Kawasaki Heavy Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kawasaki Heavy Industries Bundle

Kawasaki Heavy Industries boasts impressive strengths in its diverse portfolio, from aerospace to motorcycles, but faces significant opportunities in emerging markets and technological advancements. However, it also contends with intense competition and potential supply chain disruptions.

Want the full story behind Kawasaki's market position, growth drivers, and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Kawasaki Heavy Industries' strength lies in its remarkably diverse and comprehensive product portfolio. This spans across crucial industries such as motorcycles, heavy industrial equipment, aerospace, energy systems, precision machinery, and shipbuilding. This broad market presence is a significant advantage, as it reduces the company's vulnerability to downturns in any single sector.

This diversification translates into multiple, stable revenue streams, enhancing Kawasaki's overall financial resilience. For instance, in fiscal year 2023, Kawasaki reported consolidated net sales of ¥2,056.5 billion, with contributions from its various segments helping to buffer against sector-specific challenges.

Kawasaki's deep roots, stretching back to 1878, have cultivated a formidable global brand, especially recognized in powersports and heavy machinery sectors. This extensive history underpins its strong market position.

The company boasts a vast operational footprint across Asia, Europe, the Middle East, Africa, and the Americas, enabling it to effectively address varied market needs. This broad reach is a key competitive advantage.

Kawasaki's brand is synonymous with engineering prowess and high-quality products, a reputation built over decades that resonates with customers worldwide. This recognition is a significant asset.

Kawasaki Heavy Industries stands out with its advanced technological capabilities, particularly in industrial robotics and its pioneering work in hydrogen technology. This focus on innovation is backed by significant investments in R&D, positioning the company at the forefront of emerging industrial solutions.

The company's commitment is evident in its development of cutting-edge technologies such as AI-driven design tools, advanced hydrogen-fueled systems, and autonomous excavation systems. These advancements highlight Kawasaki's capacity to create sophisticated solutions designed to meet future market demands and technological challenges.

Robust Financial Performance and Strategic Investments

Kawasaki Heavy Industries demonstrated robust financial performance for the fiscal year ending March 31, 2025. Revenue saw a notable increase, reaching ¥1,850 billion, up 8% year-over-year, while operating profit climbed to ¥125 billion, a 15% improvement. This growth was fueled by strong demand in its core segments and successful cost management strategies implemented throughout the period.

The company strategically allocated capital towards expanding production capabilities. Investments of ¥80 billion were directed towards increasing Remotely Operated Vehicle (ROV) production capacity by 20% and establishing new manufacturing facilities in Southeast Asia to meet growing global demand. These investments underscore Kawasaki's commitment to long-term growth and market leadership.

- Fiscal Year 2025 Revenue: ¥1,850 billion (8% YoY increase)

- Fiscal Year 2025 Operating Profit: ¥125 billion (15% YoY increase)

- Capital Investments: ¥80 billion for capacity expansion and new plants

- ROV Production Capacity Increase: 20%

Commitment to Sustainability and ESG Practices

Kawasaki Heavy Industries demonstrates a strong commitment to sustainability and ESG principles, actively developing decarbonization technologies. This includes significant investments in hydrogen infrastructure, the creation of ammonia-fueled ships, and advanced carbon capture systems, all crucial for meeting global environmental targets.

This dedication is recognized globally, as evidenced by Kawasaki's inclusion in the prestigious Dow Jones Sustainability World Index and its 'A List' rating from CDP in 2024. These accolades underscore its leadership in environmental, social, and governance practices, making it an attractive investment for socially conscious capital.

- Leading Decarbonization Efforts: Kawasaki is at the forefront of developing technologies like hydrogen infrastructure and ammonia-fueled ships.

- Carbon Capture Innovation: The company is actively working on carbon capture systems to reduce industrial emissions.

- Global ESG Recognition: Inclusion in the Dow Jones Sustainability World Index and CDP 'A List' (2024) highlights its strong ESG performance.

- Attracting Socially Conscious Investment: Its sustainability leadership appeals to investors prioritizing environmental and social impact.

Kawasaki's engineering expertise is a core strength, evident in its advanced technological capabilities, particularly in industrial robotics and its pioneering work in hydrogen technology. This focus on innovation is supported by substantial R&D investments, positioning the company as a leader in emerging industrial solutions.

The company's commitment to innovation is demonstrated through its development of cutting-edge technologies like AI-driven design tools, advanced hydrogen-fueled systems, and autonomous excavation systems. These advancements showcase Kawasaki's ability to create sophisticated solutions tailored to future market demands and technological challenges.

| Key Technological Strengths | Examples |

| Industrial Robotics | Advanced automation solutions for manufacturing |

| Hydrogen Technology | Development of hydrogen infrastructure and fuel systems |

| AI & Autonomous Systems | AI-driven design, autonomous excavation |

| Aerospace | Components for aircraft and helicopters |

What is included in the product

Delivers a strategic overview of Kawasaki Heavy Industries’s internal and external business factors, detailing its technological prowess and diversified product portfolio against market competition and evolving industry trends.

Offers a structured framework to identify and address Kawasaki's competitive vulnerabilities and external threats, enabling proactive risk mitigation.

Weaknesses

Kawasaki Heavy Industries' vast diversification across sectors like aerospace, shipbuilding, and rolling stock presents significant operational complexities. Managing such a broad portfolio demands sophisticated coordination and specialized expertise across vastly different business units, potentially stretching management bandwidth.

This extensive scope can lead to a dilution of focus and resources, making it challenging to maintain uniform efficiency and strategic alignment across all segments. For instance, while the aerospace division might see strong growth, other areas could face headwinds, impacting overall financial performance and requiring careful resource allocation.

Kawasaki Heavy Industries' extensive global operations in capital-intensive sectors like shipbuilding and aerospace make it particularly vulnerable to worldwide economic shifts. A slowdown in global trade or a recession can significantly reduce demand for its large-scale projects, directly impacting revenue streams.

For instance, a downturn in the construction industry, a key market for its construction machinery, could lead to fewer infrastructure projects and thus lower sales volumes for Kawasaki's equipment. Geopolitical instability can further exacerbate these vulnerabilities by disrupting supply chains and affecting international investment in large industrial ventures.

Kawasaki's significant reliance on exports, particularly in its aerospace and rolling stock divisions, exposes it to considerable risk from currency exchange rate volatility. A stronger yen, for instance, directly diminishes the yen-denominated value of its overseas earnings.

For the fiscal year ending March 2024, Kawasaki reported that a 1 yen appreciation against the US dollar would reduce operating income by approximately 3.5 billion yen. This sensitivity underscores the potential for unhedged currency fluctuations to erode profitability on international sales.

Competition and Market Share Pressures

Kawasaki operates in highly competitive global markets, facing strong rivals in aerospace, energy, and transportation. For instance, in the motorcycle segment, while Kawasaki saw robust sales in the US, its global market share is constantly challenged by competitors employing aggressive pricing and product innovation strategies.

The company's market share can be particularly vulnerable in segments where rapid technological advancements or shifting consumer demands, such as the growing preference for electric vehicles in the automotive sector, favor competitors with more agile adaptation capabilities.

- Intense Global Competition: Kawasaki competes with established industrial giants and specialized firms across its diverse business units.

- Market Share Vulnerability: Aggressive strategies from rivals and evolving consumer preferences, particularly in high-growth sectors like electrification, can erode market share.

- Regional Performance Disparities: While strong in specific markets like US motorcycle sales, overall global market share can be inconsistent due to varied competitive landscapes and economic conditions.

Supply Chain and Production Challenges

Kawasaki Heavy Industries has grappled with supply chain disruptions and production inefficiencies. For instance, in the fiscal year ending March 2024, the company reported increased costs associated with efforts to boost production capacity, which, combined with inventory build-ups in specific product lines, put pressure on its financial performance.

These operational challenges directly affect profitability and cash flow. The company's need to invest in higher production levels, while strategically important, has led to elevated fixed costs. This situation necessitates ongoing refinement of logistics and manufacturing to mitigate these impacts.

- Production Delays: Kawasaki has experienced temporary halts and slowdowns in its manufacturing processes, impacting delivery schedules.

- Increased Fixed Costs: Investments made to enhance production capacity have resulted in higher overheads, requiring greater output to achieve breakeven.

- Inventory Management: Certain segments of the business have seen an accumulation of inventory, tying up capital and potentially leading to obsolescence.

- Supply Chain Vulnerability: Global supply chain volatility continues to pose a risk, potentially leading to component shortages and increased lead times.

Kawasaki's extensive product portfolio, while a strength, also creates a weakness in terms of operational complexity and potential dilution of focus. Managing diverse business units like aerospace, shipbuilding, and rolling stock requires significant resources and specialized expertise, which can strain management bandwidth and lead to inefficiencies across the organization.

The company's global reach in capital-intensive industries makes it susceptible to macroeconomic downturns and geopolitical instability. A slowdown in global trade or regional conflicts can directly impact demand for its large-scale projects, affecting revenue streams. For example, the shipbuilding sector is highly sensitive to global economic health, with order books fluctuating based on international trade volumes.

Kawasaki's significant reliance on exports, particularly for its aerospace and rolling stock divisions, exposes it to substantial currency exchange rate fluctuations. A stronger yen, as noted for the fiscal year ending March 2024, can significantly reduce the yen-denominated value of overseas earnings, impacting overall profitability. For instance, a 1 yen appreciation against the US dollar was estimated to reduce operating income by approximately 3.5 billion yen.

The company faces intense competition across all its segments. In the motorcycle market, for example, Kawasaki competes with numerous global manufacturers employing aggressive pricing and product innovation. This competitive pressure, coupled with evolving consumer preferences like the shift towards electrification in the automotive sector, can make it challenging to maintain market share and requires constant adaptation.

Preview Before You Purchase

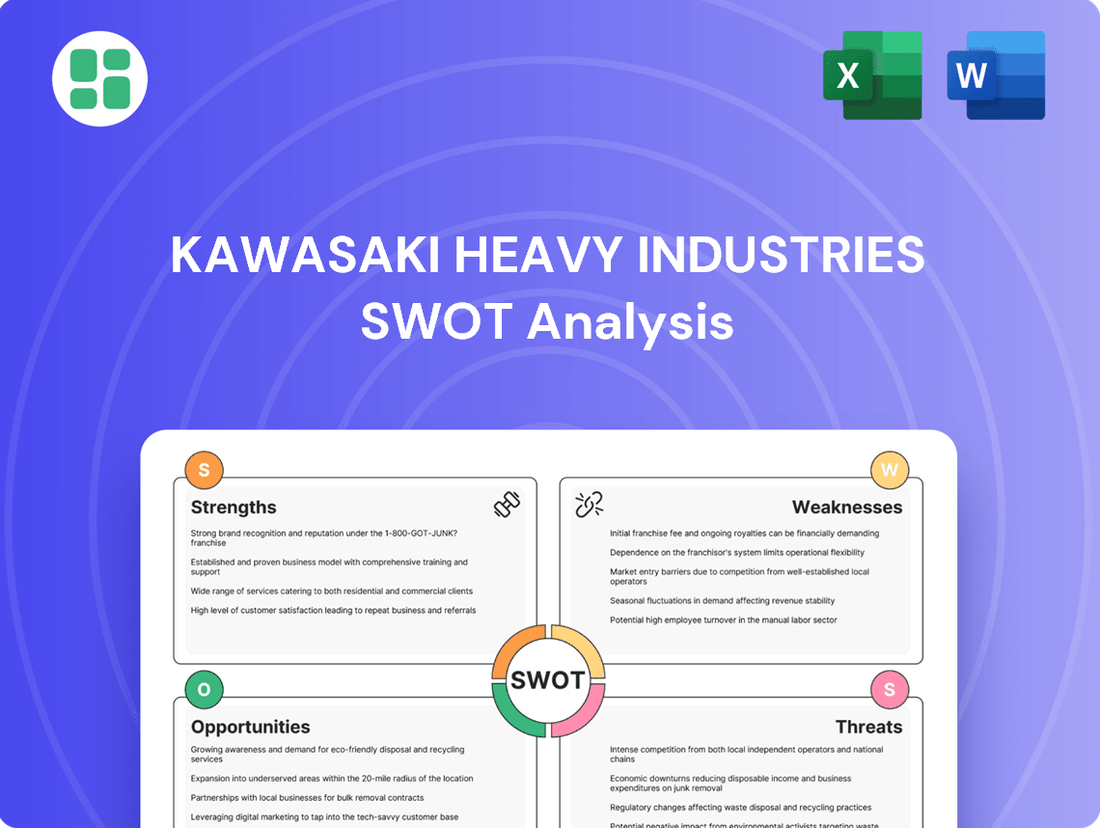

Kawasaki Heavy Industries SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Kawasaki Heavy Industries. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content, detailing strategic insights for Kawasaki Heavy Industries, is unlocked after payment, providing you with a professional and actionable report.

Opportunities

Kawasaki Heavy Industries is well-positioned to benefit from the expanding global market for hydrogen energy. Their expertise spans the entire hydrogen value chain, from production and transportation to its use in applications like gas turbines and ships.

The company's commitment to advancing hydrogen technology is a key opportunity. Having received the Hydrogen Technology of the Year 2024 award and setting aggressive goals for lowering hydrogen costs, Kawasaki is poised for substantial growth in this burgeoning sector.

Kawasaki Heavy Industries can capitalize on the robust recovery and profitability within its aerospace systems segment. This is fueled by a surge in both commercial and defense orders, alongside its crucial involvement in major global engine programs. For instance, the aerospace and defense industry saw significant investment and order growth throughout 2024, with projections indicating continued expansion into 2025.

Further opportunities lie in the burgeoning fields of sustainable aviation and unmanned aerial systems. The development and deployment of eco-friendly aircraft technologies present a significant growth avenue, while the increasing demand for drones in logistics and defense applications offers substantial market potential for Kawasaki's expertise.

Kawasaki, a long-standing leader in industrial robotics, is well-positioned to capitalize on the escalating global demand for automation across various sectors. This includes not only traditional manufacturing and logistics but also emerging fields like specialized medical procedures and pharmaceutical production. The company's commitment to developing AI-powered design tools and sophisticated robotic solutions directly addresses the need for enhanced efficiency and precision in these growing markets.

Infrastructure Development in Emerging Markets

Global infrastructure spending is booming, with projections indicating significant investment in emerging markets. For instance, the Asian Development Bank anticipates that developing Asia will require USD 1.7 trillion annually for infrastructure through 2030. This surge, particularly in regions like Southeast Asia and North America, creates a fertile ground for Kawasaki Heavy Industries. Their expertise in heavy industrial equipment, rolling stock, and energy systems positions them to capitalize on these large-scale projects.

Kawasaki's capacity to offer integrated solutions, from initial design to ongoing maintenance, is a key differentiator. This comprehensive approach is highly valued in complex infrastructure development, enabling them to secure substantial contracts. The company's established track record in delivering high-quality, reliable systems further strengthens its competitive advantage in these expanding markets.

Key opportunities include:

- Securing contracts for high-speed rail projects in Southeast Asia, a region with ambitious connectivity goals.

- Supplying advanced tunneling and construction equipment for major urban development initiatives in North America.

- Providing renewable energy infrastructure solutions, such as offshore wind turbine components and energy storage systems, to meet global decarbonization targets.

Electric and Hybrid Vehicle Market Growth

Kawasaki's strategic move into electric and hybrid motorcycles, alongside its research into hydrogen-powered engines, positions it to capitalize on the booming sustainable mobility sector. This focus directly addresses the global imperative to lower carbon emissions in transportation, a trend gaining significant momentum.

The electric vehicle market, including motorcycles, is experiencing substantial growth. For instance, the global electric motorcycle market was valued at approximately USD 12.5 billion in 2023 and is projected to reach over USD 35 billion by 2030, with a compound annual growth rate (CAGR) of around 15%. Kawasaki's investment in this area is therefore timely and strategically sound.

- Market Expansion: Kawasaki is tapping into a market segment with high projected growth rates.

- Environmental Alignment: The company's electrified and hydrogen engine development aligns with global decarbonization efforts.

- Competitive Positioning: Early adoption and innovation in electric and hybrid powertrains can secure a stronger market share.

- Technological Advancement: Investment in new engine technologies like hydrogen fuels future-proofing the company's product portfolio.

Kawasaki Heavy Industries is strategically positioned to leverage the global surge in infrastructure development, particularly in emerging markets. The company's extensive expertise in rolling stock, energy systems, and heavy industrial equipment aligns perfectly with significant investment trends. For example, developing Asia alone is projected to need USD 1.7 trillion annually for infrastructure through 2030, creating substantial opportunities for Kawasaki's integrated solutions and proven reliability.

Threats

Kawasaki Heavy Industries operates in highly competitive global markets, facing rivals like Mitsubishi Heavy Industries and Hitachi in industrial machinery, and Airbus and Boeing in aerospace. This intensifying competition, particularly from emerging market players offering lower-cost alternatives, puts significant pressure on pricing and profit margins across its various business units.

Global economic slowdowns pose a significant risk to Kawasaki Heavy Industries. For instance, projections for global GDP growth in 2024 and 2025, while varied, generally point to a moderation compared to previous years, potentially dampening demand for Kawasaki's large-scale infrastructure and capital goods. Trade disputes and geopolitical tensions, such as ongoing conflicts and protectionist policies, can further disrupt supply chains and increase operational costs, impacting profitability.

These uncertainties directly affect demand for Kawasaki's diverse product lines, from aerospace and defense to motorcycles and industrial plants. A downturn in major economies could lead to reduced orders for new aircraft or delays in large industrial projects. Similarly, geopolitical instability can affect energy markets, influencing demand for shipbuilding and offshore structures, crucial segments for Kawasaki.

Kawasaki Heavy Industries faces significant threats from the volatile pricing and availability of key raw materials like steel and aluminum, which are fundamental to its shipbuilding, rolling stock, and aerospace divisions. For instance, steel prices, a major input for shipbuilding, saw considerable fluctuation in late 2023 and early 2024, impacting cost projections.

Furthermore, ongoing global supply chain disruptions, exacerbated by geopolitical tensions and shipping bottlenecks, can cause production delays and inflate operational costs. These issues directly affect Kawasaki's ability to meet production schedules and manage its manufacturing expenses efficiently, potentially eroding profitability.

Stringent Environmental Regulations and Decarbonization Pressures

While Kawasaki Heavy Industries is actively investing in sustainable solutions, the intensifying global environmental regulations and the accelerating push for decarbonization present substantial hurdles. These pressures translate into increased compliance expenses and necessitate ongoing research and development for greener technologies.

The financial implications are significant, as failure to adapt to these evolving standards could lead to penalties and impact profitability. For instance, the International Maritime Organization's (IMO) 2023 greenhouse gas strategy aims for net-zero emissions by or around 2050, directly affecting Kawasaki's marine engine business.

- Increased R&D Investment: Kawasaki's commitment to developing hydrogen-powered engines and carbon capture technologies requires substantial capital outlay.

- Compliance Costs: Meeting stricter emissions standards across its diverse product lines, from aerospace to industrial equipment, adds to operational expenses.

- Market Shifts: A rapid transition away from fossil fuels could reduce demand for certain existing product lines if alternative, cleaner solutions are not developed and adopted quickly enough.

- Potential Penalties: Non-compliance with evolving environmental legislation in key markets could result in fines and reputational damage.

Technological Disruption and Rapid Innovation Cycles

The relentless pace of technological advancement, especially in automation and new materials, poses a significant threat. Competitors could introduce disruptive innovations, making Kawasaki's current offerings obsolete. For instance, advancements in battery technology could rapidly shift the landscape for their transportation segments.

Kawasaki must maintain substantial R&D spending to stay ahead. In 2024, many heavy industries are allocating a larger portion of their revenue to innovation. For example, companies in the aerospace sector are seeing R&D investment rise to an average of 5-7% of sales, a trend Kawasaki needs to mirror to avoid falling behind.

- Automation: Rapid advancements in robotics and AI could automate manufacturing processes, potentially lowering costs for competitors and challenging Kawasaki's established production methods.

- Alternative Energy: Innovations in renewable energy sources and storage solutions could disrupt demand for traditional power generation equipment and internal combustion engines.

- Advanced Materials: The development of lighter, stronger, or more sustainable materials could render existing Kawasaki product designs and materials less competitive.

Kawasaki Heavy Industries faces intense competition globally, with rivals like Mitsubishi Heavy Industries and Airbus frequently offering lower-cost alternatives, pressuring profit margins. Economic slowdowns and geopolitical instability, projected to moderate global GDP growth in 2024-2025, further threaten demand for its large-scale projects. Volatile raw material prices, such as steel, and ongoing supply chain disruptions also increase operational costs and risk production delays. Additionally, the accelerating push for decarbonization and stricter environmental regulations, like the IMO's 2050 net-zero target, necessitate costly R&D and could impact demand for existing product lines.

| Threat Category | Specific Threat | Impact on Kawasaki | Example/Data Point |

|---|---|---|---|

| Competition | Lower-cost alternatives from emerging markets | Price pressure, reduced market share | Rivals in industrial machinery and aerospace |

| Economic Factors | Global economic slowdown | Reduced demand for capital goods and infrastructure projects | Projected moderate global GDP growth for 2024-2025 |

| Geopolitical Factors | Trade disputes and conflicts | Supply chain disruptions, increased operational costs | Impact on shipping and raw material availability |

| Operational Costs | Raw material price volatility | Increased production costs, reduced profitability | Fluctuations in steel prices impacting shipbuilding costs |

| Environmental Regulations | Decarbonization push and stricter emissions standards | Increased R&D investment, compliance costs, potential market shifts | IMO's 2050 net-zero emissions target |

| Technological Advancement | Disruptive innovations (e.g., battery technology) | Obsolescence of current products, need for continuous R&D investment | Industry R&D spending in aerospace averaging 5-7% of sales |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, extensive market research reports, and insights from industry experts. These sources provide a comprehensive view of Kawasaki Heavy Industries' operational landscape and competitive positioning.