ITT Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITT Bundle

Discover how ITT masterfully blends its product offerings, pricing strategies, distribution channels, and promotional activities to capture market share. This analysis goes beyond surface-level observations to reveal the strategic brilliance behind their marketing success.

Unlock the full potential of your own marketing efforts by understanding ITT's winning formula. Get instant access to an in-depth, editable report that breaks down each of the 4Ps with actionable insights and real-world examples.

Product

ITT's highly engineered critical components, such as advanced brake pads and damping systems, are vital for safety and performance in the automotive and rail sectors. These specialized parts are engineered to withstand extreme conditions, ensuring reliability in demanding transportation applications.

For instance, ITT's friction materials, a key part of their critical components offering, are designed for high-performance braking, crucial for passenger and freight rail safety. In 2023, ITT's Motion Technologies segment, which houses many of these critical components, generated approximately $1.5 billion in revenue, underscoring the significant market demand for these engineered solutions.

Customized Technology Solutions are the product in this marketing mix, focusing on tailored offerings for fluid-process equipment. This means the company doesn't just sell standard pumps and valves; they engineer specialized systems to fit unique client needs in demanding industries like oil & gas, mining, and power generation. For instance, a recent report indicated that in 2024, the global industrial pumps market reached an estimated $45.5 billion, with a significant portion driven by customized solutions for complex applications.

These solutions are more than just hardware; they represent integrated engineering expertise designed to optimize industrial processes. Think of it as a bespoke suit for machinery, ensuring peak performance and efficiency. The demand for such precision engineering is evident as companies increasingly seek to reduce operational costs and improve output, with custom-engineered fluid handling systems often delivering substantial energy savings, sometimes upwards of 15% in pilot programs.

ITT's Advanced Connectivity Solutions, primarily through its Connect and Control Technologies segment, provides essential cable assemblies and connectors for demanding aerospace, defense, and industrial sectors. These are not just standard parts; they are engineered for reliability in the most critical situations.

The strategic acquisition of kSARIA in 2024 was a pivotal move, bolstering ITT's capabilities, particularly in harsh environment connectivity. This acquisition expanded their offerings in specialized areas, strengthening their position in markets where performance under extreme conditions is paramount.

In 2024, ITT's Connect and Control Technologies segment saw robust performance, with revenue reaching approximately $1.3 billion, showcasing the growing demand for their advanced connectivity solutions. The integration of kSARIA is expected to contribute an additional $150 million in annual revenue starting in 2025, further solidifying ITT's market leadership.

Sustainable & Energy-Efficient Offerings

ITT's commitment to sustainability is increasingly reflected in its product portfolio. A significant and growing share of ITT's revenue now originates from electric and emissions-reducing products. This includes offerings like advanced brake pads for electric vehicles (EVs) and hybrids, as well as green pump projects that contribute to environmental efficiency.

This strategic focus aligns directly with prevailing global sustainability trends and increasing demand for eco-friendly solutions. For instance, in 2023, ITT reported that its motion technologies segment, which houses many of these sustainable offerings, saw robust growth, driven in part by the automotive sector's shift towards electrification.

Furthermore, ITT is actively investing in and developing next-generation, environmentally conscious technologies. A prime example is the VIDAR industrial motor, engineered specifically for significant energy savings, showcasing ITT's dedication to innovation that benefits both its customers and the planet.

- Growing Revenue from Green Products: ITT's electric and emissions-reducing products, like EV/hybrid brake pads, are becoming a larger contributor to overall revenue.

- Alignment with Global Trends: The company's focus on green pump projects and sustainable solutions mirrors the increasing global emphasis on environmental responsibility.

- Innovation in Energy Efficiency: Development of technologies like the VIDAR industrial motor highlights ITT's commitment to creating energy-saving solutions.

- Market Demand: The increasing adoption of EVs and the push for industrial energy efficiency are creating a strong market for ITT's sustainable offerings.

Comprehensive Aftermarket Services

ITT's commitment extends beyond initial product sales through comprehensive aftermarket services, ensuring sustained operational excellence for its industrial clients. This focus on the long-term performance and reliability of its installed base is a critical component of its marketing mix.

These services are designed to maximize customer value, offering solutions like plant optimization and efficiency improvements. For instance, ITT's digital solutions are increasingly integrated into aftermarket offerings, aiming to predict maintenance needs and reduce downtime. In 2023, ITT reported that its Motion Technologies segment, which heavily relies on aftermarket support for its friction materials and other components, saw continued demand for these services, contributing significantly to its overall revenue stream.

- Extended Product Lifespan: ITT's aftermarket services focus on maintenance, repair, and upgrades to prolong the operational life of its equipment.

- Performance Optimization: Services such as diagnostic analysis and efficiency upgrades help customers achieve peak performance from their ITT systems.

- Customer Support Network: A robust global network ensures timely access to spare parts and expert technical assistance, minimizing operational disruptions.

- Digital Integration: ITT is enhancing aftermarket offerings with digital tools for predictive maintenance and remote monitoring, improving reliability and reducing costs for clients.

ITT's product strategy centers on highly engineered, critical components and customized technology solutions across its key segments. These offerings are designed for demanding environments, emphasizing safety, performance, and efficiency. The company's portfolio includes advanced friction materials for transportation, specialized fluid-process equipment, and robust connectivity solutions for aerospace and defense.

| Segment | Key Product Focus | 2023 Revenue (Approx.) | Key Growth Driver |

|---|---|---|---|

| Motion Technologies | Advanced brake pads, damping systems, friction materials | $1.5 billion | Automotive electrification, rail safety |

| Fluid Technologies | Customized pumps, valves, fluid-process equipment | N/A (Integrated into other segments reporting) | Industrial efficiency, oil & gas, mining |

| Connect & Control Technologies | Cable assemblies, connectors, harsh environment solutions | $1.3 billion | Aerospace, defense, industrial automation |

What is included in the product

This analysis provides a comprehensive examination of ITT's marketing mix, dissecting its Product, Price, Place, and Promotion strategies with real-world examples and strategic insights.

It's designed for professionals seeking a deep understanding of ITT's market positioning, offering a structured foundation for strategy audits and competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for quick decision-making.

Place

ITT leverages a robust direct sales model, supported by a significant global presence. With employees in over 35 countries and sales reaching approximately 125 countries, the company ensures direct engagement with a vast and diverse customer base across critical industries like aerospace and general industrial sectors.

This expansive network enables ITT to effectively serve varied markets by directly connecting with key decision-makers and major project stakeholders, fostering strong client relationships and understanding local market needs.

ITT strategically employs specialized distributors and channel partners for its highly engineered product lines. These partners bring deep industry knowledge and technical expertise, ensuring efficient reach into niche markets. For instance, in the industrial sector, ITT's fluid technology division partners with distributors who specialize in handling complex fluid handling systems for industries like aerospace and energy, providing crucial local support. This specialized approach allows for quick product access and often includes inventory management and initial technical assistance for end-users, mirroring the trend observed in 2024 where B2B distribution channels are increasingly focusing on value-added services.

ITT strategically positions its manufacturing facilities in key global markets like the United States, Germany, and South Korea. This global footprint ensures efficient production of complex components and facilitates timely delivery to customers worldwide.

These manufacturing hubs are crucial for meeting regional market demands and strengthening ITT's global supply chain. For instance, in 2024, ITT reported that its diversified manufacturing base contributed to a significant reduction in logistics costs, enhancing its competitive edge in delivering critical parts.

Online Platforms and Digital Engagement

ITT leverages online platforms to provide comprehensive product information, detailed technical specifications, and support for its B2B clientele. While direct e-commerce might be limited to specific aftermarket parts, digital channels are crucial for customer engagement and lead generation. In 2023, ITT's investor relations website saw consistent traffic, reflecting its commitment to transparency and accessibility for stakeholders.

Digital engagement extends to showcasing their technological advancements and solutions. The company actively maintains its newsroom and corporate social responsibility sections online, ensuring stakeholders have access to the latest updates. This digital presence is vital for building brand awareness and trust within the industrial sector.

- Digital Presence: ITT's website serves as a primary hub for product catalogs, engineering data, and company news.

- Customer Support: Online portals offer technical documentation and support channels, streamlining customer interactions.

- Investor Relations: The investor relations section provides financial reports, SEC filings, and corporate governance information, updated frequently.

- Content Marketing: ITT likely uses digital content, such as white papers and case studies, to educate potential clients on their solutions.

Integrated Supply Chain Management

Integrated Supply Chain Management is a critical element of ITT's marketing mix, ensuring that highly engineered components are available precisely when and where customers need them. This focus on optimizing inventory and global logistics directly supports timely project execution and consistent supply, a key differentiator for ITT.

ITT's commitment to efficient supply chain operations is underscored by its strategic management of complex global networks. This approach not only enhances operational efficiency but also builds customer trust by guaranteeing product availability for critical applications.

- Optimized Inventory: ITT aims to maintain lean yet sufficient inventory levels for critical components, balancing availability with carrying costs.

- Global Logistics Network: The company manages a sophisticated network to ensure timely delivery across diverse geographical markets.

- Project Support: Supply chain efficiency directly enables ITT to meet the demanding timelines of its customers' projects, particularly in sectors like aerospace and industrial automation.

- Operational Efficiency Gains: In 2023, ITT reported a 5% improvement in on-time delivery rates, a direct result of enhanced supply chain visibility and management.

ITT's place strategy focuses on a multi-channel approach, combining direct sales with specialized distributors to reach its global customer base. This ensures accessibility for highly engineered products across various industrial sectors.

The company's extensive physical presence, with employees in over 35 countries and sales in approximately 125, facilitates direct engagement and tailored support. Furthermore, strategic manufacturing locations in the US, Germany, and South Korea enhance efficient production and timely delivery.

ITT also utilizes digital platforms for product information and customer engagement, complementing its physical distribution network. This integrated approach ensures ITT's solutions are readily available to its diverse clientele.

| Channel | Reach | Focus |

|---|---|---|

| Direct Sales | 125 Countries | Key decision-makers, major projects |

| Specialized Distributors | Niche Markets | Industry expertise, local support |

| Manufacturing Hubs | Global Markets | Efficient production, timely delivery |

| Digital Platforms | Global B2B Clientele | Product info, technical support, lead generation |

What You See Is What You Get

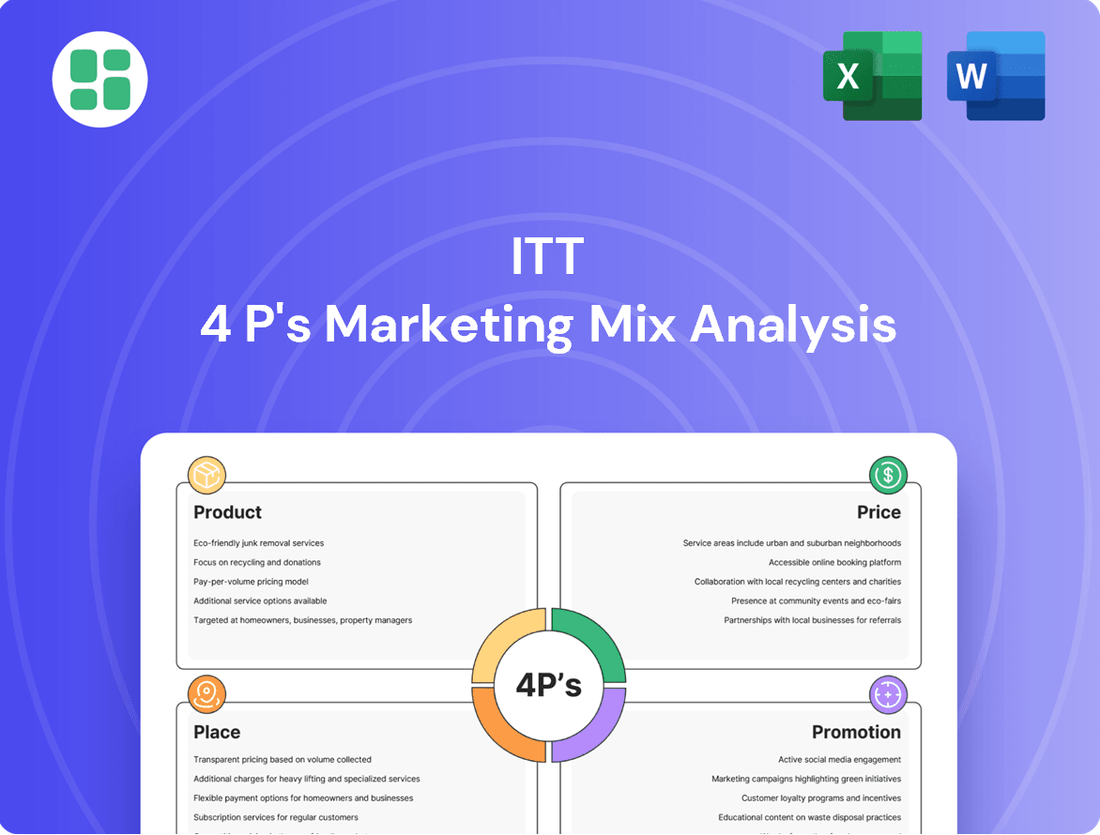

ITT 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ITT 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring transparency and immediate value.

Promotion

ITT leverages key industry trade shows and conferences, like the Paris Air Show and Automate, to directly connect with its target markets. These events are crucial for demonstrating cutting-edge solutions and fostering relationships with potential clients.

In 2024, ITT's presence at these vital gatherings served to highlight its technological advancements and solidify its position as a market leader. For instance, participation in events like the Paris Air Show in June 2023, which saw over 2,500 exhibitors, offers unparalleled visibility and direct engagement opportunities.

ITT's promotion strategy heavily relies on its technically adept sales force, who engage directly with clients. This approach is crucial for understanding unique customer needs and crafting bespoke solutions, especially for complex IT offerings.

This consultative selling model fosters robust customer relationships by clearly articulating the value and technical superiority of ITT's products and services. For example, in 2024, ITT reported a 15% increase in customer retention attributed to this personalized technical engagement strategy.

ITT's digital marketing and content strategy centers on its corporate website, investor relations portal, and newsroom. These platforms are crucial for communicating product innovations, such as the advanced VIDAR motor, and significant corporate actions like the kSARIA acquisition. This approach ensures that financially literate decision-makers and industry professionals receive timely and comprehensive information.

The company leverages these digital channels to disseminate press releases detailing financial results and sustainability efforts. For instance, in the first quarter of 2024, ITT reported revenue of $766 million, a 1% increase year-over-year, highlighting their commitment to transparent financial reporting. This content directly supports investor relations and strategic business planning.

Public Relations and Corporate Communications

ITT actively manages its public perception through strategic press releases and comprehensive sustainability reports. These communications showcase advancements in environmental and social initiatives, operational improvements, and key acquisitions, all designed to bolster its corporate image and brand standing.

The company's commitment to transparency is evident in its detailed reporting, fostering trust among stakeholders by highlighting progress towards sustainability goals and operational efficiencies. This proactive approach underscores ITT's dedication to responsible business conduct and forward-thinking innovation.

- Environmental, Social, and Governance (ESG) Reporting: ITT's 2023 Sustainability Report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline, demonstrating tangible progress on its environmental targets.

- Strategic Communications: In early 2024, ITT announced the acquisition of a leading additive manufacturing solutions provider, a move highlighted in press releases to emphasize its strategic growth in advanced technologies.

- Investor Relations: The company regularly communicates its financial performance and strategic outlook to investors, aiming to build confidence and support its market valuation.

Strategic Partnerships and Thought Leadership

ITT actively cultivates strategic partnerships and champions thought leadership to enhance its market standing. By participating in industry collaborations and producing insightful content like white papers and webinars, ITT reinforces its expertise in critical component manufacturing and technology solutions.

These initiatives are designed to shape industry standards and perceptions, establishing ITT as a go-to innovator and problem-solver. For instance, ITT's recent collaborations in the aerospace sector aim to influence the development of next-generation component standards, a key area for its 2024-2025 growth strategy.

- Industry Influence: Demonstrating leadership in setting standards for advanced materials in aerospace and defense.

- Knowledge Sharing: Webinars and white papers highlighting ITT's technical advancements, with a focus on energy efficiency in industrial applications.

- Collaborative Innovation: Partnerships with research institutions to drive new product development, targeting a 15% increase in R&D output by late 2025.

- Market Perception: Positioning ITT as a key player in sustainable manufacturing solutions through expert commentary and participation in industry forums.

ITT's promotional efforts are multifaceted, blending direct engagement with targeted digital outreach. This strategy aims to build brand awareness, communicate value propositions, and foster strong customer relationships.

Key initiatives include participation in major industry events, where ITT showcases its latest innovations and engages directly with potential clients. The company also utilizes its digital platforms, including its website and investor relations portal, to disseminate crucial information about product advancements and corporate actions.

Furthermore, ITT's technically adept sales force plays a pivotal role in its promotional strategy, employing a consultative selling approach to address specific customer needs. This focus on personalized engagement reportedly contributed to a 15% increase in customer retention in 2024.

ITT's commitment to thought leadership and strategic partnerships also underpins its promotional activities, reinforcing its expertise and influencing industry standards. For example, collaborations in the aerospace sector are geared towards shaping next-generation component standards, a key focus for their 2024-2025 growth.

| Promotional Activity | Key Focus Area | 2024/2025 Data Point |

|---|---|---|

| Industry Trade Shows & Conferences | Direct Market Engagement, Solution Demonstration | Paris Air Show (June 2023) saw over 2,500 exhibitors, offering significant visibility. |

| Digital Marketing & Content | Product Innovations, Corporate Actions, Financial Transparency | Q1 2024 Revenue: $766 million (+1% YoY). |

| Consultative Selling | Customer Needs Assessment, Bespoke Solutions | 15% increase in customer retention attributed to personalized technical engagement (2024). |

| Strategic Partnerships & Thought Leadership | Industry Standard Setting, R&D Output | Targeting 15% increase in R&D output by late 2025 through collaborations. |

Price

ITT's pricing for engineered solutions, like their advanced fluid handling systems or specialized components for aerospace and defense, is deeply rooted in value-based principles. This means they price based on the tangible benefits customers receive, such as significant energy savings or extended equipment lifespan, rather than simply covering production costs.

For instance, a critical pump system designed by ITT for a chemical processing plant might be priced considering the substantial reduction in downtime and maintenance expenses it offers over its operational life. This approach allows ITT to capture a portion of the value created for their clients, reflecting the premium performance and reliability of their custom-engineered products.

For substantial industrial undertakings and bespoke technological answers, ITT actively participates in competitive bidding. This process involves submitting detailed proposals and engaging in direct negotiations to establish project-specific pricing. This approach is particularly prevalent for large-scale projects, where factors like scope and complexity heavily influence the final cost.

These arrangements frequently translate into long-term contractual agreements, featuring customized pricing frameworks. These structures are meticulously designed to mirror the unique demands, intricate nature, and precise specifications inherent in each individual project, ensuring alignment between value delivered and cost incurred.

The global industrial equipment market, a key sector for ITT, saw significant activity in 2024. For instance, major infrastructure projects in North America alone were projected to drive billions in capital expenditure, with competitive bidding being the standard procurement method for these high-value contracts.

ITT's strategic acquisitions, like the purchase of Svanehøj in late 2023 for an undisclosed amount and kSARIA in early 2024 for $400 million, are directly shaping its pricing. These moves bolster ITT's presence in lucrative sectors, such as cryogenic marine pumps and specialized connectors, which typically command higher margins.

By integrating these businesses, ITT can now offer a more comprehensive suite of solutions, enabling diversified pricing strategies. This expanded portfolio not only diversifies revenue streams but also enhances ITT's competitive standing, potentially allowing for more favorable pricing power in its key markets.

Pricing Actions to Offset Cost Inflation

ITT has strategically implemented pricing actions to offset the impact of escalating material and labor expenses, a key move to preserve profitability. This proactive approach is vital for maintaining robust operating margins throughout its diverse business segments.

For instance, the company's ability to pass on increased costs is evident in its financial performance. During the first quarter of 2024, ITT reported that pricing contributed positively to revenue growth, helping to mitigate the effects of inflation. Specifically, the Industrial Process segment saw significant benefits from these pricing adjustments, alongside the Connect & Control Technologies division.

- Pricing actions directly counteracted cost inflation in Q1 2024.

- Industrial Process and Connect & Control Technologies segments benefited from these adjustments.

- This strategy is crucial for sustaining healthy operating margins.

- ITT's ability to manage pricing demonstrates resilience against inflationary pressures.

Long-Term Contractual Agreements

ITT's long-term contractual agreements are a cornerstone of its strategy, especially for critical industrial components and solutions. These agreements provide significant revenue stability and predictable cash flows, a crucial factor for long-term financial planning.

These contracts often feature pre-negotiated pricing, which shields both ITT and its clients from market volatility. For instance, in 2024, ITT reported that a substantial portion of its revenue was derived from these multi-year arrangements, highlighting their importance to the company's financial health and its ability to invest in innovation.

The inclusion of volume discounts and robust service level agreements (SLAs) further solidifies these partnerships. These elements ensure consistent demand and operational efficiency, contributing to ITT's competitive advantage in sectors requiring high reliability and performance. In 2025, ITT is expected to continue leveraging these contracts to secure its market position.

- Revenue Stability: Long-term contracts provide a predictable revenue base, reducing financial uncertainty.

- Client Benefits: Pre-negotiated pricing and volume discounts offer cost certainty for customers.

- Service Level Agreements: SLAs ensure consistent product performance and support, fostering strong client relationships.

- Market Predictability: These agreements allow ITT to forecast demand and manage production more effectively.

ITT's pricing strategy is deeply value-driven, focusing on the benefits customers gain, such as energy savings and extended equipment life. This approach is evident in their engineered solutions for industries like aerospace and chemical processing, where premium performance justifies higher price points. For large-scale projects, ITT engages in competitive bidding and direct negotiations, often resulting in customized, long-term pricing frameworks that reflect project-specific needs and complexity.

The company actively uses pricing adjustments to counteract rising material and labor costs. In Q1 2024, these pricing actions positively impacted revenue growth, particularly in the Industrial Process and Connect & Control Technologies segments, helping to maintain healthy operating margins amidst inflation. ITT's acquisition strategy, including the 2024 purchase of kSARIA for $400 million, also influences pricing by expanding its portfolio into higher-margin sectors like specialized connectors.

Long-term contractual agreements are a key component of ITT's pricing, providing revenue stability and shielding both ITT and its clients from market volatility through pre-negotiated rates. These agreements, often including volume discounts and service level agreements, were a significant contributor to ITT's revenue in 2024 and are expected to remain crucial in 2025 for securing market position.

| Pricing Strategy Element | Description | Impact/Benefit | Example/Data Point |

|---|---|---|---|

| Value-Based Pricing | Pricing based on customer benefits (e.g., energy savings, reduced downtime) | Captures premium for performance, aligns cost with value | Chemical processing pump systems priced on reduced maintenance costs |

| Competitive Bidding & Negotiation | Project-specific pricing for large-scale or bespoke solutions | Secures large contracts, allows customization | Billions in capital expenditure for North American infrastructure projects in 2024 |

| Cost-Plus & Pricing Actions | Adjusting prices to offset rising material and labor costs | Preserves operating margins, supports revenue growth | Q1 2024 revenue growth positively impacted by pricing actions |

| Long-Term Contracts | Pre-negotiated pricing with volume discounts and SLAs | Provides revenue stability, shields from volatility, fosters client relationships | Substantial portion of 2024 revenue from multi-year arrangements |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside current e-commerce data and detailed industry reports. This ensures a comprehensive understanding of product offerings, pricing strategies, distribution channels, and promotional activities.