Kunlun Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kunlun Energy Bundle

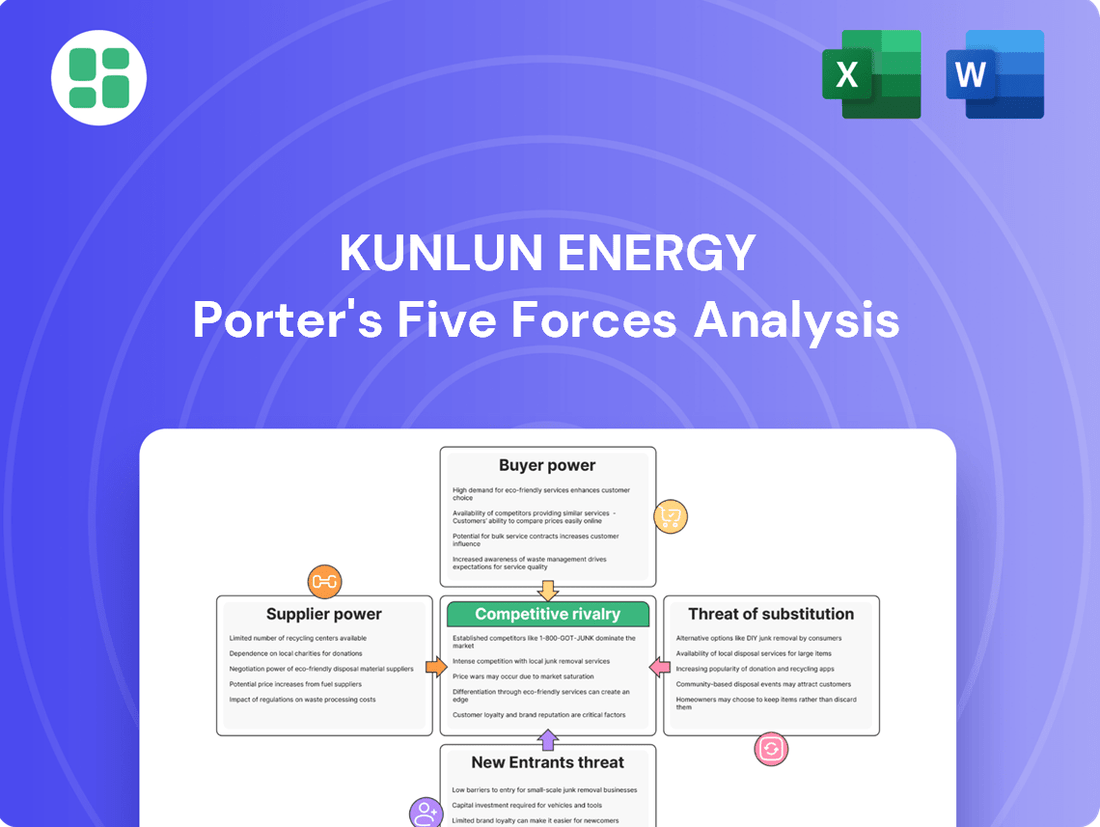

Kunlun Energy navigates a complex energy landscape shaped by powerful buyer demands and intense rivalry. Understanding the interplay of these forces is crucial for any investor or strategist. The full Porter's Five Forces Analysis reveals the true competitive intensity and strategic levers within Kunlun Energy's market.

Ready to move beyond the basics? Get a full strategic breakdown of Kunlun Energy’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Kunlun Energy's bargaining power of suppliers is significantly influenced by the concentration of upstream natural gas producers. The company often sources its gas from a few major players, frequently state-owned entities or large international corporations. This limited supplier base gives these producers considerable sway over pricing and contract conditions.

The ability to switch between different supply sources, such as domestic natural gas fields versus liquefied natural gas (LNG) imports, also plays a crucial role in moderating supplier power. For instance, in 2024, China's domestic natural gas production continued to grow, with the China National Petroleum Corporation (CNPC) reporting a 3.1% increase in its natural gas output for the first half of the year, providing some alternative to imported LNG.

Kunlun Energy's reliance on specific natural gas fields and critical pipeline infrastructure significantly influences supplier bargaining power. For instance, if a particular gas field offers unique geological characteristics or if a supplier controls essential transportation routes, Kunlun Energy faces limitations in finding alternative sources without incurring substantial costs or operational disruptions.

Switching natural gas suppliers presents significant hurdles for Kunlun Energy, often entailing substantial costs. These can include the expense and time involved in renegotiating complex, long-term supply contracts, which are typical in the energy sector.

Furthermore, adapting existing infrastructure to accommodate a new supplier's specifications or securing entirely new transportation and distribution agreements can be a major undertaking. These financial and operational barriers effectively raise the switching costs for Kunlun Energy.

The presence of high switching costs inherently limits Kunlun Energy's ability to easily change suppliers. This inflexibility directly translates to a stronger bargaining position for its current natural gas providers, as the effort and expense required to find and transition to alternatives are considerable.

Threat of Supplier Forward Integration

The threat of supplier forward integration is a significant concern for Kunlun Energy. If natural gas producers, who are suppliers to Kunlun, possess the capability or a strong incentive to move into downstream activities like distribution or city gas projects, they can directly compete with Kunlun. This possibility inherently strengthens their bargaining position, as Kunlun would be hesitant to antagonize a supplier who could easily become a formidable rival in its core markets.

For instance, major upstream players in the natural gas sector might leverage their existing infrastructure and expertise to bypass intermediaries like Kunlun and directly serve end consumers. This strategic move would not only capture additional value but also create a direct competitive threat, potentially impacting Kunlun's market share and profitability. The bargaining power of these suppliers would escalate as Kunlun faces the prospect of losing them as a supplier and gaining them as a competitor.

- Potential for Upstream Players to Enter Distribution: Major natural gas producers can leverage existing infrastructure and capital to integrate forward into city gas distribution networks.

- Increased Supplier Bargaining Power: Kunlun Energy must consider the risk of suppliers becoming direct competitors, which enhances their leverage in negotiations.

- Strategic Implications for Kunlun: The threat of forward integration by suppliers necessitates careful relationship management and a proactive strategy to maintain competitive advantage.

Regulatory Environment and State Control

The natural gas industry in China, where Kunlun Energy operates, is characterized by significant government oversight. State-controlled entities often dominate upstream supply, meaning government policies on pricing, allocation, and ownership directly influence supplier leverage.

These regulations can shift the bargaining power of suppliers. For instance, if the government mandates specific pricing structures or prioritizes certain allocation channels, it can either strengthen or weaken the position of upstream gas producers vis-à-vis downstream distributors like Kunlun Energy.

- Government Control: China's natural gas sector is largely state-controlled, impacting supplier dynamics.

- Policy Impact: Government policies on pricing and allocation directly influence supplier bargaining power.

- Kunlun's Exposure: Kunlun Energy's operations are significantly affected by these regulatory frameworks.

Kunlun Energy faces a moderate bargaining power of suppliers due to the concentrated nature of upstream natural gas producers in China. While domestic production is growing, a few major state-owned enterprises, like CNPC, often control significant reserves, granting them leverage. The ability to import Liquefied Natural Gas (LNG) provides some counter-balance, as seen in the increasing LNG import volumes in 2024, which reached approximately 70 million tonnes for the year, offering an alternative supply source.

| Supplier Characteristic | Impact on Kunlun Energy | Mitigating Factors |

|---|---|---|

| Supplier Concentration | High; few dominant producers | Growing domestic production, LNG imports |

| Switching Costs | High (contract renegotiation, infrastructure adaptation) | Long-term contracts provide stability but limit flexibility |

| Forward Integration Threat | Moderate to High; potential for suppliers to enter distribution | Focus on value-added services and customer relationships |

What is included in the product

This analysis of Kunlun Energy's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the overall industry attractiveness.

Effortlessly identify and address competitive threats with a visual breakdown of Kunlun Energy's industry landscape, simplifying strategic planning.

Customers Bargaining Power

Kunlun Energy's customer base is a mix of millions of individual residential users and significant industrial clients. For residential customers, their individual demand is small, meaning their bargaining power is quite limited.

However, large industrial users, such as power plants or manufacturing facilities, represent a substantial portion of Kunlun Energy's revenue. Their large consumption volumes give them considerable leverage, as they can negotiate better terms or explore alternative energy sources if unsatisfied.

For instance, in 2024, large industrial contracts often include clauses for volume discounts and fuel switching options, directly impacting Kunlun Energy's pricing power with these key accounts.

Customers possess significant bargaining power due to the availability of diverse energy alternatives like electricity, coal, and LPG for heating and cooking. The ease and cost associated with switching to these substitutes directly influence customer leverage, particularly if natural gas prices become less competitive. For instance, in 2024, residential electricity prices in many regions remained stable, offering a viable alternative for household energy needs, thereby constraining natural gas providers' pricing flexibility.

The price sensitivity of Kunlun Energy's customers is a critical factor in its bargaining power. Residential and small commercial users, often reliant on energy for basic needs, might exhibit lower price sensitivity. However, large industrial clients, for whom energy represents a significant portion of their operating costs, are highly price-sensitive and will actively explore competitive pricing and alternative energy sources.

Low Switching Costs for Certain Customer Segments

For certain customer segments, especially those with dual-fuel capabilities or straightforward energy requirements, the expense and hassle of transitioning away from natural gas can be minimal. This inherent flexibility allows these customers to negotiate more favorable terms or explore alternative energy suppliers.

This low switching cost translates into increased bargaining power for these customers. For instance, industrial users with the ability to switch between natural gas and other fuels, like oil or electricity, can readily leverage price discrepancies. In 2024, the volatility in global energy markets further amplified this dynamic, as some industrial consumers explored switching to more stable or cost-effective alternatives when natural gas prices spiked.

- Low Switching Costs: Customers with dual-fuel capabilities can easily switch to alternative energy sources, reducing their reliance on natural gas.

- Negotiating Power: This ease of switching empowers customers to demand better pricing and contract terms from natural gas providers.

- Market Responsiveness: In 2024, fluctuating energy prices highlighted how quickly certain customer segments could shift their energy consumption patterns, influencing market dynamics.

Regulatory Influence on Customer Pricing and Rights

Government regulations significantly influence customer pricing for natural gas, directly impacting Kunlun Energy's revenue potential. For instance, in 2024, many jurisdictions maintained price caps or regulated tariff structures for residential and commercial natural gas consumption, ensuring affordability for end-users. This regulatory intervention limits Kunlun Energy's flexibility in adjusting prices based solely on supply and demand, thereby strengthening the bargaining power of its customers.

Furthermore, consumer protection laws enacted by regulatory bodies empower customers by setting service quality standards and providing recourse for grievances. These regulations can mandate specific service levels, response times, and transparent billing practices. Kunlun Energy must adhere to these mandates, which can increase operational costs and limit its ability to pass on all cost increases to customers, further enhancing customer bargaining power.

- Price Controls: In 2024, regulated pricing mechanisms for residential natural gas in key markets limited Kunlun Energy's pricing autonomy.

- Consumer Rights: Regulations ensuring fair billing and service quality empower end-users, creating a stronger negotiating position.

- Service Standards: Mandated service level agreements can increase operational costs for Kunlun Energy, indirectly benefiting customers.

- Regulatory Oversight: Government bodies act as a check on Kunlun Energy's pricing power, amplifying customer influence.

The bargaining power of customers for Kunlun Energy is substantial, driven by several key factors. While individual residential users have limited impact, large industrial clients wield significant influence due to their high consumption volumes and the availability of alternative energy sources.

In 2024, industrial users often secured volume discounts and fuel-switching options, directly impacting Kunlun Energy's pricing flexibility. The ease with which some customers can switch fuels, coupled with price sensitivity, means Kunlun Energy must remain competitive to retain these crucial accounts.

Government regulations, including price caps and consumer protection laws, further bolster customer bargaining power by limiting Kunlun Energy's pricing autonomy and mandating service standards.

| Factor | Impact on Kunlun Energy | 2024 Relevance |

|---|---|---|

| Large Industrial Users | High Bargaining Power | Negotiated volume discounts and fuel-switching clauses were common in 2024 contracts. |

| Availability of Alternatives | Constrains Pricing | Stable residential electricity prices in 2024 provided a viable alternative for households. |

| Switching Costs | Low for some segments | Industrial users with dual-fuel capabilities could leverage price discrepancies, especially during 2024 market volatility. |

| Price Sensitivity | High for Industrial Clients | Energy costs are a significant operational expense, driving active negotiation for competitive pricing. |

| Government Regulation | Limits Pricing Autonomy | Price caps and regulated tariffs in 2024 ensured affordability, enhancing customer leverage. |

What You See Is What You Get

Kunlun Energy Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Kunlun Energy, detailing the competitive landscape and strategic positioning of the company. You'll receive this exact, fully formatted document immediately upon purchase, providing actionable insights into industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitute products. This is the complete, ready-to-use analysis file; what you're previewing is precisely what you get, professionally prepared for your business needs.

Rivalry Among Competitors

Kunlun Energy faces a competitive landscape populated by numerous players, ranging from fellow state-owned enterprises like PetroChina and Sinopec, which also have significant natural gas operations, to a growing number of regional gas distributors and even international energy companies exploring opportunities in China's expanding market. This density means direct competition for lucrative city gas distribution concessions and pipeline construction projects is intense. For instance, in 2023, China's natural gas market saw continued growth, with demand increasing, but this also attracted more participants vying for these valuable infrastructure assets and customer bases.

The natural gas market in China, a key area for Kunlun Energy, experienced robust growth leading up to 2024. For instance, China's natural gas consumption saw a notable increase, contributing to a dynamic market environment where expansion often outpaced the need for aggressive market share battles. This growth trajectory allows companies to pursue their own expansion strategies without necessarily engaging in direct, cutthroat competition for existing customer bases.

However, as certain segments of the natural gas market mature, the intensity of competitive rivalry is likely to increase. In more saturated areas, companies like Kunlun Energy must focus on differentiating their offerings and improving operational efficiency to capture or retain customers. This shift from a growth-driven market to a more competitive landscape necessitates a strategic focus on customer loyalty and value proposition enhancement.

The natural gas sector, including distribution and pipeline operations, demands massive initial capital outlays for infrastructure, resulting in very high fixed costs. For instance, in 2024, the estimated cost to build a new natural gas pipeline can range from $1 million to $5 million per mile, depending on terrain and complexity, significantly burdening companies with ongoing operational expenses.

These substantial fixed costs, combined with stringent regulatory requirements and the highly specialized nature of assets, erect formidable exit barriers. Companies find it exceedingly difficult and financially punitive to divest or cease operations, forcing them to maintain competitive pressure even when market conditions are unfavorable, thus intensifying rivalry.

Product Homogeneity and Price Competition

Natural gas itself is largely a commodity, meaning there's not much difference in the product itself from one supplier to another. This lack of unique features means companies often compete mainly on price and how reliably they can deliver the gas.

This intense price competition can really put pressure on profit margins for companies like Kunlun Energy. In 2024, the global natural gas market continued to see fluctuations, with spot prices in key regions like Europe and Asia experiencing volatility driven by supply and demand dynamics. For instance, while prices might have eased from earlier highs, the underlying cost of production and transportation remains a significant factor in competitive pricing strategies.

- Commodity Nature: Natural gas lacks significant product differentiation, making it a pure commodity.

- Price-Driven Competition: Companies primarily compete on price and supply reliability.

- Margin Squeeze: Intense price wars can reduce profitability for market participants.

- 2024 Market Context: Volatile global natural gas prices in 2024 underscored the importance of cost efficiency and reliable supply chains.

Strategic Importance and Government Support

As a significant player in the energy sector, Kunlun Energy operates in an environment where its strategic importance to the Chinese government is paramount. This often translates into substantial state support, including subsidies and favorable policies, which can significantly shape the competitive landscape. For instance, in 2023, China continued its focus on energy security and transition, with policies aimed at bolstering domestic natural gas production and distribution, directly benefiting companies like Kunlun Energy.

This government backing can create an uneven playing field, as state-owned or state-supported entities may have access to capital, regulatory advantages, or market access that private or foreign competitors do not. The intensity of rivalry is thus influenced not only by market forces but also by the extent of government intervention and the strategic priorities of the state. For 2024, it is anticipated that these trends will continue, with ongoing government support for energy infrastructure development and the promotion of cleaner energy sources.

- Strategic Importance: Kunlun Energy's role in providing essential energy services makes it strategically vital to national economic stability and development.

- Government Support: This strategic importance often leads to direct and indirect government support, such as subsidies for infrastructure projects or preferential tax treatment.

- Influence on Rivalry: Government support can alter competitive dynamics by providing advantages to state-backed entities, potentially increasing the intensity of rivalry for market share.

- 2024 Outlook: Continued government emphasis on energy security and transition is expected to maintain a supportive environment for key players like Kunlun Energy in 2024.

Kunlun Energy faces a competitive environment with numerous players, including large state-owned enterprises like PetroChina and Sinopec, alongside regional distributors and international firms. This high density of competitors leads to fierce bidding for distribution rights and pipeline projects. The natural gas market in China, while growing, sees companies vying for these valuable assets.

The commodity nature of natural gas means competition centers on price and reliability, often squeezing profit margins. For instance, global natural gas spot prices in 2024 showed volatility, emphasizing the need for cost efficiency. High fixed costs and exit barriers further intensify this rivalry, as companies are compelled to remain competitive despite unfavorable conditions.

| Competitor Type | Key Characteristics | Impact on Rivalry |

|---|---|---|

| State-Owned Enterprises (e.g., PetroChina, Sinopec) | Significant market share, access to capital, government backing | High intensity due to scale and integrated operations |

| Regional Distributors | Local market expertise, established customer relationships | Can be intense in specific geographic areas |

| International Energy Companies | Advanced technology, global experience, potential for large-scale investment | Growing influence, especially in new project development |

SSubstitutes Threaten

The threat of substitutes for natural gas is significant, with coal, electricity, LPG, and growing renewable energy sources like solar and wind posing viable alternatives. The economic attractiveness of these substitutes, influenced by fluctuating market prices and governmental incentives, directly impacts natural gas demand. For instance, in 2024, the global average cost of electricity from renewables continued its downward trend, making it a more competitive option in many sectors previously reliant on natural gas.

Technological advancements are rapidly making alternative energy sources more viable substitutes for natural gas. For instance, by 2024, the global average cost of electricity from solar photovoltaics had fallen by over 80% compared to 2010 levels, making it increasingly competitive.

Improvements in battery storage technology, such as enhanced energy density and reduced manufacturing costs, are further bolstering the reliability and attractiveness of renewables. This trend directly impacts Kunlun Energy by increasing the threat of customers switching to cleaner, more cost-effective energy solutions for power generation and heating.

Stricter environmental regulations, particularly those targeting carbon emissions, present a significant threat to Kunlun Energy. For instance, China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 intensifies the pressure on fossil fuel consumption. This push favors cleaner alternatives like solar and wind power, directly impacting the demand for natural gas, Kunlun's primary product.

Government policies actively promoting renewable energy adoption and electrification further amplify this threat. Subsidies and incentives for electric vehicles and renewable power generation make these substitutes more economically viable and appealing to consumers and industries. In 2023, China's installed renewable energy capacity continued its rapid expansion, with solar and wind power leading the growth, underscoring the increasing competitiveness of these alternatives against natural gas.

Consumer Preferences and Infrastructure Adaptability

Consumers increasingly favor cleaner energy sources, which directly impacts the demand for traditional fuels like natural gas. For instance, in 2024, the global renewable energy sector saw significant growth, with solar and wind power installations accelerating, presenting a clear alternative for heating and electricity generation.

The cost and complexity for consumers to switch to these alternatives are critical. A significant barrier remains the expense and effort involved in retrofitting homes with new heating systems, such as replacing gas boilers with electric heat pumps. This infrastructure adaptability directly influences how readily consumers can embrace substitutes, thereby affecting Kunlun Energy’s market position.

- Shifting Consumer Demand: Growing consumer preference for sustainable and low-carbon energy solutions in 2024 is a primary driver for the threat of substitutes.

- Infrastructure Costs: The expense and logistical challenges associated with consumers adapting their homes to alternative energy sources, like electric heating systems, directly influence the adoption rate of substitutes.

- Technological Advancements: Innovations in renewable energy technologies and energy efficiency solutions continue to lower the cost and improve the performance of substitutes, making them more attractive to consumers.

Impact on Different Market Segments

The threat of substitutes for Kunlun Energy's products, primarily natural gas, differs significantly across its customer base. Industrial clients, for example, often possess greater agility to shift between energy sources like coal or oil if price differentials become substantial. In 2024, fluctuating global energy prices continued to present this challenge, with some industrial sectors evaluating coal-to-gas switching economics closely.

Residential consumers, however, face a more entrenched substitution landscape. Their ability to switch is often tied to the availability and cost of alternative heating and cooking fuels, as well as the significant investment required for new appliances or infrastructure. Government policies promoting renewable energy adoption or energy efficiency also play a crucial role in shaping this segment's substitution patterns.

The company's strategic focus on expanding its city gas distribution networks aims to solidify its position and reduce the perceived threat of substitutes in the residential and commercial sectors. By making natural gas more accessible and convenient, Kunlun Energy aims to increase customer stickiness.

Key considerations for Kunlun Energy regarding substitutes include:

- Industrial Flexibility: Industrial users can more readily switch to coal or oil based on price, impacting demand for natural gas in this segment.

- Residential Inertia: Residential customers are less likely to switch due to infrastructure and appliance costs, but long-term trends and incentives matter.

- Renewable Energy Growth: The increasing adoption of renewable energy sources, particularly for heating and power generation, presents a growing, albeit longer-term, substitute threat.

- Policy Influence: Government regulations and incentives for cleaner energy or energy efficiency can significantly alter the attractiveness of natural gas versus substitutes.

The threat of substitutes for Kunlun Energy's natural gas offerings is multifaceted, driven by evolving economics, technological progress, and policy shifts. While industrial customers can more readily switch to alternatives like coal or oil based on price, residential users face higher switching costs but are increasingly influenced by clean energy trends and government incentives. The global push for decarbonization, exemplified by China's ambitious climate goals, further strengthens the position of renewable energy sources as viable substitutes.

In 2024, the cost-competitiveness of renewable energy continued to improve, with solar PV electricity costs falling significantly compared to previous years. This trend, coupled with advancements in energy storage, makes solar and wind power increasingly attractive alternatives for both heating and electricity generation, directly impacting natural gas demand.

The following table illustrates the competitive landscape of energy substitutes:

| Energy Source | 2024 Average Cost (USD/MWh) | Key Substitute Factors | Impact on Natural Gas Demand |

| Natural Gas | $7.50 - $12.00 (Varies by region) | Price volatility, infrastructure investment | Primary product for Kunlun Energy |

| Coal | $4.00 - $7.00 | Lower upfront cost, higher emissions | Direct competitor for industrial use |

| Electricity (Renewable Mix) | $3.50 - $6.00 | Falling costs, environmental benefits, grid integration | Growing substitute for heating and power |

| LPG | $10.00 - $15.00 | Portability, niche applications | Limited direct substitute for large-scale use |

Entrants Threaten

The threat of new entrants in the natural gas sector, particularly for companies like Kunlun Energy, is significantly mitigated by the sheer scale of capital required. Building essential infrastructure such as natural gas pipelines, extensive city gas distribution networks, and sophisticated LNG terminals demands billions in upfront investment. For instance, major pipeline projects can easily run into the tens of billions of dollars, making it a formidable hurdle for any new player to overcome.

This high capital expenditure acts as a powerful deterrent. Only well-established companies with access to substantial financial resources and robust credit lines can even consider entering this market. This financial barrier effectively limits the pool of potential competitors, thereby reducing the overall threat of new entrants for existing players like Kunlun Energy.

The natural gas industry is a minefield of regulations, demanding extensive permits, licenses, and approvals from multiple government agencies for everything from construction to daily operations and distribution. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent emissions standards for natural gas facilities, adding layers of compliance complexity.

Successfully navigating this intricate web of rules and securing the required clearances presents a significant barrier, effectively deterring potential new entrants from easily entering the market and competing with established players like Kunlun Energy. This regulatory burden translates into substantial upfront costs and time commitments, making market entry a challenging proposition.

New entrants into the natural gas sector, particularly those looking to compete with established players like Kunlun Energy, face substantial hurdles in securing consistent and affordable natural gas supplies. Building out the necessary pipeline infrastructure and distribution networks is a capital-intensive undertaking, often requiring years to develop.

Existing companies benefit from established relationships with suppliers and often possess long-term supply agreements, which can insulate them from price volatility and ensure a steady flow of gas. For instance, Kunlun Energy's extensive network of pipelines and storage facilities, developed over years of operation, represents a significant barrier to entry for newcomers.

The sheer scale of investment needed for upstream exploration and production, coupled with the downstream distribution, means that only well-capitalized entities can realistically consider entering the market. This high capital requirement effectively limits the number of potential new competitors.

Economies of Scale and Experience Curve Effects

Incumbent energy companies like Kunlun Energy leverage significant economies of scale in their operations. This scale provides a substantial cost advantage in areas like procurement of materials, operational efficiency, and the maintenance of extensive infrastructure, such as pipelines and processing facilities. For instance, in 2024, major integrated energy companies often report operating costs per unit that are considerably lower than what a new, smaller entrant could achieve.

New entrants face a steep challenge in matching these cost efficiencies. Without the established volume and infrastructure, they would find it difficult to compete on price. This barrier is amplified by experience curve effects, where existing players have refined their processes over time, leading to further cost reductions and operational expertise that are hard for newcomers to replicate quickly.

- Economies of Scale: Kunlun Energy’s large-scale operations in natural gas processing and distribution allow for lower per-unit costs in procurement and logistics.

- Experience Curve: Decades of operational experience have enabled incumbents to optimize maintenance schedules and reduce downtime, further lowering costs.

- Capital Intensity: The high capital requirements for building new energy infrastructure make it prohibitively expensive for new entrants to achieve competitive scale.

- Procurement Power: Established players benefit from bulk purchasing power, securing raw materials and equipment at more favorable prices than smaller competitors.

Government Policies and State-Owned Enterprise Dominance

Government policies and the significant presence of state-owned enterprises (SOEs) in the natural gas sector, particularly in markets like China, act as a substantial barrier to new entrants. These SOEs often benefit from preferential treatment, including access to capital, regulatory advantages, and established infrastructure, making it exceedingly challenging for independent companies to compete. For instance, in 2024, China's natural gas market remained heavily influenced by its major SOEs, such as China National Petroleum Corporation (CNPC) and Sinopec, which control the majority of upstream production and downstream distribution networks.

These deeply entrenched players, bolstered by government backing, can leverage their scale and market power to outmaneuver smaller, newer competitors. New entrants face hurdles such as obtaining necessary licenses, securing long-term supply agreements, and building out their own infrastructure, all while competing against entities with a substantial head start and often lower cost of capital due to state guarantees. The regulatory landscape itself can be a deterrent, with policies often designed to maintain stability and control within the existing SOE framework.

- Dominant SOEs: In 2024, major state-owned enterprises like CNPC and Sinopec continued to dominate China's natural gas market, controlling over 70% of the country's gas supply and infrastructure.

- Policy Favoritism: Government policies frequently provide advantages to incumbents, including easier access to permits, subsidies, and favorable loan terms, creating an uneven playing field for new entrants.

- Infrastructure Control: New companies must contend with the fact that existing SOEs control the vast majority of the natural gas pipeline network and storage facilities, necessitating significant investment for independent access or duplication.

- Capital and Regulatory Hurdles: The high capital requirements for infrastructure development and the complex regulatory approval processes, often favoring established players, significantly increase the threat of new entrants.

The threat of new entrants for Kunlun Energy is considerably low due to the immense capital investment required for infrastructure like pipelines and LNG terminals, easily costing billions. For instance, in 2024, the average cost to construct a new major natural gas pipeline could range from $10 million to $20 million per mile. This financial barrier significantly limits the number of potential competitors, as only entities with substantial financial backing can even consider entering the market.

Furthermore, stringent government regulations and the need for numerous permits and licenses add another layer of difficulty. Navigating this complex regulatory landscape, which includes environmental compliance as seen with EPA standards in 2024, demands significant time and resources, acting as a powerful deterrent for new companies.

Established players like Kunlun Energy also benefit from secured long-term supply agreements and extensive existing infrastructure, creating a significant competitive advantage. Newcomers would struggle to match the economies of scale and procurement power enjoyed by incumbents, who can often secure materials and operational efficiencies at lower per-unit costs.

| Barrier Type | Description | Example (2024 Context) |

|---|---|---|

| Capital Requirements | High upfront investment for infrastructure (pipelines, terminals). | Pipeline construction costs can reach $10-20 million per mile. |

| Regulatory Hurdles | Complex licensing, permits, and compliance (e.g., environmental standards). | Ongoing enforcement of emissions standards by agencies like the EPA. |

| Access to Supply | Established relationships and long-term contracts for natural gas. | Incumbents' secured supply chains reduce price volatility for them. |

| Economies of Scale | Cost advantages from large-scale operations and procurement. | Lower operating costs per unit for integrated energy majors. |

| Government Policy/SOEs | Preferential treatment for state-owned enterprises. | Dominance of SOEs like CNPC and Sinopec in key markets. |

Porter's Five Forces Analysis Data Sources

Our Kunlun Energy Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, investor presentations, and public filings. We also leverage industry-specific research from reputable market intelligence firms and analysis from financial news outlets to provide a comprehensive view of the competitive landscape.