ITC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ITC Bundle

ITC's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business operating within or looking to enter its markets.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ITC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ITC's diverse and localized sourcing strategy significantly dilutes supplier bargaining power. By sourcing from over 5 million farmers in its agri-business, ITC avoids over-reliance on any single supplier, a critical advantage in managing costs and ensuring supply stability. This vast network is a testament to their commitment to local economies and a robust supply chain.

The fact that over 90% of ITC's raw material needs are met through domestic sourcing further strengthens its position. This localized approach not only supports rural livelihoods but also builds a resilient supply chain, less susceptible to international trade volatilities and currency fluctuations. It allows for quicker response times and greater control over material quality.

ITC's significant reliance on agricultural commodities for approximately 40% of its raw material costs places it directly in the path of supplier bargaining power. Fluctuations in the prices of key inputs like wheat, edible oil, cocoa, and leaf tobacco, driven by weather, yields, and global market dynamics, can exert considerable cost pressure.

This volatility was evident with the high-cost leaf tobacco inventory experienced in FY25, demonstrating how external agricultural market swings can directly impact ITC's profitability and operational planning.

ITC's Agri Business segment is a key player in managing supplier power. By directly engaging in agriculture, ITC secures essential raw materials like leaf tobacco for its cigarettes and wheat and other produce for its food division. This backward integration strategy reduces reliance on external suppliers, thereby diminishing their bargaining leverage.

In 2023-24, ITC's Agri Business division reported revenues of INR 11,081.76 crore, showcasing its significant scale. This robust presence allows ITC to influence sourcing costs and ensure quality, directly counteracting the potential for suppliers to dictate terms and prices.

Limited Differentiation in Certain Materials

In segments like paperboard and packaging, raw materials such as wood pulp are largely commoditized. This lack of differentiation among suppliers means ITC has limited leverage when it comes to sourcing these essential inputs.

The commodity nature of these materials directly impacts ITC's input costs. When suppliers increase prices for wood pulp, for example, these costs can be passed on, affecting the company's profitability. For instance, global pulp prices saw fluctuations in early 2024, with benchmark NBSK pulp prices in Northern Europe averaging around $1,400 per metric ton in Q1 2024, a figure that can significantly influence packaging material costs.

- Commoditized Inputs: Wood pulp and other basic packaging materials offer little room for supplier differentiation.

- Price Sensitivity: ITC's reliance on these commodities makes it vulnerable to supplier price hikes.

- Impact on Costs: Fluctuations in global commodity prices, like those seen in early 2024 for wood pulp, directly affect ITC's operational expenses.

Regulatory and Environmental Impact on Costs

Suppliers' bargaining power can be significantly influenced by regulatory and environmental shifts, potentially increasing their costs. For instance, new environmental compliance mandates or changes in tax structures, like the Goods and Services Tax (GST) implementation in India, can lead to higher operational expenses for suppliers.

These increased costs often translate into higher input prices for companies like ITC. Suppliers who must invest in new technologies or processes to meet these regulations may find themselves in a stronger position to negotiate better terms, effectively enhancing their bargaining power.

- Regulatory Compliance Costs: For example, stricter emission standards for agricultural inputs or packaging materials could force suppliers to adopt more expensive production methods.

- Environmental Mandates: The push for sustainable sourcing and reduced carbon footprints may require suppliers to invest in certifications or alternative, pricier raw materials.

- Taxation Impact: Changes in indirect taxes can directly affect the cost of goods for suppliers, which they may then pass on to their buyers.

ITC's bargaining power with suppliers is a mixed bag, influenced by its vast sourcing network and backward integration, yet challenged by commodity markets and regulatory shifts.

While ITC's direct engagement with over 5 million farmers and its Agri Business division's INR 11,081.76 crore revenue in 2023-24 significantly reduce reliance on external suppliers for key inputs like leaf tobacco, other segments face different dynamics.

The commoditized nature of inputs like wood pulp for its paperboard and packaging business, where global prices averaged around $1,400 per metric ton for NBSK pulp in early 2024, leaves ITC more susceptible to supplier price increases.

Furthermore, regulatory and environmental mandates can increase supplier costs, which are often passed on to ITC, thereby strengthening supplier bargaining power.

What is included in the product

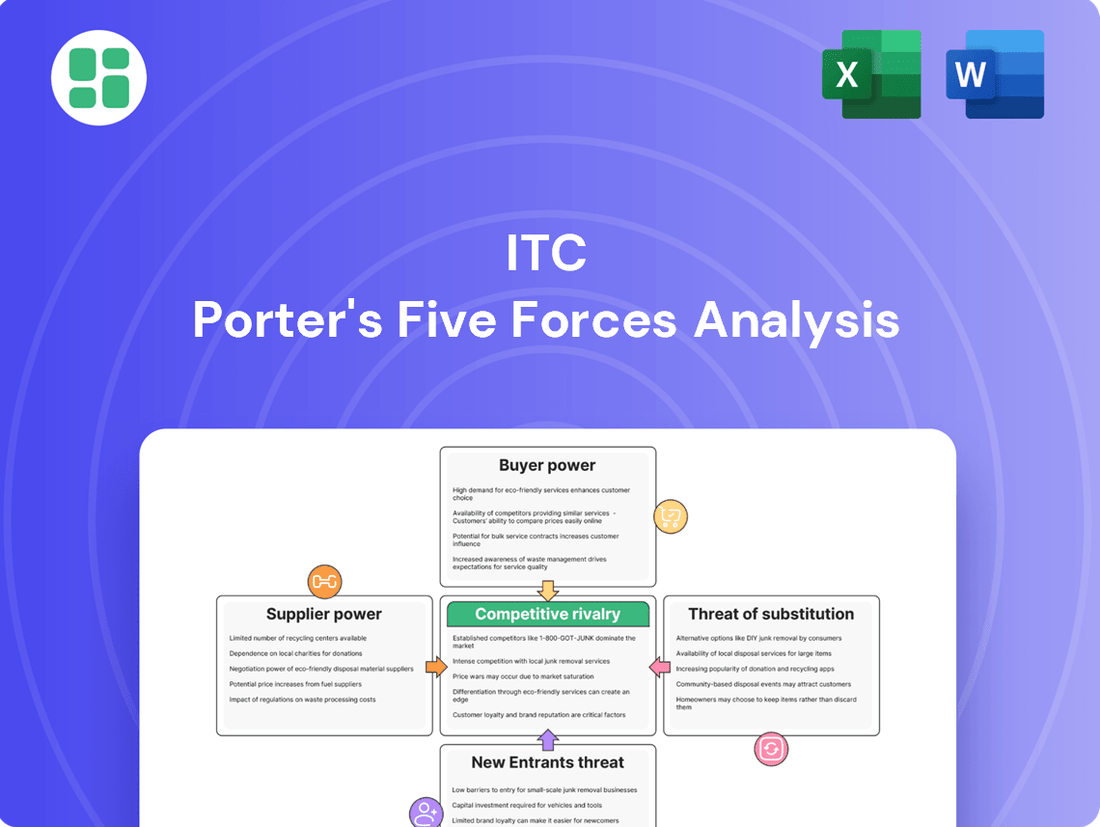

This analysis examines the five competitive forces shaping ITC's industry: the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and neutralize competitive threats with a visual, actionable framework.

Customers Bargaining Power

ITC's extensive distribution network, reaching almost seven million retail outlets and over 260 million households in India, significantly reduces the bargaining power of customers. This broad accessibility means consumers have numerous options to purchase ITC products, lessening their dependence on any single retailer or channel.

ITC's formidable brand portfolio significantly curtails customer bargaining power. Brands like Aashirvaad in staples, Sunfeast in biscuits, and Savlon in personal care have cultivated deep consumer loyalty. This loyalty means customers are less likely to switch for minor price differences, effectively weakening their ability to demand lower prices.

ITC's expansive rural distribution network means a substantial portion of its customer base operates in price-sensitive markets. This sensitivity is a direct driver of customer bargaining power, as these consumers are more likely to switch brands if price points are not aligned with their perceived value. For instance, in 2024, a significant percentage of rural Indian households still prioritize affordability in their purchasing decisions across FMCG categories, directly impacting ITC's pricing flexibility.

Evolving Consumer Preferences and Premiumization

Consumers are increasingly seeking products that prioritize health, nutrition, hygiene, convenience, and overall wellness. This shift in demand significantly influences market dynamics.

ITC has actively addressed these evolving preferences, launching over 100 new products in fiscal year 2025 alone. This proactive approach demonstrates a commitment to meeting contemporary consumer needs.

The company's strategic focus on premiumization allows it to cater to these sophisticated demands. By offering higher-value products, ITC can potentially mitigate direct price bargaining from customers in these premium segments.

- Evolving Consumer Demands: Growing preference for health, nutrition, hygiene, convenience, and wellness products.

- ITC's Product Innovation: Launch of over 100 new products in FY25 to align with consumer trends.

- Premiumization Strategy: Focus on high-value offerings that cater to sophisticated consumer preferences and can command higher prices.

- Impact on Bargaining Power: Premiumization can reduce customers' direct price negotiation leverage in specific product categories.

Growth of Digital and Modern Trade Channels

The expansion of digital and modern trade channels significantly bolsters the bargaining power of customers. These channels, which now represent 31% of ITC's Fast-Moving Consumer Goods (FMCG) portfolio, offer consumers greater accessibility and often more competitive pricing.

This shift means customers have a wider array of choices and can more easily compare prices and product offerings. The increasing prevalence of quick commerce further amplifies this power by providing faster delivery and enhanced convenience, allowing consumers to switch between brands or retailers with minimal friction.

- Digital and Modern Trade Dominance: These channels comprise 31% of ITC's FMCG revenue, giving customers diverse purchasing avenues.

- Enhanced Price Sensitivity: Increased accessibility through these channels facilitates easier price comparisons, empowering consumers to seek better deals.

- Convenience and Speed: The rise of quick commerce offers customers faster fulfillment, increasing their ability to choose based on delivery speed and overall convenience.

The bargaining power of customers for ITC is a nuanced factor, influenced by brand loyalty, distribution reach, and evolving consumer preferences. While strong brands and wide distribution limit this power, the rise of digital channels and a growing demand for specific product attributes can amplify it.

ITC's extensive distribution network, reaching nearly seven million retail outlets, and its strong brand portfolio, featuring names like Aashirvaad and Sunfeast, generally reduce customer bargaining power by fostering loyalty and limiting easy alternatives. However, the increasing shift towards digital and modern trade channels, which now account for 31% of ITC's FMCG sales, empowers customers with more choices and easier price comparisons, especially with the rise of quick commerce.

Consumer demand for health, nutrition, and convenience is also a significant driver. ITC's response, with over 100 new products launched in FY25, aims to mitigate this by offering value beyond price. For instance, in 2024, rural Indian households' continued focus on affordability in FMCG purchases means price sensitivity remains a key aspect of customer bargaining power in these segments.

| Factor | Impact on Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Brand Loyalty & Distribution Reach | Reduces Customer Power | ITC's network covers ~7 million outlets; strong brand equity. |

| Digital & Modern Trade Channels | Increases Customer Power | 31% of FMCG sales; facilitates price comparison and switching. |

| Evolving Consumer Demands (Health, Convenience) | Can increase power if unmet; can decrease if met by ITC | Over 100 new products launched in FY25 to meet these needs. |

| Rural Price Sensitivity | Increases Customer Power | Significant rural segment prioritizes affordability in 2024 FMCG purchases. |

Preview the Actual Deliverable

ITC Porter's Five Forces Analysis

This preview showcases the complete ITC Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the industry. The document you see here is precisely the same detailed report you will receive immediately after purchase, ensuring you get the full, professionally formatted analysis without any alterations or placeholders. You can confidently proceed with your purchase, knowing you'll gain instant access to this exact, ready-to-use strategic tool.

Rivalry Among Competitors

ITC operates in highly competitive sectors, including FMCG, hotels, paperboards, and agri-business, leading to intense rivalry. In the FMCG sector alone, it contends with giants like Hindustan Unilever Limited (HUL), Nestlé India, Procter & Gamble, and Godrej Consumer Products, all fiercely competing for consumer attention and market share. This broad diversification means ITC faces a multitude of competitors across its various business verticals, amplifying the overall competitive pressure.

ITC faces intense competition from numerous local and regional players across various fast-moving consumer goods (FMCG) segments. These smaller companies often vie for market share by aggressively undercutting prices, particularly in categories such as noodles, snacks, biscuits, and everyday soaps.

This price-driven competition can create significant margin pressures for larger entities like ITC. For instance, in the biscuits market, the presence of many regional brands offering value-for-money options forces established players to either match these prices, impacting profitability, or risk losing volume share.

ITC's competitive rivalry in the cigarette segment is characterized by its substantial market dominance, holding an impressive approximately 78% share. This position is maintained despite the presence of significant competitors such as Godfrey Phillips India Ltd and Philip Morris International. The cigarette business continues to be ITC's most profitable venture, generating the financial strength needed to fuel its diversified operations.

Strategic Acquisitions and Product Launches

ITC actively manages competitive rivalry by strategically acquiring companies and launching new products. For instance, their acquisitions of Yoga Bar and 24 Mantra Organic in recent years demonstrate a clear intent to expand into high-growth segments like healthy foods and organic products.

This proactive approach allows ITC to not only counter existing competition but also to shape market dynamics by introducing innovative offerings. By continuously refreshing its product portfolio, ITC aims to capture a larger share of the Indian consumer market and reinforce its brand presence across various sectors.

- Strategic Acquisitions: ITC's acquisition of minority stakes in companies like Yoga Bar and 24 Mantra Organic signals a move into burgeoning consumer categories.

- Product Innovation: The company consistently launches new products across its diverse business segments, from FMCG to hotels, to stay ahead of rivals.

- Market Footprint Expansion: These strategies are designed to accelerate growth and strengthen ITC's competitive position within the Indian market.

Margin Pressures from Input Costs and Competition

ITC grapples with persistent margin pressures stemming from escalating input expenses, such as those for edible oils and packaging materials, alongside fierce price competition across its varied business segments. For instance, in the fiscal year 2023-24, the company navigated a challenging environment where commodity prices, while showing some moderation from previous peaks, remained a significant factor influencing profitability.

The company's strategy involves rigorous cost management initiatives and strategic pricing adjustments to safeguard its profit margins. This balancing act is crucial given the diverse nature of its operations, ranging from consumer goods to hotels and agribusiness.

- Rising Input Costs: Fluctuations in prices of key commodities like edible oils, wheat, and packaging materials directly impact production costs, squeezing margins.

- Intense Price Competition: The FMCG sector, in particular, is characterized by aggressive pricing strategies from numerous players, forcing ITC to compete on price to maintain market share.

- Cost Management Focus: ITC continuously seeks efficiencies in its supply chain and manufacturing processes to mitigate the impact of rising costs.

- Judicious Pricing Actions: The company carefully evaluates pricing strategies to pass on cost increases where feasible without significantly deterring consumer demand.

ITC faces intense rivalry across its diverse business segments, from FMCG to hotels and agri-business. In the FMCG sector, it competes with major players like HUL and Nestlé, necessitating aggressive strategies to capture market share. The company's dominance in the cigarette segment, with an approximate 78% market share in FY23-24, provides a strong financial base to counter competition elsewhere.

Despite its strong market position in cigarettes, ITC actively manages competitive pressures through strategic acquisitions, such as its recent stakes in Yoga Bar and 24 Mantra Organic, to tap into growing consumer categories. This proactive approach, coupled with continuous product innovation, aims to strengthen its overall market standing and combat rivals effectively.

The company navigates margin pressures from rising input costs, like edible oils and packaging, and fierce price competition in the FMCG space. For instance, commodity price volatility in FY23-24 underscored the need for rigorous cost management and strategic pricing to maintain profitability across its varied operations.

| Business Segment | Key Competitors | ITC's Competitive Strategy |

|---|---|---|

| FMCG | HUL, Nestlé, P&G, Godrej Consumer Products | Product Innovation, Market Footprint Expansion, Strategic Acquisitions |

| Cigarettes | Godfrey Phillips India, Philip Morris International | Market Dominance (approx. 78% share in FY23-24) |

| Hotels | Indian Hotels Company (Taj), EIH Ltd (Oberoi) | Brand Differentiation, Service Excellence, Expansion |

| Paperboards & Packaging | JK Paper, BILT, Seshasayee Paper and Boards | Cost Efficiency, Product Quality, Customer Relationships |

SSubstitutes Threaten

Growing health awareness and stricter regulations are pushing consumers away from traditional cigarettes, creating a significant threat from substitutes. Many are exploring alternatives like e-cigarettes, nicotine pouches, and even nicotine-free options. For instance, the global e-cigarette market was valued at approximately $22.7 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer preference that directly impacts ITC's core cigarette segment.

The threat of substitutes in the Fast-Moving Consumer Goods (FMCG) sector is significant due to the wide availability of alternatives. Consumers can easily switch to private label brands, generic products, or offerings from regional manufacturers, particularly for everyday staples and personal care items. This accessibility to comparable products means ITC faces constant pressure to maintain competitive pricing and product appeal. For instance, the Indian FMCG market saw private label penetration grow to around 10-15% by 2024, demonstrating consumers' willingness to explore alternatives for value.

The rise of niche and direct-to-consumer (D2C) brands poses a significant threat of substitutes for established companies like ITC. These agile players often focus on specific consumer needs, offering specialized products that can directly appeal to segments underserved by larger corporations. For instance, the booming D2C personal care market, which saw substantial growth in 2023 and continued momentum into early 2024, allows these brands to bypass traditional retail and build direct relationships with customers.

Competition from Low-Cost Imports in Paperboards

ITC's paperboards and packaging business faces a significant threat from low-cost imports, particularly from China and Indonesia. These imported products offer a cheaper alternative to domestically produced paperboards, directly impacting ITC's competitive pricing strategy.

This influx of affordable imports can erode ITC's market share as price-sensitive customers opt for these substitutes. For instance, in 2024, the global paper and pulp market saw continued price volatility, with Asian producers often leveraging lower manufacturing costs.

The availability of these cheaper substitutes forces ITC to either match lower price points, potentially squeezing profit margins, or risk losing volume to competitors. This dynamic puts considerable pressure on ITC's profitability and its ability to maintain its premium positioning in the packaging sector.

Key considerations regarding this threat include:

- Price Sensitivity: The primary driver for customers choosing imported paperboards is cost savings.

- Quality Perception: While often cheaper, the quality of imported paperboards can vary, creating a segment where ITC can differentiate.

- Trade Policies: Changes in import duties or trade agreements could impact the cost-competitiveness of these substitutes.

- ITC's Response: ITC's strategy to counter this threat likely involves cost optimization, product innovation, and emphasizing superior quality and service.

ITC's Counter-Strategy: Innovation and Premiumization

ITC actively combats the threat of substitutes by prioritizing innovation and premiumization within its diverse FMCG offerings. This strategy aims to build strong brand loyalty and offer unique value that competitors struggle to replicate.

A key element of this counter-strategy involves launching a significant number of new products. For instance, in fiscal year 2025, ITC introduced over 100 new products. This aggressive product development pipeline, with a focus on emerging categories like health, nutrition, and convenience, is designed to capture evolving consumer preferences and create distinct offerings that are less susceptible to substitution.

- Focus on Innovation: ITC's commitment to launching over 100 new products in FY25 underscores its drive to stay ahead of market trends.

- Premiumization Strategy: The company is elevating its product portfolio by emphasizing quality and unique features, making them more attractive than generic alternatives.

- Health and Nutrition Push: A significant portion of new product development is directed towards health and nutrition segments, tapping into growing consumer demand for wellness.

- Convenience Offerings: ITC is also expanding its range of convenient food and beverage options to cater to busy lifestyles, further differentiating from simpler substitute products.

The threat of substitutes for ITC's products is multifaceted, spanning from alternative product categories to different sourcing options. In the tobacco segment, evolving consumer preferences towards healthier lifestyles and stricter regulations are driving a shift towards alternatives like e-cigarettes and nicotine pouches, a market projected for significant growth. Similarly, the FMCG sector faces pressure from private labels and regional brands, necessitating competitive pricing and continuous product appeal. The paperboards business, in particular, contends with low-cost imports, forcing strategic pricing adjustments and a focus on quality differentiation.

| Business Segment | Key Substitute Threat | Impact/Example Data |

|---|---|---|

| Cigarettes | E-cigarettes, Nicotine Pouches | Global e-cigarette market valued at ~$22.7 billion in 2023, showing strong growth. |

| FMCG | Private Labels, Generic Brands | Private label penetration in India reached 10-15% by 2024. |

| Paperboards | Low-cost Imports (e.g., China, Indonesia) | Asian producers often leverage lower manufacturing costs, impacting global price dynamics in 2024. |

Entrants Threaten

ITC's diverse operations, from hotels to paperboards, demand massive upfront capital. For instance, establishing a new cigarette manufacturing plant or expanding its FMCG distribution network requires hundreds of millions of dollars in infrastructure and technology. This significant financial hurdle deters many potential competitors from entering the market.

Established brand recognition and loyalty pose a significant barrier for new entrants. ITC has spent decades building trust and preference for brands like Aashirvaad, Sunfeast, and Bingo!, making it difficult for newcomers to gain traction. For instance, in FY23, ITC's FMCG business revenue grew by 17.6%, demonstrating the strength of its consumer connect.

ITC's extensive distribution network, reaching over 2 million retail outlets across India, presents a significant threat of new entrants. Establishing a comparable reach and efficiency in supply chain management and last-mile delivery would require immense capital investment and time, making it a substantial barrier to entry for any new player in the FMCG sector.

Regulatory Hurdles and Industry Expertise

The threat of new entrants for ITC, particularly in its core tobacco business, is exceptionally low due to stringent regulatory frameworks. For instance, the Cigarettes and Other Tobacco Products (Prohibition of Advertisement and Regulation of Trade and Commerce, Production, Supply and Distribution) Act in India, enacted in 2003 and amended over time, mandates strict controls on manufacturing, packaging, and sales, creating a high barrier to entry.

Beyond tobacco, ITC's diversified portfolio, spanning FMCG, hotels, paperboards, and agri-business, demands substantial industry-specific expertise and established supply chains. Building the necessary infrastructure and brand recognition to compete effectively across these varied sectors would require immense capital investment and time, deterring most potential newcomers.

Consider the capital intensity involved; setting up a cigarette manufacturing facility compliant with all regulations, or establishing a hotel chain with the brand equity of ITC Hotels, represents a significant financial commitment. In 2023-24, ITC's revenue from cigarettes alone was ₹17,077 crore, illustrating the scale of operations required to be competitive.

- Regulatory Complexity: Strict government regulations on tobacco products, including advertising bans and health warnings, make it difficult for new players to enter and operate.

- Capital Intensity: Establishing manufacturing facilities, distribution networks, and brand presence across ITC's diverse business segments requires substantial upfront investment.

- Expertise and Relationships: Success in sectors like hotels and agri-business relies on specialized knowledge and long-standing relationships with suppliers and customers, which are hard for new entrants to replicate.

- Economies of Scale: ITC's established scale provides cost advantages in procurement and manufacturing that new entrants would struggle to match, further limiting their competitive potential.

Strategic Acquisitions and Innovation by Incumbents

ITC's aggressive pursuit of strategic acquisitions, such as its investment in Yoga Bar, significantly raises the barrier to entry for new players. By integrating established brands and expanding its portfolio, ITC effectively absorbs potential market disruptors. This consolidation of market share and brand recognition makes it considerably more challenging for emerging companies to carve out a competitive space.

Furthermore, ITC's relentless focus on product innovation and enhancing supply chain efficiency acts as a potent deterrent. The company consistently introduces new products and refines its operational processes, setting a higher standard for quality and cost-effectiveness. This continuous improvement cycle means new entrants must not only match existing offerings but also surpass ITC's evolving benchmarks, a difficult feat given the incumbent's scale and resources.

- Strategic Acquisitions: ITC's acquisition of a majority stake in Yoga Bar for approximately ₹215 crore (as of early 2023) exemplifies its strategy to consolidate market presence and absorb potential competition in high-growth segments.

- Innovation in Product Development: ITC consistently invests in R&D, leading to a pipeline of innovative products across its diverse business verticals, making it harder for new entrants to match the breadth and appeal of its offerings.

- Supply Chain Efficiency: Through investments in technology and logistics, ITC has built a robust and efficient supply chain, enabling cost advantages and faster market reach that new entrants struggle to replicate.

- Raising the Bar: The combined effect of these strategies means new entrants face a significantly higher hurdle in terms of capital investment, brand building, and operational excellence to gain meaningful traction against ITC.

The threat of new entrants for ITC is generally low due to substantial capital requirements, strong brand loyalty, and extensive distribution networks. Regulatory hurdles, especially in the tobacco sector, and the need for specialized expertise across diverse businesses further deter new players.

ITC's strategic acquisitions and continuous innovation also raise the bar for potential competitors. For instance, its investment in Yoga Bar exemplifies a strategy to consolidate market share and absorb emerging competition.

The company's scale provides significant cost advantages, making it difficult for newcomers to compete on price and efficiency.

Overall, the combination of high entry barriers, established market presence, and strategic maneuvering significantly limits the threat of new entrants across ITC's varied business segments.

| Barrier Type | Description | Example for ITC |

|---|---|---|

| Capital Intensity | High upfront investment needed for manufacturing, distribution, and brand building. | Establishing a cigarette plant or expanding FMCG distribution requires hundreds of millions of dollars. |

| Brand Loyalty & Recognition | Decades of building trust and preference for brands. | Strong consumer connect for brands like Aashirvaad and Sunfeast. |

| Distribution Network | Extensive reach across millions of retail outlets. | Reaching over 2 million retail outlets across India. |

| Regulatory Framework | Strict government controls, particularly in the tobacco industry. | The Cigarettes and Other Tobacco Products Act mandates strict controls. |

| Economies of Scale | Cost advantages from large-scale operations. | Lower procurement and manufacturing costs compared to smaller players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial filings. This comprehensive approach ensures a thorough understanding of competitive intensity and strategic positioning.