Kunlun Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kunlun Energy Bundle

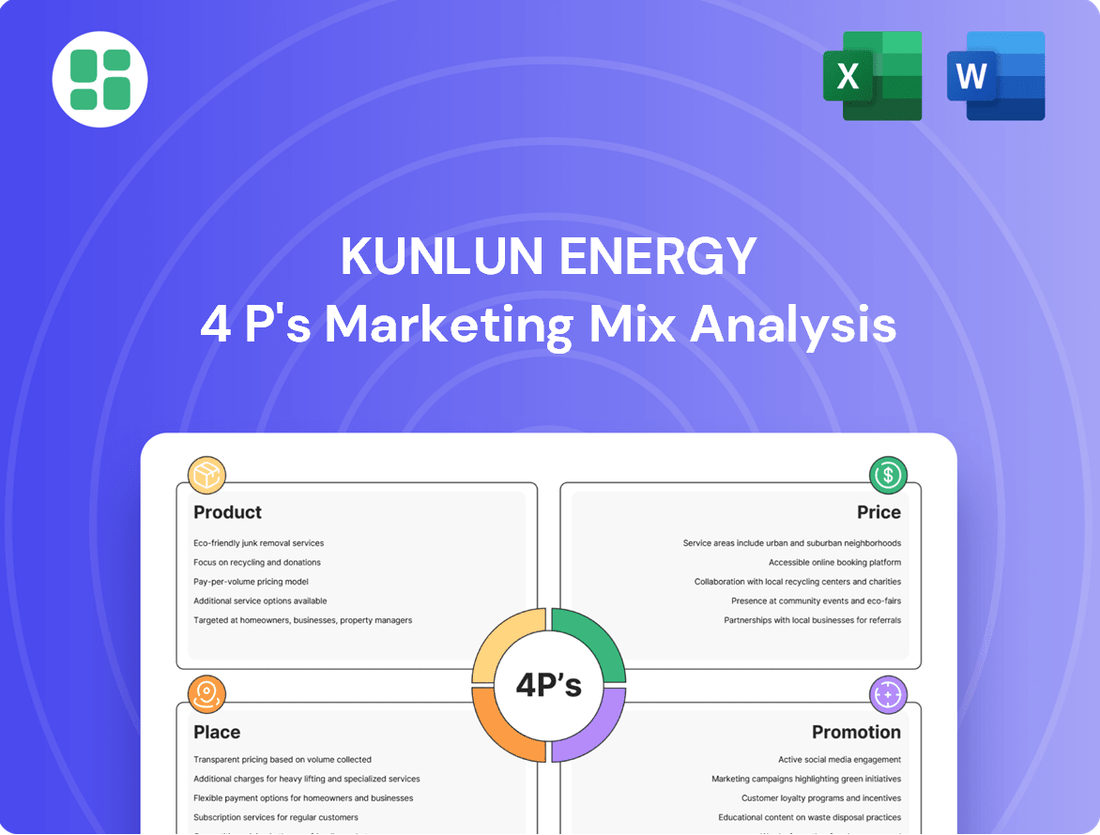

Kunlun Energy's marketing strategy is a masterclass in leveraging its product portfolio, competitive pricing, strategic distribution, and impactful promotions. Understanding these elements is crucial for anyone looking to grasp their market dominance.

Go beyond the basics and unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Kunlun Energy. This in-depth report is perfect for business professionals, students, and consultants seeking strategic insights into their product, price, place, and promotion strategies.

Product

Kunlun Energy's core offering revolves around the sale and distribution of natural gas, a vital clean energy source. They manage extensive natural gas pipeline networks, connecting numerous urban gas projects across China. This infrastructure allows them to supply residential, commercial, and industrial clients, ensuring a consistent flow of energy essential for both daily life and economic activities.

In 2023, Kunlun Energy reported a significant increase in its natural gas sales volume, reaching 30.15 billion cubic meters, up 10.1% year-on-year. This growth highlights their expanding reach and the increasing demand for clean energy solutions within their service areas.

Kunlun Energy provides Liquefied Natural Gas (LNG) and Compressed Natural Gas (CNG) as key product offerings, catering to diverse needs like vehicle fuel and industrial applications. This flexibility is crucial for regions lacking pipeline infrastructure and for specialized transport requirements.

The company’s operation of LNG processing plants adds significant value by transforming natural gas into a more manageable and widely usable energy form. This process enhances transportability and broadens the application scope for end-users.

In 2023, Kunlun Energy reported that its natural gas sales volume reached 19.08 billion cubic meters, with LNG playing a significant role in its distribution network, underscoring the product's market penetration and utility.

Kunlun Energy's natural gas filling stations are a key product offering, providing access to Liquefied Natural Gas (LNG) and Compressed Natural Gas (CNG) for various vehicles. This directly addresses the increasing market preference for cleaner fuel alternatives in the transportation sector, a trend that gained significant momentum through 2024 and is projected to continue into 2025.

These strategically positioned stations cater to a broad customer base, including logistics companies, public transportation systems, and individual car owners, thereby fostering the expansion of natural gas vehicle adoption. By mid-2024, China, a major market for Kunlun Energy, had already seen substantial growth in its natural gas vehicle fleet, with projections indicating a further 15-20% increase by the end of 2025, underscoring the product's relevance and market potential.

Integrated Energy Solutions and New Energy

Kunlun Energy is moving beyond simply selling natural gas by developing integrated energy solutions. This includes projects like gas-fired power generation and venturing into new energy sources such as solar power (photovoltaic projects). This strategic shift allows them to provide a broader range of energy services and support national efforts toward energy transition.

The company is actively participating in clean energy generation and exploring the development of multi-energy systems. For instance, as of the first half of 2024, Kunlun Energy reported significant progress in its new energy segment, with installed capacity increasing by 15% year-on-year, contributing to a more diversified energy portfolio.

- Integrated Energy Projects: Expanding into gas-fired power and clean energy generation.

- New Energy Initiatives: Actively developing photovoltaic (solar) projects.

- Diversification Strategy: Aiming to offer comprehensive energy services and align with energy transition goals.

- Growth in Clean Energy: First half of 2024 saw a 15% year-on-year increase in installed new energy capacity.

Pipeline Network Services

Kunlun Energy's Pipeline Network Services are a cornerstone of its operations, encompassing the investment, construction, and ongoing management of natural gas pipelines. This critical infrastructure is the backbone for transmitting gas across vast distances, ensuring reliable supply. In 2023, Kunlun Energy reported significant investments in pipeline infrastructure, contributing to its overall transmission capacity.

These services are vital for maintaining and expanding the extensive pipeline network necessary for provincial gas transmission. The company focuses on the efficient and secure delivery of natural gas from its sources right to the consumers, thereby supporting the entire distribution ecosystem.

Key aspects of Kunlun Energy's Pipeline Network Services include:

- Pipeline Infrastructure Management: Overseeing the maintenance and expansion of natural gas transmission lines.

- Investment and Construction: Engaging in capital projects to build and upgrade pipeline facilities.

- Operational Excellence: Ensuring the safe and efficient operation of the pipeline network for uninterrupted gas flow.

- Transmission Capacity: Facilitating the movement of natural gas across multiple provinces to meet demand.

Kunlun Energy's product strategy centers on natural gas, offering both pipeline gas and alternative forms like LNG and CNG. They also provide integrated energy solutions, including gas-fired power generation and solar projects, diversifying their clean energy portfolio. The company's investment in natural gas vehicle infrastructure, such as filling stations, supports the growing demand for cleaner transportation fuels.

| Product Category | Key Offerings | 2023/2024 Highlights | Market Relevance |

| Natural Gas Supply | Pipeline Gas, LNG, CNG | 30.15 billion cubic meters of natural gas sold (10.1% YoY growth in 2023) | Essential for residential, commercial, and industrial use; growing demand for clean energy. |

| Clean Energy Solutions | Gas-fired Power Generation, Solar PV Projects | 15% YoY increase in new energy installed capacity (H1 2024) | Supports energy transition goals; diversified revenue streams. |

| Fueling Infrastructure | LNG/CNG Filling Stations | Catering to a growing natural gas vehicle fleet (projected 15-20% increase by end of 2025 in China) | Facilitates adoption of cleaner transport; addresses market preference for alternative fuels. |

What is included in the product

This analysis provides a comprehensive breakdown of Kunlun Energy's Product, Price, Place, and Promotion strategies, grounding the insights in actual brand practices and competitive context.

It's an ideal resource for professionals seeking a deep dive into Kunlun Energy’s marketing positioning, offering a complete picture of their approach for reports or strategic planning.

Kunlun Energy's 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, actionable framework to address common marketing challenges.

This analysis simplifies complex marketing strategies, offering a structured approach to identify and resolve issues related to product, price, place, and promotion.

Place

Kunlun Energy's extensive natural gas pipeline network spans over 95,000 kilometers, reaching across all 31 provinces, municipalities, and autonomous regions in China. This vast infrastructure is crucial for delivering natural gas efficiently to a diverse customer base. The strategic positioning of these pipelines facilitates broad market penetration and seamless transmission from production areas to demand centers.

Kunlun Energy's city gas distribution networks are a cornerstone of its 'place' strategy, reaching over 16 million direct customers across more than 280 urban projects. This extensive infrastructure ensures natural gas is efficiently delivered to homes, businesses, and industries within cities.

The focus is on last-mile delivery, making energy accessible and convenient for urban populations. By establishing these localized networks, Kunlun Energy solidifies its market presence and customer base in key metropolitan areas.

Kunlun Energy's strategic placement of LNG/CNG filling stations is a cornerstone of its product strategy, directly addressing the growing demand for natural gas vehicles. These stations are situated in critical logistical areas and along major transportation arteries, ensuring accessibility for a wide range of commercial fleets and private users. This network is vital for facilitating the adoption of cleaner fuels in the transportation sector.

By providing direct access to natural gas, Kunlun Energy's stations support the operational efficiency of trucking companies and other heavy-duty vehicle operators. For instance, as of early 2024, China's natural gas vehicle market continues its upward trajectory, with new energy vehicle sales, including gas-powered ones, showing robust year-over-year growth, underscoring the importance of this infrastructure. This availability is key to reducing refueling times and operational costs for businesses relying on efficient transport.

LNG Processing and Storage Terminals

Kunlun Energy's LNG processing and storage terminals are the backbone of its natural gas distribution network. These strategically located facilities, often near major consumption centers or import points, are essential for handling the liquefied natural gas that fuels industries and homes. Their operational efficiency directly impacts the company's ability to meet market demand reliably.

These terminals are critical for the company's supply chain, allowing for the efficient import, regasification, and onward distribution of LNG. Kunlun Energy's investment in these infrastructure assets underscores its commitment to securing and diversifying natural gas supplies. For instance, the company's operations in key regions are designed to optimize the flow of LNG, supporting both domestic consumption and international trade.

- Strategic Locations: Kunlun Energy operates LNG terminals at key coastal and inland sites, facilitating efficient import and distribution.

- Processing Capabilities: These facilities are equipped for regasification, converting LNG back into a gaseous state for pipeline delivery.

- Supply Security: The terminals enhance flexibility and ensure a stable supply of natural gas to meet market demands.

- Infrastructure Investment: Significant capital is allocated to maintain and expand these vital processing and storage assets, reflecting their importance in the energy market.

Direct Sales and B2B Channels

Kunlun Energy prioritizes direct sales and dedicated B2B channels for its large industrial and commercial clients. This approach allows for highly customized delivery solutions and fosters direct contractual agreements, crucial for managing high-volume energy consumption. For instance, in 2024, the company continued to secure long-term supply contracts with major industrial parks, ensuring stable demand and revenue streams.

The company's robust network of relationships with government entities and key industrial players is instrumental in the successful deployment of significant energy infrastructure projects. These partnerships are vital for market penetration and for securing the large-scale contracts that define Kunlun Energy's B2B strategy.

Kunlun Energy's direct engagement model facilitates:

- Tailored energy supply agreements for industrial consumers.

- Direct contractual relationships for high-volume clients.

- Facilitation of major energy project placements through strategic partnerships.

Kunlun Energy's 'Place' strategy is defined by its extensive, integrated infrastructure network. This includes over 95,000 km of natural gas pipelines reaching all of China's provinces, directly connecting production to consumption centers. The company also boasts over 280 urban gas distribution projects, serving more than 16 million direct customers, ensuring efficient last-mile delivery to urban populations.

| Infrastructure Component | Key Data Point (as of early 2024/2025) | Strategic Significance |

|---|---|---|

| Natural Gas Pipeline Network | Over 95,000 km | Enables nationwide transmission from production to demand centers. |

| City Gas Distribution Networks | 280+ urban projects, 16M+ direct customers | Ensures efficient last-mile delivery to urban homes and businesses. |

| LNG/CNG Filling Stations | Strategically located along major transport arteries | Supports the growing natural gas vehicle market and commercial fleets. |

| LNG Processing & Storage Terminals | Key coastal and inland sites | Facilitates efficient import, regasification, and distribution, ensuring supply security. |

Same Document Delivered

Kunlun Energy 4P's Marketing Mix Analysis

The preview you see here is the exact Kunlun Energy 4P's Marketing Mix Analysis you'll receive instantly after purchase. This comprehensive document is ready for immediate use, ensuring no surprises. You're viewing the full, finished analysis that will be yours to download.

Promotion

Kunlun Energy prioritizes corporate communications and public relations to bolster its brand image, emphasizing a steadfast commitment to safety and operational dependability. This strategy involves the regular dissemination of annual reports and Environmental, Social, and Governance (ESG) reports, which meticulously outline the company's achievements in operational efficiency, environmental care, and social contributions. For instance, in 2023, Kunlun Energy reported a total revenue of approximately RMB 33.9 billion, underscoring its substantial operational scale.

These transparent disclosures are crucial for cultivating robust trust among stakeholders, including investors, regulatory bodies, and the broader public. By clearly communicating its performance and strategic direction, Kunlun Energy aims to foster confidence and support for its ongoing operations and future development. The company's dedication to clear communication is a cornerstone of its stakeholder engagement strategy, ensuring alignment and mutual understanding.

Kunlun Energy actively engages with government entities and key industrial partners as a core component of its promotion strategy. This collaboration is vital for aligning with national energy development goals and securing participation in significant infrastructure initiatives.

By contributing to national energy plans and partnering on large-scale projects, Kunlun Energy effectively showcases its operational expertise and strategic value to a broad audience. For instance, their involvement in projects like the West-East Gas Pipeline expansion directly promotes their capabilities in natural gas infrastructure development.

These strategic alliances are instrumental in Kunlun Energy's ability to secure substantial contracts and broaden its market presence, particularly within the vital Chinese energy sector. In 2023, the company reported a significant increase in its natural gas sales volume, partly driven by these strong partnerships.

Kunlun Energy actively promotes its commitment to green and low-carbon energy solutions, positioning itself as a key player in China's ongoing energy transition. The company emphasizes the environmental advantages of natural gas, highlighting its role as a cleaner alternative to traditional fossil fuels.

Central to this strategy is Kunlun Energy's 'Carbon Peak and Carbon Neutrality Action Plan.' This plan underscores significant investments in clean energy initiatives, including substantial projects in solar photovoltaics. For instance, by the end of 2023, the company had a total installed capacity of 1,386.7 MW for solar power, demonstrating tangible progress towards its sustainability targets.

This deliberate focus on sustainability resonates strongly with environmentally aware stakeholders, from individual investors to large institutional funds. Furthermore, it directly aligns with China's ambitious national decarbonization goals, reinforcing Kunlun Energy's strategic importance and forward-thinking approach in the evolving energy landscape.

Investor Relations and Financial Disclosures

Kunlun Energy actively cultivates strong investor relations through transparent financial disclosures. They regularly publish annual and interim reports, alongside holding annual general meetings to engage directly with stakeholders. This commitment to open communication aims to foster trust and attract further investment capital.

The company's promotional efforts within the financial community extend to sharing analyst recommendations and providing regular updates on stock performance. For instance, in their 2024 interim report, Kunlun Energy highlighted a significant increase in revenue, which was met with positive analyst sentiment, with several firms maintaining or upgrading their price targets. This proactive engagement is crucial for demonstrating financial health and growth potential.

- Transparent Reporting: Kunlun Energy provides detailed annual and interim financial reports, ensuring clarity for investors.

- Stakeholder Engagement: Annual general meetings facilitate direct interaction and information exchange with shareholders.

- Market Communication: Sharing analyst recommendations and stock performance updates actively promotes the company to the financial sector.

- Capital Attraction: Consistent and clear communication is designed to build investor confidence and attract necessary capital for growth.

Customer Service and Community Engagement

Kunlun Energy, while largely operating in B2B and infrastructure, actively cultivates customer satisfaction and community engagement, particularly for its urban gas projects. This focus is crucial for maintaining trust and operational harmony in densely populated areas.

The company prioritizes delivering high-quality services to its vast customer base, which numbers in the millions. This commitment extends to proactive community involvement and public welfare activities, demonstrating a dedication beyond core business operations. For instance, safety promotion days are a regular feature, reinforcing their commitment to the well-being of the communities they serve.

- Customer Focus: Ensuring high-quality services for millions of urban gas customers.

- Community Engagement: Actively participating in public welfare activities.

- Safety Initiatives: Conducting safety promotion days to reinforce community well-being.

- Reputation Management: Building trust and positive relationships through social responsibility.

Kunlun Energy's promotion strategy centers on transparent reporting and robust stakeholder engagement, exemplified by their consistent release of annual and ESG reports. These documents, detailing achievements in operational efficiency and sustainability, aim to build trust with investors and regulators. For instance, their 2023 revenue of approximately RMB 33.9 billion underscores their significant scale.

The company actively partners with government entities and industry leaders, aligning with national energy goals and showcasing expertise in infrastructure projects like the West-East Gas Pipeline expansion. This collaborative approach bolsters contract acquisition and market presence, contributing to a notable increase in natural gas sales volume in 2023.

Kunlun Energy champions its role in China's energy transition by promoting green, low-carbon solutions and highlighting natural gas as a cleaner alternative. Their 'Carbon Peak and Carbon Neutrality Action Plan,' backed by substantial investments in clean energy, including 1,386.7 MW of solar power capacity by the end of 2023, resonates with environmentally conscious stakeholders and national decarbonization objectives.

Investor relations are managed through clear financial disclosures and direct engagement via annual general meetings. Kunlun Energy also proactively communicates analyst recommendations and stock performance, as seen with positive sentiment following their 2024 interim report, reinforcing financial health and growth prospects.

| Key Promotion Activities | Focus Area | 2023/2024 Data Point | Impact |

|---|---|---|---|

| Corporate Communications & ESG Reporting | Brand Image, Safety, Operational Dependability | RMB 33.9 billion revenue | Builds stakeholder trust |

| Strategic Partnerships & Government Engagement | National Energy Goals, Infrastructure Development | Involvement in West-East Gas Pipeline expansion | Secures contracts, broadens market presence |

| Green Energy Promotion | Energy Transition, Sustainability | 1,386.7 MW solar capacity (end of 2023) | Aligns with decarbonization goals, attracts ESG investors |

| Investor Relations | Financial Transparency, Growth Potential | Positive analyst sentiment on 2024 interim report | Attracts capital, builds investor confidence |

Price

Kunlun Energy's city gas pricing for residential customers is heavily influenced by government regulations and national energy policies, aiming for affordability and stability. This regulatory environment, particularly in 2024, means the company must navigate evolving pricing mechanisms that directly affect its revenue streams.

For instance, the Chinese government's ongoing reforms to natural gas pricing structures, which have seen adjustments in recent years, directly impact Kunlun Energy's profit margins. These policy shifts are critical to understanding the company's financial performance in its city gas segment.

For its industrial and commercial clients, Kunlun Energy employs a market-based pricing strategy for natural gas and LNG/CNG. This approach directly links pricing to prevailing supply and demand conditions, offering a dynamic and responsive model. This flexibility is crucial for negotiating contracts and effectively countering competition from other energy providers.

This market-driven pricing allows Kunlun Energy to adapt to fluctuating market conditions, ensuring competitiveness while also safeguarding profitability. For instance, during periods of high demand or tight supply in 2024, prices would naturally adjust upwards, reflecting these market realities. Conversely, periods of oversupply would enable more competitive pricing to secure market share.

Kunlun Energy frequently enters into long-term supply agreements with key customers, often featuring negotiated pricing and the possibility of volume-based discounts. For instance, in 2023, a significant portion of their natural gas sales were under such multi-year contracts, contributing to a stable revenue stream.

These contractual arrangements are crucial for revenue predictability, as they lock in sales volumes and pricing parameters. The pricing models within these contracts typically reflect global energy market trends, logistics expenses, and the unique requirements of each client.

Cost Structure and Efficiency in Pricing

Kunlun Energy's pricing is directly tied to its operational expenses, such as the cost of acquiring natural gas, maintaining its vast pipeline network, and processing fees. The company actively pursues enhanced energy efficiency and operational streamlining to control these costs, which is crucial for offering competitive pricing in the market.

By utilizing its extensive infrastructure, Kunlun Energy aims to achieve significant economies of scale, further supporting its cost management efforts and pricing flexibility. This strategic approach allows the company to navigate market dynamics effectively.

- Cost of Goods Sold (COGS) for Kunlun Energy: In 2023, Kunlun Energy reported a COGS of approximately RMB 86.2 billion, reflecting the substantial expenses associated with gas procurement and related operational activities. This figure underscores the direct impact of input costs on their pricing.

- Operating Efficiency Improvements: The company has consistently invested in upgrading its facilities and processes. For instance, efforts to reduce energy consumption in gas processing plants have shown incremental savings, contributing to a more favorable cost structure.

- Economies of Scale through Infrastructure: Kunlun Energy's integrated network of pipelines and processing facilities allows it to handle large volumes of natural gas efficiently, reducing per-unit transportation and processing costs. This scale is a key enabler of competitive pricing.

Strategic Pricing for New Energy Ventures

As Kunlun Energy ventures into new energy areas such as solar power projects and comprehensive energy services, pricing will be carefully crafted. This means looking at early market demand, government incentives, and the lasting value of green energy.

The goal is to make these new offerings attractive to customers while also ensuring these new business lines can be profitable over time. For instance, government subsidies for renewable energy in China, which have been significant, play a key role in making photovoltaic projects competitive. In 2023, China's installed solar power capacity reached over 600 GW, demonstrating substantial market growth driven partly by supportive policies.

- Market Penetration: Pricing will be set to encourage initial adoption in emerging new energy markets, balancing competitiveness with long-term value.

- Subsidy Integration: Government subsidies for renewable energy projects, a critical factor in the 2024-2025 landscape, will be factored into pricing models to enhance affordability.

- Value-Based Pricing: The pricing strategy will reflect the long-term cost savings and environmental benefits offered by integrated energy solutions and photovoltaic projects.

- Profitability Targets: While encouraging adoption, pricing will also be designed to ensure sustainable profit margins for Kunlun Energy's new energy ventures.

Kunlun Energy's pricing strategy is multifaceted, balancing regulatory mandates with market dynamics. For residential customers, affordability and stability are paramount, dictated by government policies. Conversely, industrial and commercial clients benefit from market-based pricing for natural gas and LNG/CNG, allowing flexibility in response to supply and demand fluctuations. Long-term contracts, a key component of their strategy, offer revenue predictability through negotiated pricing and volume discounts.

| Customer Segment | Pricing Strategy | Key Influences | 2023 Data Point |

|---|---|---|---|

| Residential | Regulated, Stable | Government Policy, Affordability | N/A (Regulated) |

| Industrial/Commercial | Market-Based | Supply/Demand, Competition | Significant portion under long-term contracts |

| New Energy | Value-Based, Incentive-Driven | Market Demand, Subsidies, Environmental Value | China's solar capacity > 600 GW |

4P's Marketing Mix Analysis Data Sources

Our Kunlun Energy 4P's Marketing Mix Analysis is built on a foundation of verified public data, including annual reports, investor presentations, and official company press releases. We also incorporate insights from reputable industry research and competitive intelligence to provide a comprehensive view of their strategies.