Jack Henry Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jack Henry Bundle

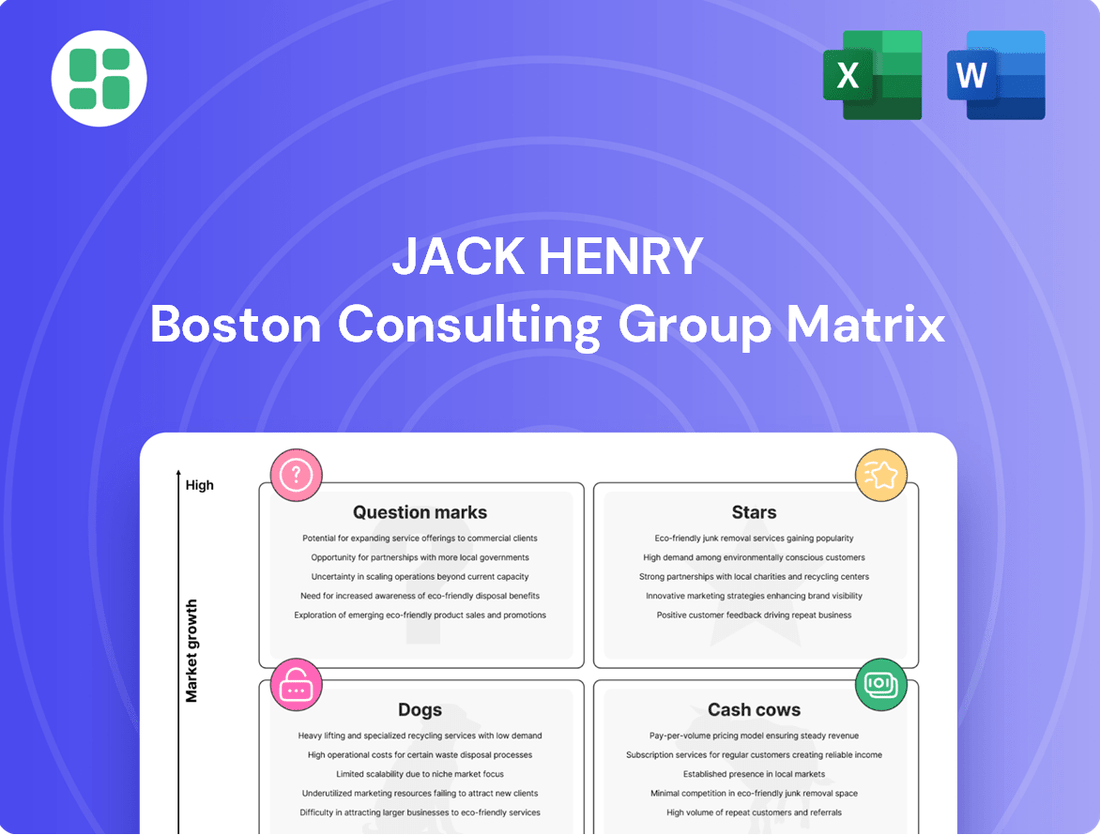

Uncover the strategic positioning of Jack Henry's product portfolio with this insightful BCG Matrix overview. See which offerings are poised for growth and which are generating consistent returns, offering a glimpse into their market dynamics.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Jack Henry.

Stars

Cloud-Native Core Banking Platforms represent a significant investment for Jack Henry, positioning them as a "Star" in the BCG Matrix. This segment is characterized by high market growth as financial institutions increasingly demand agile and scalable solutions. Jack Henry's commitment to a cloud-native, API-first approach for its core banking systems directly addresses this demand.

The company is actively investing in this area, with plans to launch its public cloud-native retail deposit core in early 2026. This strategic move aims to capture a substantial share of the evolving market for modern banking infrastructure, particularly among community banks and credit unions seeking to enhance their digital capabilities.

AI-Powered Fraud & Risk Management Solutions represent a significant opportunity for Jack Henry, placing them firmly in the Stars quadrant of the BCG Matrix. Financial institutions are prioritizing fraud detection and mitigation, with investments expected to remain high through 2025.

Jack Henry's cloud-native, AI-based offerings, such as Financial Crimes Defender and Payrailz Fraud Monitor, are well-positioned to capitalize on this trend. These solutions utilize artificial intelligence for real-time fraud detection and prevention, directly addressing a critical pain point for their client base. The market for these advanced fraud management tools is experiencing robust growth, reflecting the increasing sophistication of financial crime and the demand for effective countermeasures.

The financial industry is rapidly shifting towards real-time payment rails like FedNow and The Clearing House's RTP network, creating a significant growth opportunity. Jack Henry is well-positioned within this high-growth market, as a substantial number of financial institutions are already connected through their services.

Jack Henry is actively developing and deploying new functionalities, such as send applications, to enhance the capabilities of these instant payment networks. This proactive approach solidifies their leadership in the evolving payments landscape, ensuring clients can leverage the full potential of real-time transactions.

Advanced Digital Banking Experience Platforms

Financial institutions are heavily investing in digital banking, aiming for superior user experiences, personalized services, and effortless mobile account opening. This trend positions platforms that can deliver these capabilities as critical growth drivers.

Jack Henry’s Banno platform, along with its expanding suite of digital solutions tailored for demographics like Gen Z and small businesses, is strategically placed within this high-growth market segment. Their commitment to continuous innovation ensures they are meeting evolving customer demands.

- Market Growth: The digital banking sector is projected to see substantial growth, with mobile banking transactions expected to continue their upward trajectory. For instance, by 2024, a significant majority of banking interactions are anticipated to occur through digital channels.

- Customer Expectations: Consumers, particularly younger demographics, expect seamless, intuitive, and personalized digital experiences. This includes features like AI-driven insights and simplified onboarding processes, which Jack Henry's platforms aim to provide.

- Platform Investment: Financial institutions are allocating a larger portion of their IT budgets to digital transformation initiatives, with platforms like Banno offering integrated solutions that streamline operations and enhance customer engagement.

Small and Medium-Sized Business (SMB) Offering

Jack Henry's Small and Medium-Sized Business (SMB) offering is positioned as a star in the BCG matrix, reflecting its status as a high-growth, high-market-share segment. The company projects this area to be its fastest-growing opportunity over the next five years.

This growth is fueled by strategic investments in innovative payment solutions and the expansion of services such as lending and treasury management tailored for SMBs. For instance, in fiscal year 2024, Jack Henry reported significant growth in its digital solutions, with a substantial portion attributed to enhanced offerings for the SMB market, demonstrating their commitment to capturing market share in this lucrative space.

- Fastest-Growing Segment: Jack Henry anticipates its SMB offering to lead growth over the next five years.

- Strategic Investments: Focus on innovative payment solutions and expanded services like lending and treasury management.

- Market Capture: Aiming to secure significant market share by catering to the evolving needs of SMBs.

- Fiscal Year 2024 Performance: Digital solutions, including those for SMBs, showed robust growth, underscoring the segment's importance.

Jack Henry's Cloud-Native Core Banking Platforms, AI-Powered Fraud & Risk Management, Real-Time Payments, Digital Banking Solutions, and SMB Offerings are all strong contenders in the Stars quadrant of the BCG Matrix. These areas represent high growth markets where Jack Henry has established a significant presence and is actively investing for future expansion. The company's strategic focus on these segments underscores its commitment to innovation and meeting the evolving needs of financial institutions.

| BCG Quadrant | Jack Henry Offering | Market Growth | Jack Henry's Position | Key Driver |

|---|---|---|---|---|

| Stars | Cloud-Native Core Banking Platforms | High | Leading | Demand for agile, scalable solutions |

| Stars | AI-Powered Fraud & Risk Management | High | Strong | Increasing sophistication of financial crime |

| Stars | Real-Time Payments | High | Significant player | Shift to instant payment rails |

| Stars | Digital Banking Solutions (e.g., Banno) | High | Innovative | Consumer demand for seamless digital experiences |

| Stars | Small and Medium-Sized Business (SMB) Offering | Very High (projected fastest growing) | Aggressively expanding | Strategic investments in payments, lending, and treasury |

What is included in the product

This BCG Matrix overview details strategic recommendations for each business unit, guiding investment and divestment decisions.

A clear, one-page BCG Matrix visually pinpoints business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Jack Henry's traditional on-premise core processing systems, like SilverLake and Symitar, are true cash cows. These platforms hold a significant portion of the market, particularly with community banks and credit unions. While the market for these systems is mature, they generate a consistent and reliable revenue stream for Jack Henry, needing less aggressive investment for growth.

Established Payment Processing Services represent Jack Henry's Cash Cows. These core offerings, including ACH, wire transfers, and card processing, cater to a vast client base of financial institutions. In 2024, the demand for these foundational services remained robust, underpinning the company's stable revenue streams in a mature but indispensable market.

Jack Henry's basic digital banking suites represent a classic "cash cow" in the BCG matrix. These foundational online and mobile banking platforms are already deeply embedded within a substantial portion of their client base, generating consistent and predictable revenue streams. For instance, in fiscal year 2023, Jack Henry reported that approximately 95% of its bank customers utilized its digital solutions, underscoring the widespread adoption and stability of these offerings.

The revenue generated from these established digital suites is reliable because it primarily stems from ongoing maintenance, support, and incremental updates rather than requiring significant investment in new market development or aggressive sales efforts. This mature product category allows Jack Henry to leverage its existing infrastructure and customer relationships for steady cash flow, which can then be reinvested into other areas of the business, such as developing innovative new products or expanding into emerging markets.

Standard Compliance & Regulatory Reporting Tools

Standard Compliance & Regulatory Reporting Tools from Jack Henry are critical for financial institutions. These tools are not optional; they are a necessity for navigating the complex landscape of financial regulations.

This segment represents a classic Cash Cow within the Jack Henry portfolio. The demand for these services is consistent because regulatory requirements are ongoing and mandatory for all financial institutions. This creates a stable, predictable revenue stream, even if the market itself isn't experiencing rapid expansion.

In 2024, the financial services industry continued to face stringent regulatory scrutiny. For instance, reports from regulatory bodies like the SEC and FINRA highlighted the increasing complexity of compliance, driving demand for robust reporting solutions. Jack Henry's offerings directly address this need, ensuring clients remain compliant and avoid costly penalties.

- Mandatory Nature: Compliance tools are essential for legal operation, guaranteeing a captive customer base.

- Stable Revenue: Predictable demand ensures consistent income for Jack Henry, characteristic of a Cash Cow.

- Low Growth, High Necessity: While the market for new compliance solutions might be mature, the ongoing need for them is unwavering.

- Regulatory Environment: In 2024, the global regulatory landscape remained demanding, reinforcing the value of these tools.

Managed Services & IT Hosting for Legacy Clients

Managed Services & IT Hosting for Legacy Clients represents a significant Cash Cow for Jack Henry. Existing clients who rely on Jack Henry to manage their IT infrastructure and host their core systems and other applications generate consistent, recurring revenue. This segment is characterized by long-term contracts and the inherent stickiness of deeply integrated technology solutions.

This business line benefits from the stability of existing client relationships and the reduced need for extensive new market development. The recurring revenue model provides a predictable income stream, allowing for efficient resource allocation. In 2024, Jack Henry reported that its technology and payment solutions segment, which includes managed services, saw continued strength, contributing significantly to overall revenue. The company's focus on retaining and expanding services with its established client base underscores the value of these legacy relationships.

- Stable Recurring Revenue: Long-term contracts ensure predictable income.

- Client Stickiness: Deeply embedded technology makes switching difficult.

- Reduced Marketing Costs: Focus on existing, satisfied clients.

- Predictable Cash Flow: Supports investment in other business areas.

Jack Henry's established on-premise core processing systems, like SilverLake and Symitar, are prime examples of cash cows. These platforms are deeply entrenched, particularly within community banks and credit unions, generating steady revenue despite market maturity. This consistent income stream requires minimal new investment, allowing Jack Henry to allocate resources elsewhere.

The company's foundational payment processing services, including ACH and card processing, also function as cash cows. These are indispensable offerings for a broad client base, and their demand remained strong throughout 2024, contributing to stable revenue. The mature but essential nature of these services ensures predictable financial performance.

Jack Henry's basic digital banking suites are classic cash cows, deeply integrated with a large customer base. These platforms provide reliable revenue through ongoing maintenance and support, rather than requiring significant new development. In fiscal year 2023, approximately 95% of Jack Henry's bank customers utilized its digital solutions, highlighting their widespread adoption and revenue stability.

Standard compliance and regulatory reporting tools are essential for financial institutions and represent a significant cash cow for Jack Henry. The mandatory nature of these services ensures consistent demand, creating a predictable revenue stream. In 2024, the ongoing complexity of financial regulations, as noted by bodies like the SEC, reinforced the value and demand for these critical tools.

Managed services and IT hosting for legacy clients are also key cash cows. Long-term contracts and the deep integration of these solutions create sticky client relationships and recurring revenue. Jack Henry's technology and payment solutions segment, which includes these services, continued to show strength in 2024, underscoring the value of its established client base.

| Product/Service Category | BCG Matrix Classification | Key Characteristics | 2024 Relevance | Revenue Contribution |

|---|---|---|---|---|

| On-Premise Core Processing (SilverLake, Symitar) | Cash Cow | Mature market, high customer retention, stable revenue | Continued demand from community banks and credit unions | Significant and predictable |

| Established Payment Processing | Cash Cow | Indispensable services, broad client adoption, consistent demand | Robust demand for ACH, wire, and card processing | Reliable revenue stream |

| Basic Digital Banking Suites | Cash Cow | Deeply embedded, recurring revenue from maintenance/support | 95% of bank customers used digital solutions in FY23 | Steady and predictable |

| Standard Compliance & Regulatory Reporting | Cash Cow | Mandatory for all institutions, consistent demand | Increased regulatory complexity driving demand | Stable, recurring income |

| Managed Services & IT Hosting (Legacy) | Cash Cow | Long-term contracts, client stickiness, recurring revenue | Continued strength in technology and payment solutions segment | Significant and predictable |

What You See Is What You Get

Jack Henry BCG Matrix

The Jack Henry BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content – just a comprehensive strategic tool ready for your immediate use. You can confidently assess its value, knowing that the purchased version will be precisely the same, enabling you to seamlessly integrate its market insights into your business planning and decision-making processes. This ensures you get exactly what you need to analyze your product portfolio and allocate resources effectively.

Dogs

Legacy, Discontinued Ancillary Software Modules often fall into the Dogs quadrant of the BCG Matrix. These are typically older, niche software add-ons that Jack Henry no longer actively develops or markets to new clients, primarily serving a dwindling base of existing users.

Revenue from these modules might be declining, as evidenced by 'deconversion' figures indicating clients migrating away from these less competitive, older offerings. For instance, if deconversion revenue for ancillary modules in 2024 represented a significant portion of their overall decline, it would solidify their Dog status.

Jack Henry's older, non-API enabled integration frameworks are positioned in the Dogs quadrant of the BCG Matrix. These legacy systems, often proprietary, struggle to keep pace with the industry's shift towards open banking and API-first architectures, leading to limited growth potential.

As financial institutions increasingly demand flexible and interoperable solutions, these outdated frameworks face a declining market share. For example, in 2024, many community banks are actively migrating away from these rigid systems to embrace more modern, API-driven platforms to enhance customer experience and operational efficiency.

Niche proprietary hardware solutions often represent a declining market segment for companies like Jack Henry. These specialized, non-standard hardware offerings, once crucial, are increasingly being sidelined by the industry's shift towards flexible, cloud-based, and software-defined infrastructure. Consequently, these products typically hold a low market share.

Manually Intensive, Non-Automated Back-Office Tools

Manually intensive, non-automated back-office tools within Jack Henry's portfolio would likely fall into the Dogs quadrant of the BCG Matrix. This is due to the industry's relentless drive for operational efficiency, heavily fueled by advancements in AI and Robotic Process Automation (RPA).

These legacy systems, requiring significant human intervention for tasks like data entry, reconciliation, or customer onboarding, present a stark contrast to the streamlined, automated solutions now preferred by financial institutions. For instance, a significant portion of the financial services industry is investing heavily in automation; a 2023 survey indicated that 65% of financial firms planned to increase their spending on automation technologies.

- Low Market Share: These tools are likely losing ground to more modern, automated competitors, resulting in a shrinking customer base and reduced market presence.

- Low Growth Rate: The demand for solutions that require extensive manual input is declining as the industry prioritizes speed, accuracy, and cost reduction through technology.

- Potential for Obsolescence: Without significant investment in modernization or integration with newer technologies, these tools risk becoming entirely obsolete.

- Resource Drain: Maintaining and operating these manual systems can be costly and inefficient, diverting resources that could be better allocated to growth areas.

Products Tied to De-Converting Clients

Within the Jack Henry BCG Matrix, products tied to de-converting clients fall into the Dogs quadrant. This signifies a business segment characterized by low growth and a declining market share. The revenue generated from these de-conversions, often stemming from client acquisitions by other financial institutions or various other reasons, is largely outside of Jack Henry's direct influence and does not contribute to the company's ongoing business expansion.

This deconversion revenue represents a diminishing portion of Jack Henry's overall business. For instance, while specific figures for deconversion revenue aren't publicly isolated, industry trends show that client attrition due to mergers and acquisitions can impact financial technology providers. In 2024, the financial services sector continued to see consolidation, with hundreds of smaller institutions being acquired, directly affecting the customer base of core banking providers like Jack Henry.

- Low Market Share: The revenue stream is from clients leaving, indicating a shrinking presence in that specific segment.

- Low Growth: Deconversions are inherently a sign of decline, not expansion.

- External Factors: Client departures are often driven by external events like mergers, outside of Jack Henry's direct control.

- Strategic Focus: Resources are typically shifted away from such segments towards more promising areas of the business.

Jack Henry's legacy, discontinued ancillary software modules are prime examples of Dogs in the BCG Matrix. These are older, niche add-ons that the company no longer actively promotes, serving only a shrinking base of existing users.

Revenue from these modules is likely declining, with deconversion figures indicating clients moving to more competitive offerings. For instance, if deconversion revenue for these ancillary modules represented a notable portion of their overall decline in 2024, it would solidify their Dog status.

Older, non-API enabled integration frameworks within Jack Henry's offerings also fall into the Dogs quadrant. These legacy systems, often proprietary, struggle to adapt to the industry's move towards open banking and API-first architectures, limiting their growth potential.

As financial institutions increasingly favor flexible and interoperable solutions, these outdated frameworks face shrinking market share. In 2024, many community banks actively migrated from rigid systems to modern, API-driven platforms for better customer experience and efficiency.

Manually intensive, non-automated back-office tools are also likely Dogs due to the industry's focus on efficiency driven by AI and RPA. These legacy systems require significant human intervention, contrasting with the streamlined, automated solutions now in demand.

A 2023 survey revealed that 65% of financial firms planned to increase spending on automation technologies, highlighting the diminishing market for manual solutions.

| BCG Quadrant | Jack Henry Product Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Legacy Ancillary Software Modules | Low | Declining | Consider divestment or minimal maintenance |

| Dogs | Non-API Enabled Integration Frameworks | Low | Declining | Prioritize migration to API-driven solutions |

| Dogs | Manually Intensive Back-Office Tools | Low | Declining | Invest in automation or phase out |

Question Marks

While Payments-as-a-Service (PaaS) is seeing increased adoption, the wider Banking-as-a-Service (BaaS) market is experiencing slower growth among financial institutions. This is largely due to increasing regulatory oversight and the associated compliance expenses. For example, in 2023, the global BaaS market was valued at approximately $10.5 billion, with projections indicating continued, albeit measured, expansion.

Jack Henry's BaaS initiatives represent a segment with significant future growth potential. However, their current market penetration remains relatively low, placing them in a question mark position within the BCG matrix. This situation highlights the strategic challenge of balancing investment in a promising but nascent market against the immediate hurdles of regulatory complexity and customer acquisition.

Jack Henry is actively investigating generative AI for customer-facing roles, moving beyond efficiency gains to explore personalized financial advice and advanced automated customer service. This represents a significant growth opportunity, though adoption is currently low as these applications are in their nascent stages.

For instance, while many financial institutions are deploying AI for back-office tasks, only a fraction are experimenting with generative AI for direct customer engagement. Early pilots suggest potential for increased customer satisfaction, but widespread market acceptance and regulatory clarity are still developing.

Jack Henry's expansion into new geographic markets or significantly different domestic segments would place these initiatives in the 'Question Marks' category of the BCG Matrix. Initial product offerings and market penetration would likely be low, requiring substantial investment. For instance, in 2023, Jack Henry reported international revenue of $163.5 million, a small fraction of its total revenue, indicating ample room for growth in untapped regions.

Highly Specialized Embedded Finance Solutions

While Jack Henry has a strong foothold in Payments-as-a-Service, their engagement in more intricate embedded finance solutions that weave financial services into non-financial platforms is still in its early phases. These specialized offerings, extending beyond simple payments, represent a significant opportunity for high growth. For instance, the embedded finance market is projected to reach $7 trillion by 2030, according to some industry analyses, highlighting the vast untapped potential.

Jack Henry's current market share in these advanced, highly specialized embedded finance areas is relatively low, positioning them in the "Question Marks" quadrant of the BCG Matrix. This means they are in a developing market with high growth prospects but haven't yet established a dominant presence. For example, consider the burgeoning market for embedded lending or insurance solutions within e-commerce or SaaS platforms.

The company's strategic focus on expanding its capabilities in these complex areas, such as offering integrated lending or investment functionalities within third-party applications, could yield substantial future returns. As of early 2024, many financial institutions are still exploring the complexities of these integrations, creating a window for early movers like Jack Henry to capture significant market share.

- Nascent Adoption: Complex embedded finance solutions beyond payments are still in early adoption stages.

- High Growth Potential: These specialized areas offer significant future growth opportunities.

- Low Market Share: Jack Henry's current penetration in these niche segments is minimal.

- Strategic Focus: Expansion into advanced embedded finance is key for future revenue streams.

Advanced Data Monetization and Open Banking Ecosystems

Jack Henry's ventures into advanced data monetization and comprehensive open banking ecosystems represent a strategic push into a burgeoning market. These initiatives are classified as question marks because while the potential for revenue generation through data-driven services and ecosystem participation is significant, widespread adoption and proven, scalable revenue models are still in development. For instance, by mid-2024, the global open banking market was projected to reach over $40 billion, highlighting the immense opportunity but also the early stage of many players' participation.

Building out these ecosystems involves fostering partnerships and creating platforms where financial institutions can securely share data, enabling third-party developers to build innovative applications and services. This can unlock new revenue streams beyond traditional banking, such as personalized financial advice or integrated payment solutions. Jack Henry's role here is to provide the technological backbone and facilitate these connections, aiming to capture a share of this expanding market.

- Developing comprehensive open banking ecosystems allows financial institutions to monetize data and create new data-driven services.

- Jack Henry's initiatives in this area are question marks due to the ongoing development of wider adoption and revenue models.

- The global open banking market is a rapidly growing sector, indicating significant future potential for data monetization strategies.

- Success hinges on Jack Henry's ability to build robust platforms that facilitate secure data sharing and foster developer engagement.

Jack Henry's strategic investments in emerging technologies like generative AI for customer service and advanced embedded finance solutions fall into the Question Marks category of the BCG Matrix. These areas show high growth potential but currently have low market penetration and adoption rates for Jack Henry. For instance, while generative AI pilots are underway, widespread implementation is still in its early stages, with many financial institutions cautiously observing results. The company's focus here is on nurturing these nascent ventures into future stars, requiring careful resource allocation to navigate market uncertainties and technological evolution.

| Initiative | Market Growth Potential | Jack Henry Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Generative AI for Customer Service | High | Low | Question Mark | Requires investment to develop and scale capabilities, aiming for future market leadership. |

| Advanced Embedded Finance Solutions | Very High | Low | Question Mark | Focus on expanding offerings beyond payments, targeting complex integrations for significant revenue growth. |

| Open Banking Ecosystems | High | Low to Moderate | Question Mark | Building platforms for data monetization and new service creation, dependent on ecosystem adoption. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from company financial statements, industry growth projections, and competitive landscape analysis to provide strategic direction.