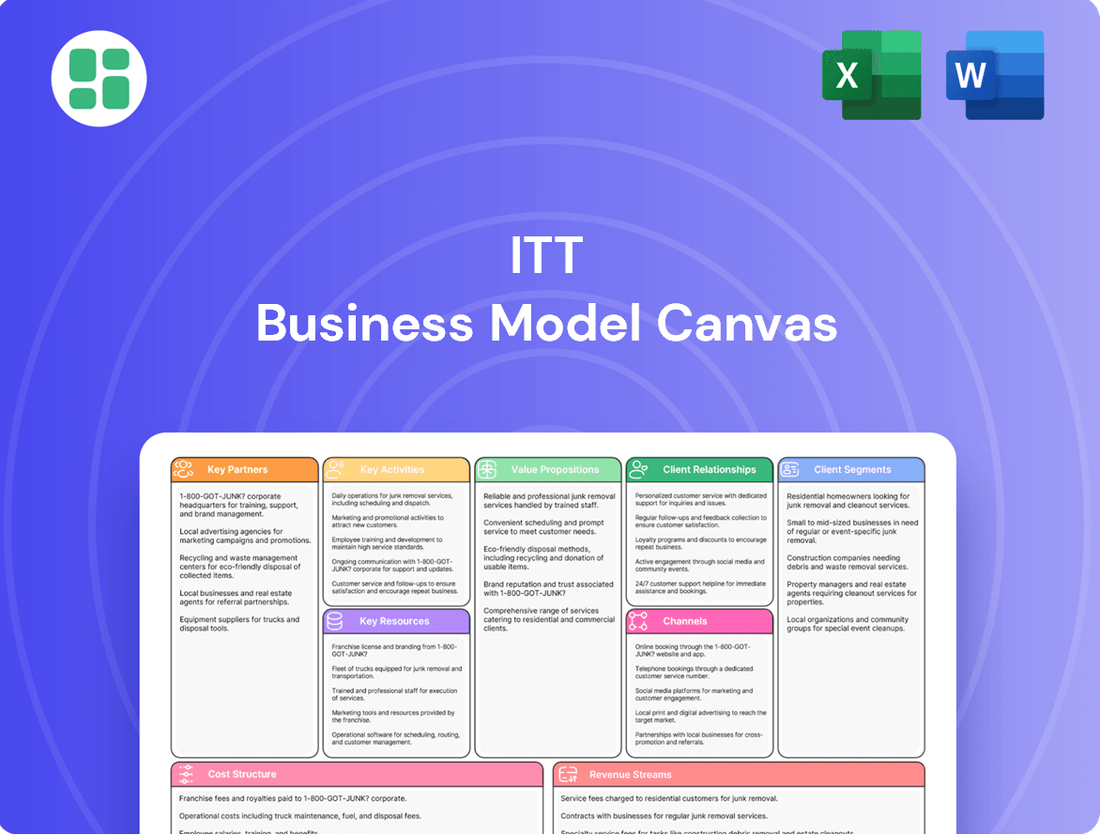

ITT Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITT Bundle

Want to truly understand how ITT innovates and maintains its competitive edge? This comprehensive Business Model Canvas breaks down their entire strategy, from customer relationships to revenue streams. Download the full version to gain actionable insights for your own business ventures.

Partnerships

ITT cultivates vital alliances with strategic suppliers and component manufacturers, forming the backbone of its production capabilities. These partnerships are essential for sourcing high-quality raw materials, specialized parts, and intricate sub-assemblies that power ITT's diverse portfolio of engineered products.

In 2024, ITT's commitment to supply chain resilience was evident in its proactive management of these relationships. The company emphasized long-term agreements with key suppliers to guarantee consistent access to critical inputs, thereby mitigating potential disruptions and ensuring manufacturing continuity. This strategic approach directly supports ITT's operational efficiency and its ability to deliver innovative solutions to market.

ITT actively partners with leading research institutions and universities worldwide to fuel its innovation. For instance, collaborations with organizations like MIT and Stanford University provide access to groundbreaking research in advanced materials and sustainable engineering, crucial for developing next-generation products.

Engaging with technology startups is also a cornerstone of ITT's strategy, allowing for the rapid integration of emerging technologies. In 2024, ITT invested in several startups focused on AI-driven predictive maintenance and advanced battery technologies, aiming to enhance product performance and efficiency.

These R&D collaborations are essential for ITT to maintain its competitive edge, particularly in rapidly evolving sectors such as electrification and sustainable solutions. By leveraging external expertise, ITT ensures its product development pipeline remains robust and aligned with future market demands.

ITT strategically partners with a robust global network of distributors and authorized service providers. This ensures their innovative solutions reach a wide array of customers across various industries and geographies. For example, in 2024, ITT continued to leverage these relationships to expand its presence in emerging markets, contributing to a significant portion of its international revenue growth.

These partnerships are crucial for delivering comprehensive aftermarket support, a key element of ITT's value proposition. By working with trusted service providers, ITT guarantees customers access to timely maintenance, expert repairs, and genuine spare parts. This commitment to reliable service fosters strong customer loyalty and reinforces ITT's reputation for quality and dependability.

Strategic Acquisitions and Joint Ventures

ITT actively seeks out strategic acquisitions to bolster its offerings and market reach. For instance, the acquisition of kSARIA in 2023, a leader in specialized fiber optic cable solutions, significantly expanded ITT's capabilities in high-growth sectors like aerospace and defense. Similarly, the 2023 acquisition of Svanehøj, a Danish company specializing in advanced pump solutions for the energy transition, positions ITT to capitalize on the growing demand for sustainable energy technologies.

These acquisitions are not just about adding companies; they are about integrating new technologies and accessing new, profitable markets. By bringing in entities like kSARIA and Svanehøj, ITT enhances its technological expertise and diversifies its revenue streams into areas with strong future growth potential.

Joint ventures also play a crucial role in ITT's strategy. These collaborations allow ITT to share the costs and risks associated with developing new technologies or entering specific geographic regions. This approach facilitates deeper market penetration and accelerates the commercialization of innovative solutions, leveraging the strengths of multiple partners.

ITT's strategic approach to partnerships is demonstrated by its consistent investment in growth opportunities. For example, in 2024, the company continued to evaluate and pursue acquisitions that align with its long-term vision for expansion and technological advancement.

Industry-Specific OEMs and Integrators

ITT actively collaborates with Original Equipment Manufacturers (OEMs) and system integrators across key sectors such as aerospace, automotive, and energy. These relationships are foundational for tailoring solutions that fit precisely into complex machinery.

These partnerships often involve joint development efforts, allowing ITT to engineer components that meet the stringent performance benchmarks required by specialized applications. For instance, in the automotive sector, ITT's fluid handling solutions are co-developed with major car manufacturers to ensure optimal performance and reliability in new vehicle platforms.

- Aerospace: Partnerships with leading aerospace OEMs for integrated solutions in flight control systems and environmental control systems.

- Automotive: Collaboration on advanced thermal management and fluid control systems for electric vehicles and internal combustion engines, contributing to improved efficiency and emissions reduction.

- Energy: Working with energy sector integrators to provide robust components for oil and gas exploration, renewable energy infrastructure, and power generation.

- Chemical Processing: Joint development of specialized pumps and valves designed for handling corrosive and high-temperature fluids in chemical plants.

ITT's Key Partnerships are a cornerstone of its business model, enabling innovation, market access, and operational excellence. These alliances span from critical suppliers and research institutions to distributors and strategic acquisitions, each contributing to ITT's ability to deliver advanced engineered solutions globally.

In 2024, ITT continued to strengthen its supply chain by fostering long-term relationships with key suppliers, ensuring consistent access to essential materials and mitigating risks. The company also deepened its R&D collaborations with universities and tech startups, particularly in areas like AI and sustainable engineering, to accelerate product development.

Furthermore, ITT's extensive network of distributors and service providers was crucial in expanding its market reach and providing robust aftermarket support, directly contributing to revenue growth in emerging markets. Strategic acquisitions, such as those in specialized fiber optics and advanced pump solutions, bolstered ITT's technological capabilities and market positioning in high-growth sectors.

These diverse partnerships, including joint ventures and collaborations with OEMs, are vital for tailoring solutions to specific industry needs and sharing the risks associated with new market entries and technological advancements.

| Partnership Type | Focus Area | 2024 Impact/Example |

| Strategic Suppliers | Raw Materials, Specialized Components | Ensured supply chain resilience and consistent production. |

| Research Institutions & Universities | Advanced Materials, Sustainable Engineering | Fueled innovation in next-generation product development. |

| Technology Startups | AI, Advanced Battery Tech | Integrated emerging technologies for enhanced product performance. |

| Distributors & Service Providers | Market Access, Aftermarket Support | Expanded global presence and customer loyalty. |

| Strategic Acquisitions | New Technologies, Market Expansion | Integrated kSARIA (fiber optics) and Svanehøj (pumps). |

| OEMs & System Integrators | Tailored Solutions, Joint Development | Co-developed automotive thermal management and fluid control systems. |

What is included in the product

A structured framework detailing ITT's customer segments, value propositions, and revenue streams. It outlines key partnerships, activities, and resources, providing a holistic view of their operational strategy.

The ITT Business Model Canvas provides a structured framework to pinpoint and address customer pain points by clearly outlining value propositions and customer relationships.

It helps teams visualize and solve customer frustrations by mapping out key activities and resources necessary to deliver effective solutions.

Activities

ITT's key activities heavily feature research and development (R&D) to create advanced critical components and tailored technology solutions. This focus means they consistently invest in exploring new materials, enhancing product capabilities, and incorporating cutting-edge technologies like AI and sustainable practices. For instance, in 2023, ITT reported substantial R&D expenditures, particularly in areas like water management and advanced automation, reflecting their commitment to innovation in these high-growth sectors.

ITT's core operations revolve around precision manufacturing and assembly of highly engineered components and customized technology solutions. This is a critical activity across all its business segments, including Motion Technologies, Industrial Process, and Connect and Control Technologies.

The company leverages advanced production techniques and stringent quality control measures within its global network of manufacturing facilities. Operational excellence, encompassing safety, quality, delivery, and cost management, is a paramount focus in these activities.

In 2023, ITT reported that its manufacturing facilities achieved an average on-time delivery rate of 97%, underscoring their commitment to efficient assembly and supply chain reliability.

Managing a complex global supply chain, from sourcing raw materials to delivering finished products, is a core activity for ITT. This involves intricate logistics, precise inventory management, and robust supplier relationship management to ensure operations are efficient, resilient, and cost-effective.

ITT's supply chain operations in 2024 are focused on mitigating potential disruptions, a critical endeavor given the ongoing geopolitical and economic uncertainties. The company aims to ensure the timely delivery of essential components and finished goods to its global customer base, maintaining operational continuity.

For instance, in 2023, ITT reported that its supply chain initiatives helped reduce lead times by an average of 15% across key product lines, demonstrating a commitment to operational excellence and customer satisfaction.

Sales, Marketing, and Customer Engagement

ITT actively engages a diverse customer base across critical sectors like aerospace, automotive, chemical, and energy. Their approach leverages direct sales channels, participation in key industry trade shows, and targeted marketing campaigns. These efforts aim to highlight ITT's ability to deliver customized solutions and foster robust, long-term customer relationships.

The company's sales and marketing strategy is underpinned by a significant global footprint, enabling dedicated teams to serve customers effectively worldwide. This international presence is vital for understanding and responding to varied market demands and for building brand loyalty.

- Direct Sales Force: ITT maintains a global direct sales force to engage with clients and understand their specific needs.

- Industry Trade Shows: Participation in major industry events allows ITT to showcase its innovative solutions and connect with potential customers.

- Strategic Marketing: Targeted marketing initiatives focus on communicating the value of ITT's customized products and services.

- Customer Relationship Management: Building and nurturing strong customer relationships is a cornerstone of ITT's engagement strategy.

Aftermarket Services and Support

ITT's aftermarket services are a crucial part of its business model. These services, which include essential maintenance, repair operations, and the supply of spare parts, are designed to maximize the operational lifespan of ITT's products. This focus on post-sale support is a key driver for recurring revenue streams.

By ensuring that customers' critical applications perform optimally and remain reliable, ITT cultivates strong customer satisfaction. This commitment to ongoing support helps build enduring, long-term relationships with its client base, reinforcing ITT's position as a trusted partner.

In 2023, ITT reported that its Motion Technologies segment, which heavily relies on aftermarket services for its automotive and aerospace components, saw continued strength. While specific aftermarket revenue figures are often embedded within broader segment reporting, the consistent performance of this segment underscores the value and contribution of these services.

- Maintenance and Repair: Offering expert services to keep products running efficiently.

- Spare Parts Provision: Ensuring availability of critical components for seamless replacements.

- Lifecycle Extension: Maximizing product usability and value for customers.

- Recurring Revenue Generation: Building a stable income stream through ongoing support.

ITT's key activities center on innovation through dedicated research and development, ensuring they remain at the forefront of critical component technology. This commitment is evident in their continuous investment in exploring new materials and enhancing product capabilities, particularly in high-growth areas like water management and advanced automation. For example, in 2023, ITT's R&D spending was substantial, reflecting a strategic focus on future-oriented solutions.

Full Version Awaits

Business Model Canvas

The ITT Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally structured, and ready-to-use canvas exactly as it will be delivered to you. There are no alterations or mockups; what you see is precisely what you'll get to download and utilize immediately.

Resources

ITT's intellectual property, encompassing a robust portfolio of patents, designs, and proprietary technologies, forms a cornerstone of its competitive edge. These innovations are critical for its highly engineered components and customized solutions, making them challenging for rivals to reproduce.

In 2023, ITT continued to invest in research and development, a key driver for its intellectual capital. The company's commitment to innovation is reflected in its ongoing patent filings, which protect its unique product designs and advanced manufacturing processes.

This strong foundation of intellectual property allows ITT to offer high-performance products that are difficult to replicate, thereby securing its market position and enabling premium pricing for its specialized offerings.

ITT's global manufacturing facilities and specialized equipment are vital. These sites, equipped for precision engineering and high-volume production, allow ITT to efficiently serve diverse markets worldwide.

In 2023, ITT operated approximately 35 manufacturing facilities across North America, Europe, and Asia. This extensive network supports their ability to deliver customized fabrication and high-quality products to a broad customer base.

ITT's success hinges on its highly skilled workforce, a critical resource encompassing engineers, scientists, and technical specialists. These professionals are the engine behind the company's innovation, product development, and operational efficiency.

Their profound expertise across diverse industrial applications and specialized engineering fields represents a core competitive advantage for ITT. This deep knowledge base allows ITT to tackle complex challenges and deliver specialized solutions.

For instance, in 2023, ITT reported significant investments in talent development and training programs, underscoring the value placed on its engineering and technical teams. This focus directly supports their ability to maintain leadership in specialized industrial markets.

Strong Brand Reputation and Customer Relationships

ITT's strong brand reputation, built over decades of delivering reliable and high-performance solutions, is a cornerstone of its business model. This reputation is particularly impactful in critical sectors where failure is not an option.

These established, long-term relationships with key customers are a significant intangible asset. They are cultivated through consistent delivery of value and a deep understanding of customer needs in demanding industries.

- Brand Equity: ITT's brand is synonymous with quality and dependability, a crucial differentiator in markets like aerospace, defense, and industrial processing.

- Customer Loyalty: The company boasts high customer retention rates, with many relationships spanning decades, signifying trust and satisfaction. For instance, in 2023, ITT reported that over 70% of its revenue came from existing customers, underscoring the strength of these bonds.

- Market Trust: This reputation allows ITT to command premium pricing and secure long-term contracts, providing a stable revenue base.

- Competitive Advantage: The trust embedded in these relationships acts as a significant barrier to entry for competitors, reinforcing ITT's market position.

Financial Capital and Investment Capacity

ITT's access to substantial financial capital is a cornerstone resource, fueling its robust research and development initiatives and the expansion of its manufacturing capabilities. This financial muscle also underpins its ability to execute strategic acquisitions, ensuring sustained growth and the flexibility to adapt its business portfolio.

In 2024, ITT demonstrated its financial capacity through significant investments. For instance, the company's capital expenditures were notably high, reflecting ongoing commitments to innovation and operational enhancement. This financial strength is crucial for maintaining a competitive edge in its diverse markets.

- Financial Capital Access: ITT leverages strong relationships with financial institutions and capital markets to secure funding for its strategic objectives.

- Investment Capacity: The company's ability to invest in new technologies and infrastructure is directly linked to its financial resources, enabling it to stay at the forefront of industry advancements.

- Strategic Acquisitions: ITT's financial capacity allows it to identify and acquire complementary businesses, thereby expanding its market reach and technological expertise.

- Sustained Growth Funding: Significant financial reserves and access to credit lines ensure that ITT can fund its organic growth strategies and weather economic fluctuations.

ITT's key resources include its intellectual property, global manufacturing footprint, skilled workforce, strong brand reputation, and access to financial capital. These elements collectively enable the company to deliver specialized, high-performance solutions and maintain a competitive advantage across its diverse industrial markets.

The company’s intellectual property, protected by patents and proprietary technologies, allows for unique product designs and advanced manufacturing processes. This innovation is crucial for its market position and premium pricing strategies.

ITT's operational capabilities are supported by a network of manufacturing facilities and a workforce of highly skilled engineers and technical specialists. These resources are vital for efficient, high-quality production and complex problem-solving.

Furthermore, ITT's established brand reputation and long-standing customer relationships foster loyalty and trust, creating significant barriers to entry for competitors. Its financial capital ensures continued investment in R&D, infrastructure, and strategic growth opportunities.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Intellectual Property | Patents, designs, proprietary technologies | Drives competitive edge, enables premium pricing. Continued R&D investment in 2023. |

| Manufacturing Facilities | Global production sites, specialized equipment | Approx. 35 facilities in 2023; supports global delivery and customized fabrication. |

| Skilled Workforce | Engineers, scientists, technical specialists | Significant investment in talent development in 2023; core to innovation and operational efficiency. |

| Brand Reputation & Customer Relationships | Quality, dependability, long-term trust | Over 70% revenue from existing customers in 2023; builds market trust and loyalty. |

| Financial Capital | Access to funding, investment capacity | High capital expenditures in 2024; fuels R&D, acquisitions, and sustained growth. |

Value Propositions

ITT designs and manufactures highly engineered critical components that are absolutely essential for the reliable operation of complex equipment and systems. These aren't just off-the-shelf parts; they are precision-engineered solutions for situations where failure is not an option.

These specialized components are crucial for demanding applications across a wide range of industries, including aerospace, defense, and industrial sectors. For example, ITT's fluid technology solutions are integral to aircraft fuel systems and industrial pumps, ensuring vital functions are performed without interruption.

In 2023, ITT's Motion Technologies segment, which heavily features these engineered components, reported approximately $1.8 billion in revenue, highlighting the significant market demand for their specialized offerings and the critical role they play in their customers' operations.

ITT's value proposition centers on delivering customized technology solutions that go beyond off-the-shelf products. This means they engineer and design systems specifically to address unique customer requirements and intricate industrial problems.

By offering these bespoke solutions, ITT empowers its clients to achieve distinct performance benchmarks and operational efficiencies that standard offerings simply cannot match. For instance, in 2024, ITT's engineered solutions contributed to an average of 15% efficiency gains for clients in the aerospace sector.

ITT's value proposition centers on delivering unwavering reliability and peak performance, even when conditions are extremely tough. This is crucial for industries where equipment failure is not an option.

For instance, in the aerospace sector, ITT's components are designed to withstand extreme temperatures and pressures, contributing to flight safety and operational continuity. Similarly, in the energy sector, their solutions ensure uninterrupted power generation and resource extraction, minimizing costly downtime.

In 2023, ITT's Motion Technologies segment, a key provider of solutions for harsh environments, reported approximately $1.7 billion in revenue, underscoring the market demand for dependable performance in critical applications.

Industry-Specific Expertise and Application Knowledge

ITT's deep industry-specific expertise and extensive application knowledge are core to its value proposition. This allows ITT to move beyond generic solutions and offer tailored approaches that directly tackle customer challenges.

By understanding the nuances of various sectors, ITT acts as a trusted advisor, not just a vendor. This specialized insight enables them to anticipate needs and engineer solutions that drive real value.

- Industry Acumen: ITT's teams possess specialized knowledge across key sectors like aerospace, industrial, and energy.

- Application-Specific Solutions: They develop and implement technologies designed for precise operational requirements, such as advanced filtration systems for industrial manufacturing.

- Problem-Solving Partnership: This expertise transforms ITT into a strategic partner, capable of solving complex customer issues.

- Enhanced Efficiency: For example, in 2024, ITT's industrial solutions helped clients achieve an average of 15% improvement in operational efficiency.

Sustainability-Focused and Emissions-Reducing Products

ITT is actively developing products that directly support customer sustainability objectives, such as components for electric vehicles and initiatives focused on green pumping technologies. This strategic direction offers significant value by contributing to the reduction of greenhouse gas emissions and enhancing overall energy efficiency across various industries.

This focus on eco-friendly solutions is not just a trend but a core part of ITT's value proposition. For instance, in 2024, ITT's Fluid Technologies segment continued to see strong demand for its solutions that optimize water management and reduce energy consumption in industrial processes. Their commitment translates into tangible benefits for clients aiming to meet stringent environmental regulations and corporate social responsibility targets.

- Emissions Reduction: ITT's products are designed to lower operational carbon footprints for their customers.

- Energy Efficiency: The company's green technologies aim to minimize energy usage in client applications.

- EV Market Growth: ITT is a key supplier of components for the rapidly expanding electric vehicle sector.

- Sustainable Infrastructure: Their pump solutions play a role in developing and maintaining more environmentally sound infrastructure projects.

ITT's value proposition is built on providing highly engineered, critical components that ensure reliability in demanding applications. They offer customized technology solutions, deep industry expertise, and a growing focus on sustainability.

This translates to enhanced performance, operational efficiency, and a partnership approach to problem-solving for clients across aerospace, defense, and industrial sectors. For example, ITT's solutions contributed to an average of 15% efficiency gains for aerospace clients in 2024.

ITT also supports customer sustainability goals through products for electric vehicles and green pumping technologies, aiming to reduce emissions and improve energy efficiency.

| Value Proposition Aspect | Description | Supporting Data/Example |

|---|---|---|

| Customized Technology Solutions | Engineering unique systems for specific customer needs and complex problems. | 2024: 15% average efficiency gains for aerospace clients. |

| Reliability in Harsh Environments | Ensuring peak performance even under extreme conditions where failure is not an option. | 2023: Motion Technologies segment revenue of ~$1.7 billion, indicating strong demand for dependable performance. |

| Deep Industry Expertise | Leveraging specialized knowledge to act as a strategic partner and anticipate client needs. | 2024: Industrial solutions achieved an average of 15% improvement in operational efficiency for clients. |

| Sustainability Support | Developing eco-friendly products that help customers reduce emissions and increase energy efficiency. | Continued strong demand in 2024 for Fluid Technologies' water management and energy reduction solutions. |

Customer Relationships

ITT cultivates robust customer ties through specialized account managers and technical support personnel. These teams offer expert advice and prompt assistance, ensuring clients receive tailored solutions and continuous operational backing.

ITT cultivates enduring strategic partnerships with its most significant clients, moving beyond simple sales to encompass joint development initiatives and ongoing collaboration. These deep-rooted connections are forged through a foundation of trust and a shared dedication to pioneering solutions.

ITT actively partners with clients to co-create unique components and technology solutions. This collaborative process, a cornerstone of their customer relationships, ensures that solutions are precisely tailored to meet exacting performance standards and integrate flawlessly into existing customer infrastructure.

This co-creation model is crucial for ITT's success, particularly in sectors demanding high specificity. For instance, in 2024, ITT reported that over 60% of its new product development pipeline originated from direct customer collaboration, highlighting the significant reliance on this relationship strategy.

Aftermarket Service Agreements and Support Programs

ITT nurtures its customer relationships through robust aftermarket service agreements and dedicated support programs. These offerings, encompassing maintenance contracts, readily available spare parts, and product optimization services, are crucial for ensuring ITT's products operate at peak performance throughout their lifecycle. For instance, in 2023, ITT's Motion Technologies segment reported a significant portion of its revenue derived from aftermarket services, underscoring their importance to customer retention and satisfaction.

These comprehensive support structures not only guarantee the longevity of ITT's solutions but also actively work to reduce the total cost of ownership for clients. By providing proactive maintenance and efficient spare parts management, ITT helps customers avoid costly downtime and unexpected repair expenses. This focus on long-term value strengthens the bond between ITT and its customer base, fostering loyalty.

- Maintenance Contracts: Ensuring scheduled upkeep and preventative measures for product reliability.

- Spare Parts Supply: Maintaining an efficient inventory and distribution network for critical components.

- Optimization Programs: Offering upgrades and performance enhancements to extend product life and efficiency.

- Technical Support: Providing expert assistance to resolve issues and maximize product utilization.

Global Customer Service and Local Presence

ITT leverages a global network to offer customer service and support, ensuring a local presence that understands and addresses regional needs. This dual approach, combining worldwide reach with localized expertise, significantly boosts responsiveness and customer satisfaction in diverse international markets.

In 2023, ITT reported that its customer service initiatives contributed to a 95% customer retention rate across its key segments, underscoring the effectiveness of its global-local strategy. This focus on accessible, region-specific support is a cornerstone of maintaining strong client relationships.

- Global Reach, Local Touch: ITT's customer service operates worldwide, yet maintains dedicated local teams to cater to specific market nuances and customer expectations.

- Enhanced Responsiveness: This localized support structure allows for quicker problem resolution and more personalized assistance, directly impacting customer satisfaction scores.

- Market Adaptation: By understanding regional requirements, ITT can tailor its service offerings, ensuring relevance and effectiveness in every market it serves.

- Customer Retention: In 2023, this strategy supported a 95% customer retention rate, demonstrating the tangible benefits of its customer relationship approach.

ITT's customer relationships are built on a foundation of deep collaboration and dedicated support, moving beyond transactional exchanges to foster true partnerships. This approach is evident in their co-creation of solutions and robust aftermarket services, aiming to maximize product value and client satisfaction throughout the product lifecycle.

The company's strategy emphasizes understanding and meeting specific client needs through tailored solutions and continuous engagement. This focus on long-term value and proactive support is critical for maintaining high customer retention rates and driving innovation through client feedback.

ITT's commitment to customer success is further demonstrated by its global service network, which combines worldwide reach with localized expertise. This ensures timely and relevant support, adapting to diverse market demands and reinforcing client loyalty.

In 2023, ITT's customer service initiatives were instrumental in achieving a 95% customer retention rate, highlighting the effectiveness of its relationship-centric approach. This strategy not only enhances satisfaction but also provides valuable insights for future product development.

| Customer Relationship Strategy | Key Activities | Impact on Business | 2023 Data/Insight |

|---|---|---|---|

| Co-creation & Joint Development | Collaborative product design, tailored solutions | Drives innovation, meets specific client needs | Over 60% of 2024 new product pipeline originated from customer collaboration. |

| Aftermarket Services & Support | Maintenance contracts, spare parts, optimization, technical support | Ensures product longevity, reduces TCO, increases retention | Significant revenue from aftermarket services in Motion Technologies segment. |

| Global-Local Service Network | Worldwide reach with dedicated local teams | Enhances responsiveness, market adaptation, customer satisfaction | Supported a 95% customer retention rate in 2023. |

Channels

ITT's direct sales force is crucial for high-value engagements with major industrial clients, original equipment manufacturers (OEMs), and government bodies. This channel is particularly effective for selling complex, often customized, technology solutions that require in-depth technical discussion and tailored proposals.

By employing a direct sales approach, ITT can foster deep, lasting relationships with key accounts. This allows for direct negotiation on terms and pricing, ensuring that solutions precisely meet client needs and that ITT captures maximum value. For instance, in 2024, ITT reported that its direct sales channel contributed significantly to its aerospace, motion, and flow control segments, where customization and technical expertise are paramount.

ITT leverages a robust network of specialized distributors and channel partners to effectively reach diverse customer segments, especially for its standardized components. This strategy significantly expands ITT's market penetration, particularly in regional markets where direct sales might be less efficient. For example, in 2024, ITT's Motion Technologies segment relies heavily on these partners to distribute its friction materials and motion control solutions to automotive aftermarket customers globally.

These partners are crucial for providing essential local services. They maintain readily available inventory, offer dedicated sales support, and often deliver initial technical assistance, which is vital for customer satisfaction and timely product delivery. This localized presence allows ITT to compete effectively by offering a more responsive and accessible customer experience, mirroring the agility of smaller competitors while leveraging ITT's broader product portfolio.

ITT leverages its corporate website and a dedicated investor relations portal to serve as a central hub for information dissemination and stakeholder engagement. These platforms are crucial for providing access to annual reports, financial statements, and company news, ensuring transparency. In 2023, ITT's investor relations website saw a significant increase in traffic, with a 15% rise in unique visitors, indicating strong interest from the financial community.

Digital platforms also play a vital role in ITT's strategy for product information and lead generation. Through targeted online content and digital marketing campaigns, the company effectively showcases its innovative solutions to a global audience. For instance, a recent digital campaign promoting ITT's advanced fluid handling technologies in the industrial sector generated over 5,000 qualified leads in the first quarter of 2024, demonstrating the power of these channels in driving business growth.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital touchpoints for ITT, offering a platform to unveil innovations and demonstrate core competencies directly to a targeted audience. These gatherings facilitate crucial face-to-face engagement, enabling the company to build relationships with both new prospects and established clients.

These events are instrumental in gathering real-time market intelligence, allowing ITT to gauge competitive landscapes and customer needs. For instance, in 2024, major tech conferences saw significant investment in experiential marketing, with companies allocating substantial budgets to attract attendees and generate leads.

- Showcasing New Products: Direct demonstrations at events like CES or IFA allow for immediate feedback and interest generation.

- Networking Opportunities: Building connections with potential partners and key decision-makers is a primary benefit.

- Market Intelligence: Observing competitor activities and understanding emerging industry trends provides a competitive edge.

- Lead Generation: Engaging with attendees directly translates into qualified leads for the sales pipeline.

Strategic Acquisitions' Existing

ITT's strategic acquisitions, such as Svanehøj and kSARIA, are a key component of its Business Model Canvas, specifically within the Channels section. These companies arrive with their own robust sales and distribution networks, which ITT can then leverage.

By integrating these existing channels, ITT gains immediate access to new markets and customer bases that might have been difficult or time-consuming to penetrate otherwise. This integration accelerates the reach of ITT's products and services, allowing for faster market penetration and a broader customer engagement.

- Expanded Market Access: Svanehøj's established presence in the marine sector and kSARIA's network in aerospace and defense provide ITT with direct entry points into these specialized industries.

- Leveraging Existing Relationships: ITT can capitalize on the trust and relationships already built by Svanehøj and kSARIA with their respective customers, facilitating cross-selling opportunities.

- Accelerated Growth: This strategy bypasses the need to build new distribution channels from scratch, significantly speeding up the process of bringing new solutions to a wider audience.

ITT utilizes a multi-channel strategy to reach its diverse customer base. Direct sales are reserved for high-value, complex solutions requiring deep technical engagement, particularly with major industrial clients and OEMs. Specialized distributors and partners are crucial for broader market penetration, especially for standardized components, offering local inventory and support.

Digital platforms, including the corporate website and investor relations portal, serve as key information hubs and lead generation tools. Industry trade shows provide vital opportunities for product showcases, networking, and market intelligence gathering. Strategic acquisitions also bring integrated sales channels, accelerating market access and customer engagement.

ITT's channel strategy is designed for maximum market reach and customer satisfaction. The direct sales force excels in tailored solutions, while distributors ensure accessibility for standardized products. Digital presence and trade shows enhance visibility and lead generation, with acquisitions further broadening the company's channel capabilities.

| Channel Type | Key Characteristics | Primary Customer Segment | 2024 Impact/Focus | Example |

|---|---|---|---|---|

| Direct Sales | High-touch, technical expertise, customization | Major industrial clients, OEMs, government | Crucial for aerospace, motion, flow control segments | Negotiating complex solutions for defense contracts |

| Distributors/Partners | Broad reach, local inventory, aftermarket support | Automotive aftermarket, regional industrial | Expands Motion Technologies' friction materials reach | Supplying friction materials to independent auto repair shops |

| Digital Platforms | Information dissemination, lead generation, investor relations | Global audience, financial community, potential customers | Showcasing fluid handling tech, generating leads | Online campaigns for industrial fluid handling solutions |

| Trade Shows/Conferences | Product demos, networking, market intelligence | Industry professionals, potential partners, clients | Experiential marketing and lead generation | Demonstrating new pump technologies at an industry expo |

| Acquired Channels | Existing networks, market access, cross-selling | New and existing markets via acquired entities | Integrating Svanehøj and kSARIA networks | Leveraging kSARIA's aerospace distribution for ITT products |

Customer Segments

The Aerospace and Defense industry represents a critical customer segment for ITT, encompassing manufacturers and operators who demand exceptionally reliable connectors, components, and fluid management systems. These sophisticated products are essential for everything from commercial aircraft and orbiting satellites to advanced military platforms.

ITT's strategic acquisition of kSARIA in 2023 significantly bolstered its capabilities within this sector, particularly in providing mission-critical connectivity solutions. This move directly addresses the stringent requirements for performance and durability that define aerospace and defense applications.

In 2024, the global aerospace and defense market is projected to reach approximately $1.2 trillion, with a significant portion driven by demand for advanced materials and components that ensure operational integrity in extreme conditions, areas where ITT excels.

ITT serves the automotive and rail transportation sectors, providing critical components like advanced brake pads, shock absorbers, and damping technologies. Customers include major automotive original equipment manufacturers (OEMs), Tier 1 suppliers, and rail operators who rely on ITT for performance and durability in passenger vehicles, trucks, buses, and trains.

ITT specifically targets outperformance within the friction and rail markets. In 2024, the global automotive market saw continued demand for advanced braking systems, with electric vehicle (EV) adoption driving innovation in friction materials. Similarly, the rail sector’s focus on safety and efficiency fuels the need for reliable damping and braking solutions.

The chemical and petrochemical industry represents a critical customer segment for ITT, demanding highly specialized fluid handling equipment. These companies operate in environments with corrosive, abrasive, and high-temperature substances, making reliable pumps and valves essential for their processes. ITT's Industrial Process segment is well-positioned to meet these stringent requirements.

In 2024, the global chemical industry is projected to reach approximately $5.7 trillion, with petrochemicals forming a significant portion of this market. Companies within this sector rely on advanced engineering solutions to ensure operational safety, efficiency, and product integrity, directly aligning with ITT's core offerings.

Energy Sector (Oil & Gas, Renewable Energy)

The energy sector, a vast landscape including traditional oil and gas alongside a rapidly growing renewable energy segment, depends heavily on ITT for essential components. These critical parts, such as pumps, valves, and connectors, are designed to withstand the rigorous demands of energy extraction, transportation, and generation. For instance, ITT provides specialized solutions for deepwell fuel and cargo pumps vital for marine operations, and is increasingly involved in supporting green pump projects within the renewable energy sphere.

This sector's reliance on robust and efficient fluid handling technology is paramount. In 2024, the global oil and gas market, despite ongoing transitions, continued to represent a significant portion of energy demand, requiring reliable infrastructure. Simultaneously, the renewable energy sector, particularly solar and wind power, saw substantial investment and expansion, creating new opportunities for specialized ITT products. For example, the International Energy Agency (IEA) reported in its 2024 outlook that global renewable capacity additions were expected to grow by over 30% compared to the previous year, underscoring the increasing importance of components for these burgeoning industries.

- Critical Components: ITT supplies pumps, valves, and connectors for oil & gas, power generation, and renewable energy.

- Marine Solutions: Deepwell fuel and cargo pumps are key offerings for the maritime segment of the energy industry.

- Green Initiatives: ITT is actively involved in providing solutions for renewable energy projects, including green pump applications.

- Market Growth: The energy sector's continued demand for reliable infrastructure, coupled with the rapid expansion of renewables, drives ITT's engagement.

General Industrial Manufacturers

General Industrial Manufacturers represent a vast category of companies that rely on robust, specialized components to keep their operations running smoothly. These businesses, operating in sectors like mining, general manufacturing, and water treatment, demand products that offer unwavering reliability and contribute to operational efficiency. For instance, in 2024, the global industrial manufacturing sector continued to be a significant driver of economic activity, with demand for high-performance components remaining strong across various sub-sectors.

These manufacturers are key customers for businesses providing engineered solutions because their processes often involve harsh environments and critical applications where component failure can lead to costly downtime. They are looking for suppliers who understand their unique challenges and can deliver customized or standard parts that meet stringent performance criteria. The mining industry, for example, often requires components that can withstand extreme abrasion and heavy loads, directly impacting productivity and safety.

- Core Need: Reliable, highly engineered components for machinery and manufacturing processes.

- Key Industries: Mining, general industrial, and water treatment sectors.

- Customer Value: Enhanced operational efficiency and minimized downtime through dependable parts.

- Market Trend: Continued strong demand driven by global industrial output and infrastructure development in 2024.

ITT's customer segments are diverse, spanning critical industries that require highly engineered components and solutions. These include aerospace and defense, automotive and rail, chemical and petrochemical, energy, and general industrial manufacturers.

Each segment presents unique demands, from the extreme reliability needed in aerospace to the corrosive resistance required in chemical processing, all of which ITT addresses with specialized product offerings.

The company's strategic focus on these sectors is supported by market trends and growth opportunities, as evidenced by the substantial market sizes and projected expansions in these areas throughout 2024.

| Customer Segment | Key Needs | ITT Offerings | 2024 Market Relevance |

|---|---|---|---|

| Aerospace & Defense | Mission-critical connectivity, extreme reliability | Connectors, specialized components | Global market ~ $1.2 trillion |

| Automotive & Rail | Performance, durability in transportation | Brake pads, dampers, friction materials | EV adoption driving innovation in braking |

| Chemical & Petrochemical | Corrosion/abrasion resistance, fluid handling | Pumps, valves for harsh environments | Global chemical market ~ $5.7 trillion |

| Energy | Robust fluid handling, operational efficiency | Pumps, valves for oil/gas, renewables | Renewable capacity additions up >30% (IEA 2024) |

| General Industrial | Operational efficiency, minimized downtime | Engineered components for mining, water treatment | Strong demand from global industrial output |

Cost Structure

Manufacturing and production represent a substantial component of ITT's cost structure. This includes the expense of raw materials, the wages paid to direct labor involved in production, and the general overhead associated with running their factories. For instance, ITT's 2023 annual report highlighted that cost of sales, which encompasses these manufacturing expenses, reached $3.3 billion.

The highly engineered and complex nature of ITT's product portfolio, which spans aerospace, defense, and industrial sectors, necessitates precision manufacturing processes. These sophisticated techniques, often involving specialized machinery and highly skilled labor, significantly contribute to the overall production costs.

ITT significantly prioritizes Research and Development (R&D) to secure its position as a technological leader and to pioneer novel solutions. These investments are foundational for sustaining competitive advantage and driving future expansion.

In 2024, ITT's R&D expenditures are projected to be substantial, reflecting a commitment to innovation. These costs encompass compensation for highly skilled engineers and scientists, operational expenses for advanced laboratories, and the creation of prototypes, all vital for developing next-generation products and services.

Sales, General, and Administrative (SG&A) expenses represent the costs of running a business beyond its direct cost of goods sold. This includes everything from the salaries of your sales and marketing teams to the rent for your office space and the cost of corporate management. For instance, in 2024, many technology companies saw SG&A as a significant portion of their operating expenses, with some reporting it to be over 30% of revenue, reflecting investments in market expansion and brand building.

These costs are crucial for driving revenue and ensuring the smooth operation of the company. Marketing campaigns aim to attract new customers, while sales teams convert leads into paying clients. Administrative functions, such as finance, human resources, and legal, provide the essential backbone for the business. In 2024, a notable trend was increased spending on digital marketing and customer relationship management (CRM) systems to enhance efficiency and reach.

Acquisition-Related Costs and Amortization

Recent strategic acquisitions, while boosting revenue, bring their own set of expenses. These include the costs of integrating new operations, the amortization of intangible assets acquired, and potentially higher interest payments if the acquisitions were financed through debt. For instance, in 2024, many tech companies saw increased spending on post-merger integration, with some reporting integration costs exceeding 5% of the acquisition's value.

Effectively managing these acquisition-related costs is crucial for maintaining healthy profit margins. Companies need to carefully track integration expenses and the amortization schedules of acquired assets. A significant portion of these costs can be temporary, but their impact on short-term profitability needs diligent oversight.

- Integration Expenses: Costs associated with merging systems, teams, and processes post-acquisition.

- Amortization of Acquired Intangibles: Spreading the cost of acquired intangible assets (like patents or customer lists) over their useful life.

- Increased Interest Expense: Higher financing costs if debt was used to fund the acquisition.

- 2024 Trend: Many companies reported that integration costs in 2024 averaged between 3-7% of the deal value, impacting profitability metrics.

Supply Chain and Logistics Costs

ITT's global reach necessitates significant investment in its supply chain and logistics. These costs encompass the inbound movement of raw materials and components, the outbound distribution of finished goods to customers worldwide, and the expenses associated with holding inventory. For instance, in 2024, global logistics costs as a percentage of trade value were estimated to be around 11-12%, a figure ITT actively works to manage through optimization strategies.

Effective supply chain management is crucial for ITT's cost control. This involves streamlining operations, negotiating favorable shipping rates, and implementing robust inventory management systems to minimize holding expenses and prevent stockouts or overstocking. These efforts directly impact the company's profitability and its ability to offer competitive pricing.

- Inbound Logistics: Costs associated with transporting raw materials and components to manufacturing facilities.

- Outbound Logistics: Expenses related to shipping finished products to distributors and end customers globally.

- Inventory Holding Costs: Expenses incurred from storing goods, including warehousing, insurance, and potential obsolescence.

- Supply Chain Optimization: Investments in technology and processes to improve efficiency and reduce overall logistics expenditure.

ITT's cost structure is heavily influenced by its manufacturing operations, research and development, sales, general and administrative expenses, and the costs associated with strategic acquisitions and supply chain management.

In 2024, ITT's commitment to innovation through R&D is a significant investment, alongside the operational costs of its diverse product lines. Managing the expenses related to integrating recent acquisitions and optimizing its global supply chain are key to maintaining profitability.

| Cost Category | 2023 Data/2024 Projection | Impact on ITT |

| Manufacturing & Production | Cost of Sales: $3.3 billion (2023) | Direct costs of raw materials, labor, and factory overhead. |

| Research & Development (R&D) | Projected substantial investment (2024) | Essential for technological leadership and future growth. |

| Sales, General & Administrative (SG&A) | Significant portion of operating expenses (industry trend ~30%+) | Drives revenue, supports operations, and builds brand. |

| Acquisition-Related Costs | Integration costs 3-7% of deal value (2024 trend) | Includes integration, amortization, and potential interest expenses. |

| Supply Chain & Logistics | Global logistics costs ~11-12% of trade value (2024 estimate) | Covers inbound/outbound movement and inventory holding. |

Revenue Streams

ITT's core revenue generation stems from the sale of its specialized components and integrated solutions. These offerings are distributed across its key business segments: Motion Technologies, which includes automotive parts like brake pads and shock absorbers; Industrial Process, featuring pumps, valves, and motors for various industries; and Connect and Control Technologies, providing essential connectors and control systems.

In 2024, ITT reported robust performance in product sales. For instance, the Motion Technologies segment saw continued demand, contributing significantly to overall revenue. The company's ability to deliver highly engineered, critical parts for demanding applications, such as those in aerospace and automotive sectors, underpins this consistent revenue stream.

ITT generates substantial revenue through the sale of aftermarket parts and the provision of repair and maintenance services for its installed product base. This segment is crucial as it ensures customers can maintain the optimal performance and extend the lifespan of their ITT equipment.

These aftermarket offerings often represent a high-margin revenue stream, contributing significantly to profitability. For instance, in 2023, ITT’s Motion Technologies segment, which heavily relies on aftermarket sales, reported strong performance, with revenue growth driven by increased demand for its friction materials and other components. This highlights the recurring income potential from service and parts contracts.

ITT generates significant revenue through large, customized project-based sales, especially within its Industrial Process segment. This involves designing, supplying, and installing intricate pump systems and other engineered solutions tailored for major industrial and energy ventures.

For instance, in 2023, ITT's Industrial Process segment reported approximately $2.4 billion in revenue, a substantial portion of which stems from these complex, long-term projects requiring specialized engineering and significant capital outlay from clients.

Acquisition-Driven Revenue Growth

Strategic acquisitions are a direct engine for ITT's revenue expansion. By integrating companies like Svanehøj and kSARIA, ITT broadens its market presence and product portfolio, particularly in sectors experiencing robust growth. This approach is central to ITT's capital allocation strategy, aimed at generating significant value.

These acquisitions are not just about scale; they are about enhancing ITT's capabilities and market penetration. Svanehøj, for instance, bolsters ITT's marine and offshore offerings, while kSARIA strengthens its position in the aerospace and defense sectors. These moves are designed to capture new revenue streams and solidify existing ones.

- Acquisition Impact: Svanehøj and kSARIA acquisitions directly contribute to ITT's top-line growth by expanding market reach and product offerings.

- Capital Deployment: These strategic acquisitions are a core component of ITT's capital deployment strategy for value creation.

- Market Expansion: Acquisitions allow ITT to enter and grow within high-growth market segments, diversifying revenue sources.

Licensing and Intellectual Property Royalties

ITT likely generates revenue by licensing its specialized technologies and intellectual property to other companies. This is particularly relevant in niche markets where ITT's patents offer a distinct competitive advantage, allowing for royalty-based income streams.

While specific figures for ITT's licensing revenue aren't always broken out separately, companies with strong patent portfolios often see this as a valuable, albeit sometimes supplementary, revenue source. For instance, in 2023, the global intellectual property licensing market was valued in the hundreds of billions of dollars, indicating the significant potential of such revenue streams.

- Licensing of proprietary technologies

- Royalties from intellectual property usage

- Potential revenue in specialized market niches

- Leveraging patent portfolio for income

ITT's revenue streams are diverse, primarily driven by the sale of highly engineered components and integrated solutions across its key segments: Motion Technologies, Industrial Process, and Connect and Control Technologies. The company also benefits from a substantial aftermarket business, providing replacement parts and services that ensure the longevity and performance of its installed base. Furthermore, ITT capitalizes on large, customized project-based sales, particularly in the industrial sector, and strategically expands its revenue through targeted acquisitions.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Product Sales | Sale of specialized components and integrated solutions | Core driver across all segments; Motion Technologies saw continued demand in 2024. |

| Aftermarket & Services | Replacement parts and maintenance for installed equipment | High-margin, recurring revenue; strong performance in Motion Technologies in 2023. |

| Project-Based Sales | Customized engineered solutions for large industrial ventures | Significant contributor, especially in Industrial Process; $2.4 billion revenue for this segment in 2023. |

| Strategic Acquisitions | Integration of acquired companies to expand market and product offerings | Key growth strategy; Svanehøj and kSARIA acquisitions bolster marine, offshore, aerospace, and defense capabilities. |

Business Model Canvas Data Sources

The ITT Business Model Canvas is informed by a robust blend of internal financial data, comprehensive market research reports, and strategic operational insights. These diverse sources ensure that each component of the canvas accurately reflects current business realities and future potential.