ITC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITC Bundle

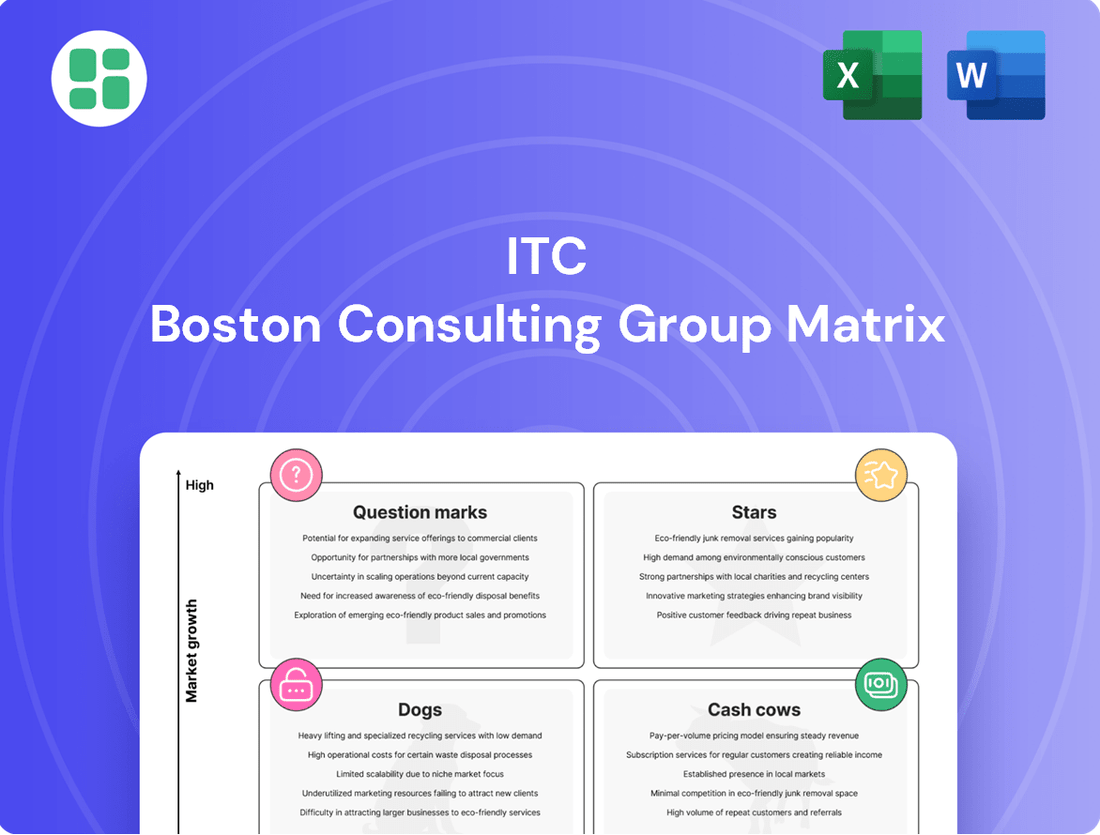

Uncover the strategic positioning of this company's products with the BCG Matrix, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This foundational understanding is crucial for informed decision-making. Purchase the full BCG Matrix to unlock a comprehensive breakdown and actionable strategic insights that will guide your investment and product development efforts.

Stars

ITC's Agri-Business segment is a shining Star in its portfolio, experiencing remarkable growth. In FY24-25, its revenue jumped by 25% to ₹19,753 crore, and the momentum continued with a 39% year-on-year surge in Q1 FY26.

This impressive performance is fueled by a strategic focus on value-added products like spices, coffee, and frozen marine items, alongside an expanding global footprint. The segment not only secures essential raw materials for ITC but also generates substantial trading revenue, solidifying its position as a key growth driver.

ITC Hotels, following its recent demerger, demonstrated robust financial health in Q4 FY25, with a 19.5% surge in consolidated profit after tax and a 4.4% rise in total revenue. This strong performance contributed to a full fiscal year revenue of ₹3,333 crore and a PAT of ₹698 crore, its best financial year yet.

As one of India's most rapidly expanding hotel chains, ITC Hotels is actively pursuing an asset-light growth model. The company aims to substantially boost its room inventory, signaling a confident and dominant presence within the thriving hospitality sector.

Aashirvaad, a cornerstone of ITC's packaged foods, is a star performer, contributing significantly to ITC's position as the second-largest FMCG player in India by sales in FY24. Despite a general slowdown in FMCG growth, Aashirvaad's strategic expansion into premium and health-conscious offerings within the robust food industry ensures its continued market leadership in staples and its ability to tap into evolving consumer demands.

ITC Infotech (IT Services)

ITC Infotech, the technology services subsidiary of ITC Limited, is demonstrating robust performance within the IT services sector. For the fiscal year 2024-25, the company reported a significant revenue increase of 11.68%, coupled with a substantial 22.10% rise in Profit After Tax (PAT). This growth trajectory suggests an expanding market presence in a sector characterized by continuous evolution and increasing demand for digital transformation and outsourcing services.

As a key player in ITC's diversified business interests, ITC Infotech's impressive financial results position it as a Star in the BCG Matrix. Its strong growth in a dynamic market indicates a capacity to capture market share and leverage opportunities in digital solutions. The company's performance underscores its potential to contribute significantly to ITC's overall portfolio value.

- Revenue Growth (FY24-25): 11.68%

- PAT Growth (FY24-25): 22.10%

- Market Position: Star (BCG Matrix)

- Sector: IT Services, Digital Solutions, IT Outsourcing

Sunfeast Biscuits & Snacks (Premium and Diversified Offerings)

Sunfeast, a flagship brand for ITC, commands a substantial share in the competitive biscuits and snacks market, a segment experiencing consistent growth within the broader FMCG landscape. This brand's strategic emphasis on premium products and a diverse range of offerings directly caters to shifting consumer preferences, bolstering the impressive performance of ITC's food division.

The brand's strong foothold and expansion into promising sub-segments solidify its classification as a Star in ITC's FMCG-Others portfolio. For instance, ITC's Foods division reported a revenue of INR 17,554 crore for the fiscal year ending March 31, 2024, with biscuits and snacks being significant contributors.

Sunfeast's success is underpinned by several key factors:

- Market Leadership: Sunfeast holds a leading position in several biscuit categories, demonstrating strong consumer loyalty and brand recall.

- Product Innovation: Continuous introduction of new flavors, formats, and healthier options keeps the brand relevant and appealing to a wide demographic.

- Distribution Network: ITC's extensive distribution reach ensures Sunfeast products are accessible across urban and rural markets.

- Premiumization Strategy: The focus on premium offerings, such as gourmet cookies and specialized snacks, allows for higher margins and caters to aspirational consumer segments.

ITC's Agri-Business segment is a standout Star, showing impressive growth. In FY24-25, its revenue climbed by 25% to ₹19,753 crore, and this momentum continued with a 39% year-on-year surge in Q1 FY26.

ITC Hotels, after its demerger, achieved its best financial year in FY25, with revenue reaching ₹3,333 crore and PAT of ₹698 crore, marking a 19.5% consolidated profit surge in Q4 FY25. The brand is aggressively expanding its room inventory through an asset-light model, solidifying its position as a rapidly growing hospitality player.

Aashirvaad, a key brand in ITC's packaged foods, is a star performer, contributing significantly to ITC's standing as India's second-largest FMCG player by sales in FY24. Its strategic expansion into premium and health-focused products within the robust food sector ensures continued market leadership and relevance to evolving consumer demands.

ITC Infotech, the technology services arm, is a definite Star, reporting an 11.68% revenue increase and a 22.10% PAT rise in FY24-25. This strong financial performance in the dynamic IT services sector highlights its growing market presence and potential to capture opportunities in digital transformation.

Sunfeast, a leading brand in ITC's Foods division, which reported INR 17,554 crore in FY24, holds a strong position in the growing biscuits and snacks market. Its focus on premium products and continuous innovation, backed by ITC's extensive distribution, makes it a Star performer.

| Business Segment | FY24-25 Revenue | Key Growth Drivers | BCG Matrix Classification |

| Agri-Business | ₹19,753 crore (25% growth) | Value-added products, global expansion | Star |

| ITC Hotels | ₹3,333 crore (FY25) | Asset-light growth, capacity expansion | Star |

| Aashirvaad (Foods) | Significant contributor to Foods Division (₹17,554 crore FY24) | Premiumization, health-conscious offerings | Star |

| ITC Infotech | 11.68% Revenue Growth (FY24-25) | Digital transformation, IT outsourcing | Star |

| Sunfeast (Foods) | Key contributor to Foods Division (₹17,554 crore FY24) | Product innovation, premiumization, distribution | Star |

What is included in the product

The ITC BCG Matrix analyzes products/units based on market share and growth, guiding investment decisions.

The ITC BCG Matrix provides a clear, visual roadmap for resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

ITC's cigarette business is a powerhouse, commanding an impressive 75-80% market share in India. This mature industry, while seeing only low single-digit growth, consistently churns out significant cash. This strong cash generation is vital, acting as the primary funding source for ITC's expansion into other promising business areas.

ITC's Traditional Paperboards & Packaging division stands as a cornerstone of the company, boasting a significant market share thanks to its extensive operational history and considerable scale. This segment, one of India's largest in the paper industry, benefits from established infrastructure and a strong customer base.

Operating within a mature market, the traditional paperboard business offers a steady stream of revenue, contributing robustly to ITC's overall financial health. While growth might be less explosive compared to emerging segments, its consistent performance underpins the company's stability and cash-generating capabilities.

For the fiscal year ending March 31, 2024, ITC's Paperboards and Specialty Papers division reported a revenue of approximately ₹16,000 crore, showcasing its substantial contribution to the conglomerate's top line.

Savlon, a cornerstone of ITC's personal care offerings, commands a substantial market presence in the hygiene sector. This category, though mature, consistently delivers robust revenue and profits, underscoring its essential role and loyal customer following.

The brand's enduring equity and extensive distribution network position it as a prime cash cow for ITC. Consequently, it demands comparatively minimal promotional investment, especially when contrasted with the higher capital needs of emerging product lines.

Mangaldeep Agarbattis

Mangaldeep Agarbattis exemplifies a classic cash cow within ITC's portfolio. Its strong market share in the Indian agarbatti sector, a segment characterized by stable, albeit low, growth, ensures consistent revenue generation. This category, deeply entrenched in consumer habits, requires minimal incremental investment for market maintenance, allowing it to reliably contribute to ITC's overall profitability.

The agarbatti market in India, while mature, continues to show resilience. For instance, in 2023, the Indian incense stick market was valued at approximately USD 1.5 billion and is projected to grow at a CAGR of around 5-6% through 2030. Mangaldeep, as a leading player, benefits from this steady demand.

- Dominant Market Position: Mangaldeep holds a significant share in the Indian agarbatti market.

- Stable Revenue Stream: The product generates consistent income for ITC due to established demand.

- Low Growth, High Profitability: Operates in a mature, low-growth category but yields substantial profits.

- Minimal Investment Needs: Requires limited capital for marketing or expansion, maximizing cash flow.

Classmate (Core Education & Stationery Products)

Classmate, a prominent name in India's education and stationery market, exemplifies a classic cash cow within the BCG matrix. Its core offerings, particularly notebooks, have cemented a strong market presence and brand loyalty, ensuring consistent revenue streams.

Despite facing a competitive landscape and moderate growth in the broader stationery sector, Classmate's foundational products remain reliable revenue generators. This stability is crucial for funding other business ventures, a hallmark of a cash cow.

- Market Share: Classmate holds a significant share in the Indian stationery market, particularly for notebooks. For instance, in fiscal year 2023-24, the stationery segment of ITC, which includes Classmate, continued to show resilience.

- Revenue Contribution: While specific standalone figures for Classmate are not always segmented, ITC's overall FMCG portfolio, where stationery is a key component, has been a major growth driver. The stationery business consistently contributes to ITC's revenue stability.

- Brand Recognition: Classmate is a household name among students and parents across India, reflecting its deep penetration and established brand equity in the education supplies segment.

- Profitability: The mature nature of its product lines and established distribution networks contribute to healthy profit margins, characteristic of a cash cow that generates more cash than it consumes.

ITC's cigarette business, a dominant player with 75-80% market share in India, functions as a prime cash cow. Despite low single-digit growth, this segment consistently generates substantial cash, enabling investment in other ventures.

The Paperboards and Specialty Papers division, with revenues around ₹16,000 crore for FY24, also represents a stable cash cow. Its large scale and established customer base in a mature market provide consistent revenue, bolstering ITC's financial foundation.

Brands like Savlon and Mangaldeep Agarbattis are also strong cash cows. Savlon benefits from strong brand equity in a mature hygiene sector, requiring minimal investment. Mangaldeep, a leader in the stable, low-growth agarbatti market, consistently generates profits with low capital needs, capitalizing on its significant market share.

| Business Segment | Market Position | Growth Rate | Cash Generation | Investment Needs |

| Cigarettes | Dominant (75-80% share) | Low single-digit | High | Low |

| Paperboards & Specialty Papers | Leading player | Moderate | Stable | Moderate |

| Savlon (Personal Care) | Strong presence | Mature | Robust | Minimal |

| Mangaldeep (Agarbatti) | Market leader | Low (stable) | Consistent | Low |

Preview = Final Product

ITC BCG Matrix

The interactive BCG Matrix you are currently viewing is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the fully functional and professionally formatted strategic tool, ready for your direct application. You can confidently expect the same high-quality analysis and design to be delivered, enabling immediate use for your business planning and decision-making processes.

Dogs

Delectable Technologies Private Limited (DTPL) was classified as a 'Dog' within ITC's portfolio, a designation underscored by its minimal financial contribution and eventual divestment. In FY24, DTPL generated a mere ₹4.8 crore in revenue, a figure that clearly illustrates its very low market presence and limited impact on ITC's broader financial performance.

The company's focus on vending machines and app-based FMCG sales, while innovative, failed to gain significant traction. This underperformance, coupled with a reduction in its operational scale prior to the divestiture, solidified its position as a low-growth, low-market-share entity.

ITC's decision to divest its entire shareholding in DTPL in May 2025 was a direct consequence of its status as a 'Dog.' This strategic move allowed ITC to reallocate resources from this underperforming asset to more promising ventures within its diverse business segments.

Within ITC's Paperboards & Packaging segment, specific low-margin or undifferentiated paper products are struggling. These products are likely considered Dogs in the BCG matrix due to their low market share and limited growth prospects.

The segment saw a substantial profit drop of 37.8% in Q1 FY26. This decline was driven by intense price competition from cheaper imports and rising wood costs, directly impacting these less differentiated paper offerings.

ITC's traditional safety matches business, a foundational element of its history, now functions within a mature and highly competitive market. This segment is characterized by low margins and limited growth potential, reflecting its status as a 'Dog' in the BCG matrix.

The safety matches industry, while stable, offers minimal scope for expansion and faces significant price-based competition. This environment results in a modest contribution to ITC's overall financial performance, with profitability being a challenge due to the commoditized nature of the product.

As of fiscal year 2023-24, while specific segment revenues for matches are not separately detailed in ITC's consolidated reports, the broader 'Other FMCG' segment, which includes matches, contributes a smaller portion compared to its dominant agribusiness and hotels divisions. The low-growth, low-margin profile firmly places this business unit in the 'Dog' quadrant, indicating it generates just enough cash to maintain its operations but offers little prospect for significant future returns.

Certain Underperforming Personal Care Sub-segments

Within ITC's expansive FMCG portfolio, certain personal care sub-segments are exhibiting underperformance, fitting the profile of Dogs in the BCG Matrix. Despite the company's focus on premiumization, the broader non-cigarette FMCG segment, which encompasses personal care, experienced a profit decline of 16.5% in Q1 FY26, coupled with sluggish revenue expansion. This financial trend suggests that some of ITC's legacy or less innovative personal care products are likely facing challenges of low market penetration and minimal growth, necessitating a strategic review.

These underperforming sub-segments are characterized by:

- Low Market Share: Products that have not gained significant traction or have been overtaken by competitors.

- Stagnant Growth: Sales figures that show little to no improvement over time.

- Limited Differentiation: Offerings that lack unique selling propositions in a competitive market.

- Need for Re-evaluation: These segments require a critical look to determine if investment in revitalization or divestment is the appropriate course of action.

Struggling or Outdated Brands in FMCG-Others

Within ITC's diverse 'FMCG-Others' segment, certain established or older brands are showing signs of struggle. This is underscored by the segment's combined gross revenue, which experienced a 1.1% decline in FY24-25. This dip suggests that brands in categories like Education and Stationery Products, Personal Care Products, Safety Matches, and Agarbattis are not keeping pace with market dynamics.

These underperforming brands likely possess a low market share and exhibit minimal growth. Their inability to connect with contemporary consumer tastes or their vulnerability to intense competition places them squarely in the 'Dog' quadrant of the BCG Matrix. This classification highlights their need for strategic re-evaluation or potential divestment.

- Underperforming Categories: Education & Stationery, Personal Care, Safety Matches, and Agarbattis within ITC's FMCG-Others.

- Revenue Trend: Combined gross revenue for these categories declined by 1.1% in FY24-25.

- Market Position: Brands in these categories likely have low market share and low growth prospects.

- Strategic Implication: These 'Dog' brands require careful assessment due to evolving consumer preferences and competitive pressures.

Delectable Technologies Private Limited (DTPL) was a 'Dog' in ITC's portfolio, showing minimal financial contribution with only ₹4.8 crore in revenue in FY24. Its focus on vending machines and app-based FMCG sales did not gain significant traction, leading to its divestment in May 2025 to reallocate resources. Similarly, certain paper products within ITC's Paperboards & Packaging segment are considered Dogs due to low market share and limited growth, exacerbated by a 37.8% profit drop in Q1 FY26 from price competition and rising wood costs.

ITC's traditional safety matches business also fits the 'Dog' profile, operating in a mature, competitive market with low margins and minimal expansion scope. While specific segment revenues aren't detailed, the broader 'Other FMCG' segment, including matches, contributes less than dominant divisions, generating just enough cash to sustain operations without significant future returns. This low-growth, low-margin profile firmly places it in the 'Dog' quadrant.

Within the 'FMCG-Others' segment, some personal care sub-segments and older brands in categories like Education & Stationery, Personal Care, Safety Matches, and Agarbattis are underperforming. This is evidenced by a 1.1% decline in combined gross revenue for these categories in FY24-25. These brands likely have low market share and growth prospects, requiring strategic re-evaluation or potential divestment due to evolving consumer preferences and competitive pressures.

| Business Segment/Category | BCG Classification | Key Indicators | Financial Snapshot (FY24/Q1 FY26) |

| Delectable Technologies (DTPL) | Dog | Low market share, low growth, minimal financial contribution | ₹4.8 crore revenue (FY24), Divested May 2025 |

| Paperboards & Packaging (Undifferentiated Products) | Dog | Low market share, limited growth prospects, intense price competition | 37.8% profit drop (Q1 FY26) |

| Safety Matches Business | Dog | Mature market, low margins, limited expansion, price competition | Modest contribution to overall performance, profitability challenges |

| FMCG-Others (Certain Personal Care, Legacy Brands) | Dog | Low market penetration, minimal growth, intense competition | 1.1% decline in combined gross revenue (FY24-25) for Education & Stationery, Personal Care, Safety Matches, Agarbattis |

Question Marks

ITC's strategic foray into new-age digital-first brands like Yogabar, Prasuma, and Mother Sparsh positions them as potential Stars in the BCG matrix. These brands tap into burgeoning consumer segments, with the health and wellness market, for instance, projected to reach $800 billion globally by 2027, according to Grand View Research. While their current market share within ITC's extensive portfolio might be modest, their presence in high-growth categories signifies considerable future potential.

These digital-first brands, despite their rapid growth, currently require substantial investment to scale and compete effectively. For example, Mother Sparsh, focusing on natural baby care, operates in a market where consumer preference for organic and chemical-free products is steadily increasing, a trend that gained further traction in 2023 and 2024. Their investment needs are geared towards expanding distribution, enhancing digital marketing efforts, and solidifying brand presence to capture a larger share of these expanding markets.

ITC's acquisition of 24 Mantra Organic marks its strategic move into the rapidly expanding organic food sector. This segment is seeing significant growth, driven by heightened consumer awareness around health and wellness. For instance, the Indian organic food market was valued at approximately USD 1.7 billion in 2023 and is projected to reach USD 12 billion by 2028, growing at a CAGR of over 30%.

Despite this promising outlook, 24 Mantra Organic's current market share within the organized organic food space is modest when compared to more established brands. This positions it as a 'Question Mark' in the BCG matrix, indicating a high-growth market where the company needs to invest substantially to build its presence and capture a leading position.

ITC's foray into moulded fibre products through its ITC Fibre Innovations Ltd. subsidiary positions this segment as a Question Mark in the BCG matrix. This venture is driven by the increasing demand for sustainable packaging solutions, a market projected for substantial growth due to heightened environmental awareness and regulatory shifts.

While the specific market share for ITC's moulded fibre products in 2024 is not publicly detailed, the broader sustainable packaging market is experiencing rapid expansion. For instance, the global moulded pulp packaging market was valued at approximately USD 20.5 billion in 2023 and is anticipated to grow at a CAGR of around 5.5% from 2024 to 2030, indicating significant future potential.

This segment, being a relatively new investment for ITC, likely holds a modest market share currently but is positioned in a high-growth industry. Therefore, it requires strategic capital allocation to scale operations, enhance product development, and capture a larger portion of this burgeoning market, aligning with the characteristics of a Question Mark.

Premium Personal Care (New Launches/Segments)

ITC is strategically focusing on premiumization in its personal care segment, introducing new, differentiated products to meet the growing consumer preference for upscale offerings. This move aims to capture a larger share of a rapidly expanding market.

While the premium personal care sector is experiencing robust growth, ITC's recent launches in this category currently hold a modest market share when compared to established market leaders. These new products are considered 'question marks' within the BCG framework.

Sustained marketing efforts and significant investment will be crucial for these premium personal care products to achieve substantial market penetration and growth. For instance, the Indian premium skincare market alone was projected to reach approximately INR 13,000 crore in 2024, indicating the potential for well-positioned new entrants.

- Focus on Premiumization: ITC's strategy involves launching differentiated, higher-end personal care products.

- Market Position: Newer premium offerings have lower market share against established competitors.

- Investment Needs: These products are 'question marks' requiring substantial marketing and investment for growth.

- Market Opportunity: The Indian premium personal care market presents significant growth potential, with specific segments showing strong upward trends.

Rural Market Penetration for FMCG

ITC's strategic push into rural markets for its FMCG portfolio, particularly with smaller, more affordable stock-keeping units (SKUs) for food items, highlights a significant growth opportunity. These markets are showing increasing disposable incomes, making them attractive targets.

However, penetrating these diverse and price-sensitive rural geographies to gain substantial market share presents a considerable challenge. It requires tailored approaches to meet local consumer needs and preferences effectively.

ITC's investment in rural expansion, including the development of these smaller SKUs, is a key initiative within its broader FMCG strategy. For instance, in fiscal year 2024, ITC reported a robust growth in its FMCG segment, with rural demand contributing significantly to this expansion.

- Rural FMCG Growth: Rural markets are projected to grow at a faster pace than urban markets for FMCG products in India, driven by rising incomes and increasing consumption.

- Affordable SKUs: The introduction of smaller pack sizes (e.g., ₹5 or ₹10 packs) by FMCG companies like ITC has been crucial in driving penetration in price-sensitive rural areas.

- Distribution Challenges: Reaching remote rural areas effectively remains a hurdle, requiring significant investment in distribution networks and last-mile delivery solutions.

- Brand Building: Building brand loyalty and awareness in rural settings necessitates localized marketing campaigns and community engagement, differentiating from urban strategies.

ITC's 24 Mantra Organic represents a Question Mark due to its presence in the high-growth organic food sector, which saw Indian market value around USD 1.7 billion in 2023. Despite this potential, its current market share is modest, necessitating significant investment to build a stronger foothold and compete effectively.

The company's venture into moulded fibre products also falls into the Question Mark category. This segment operates within the sustainable packaging market, a sector experiencing substantial growth driven by environmental concerns and regulatory changes. While specific 2024 market share data for ITC is unavailable, the broader market is expanding, requiring strategic capital allocation to scale operations and capture market share.

ITC's newer premium personal care products are also classified as Question Marks. The Indian premium skincare market alone was projected to reach approximately INR 13,000 crore in 2024, indicating a lucrative opportunity. However, these offerings currently hold a modest market share against established leaders, requiring sustained marketing and investment to achieve significant penetration.

ITC's strategic focus on rural FMCG, particularly with affordable SKUs, positions this as a growth area. While rural markets are showing increasing disposable incomes, gaining substantial market share requires tailored approaches and investment in distribution networks. The company's fiscal year 2024 performance indicated robust FMCG growth with significant rural demand contribution.

| Business Segment | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| 24 Mantra Organic | Question Mark | High (Indian organic food market ~USD 1.7 billion in 2023) | Modest | High |

| Moulded Fibre Products | Question Mark | High (Global moulded pulp packaging market ~USD 20.5 billion in 2023) | Modest | High |

| Premium Personal Care | Question Mark | High (Indian premium skincare market ~INR 13,000 crore in 2024) | Modest | High |

| Rural FMCG (Affordable SKUs) | Question Mark | High (Projected faster growth than urban for FMCG) | Modest | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth rates, to accurately position each business unit.