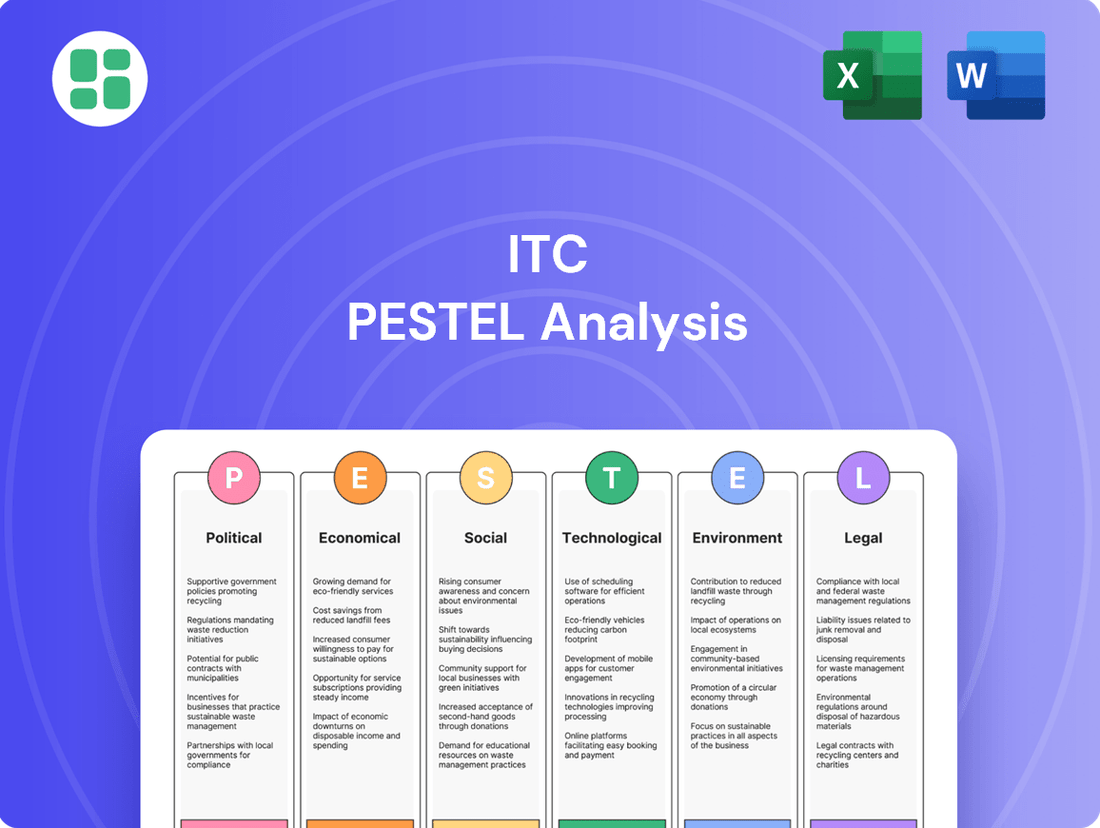

ITC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITC Bundle

Understand the complex web of external forces shaping ITC's future with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, this report provides critical insights into the opportunities and challenges ahead. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now and unlock a deeper understanding of ITC's operating environment.

Political factors

The Indian government's robust regulatory framework, particularly the Cigarettes and Other Tobacco Products Act (COTPA), continues to shape the tobacco landscape for ITC. Mandatory graphic health warnings now cover 85% of cigarette packets, a significant increase from earlier stipulations, directly impacting product visibility and brand messaging.

These stringent measures, aimed at reducing tobacco consumption, compel ITC to adapt its marketing and product design strategies. The ongoing enforcement of COTPA, including potential increases in excise duties and restrictions on advertising, presents a persistent challenge to the profitability of its dominant cigarette segment.

The Indian government's 'Make in India' campaign actively promotes domestic manufacturing, a policy that generally favors established local companies like ITC by fostering a more robust internal supply chain and potentially reducing reliance on foreign inputs. This initiative aims to boost job creation and economic growth within India.

Conversely, the imposition of high import duties on specific product categories, such as the reported 70% duty on tobacco products in 2022, presents a dual-edged sword for ITC. While these tariffs act as a protective shield for ITC's significant domestic cigarette business by making imported alternatives less competitive, they simultaneously create a barrier for the company if it wishes to expand its global reach for certain tobacco-related products or import specialized components.

India's sustained political stability since 2014 has created a highly favorable environment for companies like ITC to undertake significant long-term investments. This consistent political landscape has been a bedrock for strategic planning and execution.

ITC has demonstrably capitalized on this stability, channeling over ₹25,000 crore into its fast-moving consumer goods (FMCG) and paperboard businesses. This substantial investment underscores the confidence in the enduring political and economic framework.

This strategic allocation of capital has facilitated ITC's expansion efforts and contributed to its consistent revenue growth, directly benefiting from the predictable and supportive policy environment fostered by political stability.

Anti-Illicit Trade Measures

The Union Budget 2025 has significantly bolstered anti-illicit trade measures, particularly impacting the tobacco sector. Amendments to the Central Goods and Services Tax (CGST) Act now mandate a Track and Trace mechanism. This is a direct effort to combat the illicit cigarette trade, a persistent challenge for legitimate players like ITC.

This regulatory push is anticipated to create a more level playing field. By strengthening measures against illegal tobacco products, the government aims to curb revenue leakage and protect consumers. For ITC, this translates into a more favorable environment for its legitimate cigarette business, potentially supporting steady volume growth.

- Track and Trace Mandate: The CGST Act amendments introduced in the Union Budget 2025 require a Track and Trace system for cigarettes.

- Curbing Illicit Trade: The primary objective of these measures is to significantly reduce the prevalence of illegally traded cigarettes.

- Support for Legitimate Business: Enhanced regulatory control is expected to benefit companies like ITC by ensuring fair competition and potentially driving volume growth in their compliant product segments.

Fiscal and Export Incentives

ITC has consistently benefited from the Indian government's commitment to fostering economic growth through various fiscal and export incentives. These policy measures have played a significant role in supporting the company's diverse business segments, contributing directly to its top-line performance.

For the fiscal year 2025, ITC's financial statements indicated that approximately ₹306 crore of its total revenue was attributable to these government-provided benefits. This figure underscores the tangible impact of supportive policies on the company's financial health and operational capacity.

- Government Support: ITC leverages fiscal and export incentives provided by the Indian government.

- Revenue Contribution: These incentives directly contribute to ITC's revenue streams.

- FY25 Impact: In FY25, ₹306 crore of ITC's revenue was supported by such government benefits.

- Policy Dependence: This highlights the company's reliance on and benefit from favorable government policies.

The Indian government's consistent focus on controlling tobacco consumption through stringent regulations, like the 85% graphic health warning mandate under COTPA, directly impacts ITC's product presentation and marketing. Furthermore, the Union Budget 2025's introduction of a Track and Trace mechanism for cigarettes aims to combat illicit trade, creating a more equitable market for ITC's compliant products.

ITC's operations are significantly influenced by government policies that promote domestic manufacturing, such as the 'Make in India' initiative, which bolsters its supply chain. Conversely, high import duties, like the 70% on tobacco products in 2022, offer protection to ITC's domestic cigarette business while potentially hindering its import capabilities.

Political stability in India since 2014 has enabled ITC to make substantial long-term investments, with over ₹25,000 crore channeled into its FMCG and paperboard sectors, reflecting confidence in the stable policy environment. The company also benefits from fiscal and export incentives, which contributed approximately ₹306 crore to its revenue in FY25.

| Policy/Regulation | Impact on ITC | Data Point/Year |

|---|---|---|

| COTPA (Health Warnings) | Mandatory 85% graphic health warnings affect product visibility. | Ongoing enforcement |

| Union Budget 2025 (Track & Trace) | Combats illicit trade, levels playing field for compliant products. | Introduced 2025 |

| 'Make in India' Initiative | Supports domestic manufacturing and supply chain. | Ongoing |

| Import Duties (Tobacco) | Protects domestic business, may limit import options. | 70% duty reported in 2022 |

| Fiscal & Export Incentives | Contributed ₹306 crore to revenue. | FY25 |

What is included in the product

This ITC PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling the identification of potential threats and opportunities within the ITC's operating landscape.

The ITC PESTLE Analysis provides a structured framework to identify and understand external factors impacting business, thereby alleviating the pain of navigating complex market landscapes and unforeseen challenges.

Economic factors

India's economic growth is expected to remain strong in FY2024-25, with projections indicating a GDP growth rate of around 6.5% to 7%. This expansion is largely fueled by sustained government spending on infrastructure and a projected rebound in consumer spending, which accounts for a significant portion of the economy.

This robust macroeconomic backdrop is beneficial for ITC. The anticipated increase in disposable incomes and a general uplift in consumer sentiment will likely translate into higher demand across ITC's diverse business segments, from consumer staples to hotels and agribusiness.

Consumer spending on ITC's FMCG portfolio experienced a notable slowdown in FY2024-25, registering its weakest growth in over ten years at just 4.6%. This deceleration is symptomatic of a wider industry trend, exacerbated by fierce competition from nimble local and regional brands.

The intensifying competitive landscape, particularly the aggressive discounting strategies employed by quick commerce platforms, has directly impacted sales volumes for established players like ITC. This environment necessitates strategic adjustments to maintain market share and profitability.

Inflation continues to be a significant factor influencing ITC's operational costs. For instance, while global commodity prices have seen some easing from their peaks, many remain elevated compared to pre-2020 levels. This sustained pressure on input costs directly impacts ITC's raw material expenses across its diverse business verticals, from agri-business to paperboards.

The volatility in commodity prices, a direct consequence of inflationary pressures and geopolitical events, creates uncertainty for ITC's margin management. Even with efforts to optimize sourcing and production, the elevated cost base compared to earlier periods puts a strain on segment profitability. For example, the cost of key agricultural inputs or packaging materials can fluctuate significantly, impacting the bottom line for segments like FMCG and Paperboards.

Rural Demand Dynamics

Rural demand for fast-moving consumer goods (FMCG) saw a slowdown in the first quarter of 2025, with growth dipping compared to previous periods. Despite this, rural markets continued to demonstrate resilience, growing at a faster pace than urban consumption. ITC's business is significantly influenced by these rural dynamics, as a substantial segment of its consumer base is located in these areas, directly impacting its sales volumes and the effectiveness of its distribution networks.

ITC's performance is intrinsically linked to the health of the rural economy. For instance, in the fiscal year 2024, rural consumption contributed a notable percentage to the overall FMCG market growth, highlighting its importance. As of early 2025, while there's a moderation, the underlying trend suggests continued, albeit slower, expansion in rural purchasing power.

- Rural FMCG growth moderated in Q1 2025 but remained stronger than urban.

- ITC's significant rural consumer base makes its sales performance highly sensitive to these trends.

- Recovery in rural incomes and spending is a key driver for ITC's volume growth.

- Distribution strategies are continuously adapted to capture evolving rural demand patterns.

Demerger of Hotels Business

The demerger of ITC Hotels, set to be effective January 1, 2025, represents a pivotal economic maneuver. This strategic separation is designed to unlock greater shareholder value by establishing two distinct, focused businesses. ITC Limited will now sharpen its attention on its dominant FMCG, robust agri-business, and expanding paperboard operations.

This restructuring is anticipated to foster more efficient capital allocation and drive tailored growth strategies for each newly formed entity. For instance, ITC’s FMCG segment has shown consistent growth, with revenue from the segment reaching ₹18,330 crore in FY24, indicating strong market performance that can be further optimized independently.

- Strategic Focus: Separating hotels allows ITC to concentrate on its high-growth FMCG and agri-business verticals.

- Shareholder Value: The demerger aims to unlock value by creating more focused investment opportunities.

- Capital Allocation: Each entity can now pursue capital strategies best suited to its specific market dynamics and growth potential.

- Operational Efficiency: Streamlined operations in both the hotel and non-hotel businesses are expected to improve performance.

India's economic outlook for FY2024-25 remains robust, with projected GDP growth around 6.5% to 7%, driven by infrastructure spending and consumer demand. This positive environment supports ITC's diverse portfolio, from FMCG to hotels, by potentially increasing disposable incomes and consumer confidence.

However, ITC's FMCG segment faced a significant slowdown in FY2024-25, experiencing its weakest growth in a decade at 4.6%, impacted by intense competition and aggressive discounting, particularly from quick commerce platforms. Inflationary pressures continue to affect operational costs, with elevated commodity prices impacting raw material expenses across ITC's business units.

Rural demand for FMCG moderated in Q1 2025 but showed more resilience than urban consumption, a crucial factor for ITC given its substantial rural customer base. The demerger of ITC Hotels, effective January 1, 2025, aims to unlock shareholder value by allowing ITC to focus on its core FMCG, agri-business, and paperboard segments, with FMCG revenue reaching ₹18,330 crore in FY24.

| Economic Factor | Impact on ITC | Data/Trend (FY2024-25/Early 2025) |

|---|---|---|

| GDP Growth | Positive for demand across segments | Projected 6.5% - 7% |

| Consumer Spending (FMCG) | Slowdown in growth | 4.6% growth (weakest in a decade) |

| Inflation/Commodity Prices | Increased operational costs | Elevated compared to pre-2020 levels |

| Rural Demand | Moderated but resilient | Faster growth than urban consumption |

| Hotel Demerger | Strategic focus on FMCG/Agri | Effective January 1, 2025 |

Preview Before You Purchase

ITC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ITC PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company. You’ll gain a clear understanding of the external forces shaping ITC’s strategic landscape.

Sociological factors

Consumers are increasingly seeking packaged goods, especially those focused on health and wellness, alongside solutions that offer convenience. This trend directly impacts ITC's strategy, pushing for new product development and a broader range of offerings to meet these evolving demands.

Heightened health awareness is fueling a stronger anti-tobacco sentiment, which is a significant factor for ITC. Consequently, the company is actively working to lessen its reliance on cigarette revenue, evidenced by its substantial investments in expanding its portfolio of non-tobacco Fast Moving Consumer Goods (FMCG) categories. For instance, ITC's FMCG revenue from non-cigarette businesses grew by 12.1% in FY24, reaching INR 25,200 crore, showcasing this strategic shift.

Societal aspirations are on the rise, fueling a robust demand for travel and leisure experiences. In 2023, India's tourism sector saw a significant rebound, with domestic tourist trips reaching an estimated 1.8 billion, a substantial increase from pre-pandemic levels.

This upward trend in both domestic and international tourism presents a prime opportunity for hospitality players like ITC Hotels. The company is strategically expanding its presence, notably into Tier 2 and Tier 3 cities, to cater to this evolving consumer preference for diverse travel destinations and experiences.

The surge in digital adoption has fundamentally reshaped consumer behavior, with digitally enabled sales, encompassing e-commerce and quick commerce, now representing a significant 31% of ITC's fast-moving consumer goods (FMCG) portfolio. This evolving landscape demands continuous adjustments in how ITC reaches its customers, from optimizing supply chains to personalizing marketing efforts.

Consumers increasingly expect seamless online experiences, readily available products, and personalized engagement. ITC's ability to adapt its distribution networks and marketing strategies to cater to these digital-first preferences is paramount for maintaining relevance and capturing market share in the competitive FMCG sector.

Rural Outreach and Community Development Initiatives

ITC's deep-rooted commitment to rural India, exemplified by programs like e-Choupal and Mission Sunehra Kal, significantly bolsters its social capital and market access. These initiatives are instrumental in fostering farmer prosperity and strengthening community bonds, which in turn enhances ITC's brand reputation and market penetration across the country.

These programs directly impact over 4 million farmers, providing them with critical information, market access, and improved agricultural practices. For instance, e-Choupal, launched in 2000, has evolved into a vast digital platform, offering real-time market prices, weather forecasts, and expert advice, thereby empowering farmers to make informed decisions and improve their incomes. Mission Sunehra Kal focuses on holistic rural development, encompassing areas like water conservation, sanitation, and skill development, further solidifying ITC's positive social impact.

- e-Choupal's Impact: By providing direct access to market information and best practices, e-Choupal has demonstrably increased farmer incomes, with studies indicating improvements of up to 15-20% in some regions.

- Mission Sunehra Kal's Reach: This initiative has positively impacted over 1.5 million people in rural communities, focusing on sustainable livelihoods and improved quality of life.

- Brand Perception: ITC's sustained investment in rural development initiatives has cultivated a strong positive brand image, fostering trust and loyalty among rural consumers and stakeholders.

- Market Penetration: The deep engagement with rural communities facilitates smoother market penetration for ITC's diverse product portfolio, from agri-businesses to consumer goods.

Brand Perception and Diversification Strategy

Despite its strong diversification, ITC continues to grapple with a public perception shaped by its historical association with tobacco. This legacy can influence consumer trust and brand loyalty across its various business segments.

ITC's deliberate strategy to bolster its non-cigarette Fast-Moving Consumer Goods (FMCG), agri-business, and hospitality sectors is a direct response to these perception challenges. The company aims to cultivate a more positive and contemporary brand image that resonates with evolving societal values and sustainability concerns.

- Brand Image Shift: ITC's investment in non-tobacco businesses, such as its FMCG portfolio which saw a revenue of INR 21,853 crore in FY24, is crucial for recalibrating its public image.

- Diversification Impact: The growth in its Hotels business, which reported a revenue of INR 2,738 crore in FY24, and its Agri-Business, contributing INR 20,747 crore in FY24, demonstrates a tangible move away from its tobacco origins.

- Consumer Alignment: By emphasizing its commitment to sustainable practices and product innovation in these newer segments, ITC seeks to align with a broader base of socially conscious consumers.

Consumer preferences are shifting towards health-conscious and convenient products, prompting ITC to expand its offerings. Heightened health awareness also fuels anti-tobacco sentiment, leading ITC to reduce its reliance on tobacco revenue, with non-cigarette FMCG revenue growing by 12.1% to INR 25,200 crore in FY24.

Rising societal aspirations for travel and leisure are evident, with India's domestic tourist trips reaching an estimated 1.8 billion in 2023. ITC Hotels is capitalizing on this by expanding into Tier 2 and Tier 3 cities, catering to diverse travel preferences.

Digital adoption is reshaping consumer behavior, with digitally enabled sales now comprising 31% of ITC's FMCG portfolio. This necessitates continuous adjustments in distribution and marketing to meet demands for seamless online experiences and personalized engagement.

ITC's deep-rooted commitment to rural India through initiatives like e-Choupal and Mission Sunehra Kal enhances its social capital and market access. These programs empower over 4 million farmers, improving incomes and fostering community bonds, thereby strengthening ITC's brand reputation and market penetration.

Technological factors

ITC is actively innovating in sustainable packaging, aiming for 100% of its packaging to be recyclable, reusable, compostable, or biodegradable by 2028. This commitment is backed by significant R&D investments, reflecting a strategic response to growing consumer demand for eco-friendly options.

Key innovations include the development of paper-based packaging alternatives and the increased use of recycled plastics across its product portfolio. These advancements not only address environmental concerns but also position ITC to capitalize on the expanding market for sustainable goods.

ITC's embrace of digital transformation is fundamentally reshaping its extensive supply chain. This initiative is vital for boosting efficiency across its agri-business sourcing and FMCG last-mile delivery operations. By integrating technologies like AI and IoT, ITC aims to achieve superior inventory management and logistics optimization, ensuring smoother operations across its varied business interests.

In 2023-24, ITC reported significant advancements in digitizing its operations. For instance, its e-Choupal 4.0 platform continued to empower farmers with digital tools, enhancing procurement efficiency and traceability. This digital push is expected to yield substantial cost savings and improved service levels, critical for maintaining competitiveness in the fast-moving consumer goods (FMCG) sector.

ITC's agri-business is heavily investing in agri-tech to boost farm productivity and efficiency, with a focus on climate-smart agriculture. This integration of technology aims to optimize resource use, enhance farmer incomes, and build a resilient supply chain for its diverse agri-based portfolio, including food products.

In 2024, ITC continued to expand its digital initiatives, providing farmers with access to advisory services and market intelligence through its e-Choupal platform. This digital push is crucial for addressing the challenges posed by climate change and ensuring a steady supply of high-quality raw materials for its extensive operations.

Leveraging Data Analytics for Consumer Insights

ITC leverages advanced data analytics and artificial intelligence to understand consumer behavior, preferences, and market trends. This allows them to create more relevant products and marketing campaigns.

A data-driven strategy helps ITC refine its product portfolio and respond effectively to changing consumer needs. For instance, in the fiscal year 2023-24, ITC's FMCG segment saw robust growth, partly fueled by its ability to anticipate and cater to evolving consumer preferences through data insights.

- Deep Consumer Understanding: Utilizes AI and analytics for granular insights into purchasing habits and preferences.

- Targeted Product Development: Data informs the creation of products that resonate with specific consumer segments.

- Personalized Marketing: Enables customized marketing campaigns for enhanced customer engagement.

- Portfolio Optimization: Data analytics guides strategic decisions on product mix and market focus.

Automation and Manufacturing Process Improvements

ITC's commitment to technological advancement is evident in its manufacturing operations. Continuous upgrades in automation and process improvements are crucial for boosting efficiency, cutting costs, and ensuring consistent quality across its diverse product lines. This focus on technological integration helps ITC optimize resource allocation and maintain a strong market position.

In 2023, ITC invested significantly in modernizing its manufacturing infrastructure. For instance, its FMCG segment saw the implementation of advanced robotics in packaging lines, leading to an estimated 15% reduction in manual handling and a 10% increase in output speed at select facilities. This drive for operational excellence is a cornerstone of their strategy to remain competitive.

- Automation Integration: ITC continues to deploy advanced automation, including AI-powered quality control systems, to enhance precision and reduce defects.

- Efficiency Gains: Recent upgrades in 2024 at their paperboards and packaging plants have demonstrated a 12% improvement in energy efficiency per unit produced.

- Supply Chain Optimization: Technology is also being leveraged to streamline ITC's supply chain, improving inventory management and logistics through real-time data analytics.

- Digital Transformation: The company is actively pursuing digital transformation initiatives, integrating IoT devices and advanced analytics to drive data-driven decision-making in production.

Technological advancements are central to ITC's strategy, particularly in enhancing consumer understanding and operational efficiency. The company leverages AI and advanced analytics to gain deep insights into purchasing habits, enabling targeted product development and personalized marketing campaigns. This data-driven approach was a significant factor in the robust growth of ITC's FMCG segment in fiscal year 2023-24, as they effectively anticipated and catered to evolving consumer preferences.

ITC's commitment to digital transformation extends across its operations, from agri-business sourcing to FMCG delivery. Initiatives like e-Choupal 4.0 empower farmers with digital tools, improving procurement efficiency and traceability, with continued expansion in 2024 offering farmers advisory services and market intelligence. This digital push is crucial for optimizing resource use and building a resilient supply chain, especially in the context of climate-smart agriculture.

Manufacturing efficiency is a key focus, with ongoing investments in automation and process improvements. In 2023, upgrades at FMCG facilities included advanced robotics, leading to an estimated 15% reduction in manual handling and a 10% increase in output speed. Further, in 2024, paperboard and packaging plants saw a 12% improvement in energy efficiency per unit produced, underscoring a drive for operational excellence.

| Area of Technological Focus | Key Initiatives/Impact | Data/Statistics (2023-2024/2024) |

|---|---|---|

| Consumer Insights | AI & Advanced Analytics for understanding preferences | Drove robust FMCG growth by anticipating consumer needs (FY23-24) |

| Digital Supply Chain | e-Choupal 4.0, farmer advisory services | Enhanced procurement efficiency and traceability; expanded digital services (2024) |

| Manufacturing Automation | Robotics in packaging, AI quality control | 15% reduction in manual handling, 10% output speed increase (select FMCG facilities, 2023) |

| Operational Efficiency | Energy efficiency improvements | 12% improvement in energy efficiency per unit (paperboard & packaging plants, 2024) |

Legal factors

ITC's core cigarette business faces significant headwinds due to stringent tobacco control legislation in India, exemplified by the Cigarettes and other Tobacco Products Act (COTPA). This act imposes strict requirements for health warnings on packaging and severely limits advertising and promotional activities, directly impacting ITC's sales volumes and marketing approaches for its tobacco products.

Changes in India's Goods and Services Tax (GST) on tobacco products, including potential upward revisions anticipated in the 2025 fiscal year, directly impact ITC's pricing power and profit margins. These tax adjustments are critical for ITC's competitive positioning in the market.

The government's proactive stance, exemplified by the proposed Track and Trace mechanism under CGST Act amendments in the Union Budget 2025, presents a significant legal hurdle for illicit cigarette trade. This initiative aims to curb the grey market, which has historically siphoned off significant revenue from legitimate players like ITC.

The demerger of ITC Hotels, finalized on January 1, 2025, required extensive legal navigation, including approvals from the National Company Law Tribunal (NCLT) and the Competition Commission of India (CCI). This process underscores the critical role of robust corporate governance and strict adherence to legal frameworks in executing significant strategic business restructurings, ensuring compliance and stakeholder confidence.

Environmental Compliance and Regulations

ITC navigates a complex web of environmental regulations, from waste management mandates to emissions controls, directly influencing its operational strategies and capital allocation. The company's ambitious goal of achieving plastic neutrality and Net Zero Operations by 2050 requires constant vigilance and adaptation to increasingly stringent environmental laws and evolving sustainability standards, impacting all facets of its business.

Key areas of regulatory focus for ITC include:

- Waste Management: Adherence to regulations on solid waste disposal, recycling, and hazardous waste handling across its diverse manufacturing units.

- Emissions Control: Compliance with air and water quality standards, including those related to greenhouse gas emissions from its industrial operations.

- Sustainable Sourcing: Meeting legal requirements and voluntary commitments for sustainable agricultural practices and responsible raw material procurement.

- Product Stewardship: Ensuring products meet environmental safety standards and regulations concerning packaging and end-of-life management.

Food Safety and Quality Standards

ITC, as a prominent player in India's fast-moving consumer goods (FMCG) food sector, faces stringent food safety and quality regulations. These standards are crucial for safeguarding public health and maintaining consumer trust, especially given the high sensitivity of the food market.

Adherence to these legal frameworks, enforced by bodies like the Food Safety and Standards Authority of India (FSSAI), is non-negotiable. Non-compliance can lead to severe repercussions, including hefty fines, product recalls, and significant damage to brand reputation.

- FSSAI's Role: The Food Safety and Standards Authority of India sets comprehensive guidelines for food products, covering everything from manufacturing processes to labeling.

- Consumer Health Protection: Strict adherence ensures that products are safe for consumption, preventing foodborne illnesses and maintaining consumer confidence in ITC's brands.

- Brand Reputation: In 2023, food safety incidents led to a significant drop in consumer trust for several brands, highlighting the critical link between compliance and brand equity.

- Legal Penalties: Violations of food safety laws can result in penalties ranging from license suspension to substantial financial penalties, impacting profitability.

Legal factors significantly shape ITC's operational landscape, particularly concerning its tobacco division. The Cigarettes and other Tobacco Products Act (COTPA) continues to enforce strict regulations on packaging and advertising, impacting sales and marketing strategies. Anticipated upward revisions to the Goods and Services Tax (GST) on tobacco products in fiscal year 2025 are expected to influence ITC's pricing and profit margins.

The proposed Track and Trace mechanism, part of the CGST Act amendments in the Union Budget 2025, aims to curb illicit trade, a move beneficial for legitimate players like ITC by reducing revenue leakage from the grey market.

ITC's demerger of ITC Hotels, completed on January 1, 2025, involved navigating complex legal approvals from bodies like the National Company Law Tribunal (NCLT) and the Competition Commission of India (CCI), highlighting the importance of legal compliance in corporate restructuring.

Environmental regulations, including those for waste management and emissions control, directly influence ITC's operational strategies and capital allocation, especially in light of its 2050 Net Zero Operations goal.

Environmental factors

ITC has demonstrated a strong commitment to environmental stewardship, achieving plastic neutrality for four consecutive years. In the fiscal year 2024-25, the company successfully collected and sustainably managed an impressive 76,000 tonnes of plastic waste, directly addressing a significant environmental challenge.

This dedication is further underscored by ITC's ambitious Sustainability 2.0 Vision, which targets 100% of its packaging being either recyclable, reusable, compostable, or biodegradable by 2028. This forward-looking strategy positions ITC as a leader in combating plastic pollution and promoting a circular economy within its operations.

ITC is actively embracing the global shift towards renewable energy. In fiscal year 2024-25, the company achieved a significant milestone, sourcing 52% of its total energy consumption from renewable sources. This impressive figure not only surpasses its earlier projections but also demonstrates a strong commitment to its overarching 'Net Zero Operations' goal, slated for 2050.

ITC's commitment to water stewardship is evident in its extensive watershed development programs and rainwater harvesting initiatives. By the end of fiscal year 2024, these efforts had created a significant water storage potential, amounting to 41.7 million cubic meters, a testament to their proactive approach in water-scarce regions.

Furthermore, the company actively works to reduce specific water consumption across its manufacturing units. For instance, in fiscal year 2024, ITC achieved a 10% reduction in specific water consumption for its paperboards and specialty papers business compared to the previous year, showcasing a focused drive towards operational efficiency and sustainability.

Sustainable Sourcing and Afforestation Programs

ITC's commitment to sustainable sourcing is particularly evident in its paper and paperboard operations, where it prioritizes responsibly managed forests. This focus ensures a consistent supply of raw materials while adhering to environmental stewardship principles. The company's extensive afforestation programs are a cornerstone of this strategy, aiming to bolster green cover and actively contribute to carbon sequestration efforts.

These initiatives are not merely about compliance but are deeply integrated into ITC's business model, driving long-term value creation. By investing in afforestation, ITC mitigates risks associated with raw material availability and climate change impacts. For instance, by 2023, ITC had planted over 150 million trees through its various initiatives, demonstrating a tangible commitment to ecological regeneration.

The benefits extend beyond supply chain resilience. ITC's afforestation programs directly address environmental concerns by:

- Enhancing biodiversity through the planting of diverse native species.

- Improving soil health and water retention in degraded areas.

- Sequestering significant amounts of carbon dioxide from the atmosphere, contributing to climate change mitigation.

- Providing livelihood opportunities for rural communities involved in plantation management.

Climate Change Adaptation and Biodiversity Protection

Recognizing India's significant vulnerability to extreme weather events, ITC is actively embedding climate adaptation and mitigation strategies across its operations, with a particular focus on its substantial agri-business segment. This proactive approach aims to build resilience against climate-related disruptions.

ITC's commitment extends to implementing comprehensive, multi-layered biodiversity blueprints. These initiatives are designed to actively regenerate degraded ecosystems and promote ecological balance.

- Mangrove Conservation: ITC's efforts include significant mangrove conservation projects, vital for coastal protection and biodiversity.

- Urban Miyawaki Forests: The company is establishing urban Miyawaki forests, a rapid afforestation technique that creates dense, biodiverse mini-forests, contributing to green cover in urban areas.

- Agri-Business Resilience: ITC's agri-business, a cornerstone of its operations, is increasingly integrating climate-smart practices to safeguard crop yields and farmer livelihoods against climate volatility.

- Ecosystem Regeneration: These blueprints collectively aim to restore ecological functions and enhance natural capital, demonstrating a commitment to environmental stewardship beyond mere compliance.

ITC is actively managing its environmental footprint, achieving plastic neutrality for four consecutive years and successfully managing 76,000 tonnes of plastic waste in FY24-25. The company is committed to making 100% of its packaging recyclable, reusable, compostable, or biodegradable by 2028.

Renewable energy sourcing is a priority, with ITC achieving 52% of its total energy consumption from renewable sources in FY24-25, advancing its Net Zero Operations goal. Water stewardship is demonstrated through extensive watershed development, creating 41.7 million cubic meters of water storage potential by FY24, and reducing specific water consumption by 10% in its paperboards business in FY24.

ITC's sustainability extends to responsible sourcing and afforestation, having planted over 150 million trees by 2023 to enhance biodiversity, soil health, and carbon sequestration. Climate adaptation strategies are embedded across operations, particularly in agri-business, to build resilience against extreme weather events.

| Environmental Initiative | FY24-25 Data/Target | Impact |

|---|---|---|

| Plastic Neutrality | 4 consecutive years | Sustainable plastic waste management |

| Packaging Sustainability | 100% recyclable, reusable, compostable, or biodegradable by 2028 | Reduced plastic pollution |

| Renewable Energy Sourcing | 52% of total energy consumption | Progress towards Net Zero Operations |

| Water Storage Potential | 41.7 million cubic meters by FY24 | Enhanced water security |

| Afforestation | Over 150 million trees planted by 2023 | Biodiversity, carbon sequestration, livelihoods |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data sourced from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry-specific research firms. This ensures that each insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.