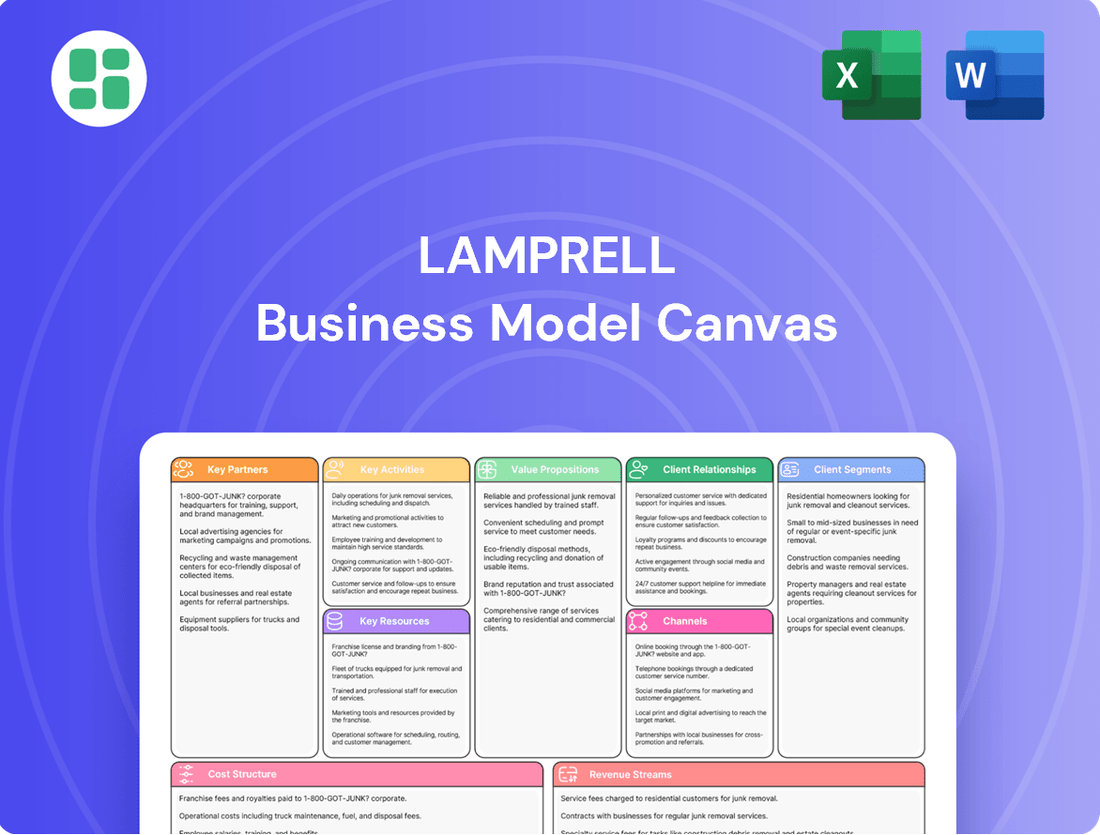

Lamprell Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lamprell Bundle

Unlock the strategic DNA of Lamprell with its comprehensive Business Model Canvas. This detailed analysis breaks down how they deliver value to their clients, manage key resources, and generate revenue in the complex energy sector. Perfect for anyone looking to understand the mechanics of a successful offshore construction company.

Dive into the operational blueprint of Lamprell with our full Business Model Canvas. Discover their customer relationships, cost drivers, and revenue streams in a clear, actionable format. This is your chance to gain insights into a leader in the maritime and energy infrastructure industry.

See how Lamprell builds its success, block by block, with our complete Business Model Canvas. From their value propositions to their revenue streams, this document offers a deep dive into their strategic framework. Download it now to benchmark your own business or inspire new ventures.

Partnerships

Lamprell cultivates enduring relationships and joint ventures with leading energy corporations such as Aramco and ADNOC Group. These collaborations are pivotal, positioning Lamprell as a favored contractor for substantial offshore and onshore energy projects.

These strategic alliances are instrumental in guaranteeing a steady stream of projects for Lamprell. They also provide the company with crucial opportunities to engage in the development of vital national energy infrastructure.

Lamprell actively partners with major offshore wind developers, including prominent entities like RWE. These strategic alliances are crucial for securing fabrication contracts for essential components such as transition pieces, which are vital for the construction of large-scale wind farms.

These collaborations are instrumental in Lamprell's strategic push into the burgeoning renewable energy sector. By working with established players, Lamprell solidifies its role in the global energy transition, contributing significantly to the development of clean energy infrastructure.

Lamprell actively forms joint ventures, notably with International Maritime Industries (IMI) in Saudi Arabia. This strategic alliance is crucial for building a robust local footprint and meeting the requirements of in-country value programs, such as IKTVA. These partnerships facilitate the pooling of specialized knowledge and the efficient use of resources, opening doors to substantial projects in vital, expanding markets.

Technology and Digital Solution Providers

Lamprell actively partners with technology and digital solution providers, including specialists in robotics and simulation. These collaborations are crucial for boosting operational efficiency and embedding advanced technologies into fabrication processes. For instance, in 2024, Lamprell continued to explore and implement AI-driven predictive maintenance solutions, aiming to reduce downtime by an estimated 15% across key operational assets.

These alliances enable Lamprell to cultivate advanced manufacturing capabilities and drive digital transformation throughout its business units. By integrating cutting-edge software and hardware, the company enhances its capacity for complex projects and improves overall project delivery timelines. The company's investment in digital twins, for example, allows for real-time performance monitoring and optimization, a key strategy for remaining competitive in the energy sector.

- Robotics Integration: Partnerships facilitate the adoption of automated welding and assembly systems, increasing precision and throughput.

- Simulation Software: Collaborations provide access to advanced simulation tools for project planning and risk assessment, improving design and execution phases.

- Digital Transformation: Working with tech firms accelerates the implementation of Industry 4.0 principles, enhancing data analytics and operational intelligence.

- Cybersecurity Solutions: Essential partnerships ensure the robust protection of digital assets and sensitive project data in an increasingly connected environment.

Supply Chain and Logistics Partners

Lamprell relies heavily on specialized suppliers and logistics partners to ensure the efficient flow of materials and fabricated structures. Collaborations with companies like Erhardt Projects for international freight forwarding are essential for managing the complexities of global supply chains.

These partnerships are vital for timely procurement and the secure, on-time delivery of large-scale components, directly impacting project timelines and cost-effectiveness. For instance, in 2024, Lamprell's ability to secure critical materials and transport them across continents without significant delays was a testament to the strength of these relationships.

- Specialized Suppliers: Sourcing high-quality materials and components from trusted manufacturers.

- Logistics Providers: Engaging experts for international freight forwarding, customs clearance, and multimodal transportation.

- Project-Specific Partnerships: Forming alliances for unique logistical challenges, such as heavy-lift operations for offshore structures.

Lamprell's key partnerships extend to technology providers, crucial for enhancing operational efficiency and digital integration. In 2024, the company focused on AI-driven predictive maintenance, aiming to reduce asset downtime by approximately 15%. These collaborations are vital for Lamprell's advanced manufacturing capabilities and digital transformation efforts, improving project delivery timelines.

These strategic alliances are essential for securing fabrication contracts for critical components, particularly in the offshore wind sector, and for developing vital national energy infrastructure. Lamprell's joint ventures, such as with International Maritime Industries, bolster its local presence and support in-country value programs like IKTVA, enabling resource pooling and market access.

Lamprell's network of specialized suppliers and logistics partners is fundamental to managing global supply chains, ensuring timely procurement and delivery of components. These relationships were critical in 2024 for navigating logistical complexities and maintaining project schedules and cost-effectiveness.

| Partner Type | Key Collaborators | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Energy Corporations | Aramco, ADNOC Group | Securing major offshore/onshore projects | Continued preferred contractor status |

| Offshore Wind Developers | RWE | Fabrication of transition pieces | Supporting renewable energy expansion |

| Technology Providers | Robotics & Simulation Specialists | Operational efficiency, digital transformation | AI predictive maintenance (15% downtime reduction target) |

| Joint Ventures | International Maritime Industries (IMI) | Local footprint, IKTVA compliance | Resource pooling, market access |

| Suppliers & Logistics | Erhardt Projects | Supply chain management, timely delivery | Navigating global logistics for project continuity |

What is included in the product

A strategic overview of Lamprell's operations, detailing its key partners, activities, and resources in the energy sector. It outlines the company's value propositions, customer relationships, and channels to market, alongside its cost structure and revenue streams.

Simplifies the complex Lamprell business into a clear, actionable framework, alleviating the pain of navigating intricate operations.

Activities

Lamprell's core business revolves around the intricate fabrication of massive offshore and onshore structures. This includes building essential components like jackup rigs, vital for offshore exploration, as well as land rigs and specialized modules for processing. Their expertise extends to constructing topsides and jackets, the critical platforms and supporting structures for offshore facilities.

These complex projects demand highly skilled engineering, precise welding, and meticulous assembly. Lamprell leverages its advanced fabrication yards, strategically located in the UAE and Saudi Arabia, to execute these demanding tasks. For instance, in 2024, the company continued to secure and execute contracts for these types of structures, reflecting ongoing demand in the energy sector.

Lamprell's core strength lies in its comprehensive Engineering, Procurement, Construction, and Installation (EPCI) services, offering clients a complete package for energy infrastructure. This integrated model covers everything from initial design and sourcing of materials to the actual construction and offshore installation of complex projects.

The company's expertise spans both traditional oil and gas ventures and the rapidly growing renewable energy sector, demonstrating its adaptability and broad market appeal. This end-to-end capability simplifies project execution for clients, ensuring seamless delivery from concept to completion.

In 2024, Lamprell continued to leverage its EPCI capabilities, securing significant contracts in offshore wind projects. For instance, the company was awarded a substantial contract for the fabrication of wind turbine components, highlighting its strategic pivot towards renewables.

Lamprell's key activities prominently feature the refurbishment and upgrading of offshore and land rigs. This process is crucial for extending the operational lifespan of these valuable assets and improving their functionality to meet evolving industry demands.

Beyond initial upgrades, Lamprell provides essential ongoing operations and maintenance services. These services are vital for ensuring the continued longevity and optimal performance of the rigs and other installed assets in the challenging energy sector.

For instance, in 2023, Lamprell secured a significant contract for the refurbishment of a jack-up rig, highlighting the ongoing demand for these specialized services. This type of work directly contributes to the company's revenue and its role in supporting the offshore energy infrastructure.

Offshore Wind Foundation Serial Production

Lamprell has significantly invested in and actively operates a dedicated serial production line specifically for offshore wind turbine generator substructures. This includes critical components like transition pieces, monopiles, and jackets, essential for the foundations of these massive turbines.

This specialized manufacturing capability firmly positions Lamprell as a key participant in the rapidly growing global offshore wind market. The demand for these foundational elements is projected to surge as more countries commit to renewable energy targets.

For instance, the global offshore wind market was valued at approximately $32.5 billion in 2023 and is expected to see substantial growth, with projections suggesting it could reach over $100 billion by 2030. Lamprell's serial production capacity directly addresses this escalating demand.

- Specialized Serial Production: Lamprell operates a dedicated line for manufacturing key offshore wind substructures.

- Key Market Position: This capability makes Lamprell a significant player in the expanding offshore wind sector.

- Market Growth: The offshore wind market is experiencing rapid expansion, with significant projected growth through 2030.

Project Management and Execution

Lamprell's project management and execution are the backbone of its success, ensuring complex energy infrastructure projects are delivered safely, on schedule, and within financial parameters. This involves meticulous planning, stringent quality assurance, and seamless coordination across all project phases for a global clientele.

The company's commitment to operational excellence is reflected in its project execution capabilities. For instance, in 2024, Lamprell continued to leverage its established project management systems to handle large-scale fabrication and construction contracts in the offshore wind and oil & gas sectors.

- Safety First: Lamprell prioritizes safety in all project execution, aiming for zero lost-time incidents.

- On-Time Delivery: The company focuses on meeting client deadlines, a critical factor in the energy sector's project timelines.

- Budget Adherence: Rigorous cost control and efficient resource allocation are key to delivering projects within budget.

- Quality Assurance: Maintaining high standards of quality throughout the fabrication and construction process is paramount.

Lamprell's key activities center on the fabrication of offshore and onshore energy infrastructure, including jackup rigs, land rigs, and processing modules. They also specialize in building topsides and jackets, crucial for offshore facilities, and provide comprehensive Engineering, Procurement, Construction, and Installation (EPCI) services. Furthermore, the company actively engages in refurbishing and upgrading existing rigs, alongside providing ongoing operations and maintenance. A significant focus in 2024 has been the serial production of offshore wind turbine generator substructures, such as transition pieces and monopiles, capitalizing on the booming renewable energy market.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Fabrication | Building offshore/onshore structures like jackup rigs, land rigs, modules, topsides, and jackets. | Continued execution of contracts for energy infrastructure projects. |

| EPCI Services | Providing end-to-end solutions from design to installation for energy infrastructure. | Leveraging integrated capabilities for large-scale offshore wind and oil & gas projects. |

| Refurbishment & Maintenance | Extending the life and improving the functionality of rigs and other assets. | Securing contracts for rig upgrades and ongoing support services. |

| Renewable Energy Production | Serial production of offshore wind substructures (transition pieces, monopiles). | Significant investment and operation of dedicated production lines to meet growing demand. The global offshore wind market was valued at approximately $32.5 billion in 2023. |

Preview Before You Purchase

Business Model Canvas

The Lamprell Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you can confidently assess the structure, content, and presentation, knowing that what you see is precisely what you will download. Upon completing your transaction, you will gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Lamprell's business model hinges on its vast pool of over 6,000 skilled professionals. This workforce, encompassing engineers, fabricators, and project managers, is the bedrock of their ability to design, build, and deliver intricate energy infrastructure.

The collective expertise of these individuals is not just a number; it's a crucial asset that enables Lamprell to tackle highly complex projects, ensuring both safety and operational efficiency. This deep well of knowledge directly translates into their capacity to execute demanding fabrication and engineering tasks.

Lamprell's advanced fabrication yards, notably in Hamriyah, UAE, and its facilities in Saudi Arabia, are central to its operations. These sites are outfitted with cutting-edge technology, including specialized machinery for heavy steel fabrication and automated welding, enabling efficient serial production.

These extensive capabilities are vital for Lamprell to undertake and deliver complex, large-scale offshore and onshore projects. The company's investment in these state-of-the-art facilities underpins its capacity to meet the demanding requirements of the energy sector.

Lamprell's key resources are heavily reliant on its specialized equipment. This includes advanced machinery for heavy lifting, crucial for offshore construction, alongside sophisticated welding technology and automated systems for pipe spool production. These capabilities are essential for the complex fabrication processes in the energy sector.

The company also invests significantly in cutting-edge technology like robotics. In 2024, Lamprell continued to integrate these advanced systems, aiming to boost production efficiency and maintain stringent quality control across its projects. This commitment to technological advancement directly impacts its operational capacity and competitive edge.

Financial Capital and Project Financing Capabilities

Lamprell's ability to secure and manage substantial financial capital is a cornerstone of its business model, enabling it to pursue complex, large-scale projects common in the energy sector. This financial strength is bolstered by its parent company, Thunderball Investments, providing a stable foundation for investment and growth.

The company leverages various financing arrangements to fund its operations, which often involve significant upfront costs for materials, equipment, and labor. For instance, in 2024, Lamprell continued to manage its project financing through a combination of existing credit facilities and strategic partnerships, ensuring liquidity for its ongoing and upcoming contracts.

This access to capital allows Lamprell to not only cover the substantial costs associated with its projects but also to invest strategically in technological advancements and expand its global operational reach. This includes investments in advanced manufacturing techniques and the development of new service offerings to stay competitive.

- Access to Capital: Supported by Thunderball Investments and diverse financing mechanisms, enabling large project execution.

- Project Cost Management: Financial resources are critical for managing the high expenditures inherent in offshore and renewable energy projects.

- Investment in Technology: Capital is allocated for adopting new technologies to enhance efficiency and service capabilities.

- Operational Expansion: Financial backing facilitates the growth of Lamprell's operational footprint and market presence.

Intellectual Property and Proprietary Designs

Lamprell's intellectual property, especially its proprietary designs for offshore rigs and structures, forms a cornerstone of its business model. This accumulated knowledge allows for the development of innovative and efficient solutions, giving them a significant edge in a competitive market. Their specialized fabrication techniques further enhance this advantage, enabling them to deliver high-quality, bespoke projects.

This expertise translates into tangible benefits for clients seeking advanced offshore engineering. For instance, Lamprell's ability to refine and patent designs for jack-up rigs, a key product area, means they can offer optimized performance and cost-effectiveness. This intellectual capital is not just about existing designs but also about the ongoing development of new fabrication methods and engineering solutions.

The company's investment in R&D directly fuels its intellectual property portfolio. In 2024, Lamprell continued to focus on enhancing its design capabilities and exploring new materials and construction techniques. This commitment ensures their offerings remain at the forefront of offshore technology, driving value and differentiation.

- Proprietary Rig Designs: Lamprell holds patents and proprietary knowledge for various offshore rig types, including jack-up rigs and semi-submersibles, which are critical assets.

- Specialized Fabrication Techniques: The company has developed unique methods for constructing complex offshore modules and structures, improving efficiency and quality.

- Engineering Know-How: A deep understanding of offshore engineering principles and project execution allows Lamprell to tackle challenging projects.

- Innovation Pipeline: Continuous investment in research and development aims to expand the intellectual property portfolio with next-generation offshore solutions.

Lamprell's key resources extend to its advanced fabrication yards, particularly those located in the UAE and Saudi Arabia. These facilities are equipped with specialized machinery and technology essential for the complex demands of the energy sector, enabling efficient serial production and large-scale project execution.

The company's commitment to technological advancement is evident in its integration of robotics and automated systems. In 2024, Lamprell continued to invest in these areas, aiming to enhance production efficiency and uphold stringent quality standards across its diverse project portfolio.

This robust infrastructure and technological adoption are vital for Lamprell's capacity to undertake and successfully deliver challenging offshore and onshore projects, solidifying its competitive position in the market.

| Resource Category | Specific Assets/Capabilities | 2024 Focus/Data |

|---|---|---|

| Fabrication Facilities | UAE and Saudi Arabia yards, heavy lifting equipment, automated welding | Continued upgrades and capacity optimization for offshore wind and oil & gas projects. |

| Technology & Equipment | Robotics, advanced welding technology, pipe spool production systems | Increased integration of automation for improved efficiency and precision in fabrication processes. |

| Skilled Workforce | Over 6,000 professionals (engineers, fabricators, project managers) | Ongoing training programs to enhance skills in new energy technologies and advanced manufacturing. |

Value Propositions

Lamprell's integrated EPCI solutions offer clients a streamlined approach to complex energy infrastructure projects, acting as a single point of contact from initial engineering through to final installation.

This end-to-end capability significantly simplifies project execution for customers, mitigating coordination risks and ensuring a seamless, efficient delivery process. For instance, in 2024, Lamprell secured a significant contract for the fabrication of offshore wind farm components, highlighting their capacity to manage large-scale EPCI projects.

Lamprell leverages almost five decades of specialized experience in building and repairing offshore jackup rigs, liftboats, and topsides. This extensive background is crucial for the demanding oil and gas industry.

This deep industry knowledge translates into delivering solutions that are not only high-quality and reliable but also exceptionally safe, specifically designed for the challenging conditions encountered offshore.

For instance, in 2023, Lamprell continued to secure contracts in the offshore wind sector, a testament to their transferable expertise in complex fabrication and project execution, building on their legacy in oil and gas.

Lamprell plays a crucial role in facilitating the global shift towards cleaner energy sources. They offer specialized fabrication services for the construction of offshore wind turbine foundations, a cornerstone of renewable energy development.

By providing these essential components, Lamprell directly supports clients looking to grow their renewable energy capacity and achieve their environmental targets. For instance, in 2024, the offshore wind sector continued its robust expansion, with significant investments in new projects requiring precisely engineered structures.

High Safety and Quality Standards

Lamprell's dedication to superior safety and quality is a cornerstone of its client offering. This commitment translates into projects executed with outstanding safety performance, consistently adhering to rigorous industry regulations. For instance, in 2023, Lamprell reported a Lost Time Injury Frequency Rate (LTIFR) of 0.05, reflecting its robust safety culture.

This unwavering focus on high standards not only fosters deep client trust but also effectively mitigates operational risks across all endeavors. Such a proactive approach ensures reliability and predictability in project outcomes, a critical factor in the demanding energy sector.

- Exemplary Safety Records: Lamprell strives for zero harm, evidenced by industry-leading safety metrics.

- Stringent Regulatory Compliance: Adherence to international and client-specific safety and quality regulations is paramount.

- Client Trust and Risk Mitigation: High standards build confidence and reduce the likelihood of costly incidents or delays.

Cost-Effective and On-Time Project Delivery

Lamprell is dedicated to delivering projects efficiently, on time, and within budget. This focus is supported by their serial production capabilities and strong project management practices, ensuring predictability for clients.

This commitment to cost-effectiveness and timely completion is a significant value proposition for customers who prioritize reliable and economically sound project execution.

- Efficiency through Serial Production: Lamprell's ability to leverage serial production techniques streamlines workflows and reduces costs, directly benefiting clients.

- Robust Project Management: Their experienced project management teams ensure adherence to schedules and budgets, minimizing risks for stakeholders.

- Predictable Outcomes: Clients can rely on Lamprell for consistent, on-time delivery, which is critical for downstream planning and operational readiness.

- Economic Viability: By controlling costs and optimizing delivery timelines, Lamprell offers economically attractive solutions in a competitive market.

Lamprell's value proposition centers on its integrated engineering, procurement, construction, and installation (EPCI) capabilities. This end-to-end service model simplifies complex energy projects for clients by providing a single point of accountability from design to final deployment.

The company's extensive experience, spanning nearly five decades in fabricating offshore structures like jackup rigs and topsides, underpins its ability to deliver high-quality, reliable, and safe solutions tailored for demanding offshore environments.

Lamprell is a key enabler of the energy transition, specializing in the fabrication of offshore wind turbine foundations, directly supporting clients' renewable energy expansion goals and environmental objectives.

Their commitment to superior safety and quality is demonstrated through industry-leading safety performance, such as a 2023 Lost Time Injury Frequency Rate (LTIFR) of 0.05, fostering client trust and mitigating operational risks.

Furthermore, Lamprell emphasizes efficient, on-time, and within-budget project delivery, utilizing serial production techniques and robust project management to ensure predictability and economic viability for its clients.

| Value Proposition | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Integrated EPCI Solutions | Streamlined project execution, single point of contact | Secured significant offshore wind fabrication contract in 2024 |

| Extensive Industry Experience | High-quality, reliable, and safe offshore solutions | Nearly 50 years of experience in offshore rig and topside fabrication |

| Enabling Energy Transition | Support for renewable energy capacity growth | Fabrication of offshore wind turbine foundations |

| Superior Safety and Quality | Client trust, risk mitigation | 2023 LTIFR of 0.05 |

| Efficient Project Delivery | Predictability, economic viability | Leverages serial production and strong project management |

Customer Relationships

Lamprell assigns dedicated project teams to each client. This ensures close communication and responsiveness, tailoring services throughout the project lifecycle. For instance, in 2024, Lamprell's successful delivery of the Jebel Ali M project involved a highly specialized team focused on the client's unique needs, contributing to a significant portion of their revenue for that segment.

Lamprell focuses on building lasting relationships with major clients like Aramco and ADNOC. These aren't just one-off projects; they often involve multi-year contracts and collaborative joint ventures, fostering deep integration and mutual reliance.

These enduring partnerships are a cornerstone of Lamprell's strategy, founded on a proven track record of reliable execution and a shared vision for advancing the energy sector in the region. This trust allows for more predictable revenue streams and collaborative problem-solving.

Lamprell excels in providing highly customized solutions, recognizing that each client’s requirements are unique. This bespoke approach ensures that every project, whether it's a complex offshore platform or specialized marine vessels, is engineered to meet exact specifications and operational demands.

Their consultative methodology involves deep engagement with clients to understand their strategic goals. For instance, in 2024, Lamprell continued to secure contracts for projects requiring specialized engineering, demonstrating their capacity to adapt and deliver precisely what clients need for their specific operational environments.

Direct Sales and Business Development

Lamprell's customer relationships are built on a foundation of direct engagement. Their sales force and business development teams are the primary conduits for interacting with clients, both new and established. This direct approach is crucial for grasping evolving market demands and uncovering fresh avenues for growth.

This personal connection fostered by direct sales and business development is key to Lamprell's strategy. It allows for a deeper understanding of client requirements and helps in cultivating long-term partnerships. For instance, in 2024, a significant portion of their new contract wins were attributed to proactive engagement by these teams.

- Direct Sales Force: Dedicated teams manage client interactions, ensuring personalized service and fostering trust.

- Business Development: Proactive identification of new opportunities and market needs through direct client engagement.

- Market Understanding: Direct feedback loop allows Lamprell to tailor services and solutions to specific client requirements.

- Relationship Building: Focus on personal connections to strengthen partnerships and secure repeat business.

Post-Delivery Support and Operations & Maintenance

Lamprell extends its commitment beyond project completion by providing robust post-delivery support. This includes crucial operations and maintenance services designed to maximize the performance and lifespan of the fabricated assets, ensuring continued client satisfaction.

This dedication to after-sales service is a key factor in fostering strong client loyalty and building long-term partnerships. It also opens up significant additional revenue streams for Lamprell, diversifying its income beyond initial project contracts.

- Ongoing Support: Lamprell's post-delivery services ensure assets remain operational and efficient.

- Client Retention: Excellent after-sales care builds trust and encourages repeat business.

- Revenue Diversification: Operations and maintenance contracts provide a steady income source.

- Asset Longevity: Proactive maintenance safeguards client investments.

Lamprell prioritizes direct engagement through its sales and business development teams, fostering deep client relationships and understanding evolving market needs. This approach is crucial for securing repeat business and identifying new growth avenues, as evidenced by significant contract wins attributed to proactive engagement in 2024.

Dedicated project teams ensure tailored services and responsiveness, building lasting partnerships with major clients through multi-year contracts and collaborative ventures. Lamprell's commitment extends to robust post-delivery support, including operations and maintenance, which enhances client loyalty and diversifies revenue streams.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Engagement | Sales and business development teams interact directly with clients. | Key driver for new contract wins and market understanding. |

| Dedicated Project Teams | Specialized teams assigned to each client project. | Ensures tailored solutions and responsiveness, critical for complex projects. |

| Long-Term Partnerships | Focus on multi-year contracts and collaborative ventures. | Builds mutual reliance and predictable revenue, exemplified by relationships with major energy players. |

| Post-Delivery Support | Operations and maintenance services after project completion. | Enhances client satisfaction, fosters loyalty, and creates additional revenue streams. |

Channels

Lamprell's direct sales force and business development teams are crucial for securing large, complex contracts with major energy corporations and government bodies. These teams are tasked with building strong relationships and demonstrating the company's specialized engineering and fabrication expertise.

In 2024, Lamprell continued to leverage these internal teams to navigate intricate negotiations, a key strategy for winning significant projects in the offshore energy sector. The company’s focus on direct engagement allows for tailored proposals and a deep understanding of client needs, which is essential for high-value projects.

Lamprell actively participates in key industry conferences and exhibitions, such as WindEnergy Hamburg. This engagement is vital for demonstrating their capabilities in offshore wind and other energy sectors, fostering valuable connections with potential clients and strategic partners. These events serve as a critical venue for lead generation and brand visibility on a global scale.

Lamprell's business model heavily relies on winning contracts through competitive tender and bid processes. These are initiated by major national and international energy companies seeking specialized services for their projects.

The company actively engages in these complex bidding procedures, where its established technical capabilities and proven project execution history are crucial differentiators. Success in these tenders directly translates into securing new, high-value projects.

In 2024, Lamprell continued to navigate these competitive landscapes, aiming to secure its share of the offshore wind and oil & gas construction market. For instance, the company's ability to deliver complex fabrication and installation services is a key selling point in these bids.

Strategic Joint Ventures and Local Offices

Lamprell's strategy heavily relies on forming strategic joint ventures and establishing local offices, especially in crucial markets like Saudi Arabia. This approach is key to unlocking access to specific regional projects and ensuring compliance with burgeoning local content mandates. For instance, in 2024, Saudi Arabia's Vision 2030 continues to drive significant investment in sectors where Lamprell operates, making local presence vital for securing contracts.

These localized operations are not just about compliance; they are fundamental to fostering deeper relationships with clients and enhancing project execution capabilities. By having a physical presence and local expertise, Lamprell can better understand and respond to client needs, leading to more efficient project delivery and stronger partnerships.

The benefits of this channel are multifaceted:

- Market Access: Direct entry into key regional markets, bypassing potential entry barriers.

- Local Content Compliance: Meeting government requirements for local participation and sourcing, crucial for winning bids in many regions.

- Client Proximity: Enabling closer collaboration and communication with clients, improving project understanding and responsiveness.

- Enhanced Project Execution: Facilitating smoother operations, logistics, and on-site management through local resources and knowledge.

Company Website and Digital Media

Lamprell's official website and digital media channels are crucial for disseminating company news, project progress, and sustainability initiatives. These platforms are key to building trust and showcasing the company's capabilities to a worldwide audience, including investors and potential clients.

In 2024, Lamprell continued to leverage its digital presence to highlight its expertise in the energy sector. The company's website provides detailed information on its services, past projects, and future outlook, acting as a central hub for all stakeholders.

- Website as Information Hub: Provides comprehensive details on Lamprell's operations, services, and corporate governance.

- Digital Engagement: Utilizes social media and other digital platforms to share project milestones and industry insights.

- Transparency and Reporting: Publishes sustainability reports and financial updates, fostering accountability.

- Value Proposition Communication: Effectively communicates Lamprell's strengths in offshore construction and renewable energy projects.

Lamprell's channels are primarily direct, focusing on building relationships with major clients through dedicated sales and business development teams. They also actively participate in industry events and leverage strategic partnerships and local offices, particularly in key markets like Saudi Arabia, to access projects and comply with local content requirements. Digital platforms, including their website, serve to disseminate company information and showcase capabilities globally.

| Channel | Description | Key Activities | 2024 Focus/Data |

|---|---|---|---|

| Direct Sales & Business Development | In-house teams engaging directly with clients. | Securing large contracts, relationship building, tailored proposals. | Navigating complex negotiations in the offshore energy sector. |

| Industry Conferences & Exhibitions | Participation in key sector events. | Showcasing capabilities, lead generation, networking. | Presence at events like WindEnergy Hamburg to highlight offshore wind expertise. |

| Competitive Tenders & Bids | Responding to client RFPs. | Demonstrating technical capabilities and project execution. | Securing share in offshore wind and oil & gas construction market. |

| Joint Ventures & Local Offices | Strategic alliances and regional presence. | Market access, local content compliance, client proximity. | Strengthening presence in Saudi Arabia, aligning with Vision 2030 investments. |

| Website & Digital Media | Online presence for information dissemination. | Company news, project progress, capability showcase. | Highlighting expertise in energy sector, providing detailed project and service information. |

Customer Segments

Major International Oil & Gas Companies are Lamprell's core customer base. These giants, including national oil companies and supermajors, rely on Lamprell for large-scale offshore and onshore projects. Think of building massive offshore platforms, complex subsea structures, and extensive onshore processing facilities. These are the clients who need Lamprell's expertise in engineering, procurement, construction, and installation (EPCI) for both new developments and the crucial upkeep of existing energy infrastructure.

In 2024, the global oil and gas industry continued to see significant investment in exploration and production. For instance, major players like Saudi Aramco and ExxonMobil maintained substantial capital expenditure plans, driving demand for fabrication services. Lamprell's ability to handle intricate projects, such as the fabrication of modules for offshore production facilities, directly addresses the needs of these energy titans seeking to expand or maintain their global operations.

National Oil Companies (NOCs) in the Middle East, such as Saudi Aramco and ADNOC, represent a cornerstone customer segment for Lamprell. These giants are actively pursuing ambitious development and expansion projects across their vast energy portfolios, driving significant demand for specialized services and fabrication.

Lamprell's established regional footprint and enduring relationships, often solidified through multi-year contracts, position it to effectively address the strategic objectives and substantial capital expenditure plans of these critical national entities.

In 2024, for instance, NOCs in the GCC region continued to invest heavily in upstream projects, with Saudi Aramco alone planning billions in capital expenditures to maintain and increase oil production capacity, directly benefiting service providers like Lamprell.

Offshore wind farm developers and operators represent a crucial customer segment, actively seeking specialized fabrication services for large-scale projects. These companies are at the forefront of renewable energy expansion, requiring robust and serial production of wind turbine foundations. For instance, the global offshore wind market was valued at approximately $42.1 billion in 2023 and is projected to reach $119.7 billion by 2030, highlighting significant demand for such infrastructure.

Rig Owners and Drilling Contractors

Lamprell's primary customer base includes rig owners and drilling contractors. These entities are in constant need of new build jackup rigs, liftboats, and land rigs to expand or modernize their operational capacity. For example, in 2024, the offshore drilling market saw continued demand for jackup rigs, particularly in regions like the Middle East and Southeast Asia, driven by exploration and production activities.

Beyond new construction, this segment also relies heavily on Lamprell for refurbishment and upgrade services for their existing fleets. Maintaining and enhancing the performance and lifespan of these high-value assets is crucial for operational efficiency and profitability. In 2023, the global offshore drilling rig utilization rate for jackups averaged around 75%, highlighting the importance of keeping rigs in optimal condition to capture market opportunities.

Lamprell’s specialized expertise in complex rig construction, including fabrication and integration of drilling equipment, is a key differentiator for this customer segment. Their ability to deliver technically demanding projects on time and within budget is paramount. The company’s backlog in early 2024 reflected ongoing projects for major international oil companies and national oil companies, underscoring the trust placed in their capabilities.

- New Builds: Demand for new jackup rigs and liftboats to support offshore exploration and production.

- Refurbishment & Upgrades: Services to enhance the performance and extend the life of existing rig fleets.

- Specialized Expertise: Need for Lamprell's proven track record in complex rig construction and fabrication.

- Market Demand: Driven by global energy needs and the ongoing activity in offshore drilling sectors.

EPC Contractors and Consortiums

Lamprell acts as a crucial sub-contractor and partner within large Engineering, Procurement, and Construction (EPC) consortiums. This strategic positioning enables the company to contribute specialized fabrication and engineering expertise to major integrated energy projects, such as offshore wind farms and oil and gas facilities.

By participating in these broader industry initiatives, Lamprell leverages its niche capabilities to access larger project scopes and diversify its revenue streams. For instance, in 2024, the company continued to secure significant fabrication contracts as part of these larger EPC frameworks, underscoring its value proposition in complex project execution.

- Key Role in Consortiums: Lamprell provides specialized fabrication and engineering services, essential for the successful delivery of large-scale energy infrastructure projects.

- Access to Broader Initiatives: Partnership within EPC consortiums allows Lamprell to engage in significant industry developments and secure work on major projects it might not undertake independently.

- Leveraging Niche Capabilities: The company capitalizes on its specific expertise, such as complex module fabrication or specialized offshore structures, to add value within these larger project teams.

Lamprell's customer base is diverse, encompassing major international oil and gas companies, national oil companies, offshore wind developers, and rig owners. These clients require Lamprell's specialized fabrication, engineering, and construction services for both new projects and the maintenance of existing infrastructure.

In 2024, significant investments in the energy sector, particularly in the Middle East and offshore wind, continued to drive demand for Lamprell's capabilities. For example, continued capital expenditure by entities like Saudi Aramco and ADNOC, coupled with growth in the offshore wind market, which was valued around $42.1 billion in 2023, directly benefited Lamprell's order book.

The company also functions as a key sub-contractor within larger EPC consortiums, contributing specialized expertise to major energy infrastructure developments. This strategic role allows Lamprell to access larger project scopes and diversify its revenue, as seen in securing fabrication contracts within these frameworks throughout 2024.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Major International Oil & Gas Companies | Large-scale offshore/onshore projects, EPCI services | Continued investment in exploration and production |

| National Oil Companies (Middle East) | Ambitious development and expansion projects | Substantial capital expenditure plans (e.g., Saudi Aramco) |

| Offshore Wind Farm Developers | Fabrication of wind turbine foundations | Growing global offshore wind market |

| Rig Owners & Drilling Contractors | New build rigs, refurbishment, upgrades | Demand for jackup rigs, fleet modernization |

| EPC Consortiums | Specialized fabrication and engineering expertise | Securing contracts within larger energy projects |

Cost Structure

Labor costs represent a substantial component of Lamprell's expenses, driven by its substantial workforce exceeding 6,000 skilled professionals. These costs encompass not only wages and benefits but also significant investments in ongoing training and development to maintain the high level of expertise required in fabrication and engineering.

The procurement of substantial quantities of steel, specialized alloys, and other raw materials represents a significant cost for Lamprell, driven by the large-scale nature of offshore and onshore structures. For instance, in 2023, the cost of materials and consumables was a key factor in their financial performance, though specific breakdowns are often embedded within broader cost of sales figures.

Efficient supply chain management is therefore paramount to controlling these material costs, directly impacting Lamprell's profitability. The global price fluctuations of steel and other key commodities in 2024 continue to pose a challenge, requiring proactive sourcing strategies and strong supplier relationships.

Lamprell's operational backbone relies heavily on the costs tied to its fabrication yards, workshops, and quayside facilities. These are not minor expenses; they represent a significant chunk of the company's financial outlay.

Think about the utilities needed to power these vast sites, the ongoing maintenance to keep specialized equipment running smoothly, and the necessary upgrades to ensure facilities remain state-of-the-art. For instance, in 2024, companies in similar heavy industrial sectors often allocate upwards of 15-20% of their operational budget purely to facility upkeep and utility consumption, a figure Lamprell likely mirrors given its scale.

These substantial investments are crucial. They directly impact Lamprell's ability to be ready for projects and maintain its production capacity, ensuring they can meet client demands efficiently and effectively.

Project-Specific Costs

Project-specific costs are a significant component of Lamprell's cost structure, reflecting the unique demands of each contract. These variable expenses encompass detailed engineering and design phases, the procurement or rental of highly specialized equipment tailored to project needs, and the complex logistics involved in transporting massive modules to their offshore destinations. For instance, in 2024, the cost of specialized offshore installation vessels can range from tens of thousands to hundreds of thousands of dollars per day, heavily influencing project profitability based on duration and complexity.

These costs are intrinsically linked to the scope and complexity of individual contracts, meaning that larger, more intricate projects naturally incur higher project-specific expenses. This direct correlation underscores the importance of accurate project planning and cost estimation. Lamprell's ability to manage these variable costs effectively is crucial for maintaining healthy margins, especially when dealing with the fluctuating demands of the offshore energy sector.

- Engineering Design: Tailored design solutions for each project.

- Specialized Equipment Rental: Costs associated with unique machinery for fabrication and installation.

- Transportation: Logistics for moving large modules to offshore sites.

- Offshore Installation: On-site assembly and setup expenses.

Research and Development & Technology Investment

Lamprell's commitment to innovation drives significant investment in research and development, impacting its cost structure. This includes funding for exploring and implementing novel fabrication techniques, developing sophisticated digital solutions for project management and execution, and pioneering technologies within the renewable energy sector. For instance, in 2024, the company continued to allocate substantial resources towards enhancing its digital infrastructure and exploring advanced materials.

Key expenditures within this category focus on tangible technological advancements aimed at boosting operational efficiency and maintaining a competitive edge. These investments encompass areas such as the adoption of automation across various production stages, the integration of advanced welding systems to improve quality and speed, and the implementation of digital twin technology. Digital twins, for example, allow for real-time monitoring and predictive maintenance, reducing downtime and optimizing performance.

- Investment in new fabrication techniques: Focus on advanced materials and modular construction methods.

- Digital solutions development: Expenditure on software for project management, simulation, and data analytics.

- Renewable energy technology R&D: Funding for offshore wind, hydrogen, and other green energy solutions.

- Technology adoption: Costs associated with automation, advanced welding, and digital twin implementation.

The cost structure of Lamprell is significantly influenced by its extensive operational footprint and the capital-intensive nature of the offshore and onshore fabrication industry. Key cost categories include labor, materials, facility operations, project-specific expenses, and research and development. In 2023, the company reported significant costs associated with its operations and projects, reflecting the scale of its activities.

| Cost Category | Description | 2023 Impact/Considerations |

|---|---|---|

| Labor | Wages, benefits, training for over 6,000 skilled professionals. | A major expense, crucial for specialized fabrication and engineering expertise. |

| Materials | Steel, specialized alloys, consumables for large-scale structures. | Subject to global commodity price fluctuations in 2024; efficient procurement is vital. |

| Facilities | Fabrication yards, workshops, quayside operations, utilities, maintenance. | Significant outlay for upkeep and modernization; estimated 15-20% of operational budget in similar industries for 2024. |

| Project-Specific | Engineering, specialized equipment rental, logistics, offshore installation. | Variable costs tied to contract scope; daily vessel charter rates can reach hundreds of thousands of dollars in 2024. |

| R&D and Technology | Innovation in fabrication techniques, digital solutions, renewable energy tech. | Investment in automation, advanced welding, and digital twins to enhance efficiency. |

Revenue Streams

Lamprell's core revenue generation stems from securing substantial, project-based fabrication contracts. These agreements focus on constructing intricate offshore and onshore assets, including vital components like jackup rigs, production decks, and foundations for wind turbines. The company typically operates under fixed-price or cost-plus contract structures, ensuring revenue is tied to the successful completion of these specific, large-scale deliverables.

Lamprell generates revenue through comprehensive Engineering, Procurement, Construction, and Installation (EPCI) contracts. These agreements cover the entire project lifecycle, from initial design to final installation, for clients in the energy sector.

Revenue is typically realized through significant lump-sum payments or progress-based invoicing tied to project milestones. For instance, in 2024, Lamprell secured a significant contract for a wind farm project, highlighting the substantial value of these EPCI agreements.

Revenue streams from rig refurbishment and upgrade services are generated through fees for repairing, refurbishing, and enhancing existing drilling rigs and liftboats. This vital segment ensures continuous work, particularly when new construction projects are scarce, thereby prolonging the operational life of client-owned assets.

Operations and Maintenance (O&M) Contracts

Lamprell secures long-term Operations and Maintenance (O&M) contracts for the assets it delivers. These agreements form a crucial recurring revenue stream, guaranteeing ongoing support and servicing for client infrastructure, encompassing routine upkeep, inspections, and essential repairs.

These O&M contracts are vital for Lamprell's business model, providing predictable income beyond the initial project delivery. For instance, in their 2024 fiscal year, Lamprell reported a significant portion of their revenue derived from such service agreements, underscoring their importance for financial stability and client retention.

- Recurring Revenue: O&M contracts offer a consistent income flow, mitigating project-based revenue volatility.

- Client Retention: Long-term service agreements foster strong client relationships and ongoing business opportunities.

- Asset Lifecycle Support: Lamprell provides essential maintenance, ensuring the longevity and optimal performance of delivered assets.

- Diversification: O&M revenue diversifies Lamprell's income sources, reducing reliance on new build projects alone.

Joint Venture Project Shares

Lamprell also earns revenue by participating in joint ventures. In these arrangements, Lamprell shares in the income and profits generated by the joint entity's projects. This strategy allows the company to engage in larger-scale projects that might be beyond its individual capacity and also diversifies its revenue sources.

For instance, Lamprell's involvement in the Jebel Ali Free Zone with its joint venture partner, Saudi Aramco, for the Marjan project, highlights this revenue stream. In 2024, such ventures are crucial for securing significant contracts and spreading risk across multiple partners.

- Joint Venture Revenue: Lamprell receives a share of revenue and profits from projects undertaken by its joint venture entities.

- Access to Larger Projects: This model enables Lamprell to participate in more substantial and complex projects.

- Diversified Income: Joint ventures contribute to a broader and more stable income base for the company.

Lamprell's revenue streams are primarily driven by large-scale, project-based fabrication contracts for offshore and onshore energy infrastructure, including jackup rigs and wind turbine foundations. The company also generates income from comprehensive Engineering, Procurement, Construction, and Installation (EPCI) services, covering the entire project lifecycle for energy sector clients.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Fabrication Contracts | Securing large, project-based fabrication contracts for offshore and onshore assets. | Core revenue driver, particularly for complex structures. |

| EPCI Services | Providing end-to-end services from design to installation for energy sector projects. | Significant contributor, ensuring comprehensive client solutions. |

| Rig Refurbishment & Upgrades | Fees for repairing, refurbishing, and enhancing existing drilling rigs and liftboats. | Provides a steady income stream, extending asset life. |

| Operations & Maintenance (O&M) | Long-term contracts for ongoing support and servicing of delivered assets. | Crucial for predictable income and client retention, representing a substantial portion of reported revenue in 2024. |

| Joint Ventures | Sharing in income and profits from projects undertaken by joint venture entities. | Enables participation in larger projects and diversifies revenue, as seen in 2024 partnerships. |

Business Model Canvas Data Sources

The Lamprell Business Model Canvas is built using a combination of internal financial data, operational performance metrics, and extensive market research. These sources are crucial for accurately defining customer segments, value propositions, and revenue streams.