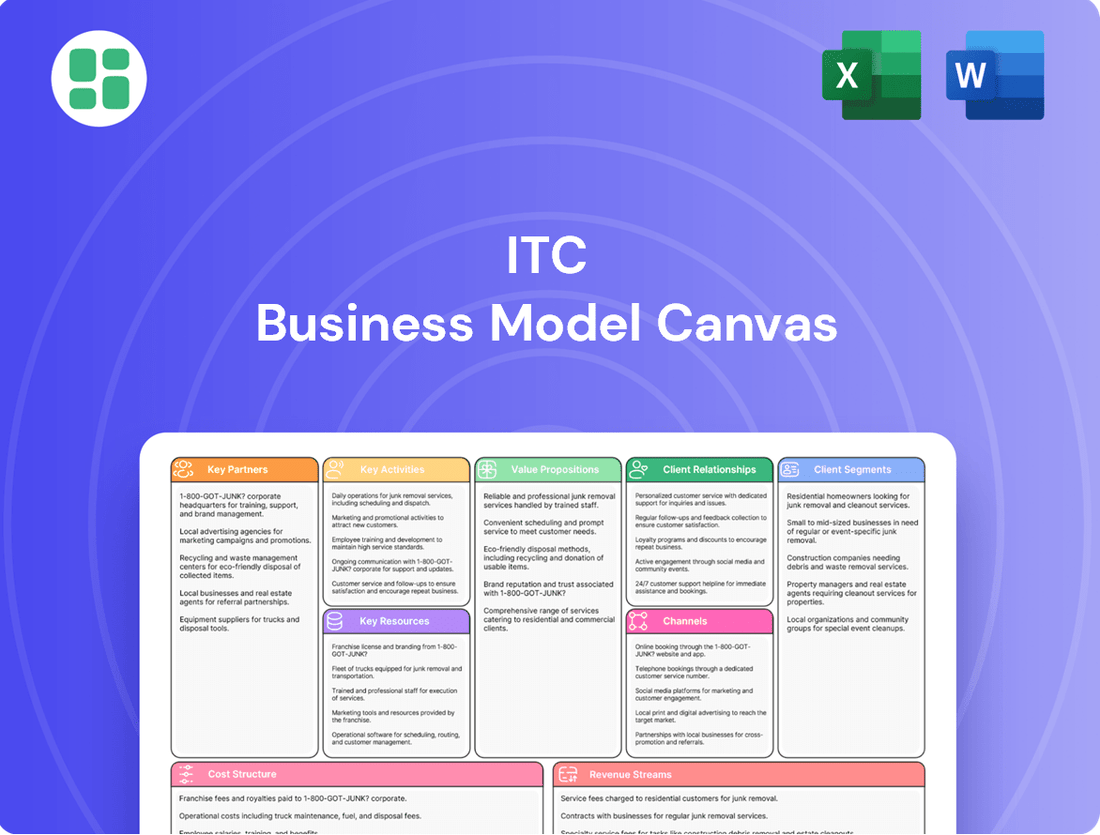

ITC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITC Bundle

Uncover the intricate workings of ITC's diversified empire with our comprehensive Business Model Canvas. This detailed analysis breaks down how ITC effectively manages its vast portfolio, from agribusiness to consumer goods, revealing its strategic advantages. Download the full canvas to gain a competitive edge and understand the core elements driving ITC's enduring success.

Partnerships

ITC's Agri-Business segment thrives on deep collaborations with Farmer Producer Organizations (FPOs) and individual farmers, forming the backbone for sourcing agricultural commodities. These relationships are vital, not only providing essential raw materials for ITC's diverse FMCG portfolio but also driving significant revenue through commodity trading.

The company's innovative phygital ecosystem, ITCMAARS, directly engages farmers, offering tailored advice, crucial agricultural inputs, and direct market access. This integrated approach is instrumental in developing climate-resilient value chains, a critical factor in ensuring sustainable sourcing and farmer prosperity.

In 2024, ITC's Agri-Business division continued to demonstrate robust performance, with its e-Choupal 4.0 initiative further strengthening its farmer connect. This digital platform empowers farmers with real-time market information and best practices, contributing to improved yields and incomes.

ITC's key partnerships with distributors and retailers are fundamental to its market penetration. The company leverages an extensive network reaching approximately seven million retail outlets across India, ensuring its wide array of products are accessible to consumers nationwide.

A significant portion, over one-third of these outlets, are directly managed by ITC, demonstrating a deep commitment to controlling its supply chain. This direct servicing approach, coupled with strategic partnerships, has been instrumental in expanding ITC's footprint, particularly in rural areas, thereby amplifying its market reach and sales potential.

ITC partners with technology and digital solution providers to drive efficiency. For instance, their investment in digital transformation aims to leverage automation and data analytics for improved field-force productivity and smarter supply chain management.

This collaboration extends to enhancing customer engagement through advanced digital platforms. ITC's focus on a smart omni-channel system for trade marketing and distribution signifies a commitment to integrating cutting-edge technology for a more seamless customer experience.

Acquisition Targets and Strategic Alliances

ITC actively seeks value-adding acquisitions and strategic partnerships to fuel growth and diversify its offerings. This inorganic expansion strategy aims to complement and enhance its existing business segments, tapping into new market opportunities and accelerating market penetration. For instance, ITC's strategic moves in the food sector, including acquisitions in organic products, underscore this commitment to portfolio enhancement and future growth potential.

These partnerships are crucial for expanding ITC's reach and capabilities. For example, in 2024, ITC continued to evaluate opportunities to strengthen its position in high-growth categories. The company’s focus remains on identifying targets that align with its long-term vision and offer synergistic benefits, thereby creating sustainable shareholder value.

- Acquisition Strategy: ITC prioritizes inorganic growth through acquisitions and strategic alliances to bolster its portfolio and market presence.

- Sector Focus: Recent acquisitions have targeted the food and organic products sectors, aligning with market trends and ITC's existing strengths.

- Growth Drivers: These partnerships are designed to unlock new revenue streams and expand market share in promising segments.

- Synergistic Benefits: ITC seeks opportunities that offer complementary advantages, enhancing operational efficiencies and competitive positioning.

Hospitality Sector Collaborations

ITC Limited, despite the demerger of its hotel business, retains a substantial stake in ITC Hotels and actively pursues collaborations to capitalize on shared synergies. This strategic alignment allows for continued leverage of brand equity and operational efficiencies across both entities, benefiting from ITC's broader consumer goods ecosystem.

ITC Hotels actively seeks partnerships for developing new properties, exemplified by its recent agreement to establish a Fortune hotel in Lucknow. This expansion is a direct response to the increasing demand within the business and leisure travel segments, aiming to broaden its market presence and enhance guest experiences.

- Strategic Stake: ITC Limited holds a significant stake in ITC Hotels post-demerger, fostering ongoing collaboration and synergy realization.

- New Property Development: Partnerships are crucial for ITC Hotels' expansion, as seen in the agreement for a Fortune hotel in Lucknow.

- Market Growth: These collaborations are designed to cater to the robust and growing demand in both business and leisure travel sectors.

ITC's extensive network of distributors and retailers is a cornerstone of its market penetration, reaching approximately seven million retail outlets across India. Over one-third of these are directly managed by ITC, showcasing a deep commitment to supply chain control and rural market expansion.

Strategic partnerships with technology providers are crucial for enhancing efficiency and customer engagement, particularly through digital transformation initiatives and advanced omni-channel systems. ITC also actively pursues value-adding acquisitions to diversify its offerings and accelerate market penetration, as seen in its focus on organic products.

In 2024, ITC continued to strengthen its farmer connect through initiatives like e-Choupal 4.0, fostering climate-resilient value chains and improving farmer incomes. The company also maintains collaborations with ITC Hotels, leveraging shared synergies and brand equity for continued growth.

What is included in the product

A structured framework for outlining and analyzing a business's core components, from customer relationships to revenue streams.

Enables a holistic view of how a company creates, delivers, and captures value, facilitating strategic planning and innovation.

The ITC Business Model Canvas acts as a pain point reliever by offering a structured yet flexible framework to visualize and refine complex business strategies.

It helps alleviate the pain of scattered ideas and unclear direction by consolidating all essential business elements onto a single, actionable page.

Activities

ITC's manufacturing backbone includes a vast network of facilities spread across India, churning out everything from everyday consumer goods to specialized paperboards and packaging solutions. These operations are geared towards efficiency, incorporating advanced technologies like automation and Industry 4.0 principles to maintain a competitive edge.

In fiscal year 2024, ITC continued to invest in modernizing its production capabilities, focusing on smart manufacturing to optimize output and quality. This strategic emphasis on technological advancement is crucial for maintaining cost-effectiveness and agility in a dynamic market landscape.

ITC's commitment to R&D is evident in its substantial investments. The company's Life Sciences & Technology Centre (LSTC) is a hub for innovation, focusing on developing novel products and improving existing ones across diverse sectors.

This R&D drive spans critical areas like biosciences, agri-sciences, and advanced materials. ITC leverages robust research platforms to create cutting-edge solutions for its product categories, including beauty, hygiene, health, and importantly, sustainable packaging initiatives.

ITC's key activities heavily rely on managing an agile and resilient supply chain. This involves sourcing agricultural raw materials locally, establishing strategically placed manufacturing facilities, and operating vast distribution networks to reach millions of retail points across India.

For instance, ITC's agri-business division works with over 4 million farmers, ensuring a consistent supply of quality raw materials. This localized sourcing is crucial for cost efficiency and product quality, supporting their extensive manufacturing operations.

The company's distribution prowess is evident in its reach, serving over 2 million retail outlets. This extensive network, a significant competitive advantage, ensures their diverse product portfolio, from FMCG to paperboards, reaches consumers effectively, even in remote areas.

Marketing, Branding, and Sales

ITC's marketing, branding, and sales activities are central to its business model, aiming to cultivate strong consumer connections with its vast array of brands. The company consistently invests in robust promotional efforts and advertising across various media platforms to enhance brand visibility and stimulate demand for its products, which span categories like FMCG, hotels, and paperboards. In the fiscal year 2023-24, ITC's FMCG segment continued its growth trajectory, demonstrating the effectiveness of these strategies in driving sales and market penetration.

The company's approach emphasizes purposeful innovation, focusing on developing products that meet changing consumer preferences and market trends. This includes a strong emphasis on premiumization, offering higher-value products, and personalization to create tailored experiences for its customers, thereby solidifying its market position and encouraging repeat purchases. ITC's dedication to these principles is reflected in its sustained market share gains in key product categories.

- Brand Building: ITC invests heavily in advertising and promotional campaigns to foster strong brand equity across its diverse portfolio.

- Consumer Focus: The company prioritizes innovation, premiumization, and personalization to align with evolving consumer demands.

- Sales Growth: These marketing efforts directly contribute to driving sales volume and expanding market reach for its various product lines.

- Market Presence: ITC's strategies aim to strengthen its competitive standing and enhance its overall market presence.

Agri-Business Operations and Rural Development

ITC's agri-business operations are extensive, focusing on sourcing, trading, and adding value to a wide range of agricultural products. In 2023-24, the company's agri-business division continued to be a cornerstone of its diversified portfolio, demonstrating robust performance and a commitment to farmer prosperity.

Beyond commercial activities, ITC actively contributes to rural development. Initiatives like ITCMAARS (Metropolitan Area Rural Services) are instrumental in empowering farmers by providing access to technology, best practices, and market linkages, thereby fostering climate-resilient value chains.

- Farmer Empowerment: ITC's e-Choupal network, a pioneering digital initiative, has reached over 4 million farmers, providing them with crucial information and services.

- Value Addition: The company processes and markets a significant volume of agricultural commodities, enhancing their value and reach in both domestic and international markets.

- Climate Resilience: ITC's focus on sustainable agriculture and climate-smart practices helps farmers adapt to changing environmental conditions, ensuring long-term viability.

- Market Linkages: By creating direct linkages between farmers and consumers, ITC's agri-business model helps reduce intermediaries and improve farmer incomes.

ITC's key activities encompass robust manufacturing, extensive R&D, and sophisticated supply chain management. The company prioritizes technological integration in its manufacturing facilities, evident in its fiscal year 2024 investments in smart manufacturing. Its Life Sciences & Technology Centre drives innovation across various product categories, including sustainable packaging. The efficient sourcing of agricultural raw materials from over 4 million farmers and a distribution network reaching 2 million retail outlets are critical operational pillars.

Preview Before You Purchase

Business Model Canvas

The ITC Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete file. Once your order is processed, you will gain full access to this same comprehensive and professionally structured Business Model Canvas, ready for your strategic planning.

Resources

ITC's strength lies in its robust brand portfolio, featuring household names like Aashirvaad, Sunfeast, Bingo!, Yippee!, Fiama, Savlon, and Classmate. These brands are cornerstones of its FMCG success, driving significant market share and consumer loyalty.

In fiscal year 2024, ITC's FMCG segment continued its growth trajectory, with its branded packaged foods business demonstrating resilience. The company's strategic focus on strengthening its iconic brands has been a key driver, contributing to sustained revenue generation and market leadership across various categories.

ITC's extensive manufacturing and logistics infrastructure, including its network of Integrated Consumer Goods Manufacturing and Logistics (ICMLs) facilities, paperboard mills, and hotels, is a cornerstone of its business model. This robust physical asset base underpins efficient nationwide production, storage, and distribution across its diverse product portfolio.

In fiscal year 2024, ITC continued to invest in and leverage this infrastructure. For instance, its FMCG business, a significant contributor to revenue, relies heavily on this network for reaching consumers effectively. The company's commitment to enhancing its supply chain capabilities through these assets ensures product availability and quality.

ITC's human capital is a cornerstone of its business model, encompassing a vast network of R&D scientists, seasoned management, and an expansive sales and distribution force. This diverse talent pool drives innovation and market penetration across its varied business segments.

The company's commitment to structured remuneration and robust talent development programs ensures a highly skilled and motivated workforce. This investment in its people is crucial for maintaining a competitive edge and fostering continuous improvement.

In 2024, ITC continued to emphasize employee development, with significant investments in training and upskilling programs designed to enhance expertise in areas like digital transformation and sustainable business practices. This focus directly supports its operational efficiency and strategic growth initiatives.

Intellectual Property and R&D Capabilities

ITC's intellectual property, including proprietary technologies and product formulations developed at its Life Sciences & Technology Centre (LSTC), forms a crucial resource. This R&D capability fuels innovation, enabling the company to create differentiated offerings and secure a competitive advantage in its diverse business segments.

The company's commitment to research and development is evident in its continuous investment, which translates into a robust pipeline of new products and processes. For instance, in fiscal year 2023-24, ITC continued to leverage its R&D strengths to enhance its portfolio across FMCG, Hotels, and Agri-Business.

- Proprietary Technologies: ITC holds patents and trade secrets for various manufacturing processes and product enhancements, particularly in its Foods and Personal Care divisions.

- Product Formulations: Unique formulations developed through extensive research, especially for its health and wellness products and premium personal care items, are key intellectual assets.

- Research Findings: Discoveries and insights from the LSTC in areas like biotechnology, material science, and sustainable agriculture contribute to ITC's long-term innovation strategy.

- R&D Investment: While specific R&D expenditure figures are often integrated into broader operational costs, the consistent output of innovative products underscores significant investment in these capabilities.

Financial Capital and Strategic Investments

ITC's strong financial foundation, evidenced by its consistent revenue and profit growth, is the bedrock for its strategic investments. In the fiscal year 2023-24, ITC reported a consolidated revenue of INR 177,044 crore, with profit after tax reaching INR 18,700 crore, underscoring its capacity to fund its ambitious growth plans and explore new avenues.

These financial resources enable ITC to not only sustain its core operations but also to actively pursue strategic acquisitions and invest in emerging business opportunities. This proactive capital allocation is crucial for maintaining its competitive edge and driving long-term shareholder value.

Furthermore, ITC strategically holds investments in other publicly traded companies. These holdings are not merely financial assets; they are designed to foster potential synergies across its diverse business verticals and unlock long-term value creation through collaborative opportunities and market insights.

- Robust Financial Health: ITC's significant revenue and profit generation in FY24 provide ample capital for operations and expansion.

- Strategic Investment Capacity: The company leverages its financial strength to invest in new ventures and potential acquisitions.

- Portfolio of Strategic Investments: ITC maintains holdings in other listed entities to cultivate synergies and enhance long-term value.

ITC's key resources encompass a powerful brand portfolio, extensive physical infrastructure, skilled human capital, valuable intellectual property, and a strong financial base. These elements collectively enable the company to execute its diverse business strategies effectively and maintain a competitive edge across its various sectors.

Value Propositions

ITC's commitment to quality assurance across its diverse product portfolio, which spans FMCG, Hotels, Paperboards & Packaging, Agri Business, and Information Technology, is a cornerstone of its value proposition. This broad reach ensures consumers have access to trusted brands like Aashirvaad, Sunfeast, and Classmate, offering both variety and reliability.

In 2024, ITC's FMCG segment continued its strong growth trajectory, with revenue from this segment witnessing a significant increase. This diversification not only provides consumers with a wide range of choices but also builds resilience for the company by spreading risk across different market segments.

ITC's commitment to sustainability is a key value proposition, evident in its pursuit of water neutrality and increased renewable energy adoption. These initiatives resonate strongly with consumers and stakeholders who prioritize environmental responsibility.

The company's focus on building climate-resilient value chains within its agri-business further reinforces this commitment. For instance, in 2023, ITC achieved a significant milestone by becoming water positive, regenerating more water than it consumed.

ITC's focus on innovation and product differentiation is a cornerstone of its strategy, evident in its continuous R&D efforts. The company consistently introduces new products across various segments, including wellness, indulgence, hygiene, and convenience, ensuring they align with shifting consumer preferences and emerging market trends.

For instance, in fiscal year 2024, ITC's FMCG businesses saw robust growth, driven by a pipeline of innovative product launches and a deeper understanding of evolving consumer needs. This commitment to R&D not only strengthens its market position but also caters to the increasing demand for healthier and more convenient options.

Extensive Reach and Accessibility

ITC's extensive reach and accessibility are cornerstones of its business model, ensuring its diverse product portfolio penetrates markets from bustling cities to remote villages across India.

This vast distribution capability means consumers can easily find ITC's popular brands, a significant advantage in a country with varied geographic and economic landscapes. For instance, in 2023-24, ITC's FMCG segment continued to see robust growth, driven by its expanding market penetration.

- Unmatched Distribution Network: ITC's supply chain covers over 2 million retail outlets, a significant portion of which are in rural India.

- Product Availability: This network ensures that products like Aashirvaad atta and Sunfeast biscuits are accessible even in the most remote corners.

- Market Penetration: In FY24, ITC's FMCG businesses saw continued market share gains in several key categories, underscoring the effectiveness of its reach.

- Consumer Trust: Consistent availability builds consumer loyalty and reinforces brand presence, contributing to sustained sales growth.

Value for Money and Premium Offerings

ITC masterfully balances accessibility and aspiration, providing value-for-money staples alongside exclusive, high-end experiences. This approach ensures broad market appeal and caters to a wide range of economic capacities.

For instance, in the fiscal year 2023-24, ITC's FMCG business continued its robust growth trajectory, demonstrating the success of its diversified portfolio. The company's ability to serve both the everyday needs of the mass market and the sophisticated demands of premium segments is a cornerstone of its market penetration.

- Dual Market Strategy: ITC effectively serves both the mass market with affordable options and the premium segment with luxury goods and services.

- Revenue Diversification: This strategy allows ITC to capture a wider customer base, leading to diversified revenue streams across various price points.

- Brand Portfolio Strength: The company leverages its strong brand equity to position both value and premium offerings competitively within their respective markets.

- Economic Resilience: By catering to different economic strata, ITC builds resilience against economic downturns that might disproportionately affect one segment.

ITC's value proposition is built on delivering quality and reliability across its diverse business segments, from fast-moving consumer goods (FMCG) to hotels and agri-business. This commitment ensures consumers receive trusted products and experiences, fostering strong brand loyalty.

The company's extensive distribution network, reaching over 2 million retail outlets, ensures widespread product availability, even in rural India. This deep market penetration, evidenced by continued market share gains in FY24, makes ITC's offerings accessible to a vast consumer base.

ITC effectively caters to a broad spectrum of consumers by balancing value-for-money staples with premium offerings. This dual market strategy diversifies revenue and strengthens brand appeal across different economic segments, as seen in the robust growth of its FMCG business in FY24.

Sustainability is a core tenet, with initiatives like water neutrality and increased renewable energy adoption resonating with environmentally conscious consumers. ITC's 2023 achievement of being water positive highlights this dedication to responsible business practices.

| Value Proposition | Description | Supporting Data (FY24 unless specified) |

|---|---|---|

| Quality & Reliability | Consistent high standards across diverse product portfolio. | Strong performance of brands like Aashirvaad, Sunfeast. |

| Extensive Distribution | Unmatched reach to over 2 million retail outlets. | Continued market share gains in key FMCG categories. |

| Dual Market Strategy | Catering to both mass-market value and premium segments. | Robust growth in FMCG, demonstrating broad appeal. |

| Sustainability Focus | Commitment to environmental responsibility. | Water positive status achieved in 2023; increased renewable energy use. |

Customer Relationships

ITC cultivates deep customer connections by maintaining a consistent brand voice and delivering high-quality products across its diverse portfolio, from everyday essentials to luxury hospitality. This commitment is designed to foster lasting consumer trust and encourage repeat business, a strategy evident in their sustained market presence.

Loyalty programs play a crucial role in ITC's customer relationship strategy, rewarding repeat engagement and strengthening brand affinity. For instance, their hotel loyalty programs aim to create a sticky customer base by offering exclusive benefits and personalized experiences, driving significant repeat stays.

ITC directly connects with its customers through its own online shops and digital efforts, like the ITC e-Store and cloud kitchens offering FoodTech services. This direct channel is crucial for gathering immediate customer feedback, tailoring experiences, and building a more robust brand relationship.

In 2024, ITC's focus on D2C initiatives is expected to drive significant growth, leveraging digital platforms to bypass traditional intermediaries. This strategy allows for better margin control and a deeper understanding of consumer preferences, as evidenced by the increasing adoption of their digital food ordering services.

ITC actively fosters customer relationships through dedicated service channels, ensuring queries and feedback are addressed promptly across its diverse portfolio, from FMCG to hotels. This commitment is underscored by initiatives like customer care helplines and digital feedback platforms, aiming to continuously refine product development and elevate customer satisfaction. In 2023-24, ITC's focus on customer centricity contributed to sustained growth in its FMCG segment, which saw a revenue increase of 11.7%, reflecting the positive impact of responsive customer engagement.

Retailer and Trade Partner Support

ITC actively supports its B2B partners, including distributors and retailers, through a multi-faceted approach. This involves robust trade marketing initiatives designed to boost sales and brand visibility at the point of purchase.

The company also invests in enhancing its digital ecosystem, providing partners with tools and platforms that streamline operations and improve engagement. For instance, in 2024, ITC continued to expand its digital trade engagement platforms, aiming to onboard a significant percentage of its retail partners onto these systems to facilitate easier ordering and inventory management.

- Trade Marketing: ITC conducts regular trade promotions and provides merchandising support to retailers, enhancing product display and consumer appeal.

- Digital Ecosystem: The company offers digital tools for order placement, inventory tracking, and market insights, improving operational efficiency for trade partners.

- Tailored Assortments: ITC works with retailers to offer product assortments that best suit local consumer preferences, thereby increasing sales velocity.

- Channel Partner Growth: These support mechanisms are crucial for strengthening channel partnerships and ensuring a smooth and efficient flow of products to the end consumer.

Community Engagement and Social Responsibility

ITC's dedication to fostering sustainable livelihoods and community development, especially through its extensive agri-business operations, cultivates significant goodwill and trust. This approach extends beyond its direct customer base to encompass a wider array of stakeholders, notably farmers and rural populations. For instance, in 2023-24, ITC's e-Choupal initiative continued to empower over 4 million farmers, providing them with critical information and services, thereby strengthening rural economies and fostering a sense of shared prosperity.

This commitment to social responsibility is not merely philanthropic; it’s a strategic pillar that enhances brand reputation and customer loyalty. By actively contributing to the well-being of communities, ITC builds a robust social capital that translates into a more resilient and supportive ecosystem for its businesses.

- Sustainable Livelihoods: ITC’s agri-business initiatives, like e-Choupal, directly impact millions of farmers, offering access to knowledge, markets, and better farming practices, thus enhancing their income and quality of life.

- Community Development: Beyond agriculture, ITC invests in rural infrastructure, education, and healthcare through its social initiatives, creating a positive ripple effect across communities.

- Stakeholder Trust: This deep engagement builds trust and loyalty not only with farmers but also with consumers who increasingly value socially conscious brands.

- Brand Equity: The strong corporate citizenship enhances ITC's brand image, making it a preferred choice for consumers and a respected entity within society.

ITC prioritizes direct customer engagement through its digital platforms, including the ITC e-Store and cloud kitchens, fostering immediate feedback loops. This D2C push in 2024 aims to deepen consumer understanding and loyalty.

Loyalty programs, particularly within its hospitality sector, are key to retaining customers by offering personalized benefits and exclusive experiences. This strategy has proven effective in building a dedicated customer base.

ITC's commitment to social responsibility, exemplified by its e-Choupal initiative supporting over 4 million farmers in 2023-24, builds significant goodwill and brand trust. This holistic approach strengthens relationships across its value chain.

The company also focuses on supporting its B2B partners through digital tools and tailored assortments, enhancing operational efficiency and sales. In 2024, continued expansion of digital trade platforms aims to integrate more retail partners.

Channels

ITC's extensive retail distribution network is a cornerstone of its business model, reaching over 2 million outlets across India. This vast reach encompasses traditional kirana stores, modern retail formats, and supermarkets, ensuring its diverse range of FMCG products, from Aashirvaad Atta to Sunfeast Biscuits, are readily available to consumers nationwide.

In 2024, ITC continued to leverage this robust network, which is crucial for its market penetration and sales volume. The company's ability to place products even in remote rural areas underscores the strategic importance of this distribution channel, contributing significantly to its FMCG revenue growth.

ITC leverages a robust, multi-tiered wholesale and distributor network to ensure its diverse product portfolio reaches consumers across India. This hierarchical structure, from large-scale distributors to smaller, local wholesalers, is fundamental to their market penetration strategy.

In 2024, ITC's extensive distribution reach was a key factor in its continued market leadership. The company managed over 7 million retail outlets, demonstrating the sheer scale of its network. This vast infrastructure allows for efficient product placement and availability, even in remote areas.

This intricate network is not just about volume; it's about strategic market segmentation. By working with different tiers of wholesalers, ITC can tailor its product offerings and promotional activities to suit the specific needs and purchasing power of various consumer groups, from urban centers to rural hinterlands.

ITC's digital strategy leverages its proprietary 'ITC e-Store' alongside major third-party e-commerce and quick commerce platforms to reach consumers. This dual approach addresses the escalating demand for online purchasing and swift delivery services.

In 2024, the Indian e-commerce market was projected to reach $130 billion, highlighting the significant opportunity for ITC's expanded digital footprint. Quick commerce, a rapidly growing segment, further enhances ITC's ability to serve immediate consumer needs.

Hotel Properties and Online Travel Agencies (OTAs)

ITC Hotels utilizes its extensive network of luxury and business properties to attract a broad customer base. This direct channel allows for brand control and personalized guest experiences.

Furthermore, ITC Hotels strategically partners with Online Travel Agencies (OTAs) to significantly expand its reach to both domestic and international travelers. This multi-channel distribution is crucial for maximizing occupancy rates and overall revenue.

- Direct Bookings: ITC Hotels' own website and reservation system offer a direct channel, often with loyalty program benefits.

- OTA Partnerships: Collaborations with platforms like Booking.com, Expedia, and MakeMyTrip provide access to a wider audience. In 2024, the global online travel market was projected to reach over $850 billion, highlighting the importance of these partnerships.

- Occupancy Maximization: The combined approach aims to fill rooms efficiently, especially during off-peak seasons, thereby boosting RevPAR (Revenue Per Available Room). ITC Hotels reported an average occupancy rate of around 75% across its properties in its latest fiscal year.

- Revenue Diversification: Relying on both direct and indirect channels helps diversify revenue streams and mitigate risks associated with over-reliance on a single booking platform.

Institutional Sales and B2B

ITC's Institutional Sales and B2B segment is a significant pillar of its diversified business model, focusing on supplying products and services to other businesses and organizations. This channel leverages ITC's extensive product portfolio and robust supply chain to cater to the specific needs of industrial clients.

The paperboards and packaging division is a prime example, directly serving various industries that require high-quality packaging solutions for their own products. In fiscal year 2023-24, ITC's Paperboards and Specialty Papers Division continued to see strong demand, contributing significantly to the company's non-cigarette FMCG revenue growth.

Furthermore, ITC's Agri-Business division actively engages in B2B trading, sourcing agricultural commodities and supplying them to other businesses, both domestically and internationally. This segment plays a crucial role in supporting India's agricultural value chain and contributes to ITC's overall revenue diversification. For instance, in FY23, the Agri Business segment reported robust performance, driven by strong exports and domestic sourcing of key commodities.

- Paperboards and Packaging: Supplies to diverse industries including FMCG, pharmaceuticals, and retail, with a focus on sustainable and innovative packaging solutions.

- Agri-Business: Engages in sourcing and trading of commodities like wheat, rice, pulses, and spices, serving both domestic and international business clients.

- Hotels: Provides hospitality services to corporate clients for events, conferences, and business travel, a key B2B service offering.

- Information Technology (ITC Infotech): Offers IT services and solutions to global businesses, further strengthening the B2B engagement across various sectors.

ITC's channels are multifaceted, designed to maximize reach and consumer engagement across its diverse product categories. The company effectively utilizes a vast physical retail network, complemented by a growing digital presence and targeted B2B engagements.

In 2024, ITC continued to prioritize its extensive physical distribution network, which is critical for its FMCG business. This network, reaching millions of outlets, ensures product availability across India, from urban centers to remote rural areas.

The company's digital channels, including its e-store and partnerships with e-commerce platforms, are increasingly important for capturing online sales and catering to evolving consumer preferences.

ITC Hotels employs a direct booking strategy alongside partnerships with Online Travel Agencies to broaden its customer base and optimize occupancy rates.

| Channel | Key Activities | 2024 Focus/Data |

| Retail Distribution | Reaching over 2 million outlets (kirana, modern retail) | Continued market penetration; 7 million retail outlets managed |

| Wholesale & Distributor Network | Multi-tiered structure for market access | Ensuring efficient product placement and availability |

| Digital Channels (e.g., ITC e-Store) | Online sales and quick commerce partnerships | Leveraging India's projected $130 billion e-commerce market |

| ITC Hotels (Direct & OTA) | Direct bookings, OTA partnerships | Maximizing occupancy (reported ~75% average); global OTA market >$850 billion |

| Institutional & B2B | Paperboards, Agri-Business, Hotels, IT services | Strong demand in Paperboards; robust performance in Agri-Business |

Customer Segments

ITC's mass market consumers represent the bedrock of its FMCG business, encompassing a colossal segment of Indian households. This includes everyone from urban dwellers to rural families who regularly purchase everyday necessities. In 2024, the sheer scale of this segment is undeniable, with India's population exceeding 1.4 billion people, a significant portion of whom are actively engaged in the consumer market for packaged foods, personal care items, and stationery.

ITC strategically targets this vast demographic by offering a diverse portfolio of brands that are both affordable and readily available across the nation. Think of staples like Aashirvaad atta, Sunfeast biscuits, and Fiama personal care products – these brands have achieved widespread recognition and trust. The company's extensive distribution network ensures these products reach even remote corners of India, making them accessible to the masses.

ITC specifically caters to consumers who prioritize quality and exclusivity in their purchases, whether it's for everyday goods or special experiences. This segment is willing to pay a premium for superior products and services.

In the Fast-Moving Consumer Goods (FMCG) sector, this translates to ITC's offerings like premium cigarette brands, gourmet food items under brands such as Sunfeast Farmlite, and sophisticated personal care products. For instance, ITC's Foods division, which includes premium offerings, saw a revenue growth of 10.5% in FY24, reaching ₹17,833 crore, demonstrating strong demand from this discerning customer base.

Within the hospitality sector, ITC Hotels appeals to affluent travelers and business executives seeking luxury accommodations and fine dining. These customers value exceptional service, world-class amenities, and unique experiences, contributing significantly to ITC's Hotels division's performance, which reported a revenue of ₹2,474 crore in FY24.

ITC's Agri-Business division directly partners with farmers, providing essential support services, facilitating market access, and sourcing a wide array of agricultural commodities. This engagement is foundational to securing a consistent supply of raw materials for its diverse product portfolio and underpins its commitment to rural economic development.

In 2023-24, ITC's e-Choupal initiative, a key touchpoint for farmers, reached over 4 million farmers across India, demonstrating the vast scale of its agricultural community engagement. The company's sourcing of key agricultural products like wheat, rice, and spices directly benefits these farming communities by offering them stable demand and competitive pricing.

Business-to-Business (B2B) Clients

ITC's Business-to-Business (B2B) client base is diverse, encompassing companies that procure a range of its core products and services. This includes businesses reliant on ITC's high-quality paperboards and innovative packaging solutions, crucial for their product presentation and supply chain efficiency.

Furthermore, ITC engages with businesses seeking agricultural commodities, leveraging its extensive sourcing network and expertise in sectors like leaf tobacco and wheat. The company also serves the corporate sector through its premium hospitality services, offering venues and tailored experiences for business events and conferences.

- Paperboards & Packaging: Businesses requiring materials for product packaging, from consumer goods to industrial applications.

- Agri-Business: Companies sourcing agricultural commodities such as leaf tobacco, wheat, and other food ingredients.

- IT Services: Businesses utilizing ITC Infotech's digital transformation and IT consulting solutions.

- Hospitality: Corporations booking venues and services for meetings, incentives, conferences, and exhibitions (MICE).

International Consumers/Markets

While ITC’s primary focus remains the Indian market, it actively engages with international consumers and markets. This engagement is primarily driven by its robust agri-business exports and a curated selection of Fast-Moving Consumer Goods (FMCG) products that find appeal globally. This international presence represents a significant avenue for diversification and future revenue growth.

ITC's agri-business segment, a cornerstone of its international strategy, exported commodities worth approximately INR 10,000 crore in FY23. This demonstrates a substantial global footprint, supplying key agricultural products to various international buyers. The company’s commitment to quality and sustainability in its agricultural sourcing further bolsters its standing in these markets.

- Agri-Business Exports: ITC is a major exporter of agricultural products, including leaf tobacco, coffee, and marine products, contributing significantly to its international revenue streams.

- FMCG Presence: Select FMCG brands, particularly in the food and personal care categories, are being strategically introduced and expanded in international markets to tap into new consumer bases.

- Diversification Strategy: The international segment is viewed as a key pillar for ITC's long-term growth and diversification, reducing reliance on any single market.

- Growing Revenue Contribution: While still a smaller portion compared to domestic sales, the revenue from international markets is showing a steady upward trend, reflecting successful market penetration and product acceptance.

ITC's customer base is broad, encompassing the mass market consumer, premium segment, farmers, and other businesses.

The mass market segment, representing the majority of India's 1.4 billion population, relies on ITC for affordable, everyday necessities. For instance, in FY24, ITC's FMCG revenue reached ₹21,055 crore, with a significant portion attributed to this segment.

Premium consumers seek quality and exclusivity, driving growth in segments like gourmet foods and luxury hospitality, as evidenced by ITC Hotels' FY24 revenue of ₹2,474 crore.

Cost Structure

The Cost of Goods Sold (COGS) represents a substantial part of ITC's expenses, directly tied to the creation of its diverse product portfolio. This includes the procurement of key raw materials like tobacco for its cigarettes, agricultural inputs for its foods and paper businesses, and the materials needed for packaging.

Manufacturing costs, encompassing factory overhead and direct labor, are also a significant component of COGS. For instance, in the fiscal year 2024, ITC's COGS increased, reflecting higher input costs and production volumes across its various segments.

Employee benefit expenses, encompassing salaries, wages, bonuses, and other related costs, represent a significant portion of ITC's operational outlay. These expenditures are directly tied to the company's vast employee base, which spans critical functions such as manufacturing, extensive distribution networks, sales operations, and essential corporate support.

For the fiscal year 2023-24, ITC reported employee benefit expenses of approximately ₹11,500 crore. This figure underscores the substantial investment in human capital required to manage its diverse portfolio of businesses, from fast-moving consumer goods (FMCG) to hotels and paperboards.

ITC invests heavily in marketing, advertising, and sales promotion to build and sustain its diverse brand portfolio. These expenses are vital for capturing consumer attention and driving sales across categories like FMCG, hotels, and paperboards.

In fiscal year 2024, ITC’s advertising and sales promotion expenses were ₹2,058 crore, reflecting a strategic commitment to brand visibility and market penetration. This significant outlay supports new product launches and reinforces existing brand equity.

Logistics and Distribution Costs

ITC's extensive supply chain and pan-India reach mean significant outlays for logistics and distribution. These costs encompass the movement of goods from production facilities to a multitude of retail touchpoints across the country.

Key components of this cost structure include:

- Transportation Expenses: Costs incurred for road, rail, and potentially other modes of transport to ensure timely delivery of products nationwide.

- Warehousing and Storage: Maintaining a network of warehouses and storage facilities to hold inventory, which involves rental, maintenance, and operational costs.

- Distribution Network Management: Expenses related to managing a vast network of distributors, wholesalers, and retailers, including associated operational overheads.

- Inventory Carrying Costs: The cost of holding inventory, including capital tied up, insurance, and potential obsolescence, which is substantial given ITC's diverse product portfolio.

For fiscal year 2023-24, while specific line items for logistics are not always segregated in public reports, the sheer scale of ITC's operations, with over 2 million retail outlets served, underscores the magnitude of these expenditures. For instance, the company's FMCG segment alone reported a revenue of ₹21,077.57 crore in FY23, implying a considerable portion of this revenue is channeled back into ensuring efficient product availability.

Research and Development (R&D) and Capital Expenditures

ITC's cost structure heavily features investments in Research and Development (R&D) and Capital Expenditures (CapEx). These are crucial for driving product innovation and upgrading its technological capabilities across its diverse business segments, from fast-moving consumer goods (FMCG) to hotels and paperboards.

Significant capital is allocated to expanding manufacturing facilities, modernizing existing infrastructure, and developing new hotel properties. These expenditures are strategically aimed at bolstering ITC's long-term growth trajectory and market competitiveness.

- R&D Investments: Focus on developing differentiated products and sustainable technologies.

- Capital Expenditures: Expansion of manufacturing capacity and modernization of plants.

- Hotel Development: Significant outlay for new property construction and upgrades.

- Infrastructure Modernization: Ongoing investment in supply chain and distribution networks.

ITC's cost structure is dominated by the Cost of Goods Sold (COGS), which includes raw materials and manufacturing expenses, and employee benefit expenses, reflecting its large workforce. Significant investments are also made in marketing and sales promotion to maintain brand presence.

Logistics and distribution costs are substantial due to its extensive pan-India network. Furthermore, R&D and capital expenditures are crucial for innovation and infrastructure development across its diverse business segments.

For FY24, ITC's COGS and employee benefit expenses represented major cost drivers. Advertising and sales promotion stood at ₹2,058 crore, highlighting the emphasis on brand building.

| Cost Component | FY23-24 (Approximate) | Significance |

|---|---|---|

| COGS | Substantial | Raw materials, manufacturing |

| Employee Benefits | ₹11,500 crore | Large workforce costs |

| Advertising & Sales Promotion | ₹2,058 crore | Brand visibility and market penetration |

| Logistics & Distribution | High (implied by scale) | Extensive network reach |

| R&D and CapEx | Significant | Innovation and infrastructure |

Revenue Streams

The cigarette segment is ITC's bedrock, consistently delivering the lion's share of profits and revenue, even as the company expands into diverse sectors. This segment's robust earnings act as a crucial financial engine, powering growth and innovation across ITC's other business verticals.

In the fiscal year 2024, ITC's revenue from the cigarette business stood at a significant INR 18,578 crore, showcasing its enduring dominance. This segment's profitability is key to funding the company's strategic investments in areas like agribusiness and paperboards.

ITC's non-cigarette Fast-Moving Consumer Goods (FMCG) segment, encompassing brands like Aashirvaad in packaged foods, Fiama in personal care, and Classmate in stationery, represents a substantial and expanding revenue source. This diversification is a cornerstone of the company's strategic growth, moving beyond its traditional tobacco business.

In fiscal year 2023-24, ITC's FMCG (excluding cigarettes) business demonstrated robust growth, with revenues reaching ₹23,500 crore. This segment's increasing contribution highlights its importance in ITC's overall financial performance and its success in building a diverse portfolio.

ITC's Agri-Business segment is a significant revenue generator, primarily through the trading of agricultural commodities like wheat, rice, and pulses. In fiscal year 2023-24, this segment demonstrated robust performance, contributing substantially to the company's top line.

Beyond commodity trading, the segment also thrives on selling value-added agri-products, such as processed foods and branded staples. This dual approach allows ITC to not only meet its internal raw material needs but also to capture export markets, reinforcing its position as a major agri-exporter.

Paperboards, Paper & Packaging Sales

Revenue from paperboards, specialty papers, and packaging solutions is a core pillar for ITC. This segment caters to diverse industrial needs, emphasizing a commitment to sustainability and eco-friendly product development. For the fiscal year 2024, ITC's Paperboards and Packaging segment reported a revenue of ₹10,370 crore, highlighting its substantial contribution to the company's overall financial performance.

The company's focus on providing sustainable and eco-friendly alternatives within its paper and packaging offerings resonates strongly with market demand. This strategic emphasis not only drives sales but also positions ITC as a responsible player in the industry.

- Significant Revenue Contribution: The Paperboards and Packaging segment generated ₹10,370 crore in revenue for FY24, demonstrating its importance to ITC's financial health.

- Diverse Industry Service: This segment provides essential products and solutions to a wide array of industries, showcasing its broad market reach.

- Sustainability Focus: ITC actively promotes and develops sustainable and eco-friendly paper and packaging alternatives, aligning with global environmental trends.

Hospitality Services (Hotels)

ITC's hospitality arm, now operating as ITC Hotels Limited with ITC Limited holding a 40% stake, draws revenue from a multifaceted approach. This includes providing premium accommodation, along with extensive food and beverage services. The business also capitalizes on banqueting and comprehensive event management, catering to a discerning clientele seeking luxury experiences.

In the fiscal year 2023-24, ITC Hotels demonstrated robust performance. The segment's revenue from operations reached ₹2,361.78 crore, reflecting strong demand for its high-end services. This growth underscores the segment's focus on delivering exceptional guest experiences across its portfolio of luxury properties.

- Accommodation: Revenue generated from room bookings in its luxury hotel properties.

- Food & Beverage: Income from restaurants, bars, and in-room dining services.

- Banqueting & Events: Earnings from hosting conferences, weddings, and other social and corporate gatherings.

- Other Services: Revenue from ancillary services such as spas, retail outlets within hotels, and business centers.

ITC's revenue streams are diverse, spanning multiple sectors. The cigarette business remains a profit powerhouse, with INR 18,578 crore in revenue for FY24. Its non-cigarette FMCG segment, including brands like Aashirvaad, generated ₹23,500 crore in FY23-24, showcasing significant growth. The Paperboards and Packaging segment contributed ₹10,370 crore in FY24, emphasizing sustainability. Additionally, the Agri-Business segment thrives on commodity trading and value-added products, while ITC Hotels reported ₹2,361.78 crore in operational revenue for FY23-24.

| Segment | FY24 Revenue (INR Crore) | FY23 Revenue (INR Crore) | Key Products/Services |

|---|---|---|---|

| Cigarettes | 18,578 | N/A | Cigarettes |

| FMCG (Non-Cigarette) | 23,500 (FY23-24) | N/A | Packaged Foods, Personal Care, Stationery |

| Paperboards & Packaging | 10,370 | N/A | Paperboards, Specialty Papers, Packaging Solutions |

| Hospitality | 2,361.78 (FY23-24) | N/A | Accommodation, Food & Beverage, Banqueting |

| Agri-Business | N/A | N/A | Commodity Trading, Value-Added Agri-Products |

Business Model Canvas Data Sources

The ITC Business Model Canvas leverages extensive market research, internal operational data, and customer feedback to inform each segment. This ensures a comprehensive and actionable representation of the business strategy.