Jack Henry PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jack Henry Bundle

Unlock critical insights into Jack Henry's operating environment with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the financial technology landscape. Equip yourself with the strategic foresight needed to navigate these external forces and capitalize on emerging opportunities. Purchase the full analysis now for actionable intelligence.

Political factors

The financial technology sector faces a dynamic regulatory environment, with a growing emphasis on data privacy, consumer safeguards, and overall financial system stability. For instance, the U.S. Treasury Department's 2024 report on financial innovation highlighted the need for updated regulations to address emerging risks in digital assets and fintech.

Jack Henry, as a critical technology partner for banks and credit unions, must navigate these evolving rules, ensuring its offerings help clients meet compliance requirements. This includes adapting to new data governance standards, such as those potentially influenced by the ongoing discussions around AI in financial services, which could increase product development timelines and compliance expenditures.

Government initiatives like regulatory sandboxes and digital transformation incentives are actively shaping the FinTech landscape, presenting significant opportunities for companies like Jack Henry. These programs aim to streamline the adoption of cutting-edge technologies within the financial sector.

Policies encouraging open banking and the integration of AI, for instance, directly align with Jack Henry's core offerings. In 2024, the U.S. government continued to explore frameworks to support these advancements, with various agencies releasing guidance and proposals to foster innovation while ensuring consumer protection.

The increasing focus on national cybersecurity resilience by governments worldwide directly influences the demand for advanced security solutions within the financial sector, a frequent target for cyber threats. In 2024, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) reported a significant rise in ransomware attacks targeting financial services, underscoring the urgency for robust defenses.

Jack Henry's portfolio, which includes risk management and secure processing platforms, is vital for financial institutions aiming to satisfy heightened government mandates for safeguarding sensitive customer data. For instance, compliance with regulations like the Gramm-Leach-Bliley Act (GLBA) requires financial firms to implement comprehensive security programs, a need Jack Henry addresses.

Global Economic and Trade Policies

Global economic and trade policies significantly influence the environment in which Jack Henry operates. For instance, the World Trade Organization (WTO) reported that global trade growth was projected to be 2.6% in 2024, a slight increase from 0.9% in 2023, indicating a potentially more favorable climate for international business and the financial institutions Jack Henry serves.

Shifting trade agreements and geopolitical stability directly impact the investment capacity and operational health of Jack Henry's financial institution clients. A stable global economic outlook, supported by robust trade policies, generally translates to increased client spending on technology and services, including those provided by Jack Henry.

Policies affecting cross-border financial services are particularly relevant. As of early 2024, discussions around digital trade agreements and data localization continue, which can either streamline or complicate the expansion plans of large financial institutions. This, in turn, shapes their demand for Jack Henry's integrated global solutions.

- Trade Policy Impact: Fluctuations in global trade policies can affect the profitability and growth potential of financial institutions, influencing their IT spending.

- Geopolitical Stability: Periods of geopolitical tension can disrupt international markets, potentially leading to reduced investment in new technologies by banks.

- Cross-Border Services: Evolving regulations on international financial data flow and services directly impact the need for scalable, global technology platforms.

- Economic Growth Forecasts: Projections like the IMF's 2024 global growth forecast of 3.1% suggest a moderate expansion, potentially supporting increased demand for financial technology solutions.

Data Localization and Cross-Border Data Flow Regulations

The global push for data localization and tighter rules on cross-border data transfers presents a significant hurdle for companies like Jack Henry. As more nations mandate that data be stored within their borders, Jack Henry must navigate these complex, often conflicting, regulations. This can directly impact where they invest in infrastructure and how they structure their cloud services to remain compliant across different markets.

These evolving regulations can lead to increased operational costs and complexity. For instance, in 2024, several countries, including India and Vietnam, have been actively updating or implementing new data protection laws that could affect how financial data is handled internationally. Jack Henry's ability to adapt its service delivery models to meet these diverse requirements will be crucial for its continued global expansion and the seamless operation of its cloud-based solutions.

- Data Localization Mandates: Governments worldwide are increasingly requiring sensitive data, particularly financial data, to be stored and processed within their national borders.

- Cross-Border Data Flow Restrictions: New regulations are often placed on how data can be transferred between countries, necessitating robust compliance frameworks.

- Impact on Infrastructure: These trends can force companies to invest in new, geographically dispersed data centers, increasing capital expenditure.

- Service Delivery Model Adjustments: Jack Henry may need to tailor its cloud offerings and data management strategies to comply with the specific data residency and transfer rules of each operating region.

Government policies directly shape the financial technology landscape, with a strong focus on data privacy and consumer protection. For example, the U.S. Treasury's 2024 report emphasized updating regulations for digital assets, impacting how companies like Jack Henry must adapt their offerings to ensure client compliance.

Initiatives promoting open banking and AI adoption, such as those explored by U.S. agencies in 2024, create opportunities for Jack Henry. These policies aim to foster innovation while maintaining consumer safety, aligning with Jack Henry's role in providing essential financial technology solutions.

National cybersecurity mandates, driven by increasing threats like ransomware attacks on financial services reported by CISA in 2024, highlight the critical need for robust security platforms. Jack Henry's risk management tools are essential for financial institutions meeting these heightened government security requirements.

Global economic policies and trade agreements influence client spending on technology. The WTO's 2024 projection of 2.6% global trade growth suggests a more supportive environment for financial institutions and their investment in services like those provided by Jack Henry.

What is included in the product

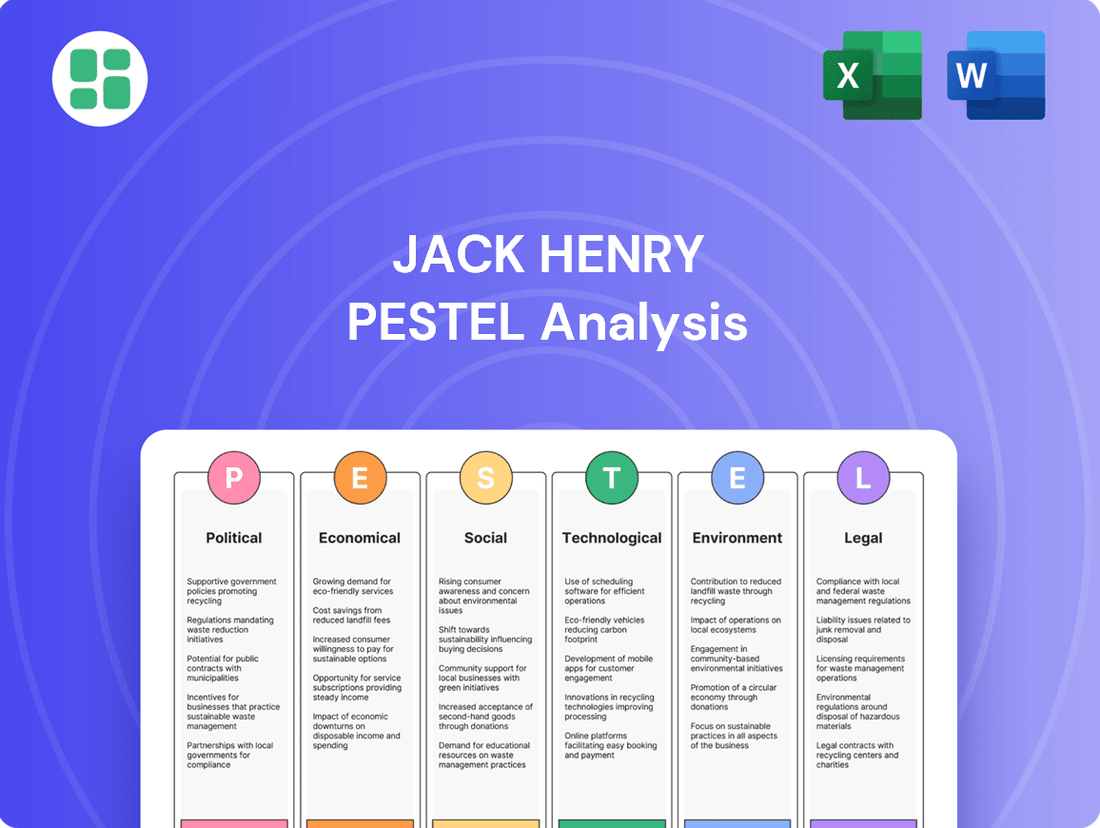

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Jack Henry, providing a comprehensive overview of the external landscape.

The Jack Henry PESTLE analysis offers a structured framework that simplifies complex external factors, allowing teams to focus on actionable insights and strategic planning rather than getting lost in data overload.

Economic factors

The prevailing interest rate environment significantly impacts Jack Henry's client base, which comprises financial institutions. For instance, as of early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that generally supports higher net interest margins for banks. This increased profitability can translate into greater capacity for banks to invest in the technology solutions Jack Henry provides.

Conversely, a sustained period of lower interest rates, such as those seen in the decade preceding 2022, typically compresses bank profit margins. This compression can lead to tighter IT budgets for banks, potentially slowing their adoption of new technologies or reducing their spending on existing solutions. The Federal Reserve's actions and market expectations for future rate movements are therefore critical indicators for Jack Henry's sales pipeline and growth prospects.

Robust economic growth, characterized by rising consumer spending and business investment, directly fuels the financial health of community banks and credit unions. For instance, the U.S. economy experienced a GDP growth of 2.5% in 2023, a positive sign for financial institutions. This environment encourages them to allocate capital towards technology upgrades and service expansion, which translates into increased demand for Jack Henry's solutions.

Conversely, economic downturns or recessionary periods can dampen the investment capacity of these smaller financial players. A slowdown in lending and deposit growth, common during recessions, might force them to postpone or reduce spending on new technology. This could lead to slower revenue growth for Jack Henry, as new sales and upgrade cycles are extended.

The health of the financial sector itself is a critical economic factor. As of Q1 2024, the banking sector, while generally stable, faced ongoing challenges related to interest rate volatility and regulatory scrutiny. The ability of community banks and credit unions to maintain profitability and capital adequacy directly influences their willingness and ability to invest in the digital transformation solutions that Jack Henry provides.

Rising inflation in 2024 and early 2025 is directly impacting Jack Henry's operational expenses. We're seeing significant increases in costs for essential resources like skilled labor, critical hardware components, and energy, all of which are vital for maintaining their technology infrastructure and service delivery.

These escalating costs pose a direct threat to Jack Henry's profit margins. To counteract this, the company is likely focusing on strategic pricing adjustments for its financial technology solutions and driving internal operational efficiencies. The goal is to absorb some of these inflationary pressures without compromising the competitive value of their offerings to financial institutions.

Competition in the FinTech Market

The financial technology sector is incredibly dynamic, with a constant influx of new players and increasingly sophisticated offerings. This intense competition puts significant economic pressure on established companies like Jack Henry to not only keep pace but also to consistently prove their worth. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to reach over $7.5 trillion by 2030, highlighting the rapid growth and intense rivalry.

This competitive landscape directly impacts Jack Henry's economic strategy. It necessitates substantial investments in research and development to foster innovation and requires careful consideration of pricing models to remain attractive to clients. Differentiation becomes paramount to stand out amidst the noise and secure both client retention and new business acquisition.

- Increased R&D Spending: To counter emerging threats and capitalize on new opportunities, companies like Jack Henry must allocate a larger portion of their budgets to innovation.

- Price Sensitivity: The availability of numerous alternative solutions can lead clients to become more price-sensitive, forcing providers to optimize their cost structures and pricing strategies.

- Mergers and Acquisitions: The competitive environment often fuels consolidation, with larger players acquiring smaller, innovative firms to gain market share and technological advantages.

- Focus on Value Proposition: Demonstrating clear and measurable value, beyond just features, is crucial for retaining clients in a market where switching costs can be perceived as lower.

Client Investment in Digital Transformation

Financial institutions are increasingly channeling capital into digital transformation initiatives, recognizing it as a critical economic imperative. This surge in investment directly translates to heightened demand for Jack Henry's comprehensive suite of core processing platforms and advanced digital banking solutions. Banks and credit unions are strategically allocating resources to modernize their operations, aiming to achieve greater efficiency, significant cost reductions, and a superior customer experience. For instance, a significant portion of the projected IT spending by U.S. financial institutions in 2024, estimated to reach $198 billion, is earmarked for digital modernization efforts.

This strategic pivot towards digital capabilities is not merely a trend but a fundamental economic driver for companies like Jack Henry. The focus on enhancing operational agility and cost-effectiveness through technology directly fuels the company's growth trajectory.

- Increased IT Budgets: U.S. financial institutions are projected to spend $198 billion on IT in 2024, with a substantial portion dedicated to digital transformation.

- Efficiency Gains: Institutions are investing to streamline processes, which benefits technology providers offering scalable solutions.

- Customer Experience Focus: A key driver for digital investment is improving customer engagement and retention, creating demand for user-friendly digital platforms.

- Cost Reduction Mandate: The economic pressure to reduce operating expenses pushes financial firms towards technology that offers long-term cost savings.

Economic factors significantly influence Jack Henry's operating environment, particularly through interest rate fluctuations and overall economic growth. As of early 2024, the Federal Reserve's benchmark rate held steady between 5.25%-5.50%, generally benefiting banks by supporting higher net interest margins, which in turn can boost their IT investment capacity. Conversely, economic downturns can reduce financial institutions' spending power on technology upgrades.

Inflation is a notable concern, with rising costs for labor, hardware, and energy impacting Jack Henry's operational expenses and potentially squeezing profit margins. The company must strategically manage pricing and operational efficiencies to mitigate these pressures. The competitive FinTech market, valued at approximately $2.4 trillion in 2023 and projected to exceed $7.5 trillion by 2030, necessitates continuous innovation and competitive pricing from Jack Henry.

| Economic Factor | Impact on Jack Henry | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Interest Rates | Higher rates can boost bank profitability, increasing IT spending capacity. Lower rates can compress margins, potentially reducing IT budgets. | Federal Reserve benchmark rate: 5.25%-5.50% (early 2024). |

| Economic Growth (GDP) | Robust growth fuels financial institution health and investment in technology. Downturns can dampen spending. | U.S. GDP growth: 2.5% in 2023. |

| Inflation | Increases operational costs (labor, hardware, energy), potentially impacting profit margins. | Inflationary pressures observed in early 2024 and projected into 2025. |

| FinTech Market Growth | Intense competition requires ongoing R&D investment and competitive pricing. | Global FinTech market valued at ~$2.4 trillion (2023), projected to reach ~$7.5 trillion by 2030. |

| Digital Transformation Investment | Drives demand for Jack Henry's core processing and digital banking solutions. | U.S. financial institutions' IT spending projected at $198 billion for 2024, with significant allocation to digital modernization. |

Preview Before You Purchase

Jack Henry PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Jack Henry PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Jack Henry's strategic landscape.

Sociological factors

Societal shifts are heavily favoring digital interactions, with consumers increasingly expecting seamless banking through mobile apps and online platforms. This trend directly shapes Jack Henry's strategic priorities, pushing for innovation in digital solutions that offer personalized experiences and efficient transactions.

Data from 2023 indicates that over 75% of banking customers utilize digital channels for their primary banking needs, underscoring the critical importance for financial institutions to invest in robust digital infrastructure. Companies like Jack Henry are pivotal in enabling this transition by providing the technology that facilitates these evolving consumer preferences.

Demographic shifts are profoundly impacting the financial sector. The increasing prominence of Gen Z and Millennials, who overwhelmingly favor digital-first banking experiences, means that financial institutions need technology partners like Jack Henry that can cater to their preferences for seamless, app-based interactions. This generation's digital native status demands intuitive and efficient mobile banking solutions.

Furthermore, a significant societal push towards financial inclusion is reshaping market expectations. There's a growing demand for banking technologies that can extend services to previously underserved communities, including low-income individuals and those in rural areas. This requires accessible platforms and tools that simplify account opening and transaction management, ensuring broader participation in the financial system.

Societal concerns about data privacy and the security of online financial transactions are increasingly critical. A 2024 survey indicated that over 60% of consumers cite data security as their primary concern when choosing a digital banking provider, directly impacting their willingness to adopt new services.

Jack Henry must therefore prioritize building and maintaining trust by offering exceptionally secure and reliable platforms. Consumer confidence is a direct driver of adoption and usage for digital banking solutions; for instance, financial institutions with robust cybersecurity measures reported a 15% higher customer retention rate in 2024 compared to those with weaker protections.

Workforce Trends in Financial Services

Sociological shifts are significantly reshaping the financial services workforce. There's a pronounced demand for remote work capabilities, with a 2024 survey indicating that 60% of financial services professionals prefer hybrid or fully remote arrangements. Simultaneously, the need for skilled technology talent is escalating, as institutions increasingly rely on digital transformation.

Jack Henry's offerings can address these trends by enabling financial institutions to manage their workforce more efficiently. Through automation and digital tools, clients can streamline operations and potentially reduce the need for certain manual roles. However, Jack Henry itself faces the challenge of attracting and retaining its own specialized tech talent in a competitive market.

- Remote Work Demand: A 2024 study found that 60% of financial services employees favor hybrid or remote work.

- Tech Talent Gap: The financial sector is experiencing a shortage of cybersecurity and data analytics professionals.

- Automation's Role: Solutions like Jack Henry's can automate tasks, impacting workforce needs for financial institutions.

- Internal Talent Acquisition: Jack Henry must compete for skilled employees to develop and maintain its technology solutions.

Demand for Personalized Financial Experiences

Consumers are increasingly seeking financial services that feel custom-made for them. This demand is fueled by the widespread availability of data and sophisticated artificial intelligence, allowing for tailored advice and product suggestions. For instance, a 2024 report indicated that 70% of consumers are more likely to engage with financial institutions that offer personalized experiences.

This societal shift directly impacts financial technology providers like Jack Henry. Institutions are actively looking for partners who can deliver hyper-personalization, which is crucial for building stronger customer connections and fostering loyalty. By enabling these personalized interactions, Jack Henry can help banks and credit unions differentiate themselves in a competitive market.

- Personalization as a Key Driver: 70% of consumers prefer personalized financial advice.

- AI and Data Analytics: These technologies are central to delivering tailored experiences.

- Customer Loyalty: Hyper-personalization is a significant factor in retaining customers.

- Market Differentiation: Financial institutions leverage personalization to stand out.

The growing emphasis on environmental sustainability is a significant sociological factor influencing financial institutions. Consumers and investors alike are increasingly scrutinizing companies' environmental, social, and governance (ESG) practices, demanding transparency and demonstrable commitment to eco-friendly operations. This societal pressure is compelling financial firms to integrate sustainability into their core strategies and product offerings.

Financial institutions are responding by developing green financial products and services, such as sustainable investment funds and green bonds, to meet this demand. Furthermore, there's a societal push for greater corporate social responsibility, with a focus on ethical business conduct and community engagement. A 2024 survey revealed that over 55% of consumers consider a company's social impact when making purchasing decisions, including financial services.

Jack Henry's role in this evolving landscape involves providing technology solutions that enable financial institutions to track and report on their ESG metrics. This includes facilitating data collection for sustainability initiatives and supporting the development of transparent reporting mechanisms. The company's platforms can help clients demonstrate their commitment to environmental stewardship and social responsibility, thereby enhancing their brand reputation and customer appeal.

| Sociological Factor | Impact on Financial Institutions | Jack Henry's Role | Relevant Data (2024/2025) |

|---|---|---|---|

| Environmental Consciousness | Demand for ESG-compliant products and services; increased scrutiny of corporate practices. | Enabling ESG data tracking and reporting; supporting green product development. | 55% of consumers consider social impact in purchasing decisions. |

| Digital Lifestyle | Preference for seamless mobile and online banking experiences. | Providing robust digital banking platforms and personalized solutions. | 75% of banking customers use digital channels for primary needs. |

| Demographic Shifts | Catering to digital-native younger generations (Gen Z, Millennials). | Developing intuitive, app-based banking solutions. | Younger generations overwhelmingly favor digital-first banking. |

| Financial Inclusion | Expanding access to financial services for underserved communities. | Offering accessible platforms for account opening and transaction management. | Growing demand for services in rural and low-income areas. |

| Data Privacy & Security | Consumer concern over online transaction security. | Ensuring exceptionally secure and reliable platforms. | 60% of consumers cite data security as a primary concern. |

| Personalization Expectations | Demand for tailored financial advice and product suggestions. | Delivering hyper-personalization through AI and data analytics. | 70% of consumers engage more with personalized experiences. |

| Workforce Evolution | Demand for remote work and skilled tech talent. | Enabling efficient workforce management through automation; attracting tech talent. | 60% of financial services professionals prefer remote/hybrid work. |

Technological factors

The rapid evolution of artificial intelligence and machine learning presents significant opportunities for Jack Henry. AI can bolster fraud detection capabilities, streamline back-office processes, and create more personalized customer interactions, all vital for staying competitive in the financial technology sector.

By integrating AI, Jack Henry can improve risk management, offering enhanced security and operational efficiency to its financial institution clients. This technological advancement is a key driver for future product development and service enhancement.

The cybersecurity landscape is increasingly challenging, with threats like ransomware and AI-driven phishing becoming more sophisticated. This demands ongoing investment in robust security solutions. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the critical need for strong defenses.

As a key technology provider in the financial sector, Jack Henry must deliver advanced security features. Protecting client data and their customers' information from these evolving dangers is paramount. In 2024, financial institutions are prioritizing investments in areas like identity and access management and threat detection to combat these growing risks.

Financial institutions are increasingly embracing cloud computing, a trend directly impacting Jack Henry. This shift is driven by the cloud's inherent scalability, efficiency gains, and improved security capabilities. For instance, a significant portion of financial services workloads are expected to be cloud-based by 2025, highlighting the growing reliance on these platforms.

Jack Henry's success hinges on its capacity to deliver secure and compliant cloud-based banking solutions. As more banks migrate their operations to the cloud, providers like Jack Henry that can offer robust, regulated platforms will solidify their market standing. The company's investment in cloud infrastructure and services directly supports its ability to meet evolving client demands in this technologically advanced landscape.

Open Banking and API Integration

The push for open banking and the increasing reliance on APIs are fundamentally reshaping financial services, fostering unprecedented data sharing and collaboration. Jack Henry's strategic imperative is to ensure its platforms offer robust API integration capabilities. This allows financial institutions to seamlessly connect with a wider array of FinTech partners, thereby unlocking the potential to deliver novel and customer-centric services.

This integration is crucial for staying competitive. For instance, by mid-2024, a significant percentage of financial institutions are expected to have adopted open banking strategies to enhance customer experience and operational efficiency. Jack Henry's ability to facilitate these connections directly impacts its clients' capacity to innovate.

- API-first architecture: Jack Henry's commitment to an API-first approach enables flexible integration with third-party applications.

- FinTech partnerships: Facilitating connections with FinTechs allows banks to offer specialized services like advanced fraud detection or personalized budgeting tools.

- Data security and compliance: Robust API management ensures secure data exchange, adhering to evolving regulatory frameworks like PSD2.

Emergence of Blockchain and Distributed Ledger Technologies

Blockchain and distributed ledger technologies (DLT) continue to mature, presenting opportunities to transform financial services, particularly in payment systems and record management. Jack Henry must actively assess these innovations for their potential integration into its offerings, focusing on enhancing payment processing efficiency and bolstering secure data handling capabilities.

The financial sector's adoption of blockchain is steadily increasing. For instance, the global blockchain in financial services market was valued at approximately $3.4 billion in 2023 and is projected to reach $28.8 billion by 2030, demonstrating significant growth potential. This trend underscores the importance for companies like Jack Henry to explore DLT for streamlining cross-border payments, improving transaction transparency, and enhancing the security of financial data.

- Market Growth: The global blockchain in financial services market is expected to grow from $3.4 billion in 2023 to $28.8 billion by 2030, at a compound annual growth rate (CAGR) of 36.3%.

- Use Cases: Key applications include faster and cheaper cross-border payments, enhanced trade finance processes, and more secure digital identity verification.

- Regulatory Landscape: While adoption is growing, regulatory clarity around blockchain and DLT remains a critical factor influencing widespread implementation.

- Strategic Imperative: Jack Henry's strategic evaluation of these technologies is crucial for maintaining a competitive edge in payment processing and data security solutions.

Technological advancements, particularly in AI and cloud computing, are reshaping financial services, directly impacting Jack Henry's operational landscape and product development strategies.

The increasing sophistication of cyber threats necessitates continuous investment in robust security measures, with global cybercrime costs projected to reach $10.5 trillion annually by 2025.

The adoption of open banking and APIs is fostering greater data sharing and collaboration, requiring Jack Henry to ensure seamless integration capabilities to support client innovation and enhanced customer experiences.

Blockchain and DLT are maturing, offering opportunities to improve payment processing and data security, with the blockchain in financial services market expected to grow significantly.

| Technology Area | Key Trend/Impact | Jack Henry Relevance | Market Data/Projection |

|---|---|---|---|

| Artificial Intelligence | Enhanced fraud detection, process automation, personalized customer experiences | Improves risk management, drives product development | AI in financial services market projected to grow significantly |

| Cloud Computing | Scalability, efficiency, improved security | Enables secure, compliant cloud-based banking solutions | Majority of financial services workloads expected to be cloud-based by 2025 |

| Open Banking & APIs | Data sharing, collaboration, new service delivery | Facilitates FinTech partnerships, unlocks innovation for clients | Growing adoption of open banking strategies by financial institutions |

| Blockchain & DLT | Payment system transformation, secure record management | Enhances payment efficiency, bolsters data security | Blockchain in financial services market valued at $3.4B in 2023, projected to reach $28.8B by 2030 |

| Cybersecurity | Increasingly sophisticated threats (ransomware, AI-driven phishing) | Demands ongoing investment in robust security solutions | Global cost of cybercrime projected to reach $10.5T annually by 2025 |

Legal factors

Data privacy and security regulations are a significant legal factor for Jack Henry. Laws like the Gramm-Leach-Bliley Act and the California Consumer Privacy Act (CCPA) impose strict requirements on how financial institutions handle customer data, directly influencing Jack Henry's product development and operational procedures. Failure to comply can result in substantial penalties; for instance, CCPA violations can lead to fines of $2,500 per unintentional violation and $7,500 per intentional violation, impacting profitability and reputation.

Financial institutions are under immense pressure to adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, a trend that intensified throughout 2024 and is projected to continue. These stringent requirements, aimed at curbing financial crime, directly fuel the demand for advanced technology solutions capable of automating and refining compliance efforts. For instance, the global AML software market was valued at approximately $2.5 billion in 2023 and is expected to grow significantly, reflecting this regulatory push.

Jack Henry's platforms are therefore critical in enabling their clients to meet these evolving regulatory obligations with greater efficiency and accuracy. By offering robust tools for identity verification, transaction monitoring, and suspicious activity reporting, Jack Henry helps financial institutions navigate the complex landscape of AML/KYC compliance. Failure to comply can result in substantial fines; in 2023 alone, global AML fines exceeded $5 billion, underscoring the financial imperative for robust compliance systems.

Regulations around payment systems are a critical factor for Jack Henry. The ongoing development of real-time payment initiatives, such as the Federal Reserve's FedNow service, directly influences how Jack Henry designs and offers its payment processing solutions. Ensuring compliance with these evolving rules is paramount for facilitating secure and efficient transactions for their financial institution clients.

Jack Henry's ability to adapt its payment platforms to meet new regulatory requirements, like those stemming from FedNow's expansion, is key. For instance, as of Q1 2024, FedNow has seen significant adoption by financial institutions, processing millions of transactions. This necessitates Jack Henry's payment solutions to be robust and compliant to support this growing real-time payment ecosystem.

Intellectual Property Rights and Patent Protection

Jack Henry's competitive edge hinges on protecting its vast array of technology solutions and innovations through robust intellectual property rights, including patents and copyrights. These legal safeguards are paramount for defending its proprietary software and services against unauthorized use and imitation. In 2023, the company reported significant investment in research and development, underscoring the importance of IP in maintaining its market position.

The legal landscape governing intellectual property directly impacts Jack Henry's ability to maintain exclusivity over its unique offerings. Strong patent protection ensures that competitors cannot easily replicate its core technologies, which is essential in the rapidly evolving fintech sector. For instance, the increasing complexity of financial regulations globally necessitates continuous innovation, making IP a critical asset.

- Patent Protection: Safeguards Jack Henry's proprietary software and service innovations from direct copying.

- Copyrights: Protects the underlying code and creative elements of its technology solutions.

- Infringement Prevention: Legal frameworks are vital to deter and address any unauthorized use of its intellectual assets.

- R&D Investment: Continued investment in innovation, as seen in its 2023 R&D spending, directly correlates with the need for strong IP protection.

Contractual Obligations and Service Level Agreements

Jack Henry's operations are deeply intertwined with contractual obligations and rigorous Service Level Agreements (SLAs) established with its diverse financial institution clientele. These agreements, covering critical areas like system uptime, data security protocols, and the precise delivery of services, form the bedrock of client trust and operational integrity.

Failure to meet these legally binding commitments can lead to significant repercussions, including financial penalties, reputational damage, and potential loss of business. For instance, a breach of an SLA regarding system availability could trigger substantial service credits for the affected client, impacting Jack Henry's revenue and profitability. In fiscal year 2024, the financial services sector saw an increase in litigation related to data breaches and service disruptions, underscoring the importance of robust contractual adherence.

- Contractual Compliance: Ensuring all client contracts meet regulatory standards and clearly define responsibilities.

- SLA Monitoring: Implementing advanced systems to track and report on performance against uptime and service delivery metrics.

- Data Security Clauses: Adhering to strict data protection clauses within contracts, especially with evolving regulations like GDPR and CCPA.

- Dispute Resolution: Establishing clear protocols for addressing and resolving disputes arising from contractual or SLA disagreements.

The legal framework surrounding financial technology is constantly evolving, and Jack Henry must navigate these changes to ensure compliance and maintain client trust. This includes adapting to new data privacy mandates and cybersecurity regulations, which are becoming increasingly stringent globally. For example, as of mid-2024, many jurisdictions are enhancing their data localization requirements, impacting how financial data can be stored and processed.

Anti-money laundering (AML) and know your customer (KYC) regulations continue to be a major focus. Financial institutions are investing heavily in compliance technology, with the global RegTech market projected to reach over $50 billion by 2027, up from an estimated $20 billion in 2023. Jack Henry's solutions play a crucial role in helping clients meet these demands.

Intellectual property laws are vital for protecting Jack Henry's innovations. The company's significant R&D investments, which saw a notable increase in 2023, necessitate strong patent and copyright protections to maintain its competitive edge against rapidly evolving fintech solutions.

Contractual obligations and service level agreements (SLAs) are fundamental to Jack Henry's client relationships. Adherence to these agreements, especially concerning system uptime and data security, is critical. In fiscal year 2024, the financial services sector experienced a rise in litigation related to service disruptions, highlighting the importance of robust contractual compliance.

| Legal Area | Impact on Jack Henry | 2023-2024 Trend/Data |

|---|---|---|

| Data Privacy & Security | Requires robust data handling protocols and compliance with evolving regulations like CCPA. | Increased focus on data localization; CCPA fines can reach $7,500 per intentional violation. |

| AML/KYC Compliance | Drives demand for automated compliance solutions. | Global RegTech market growth; AML fines exceeded $5 billion in 2023. |

| Intellectual Property | Protects proprietary software and services from infringement. | Increased R&D investment in 2023 necessitates strong IP protection. |

| Contractual Obligations/SLAs | Ensures service delivery standards and client trust. | Rise in litigation for service disruptions in FY2024; SLA breaches can trigger service credits. |

Environmental factors

Financial institutions are facing mounting pressure to report on Environmental, Social, and Governance (ESG) factors, with a significant portion of investors now considering ESG criteria in their decisions. For instance, a 2024 survey indicated that over 70% of institutional investors actively integrate ESG into their investment processes.

This growing demand directly impacts Jack Henry, requiring a keen focus on its operational environmental footprint, particularly the energy usage of its data centers. Companies like Jack Henry are seeing increased scrutiny on their sustainability practices.

Furthermore, Jack Henry is challenged to develop technological solutions that enable its banking clients to effectively track, manage, and report on their own ESG performance, thereby meeting regulatory and stakeholder expectations in the evolving financial landscape.

Jack Henry's operations, like many in the tech sector, are tied to significant energy consumption from its IT infrastructure, particularly data centers. This is a growing environmental concern. For instance, global data center energy consumption was projected to reach over 1,000 terawatt-hours (TWh) annually by 2026, a substantial portion of worldwide electricity use.

Consequently, there's increasing pressure on companies like Jack Henry to implement more energy-efficient technologies and operational strategies. This includes optimizing cooling systems, utilizing more efficient hardware, and exploring cloud solutions that may offer better economies of scale in energy use. The company's commitment to sustainability will likely be measured by its progress in reducing this energy footprint.

Furthermore, the push towards renewable energy sources is a key environmental factor. Many corporations are setting targets to power their operations with clean energy. By 2024, a significant number of large tech companies have pledged to achieve 100% renewable energy sourcing for their global operations, indicating a strong market trend that Jack Henry may need to align with to maintain its competitive and environmental standing.

Financial institutions are increasingly prioritizing climate risk assessment and disclosure. This trend necessitates robust tools for banks and credit unions to evaluate their environmental exposures, a key component of modern PESTLE analysis. Jack Henry is well-positioned to enhance its offerings to help clients integrate climate risk data into critical lending and investment decisions, reflecting a growing market demand for such capabilities.

Waste Management and Electronic Waste (E-Waste)

The increasing volume of electronic waste, or e-waste, presents a significant environmental challenge. As technology rapidly evolves, the lifecycle of hardware and software products, from creation to eventual disposal, generates substantial waste streams. This trend is escalating globally, with projections indicating continued growth in e-waste generation.

Jack Henry, as a key player in providing technology solutions, must integrate sustainable waste management practices. This includes responsible sourcing of materials, extending product lifecycles, and establishing robust recycling programs for electronic components. Minimizing the environmental footprint associated with their products is crucial for both regulatory compliance and corporate responsibility.

Consider these points regarding e-waste management for companies like Jack Henry:

- Global E-waste Surge: The United Nations' Global E-waste Monitor 2024 reported that global e-waste generation reached a record 62 million tonnes in 2023, an increase of 82% since 2010. This highlights the growing scale of the issue.

- Recycling Rates: Despite the increase in waste, only about 22.3% of the 62 million tonnes of e-waste generated in 2023 was officially documented as collected and recycled. This low recycling rate underscores the need for improved infrastructure and corporate initiatives.

- Resource Recovery Potential: E-waste contains valuable materials such as gold, silver, copper, and palladium. In 2023, the value of these secondary raw materials in global e-waste was estimated at $93 billion, representing a significant missed economic opportunity if not properly managed.

- Regulatory Landscape: Governments worldwide are implementing stricter regulations on e-waste disposal and producer responsibility. Companies like Jack Henry need to stay abreast of these evolving legal frameworks, such as extended producer responsibility (EPR) schemes, to ensure compliance and mitigate risks.

Remote Work and Reduced Physical Footprint

The widespread adoption of remote and hybrid work, partly driven by environmental consciousness aiming to cut down on commuting, significantly affects Jack Henry's operational model and that of its clientele. This societal shift directly influences the company's need for physical office space.

A reduced physical office footprint, a consequence of increased remote work, offers Jack Henry opportunities to lower its environmental impact. This includes decreased energy consumption for heating, cooling, and lighting, as well as reduced waste generation typically associated with large office environments.

For instance, in 2024, many businesses continued to re-evaluate their real estate needs. Companies like those Jack Henry serves often reported downsizing office spaces by 10-20% compared to pre-pandemic levels, leading to substantial reductions in utility costs and associated carbon emissions.

- Reduced Commuting Emissions: The shift to remote work directly curtails emissions from employee commutes, a significant environmental benefit.

- Lowered Office Energy Consumption: Fewer occupied physical spaces translate to less energy used for lighting, HVAC, and electronic equipment.

- Decreased Resource Usage: A smaller office footprint generally means less consumption of paper, water, and other office supplies.

- Potential for Real Estate Optimization: Companies can strategically downsize or repurpose office spaces, aligning with sustainability goals and reducing operational overhead.

Environmental factors significantly shape Jack Henry's operational landscape, driven by increasing investor and regulatory focus on ESG. The company must address its energy consumption, particularly within data centers, a critical area for sustainability improvement. For example, global data center energy use is projected to rise, making energy efficiency a key performance indicator.

The growing volume of electronic waste is another major concern, necessitating responsible management of hardware lifecycles. With global e-waste reaching 62 million tonnes in 2023, Jack Henry is challenged to implement robust recycling and material sourcing practices.

Furthermore, the shift towards remote and hybrid work models presents opportunities for Jack Henry to reduce its physical footprint and associated environmental impact, aligning with broader corporate sustainability trends observed in 2024.

Jack Henry's clients also require solutions to manage their own environmental risks, such as climate change impacts. By offering tools for climate risk assessment, Jack Henry can support financial institutions in making more informed, sustainable decisions.

PESTLE Analysis Data Sources

Our PESTLE analysis for Jack Henry is built on a robust foundation of data from official government publications, reputable financial institutions like the Federal Reserve, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the financial technology sector.