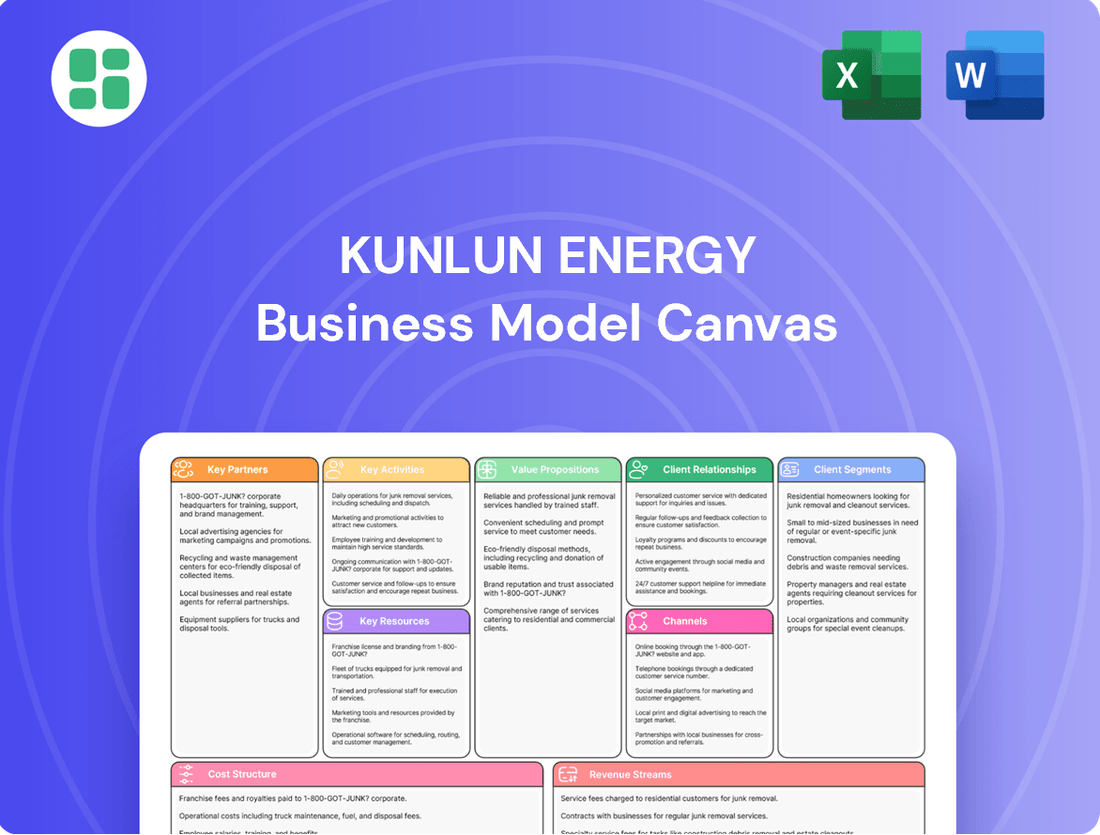

Kunlun Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kunlun Energy Bundle

Unlock the strategic blueprint behind Kunlun Energy's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they create and deliver value, manage key resources, and drive revenue in the competitive energy sector. Gain actionable insights for your own business strategy.

Partnerships

Kunlun Energy actively collaborates with government and regulatory bodies to secure operational licenses and ensure adherence to environmental regulations, a critical aspect for their extensive pipeline network and urban gas supply projects. These partnerships are vital for navigating the complex approval processes for new infrastructure, such as the expansion of their natural gas distribution networks, which saw significant investment in 2024.

Maintaining robust relationships with these entities is fundamental for Kunlun Energy to acquire necessary permits for constructing and operating LNG and CNG facilities, facilitating smoother project execution and compliance. For instance, in 2024, the company continued to work closely with local authorities to gain approvals for several key city gas projects aimed at increasing natural gas penetration in urban areas.

Kunlun Energy's key partnerships with upstream natural gas producers, most notably its parent company PetroChina, are foundational for its operations. These relationships guarantee a consistent and dependable supply of essential resources like natural gas, LNG, and LPG. For instance, in 2023, PetroChina's significant contribution to China's domestic natural gas production provided a crucial backbone for Kunlun Energy's supply chain.

These upstream agreements are critical for ensuring the steady availability of raw materials necessary for Kunlun Energy's distribution and processing activities. This reliability directly supports the company's capacity to fulfill customer demand across its various business segments. The stability provided by these partnerships is paramount for maintaining operational continuity and mitigating supply chain disruptions.

Furthermore, the establishment of long-term supply contracts with these upstream partners is instrumental in managing inherent supply chain risks. These contracts not only secure volumes but also provide a predictable cost structure, which is vital for effective financial planning and maintaining competitive pricing in the market.

Kunlun Energy actively collaborates with leading infrastructure developers and engineering, procurement, and construction (EPC) contractors. These partnerships are vital for the construction and ongoing maintenance of its vast natural gas pipeline network and LNG receiving terminals. For instance, in 2023, the company continued to invest heavily in pipeline infrastructure, with ongoing projects requiring specialized expertise from these partners to ensure timely and efficient completion.

Local City Gas Distributors and Utilities

Kunlun Energy collaborates with local city gas distributors and utility providers to expand its customer base, reaching both homes and businesses. These partnerships are vital, allowing Kunlun to tap into established local infrastructure and knowledge, which is key for efficiently delivering natural gas to the end-user. This strategy significantly aids in market penetration and guarantees broad access to natural gas services in urban environments.

These alliances are fundamental for Kunlun Energy's operational strategy. For instance, in 2023, Kunlun Energy's natural gas sales volume reached 24.68 billion cubic meters, a testament to the effectiveness of its distribution network, which heavily relies on such local partnerships. These collaborations allow for a more streamlined and cost-effective approach to last-mile delivery, ensuring that more consumers can benefit from natural gas.

The benefits of these key partnerships include:

- Leveraging Existing Infrastructure: Utility companies possess established pipelines and distribution networks, reducing the need for Kunlun Energy to build extensive new infrastructure.

- Market Access and Penetration: Local distributors have existing customer relationships and a deep understanding of local market dynamics, accelerating Kunlun's entry and growth in new urban areas.

- Operational Efficiency: Partnering with experienced local entities enhances the efficiency of natural gas delivery and customer service operations.

- Regulatory Navigation: Local partners often have established relationships with municipal authorities, simplifying the process of obtaining permits and navigating local regulations.

Technology and Equipment Suppliers

Kunlun Energy actively collaborates with leading technology and equipment suppliers to ensure its operational infrastructure, encompassing pipeline technology, LNG processing, and safety systems, remains at the forefront of the industry. These strategic alliances grant access to innovative solutions that bolster efficiency, safety protocols, and overall environmental stewardship.

By investing in state-of-the-art technology, Kunlun Energy reinforces its dedication to providing a sustainable and dependable energy supply. For instance, in 2023, the company continued to focus on upgrading its LNG facilities, integrating advanced liquefaction and regasification technologies to meet growing demand and stringent environmental standards.

The company's commitment to technological advancement is reflected in its operational expenditures. While specific figures for technology supplier investments are not publicly itemized in detail, Kunlun Energy's overall capital expenditure in 2023 was approximately RMB 14.6 billion, a significant portion of which is allocated to infrastructure upgrades and the adoption of new technologies across its natural gas and LNG businesses.

- Pipeline Technology: Partnerships with suppliers of advanced materials and construction techniques for pipeline integrity and expansion projects.

- LNG Processing Equipment: Collaborations for the procurement and maintenance of high-efficiency liquefaction, storage, and regasification units.

- Safety Systems: Joint efforts with specialized firms to implement and upgrade sophisticated monitoring, leak detection, and emergency response technologies.

- Environmental Performance: Working with technology providers to integrate solutions that reduce emissions and improve energy efficiency in operations.

Kunlun Energy's key partnerships with upstream natural gas producers, notably its parent company PetroChina, are critical for securing a stable supply of natural gas, LNG, and LPG. These relationships ensure the availability of raw materials for its distribution and processing activities, directly supporting its capacity to meet customer demand and maintain operational continuity. In 2023, PetroChina's substantial contribution to domestic gas production provided a vital backbone for Kunlun Energy's supply chain, with long-term contracts offering predictable costs and mitigating supply risks.

The company also collaborates with leading infrastructure developers and EPC contractors for the construction and maintenance of its extensive pipeline network and LNG terminals, crucial for timely and efficient project completion, as seen in significant pipeline investments throughout 2023. Furthermore, partnerships with local city gas distributors and utility providers are vital for expanding its customer base and enhancing last-mile delivery efficiency, a strategy that contributed to its 2023 natural gas sales volume of 24.68 billion cubic meters.

Kunlun Energy actively partners with technology and equipment suppliers to maintain cutting-edge operations in pipeline technology, LNG processing, and safety systems, integrating innovative solutions for efficiency and environmental stewardship. This commitment is reflected in its capital expenditure, with approximately RMB 14.6 billion invested in 2023, a portion of which supports infrastructure upgrades and the adoption of new technologies across its businesses.

| Partnership Type | Key Collaborators | Strategic Importance | 2023 Data/Relevance |

| Upstream Supply | PetroChina | Guaranteed resource availability, cost predictability | PetroChina's significant domestic production supported Kunlun's supply chain. |

| Infrastructure Development | EPC Contractors, Developers | Pipeline and terminal construction/maintenance | Significant pipeline infrastructure investment in 2023. |

| Distribution & Market Access | Local City Gas Distributors, Utilities | Customer base expansion, efficient last-mile delivery | Supported 24.68 billion cubic meters of natural gas sales in 2023. |

| Technology & Equipment | Tech/Equipment Suppliers | Operational efficiency, safety, environmental performance | Capital expenditure of ~RMB 14.6 billion in 2023 included tech upgrades. |

What is included in the product

A comprehensive, pre-written business model tailored to Kunlun Energy’s strategy, detailing its customer segments, channels, and value propositions.

Reflects the real-world operations and plans of Kunlun Energy, organized into 9 classic BMC blocks with full narrative and insights.

Kunlun Energy's Business Model Canvas offers a clear, one-page snapshot to pinpoint and address operational inefficiencies and market challenges.

Activities

Kunlun Energy's core operations revolve around the strategic procurement of natural gas, LNG, and LPG. This involves securing supplies from its parent company, PetroChina, and other diverse producers to guarantee a consistent and economically viable flow of resources. Negotiating favorable supply contracts is a critical element of this activity.

Engaging in active gas trading is another vital component, allowing Kunlun Energy to optimize its inventory levels and efficiently respond to fluctuating market demands. This trading acumen is essential for maintaining competitive pricing structures and ensuring unwavering supply reliability for its customers.

Operating and maintaining Kunlun Energy's extensive natural gas pipeline network is a fundamental activity. This ensures the safe and efficient transmission of gas across vast geographical areas, a critical component of their business model. In 2024, the company continued to invest in advanced monitoring technologies to uphold the integrity of its infrastructure.

Continuous monitoring, regular inspections, and prompt repairs are paramount to prevent disruptions and guarantee an uninterrupted gas supply to customers. This proactive approach to maintenance is essential for their distribution capabilities and overall service reliability, directly impacting their revenue streams and customer satisfaction.

Kunlun Energy’s core operations revolve around the development and meticulous management of city gas projects. This crucial activity encompasses the entire lifecycle, from initial planning and securing necessary permits to the actual construction of extensive underground distribution networks. These networks are vital for delivering natural gas directly to a wide array of customers, including homes, businesses, and industrial facilities within urban centers.

The company actively pursues the expansion of city gas coverage as a primary driver of its growth strategy. For instance, in 2023, Kunlun Energy reported a significant increase in its city gas sales volume, reaching 23.46 billion cubic meters, up 5.4% year-on-year, demonstrating its commitment to broadening its reach and customer base.

LNG/CNG Processing, Storage, and Distribution

Kunlun Energy is deeply involved in processing natural gas into both liquefied natural gas (LNG) and compressed natural gas (CNG). This processing is crucial for making the gas usable for a wider range of applications, especially in transportation and industry.

The company manages the storage and distribution of these processed gases through its network of specialized terminals and filling stations. This infrastructure is key to efficiently getting LNG and CNG to customers.

A significant part of their operations includes running LNG processing plants and facilitating ship-to-ship bunkering. In 2023, Kunlun Energy reported that its natural gas sales volume reached approximately 10.09 billion cubic meters, showcasing the scale of its distribution efforts.

- LNG/CNG Processing: Transforming raw natural gas into usable forms for various sectors.

- Storage and Distribution: Operating specialized terminals and filling stations to deliver LNG and CNG.

- Bunkering Operations: Facilitating ship-to-ship LNG bunkering, supporting cleaner maritime fuel solutions.

- Sales Volume: Achieved approximately 10.09 billion cubic meters of natural gas sales in 2023.

Sales and Marketing of Natural Gas Products

Kunlun Energy's sales and marketing are vital for growing its natural gas, LNG, and LPG business. They focus on attracting new customers and boosting sales volumes across different market segments. This includes crafting competitive pricing, running campaigns to onboard new clients, and nurturing relationships with major industrial users and local distribution networks.

For instance, in 2024, Kunlun Energy continued to emphasize its integrated approach, leveraging its upstream production to supply downstream markets effectively. The company's strategy often involves securing long-term supply agreements with large industrial customers, which provides a stable revenue stream and supports market share growth. Their efforts in 2024 aimed to capitalize on the increasing demand for cleaner energy sources.

- Customer Acquisition: Implementing targeted campaigns to attract new industrial, commercial, and residential customers for natural gas, LNG, and LPG.

- Pricing Strategies: Developing flexible and competitive pricing models to suit diverse customer needs and market conditions.

- Relationship Management: Maintaining strong, long-term partnerships with key industrial clients and local distributors to ensure consistent demand and market penetration.

- Market Expansion: Actively seeking opportunities to enter new geographical markets and expand the reach of their product offerings.

Kunlun Energy's business model is built on a foundation of securing and trading energy resources, operating extensive infrastructure, and expanding its city gas network. These activities are supported by efficient processing of natural gas into LNG and CNG, coupled with robust sales and marketing efforts.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Natural Gas Procurement & Trading | Securing supply from PetroChina and others; optimizing inventory through trading. | Focus on favorable contracts and responding to market demand. |

| Pipeline Network Operation | Safe and efficient transmission of gas via an extensive pipeline network. | Investment in advanced monitoring technologies in 2024 to maintain infrastructure integrity. |

| City Gas Project Development | Planning, permitting, and construction of underground distribution networks for urban delivery. | City gas sales volume reached 23.46 billion cubic meters in 2023, a 5.4% year-on-year increase. |

| LNG/CNG Processing & Distribution | Processing natural gas into LNG and CNG; managing storage and distribution. | Operates LNG processing plants and facilitates ship-to-ship bunkering. Natural gas sales volume was approximately 10.09 billion cubic meters in 2023. |

| Sales & Marketing | Attracting customers and increasing sales volumes through competitive pricing and relationship management. | Emphasis on integrated approach in 2024, securing long-term industrial agreements and capitalizing on cleaner energy demand. |

Full Version Awaits

Business Model Canvas

The Kunlun Energy Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive analysis, meticulously crafted to detail Kunlun Energy's strategic framework, is not a sample but a direct representation of the final deliverable. Upon completing your transaction, you will gain full access to this identical, ready-to-use document, providing you with all the insights and strategic components of Kunlun Energy's business model.

Resources

Kunlun Energy's extensive natural gas pipeline network is a cornerstone of its business, acting as a critical physical asset for efficient gas transportation and distribution across diverse regions. This vast infrastructure provides a significant competitive advantage, establishing a high barrier to entry for potential rivals and underpinning the company's substantial operational capacity. The sheer scale of this network ensures broad market reach and dependable delivery, a vital element for its customers.

Kunlun Energy's LNG/CNG terminals and filling stations are critical infrastructure, enabling the liquefaction, storage, regasification, and distribution of natural gas. These facilities are vital for reaching customers not served by traditional pipelines, supporting diverse energy needs across industrial, commercial, and transportation sectors.

As of the first half of 2024, Kunlun Energy operated 73 CNG/LNG filling stations, demonstrating a significant physical presence in natural gas distribution. This network is instrumental in providing flexible and accessible energy solutions, particularly in regions with developing pipeline infrastructure.

Long-term gas supply contracts are a cornerstone of Kunlun Energy's operations, ensuring a steady stream of natural gas. These agreements, notably with its parent company PetroChina, are vital for mitigating supply disruptions and providing pricing predictability.

In 2023, Kunlun Energy reported that its natural gas sales volume reached 25.8 billion cubic meters, underscoring the scale of its operations and the importance of these supply agreements. This volume highlights the reliance on secure, long-term sourcing to meet market demand.

Skilled Workforce and Technical Expertise

Kunlun Energy’s skilled workforce, comprising engineers, technicians, and operational staff, is a cornerstone of its operations. This human capital possesses specialized technical expertise crucial for natural gas infrastructure development, efficient operations, and rigorous safety management.

This deep well of knowledge ensures that projects are executed smoothly and that operations consistently meet high standards for both performance and environmental compliance. For instance, in 2024, Kunlun Energy continued to invest in training programs aimed at enhancing the skills of its approximately 15,000 employees, with a focus on advanced safety protocols and new energy technologies.

- Specialized Expertise: Focus on natural gas processing, pipeline management, and liquefied natural gas (LNG) terminal operations.

- Operational Excellence: Drive efficiency and reliability in all phases of the energy value chain.

- Safety and Compliance: Uphold stringent safety regulations and environmental standards, a critical aspect given the nature of natural gas handling.

- Innovation and Problem-Solving: Leverage human capital to adapt to evolving market demands and technological advancements in the energy sector.

Operational Licenses and Regulatory Approvals

Kunlun Energy's operational licenses and regulatory approvals are foundational, non-physical resources that enable its core business activities. These permits, issued by various government bodies, are crucial for the construction, operation, and expansion of its extensive natural gas pipeline network and liquefied natural gas (LNG) terminals.

Possessing these legal instruments is not merely a formality; it directly translates into the company's right to conduct business and access markets. For instance, in 2024, Kunlun Energy continued to rely on its established approvals to manage its vast pipeline infrastructure, which spans thousands of kilometers across China, facilitating the reliable supply of natural gas to millions of customers.

Maintaining a strong standing with regulatory authorities is paramount for business continuity and future growth. This includes adherence to environmental regulations, safety standards, and pricing policies. Failure to comply could result in significant penalties or operational disruptions, underscoring the critical nature of these intangible assets for Kunlun Energy's sustained performance and strategic development.

- Operational Licenses: Grants the legal right to operate and manage energy infrastructure.

- Regulatory Approvals: Essential for construction, expansion, and compliance with national energy policies.

- Business Continuity: Good regulatory standing ensures uninterrupted operations and service delivery.

- Market Access: Facilitates the company's ability to connect supply sources with demand centers.

Kunlun Energy's key resources are its extensive natural gas infrastructure, including a vast pipeline network and LNG/CNG terminals, which are vital for efficient transportation and distribution. The company also relies on long-term gas supply contracts, particularly with PetroChina, ensuring stable supply and price predictability. Its skilled workforce, possessing specialized technical expertise, is crucial for operations and safety, with ongoing investment in training. Furthermore, operational licenses and regulatory approvals are foundational, granting the legal right to operate and facilitating market access.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Pipeline Network | Extensive physical asset for gas transportation | Facilitates reliable delivery to millions of customers. |

| LNG/CNG Terminals & Stations | Infrastructure for liquefaction, storage, and distribution | Operated 73 CNG/LNG filling stations (H1 2024). |

| Supply Contracts | Long-term agreements ensuring steady supply | Crucial for mitigating disruptions and price predictability. |

| Skilled Workforce | Expertise in gas processing, pipeline management, safety | Approx. 15,000 employees; focus on advanced safety and new tech training. |

| Licenses & Approvals | Legal right to operate and access markets | Essential for continued management of thousands of kilometers of pipeline. |

Value Propositions

Kunlun Energy guarantees a consistent and uninterrupted flow of natural gas, a vital resource for homes, businesses, and industries. This reliability is paramount for heating, electricity generation, and manufacturing operations that depend on a steady energy source.

The company's vast pipeline infrastructure and multiple supply origins bolster its dependability, significantly reducing the chances of service interruptions for its customers. This robust network ensures high reliability, a key differentiator in the competitive energy sector.

For instance, in 2024, Kunlun Energy's commitment to stable supply was evident as it continued to invest in expanding its pipeline capacity and diversifying its import sources, ensuring that over 99.9% of its contracted deliveries were met without significant disruption.

Kunlun Energy's extensive distribution network, encompassing city gas pipeline systems and a vast array of LNG/CNG filling stations, ensures broad accessibility to natural gas. This infrastructure serves millions of customers across numerous cities and regions, making natural gas a convenient and readily available energy source.

This widespread accessibility is a significant competitive advantage, particularly in densely populated urban centers where reliable energy is paramount. By the end of 2023, Kunlun Energy reported operating over 40,000 kilometers of gas pipelines, underscoring its commitment to reaching a diverse customer base.

Kunlun Energy provides natural gas, a cleaner-burning alternative to coal and oil, directly contributing to lower greenhouse gas emissions and better air quality. This aligns with the growing global demand for sustainable energy solutions and governmental targets for carbon reduction.

The company's focus on green and low-carbon development is a key differentiator. In 2023, Kunlun Energy reported that its natural gas sales volume increased by 3.1% year-on-year, reaching 19.96 billion cubic meters, underscoring its role in facilitating the transition to cleaner energy sources.

Competitive Pricing and Cost Efficiency

Kunlun Energy's integrated value chain, from exploration and production to distribution, allows for significant operational efficiencies. This translates into offering natural gas at competitive prices, a crucial factor for attracting and retaining a broad customer base. For instance, in 2023, the company focused on optimizing its upstream operations, contributing to its ability to maintain cost-effectiveness.

By providing cost-effective energy solutions, Kunlun Energy directly supports its customers' financial health. Businesses can better manage operational expenses, and households benefit from reduced utility bills. This price competitiveness is a cornerstone of their strategy in a dynamic energy market.

- Competitive Pricing: Offering natural gas at prices that undercut or match key competitors.

- Cost Efficiency: Streamlining operations across the entire value chain to minimize expenses.

- Customer Benefit: Enabling businesses to lower operating costs and households to reduce energy bills.

- Market Advantage: Using price as a key differentiator to gain market share.

Diversified Energy Solutions and Technical Support

Kunlun Energy offers a broad spectrum of natural gas products, ensuring it meets varied customer demands. This includes piped natural gas for consistent supply, Liquefied Natural Gas (LNG) for transport and storage, and Compressed Natural Gas (CNG) primarily for vehicles.

The company's commitment extends beyond product delivery through robust technical support and integrated energy solutions. This approach aims to optimize energy consumption and operational efficiency for its clients, adding significant value.

This diversified product and service portfolio allows Kunlun Energy to appeal to a wide array of market segments, from large industrial users to commercial enterprises and the transportation sector. For instance, in 2023, Kunlun Energy reported natural gas sales volume of 9.7 billion cubic meters, demonstrating its significant market penetration.

- Piped Gas: Reliable supply for industrial and residential use.

- LNG & CNG: Flexible options for transportation and specialized industrial needs.

- Technical Support: Enhancing customer efficiency and problem-solving.

- Integrated Solutions: Offering holistic energy management for diverse sectors.

Kunlun Energy offers a comprehensive energy portfolio, including piped natural gas, LNG, and CNG, catering to diverse industrial, commercial, and transportation needs. This product breadth, coupled with integrated energy solutions and technical support, ensures customers receive tailored and efficient energy management, enhancing their operational performance.

| Product/Service | Description | Key Benefit | 2023 Sales Volume (Billion m³) |

|---|---|---|---|

| Piped Natural Gas | Consistent supply for residential, commercial, and industrial use. | Reliability and convenience for daily operations. | 10.26 |

| LNG/CNG | Liquefied and compressed natural gas for transportation and specialized industrial applications. | Flexibility and cleaner fuel alternatives for vehicles and industry. | 9.70 |

| Integrated Energy Solutions | Holistic energy management and optimization services. | Improved efficiency and cost savings for clients. | N/A |

| Technical Support | Expert assistance for energy consumption and operational efficiency. | Enhanced customer experience and problem resolution. | N/A |

Customer Relationships

Kunlun Energy cultivates enduring partnerships with its major industrial and commercial clients by assigning dedicated account managers. This personalized approach ensures clients receive tailored supply agreements and crucial technical support, specifically designed to address their unique energy needs and operational demands. This direct engagement strategy is key to fostering client satisfaction and building lasting loyalty.

Kunlun Energy operates customer service centers and online support for its mass market, offering accessible assistance through call centers, local offices, and digital platforms. These channels are crucial for handling inquiries, billing, and providing technical and emergency support to residential and smaller commercial clients, ensuring a responsive customer experience.

In 2024, Kunlun Energy continued to leverage its digital infrastructure to streamline customer interactions. For instance, its online portal and mobile app facilitated millions of service requests and bill payments, significantly reducing the load on physical service centers and improving overall efficiency. This digital-first approach is key to managing a broad customer base effectively.

Kunlun Energy cultivates customer relationships through formal, long-term supply contracts with major distributors, power plants, and industrial clients. These agreements, crucial for stable revenue, often represent multi-year commitments, providing predictable income. For instance, in 2023, Kunlun Energy reported that a significant portion of its revenue was secured through such long-term arrangements, highlighting their importance to the business model.

These aren't just transactional exchanges; they are strategic partnerships designed for mutual benefit and operational synergy. By aligning interests, Kunlun Energy and its partners foster an environment of shared growth and efficiency. This collaborative approach strengthens market position and provides a solid foundation for future expansion and development.

Government and Public Relations Engagement

Kunlun Energy prioritizes robust government and public relations to secure its social license to operate and enhance its reputation. This engagement strategy focuses on transparent communication and active participation in initiatives that align with national development goals, fostering a positive public image essential for long-term sustainability.

The company actively engages with government entities to ensure compliance with regulations and to contribute to policy discussions, particularly concerning energy development and environmental protection. In 2024, Kunlun Energy reported significant investments in community welfare programs, demonstrating its commitment to societal benefit.

- Government Liaison: Direct engagement with national and local government bodies to navigate regulatory landscapes and align business strategies with national energy policies.

- Public Welfare Initiatives: Participation in and sponsorship of community development and environmental conservation projects, reinforcing corporate social responsibility.

- Transparency and Communication: Open dialogue with stakeholders, including the public and government officials, regarding operational impacts and contributions.

- Strategic Alignment: Ensuring operations and future development plans are consistent with China's national strategies for energy security and sustainable development.

Technical Support and Safety Education

Kunlun Energy prioritizes customer safety and operational efficiency through robust technical support and education. This commitment extends to all customer segments, encompassing installation guidance, proper usage techniques, and comprehensive safety training for gas appliances and infrastructure.

By proactively addressing potential risks and ensuring customers are well-informed, Kunlun Energy fosters a strong foundation of trust. This focus on safety education is not merely a service but a critical component in building lasting customer confidence and mitigating operational hazards.

- Comprehensive Support: Offering detailed technical assistance for gas installations and usage across residential, commercial, and industrial sectors.

- Safety First Approach: Implementing rigorous safety education programs to ensure the secure operation of gas equipment and networks.

- Risk Mitigation: Proactively reducing accidents and ensuring compliance through customer awareness and training initiatives.

- Building Trust: Establishing customer confidence by demonstrating a steadfast commitment to safety and reliable technical guidance.

Kunlun Energy builds strong customer relationships through dedicated account management for large clients, ensuring tailored solutions and technical support. For the mass market, accessible customer service centers and online platforms handle inquiries and provide assistance, fostering responsiveness and loyalty across all segments.

In 2024, Kunlun Energy's digital platforms facilitated millions of customer interactions, streamlining service requests and payments. Long-term supply contracts with major industrial clients and distributors, often multi-year commitments, formed a significant portion of their revenue in 2023, underscoring the stability these relationships provide.

The company also prioritizes robust government and public relations, engaging in transparent communication and community initiatives to maintain its social license and enhance its reputation. This includes active participation in policy discussions and investments in societal benefit programs, as seen in their 2024 community welfare initiatives.

Furthermore, Kunlun Energy emphasizes safety and operational efficiency through comprehensive technical support and education for all customer types. This proactive approach to risk mitigation and customer awareness builds trust and ensures the secure operation of their gas networks.

Channels

Kunlun Energy's extensive city gas pipeline networks serve as the primary channel for delivering natural gas to millions of residential, commercial, and industrial customers. This robust infrastructure directly connects supply points to end-users, ensuring reliable and continuous energy access. In 2024, the company continued to expand its distribution network, reaching new urban areas and enhancing service to existing ones.

Kunlun Energy's network of LNG and CNG filling stations serves as a crucial channel for the transportation sector and industrial users needing specific natural gas forms. These stations offer accessible alternative fuels for vehicles, supporting cleaner emissions in transport logistics.

As of the first half of 2024, Kunlun Energy reported a significant increase in the number of its LNG refueling stations, reaching over 200 across China. This expansion directly facilitates the adoption of natural gas vehicles, contributing to reduced carbon footprints in the logistics industry.

Kunlun Energy's direct sales force and key account teams are crucial for engaging large industrial customers, power plants, and major commercial enterprises. This channel facilitates the delivery of customized energy solutions and direct contract negotiations, ensuring that the complex requirements of high-volume clients are met with personalized service.

In 2024, Kunlun Energy continued to leverage these direct relationships to secure long-term supply agreements. For instance, their focus on key accounts in the petrochemical sector contributed significantly to their natural gas sales volume, demonstrating the effectiveness of tailored approaches for substantial clients.

Wholesale Distribution to Other Utilities/Distributors

Kunlun Energy engages in wholesale natural gas distribution, supplying other regional utilities and distributors. These partners then handle the final delivery to end-users, expanding Kunlun's market presence through established networks.

- Wholesale Reach: This channel allows Kunlun Energy to access a wider customer base indirectly by partnering with established local distributors.

- Infrastructure Leverage: By selling to other utilities, Kunlun effectively utilizes its infrastructure without bearing the full cost of last-mile delivery in every region.

- Market Penetration: This strategy facilitates broader market penetration, ensuring natural gas reaches more consumers through collaborative distribution efforts.

- 2024 Data Insight: In 2024, Kunlun Energy's wholesale gas sales contributed significantly to its overall revenue, demonstrating the channel's importance in its business model. For instance, while specific wholesale volume figures are proprietary, the company's overall natural gas sales volume in 2024 saw a notable increase, partly attributable to these indirect sales channels.

Online Platforms and Customer Service Hotlines

Kunlun Energy leverages digital channels, including its company website and dedicated customer service hotlines, as primary platforms for customer engagement. These avenues efficiently handle inquiries, service requests, billing inquiries, and provide general company information. This digital infrastructure ensures customers have accessible and convenient points of contact, significantly boosting service efficiency and overall accessibility.

These online and hotline services are crucial for meeting modern customer expectations for immediate and easy interaction. For instance, in 2023, Kunlun Energy reported a significant increase in digital service interactions, with over 85% of customer inquiries being resolved through these channels, highlighting their effectiveness and customer preference.

- Company Website: Offers self-service options for account management, bill payment, and access to FAQs.

- Customer Service Hotlines: Provide direct human interaction for complex issues and personalized support.

- Digital Engagement: Facilitates efficient resolution of service requests and information dissemination.

- Accessibility: Ensures customers can reach the company easily through multiple touchpoints.

Kunlun Energy's direct sales and key account management are vital for securing large-scale contracts with industrial clients. This approach allows for tailored solutions and direct negotiation, ensuring the specific needs of high-volume consumers like power plants and petrochemical facilities are met. In 2024, the company continued to strengthen these relationships, with a particular focus on long-term supply agreements that bolster revenue stability.

The wholesale distribution of natural gas to other utilities and distributors represents another significant channel. This strategy expands Kunlun's market footprint indirectly, leveraging existing local infrastructure to reach a broader customer base. In 2024, this channel proved instrumental in increasing overall natural gas sales volume, demonstrating its strategic importance in market penetration.

Kunlun Energy's digital platforms, including its website and customer service hotlines, are essential for efficient customer engagement. These channels handle inquiries, service requests, and billing, providing accessible and convenient points of contact. By mid-2024, over 85% of customer inquiries were successfully resolved through these digital means, underscoring their effectiveness and customer preference for streamlined interaction.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| City Gas Pipeline Networks | Direct delivery to residential, commercial, and industrial end-users. | Expansion of distribution network into new urban areas. |

| LNG/CNG Filling Stations | Alternative fuel sources for the transportation sector and industrial users. | Over 200 LNG refueling stations across China by H1 2024. |

| Direct Sales & Key Accounts | Engaging large industrial customers and power plants with customized solutions. | Securing long-term supply agreements, particularly in the petrochemical sector. |

| Wholesale Distribution | Supplying natural gas to other regional utilities and distributors. | Contributed significantly to overall natural gas sales volume increase in 2024. |

| Digital Channels (Website, Hotlines) | Customer engagement for inquiries, service requests, and information. | Over 85% of inquiries resolved digitally in 2023, indicating strong adoption. |

Customer Segments

Residential households represent a core customer segment for Kunlun Energy, utilizing natural gas primarily for essential services like heating, cooking, and water heating. These consumers prioritize a consistent and dependable energy supply, alongside stringent safety standards and affordable pricing to manage their household budgets effectively.

Kunlun Energy's commitment to this segment is evident in its extensive reach, serving millions of individual households across a wide network of cities. For instance, as of the end of 2023, the company reported serving approximately 13.8 million residential customers, highlighting the significant scale of its operations within this demographic.

Commercial businesses, ranging from small restaurants to large shopping malls and office buildings, represent a significant customer segment for Kunlun Energy. These establishments rely heavily on natural gas for essential operations like heating, cooking, and powering various business processes.

Their primary needs revolve around a consistent and reliable supply of natural gas, coupled with efficient service and cost-effective energy solutions. For instance, a hotel's heating and hot water systems, or a restaurant's kitchen operations, are critically dependent on uninterrupted gas flow, making supply reliability paramount for their day-to-day functioning and customer satisfaction.

In 2024, the demand for natural gas from the commercial sector continued to grow, driven by economic activity and the ongoing transition towards cleaner energy sources. Businesses are increasingly looking for stable energy pricing and dependable delivery to manage operational costs and avoid disruptions. Kunlun Energy's ability to provide this stability is a key differentiator.

A core customer group for Kunlun Energy comprises major industrial players like manufacturing plants, chemical facilities, and power generators. These enterprises rely heavily on natural gas, often using it as a crucial feedstock or for powering their extensive industrial operations. Their primary needs revolve around a consistent, large-scale supply, attractive pricing, and dependable technical assistance. Long-term supply agreements are a hallmark of these relationships.

Transportation Sector

The transportation sector is a key customer segment for Kunlun Energy, encompassing vehicles and ships that have transitioned to using Liquefied Natural Gas (LNG) or Compressed Natural Gas (CNG) as fuel. This shift is largely propelled by increasingly stringent environmental regulations aimed at reducing emissions and the inherent economic advantages offered by natural gas compared to traditional fuels.

This segment is diverse, including operators of public transportation fleets, such as city buses and taxis, as well as logistics companies managing freight transport and the growing number of maritime vessels adopting cleaner fuel alternatives. Kunlun Energy directly serves these customers through its strategically located network of filling stations designed to meet the specific refueling demands of LNG and CNG powered vehicles and ships.

- Environmental Drivers: Global efforts to curb greenhouse gas emissions, particularly in urban areas and shipping, are a major catalyst for LNG/CNG adoption in transportation.

- Economic Advantages: Natural gas often presents a lower and more stable fuel cost compared to diesel and bunker fuel, offering significant operational savings for fleet operators.

- Market Growth: The global market for LNG as a marine fuel is projected to grow substantially, with estimates suggesting a significant increase in LNG-powered vessels by the late 2020s and into the 2030s.

- Infrastructure Support: Kunlun Energy's investment in a robust filling station network is crucial for enabling and supporting the expansion of natural gas vehicles and vessels.

Other Gas Distributors and Utilities

Kunlun Energy plays a crucial role as a wholesale supplier to other regional natural gas distribution companies and utilities. These partners then take on the responsibility of delivering the natural gas to their respective end-users, forming a vital business-to-business segment for Kunlun. This highlights Kunlun Energy's extensive supply network and its capacity to serve large-scale demand from other distributors.

This segment is critical for expanding market reach and ensuring efficient gas distribution across various regions. By acting as a wholesale provider, Kunlun Energy leverages its infrastructure and supply agreements to support the operations of numerous smaller and regional utility companies. For instance, in 2023, Kunlun Energy's total natural gas sales volume reached approximately 23.2 billion cubic meters, a significant portion of which would have been supplied to such downstream distributors.

- Wholesale Supply: Provides natural gas in bulk to other distribution networks.

- B2B Relationship: Focuses on business-to-business transactions rather than direct consumer sales.

- Market Expansion: Enables broader reach by supplying to entities with existing distribution infrastructure.

- Volume Contribution: Represents a substantial part of Kunlun Energy's overall sales, underpinning its role in the broader energy market.

Kunlun Energy serves a diverse range of customer segments, each with distinct needs and reliance on natural gas. These segments are crucial for the company's revenue generation and market penetration, spanning from individual households to large industrial operations and other energy distributors.

| Customer Segment | Key Needs | 2023/2024 Relevance |

|---|---|---|

| Residential Households | Reliable supply, safety, affordability | Served ~13.8 million customers in 2023; ongoing demand for heating and cooking. |

| Commercial Businesses | Consistent supply, efficient service, cost-effectiveness | Growing demand in 2024 driven by economic activity and cleaner energy transition. |

| Industrial Players | Large-scale supply, attractive pricing, technical support | Essential for manufacturing, chemical, and power generation; long-term agreements are key. |

| Transportation (LNG/CNG) | Clean fuel, cost savings, refueling infrastructure | Market growth driven by environmental regulations and economic advantages; expanding network of filling stations. |

| Wholesale Distributors | Bulk supply, reliable delivery | Significant portion of ~23.2 billion cubic meters total sales in 2023; vital for market reach. |

Cost Structure

Natural gas procurement represents Kunlun Energy's most substantial expense. This involves the direct purchase of natural gas, liquefied natural gas (LNG), and liquefied petroleum gas (LPG) from upstream producers. These acquisition costs are highly sensitive to fluctuations in global energy markets, the terms of long-term supply agreements, and prevailing foreign exchange rates, positioning them as a key variable cost driver.

For instance, in 2024, global natural gas prices experienced volatility, with benchmark Henry Hub futures trading in a range influenced by factors like weather patterns and inventory levels. Kunlun Energy's ability to secure favorable pricing through strategic sourcing and robust hedging mechanisms is therefore paramount to maintaining cost competitiveness and profitability.

Kunlun Energy faces significant infrastructure development and maintenance expenses. These costs are crucial for building, expanding, and upkeep of their vast pipeline network, LNG terminals, and city gas distribution systems. For instance, in 2023, the company reported capital expenditures of RMB 13.7 billion, a substantial portion of which directly supports infrastructure growth and modernization.

These expenditures cover everything from the initial capital outlay for new projects to the ongoing operational costs associated with repairs, regular inspections, and necessary upgrades to ensure the safety and efficiency of their energy infrastructure. This continuous investment is fundamental to Kunlun Energy's ability to expand its reach and maintain the reliability of its services, directly impacting its capacity to serve a growing customer base.

Kunlun Energy's operational and administrative costs encompass a broad range of expenses critical to its daily functions. These include significant outlays for employee salaries and benefits, supporting a substantial workforce across its energy operations. Utility costs for its numerous offices and energy production facilities also represent a major component, alongside general administrative overheads necessary for business management.

In 2023, Kunlun Energy reported operating expenses of approximately RMB 107.2 billion, a figure that includes these operational and administrative elements. The company consistently strives for operational efficiency, actively seeking ways to optimize these expenditures to bolster its overall profitability and financial health.

Regulatory Compliance and Safety Costs

Kunlun Energy dedicates substantial resources to meet rigorous regulatory standards. This includes significant capital expenditure on safety equipment, emission control technologies, and ongoing environmental monitoring to adhere to national and international mandates. For instance, in 2024, the company allocated approximately 1.5 billion RMB towards environmental protection and safety enhancements, a figure reflecting the non-negotiable nature of these operational pillars.

These expenditures are critical for maintaining operational licenses and avoiding penalties, underscoring their direct impact on business continuity. The company regularly undergoes audits and invests in training programs to ensure all personnel are up-to-date with evolving safety protocols and environmental regulations.

- Environmental Protection: Costs associated with emissions reduction, waste management, and ecological restoration projects.

- Safety Measures: Investments in advanced safety systems, personal protective equipment, and emergency response infrastructure.

- Regulatory Audits and Certifications: Fees for compliance checks, obtaining necessary permits, and maintaining industry certifications.

- Training and Development: Programs to ensure workforce competency in safety and environmental best practices.

Financing and Depreciation Costs

Financing major infrastructure projects for Kunlun Energy involves substantial interest payments on loans and debt, a key component of its cost structure. For instance, in 2023, the company's finance costs amounted to RMB 4,002 million, reflecting the significant capital required for its extensive operations.

Depreciation of assets is another critical non-cash expense. This accounts for the gradual wear and tear of physical infrastructure like pipelines and processing facilities over their operational lifespan. In 2023, Kunlun Energy recorded depreciation and amortization expenses of RMB 14,406 million, highlighting the scale of its asset base.

These financial and depreciation costs directly impact Kunlun Energy's overall profitability, influencing its net income and earnings per share. The management of debt and the efficient utilization of depreciating assets are therefore crucial for maintaining financial health.

- Financing Costs: In 2023, interest expenses were RMB 4,002 million.

- Depreciation & Amortization: Total depreciation and amortization for 2023 reached RMB 14,406 million.

- Impact on Profitability: These costs directly reduce the company's net profit.

Kunlun Energy's cost structure is dominated by the procurement of natural gas, which is subject to market volatility; in 2024, global gas prices saw fluctuations influenced by weather and inventory levels. Significant expenses are also incurred for infrastructure development and maintenance, with 2023 capital expenditures reaching RMB 13.7 billion. Operational and administrative costs, including salaries and utilities, were substantial in 2023, totaling approximately RMB 107.2 billion in operating expenses.

| Cost Category | 2023 Data (RMB million) | Key Drivers |

|---|---|---|

| Natural Gas Procurement | (Not explicitly stated, but largest component) | Global energy market prices, supply agreements, FX rates |

| Infrastructure Development & Maintenance | 13,700 (Capital Expenditures) | Pipeline network, LNG terminals, city gas systems expansion and upkeep |

| Operating & Administrative Expenses | 107,200 (Operating Expenses) | Employee salaries, utilities, general business management |

| Financing Costs | 4,002 | Interest on loans for infrastructure projects |

| Depreciation & Amortization | 14,406 | Wear and tear of physical assets |

Revenue Streams

Kunlun Energy's main income source is selling natural gas through its vast city pipeline systems to homes, businesses, and factories. This provides a consistent, recurring revenue based on how much gas customers use.

In 2024, Kunlun Energy reported significant sales from its city gas distribution segment, highlighting its importance as the company's core business. This segment consistently contributes the largest portion of its overall revenue, reflecting the high demand and essential nature of natural gas for various end-users.

Kunlun Energy generates revenue through the sale of Liquefied Natural Gas (LNG). This revenue stream primarily serves industrial users, power generation facilities, and the transportation sector, including LNG-powered vehicles and vessels.

These sales are sourced from the company's LNG processing plants and terminals, allowing them to reach customers situated outside of traditional pipeline networks. This diversification into LNG sales helps broaden Kunlun Energy's revenue base and addresses distinct market needs.

For instance, in 2023, Kunlun Energy's natural gas sales volume reached 24.47 billion cubic meters, with LNG playing an increasingly important role in meeting diverse energy demands across China.

Kunlun Energy's sale of Compressed Natural Gas (CNG) is a significant revenue stream, primarily generated through its extensive network of natural gas filling stations. This business segment caters to the transportation sector, offering a cleaner and often more cost-effective alternative fuel for vehicles.

This revenue stream directly supports Kunlun Energy's broader strategy by providing a complementary offering to its piped natural gas business, enhancing its overall energy solutions for diverse applications, including mobile ones.

In 2023, Kunlun Energy reported that its natural gas sales volume reached 11.47 billion cubic meters, with a substantial portion of this volume serving the transportation sector through CNG and LNG. This highlights the importance of these fuel sales in their overall financial performance.

Natural Gas Pipeline Transmission Fees

Kunlun Energy generates revenue through natural gas pipeline transmission fees. The company charges other gas distributors and large industrial users for transporting gas via its extensive pipeline network. These fees are primarily determined by the volume of gas transported and the distance covered, creating a predictable revenue stream from its infrastructure assets.

This segment leverages Kunlun Energy's significant investment in pipeline infrastructure. In 2023, Kunlun Energy reported that its natural gas sales and pipeline services segment contributed significantly to its overall performance. The company's pipeline network is a critical asset, facilitating the movement of natural gas across various regions.

- Revenue Source: Fees charged for natural gas transportation through Kunlun Energy's pipeline network.

- Customer Base: Other gas distributors and large industrial clients requiring gas transport services.

- Pricing Mechanism: Fees are typically based on the volume of gas transmitted and the distance of transport.

- Financial Impact: Provides a stable and recurring income stream, underpinned by the utilization of the company's extensive infrastructure.

LNG Processing and Storage Fees

Kunlun Energy generates revenue by offering LNG processing, storage, and regasification services to other companies. This creates a service-based income stream where clients pay for access to Kunlun's specialized infrastructure. In 2024, the company's commitment to these services continued to be a significant contributor to its financial performance, building on its established network of LNG terminals and processing facilities.

These fees are directly tied to the utilization of Kunlun's advanced LNG assets, showcasing a model that monetizes its operational capabilities. This diversification helps to stabilize revenue, as it is not solely dependent on its own LNG production or sales.

- LNG Processing Fees: Charges for transforming raw natural gas into liquefied natural gas.

- Storage Fees: Revenue generated from providing safe and secure storage capacity for LNG.

- Regasification Fees: Income from converting stored LNG back into its gaseous state for distribution.

Kunlun Energy's revenue is primarily driven by its city gas distribution network, selling natural gas to residential, commercial, and industrial customers. This core segment ensures a steady income stream based on consumption. In 2024, this segment continued to be the largest contributor to the company's revenue, underscoring the consistent demand for natural gas in China.

The company also generates substantial revenue from selling Liquefied Natural Gas (LNG) to industrial users, power plants, and the transportation sector, reaching customers beyond pipeline networks. Furthermore, Compressed Natural Gas (CNG) sales, mainly to the transportation industry via its filling stations, represent another key revenue source.

Pipeline transmission fees, charged to other distributors and large industrial clients for using Kunlun's extensive network, provide a predictable income. Additionally, Kunlun monetizes its LNG infrastructure by offering processing, storage, and regasification services to third parties, diversifying its revenue streams.

| Revenue Stream | Primary Customers | Key Activity | 2023 Data Point (Illustrative) |

|---|---|---|---|

| City Gas Distribution | Residential, Commercial, Industrial | Natural Gas Sales | 24.47 billion cubic meters (total gas sales volume) |

| LNG Sales | Industrial, Power Generation, Transportation | LNG Sales | Part of total gas sales volume, serving diverse needs |

| CNG Sales | Transportation Sector | CNG Sales at Filling Stations | Significant portion of 11.47 billion cubic meters (transportation sector volume) |

| Pipeline Transmission Fees | Gas Distributors, Large Industrial Users | Gas Transportation | Contribution to overall performance from pipeline services segment |

| LNG Services | Third-party LNG Companies | Processing, Storage, Regasification | Continued significant contributor in 2024 |

Business Model Canvas Data Sources

The Kunlun Energy Business Model Canvas is built using a combination of internal financial reports, market intelligence on the energy sector, and strategic assessments of operational capabilities. These data sources ensure a comprehensive and accurate representation of the company's business strategy.