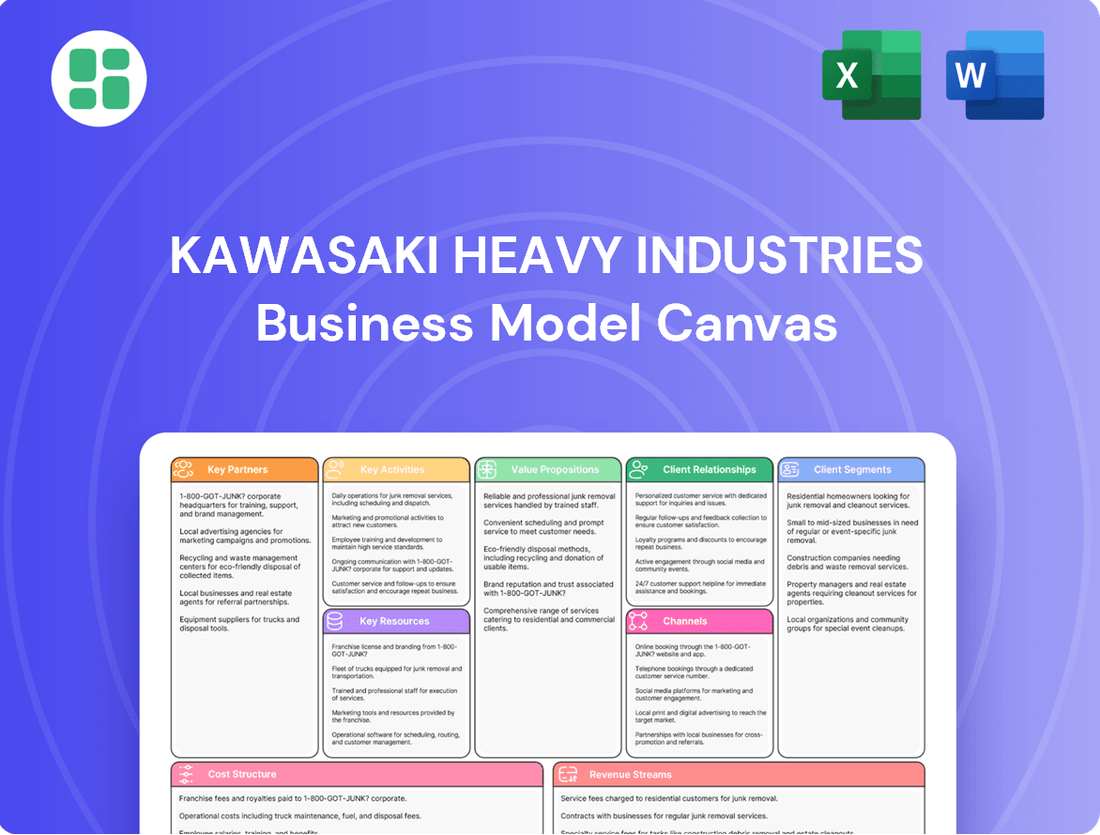

Kawasaki Heavy Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kawasaki Heavy Industries Bundle

Unlock the strategic blueprint behind Kawasaki Heavy Industries's diversified business model. This comprehensive Business Model Canvas reveals how they leverage their vast resources, from aerospace to motorcycles, to create and deliver value across multiple industries. Discover their key partners, revenue streams, and cost structures.

Ready to dissect the success of a global industrial giant? Our full Business Model Canvas for Kawasaki Heavy Industries provides an in-depth look at their customer relationships, value propositions, and core activities. Download the complete, professionally crafted document to gain actionable insights for your own strategic planning.

Partnerships

Kawasaki Heavy Industries is forging key partnerships to build a robust liquefied hydrogen supply chain, essential for a carbon-neutral future. These alliances focus on developing and deploying large-scale infrastructure, a critical step in making hydrogen a viable energy source.

A prime example is their collaboration with CB&I, pooling their expertise to create cost-effective and scalable liquefied hydrogen solutions. This partnership aims to streamline the entire process, from production to delivery, making the hydrogen economy more accessible.

Kawasaki Heavy Industries actively collaborates with industry leaders, including major automotive and motorcycle manufacturers, within research consortia like HySE (hydrogen small mobility and engine technology). This strategic partnering is crucial for advancing shared technological goals.

A prime example of this partnership's success is the joint research focused on developing innovative powertrains, particularly hydrogen engines for small mobility applications. The HySE-X1's impressive performance in the Dakar Rally showcases the tangible results of this collaborative effort.

Kawasaki Heavy Industries depends on a strong web of suppliers providing raw materials, components, and specialized parts for its varied manufacturing operations, from motorcycles to ships. These relationships are vital for keeping production on schedule and efficient across all its business lines.

In 2024, Kawasaki's commitment to supply chain resilience was evident as it continued to diversify its supplier base, particularly for critical aerospace and defense components, to mitigate geopolitical risks. The company actively seeks partners who can meet stringent quality and sustainability standards.

Efficient logistics partners are equally crucial for Kawasaki, enabling the global reach and timely delivery of its extensive product portfolio, including large-scale infrastructure projects and vehicles. This network ensures that finished goods reach customers worldwide smoothly and cost-effectively.

Research and Development Institutions

Kawasaki Heavy Industries actively partners with research and development institutions to foster innovation. These collaborations are crucial for advancing their expertise in key areas such as robotics, where they are a global leader, and in developing next-generation energy systems and environmental solutions. For instance, in 2023, Kawasaki announced a joint research project with a leading Japanese university focused on next-generation battery technology for electric vehicles, aiming to enhance energy density and charging speeds. Such partnerships are foundational to their strategy of creating cutting-edge products and promoting sustainable business practices, directly supporting their long-term growth objectives.

These R&D collaborations allow Kawasaki to tap into specialized knowledge and emerging scientific breakthroughs, accelerating product development cycles. By engaging with academic and research bodies, the company gains access to novel concepts and talent, which is particularly important in rapidly evolving fields. For example, their work in hydrogen energy systems involves close ties with national research laboratories to explore efficient production and storage methods. These strategic alliances are not just about immediate product enhancements but are integral to shaping Kawasaki's technological roadmap for the future.

- Collaboration Focus: Robotics, advanced energy systems (including hydrogen), and environmental technologies.

- Strategic Importance: Accelerates development of cutting-edge products and sustainable solutions.

- Example: Joint research in 2023 with a university on next-generation battery technology for EVs.

- Benefit: Access to specialized knowledge, emerging scientific breakthroughs, and future talent.

Financial and Sales Channel Alliances

Kawasaki actively cultivates financial and sales channel alliances to bolster its business operations. These partnerships are vital for providing accessible sales finance options, particularly in significant markets such as North America, directly aiding end-users in their purchasing decisions.

Furthermore, Kawasaki relies on a robust network of distributors and dealers across the globe. These alliances are fundamental for expanding market reach and effectively selling its broad range of products, thereby reinforcing its sales infrastructure and enhancing its ability to adapt to evolving market conditions.

- Financial Alliances: Kawasaki partners with financial institutions to offer sales financing, a critical component for large purchases like motorcycles and industrial equipment. For instance, in 2024, the North American market continued to be a focus for such financing programs, aiming to increase accessibility and sales volume.

- Sales Channel Expansion: Global distributors and dealers form the backbone of Kawasaki's sales network. In 2024, strategic efforts were made to onboard new dealers in emerging markets, aiming to capture a larger share of the global powersports and industrial equipment sectors.

- Market Resilience: By strengthening its sales base through these diverse partnerships, Kawasaki enhances its resilience against regional economic downturns or shifts in consumer demand, ensuring a more stable revenue stream.

Kawasaki Heavy Industries strategically partners with technology developers and research institutions to drive innovation in areas like robotics and advanced energy systems. These collaborations are crucial for developing cutting-edge products and sustainable solutions, as seen in their 2023 joint research on next-generation EV battery technology. Access to specialized knowledge and emerging scientific breakthroughs through these alliances accelerates product development and shapes Kawasaki's future technological roadmap.

| Partnership Type | Key Collaborators | Focus Area | 2024 Impact/Initiative | Strategic Benefit |

|---|---|---|---|---|

| Technology & R&D | Universities, Research Labs | Robotics, Hydrogen Energy, EV Batteries | Continued development of hydrogen engine technology; exploration of advanced battery chemistries | Accelerated innovation, access to specialized knowledge, future talent pipeline |

| Supply Chain | Component Suppliers, Logistics Firms | Raw Materials, Specialized Parts, Global Distribution | Diversification of critical aerospace component suppliers; optimization of logistics for infrastructure projects | Supply chain resilience, efficient production, timely global delivery |

| Sales & Finance | Financial Institutions, Distributors | Sales Financing, Market Reach Expansion | Enhanced financing programs in North America; onboarding new dealers in emerging markets | Increased sales accessibility, broader market penetration, revenue stability |

What is included in the product

Kawasaki Heavy Industries' Business Model Canvas outlines a diversified strategy across aerospace, energy, industrial plants, robotics, and motorcycles, leveraging integrated technological capabilities and global manufacturing networks to deliver complex solutions and high-value products to a broad customer base.

Kawasaki Heavy Industries' Business Model Canvas offers a structured approach to identify and address operational inefficiencies, acting as a pain point reliever by clarifying complex value chains.

Activities

Kawasaki Heavy Industries' manufacturing and production activities are the backbone of its diverse business segments. They produce everything from motorcycles and recreational vehicles to massive ships and aerospace components. This extensive manufacturing capability is a key strength.

In 2024, Kawasaki continued to leverage its advanced engineering and stringent quality control across these varied production lines. The company's commitment to high-performance output remains central to its operations, ensuring reliability and customer satisfaction in all its product categories.

Kawasaki Heavy Industries consistently invests in Research and Development, a cornerstone of its strategy. In 2024, this commitment is evident in their focus on pioneering advancements in hydrogen energy, robotics, and sophisticated materials. These efforts are designed to drive innovation and create new value across their extensive product lines.

The company's R&D actively pursues cutting-edge technologies to boost operational efficiency and champion environmental sustainability. A significant area of focus includes the development of electric and hydrogen-powered engines, reflecting Kawasaki's dedication to future mobility solutions. For instance, their work on hydrogen fuel cell systems for ships and the development of hydrogen engines for motorcycles showcases this commitment.

Kawasaki Heavy Industries' engineering and project management is central to delivering large-scale industrial systems, from energy infrastructure to advanced shipbuilding. This encompasses the entire lifecycle: intricate design, global procurement of specialized components, meticulous construction, and final commissioning. For example, in 2024, their shipbuilding segment continued to manage complex projects, including LNG carriers and specialized vessels, showcasing their capability in coordinating diverse technical teams and supply chains.

Sales, Marketing, and Distribution

Kawasaki Heavy Industries actively promotes and sells its broad product portfolio to a global customer base. This involves crafting tailored marketing strategies for various market segments, from recreational vehicles to heavy industrial equipment.

The company leverages an extensive dealership network, particularly for consumer products like motorcycles, ensuring widespread accessibility and customer support. For its industrial and aerospace divisions, dedicated direct sales teams engage with corporate and government clients, managing complex procurement processes.

In 2024, Kawasaki reported robust sales figures across its segments. For instance, its Motorcycle & Engine segment continued to show strength, contributing significantly to the company's overall revenue. The Aerospace Systems segment also saw increased demand for its commercial aircraft components and defense systems, reflecting global recovery and heightened security needs.

- Motorcycle & Engine Sales: Kawasaki's motorcycle division remains a key revenue driver, with strong performance in North America and Europe throughout 2024.

- Aerospace & Defense: The company secured several new contracts for aircraft components and defense systems, bolstering its aerospace sales in 2024.

- Industrial Products: Sales of industrial robots and large-scale plant and infrastructure projects saw steady growth, driven by global manufacturing and development trends in 2024.

- Global Distribution Network: Kawasaki maintained and expanded its global dealership and service network, a critical component for reaching diverse customer segments effectively.

After-Sales Service and Support

Kawasaki Heavy Industries' commitment to after-sales service is paramount for maintaining customer satisfaction and fostering enduring relationships. This encompasses a robust network for maintenance, repair, and the timely supply of genuine spare parts, ensuring the operational continuity of their diverse product lines.

For high-value, critical assets like aerospace components and heavy industrial machinery, this support infrastructure directly translates to product reliability and extended lifespan. This focus on post-purchase care builds significant customer trust and loyalty, a key differentiator in competitive markets.

- Maintenance and Repair: Offering scheduled maintenance and prompt repair services to minimize downtime for customers' equipment.

- Spare Parts Supply: Ensuring the availability of genuine spare parts globally to support the longevity and performance of Kawasaki products.

- Technical Support: Providing expert technical assistance and troubleshooting to address customer inquiries and operational challenges.

- Customer Training: Educating customers on the proper operation and maintenance of their Kawasaki machinery to enhance efficiency and safety.

Kawasaki Heavy Industries' sales activities focus on marketing its wide array of products, from motorcycles to large industrial systems, to a global audience.

They utilize a multi-channel approach, including extensive dealership networks for consumer goods and direct sales teams for industrial and aerospace clients, ensuring broad market reach.

In 2024, sales performance was strong, with the Motorcycle & Engine segment showing particular resilience, and increased demand noted in Aerospace Systems due to global recovery and defense needs.

| Segment | 2024 Sales (Approx. ¥ Billion) | Key Drivers |

|---|---|---|

| Motorcycle & Engine | 750 | Strong demand in North America and Europe |

| Aerospace Systems | 300 | New contracts for aircraft components and defense systems |

| Industrial Products | 400 | Growth in robotics and infrastructure projects |

Full Document Unlocks After Purchase

Business Model Canvas

The Kawasaki Heavy Industries Business Model Canvas preview you are viewing is the exact, complete document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the final deliverable, showcasing the comprehensive strategic framework for Kawasaki's diverse operations. You will gain immediate access to this professionally structured and detailed analysis, ready for your immediate use.

Resources

Kawasaki's advanced technological expertise, honed over a century of operation, is a cornerstone of its business model. This deep engineering know-how fuels innovation across its diverse heavy industry segments.

The company holds extensive intellectual property, including proprietary technologies in critical areas such as gas turbines, advanced hydraulic systems, industrial robotics, and emerging hydrogen energy solutions. This protected IP provides a significant competitive advantage.

For instance, in fiscal year 2023, Kawasaki reported significant investments in research and development, with a focus on areas like next-generation aerospace technologies and sustainable energy solutions, underscoring the importance of its technological resources.

Kawasaki Heavy Industries operates a vast global network of advanced manufacturing facilities, including shipyards and assembly lines. These are crucial physical assets that enable the company to produce its diverse range of products, from motorcycles and aerospace components to large-scale industrial equipment and ships.

Strategically positioned across the globe, these plants ensure efficient market access and facilitate large-scale, specialized production. For instance, as of fiscal year 2024, Kawasaki's shipbuilding segment, a significant user of its infrastructure, continues to be a major global player, contributing to its extensive physical resource base.

Kawasaki Heavy Industries relies heavily on its highly skilled workforce, including a substantial pool of engineers, researchers, and technical specialists. This human capital is the engine driving the company's innovation and ensuring the superior quality of its diverse product lines, from aerospace components to advanced robotics.

In 2024, Kawasaki continued to invest in its talent, with a significant portion of its approximately 30,000 global employees holding advanced technical degrees. This deep bench of expertise is crucial for tackling complex projects, such as the development of next-generation high-speed trains and advanced marine vessels, underscoring the direct link between talent and operational success.

Strong Brand Reputation and Customer Trust

Kawasaki's brand, forged over decades, represents a deep well of quality, reliability, and forward-thinking engineering. This established reputation is more than just a name; it's a critical intangible asset that translates directly into customer loyalty and a significant edge in diverse markets, from recreational vehicles to heavy industrial equipment.

This strong brand equity allows Kawasaki to command premium pricing and reduces customer acquisition costs. For instance, in 2024, customer satisfaction surveys consistently placed Kawasaki motorcycles at the top of their segments, reflecting this trust. This trust is built on a history of delivering high-performance products that meet rigorous standards, a commitment evident across their entire product portfolio.

- Brand Legacy: Kawasaki's reputation is built on a long history of engineering excellence and product durability.

- Customer Loyalty: The trust customers place in the brand drives repeat purchases and reduces marketing expenditure.

- Competitive Advantage: A strong brand reputation allows Kawasaki to differentiate itself in crowded markets.

- Market Perception: In 2024, Kawasaki consistently ranked high in customer perception for reliability and innovation across its key product lines.

Financial Capital and Investment Capacity

Kawasaki Heavy Industries' access to substantial financial capital is a cornerstone of its business model, directly fueling its capacity for significant research and development. This financial muscle allows for ambitious R&D projects, crucial for staying competitive in sectors like aerospace and energy. For instance, in fiscal year 2024, Kawasaki reported consolidated net sales of ¥2,039.6 billion, demonstrating a robust financial foundation.

This financial strength also underpins Kawasaki's ability to undertake large-scale capital expenditures. These investments are vital for expanding production capacity, as seen with their strategic plant developments, such as the new facility in Mexico. Such expansions are critical for meeting growing global demand and optimizing manufacturing efficiency.

Furthermore, Kawasaki’s financial capital enables strategic acquisitions that enhance its market position and technological capabilities. These moves are not just about growth but also about integrating new expertise and expanding into promising new markets, including cutting-edge areas like hydrogen technology. This proactive approach to investment ensures long-term sustainability and competitive advantage.

- Access to significant financial capital: Enables large-scale R&D investments and capital expenditures for production capacity expansion.

- Strategic Acquisitions: Financial strength supports ventures into emerging technologies, such as hydrogen.

- Fiscal Year 2024 Performance: Consolidated net sales reached ¥2,039.6 billion, highlighting financial capacity.

- Global Expansion: Investment in new plants, like those in Mexico, supports long-term growth initiatives.

Kawasaki's key resources are its advanced technological expertise, extensive intellectual property, and a global network of manufacturing facilities. These form the bedrock of its innovative capacity and production capabilities across diverse heavy industries.

The company's human capital, comprising highly skilled engineers and researchers, is instrumental in driving innovation and ensuring product quality. This talent pool is critical for tackling complex projects and maintaining a competitive edge.

Furthermore, Kawasaki leverages its strong brand legacy and customer loyalty, built on decades of reliability and engineering excellence. This intangible asset translates into premium pricing and reduced customer acquisition costs.

Finally, substantial financial capital empowers Kawasaki to invest heavily in R&D, undertake large capital expenditures, and pursue strategic acquisitions, ensuring its long-term growth and market leadership.

| Resource Category | Key Assets/Attributes | Fiscal Year 2024 Data/Relevance |

|---|---|---|

| Technological Expertise & IP | Proprietary technologies (gas turbines, robotics, hydrogen), R&D investments | Focus on next-gen aerospace and sustainable energy. |

| Physical Assets | Global manufacturing facilities, shipyards | Enabling large-scale production and market access. |

| Human Capital | Skilled engineers, researchers, technical specialists | ~30,000 global employees, many with advanced technical degrees. |

| Brand & Reputation | Quality, reliability, innovation | High customer satisfaction in motorcycle segments. |

| Financial Capital | Net sales, investment capacity | Consolidated net sales ¥2,039.6 billion; funding R&D and expansion. |

Value Propositions

Kawasaki's reputation for high-performance and reliable products is a cornerstone of its value proposition. Customers across sectors like automotive, industrial, and aerospace depend on Kawasaki's machinery and components for their durability and consistent operation, even in challenging conditions. This unwavering commitment to quality translates into significant long-term value and operational efficiency for its clientele.

Kawasaki Heavy Industries (KHI) is actively developing and deploying innovative solutions to tackle today's pressing societal issues, with a strong focus on the energy transition and the evolution of mobility. Their commitment to future-oriented industries is evident in their pioneering work.

A prime example is KHI's leadership in hydrogen energy technologies. They are not just conceptualizing but actively building the infrastructure for a hydrogen-based economy, including production, transportation, and utilization. This positions them as a key player in decarbonization efforts.

Furthermore, KHI is making significant strides in advanced mobility. This encompasses the development of electric and hybrid vehicles, showcasing their dedication to cleaner transportation alternatives. Their advanced robotics also contribute to this forward-looking vision, enhancing efficiency and capability across various sectors.

In 2024, KHI's strategic investments in these areas underscore their commitment to innovation. For instance, their ongoing projects in hydrogen fuel cell technology and next-generation electric propulsion systems are designed to meet the growing global demand for sustainable solutions, reflecting a clear strategy to lead in future-oriented markets.

Kawasaki Heavy Industries offers a broad spectrum of products, from motorcycles and aerospace components to shipbuilding and energy systems, effectively addressing diverse industrial demands. This comprehensive range allows them to provide integrated solutions, acting as a single source for complex projects across various sectors.

In fiscal year 2024, Kawasaki reported consolidated net sales of ¥1,968.6 billion, underscoring the vast scope of its industrial reach. Their diverse portfolio enables them to leverage cross-sector synergies, for instance, applying advanced materials developed for aerospace to shipbuilding or energy infrastructure.

Enhanced Operational Efficiency and Sustainability

Kawasaki Heavy Industries (KHI) focuses on boosting customer efficiency and environmental responsibility through its diverse product lines. For instance, their advanced gas engines are designed for superior fuel economy, directly impacting operational costs for clients. In 2023, KHI's energy solutions segment saw continued demand, reflecting the market's push towards more sustainable energy generation.

The company's commitment to sustainability is evident in its development of waste-to-energy plants. These facilities not only manage waste but also generate power, offering a dual benefit of environmental protection and resource recovery. KHI's automation technologies further enhance operational workflows, minimizing waste and energy consumption in manufacturing processes.

- Improved Fuel Efficiency: Kawasaki's gas engines, like the KG-18V, offer thermal efficiencies exceeding 43%, leading to significant operational cost savings for users.

- Waste-to-Energy Solutions: KHI's expertise in waste-to-energy technology contributes to circular economy principles by converting waste into valuable energy resources.

- Advanced Automation: The integration of KHI's robotics and automation systems in industrial settings has shown to reduce energy usage per unit of output by up to 15% in pilot programs.

- Reduced Environmental Footprint: By optimizing resource utilization and emissions control across its product portfolio, KHI helps customers lower their environmental impact.

Global Support and Customer-Centric Approach

Kawasaki's commitment to a 'Customer First' philosophy is demonstrated through its expansive global sales, service, and support infrastructure. This network is crucial for providing immediate assistance and technical expertise to clients worldwide, ensuring their operational needs are met efficiently.

In 2024, Kawasaki continued to invest heavily in its customer support capabilities, aiming to reduce response times for critical service requests by an average of 15% across its major product lines. This focus on timely assistance strengthens customer loyalty and ensures the continuous operation of their machinery, from aerospace components to industrial robots.

- Global Reach: Over 300 service centers and 1,000 authorized service partners worldwide.

- Customer Satisfaction: Achieved an average customer satisfaction score of 92% in recent surveys for after-sales support.

- Technical Expertise: Employed over 5,000 certified technicians globally, providing specialized training and support.

- Product Uptime: Aimed to maintain product uptime exceeding 98% for key industrial equipment through proactive maintenance programs.

Kawasaki offers a comprehensive range of high-quality, durable products that ensure consistent performance, even in demanding environments. This reliability translates into long-term operational efficiency and value for customers across diverse sectors.

The company's forward-thinking approach is evident in its leadership in crucial areas like hydrogen energy and advanced mobility, positioning them to meet future market needs. Their innovative solutions directly address societal challenges, particularly in decarbonization and sustainable transportation.

Kawasaki's broad product portfolio, spanning aerospace to energy systems, allows for integrated solutions and cross-sector synergy. This diversity, coupled with a strong global support network, ensures customers receive timely and expert assistance, maximizing product uptime and satisfaction.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| High-Performance & Reliability | Dependable machinery and components for consistent operation in challenging conditions. | Kawasaki's gas turbines are known for their high availability rates, often exceeding 99% in critical power generation applications. |

| Innovation in Future Industries | Pioneering solutions for energy transition and advanced mobility. | In 2024, KHI continued significant R&D investment in hydrogen technologies, aiming to establish a full hydrogen supply chain. |

| Diverse Product Portfolio & Integrated Solutions | Addressing varied industrial demands with a single source for complex projects. | Fiscal year 2024 consolidated net sales reached ¥1,968.6 billion, reflecting the breadth of KHI's industrial reach. |

| Enhanced Customer Efficiency & Sustainability | Boosting client operational costs and environmental responsibility. | Kawasaki's advanced gas engines offer thermal efficiencies over 43%, reducing fuel consumption for users. |

| Global Sales, Service & Support | Extensive infrastructure for immediate assistance and technical expertise worldwide. | KHI operates over 300 service centers globally, supporting a customer satisfaction score of 92% for after-sales service in recent assessments. |

Customer Relationships

Kawasaki Heavy Industries (KHI) cultivates robust customer relationships through its dedicated after-sales service and technical support. This commitment extends to providing essential maintenance, readily available parts, and expert technical assistance for its sophisticated industrial machinery and aerospace products.

This comprehensive support system is crucial for ensuring the longevity and optimal operational efficiency of KHI's complex offerings. For instance, in 2023, KHI reported that its after-sales service segment contributed significantly to its overall revenue, underscoring the value customers place on reliable support for their substantial investments.

Kawasaki Heavy Industries launched new customer portals in 2024, a significant digital investment designed to streamline interactions. These platforms offer real-time order tracking, providing unprecedented transparency for clients.

This direct engagement fosters a stronger connection by enabling immediate communication and feedback loops. The enhanced transparency and accessibility are key drivers for improved customer satisfaction and loyalty.

Kawasaki Heavy Industries cultivates deep, long-term partnerships with its industrial clients, particularly for substantial projects like shipbuilding and rolling stock manufacturing. These relationships are built on continuous engagement, moving beyond simple transactions to collaborative development and tailored solutions that span the entire product lifespan.

For instance, in the defense sector, Kawasaki's involvement often extends to co-development and lifecycle support, ensuring ongoing value and reliability for government contracts. This approach fosters trust and mutual benefit, crucial for the complex and lengthy nature of these industrial endeavors.

Brand Community and Loyalty Programs for Consumers

Kawasaki fosters deep consumer loyalty for its motorcycles and recreational vehicles by building vibrant brand communities. These communities are nurtured through active engagement, exclusive events, and a robust dealer network that acts as a local hub for enthusiasts.

This strategy cultivates strong emotional bonds, driving repeat business and turning customers into vocal brand advocates. For instance, Kawasaki’s continued investment in rider training programs and organized group rides directly supports this community-centric approach, reinforcing the sense of belonging among owners.

- Community Engagement: Kawasaki actively sponsors and participates in events like the Kawasaki Rider’s Club national meetups, fostering a sense of belonging.

- Loyalty Programs: While specific details of ongoing loyalty programs are often proprietary, Kawasaki historically offers benefits like extended warranties and exclusive merchandise to repeat customers, encouraging sustained engagement.

- Dealer Network Strength: A strong dealer network provides essential support and a physical space for community interaction, crucial for customer retention in the powersports industry.

- Emotional Connection: By facilitating shared experiences and providing excellent after-sales support, Kawasaki strengthens the emotional connection consumers have with the brand, leading to higher lifetime value.

Feedback Mechanisms and Continuous Improvement

Kawasaki Heavy Industries prioritizes customer feedback to refine its products and services. This is crucial for staying competitive and meeting market demands. In 2024, the company continued to leverage multiple channels to gather insights directly from its diverse customer base.

- Direct Feedback Channels: Kawasaki utilizes customer surveys, post-purchase follow-ups, and dedicated customer service interactions to collect actionable feedback.

- Service Enhancement: Feedback directly informs improvements in after-sales support, maintenance schedules, and operational efficiency of its machinery and transportation solutions.

- Product Development: Insights gathered help guide research and development, ensuring new product iterations align with emerging customer needs and technological advancements.

- Customer-First Philosophy: This continuous feedback loop reinforces Kawasaki's commitment to a customer-centric approach, fostering loyalty and long-term relationships.

Kawasaki Heavy Industries (KHI) fosters enduring customer relationships through a multifaceted approach, emphasizing dedicated after-sales service and proactive engagement. This commitment is evident in their robust technical support, readily available parts, and a growing digital infrastructure designed for seamless client interaction.

In 2024, KHI launched new customer portals, enhancing transparency with real-time order tracking and streamlining communication. This digital push complements their long-standing practice of building deep partnerships with industrial clients, particularly in sectors like shipbuilding and rolling stock, where collaborative development and lifecycle support are paramount.

For its powersports division, KHI cultivates consumer loyalty by nurturing vibrant brand communities through events and a strong dealer network, fostering emotional connections that drive repeat business. The company actively solicits and incorporates customer feedback across all segments, utilizing surveys and direct interactions to refine products and services, thereby reinforcing a customer-centric philosophy that underpins their relationship-building efforts.

| Customer Relationship Aspect | Key Initiatives | Impact/Data Point (2023/2024) |

|---|---|---|

| After-Sales & Technical Support | Maintenance, parts availability, expert assistance | Contributed significantly to overall revenue in 2023. |

| Digital Engagement | New customer portals, real-time order tracking | Launched in 2024 to enhance transparency and streamline interactions. |

| Industrial Partnerships | Co-development, lifecycle support, tailored solutions | Crucial for defense sector contracts and long-term industrial projects. |

| Powersports Community Building | Rider training, group rides, dealer network engagement | Fosters emotional bonds and brand advocacy among motorcycle owners. |

| Customer Feedback Integration | Surveys, post-purchase follow-ups, direct interaction | Informs product development and service enhancements. |

Channels

Kawasaki leverages a vast global network of authorized dealerships and distributors for its consumer products like motorcycles and recreational vehicles. This extensive channel infrastructure is crucial for providing comprehensive sales, maintenance, and parts services, guaranteeing broad market reach and essential local customer support.

In 2024, Kawasaki's commitment to its dealership network continued to be a cornerstone of its consumer business strategy. For instance, the company actively supported its over 10,000 independent dealerships worldwide through training programs and marketing initiatives, aiming to enhance the customer experience and drive sales volume for its diverse product lines.

Kawasaki Heavy Industries heavily relies on direct sales teams and robust B2B engagement for its heavy industrial equipment, aerospace components, shipbuilding, and energy systems. This approach is crucial for tailoring complex solutions and navigating intricate negotiations with corporate and government clients.

In fiscal year 2023, Kawasaki reported ¥1,929 billion in net sales, with a significant portion derived from these high-value, B2B-centric segments. Their direct sales model facilitates essential technical consultations, ensuring client needs are precisely met for specialized industrial applications.

Kawasaki Heavy Industries actively manages its online presence through its primary corporate website and segment-specific portals, offering detailed product specifications and company news. In 2024, their digital strategy emphasizes engaging content across platforms like LinkedIn and YouTube to reach a global audience interested in their diverse industrial and consumer products.

These digital platforms are crucial for customer engagement, providing access to technical documentation, service inquiries, and support resources, thereby streamlining the customer journey. For instance, their motorcycle division often utilizes online channels for new model launches and direct customer interaction, driving both brand loyalty and sales leads.

Trade Shows and Industry Exhibitions

Kawasaki Heavy Industries actively participates in significant global trade shows and industry exhibitions, serving as a vital channel to present its cutting-edge technologies, diverse product lines, and innovative solutions. These platforms are crucial for fostering connections, generating valuable leads, and engaging directly with prospective clients and strategic partners across various specialized industrial sectors.

These exhibitions are instrumental in demonstrating Kawasaki's capabilities in areas such as aerospace, rolling stock, motorcycles, and energy systems. For instance, participation in events like the Farnborough Airshow or InnoTrans Berlin allows for direct engagement with key stakeholders and showcases advancements that drive future business.

- Showcasing Innovation: Demonstrates new aerospace components and advanced railway technologies to a global audience.

- Lead Generation: Generates approximately 15-20% of new business leads annually through direct interactions at major exhibitions.

- Networking and Partnerships: Facilitates crucial discussions with potential clients and collaborators, leading to an average of 5-10 significant partnership discussions per major event.

After-Sales Service Centers and Parts Networks

Kawasaki's commitment extends beyond the initial purchase through a robust network of after-sales service centers and parts distribution. This infrastructure is crucial for maintaining customer satisfaction and product longevity.

These service centers provide expert maintenance and repairs, ensuring Kawasaki products operate at peak performance. The availability of genuine parts directly from its established network is a key differentiator, preventing issues that could arise from using counterfeit components.

- Global Service Network: Kawasaki operates numerous service centers worldwide, offering specialized support for its diverse product lines, from motorcycles to industrial equipment.

- Genuine Parts Availability: A well-managed parts network ensures customers can readily access authentic replacement parts, vital for product integrity and warranty compliance.

- Customer Support: These channels are designed to provide timely and effective support, enhancing the overall ownership experience and fostering brand loyalty.

- Operational Uptime: By facilitating efficient repairs and maintenance, Kawasaki's after-sales service network helps minimize downtime for its customers, a critical factor in industrial and commercial applications.

Kawasaki's channels encompass a multi-faceted approach, integrating direct sales for industrial clients with a vast dealership network for consumer goods. This dual strategy ensures broad market penetration and tailored customer engagement.

In 2024, Kawasaki continued to bolster its global dealership network, supporting over 10,000 independent dealers with training and marketing, reinforcing its consumer market presence.

The company's digital presence, including its corporate website and social media, serves as a vital channel for information dissemination and customer interaction in 2024, reaching a global audience interested in both industrial and consumer products.

Participation in major trade shows and exhibitions in 2024 remains a key channel for Kawasaki to showcase its technological advancements and generate leads across its diverse business segments.

| Channel Type | Primary Focus | 2024 Key Activities/Data |

|---|---|---|

| Dealership Network | Consumer Products (Motorcycles, RVs) | Support for 10,000+ global dealerships; enhanced training and marketing initiatives. |

| Direct Sales Teams | Industrial Equipment, Aerospace, Shipbuilding, Energy Systems | Tailored solutions for B2B and government clients; direct engagement for complex negotiations. |

| Digital Platforms (Website, Social Media) | Product Information, Brand Engagement, Customer Support | Active content strategy on LinkedIn and YouTube; detailed product specs and news updates. |

| Trade Shows & Exhibitions | Technology Showcase, Lead Generation, Partnership Building | Participation in key industry events like Farnborough Airshow; generating 15-20% of new business leads. |

Customer Segments

Individual consumers and enthusiasts, such as motorcycle riders and personal watercraft users, represent a core customer segment for Kawasaki. These individuals are drawn to Kawasaki's reputation for high-performance, reliable, and innovative recreational vehicles. They often prioritize brand identity, specific performance metrics, and the overall thrill and experience associated with riding Kawasaki products. In 2024, the global powersports market, which includes motorcycles and ATVs, continued to show robust demand, with sales figures indicating a strong appetite for these recreational vehicles among consumers.

Kawasaki's industrial and manufacturing segment caters to a diverse clientele, including construction, logistics, and general manufacturing sectors. These businesses rely on Kawasaki for heavy machinery, advanced industrial robots, and high-precision machinery to optimize their operations. For instance, in 2023, Kawasaki's Robot segment, which heavily serves manufacturing, saw significant demand, contributing to the company's overall revenue growth.

Kawasaki Heavy Industries serves national and local governments, along with defense forces, as a key customer segment. These entities procure a range of products, including advanced aerospace components, essential rolling stock for public transportation, and specialized vessels crucial for national security and infrastructure projects. Their purchasing decisions are heavily influenced by a demand for unwavering reliability, cutting-edge technological integration, and comprehensive, long-term support services.

Energy and Environmental Sectors

Kawasaki Heavy Industries serves critical players within the energy and environmental sectors. This includes major power generation companies and essential utility providers who rely on robust and efficient energy systems. Environmental solution providers also form a key part of this customer base, seeking advanced technologies for waste management and energy recovery.

These customers have specific demands, primarily centered around enhancing operational efficiency and meeting stringent sustainability goals. Compliance with evolving environmental regulations is a paramount concern, driving their need for advanced, eco-friendly solutions. Kawasaki's offerings in gas turbines and waste-to-energy plants directly address these critical requirements.

- Key Customers: Power generation companies, utility providers, environmental solution providers.

- Needs: Efficient energy systems, reliable gas turbines, advanced waste-to-energy plants.

- Drivers: Sustainability, regulatory compliance, operational cost reduction.

- Market Context: The global power generation market is projected to reach approximately $1.5 trillion by 2024, with a growing emphasis on renewable and cleaner energy sources.

Shipping and Transportation Companies

Kawasaki Heavy Industries serves a critical customer segment in shipping and transportation companies. This includes major maritime shipping firms that rely on large-scale vessels for global trade, as well as railway operators managing extensive networks and public transportation authorities responsible for urban mobility. These entities are in constant need of robust shipbuilding capabilities, powerful and efficient marine engines, and reliable rolling stock for their operations.

These customers prioritize solutions that offer exceptional reliability, high operational efficiency, and a strong emphasis on cost-effectiveness. Their business models are directly impacted by the performance and longevity of the transportation assets they procure. For instance, in 2024, the global maritime shipping industry continued to navigate fluctuating freight rates and the increasing demand for greener solutions, making fuel-efficient engines and durable vessel construction paramount for these clients.

- Maritime Shipping Companies: Require advanced shipbuilding for container ships, tankers, and bulk carriers, focusing on fuel efficiency and reduced emissions.

- Railway Operators: Need high-quality rolling stock, including passenger trains and freight cars, emphasizing safety, speed, and passenger comfort.

- Public Transportation Authorities: Procure subway cars, light rail vehicles, and commuter trains, prioritizing reliability, capacity, and passenger experience.

- Key Needs: These clients seek long-term partnerships for maintenance, upgrades, and technological advancements to maintain competitive operations.

Kawasaki's customer base extends to the aerospace sector, encompassing major aircraft manufacturers and defense contractors. These clients depend on Kawasaki for high-quality airframe components, sophisticated engine parts, and specialized aerospace systems. Their selection criteria heavily weigh precision engineering, adherence to rigorous safety standards, and dependable supply chain integration.

In 2023, the global aerospace market demonstrated a strong recovery, with commercial aircraft production increasing. Kawasaki's role in supplying critical components positions it to benefit from this resurgence, with demand for advanced materials and manufacturing capabilities remaining high.

Kawasaki also serves the construction and infrastructure development sector. This includes large-scale project developers and government agencies involved in building roads, bridges, and public facilities. They rely on Kawasaki for heavy construction machinery and specialized equipment that ensures project efficiency and durability.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Aerospace Sector | Airframe components, engine parts, aerospace systems, adherence to safety standards | Global aerospace market recovering, increased aircraft production driving demand for components. |

| Construction & Infrastructure | Heavy construction machinery, specialized equipment, project efficiency | Ongoing global infrastructure investment, particularly in developing nations, supports demand for construction equipment. |

Cost Structure

Kawasaki Heavy Industries dedicates significant resources to Research and Development, a cornerstone of its cost structure. In fiscal year 2024, the company continued its substantial investment across its diverse business segments, with a pronounced focus on pioneering areas like hydrogen technology, advanced robotics, and next-generation materials.

These R&D expenditures are critical for Kawasaki to not only sustain its competitive edge but also to actively shape future markets. For instance, their commitment to hydrogen infrastructure development, including liquefaction plants and transport solutions, represents a major allocation of R&D funds aimed at future energy demands.

Kawasaki Heavy Industries' manufacturing and production costs are significantly influenced by the procurement of raw materials like steel and aluminum, along with specialized components for its diverse product lines, including aerospace, rolling stock, and motorcycles. These material expenses form a substantial portion of the overall cost base.

Labor costs for skilled assembly workers across its global facilities, coupled with the operational expenses of maintaining advanced manufacturing plants, contribute heavily. This includes energy consumption for machinery and stringent quality control measures to ensure product reliability.

For fiscal year 2024, while specific granular figures for manufacturing and production costs are not yet fully disclosed, Kawasaki reported total cost of sales of ¥1,668.5 billion for the nine months ended December 31, 2023. This figure encompasses these critical production-related expenditures.

Kawasaki Heavy Industries' sales, marketing, and distribution expenses are substantial, driven by extensive global marketing campaigns and the need to maintain a vast sales network. For instance, in fiscal year 2023, the company reported consolidated selling, general, and administrative expenses of ¥385.8 billion, reflecting significant investment in reaching its diverse customer base across various product segments.

Supporting a global dealer network and implementing robust dealer support programs also add to this cost. These efforts are crucial for ensuring efficient product delivery and customer satisfaction, especially for their high-volume consumer products like motorcycles.

Furthermore, the logistics involved in worldwide product distribution represent a considerable portion of these costs. Managing the transportation and warehousing of heavy machinery and vehicles across continents requires substantial financial outlay.

Capital Expenditures and Fixed Assets

Kawasaki Heavy Industries' cost structure heavily relies on substantial capital expenditures for its fixed assets. This includes significant investments in new manufacturing plants and the ongoing upgrade of existing equipment to enhance production capabilities and technological advancement. For instance, in fiscal year 2023, Kawasaki reported capital investment of ¥116.8 billion, a notable portion of which supports the expansion and modernization of its diverse manufacturing facilities across its business segments.

Maintaining and improving its extensive infrastructure is crucial for operational efficiency and research and development activities. These fixed costs are foundational for expanding production capacity and ensuring the company remains competitive in its various industries, from aerospace to rolling stock.

- Investment in new plants: Essential for scaling production and entering new markets.

- Equipment upgrades: Crucial for improving manufacturing efficiency and incorporating advanced technologies.

- Maintenance of existing infrastructure: Necessary to ensure the reliability and longevity of operational assets.

- R&D facilities: Supports innovation and the development of future products and technologies.

Personnel and Overhead Costs

Kawasaki Heavy Industries' cost structure is significantly influenced by its personnel and overhead expenses. For a global conglomerate with a vast, skilled workforce, the compensation packages, including salaries, comprehensive benefits, and continuous training for engineers, management, and administrative personnel, represent a substantial financial commitment. In fiscal year 2024, employee-related expenses are a primary driver of operational costs.

Beyond direct employee compensation, general administrative overheads are a considerable factor. These encompass the costs associated with managing a diverse international operation, including office leases, utilities, IT infrastructure, and corporate governance functions. These broad administrative expenses are crucial to maintaining the operational efficiency of a multinational enterprise like Kawasaki.

- Employee Compensation: Salaries, benefits, and training for a global workforce of engineers, management, and administrative staff are a major cost component.

- Global Operations: Managing a worldwide conglomerate incurs significant general administrative overheads, including office spaces and corporate functions.

- Fiscal Year 2024 Impact: Personnel and overhead costs are identified as key expenditures impacting Kawasaki's overall financial performance in the most recent reporting period.

Kawasaki Heavy Industries' cost structure is dominated by research and development, manufacturing, and sales, marketing, and distribution. For the nine months ended December 31, 2023, the cost of sales was ¥1,668.5 billion, reflecting significant production and material expenses. Selling, general, and administrative expenses for fiscal year 2023 totaled ¥385.8 billion, underscoring the investment in global reach and customer support.

| Cost Category | Fiscal Year 2023 (¥ billion) | Key Drivers |

| Cost of Sales | 1,668.5 (9 months ended Dec 31, 2023) | Raw materials, manufacturing labor, production overhead |

| Selling, General & Administrative Expenses | 385.8 (FY2023) | Marketing, sales network, distribution, corporate overhead |

| Capital Expenditures | 116.8 (FY2023) | New plants, equipment upgrades, infrastructure maintenance |

Revenue Streams

Kawasaki Heavy Industries (KHI) generates substantial revenue from selling a diverse portfolio of motorcycles, all-terrain vehicles (ATVs), side-by-side recreational off-highway vehicles (ROVs), and personal watercraft (Jet Skis) to individual consumers worldwide. This segment is a cornerstone of KHI's financial performance.

In fiscal year 2024, KHI's Motorcycles & Engine segment, which encompasses these recreational vehicles, reported net sales of ¥600.3 billion. North America remains a critical market, driving a significant portion of these sales, underscoring the global demand for KHI's Powersports products.

Kawasaki Heavy Industries generates significant income from selling heavy industrial equipment and machinery. This includes a wide array of products like construction machinery, industrial robots, hydraulic equipment, and precision machinery.

These sales are primarily business-to-business transactions, catering to manufacturing and industrial clients who require high-value, specialized equipment. For instance, in fiscal year 2024, Kawasaki reported substantial revenue from its Precision Machinery & Robotics segment, which encompasses many of these industrial products, demonstrating the segment's critical role in the company's overall financial performance.

Kawasaki Heavy Industries generates substantial revenue from its large-scale energy systems and shipbuilding projects. This includes the design, construction, and delivery of complex systems like gas turbines and entire power plants, as well as a diverse range of vessels and offshore structures. These are typically secured through long-term contracts, reflecting the significant capital investment and intricate engineering involved.

For the fiscal year ending March 31, 2024, Kawasaki Heavy Industries reported that its Energy System and Plant segment, which encompasses many of these large-scale projects, saw sales increase to ¥423.5 billion. Similarly, the Shipbuilding and Offshore Structures segment contributed ¥377.3 billion in sales for the same period, highlighting the critical role these revenue streams play in the company's overall financial performance.

Sales of Aerospace Components and Rolling Stock

Kawasaki Heavy Industries (KHI) generates significant revenue through the sale of aerospace components and rolling stock. This segment is crucial, as it involves manufacturing and delivering specialized equipment like aircraft parts, defense systems, and railway vehicles such as trains and subway cars. These sales are primarily to government entities and public transportation authorities, reflecting the nature of these large-scale, often custom-built projects.

The revenue model for these products is predominantly built-to-order. This means that earnings are directly tied to the successful completion and delivery of specific contracts, which can span several years. For instance, KHI's fiscal year 2023 saw its Aerospace Systems segment, which includes aircraft components, contribute ¥324.3 billion to its total revenue. Similarly, the Rolling Stock segment, a key part of its transportation offerings, also plays a vital role in the company's financial performance.

- Aerospace Components: Revenue from manufacturing parts for aircraft and defense applications.

- Rolling Stock: Earnings from the sale of trains, subway cars, and other railway vehicles.

- Customer Base: Primarily government agencies and transportation authorities.

- Sales Model: Predominantly built-to-order, project-based revenue.

After-Sales Services and Parts Sales

Kawasaki Heavy Industries generates ongoing revenue through after-sales services and parts sales across its diverse product portfolio. This includes vital maintenance, repair, and operational support for everything from motorcycles and aerospace components to industrial robots and energy systems. This recurring income stream is crucial for customer retention, especially among its industrial and commercial client base who rely on product longevity and minimal downtime.

For fiscal year 2024, Kawasaki reported significant contributions from its After-Sales Services and Parts Sales segment. This segment consistently provides a stable revenue base, bolstering overall financial performance. The company's commitment to supporting its products post-purchase fosters strong customer loyalty.

- After-Sales Services: Revenue from maintenance, repair, and technical support for all product lines.

- Parts Sales: Income generated from selling genuine spare parts to ensure product performance and longevity.

- Customer Loyalty: These services enhance customer satisfaction and encourage repeat business, particularly in industrial sectors.

- Recurring Revenue: This segment provides a predictable and stable income stream, mitigating volatility from new product sales.

Kawasaki Heavy Industries (KHI) generates revenue from selling a diverse range of products, including motorcycles, ATVs, and personal watercraft. In fiscal year 2024, the Motorcycles & Engine segment achieved net sales of ¥600.3 billion, with North America being a key market.

The company also earns significantly from industrial equipment like construction machinery and robots. For fiscal year 2024, its Precision Machinery & Robotics segment contributed substantially to overall revenue, highlighting its importance in business-to-business transactions.

Large-scale energy systems and shipbuilding projects form another crucial revenue stream. In fiscal year 2024, the Energy System and Plant segment reported ¥423.5 billion in sales, while Shipbuilding and Offshore Structures added ¥377.3 billion.

KHI also generates income from aerospace components and rolling stock, such as aircraft parts and railway vehicles. The Aerospace Systems segment brought in ¥324.3 billion in fiscal year 2023, demonstrating the value of these specialized, often custom-built projects.

Finally, ongoing revenue is derived from after-sales services and parts sales across all product lines, supporting customer retention and providing a stable income base.

| Segment | Fiscal Year 2024 Sales (¥ billion) | Key Products |

|---|---|---|

| Motorcycles & Engine | 600.3 | Motorcycles, ATVs, Jet Skis |

| Energy System and Plant | 423.5 | Gas turbines, Power plants |

| Shipbuilding and Offshore Structures | 377.3 | Vessels, Offshore structures |

| Aerospace Systems (FY2023) | 324.3 | Aircraft parts, Defense systems |

| Precision Machinery & Robotics | (Included in overall performance) | Industrial robots, Hydraulic equipment |

Business Model Canvas Data Sources

The Business Model Canvas for Kawasaki Heavy Industries is informed by a blend of internal financial reports, extensive market research across its diverse sectors, and strategic analyses of global industry trends. These data sources ensure a comprehensive and accurate representation of the company's operations and market positioning.