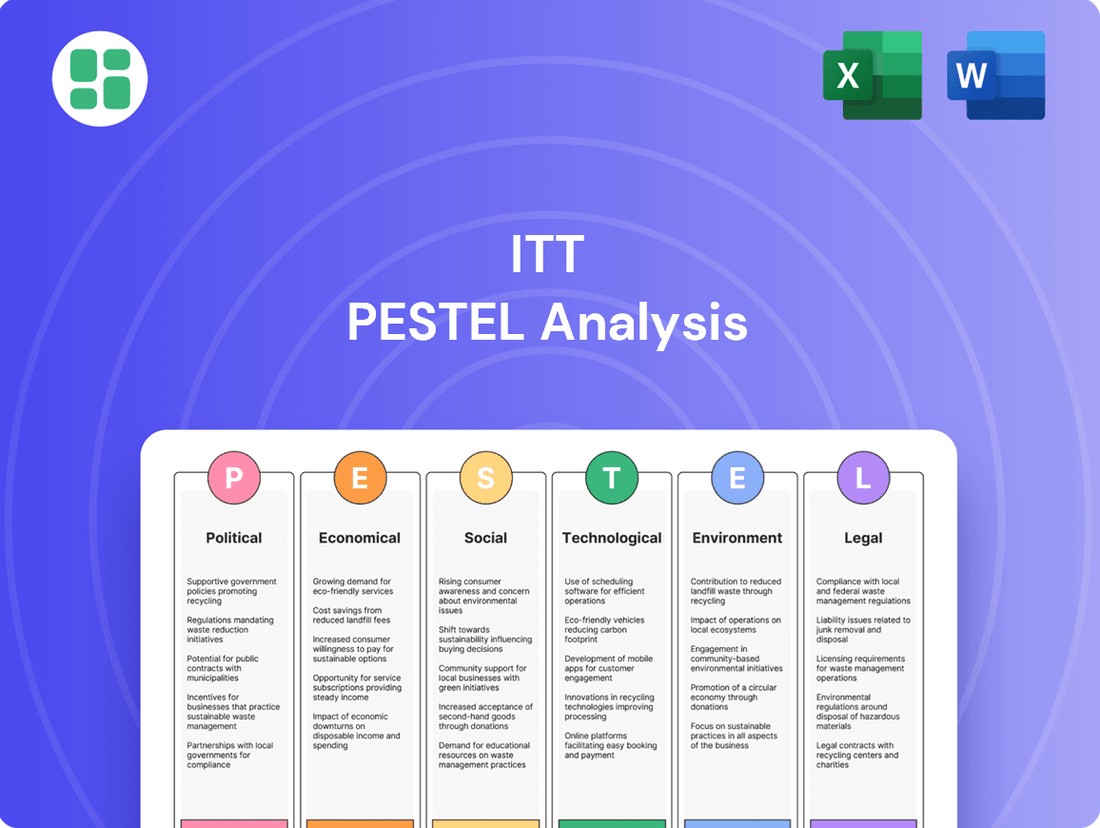

ITT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITT Bundle

Navigate the complex external forces shaping ITT's landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that will impact its future success. Gain a critical advantage by downloading the full report and arming yourself with actionable intelligence for strategic decision-making.

Political factors

Government policies and trade relations are critical for ITT Inc., a global manufacturer. For instance, the U.S. imposition of Section 301 tariffs on Chinese imports and duties on steel and aluminum directly impact ITT's operational costs and the accessibility of its markets. These trade dynamics, coupled with geopolitical stability, necessitate careful navigation of international trade policies.

ITT's extensive global footprint across North America, Europe, and Asia means the company must contend with a variety of regulatory landscapes and potential trade obstacles. For example, as of early 2024, ongoing trade tensions between major economies continue to create uncertainty for manufacturers relying on global supply chains, affecting everything from raw material sourcing to finished product distribution.

Government spending in aerospace and defense is a significant driver for ITT's Connect and Control Technologies segment, as this division supplies essential connectivity solutions for defense platforms. For instance, ITT's involvement in programs like the F-35 fighter jet, a cornerstone of U.S. and allied air power, directly translates into substantial orders and sustained revenue streams.

The defense budget for fiscal year 2024, for example, saw an increase, with the U.S. Department of Defense requesting over $886 billion, highlighting continued investment in national security. This robust spending environment generally benefits ITT, but shifts in geopolitical priorities or budget constraints can introduce volatility, impacting future contract awards and the company's order backlog.

Global and national infrastructure investment policies significantly impact ITT's Industrial Process segment. For instance, the US Bipartisan Infrastructure Law, enacted in 2021, allocates over $1.2 trillion towards upgrading roads, bridges, public transit, water pipes, broadband, and the electric grid. This creates substantial demand for ITT's specialized pumps and valves used in water management and energy transmission.

Government initiatives focusing on green energy projects are also a key driver. In 2024, many nations are accelerating investments in renewable energy infrastructure, including solar, wind, and hydrogen production. These expansions require robust fluid handling solutions, directly benefiting ITT's offerings in plant optimization and critical component supply.

Furthermore, general industrial sector upgrades, often spurred by government incentives for modernization and efficiency, play a vital role. As of early 2025, many countries are implementing policies to enhance manufacturing capabilities and reduce emissions, leading to increased demand for ITT's advanced pumping and control systems in chemical and energy processing plants.

Environmental Regulations and Incentives

Political commitments to environmental protection are increasingly shaping industrial strategies. For ITT, this translates into adapting operations and product development to meet evolving sustainability mandates, such as stricter carbon emission limits. These regulations directly influence manufacturing processes and foster demand for ITT's green technologies.

Global initiatives like the EU's Carbon Border Adjustment Mechanism (CBAM) and the U.S. Inflation Reduction Act (IRA) are significant drivers. The IRA, for example, allocates substantial funding, with over $370 billion earmarked for climate and energy security, directly impacting sectors like renewable energy and electric vehicles, which ITT serves. These policies create both compliance challenges and market opportunities for companies offering emissions-reducing solutions.

- EU's CBAM: Aims to put a carbon price on imports of certain goods, encouraging greener production globally.

- U.S. IRA: Provides significant tax credits and incentives for clean energy and electric vehicle adoption.

- ITT's Response: Focus on developing and marketing products that aid in emissions reduction and energy efficiency.

- Market Impact: Increased demand for ITT's solutions in sectors transitioning towards lower carbon footprints.

Regulatory Stability and Business Environment

ITT's global operations are significantly influenced by the political and regulatory landscapes of the 39 countries it serves. A stable and predictable regulatory environment is crucial for ITT's investment decisions and long-term strategic planning, fostering confidence for continued operations and potential expansion. For instance, a country with clear data privacy laws and consistent tax policies offers a more attractive environment for ITT's technology-driven business compared to one with frequent, unpredictable legislative shifts.

Political uncertainty or abrupt changes in government policy can introduce substantial risks, potentially impacting ITT's supply chains, market access, and overall profitability. For example, a sudden imposition of tariffs or trade restrictions in a key market could disrupt ITT's established business models. The company's success hinges on its adeptness at navigating these diverse and often complex political and regulatory challenges across its international footprint.

- Regulatory Stability: Countries with established and consistent regulatory frameworks, such as those in Western Europe and North America, generally offer a more predictable operating environment for ITT.

- Political Risk: Emerging markets or regions experiencing political instability may present higher risks due to potential policy reversals or civil unrest, impacting ITT's asset security and market continuity.

- Foreign Direct Investment (FDI) Policies: ITT's ability to invest and repatriate profits is directly tied to a country's FDI policies, with favorable policies encouraging greater capital allocation.

- Compliance Costs: Varying compliance requirements across different jurisdictions can add significant operational costs for ITT, necessitating robust legal and compliance teams.

Government stability and policy continuity are paramount for ITT's global operations. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, continues to drive demand for ITT's solutions in water and energy infrastructure through 2025. Conversely, political instability in key markets can disrupt supply chains and market access, as seen with ongoing trade tensions impacting global manufacturing.

Geopolitical shifts directly influence defense spending, a key revenue driver for ITT's Connect and Control Technologies. The U.S. defense budget for fiscal year 2024, exceeding $886 billion, underscores continued investment, benefiting ITT's involvement in platforms like the F-35. However, changes in international relations can alter defense priorities and procurement, creating market volatility.

Environmental policies, such as the U.S. Inflation Reduction Act (IRA) with its over $370 billion for climate and energy security, are creating significant opportunities for ITT's green technologies and emissions-reducing solutions through 2025. This regulatory push encourages demand for ITT's products in renewable energy and efficiency-focused industrial applications.

ITT's strategic planning is heavily influenced by national and international regulatory frameworks. For example, the EU's Carbon Border Adjustment Mechanism (CBAM) is prompting industries to adopt greener practices, a trend ITT is addressing by enhancing its eco-friendly product lines. Navigating these diverse compliance requirements across its 39 operating countries remains a critical focus for ITT's business development.

What is included in the product

This ITT PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable summary of external factors, simplifying complex ITT analysis and alleviating the stress of information overload during strategic planning.

Economic factors

ITT's business is intrinsically linked to the health of the global economy and the output of various industrial sectors. As of early 2024, while the U.S. economy has demonstrated resilience, persistent higher interest rates and inflation are creating headwinds that could temper manufacturing expansion.

Signs of a potential slowdown are emerging, with some purchasing managers' index (PMI) data in late 2023 and early 2024 indicating softening demand for manufactured goods. For instance, the ISM Manufacturing PMI hovered around 47.1 in January 2024, below the 50 mark that typically signifies contraction, suggesting that manufacturers might need to adjust production levels.

This potential reduction in manufacturing activity directly impacts ITT's order volumes for its specialized components, as companies across sectors like aerospace, automotive, and general industrial equipment may scale back their own production and investment.

Inflationary pressures continue to impact manufacturers, with input material costs showing only some stabilization. For instance, the Producer Price Index (PPI) for manufactured goods saw a 2.2% increase year-over-year as of April 2024, reflecting persistent cost pressures.

Rising total compensation, encompassing both wages and benefits, further compounds operational expenses for companies like ITT. In Q1 2024, average hourly earnings for production and non-supervisory employees in the manufacturing sector increased by 4.5% compared to the previous year, contributing to higher labor costs.

ITT must therefore focus on strategies such as productivity enhancements and strategic pricing adjustments to effectively navigate these escalating costs and preserve its robust operating margins. Successfully managing these economic headwinds will be crucial for maintaining profitability in the current environment.

Higher interest rates, as seen in the recent past, can indeed pose challenges for businesses like ITT. For instance, if the Federal Reserve maintained a target range for the federal funds rate around 5.25%-5.50% through much of 2024, this elevated cost of borrowing makes it more expensive for ITT to finance new projects or for its customers to purchase its products, potentially slowing down near-term growth.

Looking ahead to 2025, a shift towards potentially lower interest rates could significantly alter the investment landscape. If, for example, inflation moderates and the Fed begins to ease monetary policy, bringing rates down, this would reduce ITT's cost of capital. This could stimulate investment in capital-intensive sectors where ITT operates, such as advanced manufacturing and infrastructure, as borrowing becomes more affordable for both the company and its clients.

Currency Exchange Rates

Currency exchange rates significantly influence ITT's financial performance, given its extensive global reach across approximately 125 countries. Fluctuations can directly affect the reported value of international sales and the cost of imported components, impacting both revenue and profitability.

In 2023, ITT reported that unfavorable foreign currency movements acted as a headwind, necessitating proactive management. The company actively employs strategies to mitigate these impacts, focusing on robust operational execution and strategic pricing adjustments to maintain financial stability amidst currency volatility.

- Global Exposure: ITT's operations span numerous countries, making it susceptible to diverse currency movements.

- Impact on Profitability: Adverse exchange rate shifts can erode the value of foreign earnings when translated back to the reporting currency.

- Mitigation Strategies: The company utilizes operational efficiency and pricing power to counter negative currency impacts.

- 2023 Headwinds: Unfavorable currency effects were explicitly cited as a challenge impacting financial results in the most recent reporting year.

Supply Chain Stability and Costs

Ongoing global supply chain disruptions, fueled by geopolitical tensions and labor shortages, continue to impact manufacturers. These issues translate into higher operational costs and potential delays for companies like ITT. For instance, in early 2024, the Red Sea shipping disruptions alone added significant costs for rerouting vessels, impacting transit times and freight rates across various industries.

ITT, therefore, faces the challenge of increased expenses for expedited shipping and raw materials. This necessitates proactive strategies such as diversifying sourcing to mitigate risks and implementing robust supply chain management systems to ensure resilience and cost-effectiveness. The ability to adapt sourcing strategies will be crucial for maintaining competitive pricing and delivery schedules.

- Increased Freight Costs: Container shipping rates saw significant spikes in early 2024 due to rerouting around the Suez Canal, with some routes experiencing increases of over 100%.

- Material Scarcity: Shortages in key components, like semiconductors, continued to affect production schedules for many technology-reliant manufacturers throughout 2024.

- Labor Shortages: Persistent labor shortages in logistics and manufacturing sectors in 2024 contributed to production bottlenecks and increased wage pressures.

Economic factors present a mixed outlook for ITT. While U.S. economic resilience offers some support, persistent inflation and elevated interest rates, with the federal funds rate range potentially remaining at 5.25%-5.50% through much of 2024, create headwinds for manufacturing expansion and increase borrowing costs for ITT and its customers. Signs of softening demand, as indicated by ISM Manufacturing PMI figures hovering below 50 in early 2024, suggest potential adjustments in production levels across ITT's key markets.

Inflationary pressures continue to impact input costs, with the Producer Price Index for manufactured goods showing a 2.2% year-over-year increase as of April 2024. Rising labor costs, evidenced by a 4.5% increase in average hourly earnings for manufacturing production workers in Q1 2024, further compound operational expenses. Successfully navigating these economic challenges will require ITT to focus on productivity enhancements and strategic pricing.

Currency fluctuations remain a significant factor due to ITT's global presence. Unfavorable currency movements were cited as a headwind in 2023, impacting the reported value of international sales and component costs. The company's proactive management of these risks through operational execution and pricing adjustments is crucial for maintaining financial stability amidst global economic volatility.

Supply chain disruptions, including increased freight costs from rerouting around the Red Sea (with some routes seeing over 100% cost increases in early 2024) and ongoing material scarcity, continue to elevate operational expenses and introduce potential delays for ITT. Diversifying sourcing and implementing robust supply chain management are essential for resilience and cost-effectiveness.

Full Version Awaits

ITT PESTLE Analysis

The preview shown here is the exact ITT PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real snapshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ITT.

The content and structure shown in the preview is the same ITT PESTLE Analysis document you’ll download after payment, offering a complete strategic overview.

Sociological factors

The manufacturing sector, which includes ITT's operations, is grappling with a persistent shortage of skilled workers. This is largely due to an aging workforce and a noticeable decline in participation in vocational training programs. This demographic shift is creating a significant gap in the availability of experienced talent.

Looking ahead, projections suggest a substantial shortfall of manufacturing workers in the coming years. This scarcity could translate into higher labor costs and potential disruptions to production schedules for companies like ITT, which relies on a skilled workforce to maintain its operations.

ITT, with its global workforce of approximately 11,700 employees, must proactively address these talent acquisition and retention challenges. Strategies such as offering competitive compensation packages, creating clear pathways for career advancement, and investing in robust training and development programs will be crucial for mitigating the impact of the skilled labor shortage.

Consumers are increasingly prioritizing sustainability, driving demand for eco-friendly products and influencing how companies like ITT develop their offerings. This shift is evident in ITT's growing revenue from electric and emissions-reducing products, which reached about 15% of its total revenue in 2023, demonstrating a clear market response.

The heightened consumer interest in solutions like brake pads for electric and hybrid vehicles, alongside green pump projects, underscores a broader societal movement towards environmentally responsible choices. This trend presents both opportunities and challenges for ITT as it navigates evolving market expectations.

Societal expectations for corporations to act responsibly and ethically are growing, directly impacting ITT's reputation and how it interacts with everyone involved with the company. This means ITT needs to show it cares about more than just profits.

ITT's 2024 Sustainability Report highlights advancements in environmental and social goals, such as building a more inclusive workforce and expanding charitable contributions. For instance, the company reported a 15% increase in volunteer hours from its employees in 2024 compared to the previous year.

Strong performance in Environmental, Social, and Governance (ESG) areas significantly boosts ITT's ability to withstand challenges and makes it more attractive to potential employees, customers, and investors alike. Companies with robust ESG frameworks are increasingly seen as more stable and forward-thinking investments.

Health and Safety Standards in the Workplace

Societal expectations increasingly demand robust health and safety measures in the workplace, pushing companies like ITT to prioritize stringent protocols and ongoing safety improvements. This societal emphasis directly influences operational strategies and investment in safety infrastructure.

ITT’s dedication to a safe working environment is quantifiable, with 63% of its global sites achieving zero recordable safety incidents in recent reporting periods. The company actively utilizes a company-wide accident reporting and tracking tool, demonstrating a commitment to proactively identifying and mitigating potential risks across its operations.

- Societal Pressure: Growing public and employee awareness of workplace hazards necessitates proactive safety management.

- ITT's Performance: 63% of ITT's global sites reported zero recordable safety incidents, highlighting effective safety implementation.

- Risk Mitigation: The use of a centralized accident reporting and tracking tool aids in the identification and reduction of workplace risks.

- Operational Impact: A safe working environment is fundamental to employee well-being, morale, and overall operational efficiency, contributing to business continuity.

Impact of Urbanization and Industrialization

Global urbanization continues to accelerate, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This trend directly fuels demand for ITT's essential components, particularly in sectors vital to urban infrastructure such as water and wastewater management, energy distribution, and public transportation.

Industrialization, especially in emerging economies, further amplifies the need for robust and efficient systems. As manufacturing and production expand, so does the requirement for reliable pumps, valves, and connectors to manage resources and ensure operational continuity. For instance, the global industrial pumps market was valued at approximately $50 billion in 2023 and is expected to grow steadily.

- Growing Urban Populations: The increasing concentration of people in cities drives demand for advanced water treatment and distribution systems, areas where ITT holds significant expertise.

- Infrastructure Development: Urban expansion necessitates new and upgraded infrastructure, creating opportunities for ITT's engineered solutions in construction and maintenance projects.

- Industrial Efficiency Needs: As industries strive for greater efficiency and sustainability, the demand for specialized fluid handling components, like those ITT offers, rises.

- Energy Sector Demands: The expansion of energy grids and the shift towards renewable energy sources require reliable components for power generation and transmission, benefiting ITT's product portfolio.

Societal trends significantly influence ITT's market position and operational focus. Growing consumer demand for sustainable products, exemplified by ITT's 15% revenue from electric and emissions-reducing products in 2023, highlights this shift. Furthermore, increasing societal expectations for corporate responsibility are driving ITT to enhance its ESG initiatives, as seen in its 2024 Sustainability Report detailing workforce inclusivity and charitable contributions, with a 15% rise in employee volunteer hours.

Technological factors

The adoption of advanced manufacturing, often termed Industry 4.0, is a significant technological driver for ITT. This includes the integration of automation, robotics, and data analytics into production processes. For instance, a 2024 report indicated that companies investing in automation saw an average productivity increase of 15-20%.

These technologies are crucial for enhancing operational efficiency and optimizing resource utilization, directly addressing challenges like labor shortages. ITT's strategic focus on productivity improvements means leveraging these advancements in its manufacturing facilities is a key priority.

Advancements in materials science are directly impacting ITT's ability to create more robust and efficient engineered components. For instance, the development of advanced composites and alloys allows for lighter yet stronger parts, which can translate to improved fuel efficiency in aerospace applications or extended lifespan in industrial equipment. This focus on material innovation is crucial for ITT's competitive edge.

ITT's commitment to environmentally friendly technologies is a direct result of breakthroughs in materials. Their ongoing work in areas like advanced filtration materials, which reduce waste and minimize downtime in industrial processes, highlights this. The company reported that its sustainable solutions contributed to a significant portion of its revenue growth in 2024, underscoring the market demand for eco-conscious engineering.

The relentless growth in demand for seamless digital connectivity and intelligent, smart solutions is a significant technological driver for ITT. This trend directly fuels innovation within ITT's Connect and Control Technologies segment, pushing for the development of more sophisticated connectors essential for sectors like aerospace and defense. For instance, the aerospace industry's increasing reliance on networked systems and data transmission necessitates advanced, robust connectivity solutions.

Furthermore, the integration of Internet of Things (IoT) capabilities into ITT's product portfolio presents a substantial opportunity for enhanced product performance and customer value. By embedding IoT functionalities, ITT can enable real-time monitoring, predictive maintenance, and remote control of its components, thereby offering greater efficiency and operational insights to its clients. This move aligns with broader industrial trends toward greater automation and data-driven decision-making.

Research and Development (R&D) Investment

ITT consistently channels resources into research and development to stay ahead in the technology landscape. This commitment fuels the creation of innovative, tailored solutions for its diverse customer base. For instance, in 2023, ITT reported R&D expenses of $362 million, a significant investment aimed at driving future growth.

The company's strategic focus on high-growth sectors such as electrification and advanced materials is directly supported by these R&D initiatives. By investing in next-generation product development, ITT aims to capture market share and enhance its profitability in these key areas.

- R&D Investment: ITT's 2023 R&D spending reached $362 million.

- Strategic Focus: Development of cutting-edge products for electrification and advanced materials.

- Competitive Edge: Continuous innovation to maintain market leadership.

- Future Growth: R&D is crucial for achieving long-term financial targets.

Electrification and Emissions-Reducing Technologies

The global push towards electrification, especially in automotive and energy, offers substantial technological avenues for ITT. This transition is driving demand for specialized components and solutions. For instance, the automotive sector is rapidly adopting electric vehicles (EVs), with global EV sales projected to reach over 16 million units in 2024, a significant increase from previous years.

ITT is strategically positioned to benefit from this trend, showcasing its capacity for innovation through products like EV and hybrid brake pads. These components are designed to meet the unique performance requirements of electric vehicles, which often involve regenerative braking systems. Furthermore, ITT's involvement in green pump projects highlights its commitment to developing sustainable technologies.

- Automotive Electrification: Global EV sales are expected to surpass 16 million units in 2024, creating a strong market for specialized automotive components.

- Emissions Reduction: Growing regulatory pressure and consumer demand for sustainability are accelerating the adoption of emissions-reducing technologies across industries.

- ITT's Product Innovation: ITT's development of EV and hybrid brake pads and its engagement in green pump projects demonstrate its ability to adapt to and capitalize on these technological shifts.

Technological advancements are reshaping ITT's operational landscape, driving innovation and efficiency. The company's investment in Industry 4.0 concepts, including automation and data analytics, is yielding significant productivity gains, with reports in 2024 showing up to a 20% increase for adopting firms. This focus on smart manufacturing directly addresses labor challenges and enhances resource management.

Materials science breakthroughs are enabling ITT to develop stronger, lighter components, crucial for sectors like aerospace, where advanced composites offer improved fuel efficiency. Furthermore, ITT's commitment to sustainable technologies, such as advanced filtration materials, is not only reducing industrial waste but also becoming a significant revenue driver, as evidenced by its contribution to growth in 2024.

The increasing demand for digital connectivity and IoT integration is fueling innovation in ITT's Connect and Control Technologies segment. This trend is vital for sectors like aerospace and defense, which rely on robust data transmission. Embedding IoT capabilities allows ITT to offer enhanced product performance through real-time monitoring and predictive maintenance, aligning with the broader industry shift towards data-driven operations.

ITT's strategic pivot towards electrification, particularly in the automotive sector, presents substantial growth opportunities. With global EV sales projected to exceed 16 million units in 2024, ITT is well-positioned with specialized products like EV and hybrid brake pads, designed to meet the unique demands of electric vehicles and their regenerative braking systems. This aligns with the global push for emissions reduction and sustainable technologies.

Legal factors

ITT must navigate a complex global landscape of environmental regulations, with increasing scrutiny on carbon emissions and the use of substances like PFAS. For instance, the European Union's REACH regulation continues to evolve, impacting chemical sourcing and product composition.

Compliance necessitates investment in greener manufacturing processes and enhanced supply chain oversight to track emissions and chemical usage. Companies like ITT are increasingly adopting circular economy principles, aiming to reduce waste and resource consumption, which can also lead to cost savings.

Failure to adhere to these environmental mandates can result in substantial fines, with some regions imposing penalties equivalent to a percentage of global turnover. Furthermore, non-compliance can lead to market access restrictions, as seen with certain chemical bans impacting global trade.

Product liability laws and the rigorous safety standards governing critical components like brake pads and valves are central to ITT's operations as a manufacturer. Failure to meet these stringent requirements across all global markets can lead to significant legal entanglements, costly product recalls, and severe reputational harm.

Intellectual Property Rights (IPR) are crucial for ITT, particularly for its highly engineered components and customized technology solutions. Protecting these innovations through patents is vital for maintaining its competitive edge in the market. For instance, ITT's focus on advanced materials and specialized fluid handling systems often involves proprietary designs that require robust patent protection.

Navigating the diverse global legal landscape for IPR presents a significant challenge for ITT. The company must meticulously adhere to varying patent laws across different jurisdictions to effectively enforce its rights and prevent unauthorized use of its intellectual property. This global complexity means ITT must invest in legal expertise to safeguard its innovations from infringement.

Labor Laws and Employment Regulations

ITT operates with a global workforce spread across 39 countries, meaning its labor practices are governed by a complex web of local and international employment laws. These regulations cover everything from unionization rights and mandated working conditions to stringent non-discrimination policies. For instance, in 2024, the International Labour Organization reported that over 60% of countries have updated their labor laws to reflect evolving workplace dynamics, a trend ITT must actively navigate.

Adhering to these diverse legal frameworks is not just a matter of compliance but is crucial for fostering positive employee relations and mitigating the risk of costly legal battles. Failure to comply can lead to significant fines, reputational damage, and operational disruptions. For example, a 2023 report by Littler Mendelson, a global employment law firm, highlighted that labor disputes cost companies an average of $50,000 per incident, with some reaching millions.

- Global Workforce Compliance: ITT must ensure adherence to labor laws in 39 diverse jurisdictions, covering aspects like wages, working hours, and employee benefits.

- Union Relations: Regulations concerning collective bargaining and union representation vary significantly, impacting ITT's employee engagement strategies.

- Non-Discrimination and Equal Opportunity: Compliance with anti-discrimination laws, which are increasingly stringent in 2024 and 2025, is paramount to avoid legal challenges and maintain a fair workplace.

- Working Conditions: ITT is obligated to meet country-specific standards for workplace safety, health, and overall working environments.

Antitrust and Competition Laws

ITT, as a major industrial products company, must navigate a complex web of antitrust and competition laws designed to prevent market manipulation and foster a level playing field. These regulations are crucial for ensuring fair competition across its diverse markets, from aerospace to water management.

Recent activities, such as ITT's acquisition of Svanehøj and kSARIA, underscore the importance of rigorous compliance. These transactions, and indeed all market-shaping endeavors, require careful review to ensure they don't create anti-competitive effects, thereby avoiding potential legal challenges and significant financial penalties. For instance, in 2023, the US Federal Trade Commission (FTC) continued its robust enforcement, reviewing numerous mergers, indicating a heightened regulatory environment that ITT must proactively address.

- Regulatory Scrutiny: ITT's strategic moves, including mergers and acquisitions, face scrutiny under antitrust laws globally.

- Compliance Burden: Ensuring compliance with varying international competition regulations adds complexity and cost to ITT's operations.

- Market Impact: Any perceived monopolistic behavior or unfair competitive practice can lead to investigations and sanctions.

- 2024 Outlook: Continued strong enforcement by bodies like the FTC and European Commission suggests ongoing vigilance will be required.

ITT must adhere to stringent product liability and safety standards across its global operations, particularly in sectors like aerospace and automotive. Failure to meet these rigorous requirements can result in costly recalls, legal disputes, and significant damage to its reputation, as evidenced by the increasing complexity of global safety certifications in 2024.

Protecting its intellectual property, especially for highly engineered components and proprietary technologies, is critical for ITT's competitive advantage. Navigating diverse international patent laws and preventing infringement requires substantial investment in legal expertise to safeguard its innovations.

Compliance with labor laws in the 39 countries where ITT operates is essential for maintaining positive employee relations and avoiding legal challenges. The company must stay abreast of evolving regulations concerning wages, working conditions, and non-discrimination, which saw over 60% of countries updating their labor laws in 2024.

ITT's market activities, including mergers and acquisitions, are subject to antitrust and competition laws worldwide. Ensuring these transactions do not create anti-competitive effects is vital to avoid investigations and penalties, a focus reinforced by heightened enforcement from bodies like the FTC in 2023.

Environmental factors

ITT is making strides in reducing its environmental impact, particularly concerning climate change and greenhouse gas (GHG) emissions. The company has set an ambitious goal to cut its Scope 1 and Scope 2 GHG emissions by 10% by the close of 2026, using 2021 as its baseline year.

A key part of this strategy involves significant investment in renewable energy. For instance, ITT has installed solar panels at eleven of its global locations, directly contributing to a lower carbon footprint and demonstrating a tangible commitment to mitigating climate change.

Increasing scarcity of critical raw materials, like rare earth elements essential for IT hardware, compels ITT to embrace circular economy models. By 2024, demand for these materials is projected to outstrip supply, driving up costs and supply chain risks.

ITT must prioritize product design for longevity, repairability, and recyclability to reduce reliance on virgin resources. This involves investing in technologies that enhance the reusability of components and minimize waste throughout the product lifecycle, a trend gaining significant traction in the 2024 market.

Efforts to increase the percentage of recycled materials in IT products and establish robust product take-back programs are no longer optional but crucial for sustainable operations and competitive advantage. For instance, the global market for refurbished electronics is expected to reach $116 billion by 2027, highlighting a significant opportunity for ITT.

ITT's manufacturing operations, particularly within its Industrial Process segment, are characterized by substantial water consumption. This reliance on water necessitates a strong focus on efficient usage and responsible wastewater management to mitigate environmental impact and adhere to stringent water quality standards.

In 2023, ITT reported a 3% reduction in its total water withdrawal compared to the previous year, demonstrating a commitment to conservation. The company is investing in advanced filtration and recycling technologies across its facilities to further minimize its water footprint and ensure compliance with evolving environmental regulations.

Waste Management and Pollution Control

ITT is actively working to reduce landfill waste, with a goal to increase the proportion of recycled materials in its waste streams. For instance, in 2023, ITT reported that 75% of its manufacturing waste was either recycled, reused, or sent for energy recovery, a figure it aims to push higher in 2024.

The company is also focused on pollution control, implementing best available techniques (BAT) across its facilities to minimize industrial emissions. This commitment ensures compliance with stringent environmental permits and contributes to cleaner air and water quality around its operational sites. ITT invested over $5 million in pollution control technologies in 2023, a trend expected to continue in 2024 as new regulations come into effect.

- Waste Diversion Rate: Aiming for over 80% diversion from landfill by the end of 2024.

- Emissions Reduction Targets: Focusing on reducing volatile organic compound (VOC) emissions by 15% across key sites in 2024.

- Water Discharge Quality: Implementing advanced treatment systems to ensure all water discharged meets or exceeds regulatory standards.

- Energy Efficiency in Operations: Initiatives to reduce the carbon footprint associated with waste processing and pollution control equipment.

Supply Chain Environmental Footprint

ITT's supply chain environmental footprint, from raw material extraction to final delivery, is under increasing scrutiny. This includes the impact of sourcing materials and the emissions generated during manufacturing and logistics. For instance, in 2023, the transportation sector alone accounted for approximately 24% of direct CO2 emissions globally, highlighting the significance of this aspect for ITT.

Ensuring suppliers meet stringent environmental standards is crucial. Regulations like the EU Deforestation Regulation (EUDR), which came into effect in June 2023, and the upcoming Corporate Sustainability Due Diligence Directive (CSDDD) in 2024, mandate responsible sourcing and due diligence. These frameworks require companies to demonstrate that their supply chains are free from deforestation and human rights abuses, directly impacting ITT's material procurement strategies.

- Raw Material Sourcing: ITT must verify that materials are obtained ethically and sustainably, avoiding those linked to environmental degradation.

- Production Emissions: Manufacturing processes need to be optimized to reduce energy consumption and waste, aligning with global decarbonization goals.

- Transportation Logistics: Optimizing shipping routes and exploring lower-emission transport options are vital to minimizing the carbon impact of moving goods.

- Supplier Compliance: Robust auditing and engagement with suppliers are necessary to ensure adherence to evolving environmental regulations and corporate sustainability targets.

ITT is actively addressing its environmental impact through targeted initiatives. The company aims to reduce its Scope 1 and 2 GHG emissions by 10% by the end of 2026, using 2021 as a baseline, and has already installed solar panels at eleven global sites.

Scarcity of critical raw materials, such as rare earth elements, is driving ITT towards circular economy models, with demand projected to outstrip supply by 2024. This necessitates a focus on product longevity, repairability, and recyclability, a trend supported by the growing global refurbished electronics market, which is expected to reach $116 billion by 2027.

ITT's water consumption, particularly in its Industrial Process segment, is being managed through efficiency improvements and responsible wastewater practices. The company achieved a 3% reduction in water withdrawal in 2023 and is investing in advanced filtration technologies.

Waste reduction is another key focus, with ITT aiming to divert over 80% of its waste from landfills by the end of 2024. In 2023, 75% of manufacturing waste was recycled, reused, or sent for energy recovery, with plans to further improve this rate.

| Environmental Focus Area | 2023/2024 Initiatives & Targets | Impact/Projection |

|---|---|---|

| GHG Emissions | 10% reduction target for Scope 1 & 2 by 2026 (vs. 2021 baseline) | Solar panel installations at 11 global sites |

| Resource Scarcity | Embracing circular economy models | Refurbished electronics market projected at $116B by 2027 |

| Water Management | 3% reduction in water withdrawal (2023) | Investment in advanced filtration and recycling technologies |

| Waste Diversion | >80% diversion from landfill target by end of 2024 | 75% of manufacturing waste recycled/reused/recovered in 2023 |

PESTLE Analysis Data Sources

Our ITT PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations like the World Bank and IMF, and leading industry analysis firms. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.