ITT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITT Bundle

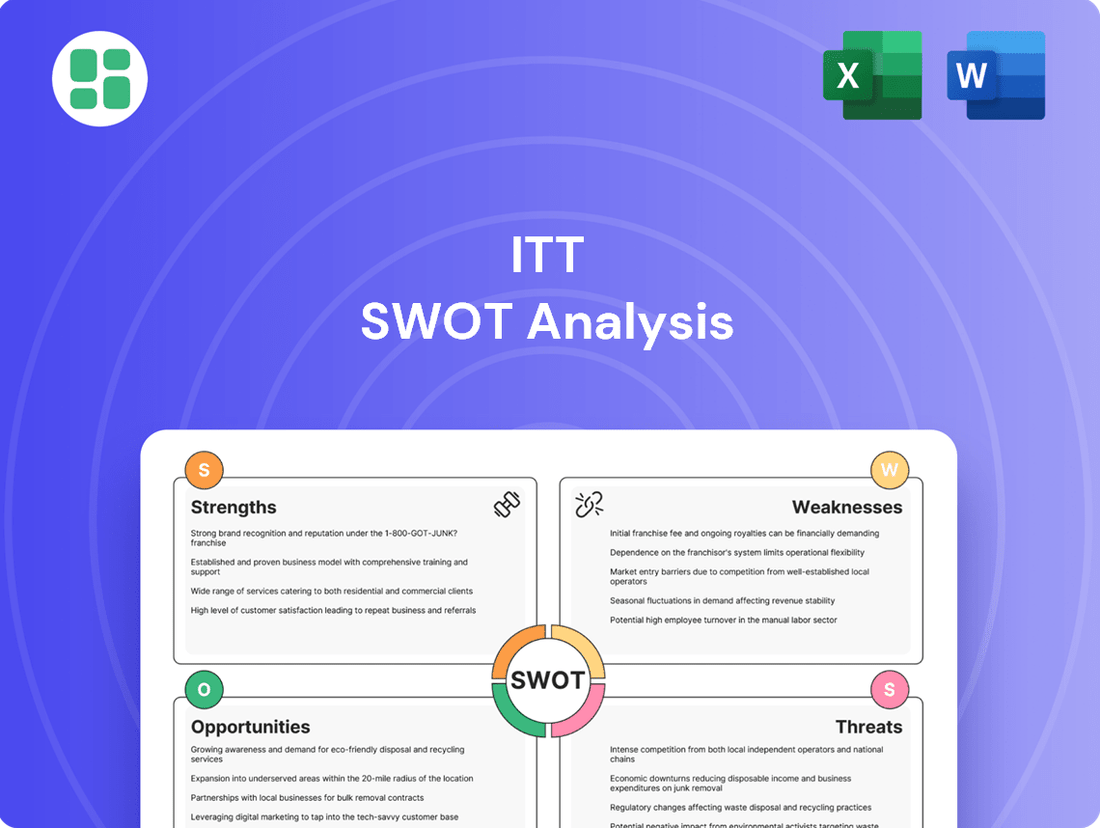

ITT's SWOT analysis reveals a company with significant strengths in its diversified portfolio and established market presence, but also highlights areas for improvement in operational efficiency and adapting to technological shifts. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind ITT's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

ITT Inc.'s strength lies in its diversified global portfolio, spanning Motion Technologies, Industrial Process, and Connect and Control Technologies. This broad operational base serves critical sectors like aerospace, automotive, energy, and general industrial markets, reducing dependence on any single industry. For instance, in the first quarter of 2024, ITT reported revenue growth across multiple segments, underscoring the resilience provided by this diversification.

ITT has showcased impressive financial resilience, with revenues climbing to $3.1 billion in 2023, a notable increase from previous years. This upward trend is expected to continue, with projections for 2025 indicating further revenue and earnings per share growth, bolstered by robust demand across its key segments.

ITT's strength lies in its highly engineered critical components and customized technology solutions, a specialization that carves out a significant competitive advantage in demanding industries. This focus on niche, high-value products fosters strong, long-term customer relationships.

The company's diverse portfolio, encompassing everything from essential automotive brake pads to sophisticated pumps and valves for harsh environments, highlights its technical prowess and broad applicability. For instance, in 2023, ITT's Motion Technologies segment, which includes friction materials like brake pads, generated approximately $1.7 billion in revenue, underscoring the market demand for these specialized components.

Strategic Acquisitions and Innovation Focus

ITT's strategic acquisitions, such as the purchase of Svanehøj for approximately $160 million in early 2024 and kSARIA, have significantly broadened its market reach, particularly in the burgeoning energy and aerospace sectors. These moves bolster ITT's product portfolio with advanced technologies and established customer bases in high-growth areas.

The company's commitment to innovation is evident in its development of next-generation solutions, including energy-saving industrial motor drives. This focus on sustainability and efficiency directly addresses global environmental trends and positions ITT to capitalize on future market demands for greener technologies.

- Market Expansion: Acquisitions like Svanehøj and kSARIA have integrated new technologies and expanded ITT's footprint in key growth industries.

- Innovation Pipeline: Development of energy-saving industrial motor drives demonstrates a forward-looking approach to sustainable solutions.

- Synergistic Growth: Strategic acquisitions are designed to create synergies, enhancing ITT's overall competitive positioning and revenue potential.

Strong Global Presence and Operational Footprint

ITT's extensive global presence is a significant strength, with operations spanning over 35 countries and sales reaching approximately 125 nations. This wide geographical reach enables ITT to capitalize on diverse market demands and regional growth trends, fostering a robust international customer base.

Strategically positioned manufacturing facilities and service centers across five continents underscore ITT's commitment to operational efficiency and customer proximity. This global network is crucial for adapting to local market needs and ensuring timely support, enhancing its competitive advantage in key international sectors.

- Global Operations: ITT operates in over 35 countries.

- Sales Reach: ITT sells products in approximately 125 countries.

- Manufacturing & Service: Facilities are located across five continents.

ITT's diversified business model, with segments like Motion Technologies, Industrial Process, and Connect and Control Technologies, provides significant resilience. This allows the company to weather downturns in specific sectors, as evidenced by its consistent revenue generation across different markets. The company's focus on highly engineered, critical components for demanding applications further solidifies its market position.

Financially, ITT demonstrated strength with revenues reaching $3.1 billion in 2023, and projections for 2025 indicate continued growth. This financial health is supported by strategic acquisitions, such as Svanehøj in early 2024, which enhance its product offerings and market reach in high-growth areas like energy. The company's commitment to innovation, including energy-saving motor drives, positions it well for future market trends.

| Segment | 2023 Revenue (Approx.) | Key Markets |

|---|---|---|

| Motion Technologies | $1.7 billion | Automotive, Aerospace |

| Industrial Process | N/A | Energy, Chemical, Food & Beverage |

| Connect and Control Technologies | N/A | Aerospace, Defense, Medical |

What is included in the product

Analyzes ITT’s competitive position through key internal and external factors, highlighting strengths, weaknesses, opportunities, and threats.

Simplifies complex ITT challenges by presenting actionable insights in a clear, structured format.

Weaknesses

While ITT has diversified its operations, several of its core segments cater to industries like automotive, energy, and general industrial sectors. These markets are inherently cyclical, meaning they can experience significant swings in demand based on broader economic conditions. For instance, a global economic slowdown, which was a concern in early 2024 due to persistent inflation and geopolitical tensions, could directly dampen demand for ITT's products in these areas.

This susceptibility to economic cycles poses a risk to ITT's revenue and profitability. A notable slowdown in the automotive sector, for example, which saw production challenges in 2023 and continued supply chain adjustments into 2024, could directly impact ITT's Motion Technologies segment. Similarly, fluctuations in energy prices and investment cycles can affect the performance of its Industrial Process segment.

Consequently, ITT must maintain a vigilant watch on macroeconomic indicators and global industry trends. Understanding potential downturns in its key end markets, such as the projected moderation in industrial production growth in some regions during 2024, is crucial for proactive risk management and strategic planning to mitigate the impact of cyclical demand shifts.

ITT's reliance on global supply chains, particularly for specialized components in its aerospace, defense, and industrial segments, presents a significant weakness. Disruptions, such as those seen in 2021 and 2022 impacting semiconductor availability, can delay production and impact revenue. For instance, the global supply chain crunch in 2022 led to extended lead times for many industrial goods, a challenge ITT likely navigated.

Furthermore, the company's exposure to raw material price fluctuations, like those for specialty metals and engineered plastics crucial for its manufacturing processes, can erode profitability. The volatility in commodity markets throughout 2023, driven by geopolitical events and inflation, underscores this vulnerability. Managing these risks requires robust supplier diversification and hedging strategies.

While ITT's acquisition strategy can drive growth, integrating acquired businesses presents significant challenges. These include merging disparate operational systems, aligning company cultures, and harmonizing technological platforms, all of which can disrupt day-to-day operations and dilute management focus.

Recent financial reports highlight these complexities, noting that temporary amortization from mergers and acquisitions, alongside foreign currency fluctuations, have acted as minor headwinds. For instance, ITT's 2023 annual report indicated that M&A integration costs and currency impacts contributed to a slight drag on earnings, underscoring the financial implications of these strategic moves.

Intense Competition in Segmented Markets

ITT faces significant headwinds from intense competition within its key industrial segments. Established giants like Xylem, IDEX, and Flowserve are formidable rivals, often possessing greater scale and brand recognition. This dynamic puts considerable pressure on ITT's pricing power and market share, necessitating substantial and ongoing investment in research and development to stay ahead.

The need for continuous innovation and operational efficiency is paramount to counter these competitive pressures. ITT must constantly refine its manufacturing processes and product offerings to maintain its edge. For instance, in the fluid technology sector, where ITT is a major player, the market is characterized by rapid technological advancements and a constant demand for more efficient and sustainable solutions.

Differentiation through specialized solutions is ITT's primary strategy to navigate this competitive landscape. By focusing on niche applications and developing highly engineered products tailored to specific customer needs, ITT aims to carve out profitable market segments. This approach allows them to command premium pricing and build strong customer loyalty, even against larger, more diversified competitors.

- Established Competitors: ITT competes directly with major players such as Xylem, IDEX, and Flowserve across its industrial sectors.

- Pricing and Market Share Pressure: Intense rivalry can lead to reduced pricing flexibility and challenges in expanding market share.

- Innovation Investment: Maintaining a competitive edge requires continuous investment in R&D to develop new technologies and improve existing products.

- Operational Efficiency: Streamlining operations and enhancing manufacturing capabilities are crucial for cost competitiveness.

Regulatory and Environmental Compliance Burdens

ITT faces significant challenges due to the complex and ever-changing regulatory environment it navigates as a global manufacturer. Compliance with environmental, health, and safety standards across multiple countries demands substantial investment in resources and can directly influence operational efficiency and overall costs.

The company must also contend with the inherent risks tied to environmental liabilities and the ongoing need to adapt to evolving climate change regulations. For instance, in 2023, ITT reported $20 million in environmental remediation expenses, highlighting the financial impact of these compliance demands.

- Global Regulatory Complexity: ITT operates in numerous jurisdictions, each with its own set of environmental and safety regulations.

- Resource Allocation: Meeting these diverse compliance requirements necessitates significant financial and human resources, potentially diverting from core business growth.

- Environmental Liabilities: Past and present operations carry potential environmental risks, leading to ongoing costs for remediation and legal compliance.

- Climate Change Adaptation: Evolving climate standards require continuous investment in sustainable practices and technology upgrades to maintain compliance and mitigate future risks.

ITT's exposure to cyclical end markets, particularly automotive and general industrial, presents a significant weakness. Economic downturns, like the projected moderation in industrial production growth seen in some regions during 2024, can directly impact demand for its products. For example, a slowdown in the automotive sector, which faced production adjustments into early 2024, could particularly affect ITT's Motion Technologies segment.

The company's reliance on global supply chains and susceptibility to raw material price volatility also pose challenges. Disruptions, similar to the semiconductor shortages experienced in 2021-2022, can delay production. Furthermore, fluctuations in commodity prices, such as those for specialty metals experienced throughout 2023, can impact profitability. ITT reported $20 million in environmental remediation expenses in 2023, underscoring ongoing compliance costs.

Intense competition from established players like Xylem and IDEX puts pressure on ITT's pricing power and market share. Maintaining a competitive edge necessitates continuous investment in R&D and operational efficiency to develop new technologies and improve product offerings, especially in dynamic sectors like fluid technology.

Integrating acquired businesses presents operational and cultural challenges, potentially disrupting day-to-day activities. ITT's 2023 annual report noted that M&A integration costs and foreign currency fluctuations acted as minor headwinds, impacting earnings.

Same Document Delivered

ITT SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing an actual excerpt from the complete ITT SWOT analysis. Purchase unlocks the entire in-depth version, providing comprehensive insights.

Opportunities

The increasing global appetite for sustainable solutions presents a significant opportunity for ITT to broaden its offerings in eco-friendly technologies. This aligns with growing investor interest in ESG (Environmental, Social, and Governance) factors, with sustainable investment funds reaching an estimated $3.7 trillion globally by the end of 2024, according to Morningstar data.

ITT's ongoing development of innovative products designed to help customers lower emissions, coupled with its internal investments in reducing its own carbon footprint, positions the company favorably within key decarbonization trends. For instance, the company's focus on water management technologies directly addresses a critical environmental challenge, a sector projected to see significant growth in the coming years.

Global infrastructure development and industrial modernization initiatives are creating a fertile ground for ITT's core businesses. These trends are directly fueling demand for the company's robust portfolio of pumps, valves, and connectors, essential components for critical projects in sectors like energy and water management.

Specifically, ITT's Industrial Process segment is well-positioned to capitalize on this surge. For instance, in the first quarter of 2024, the company reported a significant increase in its order backlog for industrial pumps, signaling strong customer commitment and future revenue potential driven by these infrastructure investments.

The aerospace and defense industries are experiencing robust demand, driven by significant new projects and ongoing modernization efforts. This sustained growth presents a substantial opportunity for ITT.

ITT's Connect & Control Technologies segment is strategically positioned to benefit from this trend, as it supplies essential components and connectors critical to these demanding applications. For instance, in 2023, this segment saw continued strong performance, with revenue growth reflecting the increasing needs of these key markets.

Recent contract wins and consistent organic expansion within ITT's Connect & Control Technologies further underscore its capacity to leverage the expanding aerospace and defense sectors, translating into tangible revenue streams and market share gains.

Strategic Mergers and Acquisitions (M&A)

ITT's strategic focus on mergers and acquisitions presents a significant opportunity for growth. By actively seeking out and integrating complementary businesses, ITT can expand its market reach and enhance its product portfolio. This approach is designed to drive future revenue and earnings per share growth.

The company's commitment to deploying capital for strategic acquisitions allows it to acquire new technologies and enter untapped markets. This M&A strategy is crucial for consolidating ITT's market position and fostering innovation. For example, in 2023, ITT completed several acquisitions, including the significant purchase of a leading advanced materials company, which is projected to add approximately $150 million in annual revenue.

- Market Expansion: Acquisitions enable ITT to enter new geographic regions and customer segments, diversifying revenue streams.

- Technology Acquisition: Gaining access to cutting-edge technologies through M&A enhances ITT's competitive edge and product development capabilities.

- Synergistic Growth: Strategic integration of acquired companies can lead to cost savings and operational efficiencies, boosting profitability.

- EPS Accretion: The company targets acquisitions that are expected to be accretive to earnings per share, directly benefiting shareholders.

Technological Advancements and Digital Transformation

Technological advancements offer significant opportunities for ITT. Embracing smart motors, automation, and digital transformation can streamline operations and elevate product capabilities. For instance, the VIDAR smart motor initiative is designed to boost efficiency and cut energy usage, paving the way for new revenue and improved profitability.

ITT can capitalize on these trends to create more competitive and sustainable solutions.

- Smart Motor Innovation: The VIDAR smart motor project exemplifies ITT's commitment to developing energy-efficient and intelligent motor solutions, a key area of growth in the industrial sector.

- Digital Transformation: Implementing digital tools and automation across ITT's value chain can lead to enhanced productivity and reduced operational costs, as seen in other industrial players who have adopted similar strategies.

- New Revenue Streams: By integrating advanced technologies into its product portfolio, ITT can tap into emerging markets and generate additional income, potentially expanding its market share.

ITT is well-positioned to benefit from the global push towards sustainable solutions, with growing investor interest in ESG factors. The company's focus on eco-friendly technologies and emission-reducing products, like those in water management, aligns with a market projected for significant expansion. This strategic alignment is further bolstered by ITT's internal efforts to reduce its own carbon footprint.

Infrastructure development and industrial modernization worldwide are driving demand for ITT's core products, such as pumps and valves. The company's Industrial Process segment, in particular, saw a strong increase in its order backlog for industrial pumps in Q1 2024, reflecting this robust demand. This trend indicates significant future revenue potential stemming from these critical global projects.

The aerospace and defense sectors are experiencing a resurgence, creating substantial opportunities for ITT. Its Connect & Control Technologies segment, which supplies essential components for these industries, demonstrated continued strong performance in 2023. Recent contract wins and organic expansion within this segment further highlight ITT's ability to capitalize on these growing markets.

ITT's strategic approach to mergers and acquisitions presents a clear path for growth, allowing it to expand market reach and enhance its product offerings. The company's acquisition of a leading advanced materials company in 2023, projected to add $150 million in annual revenue, exemplifies this strategy's potential for driving revenue and EPS growth. Technological advancements, such as the VIDAR smart motor initiative, also offer opportunities for innovation and new revenue streams.

Threats

Global economic uncertainties, including potential recessions and persistent inflation, present a significant threat to ITT. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.8% in 2024, down from 3.0% in 2023, indicating a challenging macroeconomic environment. Geopolitical tensions, such as ongoing conflicts and trade disputes, further exacerbate these risks, potentially disrupting supply chains and dampening demand for ITT's industrial and automation solutions in key markets.

Geopolitical instability and shifting trade policies, such as tariffs, pose significant threats by disrupting supply chains, inflating operational expenses, and erecting barriers to market entry. For instance, the ongoing trade tensions between major economies in 2024 and 2025 continue to create uncertainty around the cost and availability of key components for ITT's manufacturing processes.

These evolving trade dynamics necessitate continuous adaptation of ITT's operational and commercial strategies to mitigate potential impacts. The International Monetary Fund (IMF) projected in late 2024 that global trade growth would remain subdued, partly due to these persistent geopolitical risks, directly affecting companies like ITT that rely on international sourcing and sales.

ITT faces a significant threat from disruptive technologies and the rapid innovation cycles of its competitors. While ITT itself is an innovator, the sheer speed at which new technologies emerge, particularly in areas like AI-driven automation and advanced materials, could quickly render its current offerings less competitive. For instance, a competitor might introduce a 3D-printed component that drastically reduces manufacturing costs, impacting ITT's pricing power.

The company must maintain a keen focus on staying ahead of these technological curves. Failure to adapt swiftly could lead to a gradual erosion of market share, as customers gravitate towards more advanced or cost-effective solutions. In 2024, the global technology sector saw R&D spending increase by an estimated 8% year-over-year, highlighting the intense innovation pressure ITT is under to keep pace.

Fluctuations in Foreign Currency Exchange Rates

As a global player, ITT faces risks from shifting currency values. These fluctuations can impact how their international sales and operational results translate back into their primary reporting currency, potentially making earnings appear more or less volatile than they truly are. For instance, if the US dollar strengthens significantly against other currencies where ITT operates, it could reduce the reported value of foreign earnings.

These currency swings directly influence ITT's reported revenues, the cost of goods sold, and ultimately, their net profitability. This inherent volatility can create unpredictability in financial performance, making it harder for investors and management to forecast outcomes accurately. In the first quarter of 2024, ITT reported that foreign currency headwinds impacted their revenue by approximately $15 million.

The company actively manages these risks through various hedging strategies, but these measures are not always perfectly effective. The ongoing exposure means that even with hedging, significant currency movements can still present a challenge to maintaining stable financial results.

- Revenue Impact: In Q1 2024, foreign currency movements negatively impacted ITT's reported revenue by an estimated $15 million.

- Profitability Volatility: Fluctuations can lead to unpredictable swings in reported earnings due to currency translation effects on international operations.

- Hedging Challenges: While ITT employs hedging, it does not entirely eliminate the risk of unfavorable currency movements impacting financial results.

Talent Acquisition and Retention Challenges

ITT faces significant hurdles in acquiring and keeping top-tier talent, particularly engineers and technicians crucial for its advanced manufacturing and technology operations. The competitive landscape for these specialized skills means ITT must contend with potentially rising labor costs, impacting its ability to invest in new product development and maintain efficient production.

The scarcity of qualified professionals in the sector directly threatens ITT's innovation pipeline and its capacity to implement strategic growth plans. For instance, reports from the U.S. Bureau of Labor Statistics in late 2024 indicated a persistent shortage in skilled manufacturing trades, with demand outpacing supply for roles like industrial machinery mechanics.

- Talent Shortage Impact: A lack of skilled engineers could slow down the development and deployment of new technologies.

- Increased Labor Costs: Competition for talent may drive up wages, affecting ITT's operational expenses.

- Strategic Execution Risk: Difficulty in retaining key management personnel could hinder the execution of long-term business strategies.

Intensifying competition, particularly from emerging market players and agile innovators, presents a significant threat. These competitors often possess lower overheads and can introduce disruptive products or services at aggressive price points, potentially eroding ITT's market share. For example, in the industrial automation sector, new entrants in 2024 have leveraged advanced software and modular designs to offer compelling alternatives to traditional heavy machinery.

Furthermore, the increasing pace of technological obsolescence requires substantial and continuous investment in research and development to maintain a competitive edge. Failure to innovate rapidly could lead to a decline in demand for ITT's existing product lines. The global semiconductor shortage, which persisted into early 2024, also highlighted supply chain vulnerabilities that competitors with more diversified or localized sourcing could exploit.

Regulatory changes and increasing compliance burdens in various operating regions pose another substantial threat. New environmental standards, data privacy laws, and trade regulations can increase operational costs and complexity, potentially impacting profitability and market access. For instance, stricter emissions standards introduced in key European markets in 2024 necessitate costly upgrades to manufacturing processes.

| Threat Category | Specific Example/Impact | Data Point (2024/2025 Projection) |

|---|---|---|

| Intensifying Competition | Emerging market players offering lower-cost alternatives | Industrial automation sector saw new entrants in 2024 with advanced software and modular designs. |

| Technological Obsolescence | Need for continuous R&D investment; supply chain disruptions | Global semiconductor shortage persisted into early 2024, impacting production. |

| Regulatory Changes | Stricter environmental and data privacy laws | Key European markets introduced stricter emissions standards in 2024, requiring costly upgrades. |

SWOT Analysis Data Sources

This ITT SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and validated industry research to ensure a thorough and accurate assessment.