Lamprell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lamprell Bundle

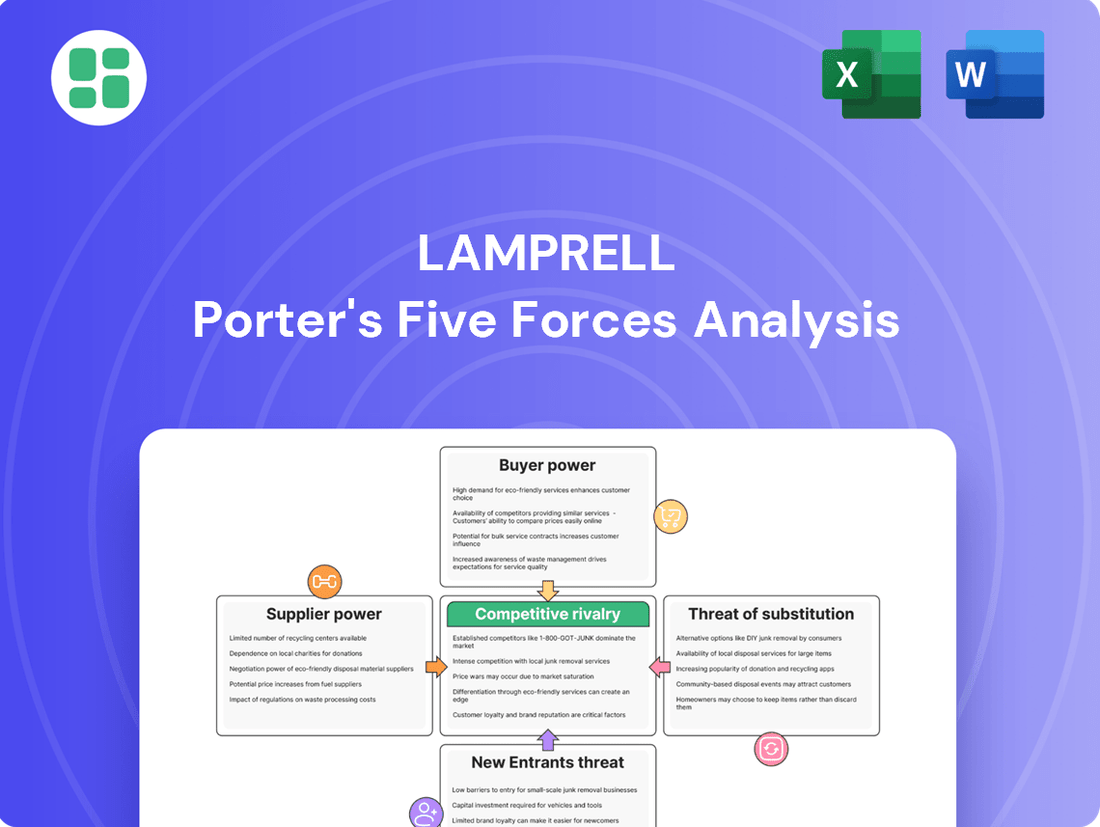

Lamprell's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating the offshore, onshore, and renewable energy sectors.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Lamprell’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Lamprell's reliance on a limited number of specialized suppliers for critical offshore fabrication components, such as high-grade steel and advanced machinery, significantly bolsters supplier bargaining power. This concentration means fewer alternatives are available, giving these suppliers considerable leverage in negotiations. For instance, the market for specialized offshore structural steel, a key input for Lamprell, is dominated by a handful of global producers, allowing them to dictate terms and pricing.

High switching costs significantly bolster the bargaining power of Lamprell's suppliers. For intricate engineering and fabrication projects, moving to a new supplier isn't as simple as changing vendors for office supplies. It often necessitates costly redesigns, rigorous requalification of parts and processes, and carries the inherent risk of project delays. These substantial hurdles make it economically unfeasible for Lamprell to frequently change suppliers, especially for critical components or ongoing long-term contracts.

The deep-seated relationships Lamprell has cultivated with its existing suppliers, particularly for specialized materials or projects spanning extended durations, create formidable switching barriers. These established ties, built on trust and proven performance, further solidify the leverage held by these current suppliers. For instance, in the offshore energy sector where Lamprell operates, sourcing specialized subsea equipment or unique alloy steels often involves suppliers with proprietary manufacturing techniques, making direct replacement by another vendor a complex and time-consuming undertaking.

Suppliers possessing proprietary technology, like advanced automation systems or specialized materials for offshore rigs, wield significant influence. Lamprell's reliance on these unique offerings, for which few alternatives exist, directly enhances supplier bargaining power. This is particularly relevant as the industry increasingly adopts digitalization and advanced materials, as seen in the growing demand for sophisticated components in modular drilling rigs.

Raw Material Price Volatility

The prices of essential raw materials, such as steel and various metals vital for fabrication, are inherently volatile due to global market dynamics. This volatility means suppliers can readily pass on increased costs, directly affecting Lamprell's project profitability and the accuracy of its budgeting. For instance, fluctuations in the London Metal Exchange (LME) prices for key commodities like aluminum or copper can significantly alter input costs for fabrication projects.

This external market instability amplifies the bargaining power of suppliers, as they can leverage these price swings to their advantage. Lamprell, like many in the fabrication industry, faces the challenge of managing these unpredictable input expenses. In 2024, global steel prices experienced notable shifts, impacting the cost base for large-scale construction and manufacturing projects.

- Steel Price Fluctuations: Global steel prices, a primary input for Lamprell, have shown significant year-over-year volatility. For example, during the first half of 2024, benchmark steel futures saw price increases driven by supply chain concerns and demand recovery in key industrial sectors.

- Metal Market Volatility: Prices for other critical metals, such as copper and nickel, also experienced substantial swings in 2024, influenced by geopolitical events and shifts in demand from sectors like renewable energy and electric vehicles.

- Impact on Project Margins: These raw material price increases directly squeeze profit margins on fixed-price contracts, forcing Lamprell to absorb higher costs or renegotiate terms, thereby strengthening supplier leverage.

Labor and Skilled Workforce Shortages

The scarcity of specialized labor and highly skilled professionals within the offshore fabrication and engineering industries grants these human resources significant supplier power. Lamprell, with its workforce exceeding 6,000 skilled individuals, is particularly reliant on a consistent influx of such expertise to maintain its operational capacity and project delivery timelines.

These labor shortages can directly translate into escalating labor costs for companies like Lamprell. For instance, in 2024, the global shortage of welders, a critical skill in offshore fabrication, continued to drive up wages. This increased cost of talent can impact project profitability and potentially delay crucial project milestones, affecting Lamprell's overall performance and competitive standing.

- Labor Scarcity Impact: Shortages of skilled welders, electricians, and engineers in the offshore sector can increase wage demands.

- Project Execution Risks: Difficulty in sourcing qualified personnel can lead to project delays and cost overruns for fabrication projects.

- Talent Retention Costs: Companies may face higher expenses to retain existing skilled workers, further impacting operational budgets.

Suppliers hold significant bargaining power when Lamprell faces limited alternatives for essential components. This is amplified by high switching costs, which involve substantial expenses and risks for Lamprell to change suppliers, making them more dependent on existing relationships and proprietary technologies. The volatile nature of raw material prices, such as steel and various metals, also empowers suppliers as they can easily pass on increased costs, directly impacting Lamprell's profitability and project budgeting.

The scarcity of specialized labor, particularly skilled welders and engineers, further strengthens supplier bargaining power by driving up labor costs. This situation can lead to project delays and increased expenses for Lamprell as they compete for talent. In 2024, global steel prices saw notable shifts, with benchmark futures increasing in the first half due to supply chain concerns and demand recovery, directly affecting fabrication project costs.

| Factor | Impact on Lamprell | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited alternatives increase leverage | Market for specialized offshore steel dominated by few global producers. |

| Switching Costs | High costs make changing suppliers difficult | Includes redesign, requalification, and risk of project delays. |

| Proprietary Technology | Reliance on unique offerings enhances supplier power | Advanced automation and specialized materials for offshore rigs are key examples. |

| Raw Material Volatility | Suppliers can pass on increased costs | London Metal Exchange (LME) prices for aluminum and copper show significant swings. Global steel prices increased in H1 2024. |

| Labor Scarcity | Shortage of skilled workers drives up wages | Global shortage of welders in 2024 led to increased wage demands. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Lamprell's position in the energy services sector.

Instantly identify and prioritize competitive threats with a visual breakdown of all five forces, streamlining strategic planning.

Customers Bargaining Power

Lamprell's customer base is notably concentrated, primarily comprising major international and national oil and gas companies (IOCs and NOCs) alongside significant renewable energy developers. For instance, entities like the ADNOC Group and RWE represent a substantial portion of Lamprell's clientele.

These large-scale clients wield considerable purchasing power, driven by the immense value and long-term commitment inherent in the contracts they award. This concentration means that a limited number of powerful buyers can effectively dictate pricing and contractual terms, thereby increasing their bargaining leverage.

Lamprell's customers, particularly those in project-based procurement like EPCI contracts for offshore wind foundations or rig refurbishments, hold significant bargaining power. These large, bespoke projects often represent a substantial portion of Lamprell's annual revenue, creating a strong dependency on securing each contract. For instance, in 2023, Lamprell secured a significant contract for offshore wind fabrication, highlighting the critical nature of individual project wins.

The offshore energy sector's inherent volatility, driven by geopolitical shifts and fluctuating energy prices, grants customers substantial leverage. This means they can readily postpone, renegotiate, or entirely scrap projects, particularly during periods of market uncertainty.

In 2024, this capability was evident as some planned offshore projects experienced delays, a trend that has somewhat tempered the otherwise positive sentiment within the sector. For instance, while investment in offshore wind continues to grow, some large-scale projects have faced timeline adjustments due to supply chain issues and rising costs, directly impacting customer commitment.

Access to Multiple Fabrication Yards

Lamprell's customers, particularly large energy companies, benefit significantly from their access to multiple fabrication yards globally. This widespread availability of fabrication capacity means clients can easily solicit bids from various providers, fostering intense price competition. For instance, major oil and gas projects often involve tenders that attract global participants, allowing clients to benchmark Lamprell's offerings against those of its international competitors.

This competitive landscape directly impacts Lamprell's bargaining power. Clients can leverage the presence of numerous fabrication yards to negotiate more favorable terms, including pricing, delivery schedules, and payment conditions. The ability to switch providers if Lamprell's proposals are not deemed competitive empowers customers to demand better value. The global oil and gas fabrication market, estimated to be worth billions, features several large, established players capable of undertaking complex projects, further intensifying this dynamic.

- Global Tender Processes: Large energy firms routinely issue global tenders for fabrication projects, enabling them to compare offers from yards worldwide.

- Price Benchmarking: Customers can readily benchmark Lamprell's pricing against that of competitors, driving down costs for major contracts.

- Provider Switching: The availability of multiple qualified fabrication yards allows clients to switch suppliers if Lamprell's terms are not competitive.

- Market Concentration: While Lamprell is a significant player, the global fabrication market includes several other large entities that can vie for the same contracts.

Demand for Cost-Effectiveness and Efficiency

Customers in the energy sector, particularly those undertaking capital-intensive offshore projects, are perpetually focused on cost optimization and operational efficiency. This translates into a strong demand for competitive pricing, punctual project completion, and superior quality deliverables from companies like Lamprell. For instance, in 2024, the average cost of offshore wind farm development continued to be a significant factor, with developers actively seeking suppliers who could demonstrate clear cost-saving measures and faster execution timelines to improve their project economics.

This persistent drive for efficiency and cost reduction is a fundamental characteristic of the energy industry, influencing contract negotiations and supplier selection. Clients frequently leverage this by pushing for more favorable contract terms that reflect their cost-saving imperatives. The pressure is on suppliers to innovate and streamline processes to meet these evolving client expectations.

- Cost Sensitivity: Energy clients, especially in offshore, prioritize cost-effectiveness due to project scale.

- Efficiency Demands: Timely delivery and high-quality solutions are crucial for operational efficiency.

- Contractual Leverage: Customers use their need for cost savings to negotiate favorable contract terms.

- Industry Norm: The pursuit of greater efficiency and lower costs is a consistent theme across the energy sector.

Lamprell's customers, primarily large international and national oil and gas companies and renewable energy developers, possess significant bargaining power due to their substantial project values and long-term commitments. The concentration of these major clients, such as ADNOC Group and RWE, means a few powerful buyers can heavily influence pricing and contract terms. This leverage is amplified as these clients can easily switch between numerous global fabrication yards, fostering intense price competition and demanding better value.

| Customer Type | Bargaining Power Drivers | Impact on Lamprell |

|---|---|---|

| Major IOCs & NOCs | High project value, long-term contracts, multiple global suppliers | Price negotiation, favorable terms, potential for project delays |

| Renewable Energy Developers | Focus on cost optimization, efficiency demands, volatile project pipelines | Pressure for competitive pricing, faster execution, cost-saving measures |

Same Document Delivered

Lamprell Porter's Five Forces Analysis

This preview showcases the complete Lamprell Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document displayed here is the exact, professionally formatted analysis you'll receive immediately after purchase, ensuring no surprises. You can confidently purchase knowing you're getting the full, ready-to-use report.

Rivalry Among Competitors

Lamprell operates in an industry with substantial fixed costs, including significant investments in large fabrication yards, specialized heavy machinery, and a highly skilled workforce. These overheads necessitate high capacity utilization to achieve profitability.

Consequently, companies like Lamprell face intense rivalry as they compete fiercely for projects to keep their facilities running efficiently. This pressure is amplified during periods of fluctuating market demand, as seen in the offshore oil and gas sector.

While the global offshore rig fabrication market is projected for growth, valued in the tens of billions of dollars, the substantial capital expenditure required remains a significant barrier to entry and a driver of competitive intensity among existing players.

Lamprell operates in a highly competitive landscape, facing intense rivalry from global giants such as NPCC, Saipem, and Hyundai Heavy Industries. These established players possess significant advantages, including decades of experience in offshore fabrication and Engineering, Procurement, Construction, and Installation (EPCI) services. For instance, Saipem reported revenues of approximately €12.2 billion in 2023, showcasing its substantial operational scale and market presence.

The competitive intensity is further amplified by these rivals’ extensive resources, deep-seated client relationships, and often, a global operational footprint. This allows them to engage in aggressive bidding strategies for high-value contracts. Hyundai Heavy Industries, a major shipbuilding and heavy industry conglomerate, consistently secures large orders, demonstrating its capacity to outmaneuver competitors in securing significant projects.

While the offshore oil and gas sector is currently in an upswing, projections indicate a plateauing of growth as we move into 2025. Certain geographical areas are already witnessing a decrease in the number of active drilling rigs and their operational capacity.

This anticipated slowdown in the more established parts of the oil and gas market could significantly heighten the competitive pressures among companies like Lamprell. As the availability of new projects diminishes, existing players will likely find themselves vying more intensely for each opportunity.

Diversification into Renewables as a Competitive Arena

Lamprell's strategic diversification into the offshore wind sector, while tapping into a burgeoning market, significantly elevates competitive rivalry. This move places Lamprell directly against established and emerging players in a highly dynamic environment.

The offshore wind energy market is experiencing robust growth, projected to see substantial investment in the coming years. For instance, the Global Wind Energy Council reported that in 2023, offshore wind capacity additions reached approximately 10.8 GW globally, a significant increase from previous years, indicating a strong competitive landscape.

- Intensified Competition: Traditional oil and gas service companies, alongside new entrants, are increasingly targeting the offshore wind market, creating a crowded competitive arena.

- Market Share Battles: As the offshore wind sector expands, companies like Lamprell face heightened competition for project contracts and market share.

- Technological Advancement: The rapid evolution of offshore wind technology necessitates continuous innovation, adding another layer to the competitive struggle.

Technological Advancements and Differentiation

Technological advancements significantly fuel competitive rivalry. Companies are constantly pushing to develop more efficient, cost-effective, and environmentally conscious solutions. For instance, Lamprell's strategic investments in serial production lines for offshore wind components and its focus on robotics projects underscore a strong drive to differentiate through innovation. This pursuit of technological superiority is crucial for gaining a competitive edge in the market.

The ability to effectively leverage digitalization and advanced engineering capabilities provides a distinct advantage. Companies that embrace these technologies can streamline operations, improve product quality, and reduce costs, thereby outperforming competitors. This focus on innovation is not just about staying competitive; it's about leading the industry in a rapidly evolving technological landscape.

- Lamprell's investment in serial production lines for offshore wind components

- Focus on robotics projects to enhance efficiency and innovation

- Digitalization and advanced engineering as key differentiators

- Drive for more efficient, cost-effective, and environmentally friendly solutions

Competitive rivalry within Lamprell's operational sectors is notably high, driven by the presence of major global players and the industry's capital-intensive nature. Companies like Saipem, with €12.2 billion in 2023 revenues, and Hyundai Heavy Industries, a consistent large-order winner, exert significant competitive pressure through their scale and established client relationships.

The offshore oil and gas market, while experiencing an upswing, is projected to plateau by 2025, intensifying competition for available projects. Lamprell's strategic move into the offshore wind sector, a rapidly growing market with approximately 10.8 GW of capacity added globally in 2023, further escalates rivalry by pitting it against both established and emerging energy companies.

Technological innovation is a critical battleground, with companies like Lamprell investing in serial production lines and robotics to gain an edge. This focus on digitalization and advanced engineering is essential for developing more efficient and cost-effective solutions in a market where differentiation is key.

| Competitor | 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|

| Saipem | €12.2 billion | Global operational footprint, EPCI expertise |

| Hyundai Heavy Industries | Not specified | Large-scale project execution, shipbuilding dominance |

| NPCC | Not specified | Regional strength, integrated services |

SSubstitutes Threaten

While Lamprell's core strength lies in offshore structures, the threat of substitutes emerges from onshore fabrication and modularization. This approach allows for the construction of certain components or smaller modules on land and their subsequent transportation, potentially reducing the demand for Lamprell's specialized offshore construction services, particularly for projects situated onshore or in near-shore environments.

This onshore capability acts as a partial substitute, especially as companies increasingly seek cost efficiencies and streamlined project execution. For instance, in 2024, the global modular construction market was projected to reach over $250 billion, indicating a significant and growing alternative for project delivery.

Furthermore, Lamprell itself contributes to this threat by offering onshore modular process systems. This internal capability highlights the viability of onshore solutions and can be seen as a direct substitute for its own offshore fabrication services when project requirements align with land-based construction.

The global transition to renewable energy sources, driven by decarbonization goals, presents a significant long-term threat to the demand for new offshore oil and gas exploration and production infrastructure. As nations increasingly prioritize net-zero emissions, capital investment is likely to divert from fossil fuels towards cleaner alternatives, thereby indirectly substituting the need for Lamprell's traditional oil and gas services.

This trend is underscored by the robust growth in the offshore wind energy sector, which is directly benefiting from this strategic shift. For instance, global investment in offshore wind reached approximately $80 billion in 2023, a substantial increase from previous years, signaling a clear redirection of resources and expertise.

The threat of substitutes in the offshore energy services sector, particularly concerning Lamprell, is significantly influenced by the choice between refurbishment and new builds. For existing rigs and vessels, clients may choose to invest in refurbishment, upgrades, or life extension projects rather than commissioning entirely new builds. This preference directly impacts the demand for new fabrication projects, a core offering for companies like Lamprell.

Lamprell does provide refurbishment services, which can capture some of this market. However, a pronounced shift towards extending the life of older assets could dampen the overall market size for new construction. The market for strategic upgrades aimed at sustaining offshore rig fleets remains active, indicating a segment where refurbishment is a viable and chosen alternative to new builds, thereby posing a competitive threat to new fabrication orders.

Direct Imports of Fabricated Structures

Clients may choose to directly import fully fabricated structures or components from countries with lower labor costs or specialized manufacturing capabilities. This practice can circumvent the need for local fabrication services, particularly for simpler or standardized projects. For instance, the Asia-Pacific region is a major hub for oil and gas fabrication, offering competitive pricing that could attract clients away from companies like Lamprell.

This direct import strategy presents a significant threat as it bypasses Lamprell's core fabrication business entirely. It's especially relevant for projects where the complexity does not necessitate local expertise or oversight.

- Threat of Direct Imports: Clients may source fully fabricated structures or components directly from overseas suppliers, particularly from regions with lower production costs.

- Cost Advantage: This bypasses local fabrication services, especially for less complex or standardized units, due to potential savings in labor and specialized facilities.

- Regional Dominance: The Asia-Pacific region is a key player in the global oil and gas fabrication market, often presenting a more cost-effective alternative for fabricated structures.

Shift to Different Drilling/Production Methods

Advancements in drilling and production technologies present a significant threat of substitution for traditional offshore fabrication services. For instance, a shift by Exploration & Production (E&P) companies towards enhanced oil recovery (EOR) techniques or subsea processing solutions could diminish the need for extensive surface infrastructure, directly impacting demand for large-scale offshore fabrication projects.

Despite this, the market for offshore modular drilling rigs is experiencing growth. This expansion is fueled by the pursuit of greater efficiency and cost reductions, alongside the increasing demand for capabilities in deepwater operations. This trend indicates a nuanced substitution, where the nature of offshore fabrication itself is evolving rather than disappearing entirely.

- Technological Shifts: E&P companies may adopt EOR or subsea processing, reducing reliance on traditional fabrication.

- Modular Rigs: Growth in modular drilling rigs highlights a demand for more efficient and cost-effective offshore solutions.

- Deepwater Focus: Enhanced deepwater capabilities are driving demand for specialized, potentially modular, offshore structures.

The threat of substitutes for Lamprell's services is multifaceted, encompassing alternative construction methods and evolving industry demands. Onshore modularization offers a cost-effective alternative, especially for projects with land-based components, as evidenced by the global modular construction market projected to exceed $250 billion in 2024.

Furthermore, the global energy transition is a significant substitute, with investments shifting from traditional oil and gas infrastructure to renewables like offshore wind, which saw approximately $80 billion in investment in 2023. Clients also opt for refurbishing existing assets over new builds, impacting demand for fabrication.

Direct imports from lower-cost regions, particularly the Asia-Pacific, bypass local fabrication needs for less complex projects. Technological advancements also play a role, with solutions like subsea processing potentially reducing the need for extensive surface fabrication, although modular rigs are seeing growth.

| Substitute Type | Description | Market Data/Impact |

|---|---|---|

| Onshore Modularization | Construction of components or modules on land for later transport. | Global modular construction market projected over $250 billion in 2024. |

| Renewable Energy Shift | Diversion of capital from fossil fuels to cleaner alternatives. | Offshore wind investment reached ~$80 billion in 2023. |

| Refurbishment vs. New Builds | Extending the life of existing assets instead of commissioning new ones. | Active market for strategic upgrades to sustain offshore rig fleets. |

| Direct Imports | Sourcing fabricated structures from overseas suppliers. | Asia-Pacific region is a major hub with competitive pricing. |

| Technological Advancements | EOR, subsea processing reducing need for surface infrastructure. | Growth in modular drilling rigs for efficiency and deepwater operations. |

Entrants Threaten

Entering the offshore fabrication and engineering sector demands significant financial outlay. Companies need to invest heavily in advanced fabrication yards, specialized heavy-lift equipment, and sophisticated machinery, alongside robust infrastructure. This substantial capital requirement acts as a significant deterrent for potential new entrants, effectively limiting the pool of new competitors.

The shipbuilding and offshore rig fabrication and repair market is inherently capital-intensive. For instance, the cost of building a modern offshore fabrication facility can easily run into hundreds of millions of dollars, with specialized equipment alone representing tens of millions. This financial barrier means only well-capitalized companies can realistically consider entering this space.

The offshore wind sector, where Lamprell operates, requires highly specialized engineering, project management, and fabrication skills. Obtaining international certifications and adhering to strict safety standards are also critical hurdles.

Developing this deep technical knowledge and securing the necessary accreditations is a significant investment in time and capital. This complexity naturally acts as a barrier, discouraging new companies from entering the market. Lamprell's nearly five decades of experience in this demanding field underscore the established expertise required.

Lamprell's established client relationships and strong reputation present a significant barrier to new entrants. For nearly 50 years, Lamprell has cultivated deep ties with major energy corporations, becoming a trusted name synonymous with reliable project execution.

Gaining access to these established networks and earning the confidence of clients who prioritize safety and a proven history is a formidable challenge for any newcomer. These risk-averse clients often favor partners with a demonstrated track record, making it difficult for new entities to displace incumbents.

Regulatory Hurdles and Environmental Compliance

The offshore energy sector faces substantial regulatory hurdles, particularly concerning environmental compliance. New entrants must navigate a complex web of international and national regulations governing safety, emissions, and operational practices. For instance, in 2024, the International Maritime Organization's (IMO) strengthened regulations on sulfur emissions continue to impact vessel operations, requiring significant investment in new fuel technologies or scrubbers for compliance.

Obtaining the necessary permits and approvals to operate offshore can be a lengthy and costly process, acting as a significant barrier to entry. These requirements often involve extensive environmental impact assessments and adherence to stringent safety standards. The increasing focus on decarbonization means that new companies must also demonstrate robust plans for reducing their carbon footprint, adding another layer of complexity to market entry.

Environmental regulations are a growing concern and a significant factor influencing the threat of new entrants. Companies are increasingly held accountable for their environmental performance, with potential fines and reputational damage for non-compliance. For example, the European Union's efforts to expand its Emissions Trading System (ETS) to the maritime sector, which could take effect in the coming years, will impose additional costs on emissions for all operators, including new ones.

- Regulatory Complexity: Navigating stringent safety and environmental laws in the offshore energy sector is a major barrier for new companies.

- Permitting Challenges: Obtaining operational permits often requires extensive, time-consuming, and expensive environmental impact studies.

- Decarbonization Demands: New entrants must present credible strategies for carbon footprint reduction, aligning with global climate goals.

- Compliance Costs: Adhering to evolving regulations, such as stricter emissions standards, necessitates significant capital investment.

Supply Chain Integration and Economies of Scale

Established players in industries like oil and gas, where Lamprell operates, often possess highly integrated supply chains and benefit from significant economies of scale in procurement. For instance, in 2023, major offshore energy service providers reported substantial cost savings through bulk purchasing of materials and optimized logistics, creating a steep uphill battle for newcomers.

New entrants would find it incredibly difficult to match these cost efficiencies without first achieving substantial operational volume and accumulating years of experience. This inherent disadvantage makes it challenging for them to compete on price against incumbents who have already amortized their investments in efficient processes.

- Capital Intensity: Industries requiring massive upfront investment, such as shipbuilding or offshore platform construction, naturally deter new entrants due to the sheer financial commitment needed to establish comparable operational capabilities.

- Supply Chain Mastery: Companies with decades of experience have honed their supply chain networks, securing preferential pricing and reliable delivery from key suppliers, a level of integration difficult for a new firm to replicate quickly.

- Operational Efficiency: Established firms leverage accumulated knowledge to optimize production processes, reduce waste, and improve turnaround times, leading to lower per-unit costs that new entrants struggle to undercut.

The threat of new entrants into the offshore fabrication and engineering sector is generally low due to substantial barriers. High capital requirements for specialized facilities and equipment, estimated in the hundreds of millions of dollars, immediately deter many potential competitors. Furthermore, the need for deep technical expertise, extensive project management capabilities, and obtaining critical safety and environmental certifications requires significant time and investment, often spanning years. Lamprell's nearly 50 years of experience highlights the depth of knowledge and established track record that newcomers must overcome.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lamprell leverages a comprehensive suite of data, including company annual reports, investor presentations, and industry-specific market research from reputable firms. We also incorporate insights from financial news outlets and regulatory filings to ensure a robust understanding of the competitive landscape.