ITC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITC Bundle

ITC's diverse portfolio presents significant strengths, but understanding its vulnerabilities and the competitive landscape is crucial for strategic planning. Our comprehensive SWOT analysis delves into these critical areas, offering actionable insights for informed decision-making.

Want the full story behind ITC's market position, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

ITC's diversified business portfolio, spanning FMCG, hotels, paperboards, and agri-business, offers significant stability by mitigating risks associated with any single sector. This broad presence acts as a natural hedge against market fluctuations, ensuring that revenue and profit growth are not solely dependent on one area. For instance, in FY24, ITC's FMCG segment continued its robust growth trajectory, contributing substantially to the company's overall performance, while its Paperboards and Packaging business also demonstrated resilience.

ITC's brand equity is a significant asset, built over decades of consistent quality and marketing. Brands like Aashirvaad, Sunfeast, and Bingo! are household names, demonstrating strong consumer trust and recall. This allows ITC to leverage its brand strength for new product launches, as seen with its expansion into newer FMCG categories.

The company's market presence is further amplified by its extensive distribution network, reaching over 2 million retail outlets across India, including a substantial presence in rural areas. This deep penetration ensures product availability and accessibility, a key differentiator in the competitive Indian market. For instance, in FY23, ITC's FMCG business continued to show robust growth, with its cigarette business also maintaining its dominance, contributing significantly to overall revenue and brand visibility.

ITC Limited boasts a robust financial profile, consistently delivering strong revenue growth and healthy profitability. For the fiscal year ending March 31, 2024, the company reported a consolidated revenue of ₹69,887 crore, a notable increase from the previous year, demonstrating sustained top-line expansion.

The company's significant cash flow generation, largely underpinned by its established cigarette business, provides a solid financial bedrock. This consistent cash generation allows ITC to strategically invest in its burgeoning FMCG portfolio and other growth initiatives, such as its hotels and paperboards divisions, without undue reliance on debt financing.

This financial resilience empowers ITC to pursue strategic acquisitions, invest in research and development, and expand its operational footprint. For instance, the company's ongoing investments in its non-cigarette FMCG businesses, which saw a revenue contribution of ₹26,357 crore in FY24, are facilitated by its strong financial health.

Extensive Distribution and Supply Chain Network

ITC's extensive distribution network is a cornerstone of its strength, particularly for its fast-moving consumer goods (FMCG) portfolio. This deep and wide-reaching infrastructure ensures products reach consumers even in remote corners of India. For instance, as of early 2024, ITC's FMCG business reaches over 2 million retail outlets, a testament to its vast penetration.

This robust network, coupled with efficient supply chain management, translates into superior product availability and timely delivery. This is a significant competitive edge in the highly fragmented Indian consumer market. ITC's investment in technology for supply chain optimization, including advanced logistics and inventory management systems, further amplifies its operational efficiency and market responsiveness throughout 2024 and into 2025.

- Vast Retail Reach: Serves over 2 million retail outlets across India as of early 2024.

- Geographic Penetration: Crucial for FMCG products, ensuring availability in diverse regions.

- Supply Chain Efficiency: Optimized logistics and inventory management enhance delivery and reduce costs.

- Technology Integration: Leveraging technology for real-time tracking and demand forecasting improves responsiveness.

Commitment to Sustainability and ESG Initiatives

ITC demonstrates a robust commitment to sustainability, evident in its substantial investments across key ESG areas. These include sustainable agriculture practices, water conservation efforts, and a growing portfolio of renewable energy projects.

This dedication to ESG not only bolsters ITC's brand image and cultivates stronger stakeholder relationships but also resonates with the increasing demand from consumers and investors for ethically operated businesses. For instance, as of early 2024, ITC had committed to achieving Net Zero emissions by 2030, a significant undertaking reflecting their proactive stance.

- Sustainable Agriculture: ITC's e-Choupal initiative, a digital platform connecting farmers, promotes sustainable farming methods, contributing to rural development and resource efficiency.

- Water Stewardship: The company has invested significantly in water conservation projects, aiming to replenish water resources and improve water use efficiency across its operations.

- Renewable Energy: ITC is expanding its renewable energy capacity, with a target to source a larger percentage of its energy needs from green sources, reducing its carbon footprint.

- Corporate Reputation: These initiatives enhance ITC's standing as a responsible corporate citizen, attracting environmentally and socially conscious investors and consumers.

ITC's diversified business model acts as a significant strength, providing resilience across various economic cycles. This broad portfolio, encompassing FMCG, hotels, paperboards, and agri-business, ensures that the company is not overly reliant on any single sector for its performance. For example, in FY24, the FMCG segment continued its strong growth, contributing substantially to the company's overall financial health.

The company possesses substantial brand equity, cultivated through decades of delivering quality products and effective marketing campaigns. Well-recognized brands like Aashirvaad and Sunfeast have built considerable consumer trust, enabling successful new product introductions and market penetration. This strong brand recall is a key asset in its competitive landscape.

ITC's extensive distribution network is a critical advantage, reaching over 2 million retail outlets across India, including deep penetration into rural markets. This vast reach ensures product availability and accessibility, a significant differentiator. In FY23, this network was instrumental in the robust growth of its FMCG business.

The company's financial strength is a notable asset, characterized by consistent revenue growth and healthy profitability. For the fiscal year ending March 31, 2024, ITC reported consolidated revenue of ₹69,887 crore, reflecting sustained expansion. This financial stability is further bolstered by significant cash flow generation, primarily from its established cigarette business.

| Metric | FY23 (₹ Crore) | FY24 (₹ Crore) | Growth (%) |

|---|---|---|---|

| Consolidated Revenue | 66,406 | 69,887 | 5.25 |

| FMCG Segment Revenue | 24,970 | 26,357 | 5.55 |

| EBITDA | 23,478 | 25,668 | 9.33 |

What is included in the product

Analyzes ITC’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential threats into opportunities.

Weaknesses

ITC's significant reliance on its cigarette segment, which accounted for approximately 43% of its total revenue in FY23, presents a notable weakness. This business is highly susceptible to government policy, with excise duties and taxes frequently adjusted, impacting profitability. For instance, the Goods and Services Tax (GST) structure in India, while simplifying some aspects, still allows for significant state-level levies and potential future increases that directly affect cigarette pricing and demand.

The ongoing global and domestic emphasis on public health, coupled with robust anti-smoking campaigns, continues to exert pressure on cigarette consumption. This trend, evident in declining smoking rates in many developed markets and a growing awareness in emerging economies like India, poses a structural headwind for ITC's core cigarette business, potentially limiting its long-term growth prospects and necessitating diversification efforts.

ITC operates in FMCG segments where competition is incredibly fierce. Companies like Hindustan Unilever and Nestlé are major rivals, alongside nimble local brands. This means ITC must constantly innovate and spend heavily on marketing to stand out, which can strain profitability.

For example, in the highly contested branded packaged foods market, growth requires significant capital outlay. ITC's personal care division also faces intense pressure from global giants and domestic players, demanding continuous product development and promotional activities to capture and retain market share.

ITC's established businesses, like paperboards and some agri-segments, are showing more modest growth compared to its rapidly expanding FMCG arm. While these mature segments contribute stability, their slower pace could temper the company's overall growth trajectory in the eyes of investors.

Brand Dilution Across Diverse Portfolio

ITC's extensive brand portfolio, spanning sectors like FMCG, hotels, and paperboards, presents a significant challenge in maintaining a cohesive brand identity. This diversification risks diluting the ITC umbrella brand if consumers struggle to connect a consistent value proposition across its varied products, from ITC Hotels to Aashirvaad atta.

The sheer breadth of ITC's operations can strain marketing budgets and strategic focus, potentially hindering the ability to deeply penetrate niche markets or effectively communicate unique selling points for each brand. For instance, in FY23, ITC's FMCG segment revenue grew by 19% to ₹19,789 crore, showcasing growth but also the complexity of managing such a diverse portfolio.

- Brand Overlap: Consumers may not clearly associate the ITC brand with specific quality or value propositions across all its diverse offerings, leading to potential confusion.

- Resource Strain: Managing a vast array of brands across disparate categories can dilute marketing resources and strategic focus, impacting the effectiveness of individual brand campaigns.

- Perception Management: Maintaining a premium perception for hotels while also competing in the mass-market FMCG space requires careful brand management to avoid negative spillover effects.

Execution Risk in New Growth Ventures

ITC's ambitious expansion into new FMCG categories and digital ventures, while promising, introduces significant execution risks. Successfully scaling these new product lines, establishing novel distribution networks, and integrating advanced digital technologies demand substantial capital outlay, the recruitment of specialized talent, and the navigation of initial market inertia.

For instance, in the fiscal year ending March 31, 2024, ITC reported a notable increase in its FMCG segment revenue, reaching INR 20,000 crore. However, the profitability of these newer, less established ventures can be volatile, with margins potentially pressured by high initial marketing spends and operational setup costs.

- Scaling Challenges: Successfully launching and expanding new FMCG product lines, like those in dairy or frozen foods, requires overcoming logistical hurdles and building brand recognition against established players.

- Distribution Network Development: Creating efficient and widespread distribution channels for new product categories, especially in diverse geographies, is a complex and resource-intensive undertaking.

- Digital Integration Costs: Investing in and effectively integrating digital platforms for e-commerce and customer engagement can lead to substantial upfront costs and require continuous adaptation to evolving technological landscapes.

- Market Acceptance: New ventures often face initial resistance from consumers accustomed to existing brands, necessitating robust marketing strategies and product differentiation to gain traction.

ITC's substantial revenue dependence on its cigarette business, which represented 43% of its total income in FY23, is a key vulnerability. This segment faces significant regulatory risks due to frequent adjustments in excise duties and taxes, directly impacting profitability. For example, while GST simplified some aspects, state-level levies and potential future increases continue to influence cigarette pricing and consumer demand.

The company's broad diversification across numerous sectors, including FMCG, hotels, and paperboards, creates a challenge in maintaining a cohesive brand identity. This wide reach risks diluting the core ITC brand if consumers struggle to connect a consistent value proposition across its varied offerings, from ITC Hotels to Aashirvaad atta.

ITC's expansion into new FMCG categories and digital initiatives carries considerable execution risks. Successfully scaling these ventures, establishing new distribution networks, and integrating digital technologies demand substantial capital, specialized talent, and overcoming initial market inertia. For instance, while ITC's FMCG segment revenue grew to INR 20,000 crore in FY24, the profitability of newer ventures can be volatile due to high initial marketing and operational costs.

| Segment | FY23 Revenue (INR Crore) | % of Total Revenue | Key Weakness |

|---|---|---|---|

| Cigarettes | ~8,400 (Estimated from 43% of total) | 43% | High regulatory dependence, excise duties |

| FMCG (Others) | 19,789 | ~40% | Intense competition, high marketing spend |

| Hotels | ~2,300 (Estimated) | ~6% | Cyclicality, capital intensive |

| Paperboards, Specialty Papers & Packaging | ~8,500 (Estimated) | ~20% | Modest growth, mature market |

Preview Before You Purchase

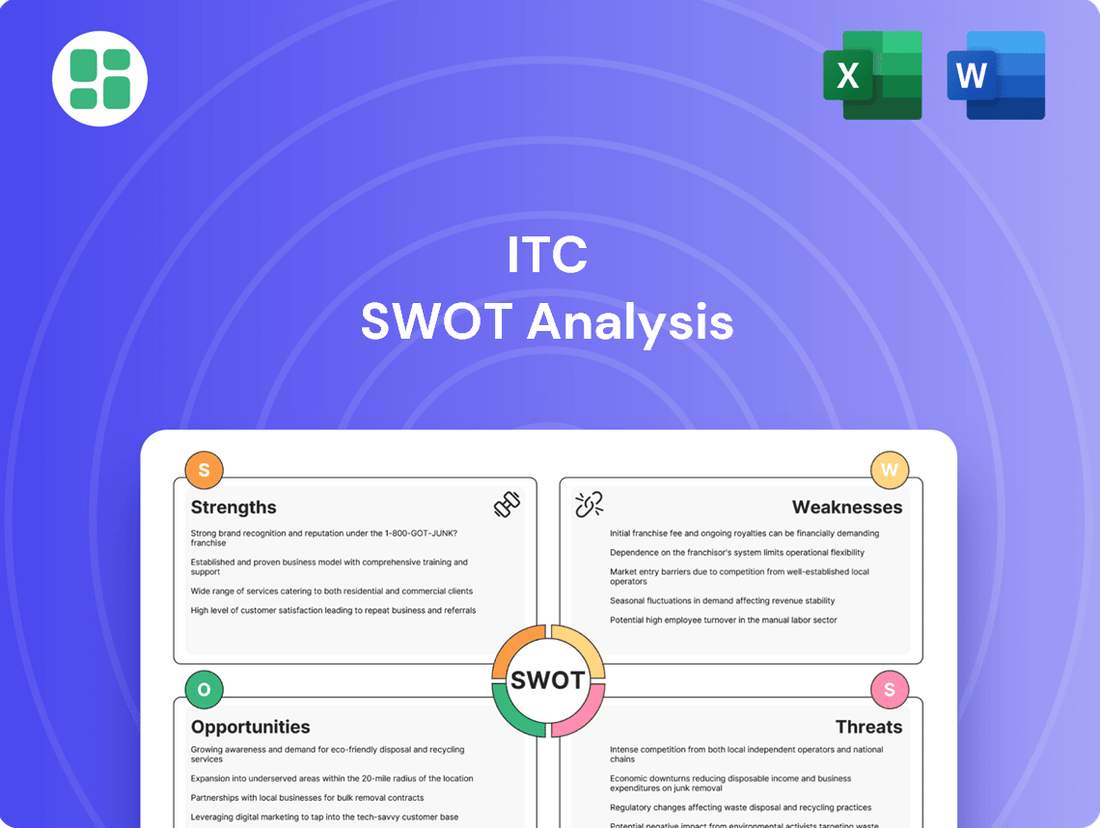

ITC SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt, ensuring transparency and a clear understanding of the value you're investing in.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at ITC's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs and insights.

Opportunities

The Indian FMCG sector is booming, driven by increasing disposable incomes and a growing demand for healthier, more convenient products. This presents a prime opportunity for ITC to broaden its offerings in these expanding categories.

ITC can capitalize on this trend by introducing new products and potentially acquiring companies to strengthen its presence in segments like health foods and ready-to-eat meals, areas showing robust growth.

ITC's established R&D and extensive distribution network are key assets that can be leveraged to successfully launch and market these new product lines, capturing a larger market share.

India's e-commerce market is booming, projected to reach $350 billion by 2025, offering ITC a significant avenue to expand its direct-to-consumer (D2C) presence. By investing in robust online sales platforms and advanced data analytics, ITC can forge deeper customer relationships and gain valuable insights into purchasing behaviors.

This digital transformation allows for more targeted marketing campaigns and efficient inventory management, crucial for optimizing operations across ITC's diverse product portfolio. The company can leverage these digital channels to personalize offers and promotions, thereby boosting sales and customer loyalty in a competitive landscape.

ITC's strong brand equity in India presents a significant opportunity for international expansion, especially for its successful FMCG brands like Aashirvaad or Sunfeast. Targeting neighboring markets like Bangladesh or Sri Lanka, where similar consumer preferences exist, could be a logical first step. This strategic move could tap into new revenue streams and mitigate risks associated with over-reliance on the domestic market.

Value Addition in Agri-Business and Rural Markets

ITC's deep roots in agri-business, cultivated through robust farmer partnerships, present a prime opportunity for enhancing value. By moving beyond raw commodity trading to processing agricultural output into higher-value food items, the company can significantly boost its profit margins. For instance, expanding its ready-to-cook and ready-to-eat segments leveraging its existing sourcing network is a clear path.

The growing economic prosperity in India's rural heartlands is a substantial, largely untapped market for ITC's fast-moving consumer goods (FMCG). As rural incomes rise, so does consumer spending on branded products. ITC can capitalize on this by developing specific product portfolios and distribution models that cater to the unique needs and preferences of these burgeoning rural consumer bases, driving significant volume growth.

- Value-added Agri-processing: ITC's extensive sourcing network, which procures over 2 million tonnes of agricultural commodities annually, can be leveraged for higher-margin processed foods, tapping into the estimated INR 1.5 lakh crore Indian processed food market.

- Rural Market Penetration: With rural incomes growing at an estimated 4.5% CAGR in recent years, ITC's FMCG business can target this demographic, which already accounts for a significant portion of its sales, by tailoring products and distribution for increased reach.

- Diversification of Agri-Sourcing: Expanding sourcing beyond traditional crops to include fruits, vegetables, and dairy can fuel new product development in the food processing sector, aligning with changing consumer tastes.

Focus on Sustainability and Green Products

Consumers are increasingly prioritizing sustainability, driving demand for eco-friendly products. ITC's established sustainability initiatives, including its focus on water conservation and renewable energy, align perfectly with this growing market preference. For instance, ITC's e-Choupal initiative has empowered millions of farmers, promoting sustainable agricultural practices, which can be leveraged for sourcing greener raw materials.

ITC is well-positioned to expand its portfolio of green products, capitalizing on this consumer shift. This strategic focus can significantly enhance brand loyalty and attract a growing segment of environmentally conscious buyers. The company’s commitment to carbon neutrality, achieved across its operations, further strengthens its appeal in this segment.

- Growing Consumer Demand: 70% of consumers globally stated they are willing to pay more for sustainable products in a 2023 NielsenIQ survey.

- ITC's Sustainability Prowess: ITC has achieved carbon positive status for 17 consecutive years and water positive for 20 consecutive years.

- Product Diversification: Expanding offerings in categories like FMCG with eco-friendly packaging and sustainable sourcing can tap into this trend.

ITC can capitalize on the burgeoning Indian FMCG market by expanding its product lines into health foods and ready-to-eat meals, leveraging its strong R&D and distribution network. The booming e-commerce sector presents a significant opportunity for direct-to-consumer sales, allowing for deeper customer engagement and targeted marketing. Furthermore, ITC's established brand equity can be leveraged for international expansion, particularly in neighboring markets with similar consumer preferences.

ITC's deep agri-business roots offer a chance to move into higher-margin processed foods, utilizing its extensive sourcing network for value-added products. The growing rural economy represents a largely untapped market for ITC's FMCG offerings, requiring tailored products and distribution strategies. Consumer demand for sustainability aligns with ITC's existing initiatives, creating an opportunity to expand eco-friendly product lines and enhance brand loyalty.

| Opportunity Area | Description | Supporting Data/Fact |

|---|---|---|

| Value-added Agri-processing | Leveraging sourcing network for higher-margin processed foods. | Indian processed food market estimated at INR 1.5 lakh crore. |

| Rural Market Penetration | Targeting growing rural consumer spending with tailored products. | Rural incomes growing at an estimated 4.5% CAGR. |

| Sustainable Product Expansion | Capitalizing on consumer preference for eco-friendly goods. | 70% of consumers willing to pay more for sustainable products (NielsenIQ, 2023). |

Threats

A significant threat for ITC is the intensifying regulatory scrutiny and taxation on tobacco products. Governments globally are implementing stricter laws, higher excise duties, and advertising restrictions on 'sin goods' to address public health concerns. For instance, in India, the Goods and Services Tax (GST) Council has periodically reviewed and increased taxes on tobacco, impacting volumes and profitability.

ITC faces significant pressure from both global giants and agile local competitors across its varied business lines, particularly in the fast-moving consumer goods (FMCG) and hospitality sectors. The Indian market's allure attracts substantial investment, fueling aggressive market penetration strategies from established multinational corporations and innovative startups alike.

This heightened competition often translates into price wars and necessitates increased marketing budgets, potentially impacting ITC's market share and profit margins. For instance, in the FMCG sector, which saw a revenue of INR 19,364 crore for FY24, brands are constantly challenged by new entrants offering differentiated products at competitive price points.

To counter this, continuous innovation and a keen understanding of evolving consumer preferences are paramount. ITC's ability to adapt its product portfolio and marketing approaches swiftly will be critical in maintaining its competitive edge against a dynamic landscape of both established and emerging players.

Consumers globally, including in India, are increasingly prioritizing health and wellness. This shift is evident in the growing demand for plant-based foods, reduced sugar options, and products with transparent ingredient lists. For instance, the Indian plant-based food market was projected to reach $500 million by 2025, indicating a significant consumer pivot.

ITC's traditional product portfolio, particularly in sectors like tobacco and certain food categories, faces a direct challenge from this health-conscious trend. As consumers actively seek out healthier alternatives and scrutinize ingredient sourcing and ethical practices, companies like ITC must proactively innovate to stay relevant and mitigate potential market share erosion.

Economic Slowdowns and Inflationary Pressures

Economic slowdowns and persistent inflation represent significant headwinds for ITC. A downturn can curb consumer spending, impacting demand for everything from cigarettes to hotels, while rising raw material costs, like those seen in agricultural inputs for FMCG, can directly pressure profit margins if price increases are limited. For instance, in fiscal year 2024, while ITC reported strong revenue growth, managing input cost volatility remained a key focus.

The company's diversified business model offers some resilience, but sectors sensitive to discretionary spending, like hotels and certain FMCG categories, are particularly vulnerable. High inflation in 2024, averaging around 5-6% in India for much of the year, necessitates careful cost management and strategic pricing to maintain competitiveness and profitability across its vast product range.

- Economic Downturns: Reduced consumer spending on non-essential goods and services.

- Inflationary Pressures: Increased raw material and operational costs, potentially squeezing margins.

- Pricing Challenges: Difficulty in passing on all cost increases to consumers, impacting affordability and demand.

Supply Chain Disruptions and Commodity Price Volatility

ITC, as a major player in manufacturing and agribusiness, faces significant risks from supply chain disruptions. Geopolitical tensions, extreme weather events, or future health crises could impede the flow of raw materials and finished goods, directly affecting its operations. For instance, the company's reliance on agricultural inputs means it's particularly vulnerable to climate-related shocks impacting crop yields and availability.

Commodity price volatility is another substantial threat. Fluctuations in the cost of key inputs like wheat, edible oils, paper pulp, and even crude oil derivatives used in packaging can significantly impact ITC's cost of goods sold. In 2024, global commodity markets have shown increased volatility, with agricultural prices experiencing upward pressure due to supply concerns in several key producing regions, directly squeezing margins for companies like ITC.

- Supply Chain Vulnerability: ITC's extensive network relies on timely procurement of diverse raw materials, making it susceptible to disruptions from events like the Red Sea shipping crisis impacting global trade routes in late 2023 and early 2024.

- Commodity Price Impact: The company's profitability is directly tied to the cost of agricultural commodities. For example, a 10% increase in the price of key grains could significantly affect its food division's margins, a trend observed in various agricultural markets throughout 2024.

- Mitigation Strategies: To counter these threats, ITC is actively pursuing strategies such as diversifying its supplier base across different geographies and investing in building more resilient and localized supply chains to buffer against external shocks.

Intensifying regulatory scrutiny and taxation on tobacco products remain a significant threat, with governments worldwide increasing excise duties and advertising restrictions. For instance, in India, periodic GST rate revisions directly impact ITC's tobacco segment profitability, a crucial revenue driver.

ITC faces fierce competition across its diverse business segments, particularly in FMCG and hospitality, from both global corporations and nimble local players. This competitive pressure, evident in the FMCG sector which generated INR 19,364 crore in FY24, often leads to price wars and increased marketing expenditure, potentially eroding market share.

The growing consumer preference for health and wellness poses a threat to ITC's traditional product portfolio, including tobacco and certain food items. As consumers increasingly seek healthier alternatives, ITC must innovate rapidly to adapt its offerings and mitigate potential market share loss in a market where the plant-based food segment alone was projected to reach $500 million by 2025.

Economic slowdowns and persistent inflation present considerable challenges, impacting consumer spending on discretionary items like hospitality services and potentially increasing operational costs for its FMCG division. With inflation averaging around 5-6% in India during 2024, managing input cost volatility and strategic pricing are critical for maintaining profitability across its extensive product range.

SWOT Analysis Data Sources

This ITC SWOT analysis is built upon a robust foundation of data, drawing from official company financial filings, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of ITC's strategic position.