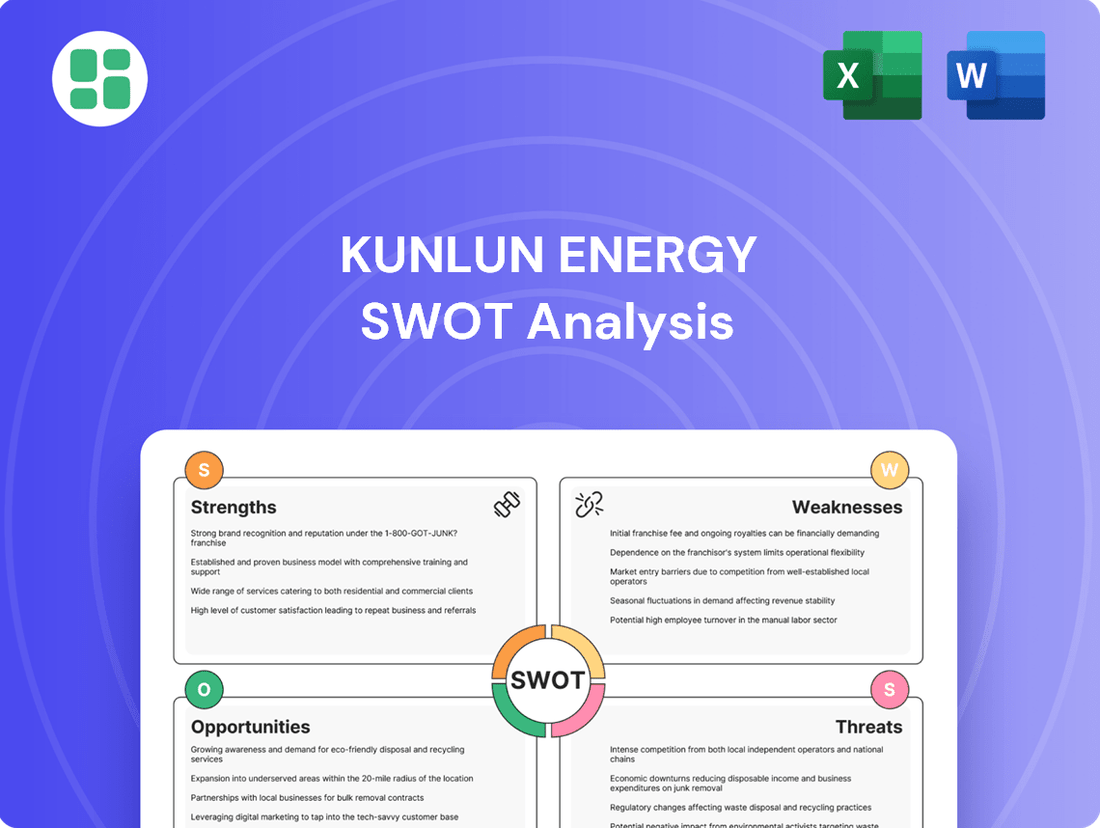

Kunlun Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kunlun Energy Bundle

Kunlun Energy, a key player in China's energy sector, boasts significant strengths in its integrated natural gas value chain and expanding pipeline network. However, it faces potential threats from evolving regulatory landscapes and increasing competition.

Want the full story behind Kunlun Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Kunlun Energy operates an impressive natural gas pipeline and city gas network, spanning 31 provinces and municipalities throughout China. This vast infrastructure is a cornerstone of its business, enabling efficient distribution and access to a broad customer base. By 2023, the company managed over 100,000 kilometers of pipelines, a testament to its extensive reach.

Kunlun Energy boasts a robustly diversified business portfolio, spanning city gas distribution, natural gas pipeline operations, LNG and CNG sales, and LNG processing plants. This broad operational scope, which includes numerous filling stations, significantly reduces reliance on any single revenue source, thereby enhancing financial stability and market adaptability. For instance, in 2023, the company reported a substantial revenue contribution from its city gas segment, demonstrating the strength of its diversified model.

As a subsidiary of China National Petroleum Corporation (CNPC), Kunlun Energy leverages the immense financial power and operational expertise of a global energy giant. This affiliation grants Kunlun Energy access to substantial capital for growth initiatives and a robust network for gas sourcing, significantly enhancing its competitive standing. CNPC's backing also translates to greater market credibility and operational stability for Kunlun Energy.

Stable and Growing Demand for Natural Gas

China's commitment to cleaner energy sources fuels a robust and expanding demand for natural gas, particularly in its urban centers and industrial heartlands. This energy transition creates a predictable and growing market for natural gas consumption. Kunlun Energy is strategically positioned to benefit from this trend, as China aims to significantly boost its gas usage, targeting 400 billion cubic meters by 2025. This trajectory offers a stable revenue stream and ample room for growth within its established service areas.

- Growing Demand: China's energy mix shift prioritizes natural gas, driving consistent consumption growth.

- Market Position: Kunlun Energy is a key player in this expanding market, benefiting from government policy.

- Revenue Stability: The increasing demand provides a solid foundation for predictable revenue generation.

- Expansion Opportunities: China's 2025 gas consumption target of 400 billion cubic meters signals significant growth potential.

Strategic Positioning in Key Urban Markets

Kunlun Energy has a strong advantage by establishing its city gas operations in many of China's most important urban areas. These cities represent the highest demand for natural gas, both for homes and businesses, giving Kunlun a ready and substantial customer base. This strategic focus on densely populated, high-consumption regions is key to its success.

This deliberate placement in major urban centers allows for more efficient management of resources and makes the most of its extensive gas pipeline and distribution infrastructure. For example, as of late 2024, Kunlun Energy reported serving over 15 million residential customers across its various city gas projects, with a significant portion concentrated in these key urban markets, highlighting the scale of its reach and the reliability of its customer base.

- Concentrated Customer Base: Focus on urban centers ensures access to a large and consistent demand for natural gas.

- Efficient Distribution: Strategic positioning optimizes the use of its infrastructure, reducing operational costs.

- Market Dominance: Presence in key cities provides a competitive edge and strengthens market share.

Kunlun Energy's extensive natural gas infrastructure, exceeding 100,000 kilometers of pipelines by 2023, provides a significant competitive advantage in China's vast market. Its diversified business model, encompassing city gas, pipeline operations, and LNG sales, offers financial resilience and adaptability. As a subsidiary of CNPC, it benefits from substantial financial backing and operational expertise, reinforcing its market stability and growth potential.

The company's strategic focus on major urban centers in China has secured a large and consistent customer base, enhancing operational efficiency and market share. China's increasing reliance on natural gas, with a target of 400 billion cubic meters by 2025, creates a favorable market environment for Kunlun Energy's expansion and revenue growth.

| Key Strength | Description | Supporting Data (2023/2024 Estimates) |

| Extensive Infrastructure | Vast network of natural gas pipelines and city gas distribution systems. | Over 100,000 km of pipelines; operations in 31 provinces. |

| Diversified Business | Operations include city gas, pipelines, LNG sales, and processing. | Significant revenue contribution from city gas segment. |

| CNPC Affiliation | Backed by China National Petroleum Corporation (CNPC). | Access to capital, sourcing network, and market credibility. |

| Strategic Market Focus | Presence in high-demand urban centers. | Serving over 15 million residential customers in key cities. |

What is included in the product

Delivers a strategic overview of Kunlun Energy’s internal and external business factors, highlighting its market position and potential for growth.

Offers a clear, actionable framework to address Kunlun Energy's market vulnerabilities and capitalize on emerging opportunities.

Weaknesses

Kunlun Energy's significant role as a natural gas distributor makes it highly susceptible to the unpredictable swings in natural gas commodity prices. While the company employs strategies to mitigate these risks, substantial price volatility can directly affect its purchasing expenses and squeeze profit margins if these costs cannot be effectively transferred to customers or offset through hedging. For instance, in early 2024, global natural gas prices experienced notable fluctuations driven by geopolitical events and weather patterns, directly impacting the cost structure for distributors like Kunlun.

Kunlun Energy's operations are deeply intertwined with China's regulatory landscape, a significant weakness. Changes in government policies regarding natural gas pricing, import tariffs, or environmental standards can directly affect profitability. For instance, shifts in the country's energy transition strategy, such as accelerated adoption of renewables or stricter emission controls, could necessitate costly adjustments to Kunlun's infrastructure and business model.

Kunlun Energy faces a significant challenge with its high capital expenditure requirements. Developing and maintaining its vast natural gas pipeline networks, city gas projects, and LNG/CNG infrastructure demands substantial and continuous investment. For instance, in 2023, the company reported capital expenditures of RMB 13.8 billion, primarily focused on expanding its gas pipeline and distribution networks.

These considerable upfront funding needs for expansion projects can strain the company's financial resources. This strain might limit its capacity to allocate capital towards other growth opportunities or to maintain its desired debt-to-equity ratios, impacting overall financial flexibility.

Environmental Scrutiny and Decarbonization Pressures

While natural gas is a cleaner alternative to other fossil fuels, Kunlun Energy faces increasing global and domestic pressure to decarbonize and transition towards renewable energy sources. This presents a significant long-term challenge for the company's core business. Despite the release of its Carbon Peaking and Carbon Neutrality Action Plan (2024 Edition) and investments in photovoltaic projects, the company may encounter heightened scrutiny and demands for greater diversification into non-gas energy solutions. Such a strategic shift could necessitate substantial capital expenditures and fundamental changes to its operational model.

The company's reliance on natural gas, even as a transition fuel, places it under the spotlight of environmental regulations and stakeholder expectations focused on a complete move away from fossil fuels. Kunlun Energy's commitment to a carbon neutrality plan is a step, but the market's demand for truly green energy solutions may outpace its current diversification efforts.

- Decarbonization Mandates: Growing regulatory and public pressure to reduce carbon emissions impacts the long-term viability of natural gas as a primary energy source.

- Diversification Costs: Expanding into renewable energy sources like solar and wind requires significant upfront investment and potentially new operational expertise.

- Competitive Landscape: Competitors making more aggressive moves into renewables could gain market share and put pressure on Kunlun Energy's growth trajectory.

- Reputational Risk: Perceived slow progress on decarbonization could lead to reputational damage and affect investor confidence.

Competition from Alternative Energy Sources

Kunlun Energy faces robust competition from rapidly advancing alternative energy sources, particularly solar and wind power. As China pushes aggressively towards its renewable energy targets, with solar and wind capacity experiencing significant year-on-year growth, the long-term market share for natural gas could face pressure. For instance, China's installed solar power capacity reached approximately 740 GW by the end of 2023, a substantial increase from previous years, and wind power also saw considerable expansion.

This intensifying competition from renewables, which are becoming increasingly cost-effective, poses a threat to Kunlun Energy's growth trajectory in certain segments and geographical areas. The company must therefore focus on maintaining competitive pricing and exploring innovative solutions to remain a preferred energy choice in a diversifying market.

- Growing Renewable Energy Capacity: China's commitment to decarbonization fuels rapid expansion in solar and wind power, directly challenging natural gas's market share.

- Cost Competitiveness: Declining costs of renewable technologies make them increasingly attractive alternatives, potentially impacting natural gas demand growth.

- Market Share Erosion Risk: Accelerated renewable energy development could slow growth or even lead to a decline in natural gas's market share in specific regions or applications.

- Need for Innovation: Continuous investment in efficiency, infrastructure, and potentially lower-carbon natural gas solutions is crucial to counter competitive pressures.

Kunlun Energy's reliance on a single primary commodity, natural gas, exposes it to significant price volatility. Fluctuations in global and domestic natural gas prices, influenced by factors like geopolitical events and weather patterns, directly impact its procurement costs and profit margins, as seen with price swings in early 2024. This makes it challenging to consistently pass on increased costs to consumers or fully mitigate risks through hedging strategies.

Same Document Delivered

Kunlun Energy SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Kunlun Energy's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis is available immediately after purchase.

Opportunities

China's ambitious environmental goals, particularly its drive to curb air pollution by shifting away from coal, create a substantial opening for natural gas. This national strategy, which the 14th Five-Year Plan actively supports through gas infrastructure development, directly benefits Kunlun Energy. It fuels demand for new city gas connections and boosts the volume of gas flowing through its pipelines, aligning perfectly with the company's core operations.

Kunlun Energy has significant opportunities to expand into less developed regions and cities across China where natural gas usage is still relatively low. This untapped market potential is substantial, offering a clear path for growth.

By strategically extending its pipeline networks and developing new city gas projects in these areas, Kunlun Energy can reach new customer segments and boost its market share. This organic expansion strategy is projected to be highly profitable.

For instance, while China's overall natural gas consumption grew by approximately 7.5% in 2023, reaching over 390 billion cubic meters, many inland and western provinces still lag in gasification rates, presenting a prime opportunity for Kunlun Energy's infrastructure development.

The increasing demand for natural gas vehicles (NGVs) due to environmental benefits and lower operating costs compared to gasoline or diesel offers Kunlun Energy a significant opportunity to grow its LNG and CNG fueling infrastructure. By expanding its network of filling stations, the company can tap into this expanding market and diversify its revenue streams.

Kunlun Energy's recent involvement in LNG bunkering operations highlights its strategic move to capitalize on the trend towards cleaner transportation fuels. This expansion into vehicle fueling infrastructure aligns with global efforts to reduce emissions and supports the transition to more sustainable energy sources in the transport sector.

Integration of Digital and Smart Technologies

Kunlun Energy is capitalizing on the integration of digital and smart technologies to boost its operations. By leveraging advanced tools like IoT, AI, and big data analytics, the company is optimizing pipeline management and enhancing the efficiency of its gas distribution network. This strategic move is also aimed at improving customer service and implementing smart metering solutions across its operations.

The adoption of these technologies is expected to yield significant benefits, including cost reductions and a marked improvement in operational safety. Furthermore, better demand forecasting capabilities will strengthen Kunlun Energy's competitive position in the market. The company's existing platform, 'Kunlun Huixiang+', has already demonstrated the success of this digital push, reporting substantial sales growth in 2024.

- Optimized Operations: IoT and AI are streamlining pipeline management and gas distribution.

- Enhanced Efficiency: Big data analytics improves demand forecasting and resource allocation.

- Customer Focus: Smart metering and digital platforms elevate customer service and engagement.

- Proven Success: The 'Kunlun Huixiang+' platform saw significant sales increases in 2024, validating the digital strategy.

Strategic Partnerships and Acquisitions

Kunlun Energy can explore strategic partnerships or acquisitions to bolster its market standing and service portfolio. For instance, acquiring smaller regional gas distributors or technology providers could consolidate its position and introduce new capabilities.

These moves offer synergies, diminish competition, and expedite growth across both conventional and new energy domains. As of early 2024, Kunlun Energy's robust financial health, evidenced by its 'A' credit rating and minimal debt, provides a solid foundation for such strategic initiatives.

- Market Consolidation: Acquiring regional players can solidify Kunlun Energy's presence in key gas distribution markets.

- Technology Access: Partnerships with tech firms can accelerate the integration of advanced energy solutions.

- Diversification: Expanding into renewable energy through acquisitions offers a hedge against fossil fuel volatility.

China's commitment to cleaner energy, particularly the shift from coal to natural gas, presents a significant growth avenue for Kunlun Energy, aligning with national environmental targets and infrastructure development plans. The company is well-positioned to benefit from increased demand for new city gas connections and higher pipeline throughput. Furthermore, expanding into underserved regions with lower gasification rates offers substantial untapped market potential, allowing for organic growth through pipeline network extension and new city gas projects. The burgeoning market for natural gas vehicles (NGVs) also provides a clear opportunity for Kunlun Energy to grow its LNG and CNG fueling infrastructure, diversifying revenue and supporting cleaner transportation solutions.

| Opportunity Area | Key Driver | Kunlun Energy's Role | Market Insight |

|---|---|---|---|

| Natural Gas Demand Growth | China's energy transition and anti-pollution policies | Supplying gas via pipelines and city gas connections | China's natural gas consumption grew ~7.5% in 2023 |

| Underserved Markets | Low gasification rates in inland/western provinces | Expanding pipeline networks and city gas projects | Significant potential for infrastructure development |

| Natural Gas Vehicles (NGVs) | Environmental benefits and lower operating costs | Expanding LNG/CNG fueling infrastructure | Growing demand for cleaner transport fuels |

Threats

The natural gas distribution landscape in China is heating up, with established state-owned giants and nimble regional operators vying for market share. This intensified competition puts pressure on pricing, potentially squeezing profit margins for companies like Kunlun Energy. For instance, as of early 2024, reports indicated a slowdown in new city gas concession awards, highlighting the difficulty in expanding through traditional means.

Securing new pipeline projects and customer contracts becomes a tougher battle, forcing players to differentiate through more attractive pricing or innovative service offerings. This competitive pressure could impact Kunlun Energy's ability to maintain its growth trajectory in key urban areas.

The global energy landscape is rapidly moving towards zero-carbon sources like solar and wind. While natural gas is a transition fuel, this accelerated shift presents a long-term threat to Kunlun Energy's reliance on natural gas, potentially reducing demand. For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 GW, a 50% increase from 2022, signaling a powerful momentum.

Future energy policies are likely to increasingly favor direct renewable integration, potentially marginalizing natural gas's role. This could impact Kunlun Energy's core business model if diversification into renewables or other low-carbon solutions isn't sufficiently pursued. The International Energy Agency (IEA) projects that renewables will account for over 90% of global electricity capacity expansion in the coming years.

As a significant player in the natural gas sector, Kunlun Energy faces considerable threats from geopolitical instability. International conflicts, trade disputes, or the imposition of sanctions can directly impact global gas supply chains and influence pricing dynamics. For instance, ongoing tensions in Eastern Europe have demonstrated how quickly energy markets can react to geopolitical events, leading to price volatility that affects companies like Kunlun.

Disruptions to crucial international liquefied natural gas (LNG) supplies or pipeline gas imports pose a direct threat to Kunlun Energy's operational capacity. Such disruptions can result in scarcity, driving up procurement costs and potentially hindering the company's ability to satisfy market demand and maintain healthy profit margins. The company's international ventures, particularly in regions like Kazakhstan, Peru, and Thailand, underscore the critical importance of energy security in safeguarding its global operations.

Strict Environmental Regulations and Carbon Pricing

Kunlun Energy faces growing pressure from increasingly strict environmental regulations. These could include new carbon pricing mechanisms or tougher emissions standards, which would likely increase operational costs. For instance, if a carbon tax were implemented, it could directly impact the company's profitability.

Compliance with these evolving rules might necessitate substantial investments in cleaner technologies or the purchase of carbon offsets. These capital expenditures and ongoing expenses could negatively affect Kunlun Energy's financial performance and overall bottom line.

The company has acknowledged these trends by launching a Methane Emission Control Action Plan. This initiative demonstrates an awareness of the regulatory landscape and the need to proactively manage its environmental impact. For example, in 2023, Kunlun Energy reported a 1.5% reduction in methane intensity, showing progress in its efforts.

- Increased Operational Costs: Potential carbon pricing and stricter emissions standards could raise operating expenses significantly.

- Capital Investment Needs: Compliance may require investments in new, cleaner technologies or carbon offset programs.

- Impact on Financial Performance: These costs could reduce profitability and affect the company's financial results.

- Proactive Measures: Kunlun Energy's Methane Emission Control Action Plan addresses these regulatory pressures, with a reported 1.5% methane intensity reduction in 2023.

Economic Slowdown and Reduced Industrial Demand

An economic slowdown in China presents a significant threat to Kunlun Energy. Reduced industrial activity directly translates to lower demand for natural gas, a key revenue driver for the company. For instance, if China's GDP growth falters, as some forecasts suggest for 2025, industrial energy consumption could contract, impacting Kunlun's sales volumes.

This downturn would likely lead to decreased revenue and profitability for Kunlun Energy. The company's reliance on industrial clients makes it particularly vulnerable to shifts in manufacturing output and overall economic health. This economic sensitivity is a critical external risk that could hinder its growth trajectory.

Key impacts include:

- Reduced Industrial Demand: A contracting economy often means less manufacturing, directly lowering natural gas consumption by industrial users.

- Lower Sales Volumes: With less demand, Kunlun Energy would experience a dip in the quantity of natural gas sold.

- Revenue and Profitability Squeeze: A combination of lower volumes and potentially softer pricing due to reduced demand would impact the company's financial performance.

- Hindered Growth Prospects: An economic slowdown can delay or cancel expansion plans and investment in new projects, affecting long-term growth.

Intensified competition in China's natural gas market, marked by a slowdown in new city gas concessions as of early 2024, pressures pricing and profit margins for companies like Kunlun Energy.

The global shift towards renewables, with record 510 GW capacity additions in 2023, poses a long-term threat to natural gas demand, potentially impacting Kunlun's core business model as the IEA projects renewables to dominate future electricity expansion.

Geopolitical instability and supply chain disruptions, exemplified by the impact of Eastern European tensions on energy markets, can lead to price volatility and increased procurement costs for Kunlun Energy, affecting its operational capacity and profitability.

Stricter environmental regulations, including potential carbon pricing, necessitate significant investments in cleaner technologies or carbon offsets, which could negatively impact Kunlun Energy's financial performance, despite proactive measures like its Methane Emission Control Action Plan showing a 1.5% methane intensity reduction in 2023.

An economic slowdown in China, with forecasts suggesting slower GDP growth for 2025, directly threatens Kunlun Energy through reduced industrial demand for natural gas, leading to lower sales volumes, revenue, and potentially hindering growth prospects.

SWOT Analysis Data Sources

This Kunlun Energy SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market intelligence from reputable industry analysts, and expert commentary from energy sector specialists to ensure a well-rounded and accurate assessment.