Kawasaki Heavy Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kawasaki Heavy Industries Bundle

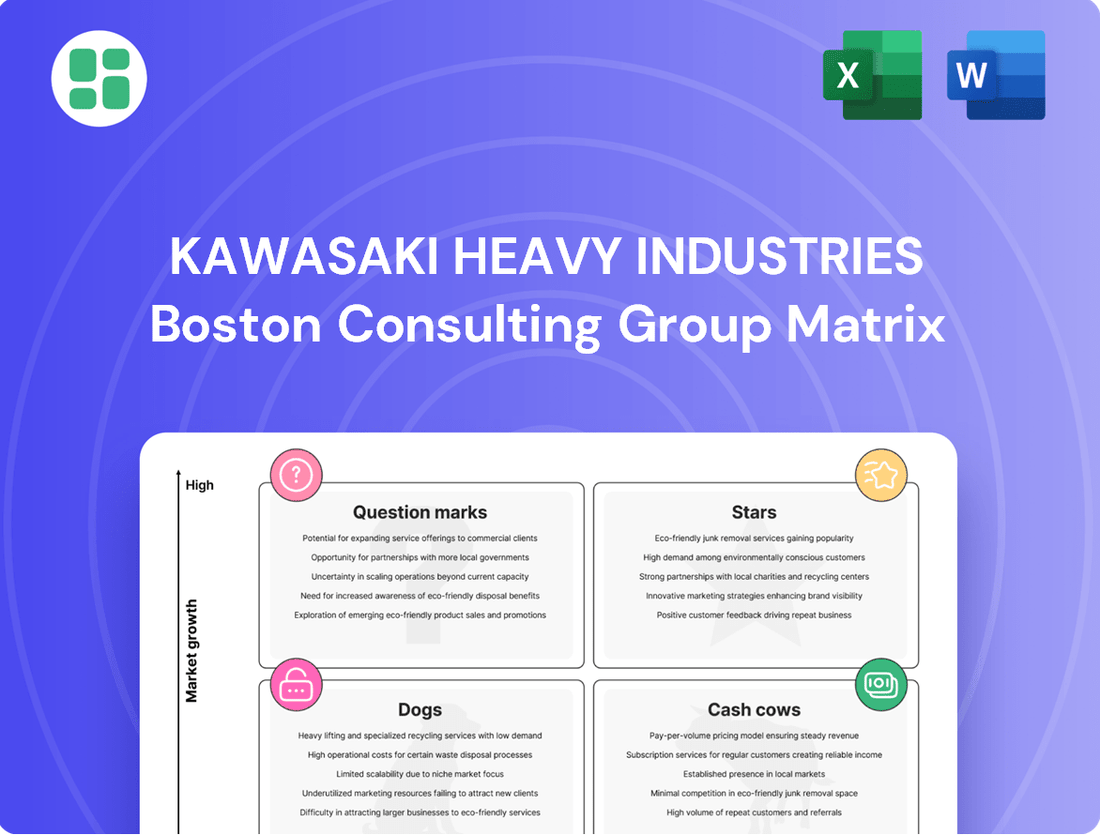

Curious about Kawasaki Heavy Industries' product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their market dynamics and unlock actionable insights for investment and product development, dive into the full report.

The complete BCG Matrix for Kawasaki Heavy Industries offers a detailed quadrant-by-quadrant breakdown, complete with data-backed recommendations. Equip yourself with a clear roadmap for smart investment decisions and strategic product management by purchasing the full version today.

Don't just wonder where Kawasaki Heavy Industries' products stand – know it. The full BCG Matrix provides the critical clarity you need to navigate this competitive landscape, offering quadrant-specific insights and strategic takeaways that will accelerate your decision-making.

Stars

Kawasaki Heavy Industries' Aerospace Systems segment is a strong performer, demonstrating significant growth and contributing substantially to the company's overall financial health. This segment has bounced back effectively from previous challenges, now representing a key revenue driver.

The Aerospace Systems division has secured increased orders from major clients, including the Ministry of Defense and Boeing. This surge in demand highlights the segment's robust market position within the rapidly expanding aerospace sector.

The exceptional performance of the Aerospace Systems segment is a primary reason behind Kawasaki Heavy Industries achieving record-high revenues and profits in fiscal year 2025, underscoring its importance to the company's success.

Kawasaki Heavy Industries holds a dominant position in the U.S. motorcycle market. In early 2025, the company saw a significant 23.7% surge in sales, outperforming key rivals such as Honda and Harley-Davidson. This robust growth, fueled by strong demand for their sport and adventure bike segments, underscores Kawasaki's substantial market share in this crucial region for powersports.

Kawasaki Heavy Industries is seeing impressive motorcycle sales growth beyond the United States, particularly in Europe. In 2024, Europe experienced a significant 20.6% surge in sales, demonstrating Kawasaki's strong market penetration in this key region.

Latin America is also a bright spot for Kawasaki's motorcycle division, showing robust growth. This expansion into diverse geographical markets underscores Kawasaki's strategic success in capturing market share in areas with high demand for motorcycles.

Industrial Robots

Kawasaki Heavy Industries' industrial robots are firmly positioned as Stars within its BCG Matrix. This segment has demonstrated consistent revenue expansion from fiscal year 2021 through the projected fiscal year 2025. This growth is fueled by a robust demand for factory automation solutions, particularly within the automotive and electronics sectors.

The broader global robotics market is experiencing substantial expansion, with projections indicating continued strong performance. This favorable market environment directly benefits Kawasaki's robotics division, highlighting its status as a high-growth, high-potential area for the company.

- Strong Revenue Growth: Kawasaki's industrial robots have seen steady revenue increases from FY2021 to FY2025.

- Driving Demand: Increased demand for factory automation across automotive and electronics industries is a key growth driver.

- Market Potential: The global robotics market's projected significant growth positions Kawasaki's offerings favorably.

- Star Performer: The combination of steady growth and a high-growth market solidifies its Star status.

Recreational Off-highway Vehicles (ROV) in North America

Kawasaki's Recreational Off-highway Vehicles (ROV) segment in North America is a significant contributor to its earnings. The company is backing this segment with substantial investment, planning to spend over JPY30 billion by 2025 to double its production capacity.

This aggressive expansion is a clear indicator of Kawasaki's confidence in the ROV market's future growth. The industry as a whole is expected to expand, and Kawasaki aims to capitalize on this trend.

Kawasaki holds a strong market position within this growing recreational vehicle sector. This high market share, combined with anticipated industry-wide expansion, positions the ROV business as a strong performer for Kawasaki.

- North American ROV Market Growth: The recreational off-highway vehicle market in North America is experiencing robust expansion, driven by increasing consumer interest in outdoor activities and adventure.

- Kawasaki's Investment: Kawasaki Heavy Industries is committing over JPY30 billion by 2025 to double its ROV production capacity, underscoring its strategic focus on this segment.

- Market Share: Kawasaki maintains a significant market share within the North American ROV industry, benefiting from its established brand and product offerings.

- Industry Outlook: The company's investment strategy is aligned with projections of continued industry-wide growth in the recreational vehicle sector.

Kawasaki's industrial robots are a prime example of a Star in its BCG Matrix. This segment has consistently shown strong revenue growth from FY2021 through the projected FY2025, driven by high demand for factory automation in sectors like automotive and electronics.

The global robotics market itself is expanding significantly, providing a fertile ground for Kawasaki's offerings. This combination of internal growth and a favorable external market solidifies the industrial robot division's status as a Star performer.

Kawasaki's Recreational Off-highway Vehicles (ROV) segment in North America is also a strong contender, showing robust growth and benefiting from increased consumer interest in outdoor activities. The company's commitment to doubling production capacity by 2025 with over JPY30 billion in investment highlights its strategic bet on this high-growth market.

This strategic investment is backed by Kawasaki's significant market share in the North American ROV industry, positioning it to capitalize on projected industry-wide expansion. The ROV business is therefore a key growth engine for Kawasaki.

| Business Segment | Market Growth | Relative Market Share | BCG Matrix Status |

|---|---|---|---|

| Aerospace Systems | High | High | Star |

| Motorcycles (US) | High | High | Star |

| Motorcycles (Europe) | High | High | Star |

| Motorcycles (Latin America) | High | High | Star |

| Industrial Robots | High | High | Star |

| Recreational Off-highway Vehicles (North America) | High | High | Star |

What is included in the product

This BCG Matrix overview for Kawasaki Heavy Industries analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic insights for investment, holding, or divestment decisions based on market share and growth.

Streamlined Kawasaki BCG Matrix for instant strategic clarity, reducing decision-making friction.

Cash Cows

Kawasaki's Rolling Stock business is a clear cash cow, demonstrating robust profitability and securing significant new contracts. For instance, their role in producing R211 subway cars for New York City Transit Authority highlights their strong position in this essential infrastructure market.

This segment consistently generates stable revenue and cash flow, a testament to the mature yet indispensable nature of railway transportation infrastructure. The demand for reliable rolling stock remains high, ensuring a predictable income stream for Kawasaki.

Kawasaki's hydraulic equipment division is a strong cash cow, consistently generating profits from its established position in the construction machinery market. As a leading provider of hydraulic components and systems, this segment benefits from a mature industry where demand is stable, allowing for predictable revenue streams.

The business model here focuses on efficiency and maintaining market share rather than aggressive expansion, meaning investments are often directed towards optimizing production and supporting existing customer bases. This strategy ensures that the hydraulic equipment segment acts as a reliable source of funds for Kawasaki, supporting other, higher-growth areas of the company. For instance, in fiscal year 2023, Kawasaki reported that its Precision Machinery and Robotics segment, which includes hydraulics, contributed significantly to overall profitability, reflecting the mature yet stable nature of this business.

Kawasaki Heavy Industries' Gas Turbines and Gas Engines are firmly positioned as Cash Cows within its BCG Matrix. These are the backbone of the Energy Solution & Marine Engineering segment, serving industrial and municipal power needs with technologies that have proven their mettle.

Their consistent demand translates into predictable and stable revenue streams for Kawasaki. In fiscal year 2023, the Energy Solution & Marine Engineering segment reported sales of ¥344.7 billion, with gas turbines and engines being key contributors to this robust performance, underscoring their reliable cash-generating ability.

Marine Engines and Propulsion Equipment

Kawasaki Heavy Industries' marine engines and propulsion equipment, particularly its LNG-fueled ship engines, represent a strong Cash Cow. This segment benefits from consistent, ongoing demand from both commercial and defense sectors, ensuring a stable revenue stream. The mature nature of this business area means it requires minimal investment for maintenance and growth, generating substantial cash flow for the company.

In 2024, Kawasaki's marine segment continued to be a significant contributor to overall revenue. For instance, the company secured orders for multiple large-scale LNG carrier engines, reflecting the sustained global interest in cleaner shipping solutions. This consistent demand underpins the Cash Cow status, as these established products generate reliable profits with predictable cash inflows.

- Consistent Demand: Commercial and defense shipbuilders provide a steady customer base for Kawasaki's marine propulsion systems.

- Stable Cash Flow: The mature marine engineering business contributes a substantial portion of segment revenue, generating reliable profits.

- LNG Engine Growth: The increasing adoption of LNG as a fuel for ships further solidifies the demand for Kawasaki's advanced engine technologies.

- Low Reinvestment Needs: As a mature product line, these engines typically require limited capital expenditure, maximizing cash generation.

Aftermarket and Parts Business (Powersports)

Kawasaki's aftermarket and parts business within its Powersports & Engine segment, though a smaller slice of the overall revenue pie, plays a crucial role. It's a strategic asset, generating consistent, recurring revenue from existing customers and products, which helps build strong brand loyalty.

This segment functions as a reliable cash cow for Kawasaki. For instance, in the fiscal year ending March 2024, while specific aftermarket revenue figures aren't broken out separately, the broader Powersports & Engine segment reported significant contributions, highlighting the importance of this ongoing income stream.

- Strategic Importance: Provides recurring revenue and enhances brand loyalty.

- Cash Cow Status: Generates stable income from existing customer base and products.

- Financial Contribution: Supports overall segment profitability, as seen in the Powersports & Engine segment's performance in FY2024.

- Customer Retention: Fosters long-term relationships through parts and service availability.

Kawasaki's expertise in producing advanced hydraulic systems for construction and industrial machinery solidifies its position as a cash cow. This division benefits from a mature market where demand for reliable, efficient components remains consistently strong.

The company's focus on optimizing production and maintaining market share in this segment ensures a steady and predictable revenue stream. In fiscal year 2023, Kawasaki's Precision Machinery and Robotics segment, which includes hydraulics, demonstrated its profitability, underscoring the stable cash generation from this mature business.

| Business Segment | BCG Category | Key Characteristics | FY2023 Contribution (Approx.) |

|---|---|---|---|

| Hydraulic Equipment | Cash Cow | Mature market, stable demand, efficient production | Significant contributor to Precision Machinery & Robotics segment profitability |

| Rolling Stock | Cash Cow | Essential infrastructure, consistent contracts (e.g., NYC R211 cars) | Robust profitability, securing significant new contracts |

| Gas Turbines & Engines | Cash Cow | Reliable power solutions, consistent demand | Key contributor to ¥344.7 billion Energy Solution & Marine Engineering sales |

| Marine Engines & Propulsion | Cash Cow | LNG-fueled engines, steady demand from commercial/defense | Continued strong performance in 2024 with new LNG carrier engine orders |

| Powersports & Engine Aftermarket | Cash Cow | Recurring revenue, customer loyalty | Supports overall Powersports & Engine segment performance (FY2024) |

What You See Is What You Get

Kawasaki Heavy Industries BCG Matrix

The preview you are currently viewing is the exact Kawasaki Heavy Industries BCG Matrix report you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered to you in its complete, unwatermarked form, ready for immediate application in your business planning.

Dogs

Kawasaki Heavy Industries' motorcycle sales saw a minor decrease in 2024, with the Chinese market being a significant contributor to this downturn. This performance indicates a relatively small presence and limited opportunities for expansion within this particular geographic area.

The Chinese motorcycle segment for Kawasaki is characterized by a low market share and dim growth prospects, fitting the profile of a 'Dog' in the BCG matrix. Such a classification suggests that this business unit might warrant a strategic review, potentially leading to divestment or a significant restructuring to improve its standing.

Kawasaki's General-Purpose Gasoline Engines are currently positioned as Dogs in their BCG Matrix. Orders received for these engines saw a decrease in 2024, signaling a potential dip in demand or a weakening competitive stance within this segment. This trend points towards low market growth and possibly a low market share, characteristic of a 'Dog' that could become a cash trap if not managed carefully.

Kawasaki Heavy Industries' older shipbuilding projects, those not focused on high-value-added segments, likely fall into the Dogs category of the BCG matrix. These are typically conventional vessels in a mature, highly competitive market where margins are squeezed.

While Kawasaki is strategically pivoting towards advanced vessels like LNG carriers and hydrogen ships, these older, less specialized projects might be experiencing slower growth and lower profitability. The shipbuilding industry, particularly for standard cargo ships, faces intense global competition, often from lower-cost producers.

For instance, in fiscal year 2023, while the overall shipbuilding market showed some resilience, the segment for standard bulk carriers and tankers continued to grapple with overcapacity and price pressures. Kawasaki's commitment to innovation in areas like LNG carriers reflects a clear strategy to move away from these lower-margin, less differentiated segments.

Outdated Construction Machinery Models

Within Kawasaki Heavy Industries' diverse industrial equipment offerings, certain older construction machinery models might be categorized as Dogs. These units often operate in mature markets where growth is sluggish and competition is fierce, especially from manufacturers offering more technologically advanced and fuel-efficient alternatives. For instance, if a particular excavator model from the early 2010s hasn't seen significant upgrades, its market share could be declining as newer versions with enhanced hydraulics and emission controls gain traction.

These underperforming assets typically command a low market share in markets that are not expanding rapidly. This situation means they generate minimal profits and may even require ongoing investment for maintenance without a clear path to significant revenue growth. Kawasaki's financial reports for 2024 would likely show a gradual decrease in sales volume for such legacy equipment if they haven't been phased out or significantly re-engineered.

- Low Market Share: Older construction machinery models often struggle to maintain significant market share against newer, more competitive offerings.

- Mature Market Dynamics: These products typically exist in markets with slow or no growth, limiting potential for increased sales.

- Intense Competition: Newer technologies and designs from rivals put pressure on older models, reducing their appeal and pricing power.

- Potential for Divestment: Companies like Kawasaki may consider divesting or discontinuing such product lines if they consistently underperform and drain resources.

Unallocated/Other Minor Segments

Kawasaki Heavy Industries' financial statements often feature an "Unallocated/Other Minor Segments" category, representing a small fraction of their total revenue. For the fiscal year ending March 31, 2024, this segment contributed approximately 3.5% to the consolidated net sales, which totaled ¥2,035.5 billion. These segments typically house diverse, smaller-scale operations or ventures that may not fit neatly into the company's core business units.

When analyzing Kawasaki's BCG Matrix, these "Unallocated/Other Minor Segments" would likely fall into the Dogs quadrant. This is due to their characteristic low market share and low growth potential, often representing products or services that are not strategically prioritized for expansion or investment. For instance, in 2023, the company divested its stake in a small joint venture related to specialized industrial equipment, a move that aligns with minimizing such low-impact segments.

- Low Revenue Contribution: In FY2024, this segment accounted for only about 3.5% of Kawasaki's ¥2,035.5 billion in net sales.

- Low Growth Potential: These segments often represent mature or declining product lines with limited prospects for significant market expansion.

- Strategic Re-evaluation: Businesses within this category are candidates for divestment or minimization if they do not align with future growth strategies.

- Example of Divestment: Kawasaki's 2023 sale of its interest in a niche industrial venture exemplifies the strategy of streamlining minor operations.

Kawasaki's older shipbuilding projects, particularly those for standard cargo ships, are classified as Dogs. These operate in a mature, intensely competitive market with squeezed margins.

While Kawasaki focuses on high-value segments like LNG carriers, these older projects face slower growth and lower profitability. The market for standard vessels continues to deal with overcapacity and price pressures, as seen in fiscal year 2023.

These segments often represent conventional vessels in a market where differentiation is minimal and competition is fierce, leading to a low market share and growth prospects.

Kawasaki's strategic shift towards advanced vessels like LNG carriers and hydrogen ships highlights their effort to move away from these less profitable, undifferentiated shipbuilding areas.

Question Marks

Kawasaki Heavy Industries is a trailblazer in hydrogen liquefaction and transport, boasting the world's first liquefied hydrogen carrier. This innovative segment is poised for substantial expansion, with projections showing its revenue climbing from JPY5 billion in fiscal year 2024 to JPY52 billion in fiscal year 2025, and a remarkable JPY400 billion by fiscal year 2030.

This positions Kawasaki's hydrogen business within a nascent market characterized by immense growth potential, although its current market share is relatively low. Significant investment will be crucial to nurture this segment and unlock its future star status within the company's portfolio.

Kawasaki Heavy Industries is actively investing in electrified and hydrogen-powered engines for its Powersports division, aiming for carbon neutrality with new model releases expected soon. This strategic push targets a rapidly expanding market for sustainable transportation solutions.

Despite this forward-looking development, Kawasaki's current market share in these nascent technologies remains relatively small. This positions electrified/hybrid motorcycles as a 'Question Mark' within the BCG matrix, demanding significant investment to capitalize on future growth potential.

Kawasaki Heavy Industries' hinotoriTM surgical robot system fits the Question Mark category within the BCG Matrix. KHI's Vision 2030 targets expanded adoption, particularly focusing on remote operation technology, a high-growth segment in medical robotics.

While the medical robotics market is expanding rapidly, KHI's current market share in this specialized niche is presumed to be relatively low. This necessitates substantial investment to achieve significant market penetration and establish a stronger competitive position.

Carbon Capture Systems

Kawasaki Heavy Industries (KHI) is actively investing in carbon capture systems, recognizing them as a crucial component of the global decarbonization push. This strategic focus aligns with their expansion into Direct Air Capture (DAC) technologies, targeting high-growth environmental markets.

While these emerging technologies represent significant future potential, KHI's current market share in carbon capture is relatively small. This is typical for nascent industries that demand substantial research and development investment and ongoing market cultivation.

- Market Position: KHI is a player in the emerging carbon capture market, with significant investment in R&D and future growth potential.

- Growth Potential: Decarbonization technologies, including carbon capture, are projected for substantial growth driven by global environmental mandates.

- Investment Needs: The sector requires significant capital for technological advancement and market penetration, impacting current market share.

- Strategic Alignment: KHI's focus on carbon capture and DAC aligns with long-term sustainability goals and evolving industrial demands.

Hybrid Light Sport Aircraft (LSA) Market Propulsion

Kawasaki Heavy Industries is strategically investing in hybrid propulsion for the Light Sport Aircraft (LSA) and kit-built aircraft segments. This move aligns with VoltAero's advancements in hybrid-electric technology, signaling a significant shift towards cleaner and more efficient aviation solutions.

This nascent market represents a high-growth opportunity for Kawasaki, where its current market share is minimal, classifying the Hybrid LSA propulsion as a 'Question Mark' in the BCG matrix. The company's commitment here suggests a strong potential for future market leadership, akin to a 'Star' if successful.

- Market Growth: The global LSA market is projected to grow, with hybrid propulsion expected to capture a significant share as regulations tighten and demand for sustainable aviation increases. For example, the broader electric aircraft market is anticipated to reach billions of dollars by the late 2020s.

- Technological Investment: Kawasaki's focus on hybrid systems indicates a substantial investment in research and development, aiming to capture a first-mover advantage in this specialized niche.

- Strategic Positioning: By targeting the LSA segment with hybrid technology, Kawasaki is carving out a distinct position in a market segment that is less saturated than commercial aviation, offering a clear path to potential dominance.

Kawasaki's investment in electric and hybrid motorcycles places them in a high-growth market with currently low market share. This necessitates significant capital for development and market penetration to achieve future success.

The hinotoriTM surgical robot system is another prime example of a Question Mark. While the medical robotics market is expanding, Kawasaki's current share is small, requiring substantial investment to gain traction.

Similarly, Kawasaki's ventures into carbon capture technologies, including Direct Air Capture, represent emerging, high-growth areas. However, their current market share is minimal, demanding considerable R&D and market cultivation.

The company's focus on hybrid propulsion for Light Sport Aircraft (LSA) also falls into the Question Mark category, with a minimal current market share in a rapidly growing sector. Success here could lead to a dominant 'Star' position.

| Business Segment | Market Growth Potential | Current Market Share | Investment Needs |

|---|---|---|---|

| Electric/Hybrid Motorcycles | High | Low | High |

| Surgical Robots (hinotoriTM) | High | Low | High |

| Carbon Capture & DAC | High | Low | High |

| Hybrid LSA Propulsion | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix for Kawasaki Heavy Industries is constructed using a blend of financial disclosures, market research reports, and official company publications. This ensures a comprehensive and accurate representation of each business unit's market share and growth potential.