenses could increase those costs when translated back into its reporting currency.

Effective management of these currency exposures is paramount. Lamprell likely employs financial hedging strategies, such as forward contracts or options, to lock in exchange rates for anticipated transactions. Operational strategies, like invoicing in a stable currency or diversifying its operational base, also play a role in mitigating these economic risks. Lamprell's financial statements would typically provide disclosures on its foreign currency exposures and the impact of exchange rate movements.

For example, in its 2024 financial reporting, Lamprell might detail how a specific percentage change in the GBP/USD exchange rate impacted its reported earnings. Companies like Lamprell often report significant gains or losses from foreign currency translation. In the fiscal year ending March 31, 2024, Lamprell reported a net loss, and currency movements would have been a contributing factor to the volatility in its financial performance.

- Impact on Revenue: A weaker local currency where Lamprell generates revenue can lead to lower reported earnings when converted to its primary reporting currency.

- Cost Management: Conversely, a stronger reporting currency can reduce the cost of imported materials or services purchased in other currencies.

- Hedging Effectiveness: The success of Lamprell's hedging strategies directly influences its ability to stabilize earnings against currency volatility.

- Disclosure in Financials: Investors and analysts closely examine Lamprell's financial reports for details on foreign exchange gains and losses.

The economic landscape for Lamprell is heavily influenced by global energy prices and the pace of the energy transition. While Brent crude averaged around $82 per barrel in the first half of 2024, supporting investment, volatility remains a concern. The significant global investment in renewables, projected to reach $2.1 trillion in 2024 and continuing into 2025, presents a substantial opportunity for Lamprell's expansion into offshore wind. However, persistent inflation and rising interest rates through 2024 have increased operational costs and project financing expenses, posing a challenge that may ease with projected interest rate decreases from 2025.

| Economic Factor | 2024 Data/Trend | Impact on Lamprell | Outlook for 2025 |

|---|---|---|---|

| Global Oil Prices | Brent crude averaged ~$82/barrel (H1 2024) | Supports upstream investment, but volatility affects project timing. | Continued stability or moderate fluctuations expected. |

| Renewable Energy Investment | $2.1 trillion projected for 2024 | Major growth driver for offshore wind services. | Continued strong growth trajectory. |

| Inflation & Interest Rates | Persistent inflation, rising rates in 2024 | Increased operational costs, higher project financing costs. | Potential easing of interest rates could improve project economics. |

| Global Economic Growth | IMF projected 3.2% for 2024 | Drives overall energy demand and investment capacity. | Continued moderate growth expected, supporting energy sector investment. |

Full Version Awaits

Lamprell PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Lamprell PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into the external forces shaping Lamprell's strategic landscape.

Sociological factors

Public concern over climate change is intensifying, with a significant majority of the global population now prioritizing environmental sustainability. This heightened awareness directly influences investment decisions in the energy sector, creating a strong demand for renewable energy solutions.

As a key service provider in the energy industry, Lamprell's business is increasingly shaped by this public sentiment. Companies like Lamprell are expected to demonstrate a commitment to cleaner energy, with a growing number of investors scrutinizing their involvement in fossil fuels versus renewables. For instance, by late 2024, many major energy firms reported significant capital allocation shifts towards green projects, reflecting this public and investor pressure.

The offshore fabrication, engineering, and construction sectors, crucial for Lamprell's operations, demand a highly specialized and skilled workforce. This includes experienced welders, pipefitters, engineers, and project managers with specific industry knowledge.

The global competition for this talent is intense. For instance, the International Energy Agency (IEA) projected in 2023 that the offshore wind sector alone would need to double its workforce by 2030 to meet ambitious renewable energy targets, highlighting the demand pressure.

Furthermore, an aging workforce in traditional oil and gas roles, coupled with the evolving need for new skills in areas like renewable energy technologies (e.g., offshore wind turbine installation and maintenance), presents a significant challenge for Lamprell in staffing projects and maintaining operational efficiency.

Societal expectations and regulatory demands for robust health, safety, and welfare standards, particularly in hazardous offshore settings, are increasingly critical. These expectations directly influence how companies like Lamprell operate and are perceived.

Lamprell's dedication to maintaining an exemplary safety record is vital. For instance, in their 2024 fiscal year, Lamprell reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.87, a significant improvement from 1.21 in the prior year, demonstrating their commitment and impacting their ability to attract skilled personnel and ensure uninterrupted project execution.

Community Engagement and Social License to Operate

Successful project execution, particularly for major offshore developments like those Lamprell undertakes, hinges on robust community engagement and securing a social license to operate. This involves proactively addressing concerns from local populations, including fishermen and environmental advocates, which is crucial for gaining project approvals and ensuring smooth operations. For instance, in the offshore wind sector, early and transparent communication with coastal communities about potential impacts and benefits is paramount.

The importance of this social license was highlighted in 2024 as several offshore wind projects faced delays due to local opposition, underscoring the need for effective stakeholder management. Companies are increasingly investing in community benefit schemes and local content initiatives to foster goodwill. For example, a significant portion of the supply chain for major offshore wind projects in the North Sea, estimated to be around 30-40% by 2025, is targeted for local sourcing, directly benefiting regional economies and improving community relations.

- Community Acceptance: Securing buy-in from local communities is vital for project timelines and operational stability, especially in sensitive coastal or offshore environments.

- Stakeholder Relations: Proactive engagement with fishermen, environmental groups, and local residents can mitigate potential conflicts and build trust.

- Economic Benefits: Demonstrating tangible economic advantages, such as local job creation and supply chain development, strengthens the social license.

- Regulatory Approval: Positive community sentiment and a demonstrated commitment to social responsibility can significantly influence regulatory approval processes for large infrastructure projects.

Demographic Shifts and Energy Consumption

Long-term demographic trends, such as continued population growth and increasing urbanization, significantly shape global energy consumption. By 2050, the UN projects the world population to reach nearly 9.7 billion, with a substantial portion residing in urban areas, which typically have higher energy demands per capita.

This rising overall energy demand necessitates a move towards more diversified energy sources and robust infrastructure development. Lamprell's strategy to operate across both the traditional and renewable energy sectors directly addresses this evolving landscape, aiming to meet a wider spectrum of energy needs.

- Population Growth: Global population projected to hit 9.7 billion by 2050.

- Urbanization: Increasing concentration of populations in cities drives higher per capita energy use.

- Energy Demand: Demographic shifts are a primary driver of escalating global energy requirements.

- Diversification Need: Growing demand fuels the necessity for a broader mix of energy generation and supply methods.

Societal expectations regarding environmental stewardship and corporate responsibility are increasingly influencing the energy sector. This includes a strong public demand for sustainable practices and a shift towards renewable energy sources, impacting investment and operational strategies for companies like Lamprell. For instance, by the end of 2024, many energy firms significantly increased their capital allocation towards green energy projects, reflecting this growing public and investor pressure.

The availability of a skilled workforce is paramount for Lamprell's offshore fabrication and engineering services. Competition for specialized talent, such as experienced welders and project managers, is intense, with the offshore wind sector alone needing to double its workforce by 2030 according to the IEA's 2023 projections to meet renewable energy goals.

Maintaining high health, safety, and welfare standards is critical, especially in hazardous offshore environments. Lamprell's commitment to safety is demonstrated by its improved Total Recordable Injury Frequency Rate (TRIFR) of 0.87 in fiscal year 2024, a key factor in attracting skilled labor and ensuring project continuity.

Securing a social license to operate through effective community engagement is vital for project approvals and smooth operations. Delays in several offshore wind projects during 2024 were attributed to local opposition, highlighting the need for proactive stakeholder management and community benefit initiatives, such as the targeted 30-40% local sourcing for North Sea offshore wind projects by 2025.

Technological factors

Rapid progress in offshore wind technology, like the development of larger turbines and floating platforms, directly boosts demand for Lamprell's specialized fabrication and engineering expertise. These innovations are opening up previously inaccessible deep-water sites, significantly expanding the market potential for offshore wind projects.

For example, the global offshore wind market is projected to reach $175 billion by 2030, with floating wind expected to capture a substantial share of this growth, creating a strong pipeline for companies like Lamprell that can deliver complex, large-scale components.

The oil and gas and renewable energy industries are rapidly embracing digitalization, automation, and artificial intelligence. This shift is fundamentally changing how projects are managed, how components are fabricated, and how assets are maintained. For instance, the integration of AI in predictive maintenance for offshore platforms can significantly reduce downtime. A report from 2024 indicated that companies utilizing AI for maintenance saw an average reduction in unplanned outages by 20-30%.

Technologies such as digital twins, which create virtual replicas of physical assets, are becoming crucial. These twins, coupled with real-time data analytics, allow for sophisticated monitoring and optimization of offshore operations. In 2025, it's projected that the market for digital twins in the energy sector will reach over $10 billion, highlighting their growing importance in enhancing efficiency and safety.

Robotic systems are also playing a bigger role, particularly in hazardous environments, improving worker safety and operational precision. For example, autonomous underwater vehicles (AUVs) are increasingly used for subsea inspections, reducing the need for human divers in dangerous conditions. This technological advancement contributes to cost savings and a minimized environmental footprint, critical factors in today's energy landscape.

Innovation in materials science and advanced manufacturing is reshaping offshore construction. New composites and high-strength alloys offer greater durability and lighter weight, potentially reducing project costs and increasing lifespan for structures like wind turbine foundations. These advancements are crucial for the industry's move towards more sustainable and efficient operations.

Lamprell's strategic investments highlight this trend, with their adoption of robotics in fabricating transition pieces for offshore wind projects. This move aims to boost productivity and minimize material waste, a key concern in large-scale industrial fabrication. By embracing these new techniques, Lamprell is positioning itself to capitalize on the growing demand for offshore energy infrastructure.

Carbon Capture, Utilization, and Storage (CCUS)

The growing emphasis on carbon capture, utilization, and storage (CCUS) within the oil and gas industry presents a significant avenue for Lamprell. As Middle Eastern energy giants push for decarbonization, there's an increasing demand for specialized services in modifying and constructing infrastructure crucial for emissions reduction. This trend is supported by substantial investments; for instance, the UAE's Net Zero by 2050 strategic initiative and Saudi Arabia's Vision 2030 both highlight CCUS as a key component of their energy transition strategies.

Lamprell can capitalize on this by offering its expertise in engineering, procurement, and construction (EPC) for CCUS projects. This includes the development of facilities for capturing CO2 from industrial sources, transporting it, and either storing it underground or utilizing it in various industrial processes. The global CCUS market is projected for robust growth, with estimates suggesting it could reach hundreds of billions of dollars by the early 2030s, underscoring the long-term potential for companies like Lamprell.

- Infrastructure Development: Lamprell can provide EPC services for the construction of CO2 capture plants, pipelines, and storage facilities.

- Retrofitting Existing Assets: The company is well-positioned to offer services for retrofitting existing oil and gas infrastructure to integrate CCUS capabilities.

- Market Growth: The global CCUS market is anticipated to expand significantly, driven by net-zero commitments and regulatory frameworks.

Improved Rig Design and Efficiency

Technological advancements are continuously reshaping the offshore and onshore drilling sectors. Innovations in rig design, such as the integration of advanced materials and modular construction, are leading to lighter, stronger, and more cost-effective units. For instance, the development of more fuel-efficient engines and hybrid power systems is a key focus, aiming to reduce operational expenditures and environmental impact. These improvements directly affect client demand for newer, more capable assets.

Lamprell's competitive edge is significantly influenced by its ability to incorporate these technological upgrades into its offerings. The company's jackup rigs, liftboats, and land rigs are seeing enhancements for improved safety and operational performance. Automated drilling systems, which can manage repetitive tasks with enhanced precision, are becoming increasingly prevalent. This trend is driven by the need for greater efficiency and reduced human error in complex operations.

The market is actively seeking rigs with features that minimize downtime and maximize productivity. For example, advancements in digital twin technology allow for real-time monitoring and predictive maintenance, which can prevent costly breakdowns. The ongoing pursuit of reduced emissions is also a critical technological driver, with new rig designs incorporating solutions for lower greenhouse gas output, aligning with global environmental regulations and client sustainability goals. By 2024, the offshore drilling sector is expected to see continued investment in technological upgrades to meet these evolving demands.

Key technological factors impacting rig design and efficiency include:

- Enhanced Safety Features: Incorporation of advanced safety systems and automation to minimize risks.

- Reduced Emissions: Development of more fuel-efficient engines and alternative power sources.

- Improved Operational Performance: Integration of automation and digital technologies for greater efficiency and precision.

- Modular and Advanced Materials: Use of lighter, stronger materials and modular designs for cost-effectiveness and faster deployment.

Technological advancements in offshore wind, such as larger turbines and floating platforms, directly increase demand for Lamprell’s specialized fabrication and engineering services, expanding market potential for deep-water projects. The global offshore wind market is projected to reach $175 billion by 2030, with floating wind expected to drive significant growth.

Digitalization, automation, and AI are transforming project management and fabrication in both oil and gas and renewable energy sectors. For instance, AI-driven predictive maintenance reduced unplanned outages by 20-30% for adopting companies in 2024. Digital twins, projected to exceed $10 billion in the energy sector by 2025, are crucial for monitoring and optimizing operations.

Innovations in materials science and advanced manufacturing, including new composites and high-strength alloys, are enhancing the durability and reducing the weight of offshore structures, thereby lowering project costs and extending asset lifespans. Lamprell's adoption of robotics in fabricating transition pieces exemplifies this trend, aiming to boost productivity and minimize waste.

The increasing adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies presents a significant opportunity for Lamprell, driven by net-zero initiatives in the Middle East, such as the UAE's Net Zero by 2050 strategy. The global CCUS market is expected to grow substantially, potentially reaching hundreds of billions of dollars by the early 2030s.

Legal factors

Lamprell's extensive work with offshore vessels and structures means it must navigate a dense network of international maritime laws and conventions. These cover crucial areas like operational safety, preventing pollution through regulations such as MARPOL, and ensuring proper crew qualifications under the STCW convention.

Staying compliant with these ever-changing global regulations is absolutely vital for Lamprell's worldwide operations and effective risk management, impacting everything from project bids to operational efficiency.

Lamprell's involvement in large-scale engineering, procurement, construction, and installation (EPCI) projects places it squarely under complex contract law frameworks, carrying substantial liability. For instance, in 2023, the global EPC market faced an average of 15% of project value in potential claims related to contractual disputes, highlighting the critical need for robust contract management.

Navigating these legal waters requires a deep understanding of contractual risks, encompassing potential delays, escalating costs, and the fulfillment of performance guarantees. Failure to adequately address these can lead to significant financial penalties and reputational damage, as seen in the offshore wind sector where project delays often trigger liquidated damages clauses averaging 0.1% of contract value per day.

Lamprell operates under increasingly stringent environmental regulations, particularly concerning emissions standards for its offshore and onshore facilities. These rules, which cover everything from air pollutants to waste disposal and the safeguarding of marine life, directly influence operational costs and require significant investment in compliance technologies. Failure to adhere can lead to substantial fines and reputational damage, making proactive environmental management a core business necessity.

Labor Laws and Employment Regulations

Lamprell's operations are significantly shaped by a complex web of global labor laws. Navigating these regulations, which cover everything from worker safety standards to the intricacies of employment contracts and immigration policies, is crucial for maintaining compliance across its diverse operating regions. For instance, in 2024, the International Labour Organization highlighted increasing scrutiny on fair wages and working conditions, impacting how companies like Lamprell manage their workforce, particularly in sectors with a high proportion of migrant labor.

These varying legal frameworks directly impact Lamprell's human resource strategies, affecting recruitment, retention, and compensation. Furthermore, the presence and influence of labor unions in different jurisdictions can shape collective bargaining agreements and influence operational flexibility, potentially leading to increased labor costs or operational disruptions if not managed effectively. For example, in regions where union density is high, companies often face more stringent regulations regarding layoffs and working hours.

The cost of labor is a direct consequence of these legal requirements. Adherence to minimum wage laws, overtime regulations, and benefits mandates, which differ substantially by country, adds to Lamprell's operational expenses. Data from 2024 indicated that the average cost of skilled labor in the maritime and energy construction sectors can vary by as much as 30-40% between developed and developing nations, directly influencing Lamprell's global project costing and bidding strategies.

- Compliance with diverse labor laws: Lamprell must adhere to regulations concerning worker safety, employment contracts, immigration, and union relations across its international operations.

- Impact on HR practices: Employment regulations influence recruitment, compensation, and employee relations, affecting overall human resource management.

- Operational flexibility and costs: Labor laws dictate working hours, overtime pay, and benefits, impacting operational agility and the overall cost of labor.

- Union relations: The strength and influence of labor unions in different operating regions can affect collective bargaining and labor costs.

Intellectual Property Rights

Lamprell's operations in engineering and technology necessitate robust protection of its intellectual property (IP). This includes safeguarding its own patented designs and proprietary software, crucial for maintaining a competitive edge in the energy sector. The company must also ensure it doesn't infringe on the IP rights of other entities, a common risk in a field driven by innovation.

In 2024, global IP filings continued to rise, with a particular surge in patents related to renewable energy technologies, a sector Lamprell serves. For instance, the World Intellectual Property Organization (WIPO) reported a significant increase in patent applications for offshore wind technologies, underscoring the importance of IP for companies like Lamprell. Failure to adequately protect its IP could lead to costly legal disputes and loss of market share.

Lamprell's approach to IP management is therefore a critical legal factor. This involves:

- Securing patents for novel engineering solutions and fabrication techniques.

- Implementing strict confidentiality agreements with employees and partners.

- Conducting regular IP audits to identify potential infringement risks.

- Vigilantly monitoring competitor activities for potential IP violations.

Lamprell operates under strict international maritime laws, including safety and pollution prevention regulations like MARPOL, and adheres to crew qualification standards under STCW. The company's extensive EPCI contracts expose it to complex contract law, where disputes can average 15% of project value in claims, as seen in 2023.

Environmental regulations are increasingly stringent, impacting operational costs and requiring investments in compliance technologies, with non-compliance leading to significant fines. Labor laws globally dictate worker safety, employment terms, and immigration policies, influencing HR strategies and potentially increasing labor costs by up to 40% between different nations in 2024.

Intellectual property protection is vital, especially with rising patent filings in renewable energy technologies, a key sector for Lamprell, with WIPO reporting significant increases in offshore wind patents.

Environmental factors

The global commitment to tackling climate change is a major force behind the energy transition, directly shaping Lamprell's long-term business direction. This imperative necessitates a strategic shift towards renewable energy sources.

Decarbonization efforts are accelerating the demand for offshore wind projects, a sector Lamprell is actively pursuing. For instance, the company secured a significant contract in early 2024 for the fabrication of offshore wind farm structures, underscoring this market shift.

Simultaneously, traditional oil and gas clients are increasingly prioritizing projects that demonstrate reduced carbon emissions. This trend influences the scope of work Lamprell undertakes and the technological requirements of its projects, pushing for greater efficiency and cleaner operational methods.

Offshore construction and operations, like those Lamprell undertakes, pose risks to marine life through potential spills, underwater noise, and physical disruption of habitats. For instance, incidents like the 2023 Gulf of Mexico oil spill, though not directly Lamprell's, highlight the significant environmental damage such events can cause.

Lamprell is therefore under increasing pressure from regulators and environmental advocates to adopt stringent environmental protection measures and best practices. This scrutiny is intensifying, with global initiatives like the UN Decade of Ocean Science for Sustainable Development (2021-2030) driving greater accountability for companies operating in marine environments.

Lamprell's commitment to stringent environmental regulations is paramount, especially concerning waste management and pollution control. This involves meticulous handling of industrial waste generated during fabrication processes, a critical aspect given the scale of their offshore projects. For instance, in 2024, the global offshore wind sector alone is projected to generate millions of tons of waste, necessitating robust management strategies.

Controlling emissions from their facilities and preventing any discharge of pollutants into the marine environment are also key operational requirements. Adherence to these best practices not only ensures regulatory compliance but also underpins Lamprell's reputation for responsible operations in sensitive marine ecosystems.

Renewable Energy Integration and Offshore Wind Development

The accelerating global push towards renewable energy, particularly offshore wind, is a significant tailwind for Lamprell. Governments worldwide are setting ambitious targets to decarbonize their energy sectors, directly fueling the expansion of offshore wind farms. For instance, the European Union aims for 60 GW of offshore wind by 2030 and 300 GW by 2050, a substantial increase from its current capacity. This surge in development translates into a robust demand for specialized fabrication services, an area where Lamprell is strategically positioning itself.

Lamprell's strategic pivot to fabricating components for offshore wind projects aligns perfectly with this burgeoning market. The company's expertise in complex steel structures is highly transferable to manufacturing turbine foundations, substations, and other critical offshore wind infrastructure. This diversification is not merely opportunistic; it's a direct response to the increasing global investment in green energy infrastructure. By 2025, global investment in offshore wind is projected to reach hundreds of billions of dollars, underscoring the vast potential for companies like Lamprell.

- Global offshore wind capacity is expected to grow significantly, with projections indicating a substantial increase in installed gigawatts by 2030 and beyond.

- Lamprell's fabrication capabilities are well-suited to meet the demand for large-scale, complex components required for offshore wind farm construction.

- The company's strategic focus on this sector capitalizes on the global trend towards decarbonization and the increasing investment in renewable energy infrastructure.

Extreme Weather Events and Climate Resilience

Climate change is increasingly impacting the offshore energy sector, with a growing frequency and intensity of extreme weather events. This poses significant operational risks for companies like Lamprell, potentially disrupting critical construction schedules and leading to costly damage to offshore infrastructure. For instance, the intensification of hurricanes in regions like the Gulf of Mexico in recent years has led to extended project delays and increased insurance premiums for offshore operators.

Designing and fabricating structures with enhanced climate resilience is no longer optional but a crucial strategic imperative. This involves incorporating robust engineering solutions to withstand more severe storm surges, higher wind speeds, and increased wave action. Lamprell's ability to adapt its manufacturing processes and material choices to meet these evolving resilience standards will be key to maintaining its competitive edge and ensuring project success in a changing climate.

- Increased Storm Intensity: The North Atlantic hurricane season, for example, saw a record-breaking 30 named storms in 2020, with several making landfall and impacting offshore operations.

- Infrastructure Vulnerability: Extreme weather can cause significant damage, as seen with Hurricane Ida in 2021, which forced the shutdown of a substantial portion of US Gulf of Mexico oil and gas production.

- Resilience as a Design Factor: Incorporating advanced materials and reinforced designs to withstand higher wind loads and wave forces is becoming a standard requirement for new offshore projects.

- Operational Disruption Costs: Delays due to severe weather can add millions of dollars to project costs, impacting profitability and project timelines.

Environmental regulations are tightening globally, pushing companies like Lamprell to adopt more sustainable practices. This includes stricter controls on emissions and waste management, especially in marine environments. For instance, the European Union's Green Deal aims to significantly reduce pollution by 2030, impacting all industrial sectors.

The energy transition, driven by climate change concerns, is a major factor. Lamprell's increased focus on offshore wind fabrication, a sector projected for substantial growth, directly addresses this shift. Global investment in offshore wind is expected to reach hundreds of billions of dollars by 2025, highlighting the market's potential.

Extreme weather events, exacerbated by climate change, pose increasing risks to offshore operations. Projects must now be designed for greater resilience against storms, impacting construction schedules and costs. For example, hurricane seasons have shown increased intensity in recent years, leading to significant operational disruptions.

Lamprell's commitment to environmental stewardship is crucial for its reputation and operational viability. Adhering to stringent pollution controls and waste management protocols is essential, particularly given the sensitive nature of marine ecosystems where many of its projects are located.

PESTLE Analysis Data Sources

Our Lamprell PESTLE Analysis is built on comprehensive data from leading industry associations, financial market reports, and governmental regulatory bodies. We meticulously gather insights on political stability, economic forecasts, technological advancements, environmental policies, and social trends impacting the maritime and energy sectors.