Kawasaki Heavy Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kawasaki Heavy Industries Bundle

Kawasaki Heavy Industries operates within a dynamic global environment shaped by political shifts, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying future opportunities. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to navigate the complexities of the aerospace, shipbuilding, and industrial sectors. Download the full version now and gain the foresight needed to make informed decisions.

Political factors

Kawasaki Heavy Industries (KHI) is a key contributor to Japan's defense sector, producing aerospace components and potentially advanced missile systems. The Japanese government's commitment to bolstering its defense capabilities, particularly evident in its 2024 and 2025 budget allocations, directly fuels demand for KHI's offerings. This strategic focus includes significant investment in indigenous defense technology development, such as the planned 'Japanese Tomahawk' missile, creating substantial opportunities for KHI.

Global trade policies, including potential tariff wars between major economies, directly affect Kawasaki Heavy Industries' (KHI) international manufacturing operations. For instance, ongoing trade friction between the US and China in 2024 could lead to increased costs for imported components or reduced demand for KHI's products in these key markets, impacting its aerospace and motorcycle divisions.

Geopolitical instability, particularly in East Asia, significantly influences Japan's defense posture and, consequently, demand for KHI's defense-related products. Military buildups by nations like China and North Korea in 2024 and 2025 are likely to sustain or increase government spending on national security, potentially boosting KHI's order book for defense systems and specialized equipment.

Japan's evolving industrial policies, with a strong emphasis on economic security and resilience, are a significant tailwind for Kawasaki Heavy Industries. Revised in May 2025, these policies are designed to bolster the nation's industrial and technological foundation.

These initiatives actively encourage public-private partnerships to foster robust supply chains and advance key technologies such as AI and robotics, areas where Kawasaki has substantial expertise and investment.

Government Support for Green Transformation

The Japanese government's commitment to a green transformation, backed by substantial multi-year funding envelopes, creates significant tailwinds for Kawasaki Heavy Industries (KHI). These initiatives specifically target the development of a robust hydrogen supply chain, directly benefiting KHI's strategic focus.

KHI is a key player in hydrogen energy, developing technologies like hydrogen gas turbines and liquefied hydrogen carriers. This aligns perfectly with Japan's ambitious decarbonization targets, such as achieving carbon neutrality by 2050. For instance, the government has allocated significant funds, with the Ministry of Economy, Trade and Industry (METI) planning to invest ¥2 trillion (approximately $14 billion USD) in hydrogen-related technologies through 2030 as part of its Green Growth Strategy.

- Government funding: Japan's Green Growth Strategy earmarks substantial investment for decarbonization technologies.

- Hydrogen focus: Initiatives support the entire hydrogen value chain, from production to utilization.

- KHI's alignment: The company's investments in hydrogen gas turbines and carriers directly leverage these government priorities.

- Decarbonization goals: KHI's activities contribute to Japan's national objective of achieving carbon neutrality by 2050.

Regulatory Compliance and Corporate Governance

Recent misconduct in marine engine testing has intensified regulatory scrutiny on Kawasaki Heavy Industries, impacting its corporate governance. This situation highlights the critical role of political and governmental oversight in ensuring operational integrity. Kawasaki's response includes forming a Special Investigative Committee and bolstering compliance measures, demonstrating a commitment to addressing these pressures.

Japan's commitment to national security, evidenced by a projected 16.5% increase in its defense budget for fiscal year 2024, directly benefits Kawasaki Heavy Industries' (KHI) aerospace and defense divisions. The government's focus on indigenous technology development, including advanced missile systems, creates significant opportunities for KHI. Furthermore, evolving industrial policies emphasizing economic security and public-private partnerships are designed to strengthen domestic supply chains, aligning with KHI's technological strengths.

| Political Factor | Impact on KHI | Supporting Data (2024/2025) |

|---|---|---|

| Defense Spending | Increased demand for aerospace and defense products. | Japan's FY2024 defense budget increased by 16.5%. |

| Industrial Policy | Favorable environment for technology development and supply chain enhancement. | Focus on economic security and public-private partnerships. |

| Geopolitical Stability | Potential for sustained or increased defense orders due to regional tensions. | Ongoing military activities in East Asia. |

What is included in the product

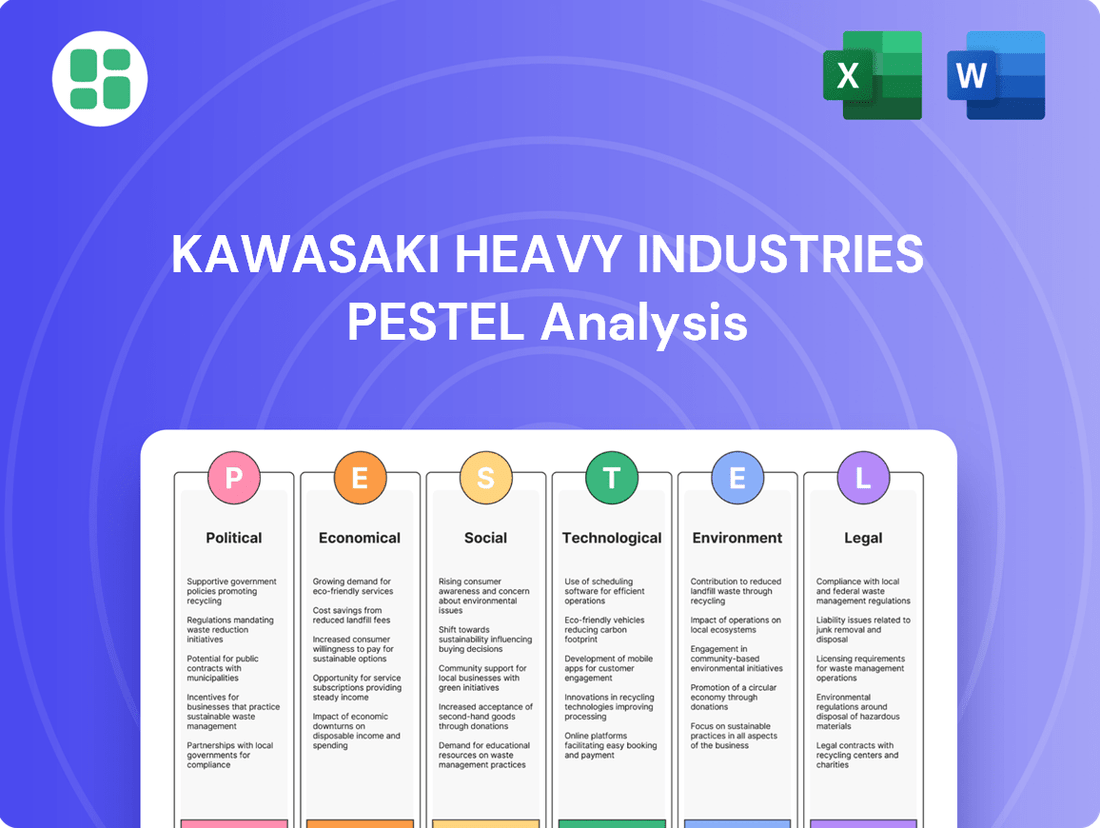

This PESTLE analysis delves into the political, economic, social, technological, environmental, and legal factors influencing Kawasaki Heavy Industries, offering a comprehensive understanding of its external operating landscape.

It provides actionable insights for strategic decision-making by examining current trends and potential future impacts on Kawasaki's diverse business segments.

A concise Kawasaki Heavy Industries PESTLE analysis summary, presented in a clear, easily digestible format, serves as a pain point reliever by enabling rapid understanding of external factors impacting the company, thus streamlining strategic decision-making.

Economic factors

The global manufacturing sector is projected to experience a rebound, with stronger growth anticipated in 2025 compared to the more subdued performance in 2024. This upswing is crucial for companies like Kawasaki Heavy Industries, which supplies a wide array of industrial machinery.

While Europe grapples with deindustrialization trends, the manufacturing outlook in key markets remains robust. The United States is expected to see a steady increase in manufacturing output, and China continues to be a major driver of global production. Furthermore, emerging economies such as India and the ASEAN nations present significant growth opportunities, with projections indicating high potential for manufacturing expansion in these regions.

Kawasaki Heavy Industries, like many manufacturers, grapples with elevated raw material prices and ongoing supply chain snags. For instance, the cost of steel, a crucial input for KHI's shipbuilding and rolling stock divisions, saw significant volatility in 2024, with some benchmarks indicating increases of up to 15% year-over-year in early periods.

Geopolitical events, such as the Red Sea shipping crisis impacting major global trade routes, directly translate to longer lead times and increased freight expenses for components and finished goods. This can affect KHI's ability to meet production schedules and manage costs across its diverse portfolio, from aerospace to motorcycles.

Currency exchange rate fluctuations, particularly involving the Japanese yen against major currencies like the U.S. dollar, significantly influence Kawasaki Heavy Industries' (KHI) financial performance. For instance, KHI's Q1 2025 results indicated that favorable exchange rates positively impacted revenue and profits in certain business segments. This demonstrates KHI's considerable exposure to currency volatility due to its extensive global operations.

Consumer Spending and Market Demand

Consumer spending habits are a critical driver for Kawasaki Heavy Industries, particularly impacting its Powersports & Engine segment. Trends in discretionary spending directly correlate with demand for products like motorcycles and recreational vehicles.

Fiscal year 2023 data highlights this sensitivity. For instance, while sales of off-road four-wheelers in the U.S. and motorcycles in Europe showed positive movement, a decline in motorcycle sales in emerging markets and reduced demand for general-purpose gasoline engines presented headwinds. This underscores the necessity for Kawasaki to maintain a diversified market approach to mitigate the impact of localized spending downturns.

- U.S. Off-Road Vehicle Demand: Positive growth observed in this segment, indicating resilience in recreational spending for specific vehicle types.

- European Motorcycle Market: Experienced an increase, suggesting consumer confidence and a willingness to spend on premium two-wheeled transport.

- Emerging Market Motorcycle Sales: Faced a decrease, pointing to potential economic pressures or shifting consumer priorities in these regions.

- General-Purpose Gasoline Engine Demand: A general decline in this area suggests broader economic factors affecting industrial and consumer equipment purchases.

Investment in Green and Digital Technologies

Kawasaki Heavy Industries is strategically positioning itself to capitalize on the burgeoning green and digital technology sectors. This includes substantial investments in areas like hydrogen supply chains and artificial intelligence (AI), reflecting a global economic shift towards sustainability and advanced digitalization. For instance, in fiscal year 2023, Kawasaki announced plans to invest ¥100 billion (approximately $700 million USD at current rates) in hydrogen-related businesses, aiming to establish a comprehensive value chain from production to utilization.

These investments are not merely opportunistic; they are deeply aligned with overarching economic trends and supportive government policies. Many nations, including Japan, are actively promoting decarbonization and digital transformation through subsidies and regulatory frameworks. Kawasaki's commitment to these fields, despite the significant upfront capital expenditure, is anticipated to fuel future revenue streams and bolster its competitive standing in the evolving industrial landscape.

- Hydrogen Investments: Kawasaki's ¥100 billion commitment for FY2023 underscores its focus on the hydrogen economy.

- AI Integration: The company is actively integrating AI across its operations to enhance efficiency and develop new digital services.

- Global Trends: Investment aligns with the global push for green energy solutions and digital infrastructure development.

- Competitive Edge: These strategic investments are designed to secure long-term growth and maintain a competitive advantage.

The global economic outlook for 2024-2025 suggests a modest recovery, with inflation moderating but remaining a concern in some regions. Interest rate policies by central banks, such as the US Federal Reserve and the European Central Bank, will continue to influence borrowing costs for capital-intensive industries like manufacturing, impacting investment decisions for companies like Kawasaki Heavy Industries.

Preview Before You Purchase

Kawasaki Heavy Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Kawasaki Heavy Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed examination of the external forces shaping Kawasaki's strategic landscape.

Sociological factors

Japan's demographic shift, with an increasing proportion of its population aged 65 and over, poses a significant challenge for Kawasaki Heavy Industries. This aging trend directly impacts the availability of a robust and skilled workforce essential for its complex manufacturing and engineering sectors, potentially leading to labor shortages.

While Japan has been implementing industrial policies to address economic challenges, the country's reliance on foreign labor remains relatively low compared to other developed nations. This necessitates Kawasaki Heavy Industries to explore advanced automation and invest in retraining existing staff to mitigate the effects of a shrinking domestic labor pool.

Recent revelations concerning misconduct in marine engine testing by Kawasaki Heavy Industries have significantly underscored the critical role of public perception and corporate responsibility. This incident, which came to light in early 2023, directly impacted the company's reputation, particularly within the maritime sector.

Kawasaki's commitment to reinforcing its compliance framework and diligently addressing the underlying issues that led to the testing irregularities is paramount. Maintaining stakeholder trust, encompassing customers, investors, and the broader public, hinges on demonstrating accountability and a genuine dedication to ethical operations.

Societal expectations are increasingly prioritizing sustainability, driving a demand for eco-friendly products and services across industries. This trend directly impacts manufacturing and business operations, pushing companies to adopt greener practices and develop environmentally responsible solutions to meet consumer preferences and regulatory pressures.

Kawasaki Heavy Industries is actively addressing this shift by investing in and developing innovative, sustainable technologies. For instance, their work on hydrogen-powered engines for ships and vehicles, along with advancements in sustainable aquaculture systems, demonstrates a commitment to reducing environmental impact. The company's stated goal of achieving carbon neutrality by 2050 further underscores this strategic pivot towards eco-conscious manufacturing and product offerings, aligning with global environmental goals and evolving market demands.

Urbanization and Infrastructure Needs

Global urbanization continues to accelerate, creating a significant demand for modern infrastructure. This trend directly benefits Kawasaki Heavy Industries, as cities expanding and developing require its heavy industrial equipment, rolling stock for public transport, and advanced energy systems. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, highlighting the sustained need for infrastructure development.

Kawasaki's engagement in critical infrastructure projects underscores its role in meeting these societal needs. The company's work on liquefied hydrogen receiving terminals, for example, supports the transition to cleaner energy sources within urban environments. Furthermore, their development of automated berthing systems for ports addresses the logistical demands of increasingly interconnected global cities, facilitating trade and economic activity.

- Urban Population Growth: The UN estimates that urban areas will house 68% of the global population by 2050, up from 57% in 2023.

- Infrastructure Investment: Global infrastructure spending is projected to reach $9.2 trillion annually by 2030, according to PwC, a significant portion of which will be in urban development.

- Energy Transition: Kawasaki's involvement in hydrogen infrastructure aligns with global efforts to decarbonize energy systems, a key aspect of sustainable urban planning.

Workforce Skills Gap and Development

The global manufacturing sector, including areas where Kawasaki Heavy Industries operates, is grappling with a significant skills gap. Demand is soaring for workers proficient in advanced technical skills, digital literacy, and crucial soft skills like problem-solving and adaptability. This trend is projected to continue, with reports suggesting that by 2025, a substantial portion of manufacturing jobs will require digital competencies that are currently lacking in many parts of the workforce.

To maintain its competitive edge, Kawasaki Heavy Industries must proactively address this by prioritizing investment in employee training and development programs. This includes upskilling existing staff and attracting new talent with the necessary competencies to operate and innovate within increasingly sophisticated manufacturing environments.

- Growing demand for digital skills: By 2025, an estimated 70% of manufacturing jobs will require some level of digital proficiency, a skill set often in short supply.

- Need for advanced technical expertise: The complexity of modern manufacturing processes, from robotics to AI integration, necessitates a workforce with specialized technical knowledge.

- Importance of soft skills: Adaptability, critical thinking, and collaboration are becoming as vital as technical skills for navigating the evolving industrial landscape.

Societal expectations are increasingly focused on sustainability, driving demand for eco-friendly products and services. Kawasaki Heavy Industries is responding by investing in green technologies like hydrogen engines and sustainable aquaculture, aiming for carbon neutrality by 2050.

Global urbanization is accelerating, creating a strong need for infrastructure that Kawasaki Heavy Industries can supply, such as rolling stock and energy systems. The UN projects 68% of the world population will be urban by 2050, underscoring continued infrastructure demand.

A significant skills gap exists in manufacturing, requiring advanced technical and digital competencies. Kawasaki Heavy Industries must invest in training and development to ensure its workforce can operate and innovate in complex, modern environments. By 2025, an estimated 70% of manufacturing jobs will require digital proficiency.

| Sociological Factor | Impact on Kawasaki Heavy Industries | Supporting Data/Trend |

|---|---|---|

| Aging Population (Japan) | Potential labor shortages in skilled manufacturing roles. | Increasing proportion of population aged 65+ in Japan. |

| Sustainability Demand | Opportunity for growth in eco-friendly product development. | Kawasaki's carbon neutrality goal by 2050; investment in hydrogen tech. |

| Global Urbanization | Increased demand for infrastructure and transport solutions. | UN projection: 68% global urban population by 2050; PwC projection: $9.2T annual infrastructure spending by 2030. |

| Skills Gap in Manufacturing | Need for workforce upskilling and talent acquisition. | Estimated 70% of manufacturing jobs requiring digital skills by 2025. |

Technological factors

Kawasaki Heavy Industries is heavily invested in advancing hydrogen technology, a key factor shaping its future. Their work spans hydrogen gas turbines, specialized liquefied hydrogen carriers, and even hydrogen-powered vehicles, demonstrating a comprehensive approach to clean energy. This commitment is further evidenced by their participation in research associations focused on hydrogen mobility and engines, alongside innovative projects like the development of Corleo, a four-legged robotic vehicle powered by hydrogen.

Kawasaki's Precision Machinery & Robotics division is at the forefront of its technological evolution, with a strong emphasis on industrial robots and sophisticated automation solutions. This division is actively developing and introducing novel robotic systems designed for a wide array of uses, from advanced medical and pharmaceutical applications to assistive robots for nursing care and even cutting-edge remote surgery platforms.

These innovations are not just about improving manufacturing efficiency; they are fundamentally reshaping how industries operate. For instance, the company's advancements in collaborative robots (cobots) are enabling safer human-robot interaction on factory floors. In 2023, the global market for industrial robots was valued at approximately $50 billion, with a projected compound annual growth rate of over 10% through 2030, highlighting the significant demand for Kawasaki's specialized offerings.

Kawasaki Heavy Industries is actively embedding digital technologies and Artificial Intelligence (AI) across its business. This strategic move is evident in their development of AI-powered mobility solutions, such as the Corleo project, and the creation of an AI Ethics Policy. These initiatives highlight Kawasaki's commitment to leveraging digital transformation to boost operational efficiency and drive innovation in new product creation.

Advanced Materials and Manufacturing Processes

Kawasaki Heavy Industries' innovation hinges on advanced materials. The integration of metal and carbon composites, like those seen in their Corleo products, significantly boosts performance and durability. This focus on material science is key to staying competitive in demanding sectors.

The company is actively pursuing cutting-edge manufacturing techniques. A prime example is their 2024 patent for a turbocharged, direct-injection two-stroke engine. This technological advancement is designed to achieve greater fuel efficiency and meet increasingly stringent environmental regulations, showcasing a commitment to both performance and sustainability.

- Advanced Materials: Utilization of metal and carbon composites in products like Corleo enhances performance and lifespan.

- Manufacturing Innovation: Development of new engine technologies, such as the patented turbocharged, direct-injection two-stroke engine (2024), aims for improved efficiency.

- Regulatory Compliance: New manufacturing processes are being designed to meet evolving environmental and performance standards.

Cybersecurity and Data Security

Cybersecurity and data security are paramount for Kawasaki Heavy Industries, given its involvement in critical infrastructure and advanced technologies. Japan's updated cybersecurity strategy, expected by the end of 2025, will emphasize stronger public-private collaboration and refined data security protocols for cutting-edge technology and AI initiatives. This directly influences Kawasaki's operational resilience and the protection of its sensitive intellectual property.

The evolving threat landscape necessitates robust defenses. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the financial imperative for companies like Kawasaki to invest heavily in security measures. This strategy will likely involve stricter compliance requirements and the adoption of advanced threat detection and response systems.

- Enhanced Data Protection: New regulations will likely mandate more stringent data handling and encryption standards for AI and advanced technology projects.

- Public-Private Partnerships: Increased cooperation with government agencies will be crucial for threat intelligence sharing and coordinated response efforts.

- AI Security Focus: Specific guidelines for securing AI systems, including data integrity and algorithmic transparency, will be a key component.

- Operational Continuity: Measures to ensure business continuity in the face of cyberattacks will be a critical consideration for Kawasaki's diverse operations.

Kawasaki Heavy Industries is heavily invested in advancing hydrogen technology, a key factor shaping its future. Their work spans hydrogen gas turbines, specialized liquefied hydrogen carriers, and even hydrogen-powered vehicles, demonstrating a comprehensive approach to clean energy. This commitment is further evidenced by their participation in research associations focused on hydrogen mobility and engines, alongside innovative projects like the development of Corleo, a four-legged robotic vehicle powered by hydrogen.

Kawasaki's Precision Machinery & Robotics division is at the forefront of its technological evolution, with a strong emphasis on industrial robots and sophisticated automation solutions. This division is actively developing and introducing novel robotic systems designed for a wide array of uses, from advanced medical and pharmaceutical applications to assistive robots for nursing care and even cutting-edge remote surgery platforms.

These innovations are not just about improving manufacturing efficiency; they are fundamentally reshaping how industries operate. For instance, the company's advancements in collaborative robots (cobots) are enabling safer human-robot interaction on factory floors. In 2023, the global market for industrial robots was valued at approximately $50 billion, with a projected compound annual growth rate of over 10% through 2030, highlighting the significant demand for Kawasaki's specialized offerings.

Kawasaki Heavy Industries is actively embedding digital technologies and Artificial Intelligence (AI) across its business. This strategic move is evident in their development of AI-powered mobility solutions, such as the Corleo project, and the creation of an AI Ethics Policy. These initiatives highlight Kawasaki's commitment to leveraging digital transformation to boost operational efficiency and drive innovation in new product creation.

Kawasaki Heavy Industries' innovation hinges on advanced materials. The integration of metal and carbon composites, like those seen in their Corleo products, significantly boosts performance and durability. This focus on material science is key to staying competitive in demanding sectors.

The company is actively pursuing cutting-edge manufacturing techniques. A prime example is their 2024 patent for a turbocharged, direct-injection two-stroke engine. This technological advancement is designed to achieve greater fuel efficiency and meet increasingly stringent environmental regulations, showcasing a commitment to both performance and sustainability.

| Technology Area | Key Development/Focus | Market Context/Impact |

|---|---|---|

| Hydrogen Technology | Hydrogen gas turbines, liquefied hydrogen carriers, hydrogen-powered vehicles | Global hydrogen market projected for significant growth, driven by decarbonization efforts. |

| Robotics & Automation | Industrial robots, collaborative robots (cobots), medical/assistive robots | Global industrial robot market valued at ~$50 billion in 2023, with >10% CAGR forecast through 2030. |

| Digital Transformation & AI | AI-powered mobility solutions, AI Ethics Policy | AI adoption is crucial for operational efficiency and new product development across industries. |

| Advanced Materials | Metal and carbon composites | Enhance product performance and durability, critical for competitiveness in high-demand sectors. |

| Manufacturing Techniques | Turbocharged, direct-injection two-stroke engine (2024 patent) | Aims for improved fuel efficiency and compliance with environmental regulations. |

Legal factors

Kawasaki Heavy Industries operates within a complex web of international trade laws and is susceptible to fluctuating tariffs. For instance, the ongoing trade tensions, particularly the US-China trade dispute, have led to duties on critical manufacturing components. This directly impacts Kawasaki's material costs and can restrict access to certain markets, requiring agile adaptation to evolving global trade policies.

In 2023, the World Trade Organization reported that global trade growth slowed significantly, partly due to these protectionist measures. Kawasaki's ability to manage supply chains and pricing strategies is therefore heavily influenced by these trade dynamics, making compliance and strategic sourcing paramount for maintaining competitiveness in its diverse global operations.

Kawasaki Heavy Industries operates within a landscape of increasingly stringent environmental regulations, particularly concerning CO2 and NOx emissions from its marine engines. These standards directly influence product development, requiring significant investment in cleaner technologies and potentially impacting manufacturing costs. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap and ongoing discussions around greenhouse gas reduction targets necessitate continuous innovation in engine design and fuel efficiency.

The company has recently been under scrutiny for misconduct findings related to marine engine testing, highlighting the critical importance of adhering to these global and national environmental compliance frameworks. Kawasaki is actively implementing corrective measures and strengthening its internal oversight to ensure future adherence to all regulatory requirements, aiming to rebuild trust and maintain its market position in a sector prioritizing sustainability.

Kawasaki Heavy Industries faces significant legal hurdles due to its wide range of products, from motorcycles to aerospace parts. Strict product liability and safety regulations in markets like the EU and US demand rigorous adherence to design and manufacturing standards. Failure to comply can result in costly recalls and lawsuits, impacting brand trust and financial performance.

Labor Laws and Employment Regulations

Kawasaki Heavy Industries navigates a complex web of labor laws and employment regulations across its global operations, particularly in its home market of Japan. Adherence to these statutes, covering everything from minimum wage and working hours to collective bargaining and workplace safety, is critical. For instance, Japan's Labor Standards Act sets strict guidelines that Kawasaki must follow.

Failure to comply can lead to significant penalties, including fines and reputational damage, impacting its ability to attract and retain talent. In 2023, the average wage increase in Japan was projected to be around 2.3%, a figure Kawasaki would consider when setting compensation policies to remain competitive.

- Compliance with Japanese Labor Standards Act: Ensures fair wages, reasonable working hours, and safe working conditions for all employees.

- Union Relations Management: Fosters constructive dialogue and adherence to agreements with labor unions, crucial for operational stability.

- Global Employment Standards: Adapts to diverse international labor laws, including those in major manufacturing hubs like the United States and Europe, affecting workforce management.

- Workplace Safety Regulations: Implements stringent safety protocols to meet or exceed legal requirements, minimizing accidents and associated liabilities.

Intellectual Property Rights and Patents

Protecting its vast intellectual property, particularly patents for groundbreaking technologies like hydrogen engines and sophisticated manufacturing techniques, is paramount for Kawasaki Heavy Industries to maintain its edge. The company's proactive approach to patent registration highlights the critical role of legal frameworks in shielding its innovations within the fiercely competitive global landscape.

In 2024, Kawasaki actively pursued and secured numerous patents, demonstrating a commitment to fortifying its technological moat. For instance, their ongoing investment in R&D, which saw a significant allocation in their fiscal year 2023 results, directly translates into a pipeline of patentable innovations. This legal strategy is essential for preventing competitors from replicating their advanced solutions, thereby preserving market share and profitability.

- Patent Filings: Kawasaki consistently ranks among leading industrial manufacturers for new patent applications, with a notable surge in filings related to sustainable technologies in 2024.

- R&D Investment: The company allocated approximately ¥150 billion (roughly $1 billion USD, depending on exchange rates) to research and development in fiscal year 2023, a substantial portion dedicated to patentable innovations.

- Global Protection: Kawasaki maintains a robust global patent portfolio, with filings strategically placed in key markets to ensure comprehensive protection of its technological advancements.

Kawasaki Heavy Industries must navigate a complex regulatory environment, including international trade laws and environmental standards. For example, the company faces scrutiny over emissions from its marine engines, necessitating investments in cleaner technologies to comply with regulations like the IMO's 2020 sulfur cap and ongoing greenhouse gas reduction targets.

In 2023, global trade growth slowed due to protectionist measures, impacting Kawasaki's supply chains and pricing. Furthermore, strict product liability and safety regulations in markets like the EU and US require rigorous adherence to design and manufacturing standards to avoid costly recalls and lawsuits.

The company's intellectual property is protected through a robust global patent portfolio, with a notable surge in filings related to sustainable technologies in 2024. Kawasaki's 2023 R&D investment of approximately ¥150 billion (roughly $1 billion USD) directly fuels this pipeline of patentable innovations, crucial for maintaining its competitive edge.

Environmental factors

Kawasaki Heavy Industries is navigating a landscape increasingly shaped by global and national climate change policies and ambitious decarbonization goals. These environmental factors directly impact the company's operational strategies and future investments, pushing for cleaner technologies and sustainable practices.

The company has proactively set significant targets, aiming for net zero emissions domestically by 2030 and across its entire value chain by fiscal 2049. This commitment is backed by substantial investments in key areas like hydrogen power generation, renewable energy solutions, and Carbon Capture, Utilization, and Storage (CCUS) technologies, reflecting a strategic pivot towards a low-carbon economy.

The global drive towards a hydrogen economy, a significant environmental trend, offers Kawasaki Heavy Industries a substantial growth avenue. By investing across the entire hydrogen value chain, from production and specialized transport like liquefied hydrogen carriers to end-use applications such as hydrogen gas turbines and engines, Kawasaki is strategically positioning itself to capitalize on the clean energy transition.

This commitment is underscored by substantial investments; for instance, Kawasaki is a key player in developing the Australia-Japan hydrogen supply chain, aiming for large-scale hydrogen exports. The company's hydrogen strategy aligns with global decarbonization goals, with many nations setting ambitious targets for hydrogen adoption, which is projected to be a multi-trillion dollar market by 2050.

Growing global awareness of resource scarcity is fundamentally reshaping industries, pushing companies like Kawasaki Heavy Industries towards circular economy principles. This shift impacts everything from raw material sourcing to waste management, requiring innovative operational strategies.

Kawasaki is actively engaging in partnerships aimed at fostering a circular economy, seeking to minimize waste and maximize resource utilization across its diverse business lines. For example, their development of sustainable aquaculture systems showcases a commitment to resource efficiency, a key tenet of circularity.

In 2023, the global market for circular economy solutions was valued at over $2.6 trillion, with projections indicating substantial growth, underscoring the economic imperative for companies to adopt these practices. Kawasaki's investments in this area position them to capitalize on this expanding market.

Emission Reduction and Air Quality Standards

Kawasaki Heavy Industries is navigating increasingly stringent emission reduction targets and air quality standards. This pressure impacts both their manufacturing processes and the environmental performance of their products, particularly in the marine sector. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap and ongoing discussions around greenhouse gas (GHG) reductions for shipping necessitate significant technological advancements.

The company is actively investing in cleaner engine technologies to meet these evolving regulations. A key focus area is the development of hydrogen-fueled engines, a promising avenue for decarbonizing marine transportation. This aligns with global efforts to curb nitrogen oxides (NOx) and carbon dioxide (CO2) emissions, with many regions implementing stricter limits on these pollutants from industrial and automotive sources.

Kawasaki's commitment to sustainability is evident in their research and development efforts. For example, they have been developing dual-fuel engines capable of running on LNG and hydrogen, aiming to reduce CO2 emissions by up to 80% compared to conventional heavy fuel oil.

- NOx and CO2 Reduction: Kawasaki is focused on lowering NOx and CO2 emissions from its marine engines, critical for compliance with international maritime regulations.

- Hydrogen Engine Development: The company is investing in hydrogen-fueled engine technology as a key strategy for future emissions compliance and market positioning.

- Regulatory Compliance: Meeting tightening air quality standards across manufacturing and product lines, including those set by bodies like the IMO, is a significant operational driver.

- Sustainable Technologies: Kawasaki is actively developing and promoting cleaner engine solutions, such as dual-fuel engines, to address environmental concerns.

Sustainable Manufacturing Practices

Kawasaki Heavy Industries is increasingly focused on sustainable manufacturing to reduce its environmental impact. This includes initiatives like improving energy efficiency in its production facilities and exploring waste-to-energy solutions. For instance, in fiscal year 2023, Kawasaki reported progress in reducing greenhouse gas emissions intensity by 12% compared to fiscal year 2013 levels, demonstrating a tangible commitment to these practices.

The company is also investigating advanced technologies such as carbon capture, utilization, and storage (CCUS) to further its environmental stewardship. These efforts are crucial as global regulations and customer expectations for greener products and processes continue to rise. Kawasaki's investment in these areas aligns with broader industry trends towards decarbonization and circular economy principles.

- Energy Conservation: Implementing advanced energy management systems across its manufacturing plants to reduce overall energy consumption.

- Waste-to-Energy: Developing and utilizing technologies to convert manufacturing byproducts and waste into usable energy, thereby reducing landfill waste and generating power.

- Carbon Capture Technologies: Researching and piloting carbon capture solutions to mitigate emissions from its industrial processes, aiming for net-zero operations in the long term.

- Sustainable Material Sourcing: Prioritizing the use of recycled and environmentally friendly materials in its product manufacturing to minimize the lifecycle environmental footprint.

Kawasaki Heavy Industries is actively responding to stringent global environmental regulations and the growing demand for decarbonization across its diverse business segments. The company's strategic investments in hydrogen technology, including production, transport, and utilization, position it to capitalize on the expanding clean energy market, which is projected to reach multi-trillion dollar valuations by 2050.

The company's commitment to sustainability is further demonstrated by its focus on circular economy principles, aiming to minimize waste and maximize resource efficiency. This aligns with a global market for circular economy solutions valued at over $2.6 trillion in 2023, highlighting the economic benefits of resource optimization.

Kawasaki is also prioritizing the reduction of emissions from its marine engines to comply with international regulations like the IMO's 2020 sulfur cap and future GHG reduction targets. Development of dual-fuel engines capable of running on hydrogen signifies a significant step towards cleaner maritime transport, with the potential to reduce CO2 emissions by up to 80%.

Furthermore, Kawasaki is implementing sustainable manufacturing practices, evidenced by a 12% reduction in greenhouse gas emissions intensity by fiscal year 2023 compared to fiscal year 2013 levels, and is exploring advanced technologies like CCUS to achieve its net-zero ambitions.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Kawasaki Heavy Industries is built on a robust foundation of data from official government publications, international financial institutions, and reputable industry analysis firms. This ensures that insights into political stability, economic trends, technological advancements, and regulatory landscapes are current and well-supported.