ITT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITT Bundle

ITT's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers and suppliers to the ever-present threat of new entrants and substitutes. Understanding these dynamics is crucial for any business operating within or looking to enter ITT's market.

The complete report reveals the real forces shaping ITT’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ITT relies on a wide array of suppliers for everything from basic raw materials to highly specialized components and sophisticated manufacturing equipment. This diversity across its Motion Technologies, Industrial Process, and Connect and Control Technologies segments means supplier power can vary greatly.

The bargaining power of ITT's suppliers becomes a significant factor when the inputs they provide are highly specialized, protected by patents, or sourced from a very limited number of providers. This is especially critical for the unique engineered components that are the backbone of ITT's product offerings.

For instance, in 2024, ITT's advanced electronic components and proprietary chemical formulations, vital for their high-performance products, are often sourced from a select few suppliers. This concentration of specialized knowledge and limited alternatives grants these suppliers considerable leverage in price negotiations and supply terms.

ITT faces significant switching costs for its IT components and specialized technologies. These costs are amplified when suppliers provide highly customized solutions or critical parts requiring rigorous certifications, such as those needed for aerospace or automotive applications. For instance, in 2024, the aerospace industry alone saw an estimated $50 billion in R&D investment, much of which is tied to specialized, integrated systems where supplier changes are exceptionally disruptive and costly.

Suppliers with unique capabilities or proprietary technology could potentially move into ITT's markets, especially if they have the manufacturing know-how and customer reach. This risk for ITT is typically moderate because of its specialized production and strong ties with demanding clients.

For instance, a key supplier to the aerospace industry, if it developed advanced integrated systems that rendered ITT's components redundant, could significantly increase its bargaining power. This forward integration would directly challenge ITT's market position.

While ITT's specialized processes and established customer loyalty offer some protection, a supplier's ability to offer a more complete solution could disrupt this balance. The threat escalates if suppliers can replicate ITT's value proposition more efficiently.

Importance of ITT to Suppliers

The degree to which ITT is a crucial customer for its suppliers significantly shapes their bargaining power. If ITT accounts for a substantial slice of a supplier's overall revenue, that supplier might be less inclined to exert strong pressure, as they depend heavily on ITT's continued business. For instance, a specialized component manufacturer that derives 40% of its sales from ITT would likely be more accommodating than one for whom ITT represents only 2% of its revenue.

Conversely, ITT's bargaining power with a supplier increases if ITT is a relatively small client for that supplier. In such scenarios, the supplier has numerous other, potentially larger, customers and is less sensitive to losing ITT's business. This dynamic means ITT must work harder to negotiate favorable terms when dealing with suppliers who have a diversified customer base, such as a major global electronics distributor where ITT is just one of many clients.

Key considerations regarding ITT's importance to suppliers include:

- Supplier Revenue Concentration: If a supplier's revenue is heavily reliant on ITT, their bargaining power against ITT is generally weaker.

- ITT's Market Share with Supplier: A higher percentage of a supplier's output sold to ITT can indicate ITT's leverage.

- Supplier Diversification: Suppliers with a broad customer base are less dependent on any single client like ITT, potentially diminishing ITT's influence.

- Switching Costs for Supplier: High costs for a supplier to retool or find new markets if ITT business is lost can also impact their leverage.

Availability of Substitute Inputs

The availability of substitute raw materials or components significantly influences the bargaining power of suppliers for ITT. If ITT can readily source alternative materials or components that meet its quality and performance benchmarks, the power of any single supplier diminishes. For instance, if a critical electronic component has multiple manufacturers offering similar specifications, ITT can more easily switch suppliers, thereby reducing price pressure from any one vendor.

However, for highly engineered and mission-critical components, particularly within sectors like aerospace and defense where ITT operates, finding direct substitutes that adhere to stringent industry specifications and certifications can be exceptionally difficult. This scarcity of viable alternatives can dramatically increase the leverage of existing suppliers. For example, specialized alloys or precision-machined parts designed for extreme environments may only have a limited number of qualified producers, granting them considerable pricing and negotiation power.

- Reduced Supplier Power: High availability of interchangeable components or raw materials allows ITT to negotiate better terms.

- Increased Supplier Power: Scarcity of specialized, high-specification inputs limits ITT's alternatives, strengthening supplier leverage.

- Industry Impact: Sectors with unique material requirements, like aerospace, often face higher supplier power due to fewer substitute options.

The bargaining power of ITT's suppliers is influenced by the availability of substitutes for their offerings. When ITT can easily find comparable materials or components, supplier leverage decreases. However, for highly specialized or certified parts, particularly in industries like aerospace, finding viable substitutes is challenging, significantly empowering those suppliers.

ITT's reliance on a few specialized suppliers for critical components in 2024, such as advanced sensors for its automotive applications, highlights this dynamic. The limited number of qualified manufacturers for these high-specification items means these suppliers can command higher prices and dictate terms, impacting ITT's cost structure.

This situation is further compounded by the fact that switching to a different supplier for these specialized items often involves substantial retooling and recertification costs for ITT, sometimes running into millions of dollars per component line.

| Factor | Impact on ITT's Supplier Bargaining Power | Example for ITT (2024 Context) |

|---|---|---|

| Availability of Substitutes | High availability reduces power; Scarcity increases power. | High availability of standard fasteners; Scarcity of proprietary seals for extreme pressure applications. |

| Supplier Concentration | Few suppliers = High power; Many suppliers = Low power. | Limited number of producers for specialized aerospace alloys. |

| Switching Costs | High costs empower suppliers; Low costs empower ITT. | Significant costs to recertify new suppliers for medical device components. |

What is included in the product

This analysis dissects the competitive forces impacting ITT, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry, to understand its market position and profitability drivers.

Effortlessly identify and quantify competitive pressures with a visual, data-driven framework, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

ITT serves major industrial, aerospace, and automotive clients, meaning a few key customers could represent a significant chunk of revenue in certain areas. This concentration of large buyers gives them considerable leverage, particularly when placing substantial orders, as they can negotiate for more favorable pricing and terms.

For instance, in the automotive sector, major original equipment manufacturers (OEMs) often have the clout to dictate terms due to the sheer volume of components they purchase. This dynamic is also pronounced in the aerospace industry, where a handful of large aircraft manufacturers hold considerable sway over their suppliers.

ITT's customers often face significant hurdles when considering a switch to a competitor, primarily due to the high switching costs associated with ITT's specialized and critical components. These costs stem from the deep integration of ITT's products into customer systems and the stringent performance requirements they must meet.

For example, in the automotive sector, a customer reliant on ITT's engineered brake systems would incur substantial expenses and time delays in re-testing, re-certifying, and re-tooling their manufacturing processes if they were to switch to a different supplier. Similarly, in aerospace, changing a critical connector supplier from ITT would necessitate rigorous validation and regulatory approvals, making such a shift impractical and costly.

These high switching costs, driven by product integration, performance criticality, and certification needs, effectively lock in ITT's customer base. This significantly reduces the bargaining power of customers, as the effort and expense involved in finding and implementing an alternative solution outweigh the potential benefits of switching. This was evident in 2024, where ITT reported strong customer retention rates across its key segments, underscoring the impact of these embedded switching costs.

Customer price sensitivity for ITT's products is a key factor, though it fluctuates across their varied markets. In sectors like automotive, where competition is fierce, customers are often more inclined to scrutinize prices. For instance, in 2024, the automotive industry continued to navigate economic pressures, potentially increasing price sensitivity among suppliers' clients.

Conversely, in industries such as aerospace and defense, the emphasis shifts heavily towards unwavering reliability and superior performance. Here, customers are typically less swayed by minor price variations, prioritizing the critical function and long-term dependability of ITT's components. This is particularly true for components essential to safety-critical systems.

The intrinsic value and essential nature of ITT's offerings in demanding applications often mean that performance and reliability take precedence over marginal cost differences. This dynamic suggests that while price is always a consideration, it may not be the sole or even primary driver in all of ITT's customer segments.

Threat of Backward Integration by Customers

ITT's major clients, often large original equipment manufacturers (OEMs), could potentially bring production of components currently sourced from ITT in-house. This backward integration would reduce their reliance on ITT and potentially lower costs. For example, a major automotive OEM could decide to manufacture certain specialized sensors or fluid handling systems internally if the investment and expertise required are deemed manageable.

The extent of this threat hinges on the complexity of ITT's offerings. Highly specialized engineering and manufacturing, demanding substantial capital and deep technical know-how, act as significant barriers. However, for more standardized or less intricate components, the risk of customers pursuing backward integration becomes more pronounced. In 2024, the trend towards vertical integration in sectors like aerospace and defense, where ITT is a key supplier, suggests a heightened awareness among large buyers of their supply chain control.

- Customer Size and Bargaining Power: Large OEMs, representing a significant portion of ITT's revenue, wield considerable influence.

- Capital Intensity of ITT's Processes: High capital requirements for ITT's specialized manufacturing deter immediate backward integration by most customers.

- Technical Expertise Barrier: The proprietary nature of ITT's engineering and manufacturing processes creates a knowledge gap for potential integrators.

- Component Standardization: Less complex or standardized components are more susceptible to backward integration efforts by customers.

Availability of Information and Alternatives

Customers in ITT's markets frequently possess extensive information about product features, pricing, and competing vendors, particularly within established industrial segments. This readily available data empowers them to make informed comparisons and seek better deals.

While ITT's strength resides in its specialized, tailor-made solutions, the inherent transparency in business-to-business transactions allows customers to leverage their knowledge of the market. This can translate into increased negotiation leverage for more advantageous pricing and contract terms.

For instance, in the industrial automation sector, a significant portion of ITT's business, customers can easily access technical specifications and pricing benchmarks from multiple suppliers. This information parity directly impacts their bargaining power.

- Information Transparency: B2B markets, especially in mature industrial sectors where ITT operates, exhibit high levels of information availability regarding product specifications and pricing.

- Customer Comparison: This transparency enables customers to readily compare ITT's offerings against those of competitors, fostering a more informed negotiation process.

- Leveraging Alternatives: The existence of viable alternatives allows customers to exert pressure on ITT to offer more favorable terms, thereby increasing their bargaining power.

- Impact on Pricing: In 2024, industries with greater information symmetry often saw price pressures increase, as customers could more effectively identify and capitalize on competitive pricing strategies.

The bargaining power of ITT's customers is moderated by several factors, including their size, the capital intensity of ITT's operations, and the technical expertise required for ITT's specialized products. While large customers can exert influence, the high barriers to entry for producing ITT's complex components limit the immediate threat of backward integration. Furthermore, information transparency in ITT's served markets allows customers to compare offerings, potentially increasing their negotiation leverage, though this is often balanced by the critical performance requirements of ITT's solutions.

| Factor | Impact on Customer Bargaining Power | ITT's Mitigation Strategy |

|---|---|---|

| Customer Size & Revenue Concentration | High for major clients (e.g., large OEMs) | Diversified customer base across segments, strong existing relationships |

| Switching Costs | Low due to deep integration and certification needs | Proprietary technology, long-term contracts, product customization |

| Price Sensitivity | Varies by sector (higher in automotive, lower in aerospace) | Value-based pricing, focus on reliability and performance |

| Threat of Backward Integration | Low for highly complex products, higher for standardized components | Maintaining technological edge, proprietary manufacturing processes |

| Information Availability | Moderate to High in mature industrial markets | Emphasis on unique value proposition, technical support, and service |

What You See Is What You Get

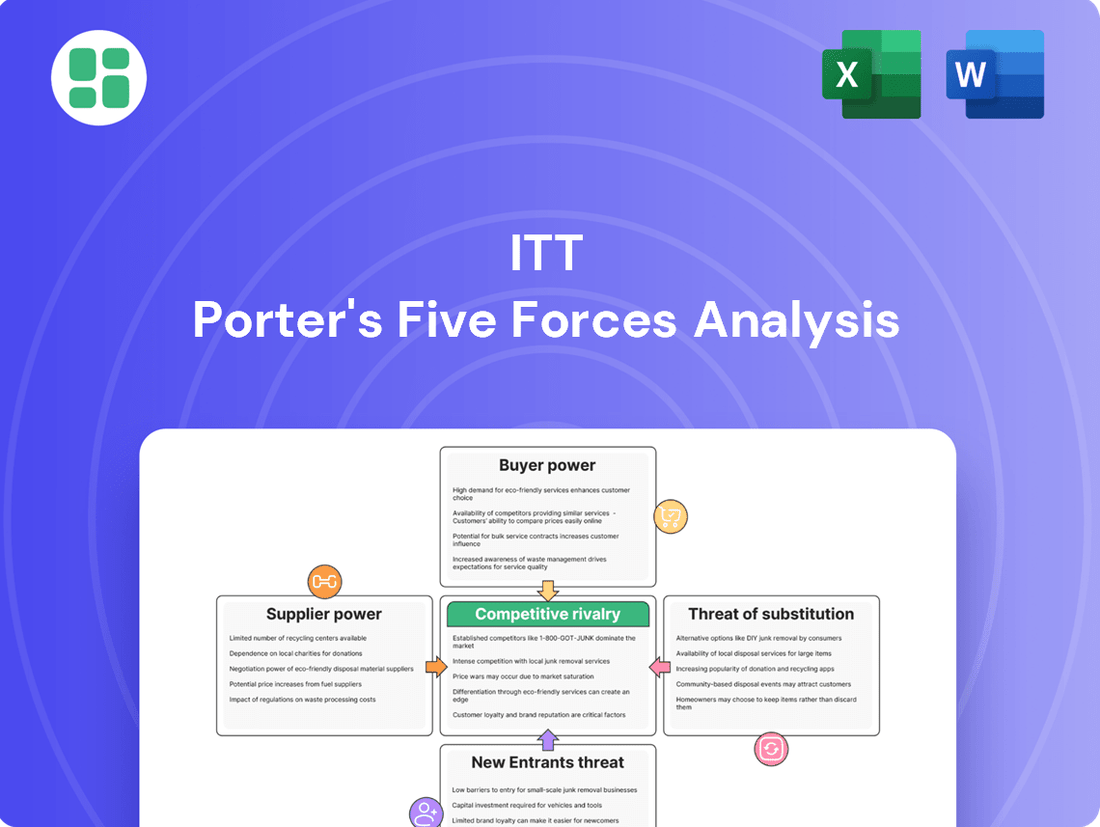

ITT Porter's Five Forces Analysis

This preview showcases the exact ITT Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You're looking at the actual, fully formatted document, ensuring no surprises or placeholder content. Once your purchase is complete, you'll gain instant access to this same detailed analysis, ready for immediate application.

Rivalry Among Competitors

ITT operates in a highly competitive environment, facing a broad spectrum of rivals. These range from large, diversified industrial conglomerates to highly specialized niche players, each vying for market share across ITT's various industrial segments.

Key competitors such as Xylem, Flowserve, and Ingersoll Rand are significant players in the industrial and flow control markets where ITT competes. These companies, along with numerous other specialized firms focusing on specific components or applications, create a dynamic and challenging competitive landscape.

For instance, in the industrial pump market, Xylem is a major competitor, while Flowserve holds a strong position in industrial flow management solutions. Ingersoll Rand competes across various industrial sectors, including fluid management and compression technologies.

This extensive and diverse competitive field necessitates that ITT continuously focuses on innovation, operational efficiency, and product differentiation to maintain its market position and drive growth.

The competitive intensity within ITT's diverse markets is directly shaped by their respective growth rates. In segments experiencing slower expansion or maturity, the struggle for existing market share often intensifies, potentially leading to price pressures and heightened promotional activities.

Conversely, ITT's strategic focus on areas like automotive electrification and defense modernization places it within dynamic, high-growth sectors. Here, competition typically centers on technological innovation, securing production capacity, and capturing emerging demand, rather than solely on price. For instance, the global automotive sensor market, a key area for ITT, was projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% leading up to 2024.

ITT's emphasis on highly engineered, critical components and bespoke technology solutions allows for significant product differentiation. This strategy helps to lessen direct competition based purely on price. For instance, ITT's development of advanced pumps for the burgeoning green energy sector, a market projected to see substantial growth in the coming years, showcases their commitment to innovation and specialized solutions.

Continuous innovation is key to ITT's competitive edge. The company's introduction of novel products, like geopolymer brake pads, not only differentiates them but also supports premium pricing strategies. This ability to offer unique, high-performance solutions is essential in the specialized markets ITT serves, where performance and reliability often outweigh cost considerations for customers.

High Exit Barriers

ITT operates in sectors like industrial components for heavy manufacturing, where exiting the market is particularly challenging. This is often due to the substantial investment in specialized machinery and facilities, coupled with significant fixed costs that make it economically unfeasible for firms to simply shut down operations. For instance, a plant designed for a specific type of industrial pump might have millions invested in unique tooling and assembly lines, making it difficult to repurpose or sell off quickly.

These high exit barriers mean that even if a particular segment becomes less profitable, companies are compelled to remain active. This persistence can lead to persistent overcapacity within the industry, as struggling firms continue to operate rather than incur the costs of closure. As a result, the competitive rivalry intensifies, with businesses fighting harder to maintain their market share and customer base, even in challenging economic conditions.

For example, in the aerospace components sector, a significant portion of ITT's business, manufacturers often face long lead times for specialized equipment and have established, long-term contracts with major aircraft producers. Divesting from such a deeply integrated supply chain is not a simple task, contributing to the stickiness of competition.

- Specialized Assets: Industries served by ITT often require highly specific, capital-intensive machinery that is difficult to redeploy or sell.

- High Fixed Costs: Significant ongoing expenses related to plant operations, maintenance, and skilled labor create a strong disincentive to exit.

- Long-Term Customer Relationships: Established ties with major industrial clients in sectors like automotive or energy create switching costs and loyalty, making it hard for firms to leave without disrupting crucial supply chains.

- Strategic Importance: In some niche industrial markets, companies may continue to operate at a loss to maintain a strategic presence or avoid losing vital intellectual property, further contributing to sustained rivalry.

Switching Costs for Customers

ITT's customers often encounter significant switching costs because the company's products are integral to critical operations and deeply integrated into existing systems. For instance, in the aerospace sector, replacing ITT's specialized connectors or fluid handling systems requires extensive re-engineering and recertification, a process that can cost millions and take considerable time. This inherent difficulty in switching makes it challenging for rivals to lure away ITT's established clientele solely on price.

These high switching costs directly contribute to a less intense competitive rivalry. When customers are locked in due to the complexity and expense of changing suppliers, ITT can maintain a more stable customer base. This stability allows ITT to focus its efforts on delivering superior value through innovation and enhanced services rather than engaging in price wars.

- High Integration: ITT's products are often deeply embedded within customer infrastructure, making replacement complex.

- Critical Applications: Many of ITT's solutions serve vital functions where reliability and performance are paramount, discouraging experimentation with new vendors.

- Reduced Price Sensitivity: The cost and effort of switching often outweigh potential short-term price savings from competitors.

- Customer Retention: This dynamic helps ITT retain its existing customer relationships, fostering loyalty and predictable revenue streams.

ITT faces intense competition from established players like Xylem and Flowserve, as well as specialized firms. This rivalry is particularly sharp in mature markets where competition often centers on price and market share acquisition. For example, the industrial pump market sees significant competition from Xylem, a major player in water technology.

However, ITT's strategy of focusing on highly engineered, differentiated products in growth sectors like automotive electrification and defense helps mitigate direct price competition. The global automotive sensor market, a key area for ITT, was projected for robust growth, with estimates around a 7% CAGR leading up to 2024, indicating a focus on innovation over price wars in these segments.

High exit barriers, such as specialized assets and long-term customer relationships in sectors like aerospace, compel companies to remain in the market, thereby sustaining competitive rivalry. This persistence can lead to overcapacity, intensifying the fight for market share among existing players.

Furthermore, significant switching costs for ITT's deeply integrated and critical solutions lock in customers, reducing price sensitivity and fostering customer loyalty. This allows ITT to maintain a stable customer base and focus on value rather than engaging in aggressive price competition.

| Competitor | Key Markets | 2024 Revenue (Estimated, Billions USD) | Focus Area |

|---|---|---|---|

| Xylem | Water Technology, Industrial Pumps | ~10.0 | Water infrastructure, smart solutions |

| Flowserve | Industrial Flow Management | ~3.8 | Pumps, valves, seals for energy and industrial sectors |

| Ingersoll Rand | Industrial Technologies, Fluid Management | ~6.0 | Compressors, pumps, climate control solutions |

SSubstitutes Threaten

The threat of substitutes for ITT's products is amplified by rapid advancements in emerging technologies and material science. Innovations like advanced composites or additive manufacturing could offer performance or cost advantages over ITT's traditional engineered components, potentially diverting customer demand. For instance, the development of novel, lighter, and stronger materials could directly challenge ITT's established offerings in sectors like aerospace and automotive.

ITT is proactively addressing this threat through significant investment in research and development. A prime example is their work on geopolymer brake pads, a material science innovation designed to offer superior performance and environmental benefits compared to conventional materials. This focus on innovation is crucial for maintaining market position against evolving substitute solutions.

Customers may opt for substitute products if they present a better performance-price balance, even if they don't fully replicate ITT's high-end features. For instance, in less demanding industrial applications, a simpler, less expensive component might be perfectly adequate, impacting ITT's premium pricing strategy.

This dynamic compels ITT to constantly reinforce the superior value and engineering behind its products to justify the cost. For example, if a competitor offers a component with 90% of ITT's functionality at 70% of the price, customers in non-critical sectors might switch, especially if macroeconomic pressures increase, as seen with rising input costs impacting manufacturing sectors globally in early 2024.

ITT's diverse customer base, spanning aerospace, automotive, chemical, and energy sectors, exhibits varying degrees of willingness to adopt new, potentially disruptive substitute solutions. For instance, in the aerospace industry, where safety and reliability are paramount, customers often require extensive testing and certification before adopting new components, slowing down the migration from established ITT products. This cautious approach significantly mitigates the immediate threat of substitutes in these critical applications.

Regulatory and Environmental Shifts

Changes in environmental regulations or evolving industry standards can significantly impact the threat of substitutes. For example, stricter emissions controls or mandates for sustainable materials could make existing products less competitive, thereby opening doors for alternative solutions. This is particularly relevant for industries like automotive, where ITT's components are utilized.

A move towards greener technologies or materials might necessitate new types of components, potentially favoring new substitutes or requiring ITT to adapt its product lines. For instance, if governments mandate a certain percentage of recycled content in manufactured goods, this could drive demand for new materials that substitute traditional ones.

ITT's strategic focus on developing sustainable products, such as advanced brake pads designed for electric vehicles, directly addresses this potential threat. By proactively innovating in areas aligned with environmental shifts, ITT aims to mitigate the risk of substitution and even capitalize on emerging market demands. In 2023, the global electric vehicle market saw substantial growth, with sales exceeding 13 million units, highlighting the increasing relevance of such sustainable product development.

- Environmental Regulations: Stricter environmental laws can make existing products obsolete, creating opportunities for substitute solutions.

- Industry Standards: Evolving standards, particularly around sustainability and energy efficiency, can favor new materials or technologies.

- ITT's Response: ITT's investment in sustainable products, like EV brake pads, aims to counter substitution threats and leverage market trends.

- Market Context: The rapidly expanding electric vehicle market, which surpassed 13 million units in sales in 2023, underscores the importance of ITT's sustainable product strategy.

Lifecycle and Maintenance Innovations

Innovations in product lifecycle management and maintenance practices can significantly impact the threat of substitutes for companies like ITT. For instance, advancements in predictive maintenance, which uses data analytics to anticipate equipment failures, could extend the operational life of existing components. This directly reduces the need for frequent replacements, acting as a substitute for new part sales.

More durable component designs also fall into this category. By engineering parts that last longer, manufacturers can decrease the overall demand for aftermarket replacements. This trend could affect ITT's aftermarket revenue streams, as customers may delay or forgo purchases of new components if their current ones prove exceptionally resilient.

ITT's own focus on reducing waste and limiting downtime through its technologies highlights this dynamic. While beneficial for customers, these innovations can inadvertently create substitutes for traditional replacement cycles. For example, if ITT's solutions enable existing machinery to operate efficiently for extended periods, the market for new or replacement parts within that segment might shrink.

- Predictive Maintenance Adoption: Industry reports from 2024 indicate a growing adoption of predictive maintenance technologies across various sectors, with some estimates suggesting the market could reach over $10 billion by 2026, up from approximately $3 billion in 2021.

- Extended Product Lifespans: Research into material science and engineering is leading to components with significantly longer service lives. For instance, advancements in wear-resistant coatings can double the lifespan of certain industrial parts.

- Aftermarket Revenue Impact: For companies heavily reliant on aftermarket sales, a 10% increase in product lifespan due to maintenance innovations could translate to a 5-7% reduction in annual replacement part demand.

- ITT's Technology Integration: ITT's investments in smart monitoring and diagnostics aim to optimize equipment performance, which, while enhancing customer value, could also reduce the frequency of component replacements, a key substitute threat.

The threat of substitutes for ITT's products is a significant consideration, driven by technological advancements and evolving customer needs. When substitute products offer a better value proposition, either through lower cost or superior performance, customers may switch, impacting ITT's market share and pricing power. This is particularly true in sectors where performance demands are not absolute, allowing for more cost-effective alternatives to gain traction.

For example, in 2024, the automotive industry continues to explore lightweight materials and advanced manufacturing techniques that could offer alternatives to ITT's traditional engineered components. Similarly, in industrial applications, simpler, more affordable solutions might suffice for less critical functions, posing a challenge to ITT's premium offerings.

| Factor | Impact on ITT | Example | 2024 Data/Trend |

| Technological Advancements | Potential for new materials/processes to outperform ITT's offerings | Advanced composites in aerospace | Increased R&D in additive manufacturing for aerospace components |

| Cost-Performance Ratio | Customers may choose cheaper substitutes if performance is adequate | Simpler industrial components | Rising input costs in early 2024 pressure manufacturers to seek cost savings |

| Emerging Market Needs | Shifts in demand due to regulations or new technologies | Sustainable materials in automotive | Growth in EV market necessitates new component solutions |

Entrants Threaten

The industrial manufacturing sector, especially for critical, engineered components, demands significant upfront investment. This includes substantial outlays for research and development, acquiring specialized machinery, and establishing robust production facilities. For instance, in 2024, the average capital expenditure for advanced manufacturing equipment can easily run into millions of dollars.

These high capital requirements serve as a formidable barrier for new players looking to enter ITT's competitive landscape. Only firms with substantial financial backing can realistically consider entering markets where the initial investment is so considerable, thereby limiting the threat of new entrants.

Existing players like ITT, a leader in fluid technology and motion control, benefit significantly from economies of scale. For instance, in 2023, ITT reported revenues of $3.1 billion, allowing for substantial purchasing power in raw materials and efficient distribution networks. This scale translates to lower per-unit production costs, a barrier that new entrants would find challenging to overcome without substantial upfront investment and immediate high-volume production.

The experience curve further solidifies ITT's competitive position. Decades of operational refinement have led to optimized manufacturing processes and proprietary knowledge, reducing waste and improving efficiency. New entrants lack this accumulated learning, meaning their initial production runs will likely be less cost-effective and potentially of lower quality compared to ITT's established, streamlined operations.

ITT's significant investment in proprietary technology and intellectual property creates a formidable barrier for new entrants. The company's focus on highly engineered, customized solutions, backed by numerous patents and deep engineering know-how, means any competitor would need substantial R&D expenditure to replicate their offerings. For instance, ITT's 2024 R&D spending of $350 million underscores this commitment to innovation, making it difficult for newcomers to compete on technological parity.

Access to Distribution Channels and Customer Relationships

The threat of new entrants regarding access to distribution channels and customer relationships for ITT is significantly mitigated by the company's deeply entrenched position. Building the necessary infrastructure and trust within demanding sectors like aerospace and automotive takes years, if not decades. For instance, ITT's long-standing partnerships mean new players face considerable hurdles in securing shelf space or even initial customer engagement.

ITT has cultivated extensive and loyal customer relationships, particularly in specialized industrial markets. These established bonds are not easily replicated; they are built on a history of reliability, tailored solutions, and deep understanding of client needs. New entrants would struggle to match this level of trust and market penetration without substantial investment and time.

- Established Networks: ITT's existing distribution networks are a formidable barrier, requiring significant capital and time for competitors to build.

- Customer Loyalty: Decades of providing reliable solutions have fostered strong customer loyalty, making it difficult for new entrants to gain traction.

- High Switching Costs: In critical industries like aerospace, the cost and complexity of switching suppliers for components like those ITT provides are often very high, further deterring new entrants.

- Brand Reputation: ITT's strong brand reputation, built over many years, provides a significant competitive advantage that new companies find challenging to overcome.

Regulatory Hurdles and Certifications

The threat of new entrants for ITT is significantly mitigated by the demanding regulatory landscape and certification requirements inherent in its core markets. For instance, the aerospace sector, a key area for ITT, mandates rigorous compliance with standards like AS9100. New companies must invest heavily in achieving and maintaining these certifications, a process that can take years and substantial capital, thereby creating a formidable barrier.

Navigating these complex compliance processes is not only costly but also time-consuming, demanding specialized expertise that startups often lack. This steep learning curve and upfront investment act as a powerful deterrent, protecting ITT's established market position.

- Aerospace & Defense: Compliance with AS9100D, ITAR, and various national defense regulations.

- Automotive: Adherence to IATF 16949 and specific OEM quality requirements.

- Medical: Meeting FDA regulations and ISO 13485 standards for components.

- Cost of Compliance: Estimates suggest achieving and maintaining certifications can cost hundreds of thousands to millions of dollars for new entrants.

The threat of new entrants for ITT is low due to substantial capital requirements, including millions in advanced manufacturing equipment in 2024, and the need for extensive R&D. Economies of scale, demonstrated by ITT's $3.1 billion revenue in 2023, further deter newcomers by offering lower per-unit costs. ITT's proprietary technology, backed by $350 million in R&D spending in 2024, and strong customer relationships built over decades, create significant barriers to entry.

| Barrier Type | Description | Example Data/Impact |

|---|---|---|

| Capital Requirements | High upfront investment for specialized machinery and facilities. | Millions of dollars for advanced manufacturing equipment (2024). |

| Economies of Scale | Lower per-unit costs due to high-volume production and purchasing power. | ITT's $3.1 billion revenue (2023) enables significant scale advantages. |

| Proprietary Technology & R&D | Investment in patents and deep engineering expertise. | ITT's $350 million R&D spending (2024) protects its innovation edge. |

| Customer Relationships & Switching Costs | Established trust and high costs for clients to change suppliers. | Long-standing partnerships in critical sectors like aerospace. |

| Regulatory & Certification Hurdles | Compliance with industry-specific standards (e.g., AS9100 in aerospace). | Hundreds of thousands to millions of dollars and years to achieve certifications. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive intensity.