Jack Henry SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jack Henry Bundle

Jack Henry's robust market position is built on strong customer relationships and a comprehensive suite of technology solutions. However, understanding their vulnerabilities and the competitive landscape is crucial for any strategic move.

Want the full story behind Jack Henry's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Jack Henry's comprehensive product suite, covering core processing, digital banking, payments, and risk management, solidifies its market leadership. This broad offering allows community banks and credit unions to efficiently manage operations and improve customer experiences through a single, integrated provider.

Jack Henry's financial performance remains robust, as evidenced by its Q2 and Q3 2025 fiscal reports. The company has showcased consistent revenue growth across its key segments: core, payments, and complementary services.

These reports highlight increased GAAP revenue and earnings per share, underscoring effective operational management and strong market demand for Jack Henry's offerings. For instance, Q3 2025 saw a notable year-over-year revenue increase of 12%, reaching $565 million, with diluted earnings per share rising by 15% to $1.15.

This sustained financial strength provides a solid bedrock for future strategic investments, research and development initiatives, and potential market expansion opportunities.

Jack Henry's established client base is a significant strength. With a history spanning nearly five decades, the company serves approximately 7,500 financial institutions, demonstrating deep market penetration and client loyalty.

This extensive network translates into a robust recurring revenue model. This predictability offers financial stability and resilience, insulating the company from the volatility often seen in the broader market.

The long-standing relationships with these institutions are a testament to the trust and reliability of Jack Henry's technology and services, creating a strong foundation for continued growth and client retention.

Focus on Innovation and Technology Modernization

Jack Henry's commitment to innovation and technology modernization is a significant strength, evident in its proactive embrace of AI and cloud computing. This strategic direction is crucial for maintaining a competitive edge in the rapidly changing financial landscape.

The company is actively transitioning to Google Cloud Platform, a move that promises enhanced scalability and operational efficiency. Furthermore, Jack Henry is integrating real-time payment capabilities, such as those enabled by FedNow, to provide clients with cutting-edge solutions.

These technological advancements ensure that Jack Henry's clients can adapt to evolving market demands and stay ahead of the curve. For instance, in fiscal year 2023, Jack Henry reported a 10% increase in revenue to $1.88 billion, partly driven by its investments in new technologies and digital solutions.

- Cloud Adoption: Strategic migration to Google Cloud Platform for improved infrastructure.

- AI Integration: Exploring and implementing artificial intelligence to enhance services.

- Real-Time Payments: Enabling clients to leverage new payment rails like FedNow.

- Digital Transformation: Driving modernization across its product portfolio.

Strong Reputation and Client Relationships

Jack Henry's strong reputation is built on a foundation of a people-first culture and a deep commitment to service excellence, particularly with its community bank and credit union clientele. This dedication fosters incredibly strong loyalty, setting Jack Henry apart in a crowded marketplace. The company's emphasis on reliable support and customized solutions directly translates into high client retention rates and valuable organic growth through positive referrals.

For instance, in fiscal year 2024, Jack Henry reported a client retention rate of over 98%, a testament to these client relationships. This focus on service excellence is a key differentiator, allowing the company to maintain its competitive edge.

- Client-Centric Approach: Fosters deep loyalty and differentiates Jack Henry.

- Service Excellence: Drives high client retention and positive word-of-mouth.

- Reliable Support: Underpins the company's strong reputation in the financial technology sector.

Jack Henry's extensive and integrated product suite, covering core processing to digital banking and payments, positions it as a market leader for community financial institutions. This broad offering enables clients to streamline operations and enhance customer experiences through a unified provider.

The company's robust financial performance, demonstrated by consistent year-over-year revenue growth, underscores market demand and effective operational management. For instance, Q3 fiscal year 2025 saw a 12% revenue increase to $565 million, with diluted earnings per share rising 15% to $1.15.

Jack Henry's deep market penetration, serving approximately 7,500 financial institutions with nearly five decades of experience, translates into a strong recurring revenue model and financial stability. This extensive client base highlights trust and reliability, fostering continued growth and retention.

A commitment to innovation, including cloud migration to Google Cloud Platform and integration of real-time payments like FedNow, ensures Jack Henry's clients remain competitive. Fiscal year 2023 revenue grew 10% to $1.88 billion, partly fueled by these technology investments.

Jack Henry's people-first culture and dedication to service excellence have cultivated exceptional client loyalty, evidenced by a client retention rate exceeding 98% in fiscal year 2024. This client-centric approach and reliable support are key differentiators in the fintech sector.

| Strength | Description | Supporting Data |

|---|---|---|

| Comprehensive Product Suite | Offers a broad range of integrated solutions for financial institutions. | Core processing, digital banking, payments, risk management. |

| Robust Financial Performance | Consistent revenue and earnings growth across key segments. | Q3 FY2025: 12% revenue growth ($565M), 15% EPS growth ($1.15). |

| Extensive Client Base & Recurring Revenue | Deep market penetration with a stable, predictable revenue stream. | Serves ~7,500 financial institutions; >98% client retention (FY2024). |

| Commitment to Innovation | Proactive adoption of cloud and real-time payment technologies. | Migrating to Google Cloud; integrating FedNow; FY2023 revenue up 10% ($1.88B). |

| Strong Reputation & Service Excellence | People-first culture driving high client loyalty and organic growth. | Client-centric approach; reliable support; positive referrals. |

What is included in the product

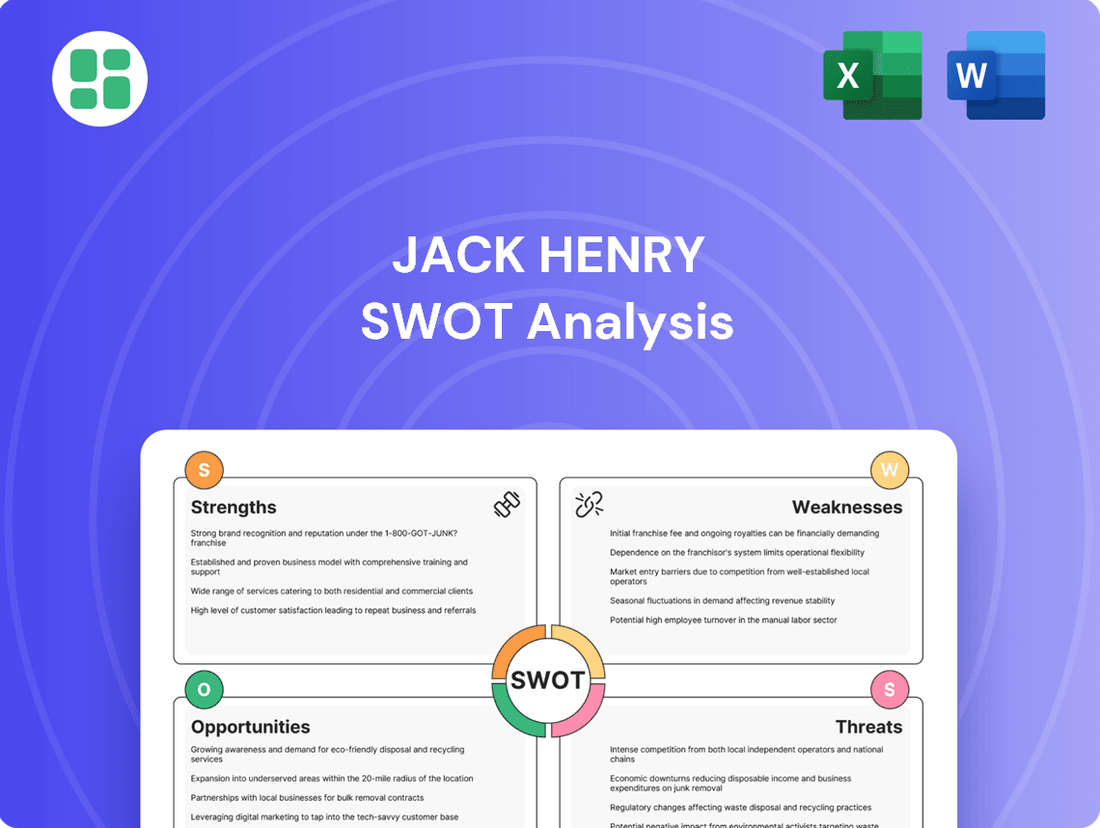

This SWOT analysis examines Jack Henry's internal strengths and weaknesses alongside external opportunities and threats, providing a comprehensive view of its strategic positioning.

Streamlines complex financial technology strategy by clearly identifying competitive advantages and market opportunities.

Weaknesses

Jack Henry's revenue can be impacted by financial institution consolidation. When a client is acquired by another bank and terminates their contract with Jack Henry, the company loses ongoing service fees, although it does receive 'deconversion revenue.' This reliance on external merger and acquisition activity makes its revenue stream susceptible to industry consolidation trends, potentially hindering long-term organic growth.

While Jack Henry has invested heavily in modernizing its technology, some of its core banking systems, built over decades, may still be perceived as legacy by newer, cloud-native fintechs. This perception could be a hurdle in attracting financial institutions prioritizing highly flexible, modular architectures or those that are digitally native.

For instance, while Jack Henry reported a 6% increase in its digital solutions segment revenue for the third quarter of fiscal year 2024, reaching $103.5 million, the sheer age of some foundational platforms can create an image challenge. This perception, even if not entirely reflective of current capabilities, might slow adoption among institutions specifically seeking the latest in agile, API-driven infrastructure.

Jack Henry faces significant competition from nimble fintech startups that are rapidly innovating and often leverage cloud-native architectures. These agile players can quickly introduce specialized solutions and adapt their pricing, posing a challenge to established providers.

The dynamic nature of the fintech landscape means that maintaining a competitive edge requires substantial and ongoing investment in technology and a commitment to rapid adaptation to new market demands.

Impact of Macroeconomic Conditions on Non-Strategic Revenue

While Jack Henry's core and payments segments demonstrate resilience and strong growth, the company's overall revenue guidance can be influenced by broader macroeconomic conditions. This susceptibility is particularly evident in non-strategic revenue streams, which may experience softening during economic downturns.

Areas like hardware sales and the timing of non-recurring projects are more vulnerable to economic headwinds. For instance, a slowdown in the broader financial services sector could lead to clients delaying or reducing expenditures on these less critical components of Jack Henry's offerings.

- Dependency on Sector Health: Jack Henry's revenue, particularly in non-strategic areas, is tied to the overall economic health and spending patterns within the financial services industry.

- Vulnerability of Non-Strategic Revenue: Segments such as hardware sales and non-recurring projects are more prone to budget cuts and delays during periods of economic uncertainty.

- Impact on Guidance: Macroeconomic concerns can temper the company's revenue forecasts, reflecting the potential for reduced demand in these less essential business areas.

Integration Complexity for Clients

Financial institutions often operate with a mosaic of existing systems, making the integration of new, comprehensive solutions like Jack Henry's a significant hurdle. This complexity is amplified when clients need to connect Jack Henry's offerings with other third-party applications they already utilize, or when internal processes must be re-engineered to accommodate the new platform. For instance, in 2024, a significant portion of financial institutions reported that system integration was a primary concern when adopting new fintech solutions, with some projects taking over a year to complete.

This integration challenge can directly impact Jack Henry's sales cycle, potentially lengthening it as clients assess the technical feasibility and resource requirements. Furthermore, the effort required from clients to adapt their workflows and ensure data consistency across disparate systems can be substantial, potentially delaying full adoption and the realization of the platform's benefits.

- Integration Hurdles: Many financial institutions rely on a mix of legacy and modern systems, complicating the seamless integration of new platforms.

- Third-Party Dependencies: Clients often require Jack Henry's solutions to interface with numerous other vendor applications, adding layers of technical complexity.

- Client Process Adaptation: The need for clients to modify their internal workflows and data management practices can be a significant barrier to rapid adoption.

- Extended Sales Cycles: The technical and operational considerations surrounding integration can lead to longer decision-making processes for potential clients.

Jack Henry's revenue is susceptible to consolidation within the financial services sector, as client acquisitions can lead to contract terminations and lost recurring service fees, despite some deconversion revenue. This reliance on external industry events can impede consistent organic growth. For example, while Jack Henry's digital solutions saw a 6% revenue increase to $103.5 million in Q3 FY2024, the overall revenue stream remains sensitive to merger and acquisition activity among its client base.

Preview Before You Purchase

Jack Henry SWOT Analysis

This is the actual Jack Henry SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re viewing a live preview of the actual SWOT analysis file, offering a clear glimpse into its comprehensive structure. The complete version, detailing all aspects of Jack Henry's strategic position, becomes available immediately after checkout.

Opportunities

Financial institutions are accelerating their digital transformation, with a significant portion migrating core operations to the cloud to boost efficiency and customer engagement. This trend is a prime opportunity for Jack Henry, as banks and credit unions increasingly seek cloud-native solutions. For instance, in 2024, a substantial percentage of financial institutions planned to increase their cloud spending, directly benefiting providers like Jack Henry who offer robust cloud-based platforms.

The accelerating adoption of real-time payment systems like FedNow, which launched in July 2023 and saw over 200 financial institutions join by early 2024, presents a significant opportunity for Jack Henry. This demand for instant transactions aligns with Jack Henry's core payment processing services, allowing for enhanced functionalities and new product development to support these faster rails.

Furthermore, the ongoing evolution of open banking, driven by regulatory push and consumer demand for data control, opens doors for Jack Henry to offer innovative solutions. By facilitating secure and efficient data sharing, the company can empower financial institutions to develop personalized services and new revenue streams, directly addressing the growing need for data-driven customer experiences.

The financial industry's increasing embrace of AI and automation for fraud detection, efficiency gains, and personalized customer service presents a significant growth avenue. Jack Henry can enhance its current offerings with more AI-driven features and create entirely new AI solutions.

By integrating these advanced capabilities, Jack Henry can help its clients lower operational costs and provide more customized client experiences, thereby boosting demand for the company's innovative technologies.

Expansion in Small and Medium-Sized Business (SMB) Market

Many financial institutions are prioritizing the expansion of services for small and medium-sized businesses (SMBs), focusing on improved payment and lending capabilities. This strategic shift presents a significant opportunity for Jack Henry to create and promote specialized solutions that cater to the distinct requirements of this market segment. By assisting its clients in effectively serving the SMB sector, Jack Henry can tap into new revenue streams and solidify its competitive standing.

The SMB market is experiencing robust growth, with many businesses actively seeking advanced financial tools. For instance, data from the U.S. Small Business Administration indicated that as of 2023, SMBs accounted for nearly half of all private sector employment. This burgeoning demand for tailored financial services makes the SMB market a prime area for Jack Henry's strategic focus and product development.

- Growing SMB Demand: Financial institutions are increasingly targeting SMBs, recognizing their critical role in the economy and their need for specialized financial solutions.

- Enhanced Services: The trend includes offering improved payment processing, digital lending platforms, and integrated treasury management services designed for SMBs.

- Revenue Growth Potential: By developing solutions for this expanding market, Jack Henry can diversify its revenue streams and capture market share.

- Market Position Strengthening: Supporting clients in serving SMBs allows Jack Henry to deepen relationships and enhance its reputation as a key technology partner.

Strategic Partnerships and Acquisitions

Jack Henry can significantly enhance its offerings by forming strategic partnerships or acquiring specialized fintech firms. This approach allows for the rapid expansion of its technological capabilities, addressing any existing product gaps and delivering more integrated solutions to clients swiftly. For instance, in 2023, Jack Henry announced a partnership with Zelle to enhance digital payment experiences, demonstrating a commitment to integrating innovative solutions.

These collaborations are crucial for accelerating the introduction of new features to the market. They also reduce the internal development workload and leverage the unique expertise found in innovative startups. By doing so, Jack Henry can maintain its competitive edge and ensure it provides comprehensive, cutting-edge solutions to its varied clientele.

- Partnerships for integrated solutions

- Acquisitions to fill product gaps

- Accelerated time-to-market for new features

- Leveraging specialized fintech expertise

The accelerating digital transformation within financial institutions, with a notable shift towards cloud-native solutions, presents a substantial opportunity for Jack Henry. As banks and credit unions increasingly prioritize efficiency and enhanced customer engagement through digital channels, Jack Henry's cloud-based platforms are well-positioned to meet this growing demand. Data from 2024 indicated a significant planned increase in cloud spending by financial institutions, directly benefiting providers like Jack Henry.

The widespread adoption of real-time payment systems, such as FedNow which saw over 200 financial institutions join by early 2024, creates a strong demand for Jack Henry's payment processing capabilities. This trend aligns with the company's core services, enabling the development of new functionalities and products that support faster transaction speeds and improved payment experiences.

The evolving landscape of open banking, driven by both regulatory initiatives and consumer desire for data control, offers Jack Henry a chance to innovate. By enabling secure and efficient data sharing, the company can help financial institutions create more personalized services and unlock new revenue streams, catering to the increasing demand for data-driven customer interactions.

The growing integration of Artificial Intelligence (AI) and automation in financial services for fraud detection, operational efficiency, and personalized customer service represents another significant growth avenue. Jack Henry can enhance its existing product suite with AI-driven features and develop new AI-powered solutions, thereby helping clients reduce costs and improve customer experiences.

Jack Henry can also capitalize on the increasing focus of financial institutions on expanding services for small and medium-sized businesses (SMBs). With SMBs accounting for nearly half of all private sector employment in the U.S. as of 2023, there's a substantial market for tailored financial solutions, including advanced payment and lending capabilities, which Jack Henry is well-equipped to provide.

Strategic partnerships and acquisitions are key opportunities for Jack Henry to rapidly enhance its technological capabilities and address product gaps. For example, its 2023 partnership with Zelle to improve digital payment experiences demonstrates this strategy. These collaborations accelerate the delivery of new features and leverage specialized fintech expertise, ensuring Jack Henry remains competitive.

Threats

The financial technology landscape is constantly battling increasingly sophisticated cyber threats, including AI-powered fraud. As a major player entrusted with sensitive financial information, Jack Henry is a significant target for these attacks. A data breach could have devastating consequences for its reputation and the trust of its clients.

The financial technology landscape Jack Henry operates within is fiercely competitive. This includes not only large, incumbent players but also a growing number of nimble fintech startups constantly pushing new solutions. For instance, in the first quarter of 2024, the fintech sector saw significant investment, indicating continued innovation and market entry.

This intense rivalry puts pressure on pricing and necessitates a relentless pace of innovation. Jack Henry must continually enhance its offerings and differentiate itself to avoid losing market share to competitors who might introduce disruptive technologies or more cost-effective solutions. Staying ahead requires a proactive and adaptable strategy.

Jack Henry faces significant threats from evolving regulatory landscapes in financial services. For instance, the Gramm-Leach-Bliley Act (GLBA) and the Bank Secrecy Act (BSA) continually update, requiring substantial investment in compliance infrastructure. These ongoing adjustments can divert resources from innovation, impacting Jack Henry's ability to maintain its competitive edge. The cost of ensuring client compliance with regulations like the Customer Identification Program (CIP) can also be substantial, adding to operational overhead.

Client Consolidation and Deconversion Risks

The ongoing wave of mergers and acquisitions within the financial sector, especially among community banks and credit unions, directly threatens Jack Henry's client relationships. When these institutions combine, there's a significant possibility that the newly formed entity will opt for the acquirer's incumbent technology solutions, potentially terminating Jack Henry's existing contracts.

While Jack Henry does generate revenue from client deconversions, this short-term financial gain ultimately signifies a long-term reduction in its customer base. For example, in the fiscal year 2023, Jack Henry reported a net revenue of $1.95 billion, and a substantial loss of even a few large clients due to consolidation could impact future growth. Industry analysts noted that the pace of M&A activity in the community banking sector remained elevated through early 2024, with over 50 deals announced in the first quarter alone.

- Client Consolidation: Financial institutions are merging, creating larger entities that may consolidate technology platforms.

- Technology Provider Transition: Acquired institutions often switch to the parent company's existing technology, risking Jack Henry's client retention.

- Deconversion Revenue vs. Attrition: While deconversions provide immediate income, they represent a permanent loss of future recurring revenue.

- Market Trend Impact: Increased M&A activity in 2024 directly increases the probability of client loss for Jack Henry.

Technological Disruption and Rapid Obsolescence

The relentless march of technology, encompassing advancements beyond current AI like sophisticated blockchain applications and quantum computing, poses a significant threat. This rapid evolution could quickly make Jack Henry's current offerings outdated. For instance, the global IT spending on AI is projected to reach $62.5 billion in 2024, a substantial increase indicating the speed of innovation.

To counter this, Jack Henry faces the ongoing challenge of substantial investment in research and development. Failing to stay ahead of these technological waves risks allowing nimble new competitors with novel approaches to gain a significant advantage. The company's ability to adapt and integrate emerging technologies will be critical for its sustained relevance in the financial technology sector.

- Rapid Technological Advancement: Emerging tech like advanced blockchain and quantum computing could disrupt existing financial solutions.

- Risk of Obsolescence: Jack Henry's current technology platforms may become outdated if not continually updated.

- R&D Investment Necessity: Significant and ongoing investment in research and development is crucial to anticipate and adapt to these shifts.

- Competitive Threat: New entrants with fundamentally different technological approaches pose a direct competitive risk.

Jack Henry is vulnerable to sophisticated cyberattacks, including AI-driven fraud, which could damage its reputation and client trust given its handling of sensitive financial data.

The competitive fintech landscape, with both established players and innovative startups, pressures Jack Henry on pricing and demands continuous innovation to retain market share.

Evolving financial regulations require significant investment in compliance, potentially diverting resources from innovation and impacting Jack Henry's competitive stance.

The increasing pace of mergers and acquisitions among financial institutions poses a threat as acquired entities may switch to the parent company's technology, leading to client attrition for Jack Henry.

SWOT Analysis Data Sources

This Jack Henry SWOT analysis is built on a foundation of credible data, including their official financial filings, comprehensive market research reports, and insights from industry experts and analysts.