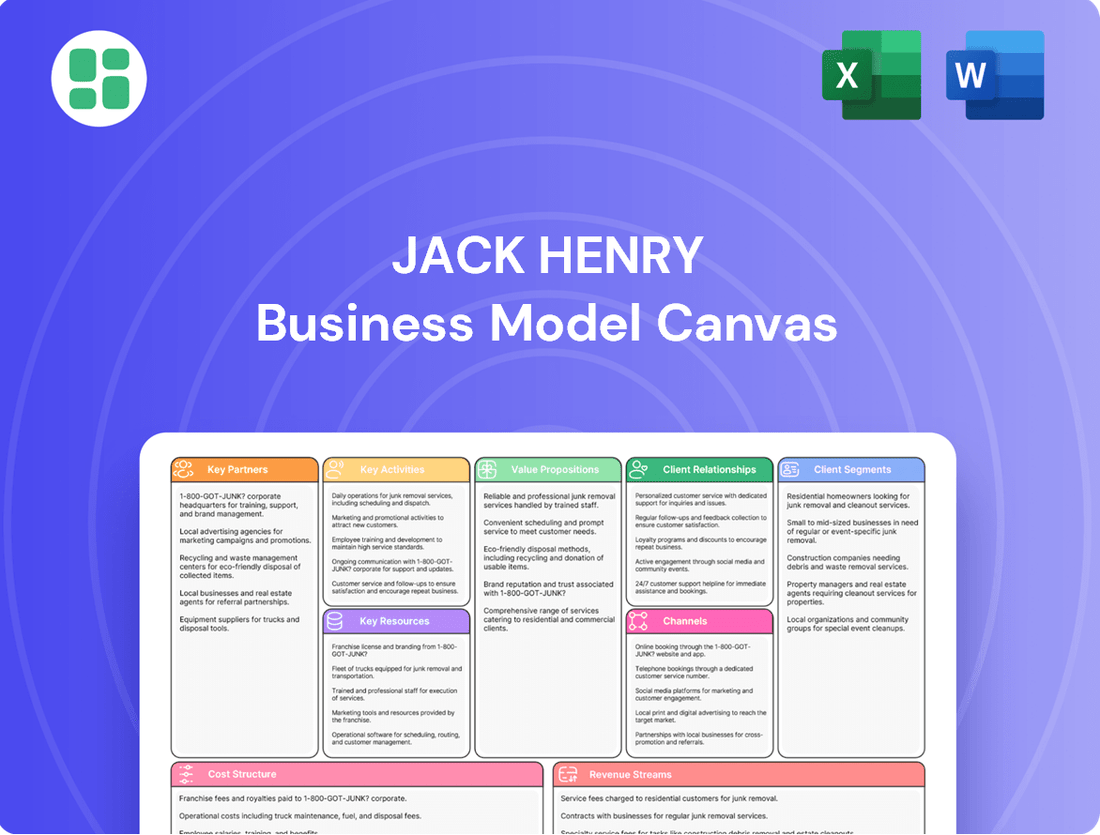

Jack Henry Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jack Henry Bundle

Discover the intricate workings of Jack Henry's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Perfect for strategists and innovators seeking to deconstruct a winning formula.

Partnerships

Jack Henry actively partners with leading fintech companies to integrate their innovative solutions into its ecosystem, enhancing its offerings for financial institutions. For instance, in 2024, Jack Henry announced a significant expansion of its fintech partnership program, bringing on board over 15 new specialized providers across areas like digital account opening and AI-driven fraud detection.

This collaboration allows banks and credit unions to access a vibrant array of modern capabilities and specialized expertise, often through APIs. These partnerships help accelerate time to market for new features and reduce operational burdens for clients, as seen with the recent integration of a new digital lending platform that reduced onboarding time for small business loans by an average of 30% for participating institutions.

Jack Henry is actively pursuing technological modernization and a significant cloud transition, forging strategic alliances with major cloud service providers. This commitment to public cloud-native formats is designed to boost the efficiency, security, and scalability of their offerings.

These collaborations are vital for accelerating innovation and ensuring robust protection for accountholder data. For instance, in 2024, Jack Henry continued to expand its cloud-based solutions, leveraging partnerships to deliver enhanced digital banking experiences.

Jack Henry actively participates in industry associations and hosts its own user conferences, such as Jack Henry Connect, to cultivate strong relationships and gather valuable feedback from its extensive client base and technology collaborators. These gatherings are crucial for understanding evolving business trends and developing effective strategies.

These forums serve as vital platforms for open dialogue on emerging trends, smart strategies, and cutting-edge solutions within the financial services sector. For instance, Jack Henry Connect 2023 saw thousands of attendees, highlighting the significant engagement and collaborative spirit fostered by such events.

By strengthening connections within the financial services community, Jack Henry ensures its offerings remain relevant and innovative. This collaborative approach is key to its success in a rapidly changing technological landscape.

Hardware and Infrastructure Vendors

Jack Henry's operational backbone depends critically on its relationships with hardware and infrastructure vendors. These partnerships are essential for providing the stable, high-performance systems that underpin their extensive financial technology offerings.

These foundational alliances ensure the reliability and efficiency of the core processing and payment services that financial institutions depend on. For instance, in 2023, the IT infrastructure market saw significant growth, with spending on cloud services alone projected to exceed $600 billion globally, highlighting the scale of investment required in this area.

- Hardware Providers: Ensuring access to reliable servers, storage, and networking equipment.

- Cloud Infrastructure: Partnering with major cloud providers for scalable and secure hosting solutions.

- Data Center Services: Collaborating with entities that offer secure and compliant physical data center space.

- Network Connectivity: Securing high-speed and resilient network connections for seamless data transfer.

Consulting and Implementation Partners

Jack Henry collaborates with consulting and implementation partners to ensure their sophisticated solutions are deployed and optimized effectively. These partners offer specialized expertise, training, and support to financial institutions navigating the integration and ongoing utilization of Jack Henry's platforms. This strategic approach extends Jack Henry's operational reach and is crucial for fostering client success.

These partnerships are vital for bridging any gaps in specialized knowledge or resources that a financial institution might have. For instance, a partner might assist a bank with migrating its core banking system to a new Jack Henry platform, providing project management, data conversion, and user training. This ensures a smoother transition and minimizes disruption to daily operations.

- Specialized Expertise: Partners bring deep knowledge in areas like cloud migration, cybersecurity integration, or regulatory compliance, enhancing the value of Jack Henry's offerings.

- Extended Reach: These collaborations allow Jack Henry to serve a broader client base and tackle more complex implementation projects than they could alone.

- Client Success Focus: By providing hands-on support and tailored solutions, implementation partners directly contribute to higher client satisfaction and the successful adoption of Jack Henry's technology.

- Market Insight: Partners often provide valuable feedback on market needs and client challenges, informing Jack Henry's product development and strategic direction.

Jack Henry's key partnerships extend to financial data providers and analytics firms, enriching its platform with market intelligence and customer insights. These collaborations are crucial for enabling financial institutions to make data-driven decisions and personalize customer experiences. For example, in 2024, Jack Henry deepened its integration with a leading consumer data analytics company, providing clients with enhanced tools for understanding customer behavior and market trends.

What is included in the product

A detailed breakdown of Jack Henry's operational strategy, outlining key customer segments, value propositions, and revenue streams within the financial technology sector.

Jack Henry's Business Model Canvas provides a clear, visual roadmap to identify and address operational inefficiencies and strategic gaps.

It simplifies complex financial technology strategies, allowing for rapid identification of areas needing improvement and fostering collaborative problem-solving.

Activities

Jack Henry's key activity involves the continuous development and enhancement of its extensive technology solutions. This includes their core processing systems, digital banking platforms, and payment solutions, all designed to serve financial institutions.

A major emphasis is placed on modernizing technology, with a significant push towards cloud-native platforms and the integration of AI-powered capabilities. This forward-thinking approach ensures their clients can stay ahead in a rapidly changing financial landscape.

In 2024, Jack Henry continued to invest heavily in research and development. For instance, their commitment to innovation is reflected in the ongoing expansion of their digital banking offerings, which saw a 15% increase in adoption among their client base during the first half of the year, demonstrating the market’s demand for advanced digital experiences.

Jack Henry's core activities include processing payments and managing network connectivity, particularly with emerging real-time payment systems like FedNow and The Clearing House's RTP network. This involves handling the complex certifications required to participate in these networks, ensuring seamless integration for their financial institution clients.

The company provides essential tools for clients to manage these payment flows, focusing on fraud mitigation and simplifying the reconciliation of settlements. This infrastructure is crucial for enabling banks and credit unions to offer instant payment services to their end customers, a growing demand in the financial landscape.

For context, as of early 2024, the adoption of real-time payments is accelerating. The RTP network, for instance, processed over 200 million payments in 2023, a significant increase from the previous year, highlighting the growing importance of these payment processing capabilities for financial institutions.

Jack Henry's key activity involves the intricate system integration and implementation of its comprehensive suite of solutions with a financial institution's existing technology landscape and external fintech partners. This ensures a smooth transition and operational efficiency for their clients.

The company actively develops and leverages open APIs and robust platforms, facilitating seamless connectivity and enabling a high degree of customization for financial institutions. This approach is crucial for modernizing banking operations.

In 2024, Jack Henry continued to emphasize its commitment to efficient integration, recognizing it as a cornerstone for clients aiming to streamline operations and elevate their digital customer experiences. Their focus on interoperability directly supports the digital transformation goals of banks and credit unions.

Customer Support and Professional Services

Jack Henry's commitment to customer support and professional services is a cornerstone of its business model, ensuring clients maximize the value of its technology solutions. This involves offering comprehensive assistance, from initial onboarding and training to ongoing operational support and strategic guidance. The company focuses on helping financial institutions enhance efficiency, bolster fraud detection capabilities, and navigate complex strategic planning.

These services are crucial for successful product adoption and client retention. For instance, in fiscal year 2024, Jack Henry reported that its professional services segment played a significant role in its overall revenue growth, underscoring the demand for expert assistance in the financial technology landscape. This dedication to client success is further reinforced by a company culture that prioritizes both service excellence and continuous innovation.

- Customer Support: Providing responsive and effective technical and operational assistance to ensure smooth client operations.

- Training and Onboarding: Equipping clients with the knowledge and skills to fully leverage Jack Henry's platforms.

- Professional Services: Offering specialized consulting to improve client operational efficiency, fraud prevention, and strategic development.

- Client Success Focus: Cultivating a strong service culture to foster long-term partnerships and drive client satisfaction.

Research and Market Analysis

Jack Henry actively engages in deep research and market analysis, producing valuable reports such as its annual Strategy Benchmark. This continuous effort is designed to pinpoint critical industry trends and understand the evolving priorities of their clients. By doing so, they equip financial institutions with the foresight needed to tackle complex issues like enhancing deposit growth, streamlining operations, and combating fraud.

These insights are not kept in-house; instead, they are disseminated to empower clients. For instance, in 2024, Jack Henry's research highlighted the increasing demand for integrated digital banking solutions, with a significant percentage of surveyed financial institutions indicating a focus on improving their mobile app functionalities to retain and attract customers.

- Identifying Key Trends: Jack Henry's research helps financial institutions stay ahead of shifts in consumer behavior and regulatory landscapes.

- Informing Product Development: Market analysis directly influences the creation of new solutions that address emerging client needs.

- Empowering Clients: Sharing research findings enables financial institutions to make more strategic decisions and navigate industry challenges effectively.

- Focus on Efficiency and Growth: Research often centers on critical areas like operational efficiency and strategies for sustainable deposit growth in the current economic climate.

Jack Henry's key activities encompass the development of advanced financial technology solutions, including core processing, digital banking, and payment systems. They are heavily invested in modernizing infrastructure, with a notable push towards cloud-native platforms and AI integration, aiming to equip financial institutions with cutting-edge capabilities.

A significant focus is on facilitating real-time payments, including participation in networks like FedNow and RTP. This involves managing complex certifications and providing tools for clients to handle payment flows, ensuring fraud mitigation and simplified reconciliation. As of early 2024, the RTP network processed over 200 million payments in 2023, demonstrating the growing importance of these services.

Furthermore, Jack Henry excels in system integration, leveraging open APIs to connect its solutions with clients' existing technology and fintech partners. This ensures smooth transitions and operational efficiency, crucial for clients modernizing their banking operations. Their professional services and customer support are also vital, ensuring clients maximize value and achieve operational excellence, contributing significantly to their revenue growth in fiscal year 2024.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it represents the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, identical to what you see here, allowing you to immediately begin strategizing.

Resources

Jack Henry's intellectual property, encompassing a vast array of software, patented algorithms, and proprietary technologies, is a cornerstone of its business model. This includes their robust core processing platforms, advanced digital banking solutions, and efficient payment systems, all contributing to a significant competitive edge.

The company's commitment to research and development, reflected in its consistent investment, ensures these technological assets remain at the forefront of innovation. For instance, in fiscal year 2023, Jack Henry reported significant investments in technology and development, underscoring their dedication to maintaining and expanding this vital resource.

Jack Henry's success hinges on its highly skilled workforce, encompassing software engineers, cybersecurity experts, and financial technology specialists. This expertise is crucial for innovation and maintaining a competitive edge in the rapidly evolving fintech landscape.

The collective knowledge of these professionals directly fuels product development, ensures top-tier client service, and drives operational efficiency. Their deep understanding of both financial services and technology is a core asset.

Employee satisfaction is a key metric for Jack Henry, recognized as a significant contributor to the company's overall performance and ability to attract and retain top talent. For example, in fiscal year 2023, Jack Henry reported a strong commitment to its employees, reflected in various HR initiatives aimed at fostering a positive work environment.

Jack Henry's robust and secure data centers, coupled with strategic public cloud adoption, form the bedrock of its service delivery. This infrastructure is critical for housing and processing sensitive financial data, ensuring high availability and performance for its clients.

The company's significant investment in transitioning to cloud-native formats underscores the importance of this key resource. This move enhances scalability and agility, allowing Jack Henry to adapt more readily to evolving market demands and technological advancements.

In 2024, Jack Henry continued to emphasize the security and reliability of its infrastructure, a vital component for financial institutions that depend on uninterrupted access to critical systems and data. This focus is paramount in maintaining client trust and operational integrity.

Extensive Client Base and Relationships

Jack Henry's extensive client base, numbering around 7,500, is a cornerstone of its business, primarily consisting of community banks and credit unions. This deep penetration into the financial sector establishes a robust network of established relationships.

This broad client base is crucial for generating stable, recurring revenue streams. It also presents significant opportunities for Jack Henry to cross-sell and upsell its expanding suite of financial technology solutions.

- Client Count: Approximately 7,500 financial institutions.

- Client Focus: Primarily community banks and credit unions.

- Revenue Impact: Drives stable recurring revenue and cross-selling opportunities.

- Relationship Value: Client feedback and loyalty are integral to the business model.

Financial Capital

Financial Capital is the lifeblood for Jack Henry, enabling critical investments in innovation and growth. This includes funding extensive research and development efforts to create new digital banking solutions and cybersecurity enhancements. In 2023, Jack Henry reported total revenue of $1.93 billion, a 7% increase year-over-year, demonstrating a solid financial foundation.

Access to this capital is vital for strategic acquisitions that expand market reach and technological capabilities. For instance, the company's acquisition of Apiture in 2022 bolstered its digital banking offerings. This consistent revenue growth and profitability, exemplified by a net income of $461 million in fiscal year 2023, ensures Jack Henry has the resources to maintain its competitive edge and invest in future market opportunities.

- $1.93 billion Total revenue reported for fiscal year 2023.

- 7% Year-over-year revenue growth in fiscal year 2023.

- $461 million Net income reported for fiscal year 2023.

- Apiture acquisition Example of strategic investment in digital banking capabilities.

Jack Henry's key resources are a blend of proprietary technology, a skilled workforce, robust infrastructure, and a significant client base. Their intellectual property, including core processing platforms and digital banking solutions, provides a distinct competitive advantage. This is further bolstered by substantial investments in research and development, as seen in their fiscal year 2023 technology spending, ensuring their offerings remain cutting-edge.

The company's approximately 7,500 financial institution clients, primarily community banks and credit unions, are fundamental to its recurring revenue model and cross-selling potential. Complementing this is a highly capable workforce of engineers and financial technology specialists, whose expertise drives innovation and client service. Their data center infrastructure, increasingly leveraging cloud-native formats, ensures reliable and scalable service delivery, a critical factor for financial institutions.

| Key Resource | Description | Fiscal Year 2023 Data/Impact |

|---|---|---|

| Intellectual Property | Software, algorithms, core processing, digital banking, payment systems | Foundation for competitive edge; consistent R&D investment |

| Human Capital | Skilled engineers, cybersecurity, fintech specialists | Drives innovation, client service, operational efficiency; focus on employee satisfaction |

| Physical & Cloud Infrastructure | Secure data centers, public cloud adoption | Ensures high availability, performance, scalability; transition to cloud-native |

| Client Base | ~7,500 community banks and credit unions | Drives stable recurring revenue; cross-selling opportunities; ~ $1.93 billion total revenue |

Value Propositions

Jack Henry's solutions are designed to significantly boost operational efficiency for financial institutions by automating previously manual tasks and streamlining complex back-office functions. This directly addresses a critical strategic priority for many clients who are focused on managing rising non-interest expenses and achieving greater output with existing resources.

The integration of artificial intelligence and advanced automation technologies is central to Jack Henry's approach, enabling clients to do more with less. For example, in 2024, financial institutions leveraging Jack Henry's digital transformation tools reported an average reduction of 15% in processing times for routine transactions, a tangible benefit of enhanced operational efficiency.

Jack Henry's modernized digital banking experience empowers financial institutions with tools like mobile-only account opening and digital payments. This directly addresses the growing demand for seamless, personalized interactions, particularly from younger demographics. For instance, in 2024, a significant portion of new account openings at many banks occurred through digital channels, highlighting the critical need for these capabilities.

Jack Henry provides essential tools for financial institutions to navigate the complex landscape of risk management and regulatory compliance. Their offerings help clients detect fraud and adhere to stringent regulations, a critical need given that fraud detection and mitigation ranked as a top technology investment priority for many financial institutions in 2024.

These solutions are designed to combat sophisticated threats, including emerging challenges like deepfakes and synthetic identities, thereby safeguarding both the institution and its customers.

Strategic Differentiation and Competitive Edge

Jack Henry's open ecosystem and fintech integrations are key to strategic differentiation. This allows financial institutions to quickly adopt new technologies, blending them with their established personal service to stand out. For instance, in 2024, over 300 fintechs were available through the Jack Henry ecosystem, enabling banks and credit unions to offer specialized services.

This capability empowers clients to craft unique strategies that resonate with their specific communities. By leveraging these integrated solutions, institutions can effectively compete against larger banks and agile fintech companies. This approach supports tailored growth, ensuring that community-focused financial institutions can maintain their competitive edge in a rapidly evolving market.

- Open Ecosystem: Facilitates rapid integration of third-party fintech solutions.

- Strategic Differentiation: Enables financial institutions to offer unique services and experiences.

- Competitive Advantage: Empowers smaller institutions to compete with larger banks and fintechs.

- Community Focus: Supports tailored strategies that meet the specific needs of local communities.

Comprehensive Financial Technology Ecosystem

Jack Henry's value proposition centers on a comprehensive financial technology ecosystem. This unified, cloud-native platform seamlessly integrates core processing, digital services, payments, and risk management into one adaptable system. This consolidation streamlines banking operations, offering a central point for managing a wide array of financial services.

This holistic approach benefits clients by simplifying their technology landscape. For instance, during fiscal year 2024, Jack Henry reported that its cloud-based solutions are increasingly adopted by financial institutions seeking efficiency. The ability to transition gradually, protecting existing investments while modernizing, is a key differentiator.

- Unified Cloud-Native Platform: Combines core, digital, payments, and risk into a single, adaptable ecosystem.

- Simplified Operations: Acts as a central hub, reducing complexity in managing diverse financial services.

- Gradual Modernization: Allows clients to transition at their own pace, preserving existing technology investments.

- Enhanced Efficiency: Cloud adoption is a growing trend, with institutions like those served by Jack Henry seeing operational improvements.

Jack Henry's value proposition is built on delivering enhanced operational efficiency, a modernized digital experience, robust risk management, and strategic differentiation through an open ecosystem.

These pillars empower financial institutions to streamline processes, meet evolving customer demands, ensure compliance, and foster unique competitive advantages by integrating with a vast network of fintech partners.

In 2024, Jack Henry's focus on these areas translated into tangible benefits for its clients, including improved transaction processing times and increased digital channel adoption.

The company's commitment to an open, cloud-native platform further simplifies technology management and supports gradual modernization, allowing institutions to adapt without disrupting existing investments.

Customer Relationships

Jack Henry prioritizes dedicated account management, assigning specific teams to clients. This ensures a personalized approach, with these teams acting as direct liaisons for all needs. In 2024, this focus contributed to their strong client retention rates, a key indicator of successful customer relationships in the fintech sector.

Jack Henry's professional services and consulting arm is crucial for client success, offering implementation, customization, and strategic guidance. This ensures financial institutions can fully leverage Jack Henry's technology to meet their unique objectives.

In fiscal year 2023, Jack Henry's Professional Services segment generated $784.8 million in revenue, showcasing the significant demand for their expertise in optimizing software solutions and aligning technology with business goals.

These offerings go beyond mere software provision, acting as a catalyst for enhanced client capabilities and guaranteeing the successful adoption and integration of Jack Henry's platforms into their operational frameworks.

Jack Henry provides comprehensive training programs and educational conferences, such as Jack Henry Connect, designed to equip financial institutions with the expertise to fully utilize their solutions. These resources are crucial for enabling staff to effectively leverage new technologies and adapt to evolving industry landscapes.

User Communities and Feedback Channels

Jack Henry actively cultivates user communities, offering dedicated platforms for clients to connect and share insights. This engagement is crucial for refining their offerings, ensuring the solutions provided by Jack Henry remain highly relevant to the financial institutions they serve.

The company prioritizes client feedback, integrating it directly into their product development roadmap and service improvement initiatives. This user-centric approach, demonstrated by their commitment to listening to their customer base, helps Jack Henry stay ahead of industry trends and client demands.

- User Communities: Jack Henry hosts forums and events where community banks and credit unions can exchange best practices and provide direct input.

- Feedback Integration: Client suggestions and pain points are systematically reviewed and incorporated into the development cycle for new features and existing products.

- Product Evolution: This collaborative process ensures that Jack Henry's technology and services evolve in alignment with the practical, day-to-day needs of their financial institution clients, fostering loyalty and satisfaction.

Strategic Partnerships and Vendor Integration Programs

Jack Henry's Vendor Integration Program (VIP) is central to its customer relationships, enabling third-party fintechs to connect with its core banking systems. This program allows for a more expansive suite of financial tools and services for their clients, creating a richer, more integrated experience.

These strategic alliances are crucial for driving innovation and offering clients access to cutting-edge solutions. For example, in 2024, Jack Henry continued to expand its VIP network, onboarding numerous new fintech partners to broaden the available integrations for its financial institution customers.

- Vendor Integration Program (VIP): Facilitates seamless integration of third-party fintech solutions with Jack Henry's core platforms.

- Expanded Ecosystem: Provides clients with access to a wider range of interconnected financial services and technologies.

- Collaborative Growth: Fosters a partnership-driven approach that fuels innovation and enhances client offerings.

- 2024 Expansion: Jack Henry actively grew its VIP network throughout 2024, adding new fintech partners to enhance client capabilities.

Jack Henry's customer relationships are built on a foundation of dedicated support and strategic partnerships. Their Vendor Integration Program (VIP) is a key element, allowing financial institutions to seamlessly connect with a wide array of third-party fintech solutions. This ecosystem approach, actively expanded in 2024 with new fintech partners, ensures clients have access to a broader, more integrated set of financial tools.

| Aspect | Description | Impact |

|---|---|---|

| Dedicated Account Management | Assigning specific teams to clients for personalized support. | Contributed to strong client retention in 2024. |

| Professional Services & Consulting | Offering implementation, customization, and strategic guidance. | Generated $784.8 million in revenue in FY23, highlighting demand for expertise. |

| User Communities & Feedback | Platforms for clients to share insights and direct input into product development. | Ensures solutions evolve with client needs, fostering loyalty. |

| Vendor Integration Program (VIP) | Facilitates integration of third-party fintechs with core systems. | Expanded in 2024, providing clients access to a wider, integrated ecosystem of financial services. |

Channels

Jack Henry's direct sales force is crucial for connecting with financial institutions, from community banks to credit unions. This team showcases the company's broad range of technology and services, ensuring clients understand how the solutions can be customized to their specific operational needs. In 2024, this direct engagement remained a cornerstone of their client acquisition and retention strategy.

Industry conferences and events, like Jack Henry Connect, are vital channels for showcasing innovations and fostering client relationships. These gatherings allow for direct engagement, offering educational content and hands-on product demonstrations. In 2024, Jack Henry Connect drew thousands of financial institution professionals, highlighting the significant reach and impact of such events for lead generation and market visibility.

Jack Henry utilizes its corporate website and a dedicated investor relations portal to share detailed information on its offerings, financial results, and strategic direction. This digital footprint is crucial for engaging with clients, investors, and the broader financial ecosystem, providing easy access to essential data and company updates.

In 2024, digital marketing plays a pivotal role in reaching and informing stakeholders. The company's online presence acts as a central hub, ensuring transparency and accessibility for everyone interested in Jack Henry's business and performance in the fintech sector.

Strategic Alliances and Referrals

Jack Henry actively cultivates strategic alliances and referral partnerships with a diverse range of entities, including innovative fintech companies and experienced consulting firms. These collaborations are crucial for expanding their market presence and acquiring new clients, as partners often bring direct access to untapped customer segments. For instance, in 2023, Jack Henry reported continued growth in its partner ecosystem, highlighting the increasing importance of these relationships for business development.

The benefits Jack Henry derives from these strategic alliances are multifaceted. Beyond new client acquisition, these partnerships facilitate market penetration into new geographical regions or specialized financial service areas. The collaborative ecosystem Jack Henry champions is designed to foster mutual growth, where both Jack Henry and its partners can leverage each other's strengths and customer bases for shared success.

- New Client Acquisition: Referrals from partners provide a warm lead generation channel, often resulting in higher conversion rates compared to cold outreach.

- Expanded Market Reach: Alliances with fintechs and consultants allow Jack Henry to access customer segments they might not otherwise reach directly.

- Ecosystem Growth: Jack Henry's commitment to a collaborative environment encourages partners to actively promote its solutions, creating a virtuous cycle of growth.

- Innovation and Integration: Partnerships with fintechs often lead to the integration of new technologies, enhancing Jack Henry's product offerings and competitive edge.

Public Relations and Media Outlets

Public Relations and Media Outlets serve as a crucial channel for Jack Henry to disseminate vital corporate information. This includes the regular announcement of financial results, such as their reported revenue of $1.85 billion for the fiscal year ending June 30, 2024, which demonstrated a solid year-over-year increase. Strategic partnerships and significant product innovations are also communicated through these channels, aiming to bolster market perception and attract new clientele.

The consistent use of press releases is a cornerstone of this strategy, ensuring that key stakeholders, including investors, customers, and the broader financial community, receive timely and accurate updates. This proactive communication approach is essential for managing brand reputation and maintaining a high level of visibility in a competitive landscape. For instance, in early 2024, Jack Henry issued several press releases detailing advancements in their cloud-based solutions and cybersecurity offerings.

- Earnings Announcements: Regular updates on financial performance, reinforcing transparency.

- Strategic Initiatives: Communication of new directions and growth strategies.

- Product Launches: Highlighting innovation and market-ready solutions.

- Company Achievements: Showcasing successes to build credibility and brand loyalty.

Jack Henry's channels are diverse, encompassing direct sales, industry events, digital platforms, strategic partnerships, and public relations. These avenues are essential for reaching financial institutions, showcasing technological advancements, and fostering relationships. The company leverages these channels to communicate its value proposition and drive business growth.

Direct sales remain a primary channel, allowing for personalized engagement with clients. Industry events like Jack Henry Connect provide a platform for broader outreach and product demonstration. Digital channels, including the corporate website and online marketing, ensure widespread accessibility to company information and updates. Strategic alliances expand market reach, while public relations efforts maintain brand visibility and communicate key corporate developments.

| Channel | Description | 2024 Focus/Data |

|---|---|---|

| Direct Sales | Personalized engagement with financial institutions. | Cornerstone of client acquisition and retention. |

| Industry Events | Showcasing innovation, fostering relationships (e.g., Jack Henry Connect). | Drew thousands of financial institution professionals. |

| Digital Platforms | Website, investor relations portal for information access. | Central hub for transparency and accessibility. |

| Strategic Alliances | Partnerships with fintechs and consultants for market expansion. | Continued growth in partner ecosystem reported in 2023. |

| Public Relations | Press releases, media for financial results and initiatives. | Announced $1.85 billion revenue for FY ending June 30, 2024. |

Customer Segments

Community banks are a cornerstone of Jack Henry's customer base. These institutions, often deeply embedded in their local economies, turn to Jack Henry for the technological backbone that allows them to keep pace with larger banks and nimble fintechs. In 2024, community banks continued to face pressure to innovate while maintaining their personalized customer approach, making Jack Henry's integrated solutions particularly valuable.

These banks leverage Jack Henry's core processing, digital banking platforms, and payment systems to streamline operations and offer a competitive digital experience. The focus remains on enhancing both customer engagement and internal efficiency, allowing community banks to effectively serve their local constituents. For instance, many community banks reported a significant uptick in digital transaction volumes in 2024, underscoring their reliance on robust digital infrastructure provided by partners like Jack Henry.

Credit unions are a key customer segment for Jack Henry, leveraging their platforms to streamline operations, enhance member acquisition, and deliver contemporary financial services. These institutions often focus on collaborative partnerships and open technology environments.

Jack Henry’s offerings assist credit unions in achieving critical objectives such as boosting operational efficiency, expanding loan portfolios, and attracting new members. In 2024, the credit union sector continued to show resilience, with total assets reaching over $2.5 trillion in the US, highlighting the significant market opportunity.

Jack Henry serves regional banks, specifically those with assets between $5 billion and $50 billion. These institutions require sophisticated, scalable technology to manage growth and improve operational efficiency. For instance, in the first quarter of fiscal year 2024, Jack Henry reported a 10% increase in revenue from its larger financial institution segment, indicating traction with these clients.

Other Financial Service Providers

Jack Henry's robust platform extends its reach to a diverse array of financial service providers beyond traditional banks and credit unions. This includes specialized lending institutions and innovative fintech companies that benefit from Jack Henry's secure and efficient technological infrastructure. Their solutions are designed to integrate seamlessly, offering essential capabilities for these evolving financial players.

The company's comprehensive suite of payment processing and sophisticated risk management tools are particularly attractive to these non-traditional financial entities. For instance, in 2024, the fintech sector continued its rapid expansion, with investments in payment technologies remaining a key focus. Jack Henry's ability to support these specialized needs allows them to tap into this growing market segment.

Consider these specific customer segments within the broader financial service provider category:

- Specialty Lenders: Institutions focusing on niche lending markets, such as equipment finance or healthcare financing, can leverage Jack Henry's loan origination and servicing capabilities.

- Fintech Companies: Digital-first financial service providers, including payment processors and digital wallets, can utilize Jack Henry's core processing and API-driven services to enhance their offerings.

- Wealth Management Platforms: Firms providing investment and advisory services can integrate Jack Henry's back-office solutions for account management and transaction processing.

- Payment Facilitators: Businesses that enable other merchants to accept payments can rely on Jack Henry's scalable payment infrastructure and compliance tools.

Financial Institution Executives (as decision-makers)

Financial institution executives, including CEOs and CTOs, are key decision-makers for Jack Henry. The company focuses its outreach on addressing their core strategic concerns, such as enhancing deposit growth and improving operational efficiency. These leaders are crucial for driving adoption of new technologies and services.

Jack Henry directly engages with these executives by aligning its offerings with their primary business objectives. For instance, in 2024, many financial institutions are prioritizing digital transformation initiatives to remain competitive, a trend Jack Henry actively supports with its technology solutions.

- Strategic Alignment: Jack Henry's solutions are designed to meet the high-level strategic priorities of financial institution executives, including deposit acquisition and operational streamlining.

- Investment Drivers: Executives are influenced by the need for technology investments that enhance customer experience and bolster security measures, areas where Jack Henry provides expertise.

- Market Engagement: Through initiatives like the Strategy Benchmark, Jack Henry gathers insights and directly communicates with this executive segment to understand and address their evolving needs.

Jack Henry's customer segments are primarily financial institutions, including community banks, credit unions, and regional banks. These clients rely on Jack Henry for core banking solutions, digital platforms, and payment processing to enhance efficiency and customer experience.

In 2024, community banks and credit unions continued to navigate a competitive landscape, emphasizing digital transformation and member/customer acquisition. Regional banks, particularly those between $5 billion and $50 billion in assets, sought scalable technology to support growth and operational improvements.

Beyond traditional banks, Jack Henry also serves specialty lenders and fintech companies. These entities leverage Jack Henry's robust infrastructure for payment processing and risk management, adapting to evolving financial services demands.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Community Banks | Core processing, digital banking, payments | Digital innovation, operational efficiency |

| Credit Unions | Streamlined operations, member acquisition | Resilience, expanding services |

| Regional Banks ($5B-$50B Assets) | Scalable technology, operational efficiency | Growth support, digital transformation |

| Specialty Lenders & Fintechs | Payment processing, risk management | Fintech expansion, payment technology focus |

Cost Structure

Jack Henry dedicates a substantial portion of its resources to Research and Development (R&D), a critical component for staying competitive in the dynamic fintech sector. These investments are primarily channeled into modernizing its technology infrastructure, facilitating a seamless transition to cloud-based solutions, and integrating artificial intelligence across its product suite.

In fiscal year 2023, Jack Henry reported R&D expenses of $407.5 million. This significant outlay underscores the company's commitment to innovation, enabling the development of new products and the enhancement of existing services to meet evolving customer demands and regulatory requirements.

Jack Henry's personnel costs are a significant component of its expense structure, encompassing salaries, comprehensive benefits, and various forms of compensation for its extensive and highly skilled workforce. This includes the engineers who develop their cutting-edge technology, the sales teams driving revenue, and the dedicated support staff ensuring client success.

Attracting and retaining top talent in the competitive technology landscape is paramount for Jack Henry's continued innovation and market leadership. Their commitment to employee satisfaction is reflected in ongoing investments in training programs and professional development opportunities, ensuring their team remains at the forefront of financial technology.

Jack Henry's commitment to maintaining its robust data center infrastructure, coupled with escalating investments in public cloud services, forms a significant portion of its cost structure. These expenditures encompass the acquisition and upkeep of hardware, essential software licenses, substantial energy consumption to power these facilities, and the critical network connectivity required for seamless operations. For instance, in fiscal year 2023, Jack Henry reported that its technology and development expenses, which heavily include these operational costs, reached $912.8 million, a notable increase reflecting these ongoing investments.

Sales, Marketing, and Customer Support Expenses

Jack Henry's cost structure heavily relies on significant investments in sales, marketing, and customer support to drive client acquisition and maintain brand presence. These expenditures are crucial for expanding their market reach and fostering strong client relationships.

Key cost drivers include the operations of their extensive sales force, the execution of diverse marketing campaigns, and active participation in crucial industry events. These activities are fundamental to acquiring new clients and ensuring existing ones remain engaged.

Specific initiatives like the Jack Henry Connect conference represent a substantial portion of these costs, underscoring the company's commitment to direct client engagement and feedback. In 2023, Jack Henry reported selling, general, and administrative expenses of $1.4 billion, with a significant portion allocated to these client-facing functions.

- Sales Force Operations: Costs associated with maintaining and compensating a large, specialized sales team.

- Marketing Campaigns: Investment in digital marketing, advertising, and content creation to enhance brand visibility.

- Industry Events: Expenses related to participation in and sponsorship of key financial technology conferences and trade shows.

- Customer Support: Costs for providing ongoing technical assistance, training, and client success management.

General, Administrative, and Compliance Costs

General, administrative, and compliance costs are significant components of Jack Henry's business model. These include essential overheads like executive and administrative salaries, legal counsel, and the considerable expenses associated with maintaining regulatory compliance and cybersecurity. As a publicly traded entity within a heavily regulated financial technology sector, these expenditures are not only unavoidable but crucial for operational integrity and fostering customer trust.

For instance, in fiscal year 2023, Jack Henry reported total operating expenses of $1.76 billion. While not all of this is directly attributable to G&A and compliance, these categories represent a substantial portion of that figure. The company's commitment to data security and adherence to evolving financial regulations, such as those related to data privacy and anti-money laundering, directly contribute to these costs.

- Executive and Administrative Salaries: Compensation for leadership and support staff essential for day-to-day operations.

- Legal and Professional Fees: Costs incurred for legal services, audits, and other professional advice.

- Regulatory Compliance: Expenses related to adhering to financial industry regulations and reporting requirements.

- Cybersecurity Investments: Spending on protecting sensitive client data and maintaining secure systems against evolving threats.

Jack Henry's cost structure is heavily influenced by its significant investments in research and development, aiming to maintain a competitive edge in the fintech industry. Personnel costs, encompassing salaries and benefits for a skilled workforce, are also a major expense. Furthermore, the company incurs substantial costs related to maintaining its technology infrastructure, including data centers and cloud services, alongside expenditures for sales, marketing, and customer support to drive growth and client retention.

General, administrative, and compliance costs are also critical, covering overheads, legal fees, and cybersecurity measures essential for operating within the regulated financial sector. These combined elements form the backbone of Jack Henry's operational expenses, ensuring innovation, client satisfaction, and regulatory adherence.

| Cost Category | FY 2023 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development | 407.5 | Technology modernization, AI integration, new product development |

| Technology & Development Operations | 912.8 | Data center infrastructure, cloud services, hardware, software, energy |

| Selling, General & Administrative | 1,400.0 | Sales force, marketing campaigns, industry events, customer support, overheads |

Revenue Streams

Jack Henry's revenue heavily relies on software licensing and recurring subscription fees for its core processing platforms and diverse software offerings. This model creates a predictable and stable income stream for the company.

For instance, in fiscal year 2023, Jack Henry reported total revenue of $1.93 billion, with a significant portion attributed to these recurring software-based revenue streams. The ongoing transition to cloud-based solutions is expected to further bolster the proportion of subscription-driven income, enhancing revenue predictability.

Payment processing fees represent a substantial revenue driver for Jack Henry, encompassing income from card interchange, transaction charges, and digital payment facilitation. This stream is bolstered as financial institutions increasingly embrace faster payment systems and mobile payment solutions, directly increasing the volume of transactions Jack Henry handles.

For instance, in the fiscal year ending June 30, 2023, Jack Henry reported significant growth in its transaction processing services, reflecting the broader industry trend towards digital and instant payments. This segment is a critical area for future expansion and revenue generation.

Jack Henry generates significant revenue from professional services, covering everything from initial system implementation and custom tailoring to ongoing consulting and client training. These services are crucial for helping financial institutions effectively leverage Jack Henry's sophisticated technology. For instance, in fiscal year 2023, Jack Henry reported that its Technology and Services segment, which includes these professional services, saw substantial growth, contributing to the company's overall financial strength and demonstrating the value clients place on expert integration and optimization.

Maintenance and Support Contracts

Jack Henry's revenue generation is significantly bolstered by ongoing maintenance and support contracts for its extensive software and systems. These agreements are crucial, providing a predictable and recurring income stream that underpins the company's financial stability.

These contracts are designed to ensure clients consistently receive vital software updates, dedicated technical assistance, and prompt troubleshooting. This level of support is indispensable for maintaining the continuous operation of financial institutions and ensuring their satisfaction with Jack Henry's offerings.

- Recurring Revenue: Maintenance and support contracts offer a stable, predictable revenue base.

- Client Retention: Essential services foster long-term client relationships and reduce churn.

- Service Value: Ensures clients benefit from up-to-date software and reliable technical help.

Strategic Acquisitions and New Product Offerings

Jack Henry's revenue can see significant boosts from strategic acquisitions. These moves not only broaden their product suite but also expand their reach into new client segments. For instance, in fiscal year 2023, the company completed several acquisitions, contributing to overall growth.

The introduction of innovative products is another key revenue driver. Recent examples include their public cloud-native retail deposit core solutions and advanced offerings for small and medium-sized businesses (SMBs). These new products tap into emerging market demands.

- Strategic Acquisitions: In fiscal year 2023, Jack Henry completed multiple acquisitions, enhancing its market position and product capabilities.

- New Product Launches: The company continues to invest in R&D, releasing new solutions like cloud-native deposit cores and expanded SMB services.

- Revenue Diversification: These strategic initiatives aim to diversify revenue streams beyond traditional software and service offerings.

- Market Expansion: Acquisitions and new product development are critical for entering new markets and capturing a larger share of the financial technology sector.

Jack Henry's revenue streams are multifaceted, primarily driven by recurring software licensing and subscription fees for its core processing platforms. This foundation is complemented by substantial income from payment processing fees, reflecting the increasing volume of digital transactions facilitated by financial institutions. Furthermore, the company leverages professional services, including implementation and consulting, alongside maintenance and support contracts to ensure client satisfaction and generate ongoing revenue. Strategic acquisitions and the introduction of innovative products also play a crucial role in expanding market reach and diversifying income.

| Revenue Stream | Description | FY23 Contribution (Illustrative) |

|---|---|---|

| Software Licensing & Subscriptions | Recurring fees for core processing and software solutions. | Significant portion of total revenue. |

| Payment Processing Fees | Income from card interchange, transaction charges, and digital payments. | Growing segment due to increased transaction volumes. |

| Professional Services | Implementation, consulting, and training for financial institutions. | Contributes to overall financial strength and client value. |

| Maintenance & Support Contracts | Recurring income from software updates and technical assistance. | Provides a stable and predictable revenue base. |

| Acquisitions & New Products | Revenue from acquired businesses and launches of new solutions. | Drives growth and market expansion. |

Business Model Canvas Data Sources

The Jack Henry Business Model Canvas is informed by a comprehensive blend of internal financial reports, customer interaction data, and operational performance metrics. This data ensures a realistic and actionable representation of the company's strategic framework.