Kawasaki Heavy Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kawasaki Heavy Industries Bundle

Kawasaki Heavy Industries navigates a complex landscape shaped by intense rivalry, significant buyer power in certain segments, and the constant threat of new entrants in its diverse markets. Understanding the influence of powerful suppliers and the potential disruption from substitute products is crucial for strategic planning.

The complete report reveals the real forces shaping Kawasaki Heavy Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Kawasaki Heavy Industries often faces significant supplier bargaining power due to its reliance on a select group of providers for highly specialized components. This is particularly evident in sectors like aerospace and shipbuilding, where unique materials or advanced technological parts are essential.

For instance, in 2023, the global aerospace market saw a continued demand for advanced composite materials and sophisticated avionics, with a limited number of manufacturers possessing the necessary certifications and production capacity. This concentration inherently grants these suppliers leverage.

The high switching costs associated with changing suppliers for these critical, often custom-engineered, components further solidify the suppliers' position. This means Kawasaki may have less flexibility to negotiate prices or terms when these specialized parts are crucial for production timelines and product quality.

Raw material price volatility significantly impacts Kawasaki Heavy Industries. Suppliers of essential inputs such as steel, aluminum, and rare earth elements hold considerable sway due to unpredictable price swings and potential supply chain disruptions. For instance, in 2024, the price of steel pipes saw an upward trend, contributing to broader volatility in industrial commodity markets. This instability directly influences Kawasaki's manufacturing expenses across its varied product lines, from motorcycles to aerospace components.

Suppliers who invest significantly in cutting-edge manufacturing technologies or develop unique innovations, like advanced materials for the aerospace sector or sophisticated hydraulic components, gain the ability to charge premium prices. Kawasaki Heavy Industries may find itself reliant on these supplier advancements to ensure its own products maintain a competitive edge and deliver superior performance.

Supplier concentration in specific segments

Kawasaki Heavy Industries, despite its broad operational scope, faces supplier concentration in niche areas. For instance, in the aerospace sector, specialized components or advanced materials might be sourced from a limited number of providers. This concentration can grant these suppliers significant leverage.

This leverage translates into the ability to influence pricing and delivery timelines, directly impacting Kawasaki's production costs and operational efficiency. For example, a single supplier for a critical aerospace engine part could command higher prices if alternatives are scarce or non-existent.

- Supplier Concentration: In segments like aerospace and defense, specialized components often come from a limited pool of suppliers.

- Impact on Kawasaki: This concentration can lead to less favorable pricing and potential disruptions to delivery schedules for Kawasaki.

- Example: A sole-source supplier for a critical aerospace sub-assembly could dictate terms, increasing costs for Kawasaki's defense segment.

Switching costs for Kawasaki

The switching costs for Kawasaki Heavy Industries from its suppliers can be substantial, particularly concerning specialized components that demand rigorous qualification, testing, and intricate integration into Kawasaki's complex machinery and systems. For instance, developing a new supplier for critical aerospace or shipbuilding components could involve extensive re-engineering and validation processes, potentially costing millions of yen and delaying production schedules significantly.

These high barriers to changing suppliers directly enhance the bargaining power of existing suppliers. They know that Kawasaki faces considerable financial and operational penalties if they decide to switch, allowing these suppliers to potentially command higher prices or more favorable terms. This situation is particularly acute in industries where component standardization is low and supplier relationships are deeply embedded in the product development lifecycle.

- High Integration Costs: Switching suppliers for specialized components like advanced engine parts or navigation systems requires significant re-tooling and re-testing, impacting production timelines.

- Regulatory Compliance: Many of Kawasaki's products, such as aircraft or industrial equipment, must meet stringent safety and performance regulations, making supplier changes complex and time-consuming due to recertification needs.

- Intellectual Property and Know-How: Established supplier relationships often involve shared proprietary knowledge or custom-designed parts, creating a dependency that discourages switching.

Kawasaki Heavy Industries faces considerable supplier bargaining power due to the specialized nature of many of its components, especially in sectors like aerospace and shipbuilding. This reliance on a limited number of providers for critical, often custom-engineered parts, grants these suppliers leverage in pricing and delivery terms.

For example, the aerospace industry in 2023 continued to see a concentration of suppliers for advanced materials and avionics, with few manufacturers holding the necessary certifications. This scarcity directly empowers these suppliers. Furthermore, the high costs associated with switching suppliers for these integrated and rigorously tested components mean Kawasaki has limited flexibility, impacting production costs and timelines.

Supplier concentration is a key factor for Kawasaki, particularly in niche markets. For instance, in 2024, the global market for specialized industrial robots and advanced manufacturing equipment saw a continued reliance on a few key component providers for highly sophisticated sensors and control systems. This limited supplier base allows them to negotiate favorable terms.

The bargaining power of Kawasaki's suppliers is amplified by the significant switching costs involved. For critical aerospace or shipbuilding parts, re-qualifying and integrating a new supplier can involve millions in costs and substantial production delays. In 2024, regulatory hurdles in the defense sector further cemented this, as recertification for new component suppliers for military-grade equipment can take years, reinforcing the power of established providers.

| Factor | Impact on Kawasaki | Example (2023-2024) |

|---|---|---|

| Supplier Concentration | Limited options for critical components | Specialized aerospace materials from a few certified manufacturers |

| Switching Costs | High financial and time penalties for changing suppliers | Re-engineering and re-testing of complex engine parts for shipbuilding |

| Supplier Differentiation | Reliance on suppliers for technological advancements | Advanced hydraulic systems for industrial machinery requiring unique innovations |

What is included in the product

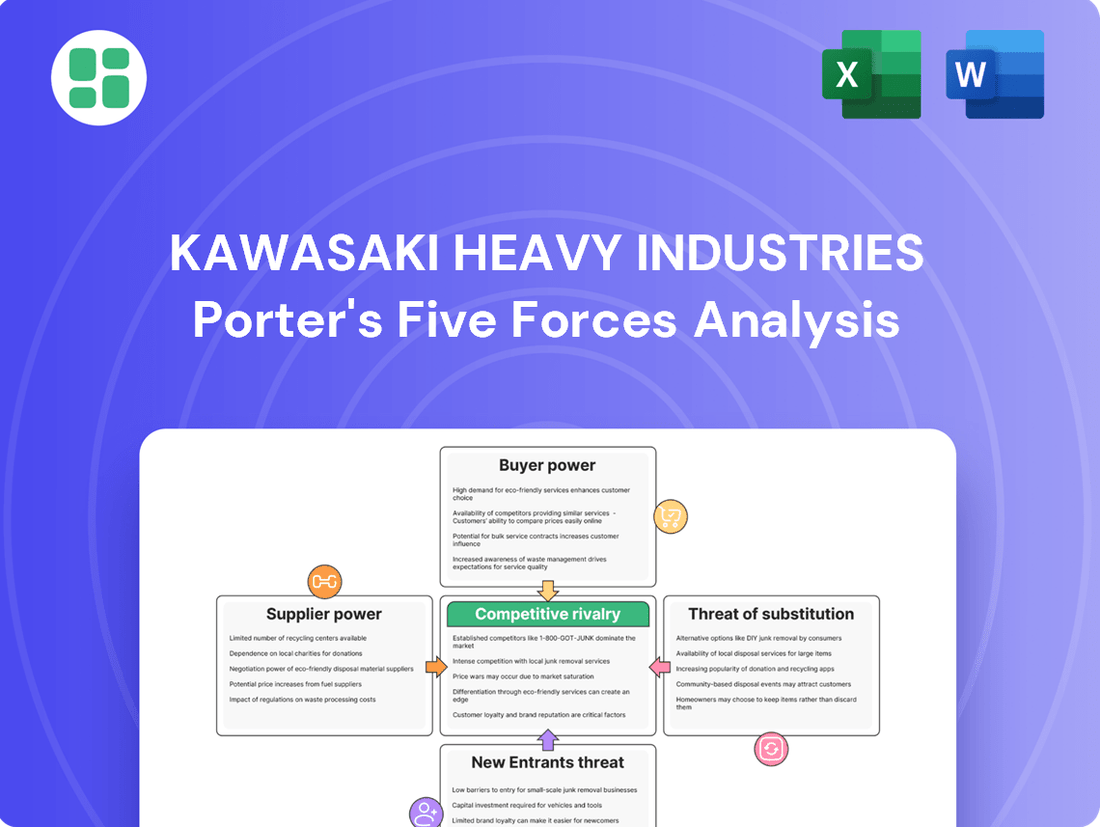

This Porter's Five Forces analysis for Kawasaki Heavy Industries delves into the competitive intensity within its diverse industrial sectors, examining supplier and buyer power, the threat of new entrants and substitutes, and the overall industry rivalry.

Quickly identify and address competitive threats with a visual breakdown of Kawasaki's industry landscape, simplifying complex strategic challenges.

Customers Bargaining Power

Kawasaki Heavy Industries (KHI) benefits from a remarkably diverse customer base, spanning from individual motorcycle enthusiasts to major global corporations and government entities. This broad reach means that no single customer segment typically holds significant sway over pricing or terms. For example, while a large aerospace client might represent substantial revenue, KHI's extensive work in shipbuilding, railway systems, and energy infrastructure provides a buffer against any single customer's demands.

In consumer-facing segments like motorcycles and recreational vehicles, customers often exhibit higher price sensitivity, especially in emerging markets. For instance, in 2024, the global motorcycle market saw varied demand based on economic conditions, with price being a key determinant for many buyers in developing economies. This sensitivity can limit Kawasaki's ability to significantly increase prices without impacting demand and market share.

Kawasaki Heavy Industries often deals with large industrial clients, such as major shipping companies or national railway operators, who possess significant bargaining power. These clients, undertaking massive projects, can dictate terms due to the sheer volume and value of their orders, influencing pricing and specifications.

For instance, in the shipbuilding sector, a single large order for multiple vessels can represent a substantial portion of Kawasaki's annual production. This leverage allows these clients to demand competitive pricing, extended payment terms, and highly specific customizations, directly impacting Kawasaki's profit margins and operational flexibility.

Availability of alternative suppliers for customers

Kawasaki Heavy Industries faces a moderate level of customer bargaining power, especially in segments with readily available alternatives. For instance, in the construction machinery sector, customers can often source similar equipment from various global manufacturers, allowing them to negotiate better terms or switch suppliers if pricing or terms are unfavorable. This is further amplified by the availability of standardized components and technologies across the industry.

The presence of numerous competitors offering comparable products, particularly in mass-market segments like motorcycles, means customers have significant choice. This can lead to price sensitivity and a greater inclination to shop around for the best deals, directly impacting Kawasaki's pricing power. For example, the global motorcycle market in 2024 features a wide array of brands competing on price and features.

- Increased customer choice in standardized product lines like construction machinery and motorcycles.

- Downward pressure on pricing due to customer ability to switch suppliers.

- The global motorcycle market in 2024 is highly competitive, offering customers numerous alternatives.

Long-term relationships and after-sales service importance

In sectors like aerospace and heavy machinery, where Kawasaki Heavy Industries (KHI) operates, customers often form long-term relationships. These aren't just about initial purchase; they extend to critical after-sales service, maintenance, and upgrades. This deepens the customer's commitment and reliance on KHI's expertise.

This reliance, however, can also empower customers. Knowing that switching providers would be costly and disruptive, they can leverage their position to negotiate favorable terms for ongoing support and parts. For instance, in 2023, the global aerospace MRO (Maintenance, Repair, and Overhaul) market was valued at approximately $90 billion, highlighting the significant ongoing expenditure and the importance of service relationships.

KHI's commitment to robust after-sales service, including technical support and spare parts availability, directly influences customer loyalty. However, it also means customers have leverage to demand high standards and potentially better pricing throughout the product's operational life. This dynamic shapes the bargaining power of these industrial clients.

- Long-term dependencies: Customers in heavy industries often require continuous support, making switching difficult.

- After-sales service leverage: The necessity of maintenance and parts gives customers a voice in pricing and service levels.

- Market context: The substantial value of the aerospace MRO market in 2023 ($90 billion) underscores the financial weight of these ongoing customer relationships.

- Customer empowerment: Strong service offerings can create customer lock-in but also provide them with bargaining power for better terms.

Kawasaki Heavy Industries (KHI) faces moderate customer bargaining power, particularly in segments where products are standardized and alternatives are readily available, such as construction machinery and motorcycles.

In 2024, the global motorcycle market, a key consumer segment for KHI, continued to be highly competitive, with numerous brands offering comparable models, intensifying price sensitivity and giving buyers significant leverage to seek the best value.

While KHI's large industrial clients, like those in shipbuilding and aerospace, possess considerable purchasing volume, their long-term reliance on KHI for specialized support and parts can create a degree of customer lock-in, which they can leverage to negotiate favorable terms for ongoing services.

| Customer Segment | Key Leverage Points | Impact on KHI |

|---|---|---|

| Motorcycle Enthusiasts (Mass Market) | High price sensitivity, abundant alternatives | Downward pressure on pricing, limits price increases |

| Aerospace & Shipbuilding Clients (Large Industrial) | Large order volumes, long-term service dependency | Negotiating power on pricing, terms, and after-sales service |

| Railway & Energy Infrastructure Clients | Significant project scale, potential for long-term contracts | Ability to influence specifications and payment terms |

Full Version Awaits

Kawasaki Heavy Industries Porter's Five Forces Analysis

This preview showcases the complete Kawasaki Heavy Industries Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you are viewing is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring no surprises and immediate usability for your strategic planning.

Rivalry Among Competitors

Kawasaki Heavy Industries navigates a fiercely competitive landscape. In the powersports sector, rivals like Honda, Yamaha, and Suzuki constantly push innovation, impacting Kawasaki's market share. For instance, the global motorcycle market, a key segment for Kawasaki, saw significant growth in 2024, with demand for diverse models intensifying the rivalry.

The heavy machinery division faces formidable opposition from giants such as Komatsu and Caterpillar. These companies vie for dominance in infrastructure projects worldwide, requiring Kawasaki to maintain cutting-edge technology and cost-effectiveness. The construction equipment market, particularly in Asia, remained highly competitive throughout 2024, with significant investments in new product lines by major players.

Furthermore, its aerospace and shipbuilding operations contend with established global leaders, necessitating a relentless focus on technological advancement and operational excellence to secure contracts and maintain profitability in these capital-intensive industries. The global shipbuilding order book for 2024 showed robust activity, but also highlighted intense bidding among major shipbuilders.

Industries where Kawasaki Heavy Industries operates, such as shipbuilding and aerospace, are notorious for their substantial fixed costs. For instance, building a shipyard or an aircraft manufacturing facility requires massive capital investment, often running into billions of dollars. This high upfront expenditure means companies must maintain high production levels to spread these costs, making them susceptible to intense price competition to keep factories running.

The significant barriers to exit in these sectors further exacerbate competitive rivalry. Specialized machinery, highly skilled labor forces, and long-term contracts mean that shutting down operations or divesting assets is often prohibitively expensive and complex. Consequently, even in periods of low demand, companies like Kawasaki are incentivized to continue production, often at lower margins, to avoid the crippling costs associated with exiting the market.

In 2023, the global shipbuilding market, a key area for Kawasaki, saw intense competition. While specific figures for Kawasaki's fixed costs aren't publicly detailed in this context, the industry's nature dictates that a single large shipbuilding order can be worth hundreds of millions, even billions, of dollars, underscoring the scale of investment and the pressure to secure such contracts. This environment naturally leads to aggressive pricing to secure market share and maintain operational viability.

Kawasaki actively differentiates its offerings through a strong emphasis on technological innovation. For instance, their significant investments in hydrogen technology, advanced robotics, and more fuel-efficient engine designs directly address evolving market demands and regulatory pressures. This commitment to R&D is a critical battleground, as competitors continuously introduce new models and enhanced features to capture market share.

Global market presence and regional dynamics

Kawasaki Heavy Industries faces a competitive landscape that shifts significantly based on geographical location. In mature markets like North America and Europe, established global players with extensive product portfolios and strong brand recognition, such as Siemens and General Electric, often dominate. These companies leverage their long-standing relationships and technological advancements to maintain market share.

Conversely, in rapidly developing economies across Asia and Latin America, the competitive intensity is often driven by emerging local manufacturers. These regional competitors can offer more cost-effective solutions and are often more attuned to specific local market needs and regulatory requirements. For instance, in the Asian motorcycle market, brands like Honda and Yamaha face robust competition from domestic players like Bajaj Auto in India and Loncin in China, which have rapidly expanded their capabilities and market reach.

Kawasaki's extensive global footprint necessitates navigating these varied competitive dynamics. The company must adapt its strategies to address the entrenched market power of incumbents in developed regions while simultaneously competing with agile, cost-sensitive local players in emerging markets. This requires a nuanced approach to product development, pricing, and distribution channels tailored to each specific regional context.

- Developed Markets: Dominated by established global players like Siemens and General Electric, focusing on advanced technology and brand loyalty.

- Emerging Markets: Characterized by strong competition from local manufacturers who offer cost-effective solutions and cater to specific regional demands.

- Regulatory Environments: Varying regulations across different regions add another layer of complexity for global competitors like Kawasaki.

- Strategic Adaptation: Kawasaki must tailor its market approach, from product offerings to pricing, to effectively compete in diverse regional landscapes.

Consolidation and strategic alliances

Kawasaki Heavy Industries operates within a sector increasingly defined by consolidation and strategic alliances. Competitors are actively pursuing mergers and partnerships to bolster their market position. For instance, in the aerospace sector, a key area for Kawasaki, there's a continuous trend of major players integrating to gain efficiencies and share the immense costs associated with developing new aircraft technologies. This consolidation directly impacts Kawasaki by potentially creating larger, more formidable rivals with greater financial and operational leverage.

These strategic moves are often driven by the pursuit of economies of scale, which allows companies to reduce per-unit production costs. Furthermore, sharing research and development expenses is crucial in capital-intensive industries like shipbuilding and heavy machinery, where innovation cycles are long and expensive. By forming alliances, companies can also broaden their geographical reach and access new customer segments more effectively. For example, in 2024, several major players in the global industrial robotics market announced new joint ventures aimed at developing next-generation automation solutions, a move that directly influences the competitive intensity for Kawasaki's own robotics division.

- Industry Consolidation: Competitors are merging or acquiring smaller firms to increase market share and operational efficiency.

- Strategic Alliances: Partnerships are formed to share R&D costs, access new technologies, and expand market reach.

- Economies of Scale: Consolidation enables companies to achieve lower per-unit production costs, enhancing price competitiveness.

- R&D Cost Sharing: Alliances help distribute the significant financial burden of innovation in capital-intensive sectors.

Kawasaki Heavy Industries faces intense competition from global giants and agile local players across its diverse business segments. In powersports, rivals like Honda and Yamaha continually innovate, intensifying rivalry, especially as the global motorcycle market saw robust growth in 2024. Similarly, the heavy machinery division contends with industry leaders such as Komatsu and Caterpillar, with the Asian construction equipment market remaining highly competitive in 2024 due to significant new product investments.

The aerospace and shipbuilding sectors present their own competitive challenges, with established global leaders demanding relentless technological advancement and operational excellence. The shipbuilding order book in 2024 was active but marked by fierce bidding. High fixed costs and significant barriers to exit in these capital-intensive industries compel companies like Kawasaki to maintain high production levels, often leading to aggressive pricing strategies to secure market share and operational viability.

Kawasaki differentiates itself through innovation, investing heavily in areas like hydrogen technology and advanced robotics to meet evolving market demands. However, competitors are also actively consolidating and forming strategic alliances in 2024, particularly in industrial robotics, to achieve economies of scale and share R&D costs. This trend creates larger, more formidable rivals, demanding continuous adaptation from Kawasaki to maintain its competitive edge in a dynamic global market.

SSubstitutes Threaten

For Kawasaki's motorcycle division, substitutes like cars, public transportation, and electric bicycles pose a significant threat, particularly for urban commuting. While motorcycles provide agility and often better fuel economy, evolving consumer desires and infrastructure improvements could steer demand towards these alternatives. For instance, rising fuel prices in 2024 could make the lower running costs of public transport or e-bikes more appealing to a broader segment of potential buyers.

The threat of substitutes for Kawasaki Heavy Industries in the heavy industrial equipment sector is influenced by evolving construction methods. Innovations like modular construction and 3D printing offer alternatives that could lessen reliance on traditional heavy machinery for certain applications. For instance, the global 3D printing construction market was valued at approximately $1.4 billion in 2023 and is projected to grow significantly.

Despite these advancements, traditional heavy equipment remains crucial for large-scale infrastructure projects, such as dams, bridges, and high-rise buildings. The sheer scale and complexity of these undertakings often necessitate the robust capabilities and established efficiency of conventional machinery, limiting the immediate substitutability for core infrastructure development.

The increasing sophistication of virtual collaboration tools presents a significant threat to Kawasaki Heavy Industries' aerospace segment, particularly commercial aviation. As businesses adopt more robust remote work capabilities, the need for traditional business travel, a key driver of aircraft demand, could diminish.

In 2024, the global business travel market, while recovering post-pandemic, is still navigating the impact of hybrid work models. Companies are re-evaluating travel budgets, with a notable portion of previously essential trips now being replaced by virtual meetings, potentially dampening long-term demand for new aircraft orders.

Alternative energy and propulsion systems

Kawasaki Heavy Industries' energy systems and marine engineering operations contend with a significant threat from alternative energy and propulsion systems. The global push for decarbonization is accelerating the adoption of technologies like solar and wind power for electricity generation, directly impacting demand for traditional energy infrastructure. For instance, renewable energy sources accounted for approximately 30% of global electricity generation in 2023, a figure projected to rise substantially.

In the marine sector, the emergence of purely electric and hydrogen-fueled propulsion systems presents a direct substitute for conventional engine technologies that Kawasaki offers. Major shipping lines are increasingly investing in and piloting these cleaner alternatives. By the end of 2024, over 100 new vessels were reported to be on order with alternative fuel capabilities, signaling a clear market shift.

These substitutes are driven by tightening environmental regulations and growing consumer demand for sustainability. This trend necessitates continuous innovation and adaptation from companies like Kawasaki to remain competitive. The market for green shipping technologies, including hydrogen fuel cells and battery-electric systems, is expected to grow at a compound annual growth rate of over 15% through 2030.

- Renewable energy sources are increasingly displacing traditional power generation methods.

- Electric and hydrogen propulsion systems offer viable alternatives for marine vessels.

- Regulatory pressures and sustainability demands are key drivers of substitute adoption.

- The green shipping technology market is experiencing rapid expansion.

Automation and robotics as substitutes for human labor

Kawasaki Heavy Industries operates in a landscape where automation and robotics themselves serve as substitutes for human labor, particularly within its precision machinery and robotics division. This creates a dynamic where the company is both a provider and a potential victim of this substitution trend.

For Kawasaki's heavy industrial equipment, the increasing adoption of automation and robotics in sectors like construction and manufacturing presents a significant threat. As these industries become more automated, the demand for certain types of human-operated heavy machinery could decline over the long term.

- Advancing Robotics Capabilities: The continuous improvement in robotic technology means that tasks previously requiring human operators for heavy machinery are becoming increasingly feasible for automated systems.

- Cost Efficiency of Automation: Over time, the total cost of ownership for automated solutions, including initial investment and maintenance, may become more competitive compared to human labor for certain heavy industrial applications.

- Productivity Gains: Automated systems can often operate for longer periods and with greater precision than human operators, leading to potential productivity gains that incentivize their adoption.

The threat of substitutes for Kawasaki Heavy Industries is multifaceted, impacting its diverse business segments. In the motorcycle division, alternatives like electric scooters and advanced public transport systems are gaining traction, particularly in urban environments. For its industrial equipment, innovations in construction technology and automation present substitutes that can reduce the need for traditional heavy machinery.

The aerospace sector faces substitution from advanced virtual collaboration tools, potentially decreasing business travel and thus aircraft demand. Furthermore, the energy and marine sectors are seeing a significant shift towards renewable energy sources and alternative propulsion systems, driven by environmental concerns and regulations, directly challenging Kawasaki's established offerings.

| Kawasaki Segment | Primary Substitutes | Key Drivers for Substitution | 2024/2023 Data Point |

|---|---|---|---|

| Motorcycles | Electric Scooters, Public Transport, E-bikes | Urbanization, Fuel Costs, Environmental Awareness | E-bike market projected to reach $80 billion by 2028. |

| Heavy Industrial Equipment | Modular Construction, 3D Printing, Advanced Robotics | Efficiency Gains, Cost Reduction, Automation Trends | Global construction robotics market valued at $1.5 billion in 2023. |

| Aerospace | Virtual Collaboration Tools | Remote Work Adoption, Travel Cost Reduction | Business travel spending in 2024 expected to reach 95% of 2019 levels, but hybrid models persist. |

| Energy & Marine | Renewable Energy, Electric/Hydrogen Propulsion | Decarbonization Goals, Environmental Regulations, Sustainability Demand | Renewable energy share in global electricity generation reached 30% in 2023. |

Entrants Threaten

Kawasaki Heavy Industries operates across highly capital-intensive sectors like aerospace, shipbuilding, and heavy machinery. These industries demand substantial upfront investment in advanced manufacturing facilities, cutting-edge research and development, and rigorous testing protocols. For example, developing a new aircraft or a large-scale industrial robot requires billions in capital expenditure.

The sheer scale of investment needed for R&D and production in these areas creates a formidable barrier to entry. New companies would struggle to match the technological expertise and economies of scale that established players like Kawasaki have cultivated over decades. This high capital intensity significantly deters potential new competitors from entering the market.

Kawasaki Heavy Industries benefits significantly from its deeply entrenched brand loyalty and a stellar global reputation, cultivated over many decades. This is particularly evident in its highly competitive powersports and industrial equipment sectors, where trust and recognition are paramount.

New companies entering these markets would face a formidable barrier in replicating Kawasaki's established brand equity. They would need to commit substantial resources to marketing and ensuring product quality to even begin building a comparable level of customer trust and recognition.

For instance, Kawasaki's motorcycle division consistently ranks high in customer satisfaction surveys, a testament to years of product development and brand building. In 2023, Kawasaki Motors Corporation reported net sales of ¥1,605.9 billion, showcasing the scale and success of its established operations.

Kawasaki Heavy Industries operates in sectors like aerospace and shipbuilding, which are inherently complex due to rigorous regulatory frameworks. Obtaining necessary certifications and adhering to stringent safety and environmental standards requires substantial investment and expertise, significantly deterring new entrants.

For instance, the aerospace industry demands compliance with regulations from bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). In 2024, the cost of achieving and maintaining these certifications can run into millions of dollars, alongside lengthy approval processes that can take years, effectively blocking smaller or less capitalized competitors.

Access to distribution channels and supply chains

Kawasaki Heavy Industries leverages its extensive global distribution networks and deeply integrated supply chains, built over decades across its diverse business segments. This infrastructure is a formidable barrier for any new competitor looking to enter the market.

New entrants would face substantial hurdles and significant capital investment to establish comparable sales, service, and parts distribution networks, particularly for highly specialized and complex industrial machinery and systems. The sheer scale and established nature of Kawasaki's operations make replicating this aspect extremely difficult and costly.

For instance, in the aerospace sector, securing the necessary certifications and building relationships with airlines for maintenance and parts supply chains is a lengthy and capital-intensive process. Similarly, in the motorcycle division, establishing a widespread dealer network capable of handling sales, repairs, and warranty services requires considerable time and financial commitment. As of 2024, the cost to establish a comparable global distribution network for industrial equipment can easily run into hundreds of millions of dollars, if not billions, depending on the scope.

- Established Global Networks: Kawasaki possesses a robust and widespread network for sales, service, and parts across its core business areas.

- High Entry Costs: New entrants face substantial financial and time investment to build equivalent distribution and supply chain capabilities.

- Complexity of Industrial Products: The specialized nature of Kawasaki's offerings, from aerospace components to heavy industrial machinery, necessitates sophisticated support infrastructure.

- Competitive Disadvantage: Lacking established channels, new players would struggle to offer the same level of customer support and product availability as Kawasaki.

Proprietary technology and intellectual property

Kawasaki Heavy Industries' robust portfolio of patents and proprietary technologies significantly deters new entrants. For instance, their advanced engine designs for motorcycles and aerospace, along with cutting-edge robotics and emerging hydrogen energy solutions, represent substantial R&D investments.

These innovations act as a formidable barrier to entry, as newcomers would need to replicate or acquire similar technological capabilities, a process demanding considerable capital and time. In 2023, Kawasaki reported significant investment in research and development, underscoring their commitment to maintaining a technological edge.

- Proprietary Technology: Kawasaki holds numerous patents across diverse sectors like aerospace, robotics, and energy.

- High R&D Investment: Significant capital is poured into developing unique technologies, making replication costly for rivals.

- Intellectual Property Barrier: Patents create a legal and practical hurdle for new companies seeking to enter Kawasaki's markets.

- Licensing Costs: New entrants might face substantial costs if they opt to license existing technologies rather than develop their own.

The threat of new entrants for Kawasaki Heavy Industries is generally low due to the substantial barriers in its core markets. High capital requirements for manufacturing and R&D, coupled with established brand loyalty and complex regulatory environments, make it difficult for newcomers to compete effectively. Furthermore, Kawasaki's extensive global distribution networks and proprietary technologies create significant hurdles for potential entrants seeking to establish a foothold.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions needed for advanced facilities, R&D, and testing (e.g., aerospace). | Severely limits entry for less capitalized firms. |

| Brand Loyalty & Reputation | Decades of trust and recognition, especially in powersports. | New entrants need massive marketing spend to build comparable equity. |

| Regulatory Hurdles | Strict safety, environmental, and certification standards (e.g., FAA, EASA). | Lengthy and costly approval processes deter new players. |

| Distribution Networks | Established global sales, service, and parts infrastructure. | Replicating this requires immense capital and time. |

| Proprietary Technology | Patents and unique innovations in engines, robotics, and energy. | High R&D investment creates a technological moat. |

Porter's Five Forces Analysis Data Sources

Our Kawasaki Heavy Industries Porter's Five Forces analysis is built on a foundation of robust data, integrating information from their annual reports, investor presentations, and financial filings. We also leverage industry-specific market research reports and competitor analyses to provide a comprehensive view of the competitive landscape.