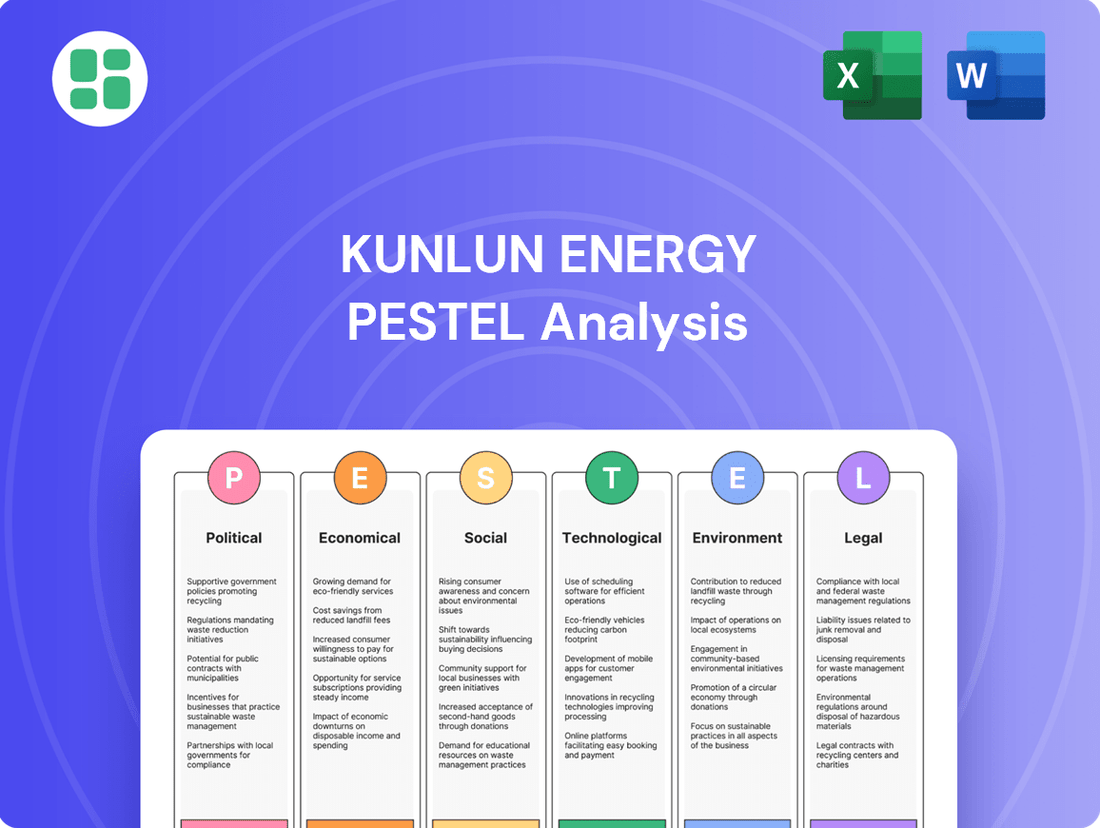

Kunlun Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kunlun Energy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Kunlun Energy's trajectory. This comprehensive PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full report now to gain a strategic advantage.

Political factors

China's government places a high priority on energy security, a crucial factor for natural gas providers like Kunlun Energy. New regulations, implemented from August 2024, are designed to boost the natural gas sector's efficiency and guarantee supply, particularly for essential consumers such as residential users and healthcare facilities. This strategic emphasis on national energy needs suggests a potentially stable demand environment and supportive operating conditions for companies aligned with these objectives.

China's ambitious goal of reaching carbon neutrality by 2060 is a major driver for the energy industry. This commitment translates into policies that are increasingly limiting the production of certain petrochemicals using natural gas and actively encouraging a shift towards cleaner energy sources. Kunlun Energy must therefore integrate these national environmental targets into its strategic planning, including specific measures for methane emission reduction and achieving carbon peaking, as outlined in its 2024 operational roadmap.

Global geopolitical tensions, particularly those impacting major energy-producing regions, can significantly influence the availability and cost of natural gas for import-dependent nations like China. Disruptions in key supply routes or shifts in international trade policies can create price volatility, directly affecting Kunlun Energy's operational costs and its ability to secure competitive pricing for its gas procurement.

China's extensive network of agreements for Liquefied Natural Gas (LNG) and pipeline gas with countries such as Russia, Turkmenistan, and Australia are critical. For instance, the Power of Siberia pipeline, a major conduit for Russian gas, underscores the importance of bilateral relations. Any imposition of tariffs or trade restrictions by China or its suppliers could directly impact Kunlun Energy's supply chain efficiency and necessitate adjustments to its pricing strategies.

The stability of these international relationships is paramount for maintaining a diverse and reliable natural gas supply portfolio for Kunlun Energy. A robust network of suppliers mitigates risks associated with single-source dependency, ensuring greater resilience against geopolitical shocks and supporting consistent market operations.

Regulatory Environment and Market Liberalization

The regulatory environment in China significantly impacts Kunlun Energy, particularly with the establishment of PipeChina. This entity influences how natural gas is transported and priced, directly affecting Kunlun's pipeline access and distribution costs. For instance, PipeChina's operational framework, which began consolidating assets in 2020, dictates terms for third-party access, a critical factor for Kunlun's business model.

While China's natural gas market is progressively liberalizing and fostering greater competition, government policies remain a dominant force. These policies continue to shape contract negotiations, influencing market share dynamics and setting the terms for how companies like Kunlun Energy can operate and expand. The government's long-term energy strategy, aiming for increased natural gas utilization, provides a backdrop for these regulatory developments.

Navigating these evolving regulations is crucial for Kunlun Energy to maintain and enhance its operational efficiency and market standing. The company must adapt to new pricing mechanisms and access rules to optimize its supply chain and competitive positioning within the expanding Chinese energy sector. This includes staying abreast of any policy shifts that might affect its contractual agreements or future investment decisions.

- Regulatory Influence: PipeChina's role in managing national gas pipelines directly affects Kunlun Energy's operational costs and access to markets.

- Market Liberalization: Despite increasing competition, government policies still heavily influence contract terms and market share in China's natural gas sector.

- Policy Adaptation: Kunlun Energy's success hinges on its ability to adapt to and leverage the evolving regulatory landscape for optimal efficiency and market positioning.

Government Support for Infrastructure Development

China's commitment to bolstering its energy infrastructure, particularly in natural gas, is a significant political factor for Kunlun Energy. By 2025, the government is prioritizing the expansion of natural gas pipeline and storage capacity to address existing shortfalls and bolster energy security. This strategic focus directly benefits Kunlun Energy, given its core operations in natural gas pipeline networks and LNG processing terminals.

This governmental push creates substantial opportunities for Kunlun Energy to not only expand its existing infrastructure but also to enhance the stability and reach of its supply chains. For instance, the National Development and Reform Commission (NDRC) has outlined plans to increase natural gas storage capacity significantly, aiming to meet peak demand more effectively. Kunlun Energy is well-positioned to capitalize on these initiatives, potentially securing new projects and contracts related to pipeline construction and terminal upgrades.

- Government Investment: China's 14th Five-Year Plan (2021-2025) emphasizes energy security, with substantial planned investments in natural gas infrastructure, including pipelines and storage facilities.

- Policy Support: Favorable policies and potential subsidies for companies involved in natural gas infrastructure development can reduce capital expenditure and improve project viability for Kunlun Energy.

- Market Expansion: Government-led infrastructure projects often open up new regions for natural gas distribution, allowing Kunlun Energy to expand its customer base and operational footprint.

China's government prioritizes energy security, which is a significant political factor for Kunlun Energy. New regulations from August 2024 aim to improve efficiency and guarantee natural gas supply, especially for residential and healthcare users. This focus on national energy needs suggests a stable demand and supportive environment for companies like Kunlun Energy.

The nation's commitment to carbon neutrality by 2060 drives policies favoring cleaner energy. Kunlun Energy must align its strategy with these environmental targets, including methane emission reduction, as detailed in its 2024 roadmap, to navigate the evolving energy landscape.

Geopolitical tensions can affect natural gas availability and cost for import-dependent China, impacting Kunlun Energy's procurement prices and operational expenses. China's extensive LNG and pipeline gas agreements, such as with Russia, are critical; trade restrictions could disrupt supply chains and necessitate pricing adjustments.

The establishment of PipeChina significantly influences Kunlun Energy's pipeline access and distribution costs, as the entity manages national gas transport and pricing. While China's market is liberalizing, government policies remain dominant, shaping contract terms and market share dynamics for companies like Kunlun Energy.

China's 14th Five-Year Plan (2021-2025) highlights energy security, with substantial investments planned for natural gas infrastructure, including pipelines and storage. This governmental push creates opportunities for Kunlun Energy to expand its infrastructure and supply chains, potentially benefiting from favorable policies and subsidies.

What is included in the product

This Kunlun Energy PESTLE analysis dissects the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic positioning.

It provides actionable insights into market dynamics, regulatory landscapes, and future trends to inform strategic decision-making and identify opportunities.

Kunlun Energy's PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, enabling quick understanding of external factors impacting the company.

Economic factors

Global and regional natural gas prices, particularly spot Liquefied Natural Gas (LNG) prices, have a direct and significant impact on Kunlun Energy's revenue and overall profitability. When these prices are high, it generally translates to better earnings for the company.

For the 2024-2025 period, Chinese national oil and gas companies, including those associated with Kunlun Energy, are anticipating a reduction in pipeline gas sales contract prices. This strategic shift is driven by an oversupply situation and increasing competition from the downward trend observed in spot LNG prices, which could compress margins.

China's economic expansion is a primary driver for both industrial and residential demand for natural gas. As the economy grows, so does the need for energy to power factories and heat homes.

While some projections indicate a modest dip in China's natural gas demand for 2025, the long-term picture remains robust. This sustained demand is fueled by ongoing urbanization and the continued growth of industries across Asia, creating a favorable environment for natural gas consumption.

Kunlun Energy's sales performance is directly correlated with China's economic health and its overall energy consumption trends. When the economy thrives, Kunlun Energy typically sees increased sales volume.

Kunlun Energy is strategically channeling capital into green and low-carbon initiatives, notably distributed photovoltaic projects and gas-fired power generation. This focus underscores a significant economic pivot towards sustainability, with such investments expected to bolster long-term financial health by tapping into growing green finance markets.

The company's dedication to a diversified multi-energy system, including these clean energy ventures, is designed to create new revenue avenues. For instance, by mid-2024, the company reported substantial progress in its renewable energy segment, with installed capacity for distributed solar power reaching new highs, reflecting a commitment to a low-carbon future and enhanced energy security.

Dividend Policy and Shareholder Returns

Kunlun Energy's commitment to shareholder returns is evident with the approval of its final ordinary dividend for the financial year ending December 31, 2024, scheduled for payment in July 2025. This policy is a key factor for investors. The company's robust financial health, underscored by a 5% profit increase in 2024, provides a solid foundation for sustaining these dividend payouts, which are vital for attracting and retaining investor confidence.

The dividend policy directly impacts how investors perceive the company's value and future prospects. A consistent and growing dividend can signal financial stability and management's confidence in future earnings. For Kunlun Energy, this means that its ability to generate profits and manage its cash flow effectively will be closely scrutinized by shareholders and potential investors alike, especially in the context of broader economic conditions that might affect energy sector profitability.

- Dividend Payout: Kunlun Energy's final ordinary dividend for FY2024 is set for payment in July 2025.

- Profit Growth: The company reported a 5% increase in profit for the 2024 financial year.

- Investor Attraction: Consistent dividend policies are crucial for attracting and retaining a strong investor base.

- Financial Health Indicator: The ability to pay dividends reflects positively on the company's financial performance and stability.

Global LNG Market Dynamics

The global liquefied natural gas (LNG) market experienced a notable upswing in demand during 2024, with Asia, especially China and India, leading the charge in consumption. This resurgence is a key factor for companies like Kunlun Energy, which operates significantly within the LNG sector. The overall stability of this market, however, continues to be a point of concern, largely influenced by ongoing geopolitical tensions and evolving regulatory landscapes across various nations.

Kunlun Energy's strategic positioning as a major participant in LNG sales and processing means it is directly impacted by these fluctuating global supply and demand trends. The company must navigate the inherent pricing volatility that characterizes the LNG market, a volatility often exacerbated by unforeseen international events and shifts in energy policies. For instance, in early 2024, spot LNG prices in Asia saw significant fluctuations, with some reports indicating a rise of over 30% in certain periods compared to late 2023, underscoring the dynamic nature of the market.

- Asian Demand Resurgence: China's LNG imports in the first half of 2024 increased by approximately 15% year-on-year, while India's demand grew by nearly 10%, according to preliminary trade data.

- Geopolitical Influence: Ongoing conflicts and trade disputes continue to cast a shadow over supply chain reliability, potentially impacting shipping routes and delivery costs for LNG.

- Regulatory Impact: Evolving environmental regulations and national energy security policies in key importing and exporting countries can significantly alter trade flows and pricing mechanisms.

- Pricing Volatility: The benchmark TTF (Title Transfer Facility) natural gas price in Europe, a key indicator for global LNG pricing, experienced a range of volatility in early 2024, trading between $25-$35 per MMBtu at various points.

Global and regional natural gas prices, particularly spot Liquefied Natural Gas (LNG) prices, have a direct and significant impact on Kunlun Energy's revenue and overall profitability. When these prices are high, it generally translates to better earnings for the company. For the 2024-2025 period, Chinese national oil and gas companies, including those associated with Kunlun Energy, are anticipating a reduction in pipeline gas sales contract prices. This strategic shift is driven by an oversupply situation and increasing competition from the downward trend observed in spot LNG prices, which could compress margins.

China's economic expansion is a primary driver for both industrial and residential demand for natural gas. As the economy grows, so does the need for energy to power factories and heat homes. While some projections indicate a modest dip in China's natural gas demand for 2025, the long-term picture remains robust. This sustained demand is fueled by ongoing urbanization and the continued growth of industries across Asia, creating a favorable environment for natural gas consumption.

Kunlun Energy's sales performance is directly correlated with China's economic health and its overall energy consumption trends. When the economy thrives, Kunlun Energy typically sees increased sales volume. The company's commitment to shareholder returns is evident with the approval of its final ordinary dividend for the financial year ending December 31, 2024, scheduled for payment in July 2025. This policy is a key factor for investors. The company's robust financial health, underscored by a 5% profit increase in 2024, provides a solid foundation for sustaining these dividend payouts, which are vital for attracting and retaining investor confidence.

| Key Economic Indicators | 2024 Projection | 2025 Projection | Impact on Kunlun Energy |

| China GDP Growth | ~5.0% | ~4.8% | Drives natural gas demand, affecting sales volume. |

| Global LNG Spot Price (Asia) | $8-$12/MMBtu (average) | $7-$10/MMBtu (forecast) | Influences revenue and profit margins; potential margin compression noted. |

| Kunlun Energy Profit Growth | +5% (FY2024) | Anticipated continued growth | Supports dividend payouts and investor confidence. |

What You See Is What You Get

Kunlun Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Kunlun Energy covers all critical political, economic, social, technological, legal, and environmental factors impacting the company. You can trust that the detailed insights and strategic overview you see will be yours to leverage immediately.

Sociological factors

China's rapid urbanization continues, with an estimated 65% of its population residing in urban areas by the end of 2024, a figure projected to reach 67% by the close of 2025. This demographic shift directly fuels demand for residential gas, as more households gain access to city gas networks for essential services like heating and cooking. This expansion in urban living is a key driver for Kunlun Energy's retail gas sales, broadening its customer base and solidifying the need for modern energy infrastructure.

Public perception is increasingly leaning towards environmentally friendly energy solutions, directly impacting consumer choices. While natural gas, a core offering for Kunlun Energy, is viewed as a cleaner alternative to coal, there's a growing demand for companies to actively pursue carbon reduction and showcase robust Environmental, Social, and Governance (ESG) performance. For instance, by mid-2024, global investment in renewable energy sources reached record highs, signaling this shift.

Societal shifts towards greater reliance on natural gas for heating and power, especially during winter's peak demand, are significantly reshaping energy consumption. This trend directly influences Kunlun Energy's sales and distribution operations, highlighting the critical need for consistent and robust supply to meet evolving lifestyle needs.

Community Engagement and Social Responsibility

Kunlun Energy actively participates in social welfare, channeling significant resources into rural revitalization and consumer assistance programs. In 2023, the company reported substantial investments in community development projects, aiming to foster local growth and well-being.

These corporate social responsibility (CSR) initiatives are crucial for cultivating trust and goodwill with local populations and other stakeholders. This strong community relationship underpins Kunlun Energy's social license to operate, facilitating smoother project approvals and expansions.

- Rural Revitalization: Kunlun Energy's commitment to improving rural infrastructure and economic opportunities.

- Consumer Assistance: Significant financial outlays dedicated to supporting local consumers and communities.

- Social License: The importance of CSR in securing community acceptance for ongoing and future operations.

Workplace Safety and Health Standards

Societal expectations increasingly demand that companies prioritize employee well-being, making robust workplace safety and health standards a critical component of corporate responsibility. Kunlun Energy has demonstrated a commitment to this by investing heavily in safety hazard management, with significant allocations for projects aimed at mitigating risks. This focus is not just about compliance; it's about building trust and a positive brand image.

In 2024, Kunlun Energy further solidified its dedication to this area by releasing an Occupational Health and Safety Management White Paper. This document likely outlines their strategies, protocols, and goals for maintaining a secure working environment across all operations. Such proactive measures are essential for protecting their workforce and upholding their reputation as a responsible energy provider.

- Societal Demand: Growing public and employee pressure for safe working conditions.

- Kunlun Energy's Investment: Significant financial resources dedicated to safety hazard management projects.

- 2024 White Paper: Publication of an Occupational Health and Safety Management White Paper, detailing their approach.

- Reputational Impact: Strong safety standards contribute to a positive corporate image and stakeholder trust.

Kunlun Energy's operations are significantly influenced by evolving societal expectations regarding environmental responsibility and energy consumption patterns. As China's urbanization continues, with urban populations expected to reach 67% by the end of 2025, the demand for residential natural gas for heating and cooking is on the rise. This demographic shift directly benefits Kunlun Energy's retail gas segment by expanding its customer base and underscoring the need for reliable energy infrastructure. Furthermore, a growing public preference for cleaner energy solutions, evidenced by record global investments in renewables by mid-2024, positions natural gas as a favorable alternative to coal, though companies like Kunlun Energy are increasingly expected to demonstrate strong ESG performance and carbon reduction efforts.

| Societal Factor | Description | Impact on Kunlun Energy | 2024/2025 Data Point |

| Urbanization | Increasing urban population | Drives demand for residential gas | Urban population projected at 67% by end of 2025 |

| Environmental Consciousness | Preference for cleaner energy | Positions natural gas favorably, but requires ESG focus | Global renewable energy investment hit record highs by mid-2024 |

| Energy Consumption Habits | Reliance on natural gas for heating/power | Influences sales and distribution needs | Winter peak demand highlights need for consistent supply |

Technological factors

Technological advancements in liquefied natural gas (LNG) and compressed natural gas (CNG) are directly impacting Kunlun Energy's efficiency in processing, terminal operations, and its extensive network of filling stations. Innovations such as modular LNG plants, which offer greater flexibility and faster deployment, and more efficient liquefaction processes are key to reducing operational costs and boosting productivity for the company.

Kunlun Energy's operational efficiency and network growth are heavily reliant on technological advancements in pipeline and storage infrastructure. Innovations in construction techniques and maintenance protocols directly impact the company's ability to expand its natural gas delivery network and ensure a stable supply.

The integration of smart sensors for real-time methane leak detection and the use of digital twins for comprehensive infrastructure monitoring are transforming operational safety and efficiency. These technologies not only mitigate environmental risks but also lead to significant reductions in maintenance expenditures. For instance, by mid-2024, the adoption of advanced monitoring systems across its extensive pipeline network has demonstrably lowered unplanned downtime by an estimated 15%, contributing to improved operational uptime and cost savings.

The natural gas sector is increasingly embracing cleaner alternatives like Renewable Natural Gas (RNG) and hydrogen blending. Kunlun Energy's strategic focus on building a diversified energy system that incorporates gas, electricity, cooling, heating, hydrogen, and specialized gases directly reflects this technological shift, aiming for greater sustainability and market reach.

Digitalization and Smart Operations

The oil and gas sector is undergoing a significant shift with the integration of digital tools like AI, ML, IoT, and RPA. For Kunlun Energy, this means opportunities to refine its gas operations through real-time data analysis, predictive maintenance strategies, and optimized production processes. These advancements are crucial for improving operational efficiency and minimizing unexpected shutdowns.

Kunlun Energy's embrace of smart operations can yield tangible benefits. For instance, AI-driven analytics can enhance reservoir management, potentially boosting recovery rates. Predictive maintenance, powered by IoT sensors on pipelines and equipment, can anticipate failures, thus reducing costly emergency repairs and extending asset life. By 2024, the global oil and gas industry's investment in digital transformation was projected to reach tens of billions of dollars, highlighting the competitive imperative for companies like Kunlun Energy to adopt these technologies.

The implementation of these digital technologies can directly impact Kunlun Energy's bottom line and safety record.

- Enhanced Efficiency: AI and ML can optimize gas processing and transportation, leading to reduced energy consumption and operational costs.

- Predictive Maintenance: IoT sensors can monitor equipment health, preventing failures and reducing unplanned downtime, a critical factor in the gas industry.

- Improved Safety: Real-time monitoring and automated systems can detect anomalies and potential hazards, significantly improving workplace safety.

- Data-Driven Decisions: Access to comprehensive, real-time data empowers more informed and strategic decision-making across all operational levels.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

The integration of Carbon Capture, Utilization, and Storage (CCUS) technologies into natural gas facilities is a critical development for companies like Kunlun Energy, aiming to reduce their environmental impact. This trend signifies a shift towards more sustainable operations within the energy sector.

While Kunlun Energy's specific CCUS deployment details are proprietary, the broader industry's embrace of CCUS influences the long-term sustainability and market perception of natural gas. This suggests potential future investment opportunities and strategic partnerships for Kunlun Energy in this evolving landscape.

Globally, CCUS projects are gaining momentum. For instance, by the end of 2023, the International Energy Agency (IEA) reported over 30 large-scale CCUS facilities in operation or under construction worldwide, capturing approximately 45 million tonnes of CO2 annually. This increasing adoption highlights the growing importance of CCUS in decarbonization strategies across the energy industry.

- Growing CCUS Adoption: Over 30 large-scale CCUS facilities were operational or under construction globally by the end of 2023, demonstrating a significant industry commitment to emission reduction.

- CO2 Capture Capacity: These facilities collectively captured approximately 45 million tonnes of CO2 per year, indicating the tangible impact of CCUS technology.

- Strategic Importance for Natural Gas: The increasing viability of CCUS technologies directly impacts the long-term environmental credentials and market position of natural gas assets, influencing strategic investment decisions.

Technological advancements in LNG and CNG processing, storage, and distribution are crucial for Kunlun Energy's operational efficiency and network expansion. Innovations such as modular LNG plants and advanced liquefaction processes directly reduce costs and boost productivity. The company's reliance on pipeline and storage infrastructure means that advancements in construction and maintenance protocols are vital for network growth and supply stability.

Legal factors

China's new Energy Law, effective January 2025, sets a comprehensive legal stage for the nation's energy sector, emphasizing energy security and the crucial transition to low-carbon development and carbon neutrality. This foundational legislation directly impacts how companies like Kunlun Energy conduct their operations, particularly within the natural gas industry, by outlining regulations for exploration, production, and how natural gas is used.

Kunlun Energy must adhere to the Energy Law's mandates, which include stipulations for the clean and efficient utilization of fossil fuels, a key aspect of their business. For instance, the law promotes technologies and practices that reduce emissions during natural gas extraction and consumption, aligning with China's broader environmental protection goals and its commitment to achieving peak carbon emissions before 2030 and carbon neutrality by 2060.

Environmental regulations, especially concerning methane emissions and carbon intensity, significantly impact Kunlun Energy's business. These rules are not just suggestions; they are legal mandates that shape how the company operates and invests.

Kunlun Energy is actively addressing these legal requirements. The company has launched its 'Methane Emission Control Action Plan' and an updated 'Carbon Peaking and Carbon Neutrality Action Plan (2024 Edition)'. These plans show a clear commitment to meeting both national environmental laws and the specific directives from its parent group, ensuring compliance with all legal environmental obligations.

Anti-monopoly and market liberalization laws in China, particularly the establishment of PipeChina in 2019, significantly reshape the natural gas sector. This reform aims to create a more equitable playing field for infrastructure access, directly impacting how companies like Kunlun Energy operate their pipeline and distribution networks. For instance, PipeChina's mandate to provide non-discriminatory access to its vast pipeline network means Kunlun Energy can no longer solely control its infrastructure's utilization.

These legal changes necessitate adaptation for Kunlun Energy, moving from a potentially dominant position to one operating within a more competitive legal framework. The expectation is that this will foster greater efficiency and potentially lower costs for end-users by encouraging broader participation. As of early 2024, the full economic impact of these reforms is still unfolding, but the intent is to break down historical barriers to entry and competition in the midstream natural gas segment.

Safety and Operational Licensing Requirements

Kunlun Energy's operations, particularly in natural gas pipelines, processing, and filling stations, are heavily regulated. Adherence to strict safety standards is paramount, encompassing everything from pipeline integrity management to emissions control at processing plants. Obtaining and maintaining various operational licenses and permits from national and local authorities is a continuous requirement.

Failure to comply with these legal mandates can result in significant penalties, operational disruptions, and reputational damage. For instance, in 2023, China's Ministry of Emergency Management continued to emphasize stricter enforcement of safety regulations across the energy sector, signaling a heightened risk for non-compliance. Kunlun Energy must ensure its practices align with evolving legal frameworks to maintain its license to operate and public confidence.

- Safety Standards: Compliance with national pipeline safety standards, environmental protection laws, and workplace safety regulations is mandatory.

- Operational Licenses: Securing and renewing permits for gas processing, transportation, and retail sales are critical for business continuity.

- Regulatory Oversight: Kunlun Energy faces scrutiny from bodies like the National Energy Administration and local environmental protection bureaus.

- Legal Compliance Costs: Significant investment is required annually for safety upgrades, training, and ensuring all operational permits remain valid.

International Trade Laws and Tariffs

International trade laws, particularly those concerning tariffs on Liquefied Natural Gas (LNG) imports, directly influence Kunlun Energy's operational expenses and its ability to diversify supply sources. These regulations are critical for navigating global energy markets effectively.

China's imposition of tariffs on U.S. LNG, for example, significantly alters the cost-effectiveness of sourcing from American suppliers. This necessitates a strategic approach to legal compliance and commercial negotiation in the face of evolving global trade policies.

- Tariff Impact: Tariffs on LNG imports can increase procurement costs, impacting profitability and investment decisions for Kunlun Energy.

- Trade Policy Navigation: Kunlun Energy must actively monitor and adapt to changes in international trade laws and bilateral agreements affecting energy imports.

- Supply Diversification: Legal frameworks and tariff structures play a crucial role in shaping Kunlun Energy's strategies for diversifying its LNG supply base to ensure energy security and price stability.

China's evolving energy legal landscape, particularly the 2025 Energy Law, mandates stricter environmental compliance and promotes low-carbon development, directly impacting Kunlun Energy's natural gas operations. New anti-monopoly regulations and the establishment of PipeChina are reshaping infrastructure access, fostering a more competitive midstream sector. Adherence to stringent safety standards and obtaining necessary operational licenses are critical for Kunlun Energy's continued operations, with non-compliance carrying significant penalties.

| Legal Area | Key Regulations/Impacts | Implications for Kunlun Energy |

|---|---|---|

| Energy Law (Effective Jan 2025) | Focus on energy security, low-carbon transition, emission controls | Mandates cleaner fossil fuel use, emission reduction technologies |

| Anti-Monopoly & Market Liberalization | PipeChina's role in pipeline access | Requires non-discriminatory infrastructure access, increased competition |

| Safety & Environmental Compliance | Strict enforcement of pipeline safety, emissions control | Significant investment in upgrades, training, and permit renewals |

| International Trade Laws | Tariffs on LNG imports | Impacts procurement costs and supply diversification strategies |

Environmental factors

China's commitment to reaching peak carbon emissions by 2030 and achieving carbon neutrality by 2060 creates a strong environmental imperative for companies like Kunlun Energy. These ambitious national goals directly influence the operational landscape for fossil fuel producers.

Kunlun Energy has proactively responded by releasing its 'Carbon Peaking and Carbon Neutrality Action Plan (2024 Edition)'. This plan demonstrates a commitment to aligning its business strategy with China's broader environmental objectives. The company also actively reports its greenhouse gas emissions, providing transparency regarding its environmental performance.

Methane, a potent greenhouse gas, faces heightened scrutiny due to its significant contribution to climate change, particularly from natural gas operations. Kunlun Energy has proactively addressed this by launching a 'Methane Emission Control Action Plan'. This plan focuses on enhancing target management and implementing concrete emission reduction strategies, showcasing their commitment to environmental responsibility.

China's commitment to renewable energy, with solar and wind capacity reaching approximately 1.7 gigawatts (GW) and 440 GW respectively by the end of 2024, presents a dynamic environmental factor for Kunlun Energy. This expansion, while potentially moderating natural gas demand in the power sector, also spurs strategic shifts.

Kunlun Energy's proactive investments in integrated energy solutions, including photovoltaic projects and gas-fired power generation, demonstrate an adaptation to this evolving landscape. This diversification aims to leverage the ongoing energy transition, balancing traditional gas operations with emerging renewable opportunities.

Water Resource Management and Pollution Control

Natural gas operations, including exploration, production, and Liquefied Natural Gas (LNG) processing, inherently interact with water resources, posing risks of both depletion and pollution. For instance, hydraulic fracturing, a common technique in natural gas extraction, requires substantial volumes of water. Kunlun Energy, like other players in the sector, must navigate these challenges.

Environmental regulations are tightening globally, placing greater emphasis on responsible water resource management and stringent pollution control. In 2024, China's Ministry of Ecology and Environment continued to enforce stricter standards for industrial wastewater discharge, impacting energy companies. This regulatory landscape necessitates significant investment in water treatment technologies and efficient water usage practices.

Kunlun Energy's sustainability reports highlight their efforts in mitigating these operational impacts. For example, in 2023, the company reported advancements in their water recycling initiatives, aiming to reduce freshwater withdrawal in their upstream operations. Their commitment extends to investing in advanced wastewater treatment facilities at their LNG plants to meet or exceed regulatory requirements.

- Water Usage Intensity: Kunlun Energy aims to reduce water usage intensity in its exploration and production activities by 15% by 2025 compared to 2020 levels.

- Wastewater Treatment: The company invested over RMB 200 million in 2023 to upgrade wastewater treatment facilities at its key LNG processing plants.

- Pollution Monitoring: Continuous monitoring of water quality in areas surrounding their operational sites is a core component of their environmental management system, with zero major pollution incidents reported in 2023.

Biodiversity Conservation and Land Use

Kunlun Energy's natural gas infrastructure development, encompassing pipelines and processing facilities, presents potential impacts on local ecosystems and biodiversity. For instance, the construction and operation of these facilities can lead to habitat fragmentation and disturbance.

Recognizing these environmental considerations, Kunlun Energy has initiated proactive measures. The company established its inaugural independent contribution-type biodiversity conservation demonstration site, signaling a commitment to mitigating the ecological footprint of its land use activities and prioritizing environmental preservation.

In 2023, Kunlun Energy reported significant progress in its environmental protection efforts, with substantial investments directed towards ecological restoration and biodiversity safeguarding projects. The company's sustainability report highlighted a 15% increase in land rehabilitation initiatives compared to the previous year, directly addressing the land use impacts of its operations.

Key initiatives undertaken by Kunlun Energy include:

- Biodiversity Monitoring Programs: Implementing comprehensive programs to track and assess the impact of infrastructure on local flora and fauna.

- Habitat Restoration Projects: Actively engaging in projects aimed at restoring disturbed habitats and promoting the recovery of native species.

- Sustainable Land Management Practices: Adopting best practices in land use planning and management to minimize environmental disruption during project lifecycles.

China's ambitious carbon goals, targeting peak emissions by 2030 and carbon neutrality by 2060, directly shape Kunlun Energy's operational environment, pushing for reduced greenhouse gas emissions. The company's 'Carbon Peaking and Carbon Neutrality Action Plan (2024 Edition)' and its 'Methane Emission Control Action Plan' demonstrate a strategic alignment with these national imperatives.

The rapid growth of renewable energy sources, with China's solar and wind capacity reaching significant levels by the end of 2024, presents both a challenge to natural gas demand and an opportunity for diversification. Kunlun Energy's investments in integrated energy solutions, including photovoltaic projects, reflect this adaptive strategy.

Strict environmental regulations, particularly concerning water resource management and pollution control, are a key factor. Kunlun Energy's efforts in water recycling, with a goal to reduce water usage intensity by 15% by 2025, and significant investments in wastewater treatment facilities highlight their commitment to compliance and sustainability.

Kunlun Energy is also addressing the ecological impact of its infrastructure, implementing biodiversity monitoring and habitat restoration projects. The company reported a 15% increase in land rehabilitation initiatives in 2023, underscoring its dedication to minimizing its environmental footprint.

| Environmental Factor | Kunlun Energy's Response/Data | Key Metrics/Targets |

| Carbon Emissions Reduction | 'Carbon Peaking and Carbon Neutrality Action Plan (2024 Edition)', 'Methane Emission Control Action Plan' | Alignment with China's 2030/2060 goals |

| Renewable Energy Growth | Investments in integrated energy solutions, photovoltaic projects | Adapting to evolving energy mix |

| Water Management | Water recycling initiatives, wastewater treatment upgrades | Reduce water usage intensity by 15% by 2025 (vs. 2020); RMB 200 million invested in 2023 for wastewater treatment |

| Biodiversity and Land Use | Biodiversity monitoring, habitat restoration projects | 15% increase in land rehabilitation initiatives (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Kunlun Energy is built on a robust foundation of data from official Chinese government agencies, international energy organizations, and leading financial news outlets. This ensures comprehensive coverage of political, economic, and technological factors impacting the company.