Itafos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

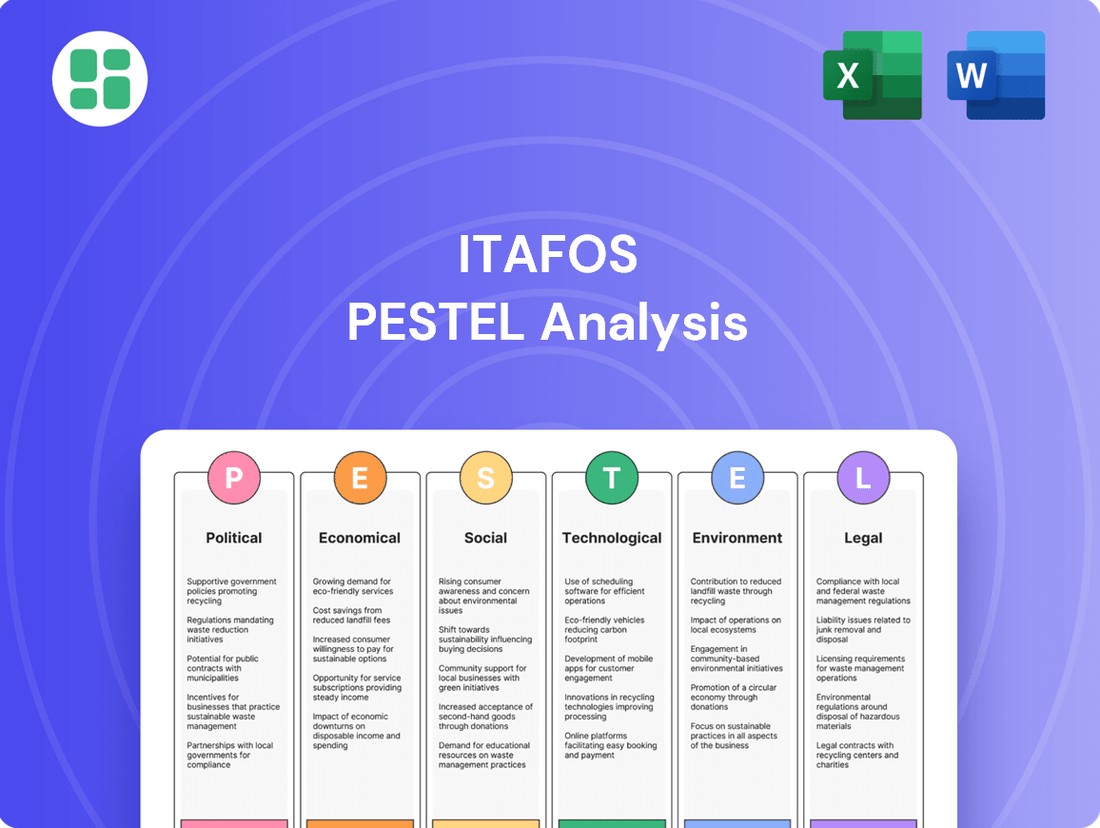

Navigate the complex external forces shaping Itafos's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Gain the strategic foresight needed to make informed decisions and secure your competitive advantage. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies regarding agricultural subsidies in North and South America significantly shape fertilizer demand. For instance, the United States' Farm Bill often includes programs that support crop production, directly influencing farmers' purchasing power for inputs like fertilizers. In 2024, continued or adjusted subsidy levels will be a key indicator for fertilizer consumption trends.

Changes in these agricultural support mechanisms can lead to fluctuations in farmer profitability and, by extension, their capacity to invest in fertilizers. A reduction in subsidies might dampen demand, impacting Itafos's sales volumes, while expanded programs could boost them. The outlook for 2025 will depend on how these policy decisions evolve across key markets.

Trade policies significantly influence Itafos's operations by affecting the import of raw materials and the export of finished fertilizer products. Fluctuations in international trade agreements and the imposition of tariffs can directly impact supply chain costs and market accessibility in key regions. For instance, trade disputes between major agricultural producers and fertilizer exporters, such as those seen in recent years concerning China and the United States, can create price volatility and disrupt established import/export flows.

New tariffs, particularly on essential fertilizer components like phosphate rock or urea, can increase Itafos's production expenses. This, in turn, may necessitate higher pricing for its products, potentially reducing competitiveness in price-sensitive markets. Conversely, favorable trade agreements can lower barriers, facilitating smoother market entry and potentially boosting sales volumes for Itafos's offerings in 2024 and beyond.

Political stability in Itafos' key operating regions, such as Brazil and the United States, directly impacts its operational efficiency and investment decisions. Uncertainty stemming from potential government changes or policy shifts can disrupt supply chains, affecting the reliable sourcing of raw materials crucial for its fertilizer production. For instance, Brazil's political landscape, while showing signs of stabilization, still presents a degree of risk for foreign investment and long-term project planning.

Regulatory Framework for Agriculture

The agricultural sector operates within a complex web of regulations that directly influence demand for fertilizers and shape operational landscapes. Policies concerning land use, permissible crop cultivation, and specific agricultural practices can either foster growth or introduce limitations for companies like Itafos. For instance, government incentives for sustainable farming might boost demand for specialized, eco-friendly fertilizers, while restrictions on certain fertilizer types could necessitate product adaptation or market shifts.

In 2024, many jurisdictions continued to refine their agricultural policies, with a notable focus on environmental sustainability and food security. For Itafos, this translates to navigating varying national and international standards for fertilizer production and application.

- Land Use Regulations: Policies dictating where and what can be farmed directly impact the scale of fertilizer application and the types of crops requiring nutrient support.

- Crop Cultivation Mandates: Government programs promoting specific crops, such as those emphasizing nitrogen-fixing legumes or drought-resistant varieties, indirectly influence the demand for particular fertilizer formulations.

- Environmental Protection Laws: Regulations aimed at preventing water pollution from agricultural runoff, for example, can lead to stricter controls on fertilizer application rates and types, pushing for more efficient nutrient delivery systems.

- Subsidies and Support Programs: Government financial assistance for farmers adopting certain practices or cultivating specific crops can significantly alter fertilizer purchasing patterns.

Geopolitical Events and Supply Chain Resilience

Geopolitical events significantly impact fertilizer supply chains. For instance, the ongoing conflict in Eastern Europe has led to disruptions in the supply of key fertilizer components like natural gas and potash, driving up global prices. Itafos, with its focus on North and South American markets, is strategically positioned to mitigate some of these risks by diversifying its sourcing and logistics. The company’s efforts to secure stable raw material inputs are crucial for maintaining consistent production and meeting demand in these key regions.

Itafos's resilience in the face of global supply chain volatility is paramount. The company has been actively working to strengthen its supply chain by:

- Diversifying raw material suppliers: Reducing reliance on single-source regions vulnerable to geopolitical instability.

- Optimizing logistics: Enhancing transportation networks to ensure timely delivery to its core markets in the Americas.

- Investing in production capacity: Increasing internal production capabilities to buffer against external supply shocks.

- Monitoring geopolitical developments: Proactively assessing risks associated with international conflicts and sanctions that could affect fertilizer availability and pricing.

Government policies, particularly agricultural subsidies and trade agreements, directly influence fertilizer demand and Itafos's market access. For example, the 2024 US Farm Bill's support programs impact farmer purchasing power, while evolving trade tariffs on key inputs like urea can affect production costs. Political stability in operating regions like Brazil and the US is also crucial for supply chain reliability and investment planning.

What is included in the product

This PESTLE analysis provides a comprehensive overview of how external macro-environmental factors influence Itafos across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help Itafos navigate market dynamics and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

Global fertilizer price volatility significantly impacts Itafos's revenue and profitability. Fluctuations in phosphate and specialty fertilizer prices, driven by supply-demand imbalances, energy costs, and geopolitical events, directly affect the company's financial performance.

For instance, in early 2024, global phosphate prices experienced a notable dip due to increased supply from major producers and softened demand in key agricultural regions. This downward pressure on prices can compress Itafos's profit margins if not managed effectively through strategic sourcing and pricing strategies.

Conversely, periods of high energy costs, particularly natural gas prices which are a key input for nitrogen-based fertilizers, can drive up production costs for all fertilizer types. This was evident in late 2023 when rising energy prices contributed to a general upward trend in fertilizer markets, potentially benefiting Itafos's top line but also increasing its operational expenses.

Itafos's profitability is significantly influenced by the cost of its primary raw material, phosphate rock, and essential energy inputs like natural gas. Fluctuations in these costs directly impact production expenses. For instance, if natural gas prices surge, the cost of producing sulfuric acid, a key component in fertilizer manufacturing, will rise, potentially squeezing Itafos's profit margins if these increases cannot be passed on to customers.

The economic health of North and South American agricultural sectors directly impacts farmer income and their capacity for fertilizer investment. Robust agricultural economies, characterized by strong commodity prices and favorable yields, typically translate into higher farmer profitability, thereby increasing their willingness to spend on essential inputs like fertilizers. For Itafos, this translates into enhanced demand for its phosphate and nitrogen-based products.

In 2024, projections for agricultural GDP growth in key Itafos markets, such as Brazil and the United States, indicate a generally positive, albeit varied, outlook. Brazil's agricultural sector, a significant consumer of fertilizers, is expected to see continued expansion, driven by demand for soybeans and corn. Similarly, the U.S. agricultural economy, while facing some inflationary pressures on input costs, maintains a strong underlying demand for crop nutrients to support its vast production capacity.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Itafos, which operates and sells in South America. For instance, a weakening of local currencies against the US dollar, the primary currency for many of its transactions, can directly affect reported revenues when translated back. This volatility also influences the cost of imported raw materials and equipment, potentially increasing operational expenses.

The affordability of Itafos's fertilizer products for local farmers is also a key concern. When the local currency depreciates, the cost of fertilizers in local terms rises, which can dampen demand. For example, if the Uruguayan peso weakens against the dollar, Itafos's sales in Uruguay become less valuable in USD terms, and the price of its products in pesos might need to increase to maintain profitability, impacting farmer purchasing power.

Consider these points regarding exchange rate impacts:

- Revenue Translation: A depreciation of the Brazilian Real or Uruguayan Peso against the US Dollar reduces the USD value of sales made in those countries.

- Cost of Goods Sold: Fluctuations can increase the cost of imported inputs like natural gas or phosphate rock, impacting Itafos's gross margins.

- Pricing Strategy: Itafos may need to adjust product pricing in local currencies to offset exchange rate losses, potentially affecting market competitiveness and farmer affordability.

- Competitive Landscape: Local competitors who source inputs domestically or have less international exposure might gain a pricing advantage during periods of significant currency depreciation.

Inflation and Interest Rates

Inflation significantly impacts Itafos's operational costs. Rising prices for essential inputs like labor, fuel for logistics, and spare parts for machinery directly increase expenses. For instance, the global inflation rate hovered around 5.9% in 2023, with many commodity prices remaining elevated, directly affecting Itafos's cost of goods sold and overall profitability. This necessitates careful cost management and potential price adjustments for their products.

Rising interest rates present a dual challenge for Itafos. Higher borrowing costs can strain the company's ability to finance new projects or refinance existing debt, potentially slowing down expansion plans and capital investments. In 2024 and 2025, central banks are expected to maintain tighter monetary policies, keeping interest rates at higher levels than in previous years. This environment directly affects Itafos's financial stability by increasing its cost of capital and influencing the attractiveness of future investment opportunities.

- Increased Operational Expenses: Global inflation in 2023 averaged 5.9%, impacting Itafos's costs for labor, logistics, and maintenance.

- Higher Borrowing Costs: Expected interest rate policies for 2024-2025 will increase Itafos's debt servicing expenses.

- Investment Decision Impact: Elevated interest rates can make new capital projects less financially viable for Itafos.

- Financial Stability Concerns: The combination of inflation and rising rates can pressure Itafos's profit margins and cash flow.

Global fertilizer price volatility significantly impacts Itafos's revenue and profitability, with phosphate prices experiencing dips in early 2024 due to increased supply. Conversely, rising energy costs in late 2023 pushed fertilizer prices up, impacting both revenue and operational expenses for Itafos.

Itafos's profitability is directly tied to the cost of raw materials like phosphate rock and energy inputs such as natural gas, with surges in natural gas prices in late 2023 increasing production costs for sulfuric acid.

The economic health of North and South American agricultural sectors, projected for positive GDP growth in 2024, particularly in Brazil and the U.S., influences farmer income and their capacity for fertilizer investment, driving demand for Itafos's products.

Currency fluctuations, especially the depreciation of South American currencies against the US dollar, affect Itafos's reported revenues and the cost of imported inputs, impacting profit margins and potentially requiring pricing adjustments that affect farmer affordability.

Preview Before You Purchase

Itafos PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Itafos PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, detailing the political, economic, social, technological, legal, and environmental factors affecting Itafos.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Itafos's external environment.

Sociological factors

The world's population is projected to reach approximately 8.5 billion by 2030, a significant increase that directly fuels the demand for food. This escalating need for sustenance places immense pressure on agricultural systems, underscoring the critical role of fertilizers in boosting crop yields to meet global food security requirements.

As a key producer of phosphate and nitrogen fertilizers, Itafos plays a vital role in this ecosystem. By supplying essential crop nutrients, Itafos directly contributes to enhancing agricultural productivity, enabling farmers worldwide to produce more food and thereby bolstering global food security efforts.

Consumers are increasingly prioritizing sustainably sourced, organic, and non-GMO food options. This shift directly impacts agricultural practices, influencing the demand for specific types of fertilizers. For instance, a 2024 report indicated that 65% of consumers are willing to pay more for sustainably produced goods, a trend that directly affects fertilizer choices.

Itafos can adapt by expanding its portfolio to include more eco-friendly fertilizer solutions or by highlighting the sustainability aspects of its existing products in marketing campaigns. By aligning with these evolving consumer preferences, Itafos can capture a larger share of a growing market segment, potentially seeing increased demand for its products as farmers respond to consumer pressure.

In North and South America, the adoption of modern farming techniques like precision agriculture and regenerative agriculture is on the rise. For instance, precision agriculture, which uses data and technology to optimize crop yields and resource use, saw an estimated market size of over $7.5 billion globally in 2023, with significant growth projected in the Americas by 2030. This increasing embrace by farmers directly boosts demand for specialized fertilizers that are applied efficiently, aligning perfectly with Itafos's product offerings.

Awareness and Education on Nutrient Management

There's a growing understanding among farmers and the general public regarding the importance of managing nutrients effectively to maintain soil health. This heightened awareness presents an opportunity for Itafos to actively engage in educational programs. By promoting the responsible application of its fertilizers, Itafos can help farmers boost crop yields while simultaneously mitigating any negative environmental consequences.

Itafos can leverage this trend by developing and sharing best practices for nutrient management. For example, initiatives that demonstrate how to optimize fertilizer use based on soil testing and crop needs can be particularly impactful. Such programs not only enhance Itafos's brand reputation as a responsible supplier but also contribute to more sustainable agricultural practices across the board.

Consider the impact of digital platforms: As of early 2024, agricultural extension services and industry groups are increasingly using online resources, webinars, and mobile apps to disseminate information on soil health and nutrient management. Itafos could partner with these platforms or create its own to reach a wider audience. For instance, a 2023 report indicated that over 60% of farmers surveyed were actively seeking digital tools to improve their farm management, including nutrient application.

- Increased Farmer Demand for Sustainable Solutions: Farmers are actively seeking products and knowledge that improve soil health and reduce environmental impact, aligning with Itafos's product portfolio.

- Public Scrutiny on Agricultural Practices: Growing public awareness of environmental issues puts pressure on agricultural companies to demonstrate responsible product stewardship.

- Government and NGO Support for Education: Many governmental and non-governmental organizations are funding and promoting educational programs on efficient nutrient management, creating potential partnership opportunities for Itafos.

- Technological Integration in Farming: The adoption of precision agriculture technologies, supported by data-driven nutrient management, is on the rise, offering avenues for Itafos to showcase product efficacy.

Rural Demographics and Labor Availability

Rural demographic shifts, such as an aging farmer population, directly impact labor availability. This trend, observed globally, means fewer hands are available for traditional farming tasks, increasing the demand for mechanized and technology-driven solutions. For instance, in many agricultural regions, the average age of farmers has been steadily rising, with some reports indicating it's now well into the late 50s. This demographic reality creates a greater need for fertilizers that are not only effective but also easy to apply, reducing the physical burden on a smaller, older workforce.

The decline in available rural labor and the increasing age of farmers are key drivers for the adoption of advanced farming technologies, including precision agriculture and sophisticated fertilizer application systems. This can influence the demand for Itafos's product offerings, pushing towards solutions that maximize efficiency and minimize labor input. As older farmers retire and fewer young people enter the profession, the appeal of products that simplify operations and deliver precise nutrient delivery will likely grow.

- Aging Farmer Population: In many developed agricultural nations, the average age of farmers has surpassed 55 years, indicating a shrinking and aging labor pool.

- Mechanization Demand: This demographic trend fuels demand for advanced machinery and automated systems for planting, harvesting, and fertilizer application.

- Fertilizer Application Trends: Consequently, there's an increased interest in easy-to-apply, high-efficiency fertilizer products that reduce labor requirements.

- Technology Adoption: The need to compensate for labor shortages accelerates the adoption of precision agriculture technologies, influencing fertilizer product development and marketing.

Sociological factors significantly shape the agricultural landscape, influencing demand for fertilizers and farming practices. A growing global population, projected to reach 8.5 billion by 2030, directly escalates the need for food, thereby increasing the demand for fertilizers to boost crop yields and ensure food security.

Consumer preferences are shifting towards sustainably sourced and organic foods, with a 2024 survey indicating 65% of consumers willing to pay more for such products. This trend encourages farmers to adopt practices that align with these demands, potentially influencing the types of fertilizers they seek.

The agricultural sector is also experiencing demographic shifts, including an aging farmer population, with the average age in many regions exceeding 55 years. This necessitates more efficient and less labor-intensive farming solutions, including advanced fertilizer application methods.

Furthermore, the increasing adoption of precision agriculture, a market valued over $7.5 billion globally in 2023, highlights a growing reliance on data-driven approaches to optimize resource use, including fertilizer application.

| Sociological Factor | Trend/Impact | Implication for Itafos |

|---|---|---|

| Population Growth | Projected 8.5 billion by 2030, increasing food demand. | Higher demand for fertilizers to enhance crop yields. |

| Consumer Preferences | Demand for sustainable/organic food (65% willing to pay more in 2024). | Opportunity for eco-friendly fertilizer solutions and marketing. |

| Demographics | Aging farmer population (average age >55 in some regions). | Increased demand for easy-to-apply, labor-saving fertilizer products. |

| Technology Adoption | Precision agriculture market >$7.5 billion (2023). | Demand for fertilizers optimized for data-driven application. |

Technological factors

Technologies like GPS, sensors, and AI are revolutionizing farming, allowing for highly precise fertilizer application. This means farmers can use exactly what's needed, where it's needed, significantly cutting down on waste and improving nutrient uptake. For instance, the global precision agriculture market was valued at approximately $8.5 billion in 2023 and is projected to reach $20.8 billion by 2030, showcasing rapid adoption.

Itafos can capitalize on this by developing fertilizer products specifically formulated for, or compatible with, these advanced precision agriculture systems. By offering solutions that integrate seamlessly with data analytics platforms used by farmers, Itafos can demonstrate enhanced efficiency and deliver greater value, potentially increasing their market share in this growing segment.

Ongoing research is yielding advanced fertilizer formulations like slow-release and bio-fertilizers, aiming to boost nutrient absorption and minimize environmental harm. These innovations represent a significant technological shift in agriculture.

Itafos has an opportunity to enhance its product portfolio by integrating these cutting-edge fertilizer technologies. For instance, the global bio-fertilizer market was valued at approximately USD 17.9 billion in 2023 and is projected to reach USD 36.2 billion by 2030, indicating strong market demand for sustainable solutions.

AI and machine learning are revolutionizing crop management through predictive analytics. This technology helps farmers make smarter decisions about crop health and nutrient application, leading to better yields. For instance, advanced algorithms can analyze vast datasets on weather patterns, soil conditions, and historical crop performance to forecast potential issues and recommend precise interventions.

Itafos can significantly leverage these AI-driven insights to enhance its product development and recommendation services. By integrating machine learning models, Itafos can offer more tailored fertilizer solutions and application strategies, directly addressing the specific needs of individual farms. This data-driven approach allows for optimized nutrient use, potentially reducing waste and improving soil health, aligning with sustainable agricultural practices.

Digital Twin Technology and Farm Simulation

Digital twin technology is rapidly transforming agriculture by creating precise virtual replicas of farms. This allows for sophisticated simulations of various farming practices, including the impact of different fertilizer application rates and timings. For Itafos, this means a powerful new tool to test and refine its product offerings in a risk-free, digital environment.

By simulating crop growth under diverse conditions using digital twins, Itafos can gain invaluable insights into how its fertilizers perform. This data-driven approach can directly inform product development, leading to more targeted and effective fertilizer formulations. Furthermore, it enables the creation of highly specific application guidelines tailored to individual farm digital twins, optimizing nutrient delivery and minimizing waste.

- Market Growth: The global digital twin market is projected to reach $100.5 billion by 2027, with agriculture being a significant growth sector.

- Simulation Benefits: Farm simulations using digital twins can improve crop yields by up to 15% through optimized resource management.

- Product Refinement: Itafos can leverage these simulations to validate the efficacy of its enhanced urea and phosphate products in varied soil and climate scenarios.

Automation and Robotics in Farming Operations

The agricultural sector is increasingly embracing automation and robotics to enhance efficiency. This trend directly impacts Itafos, as its fertilizer products need to be compatible with or optimized for these advanced farming systems, ensuring seamless integration with automated planting, spraying, and harvesting equipment. For instance, precision agriculture techniques, often powered by robotics, require fertilizers that can be applied with high accuracy.

The adoption of these technologies is accelerating, with global agricultural robotics market expected to reach approximately $22.5 billion by 2027, growing at a CAGR of over 15%. This signifies a substantial shift towards smarter farming practices.

- Precision Application: Automated systems allow for precise fertilizer application, reducing waste and improving nutrient uptake, which Itafos's products must support.

- Data Integration: Robotics and automation generate valuable data that can inform fertilizer management strategies, requiring Itafos to consider how its products fit into these data-driven approaches.

- Efficiency Gains: Streamlined operations through automation can lead to reduced labor costs and increased yields, making Itafos's offerings more attractive if they contribute to these gains.

- Market Demand: As more farms adopt these technologies, there will be a growing demand for fertilizers that are specifically formulated or packaged for automated delivery systems.

Technological advancements in precision agriculture, including AI, GPS, and sensor technology, are driving significant efficiency gains. These tools enable highly targeted fertilizer application, minimizing waste and maximizing nutrient uptake. The global precision agriculture market, valued at around $8.5 billion in 2023, is expected to reach $20.8 billion by 2030, highlighting rapid innovation and adoption.

Legal factors

Environmental regulations are becoming significantly tougher for fertilizer producers, focusing on reducing greenhouse gas emissions and improving waste management. For instance, the European Union’s Green Deal aims for climate neutrality by 2050, which directly impacts energy-intensive industries like fertilizer manufacturing. Itafos must adapt to these evolving standards, potentially requiring substantial investments in cleaner production technologies and more efficient waste disposal systems to maintain compliance and operational viability.

Itafos must strictly comply with evolving legal mandates concerning fertilizer product safety and quality control. These regulations, often updated by bodies like the EPA in the United States and similar agencies globally, dictate precise standards for chemical composition, impurity levels, and manufacturing processes. For instance, the EPA's Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) requires rigorous testing and registration for pesticide products, including many fertilizers, ensuring they do not pose unreasonable risks to human health or the environment.

Comprehensive labeling is a critical legal component, demanding transparency about nutrient content, potential hazards, safe handling instructions, and recommended application rates. In 2024, regulatory bodies continue to emphasize clear communication regarding environmental impact, such as potential runoff effects. Failure to meet these labeling standards, which are subject to ongoing review and amendment, can result in significant fines, product recalls, and erosion of consumer confidence, directly impacting Itafos's market access and brand reputation.

Itafos operates within a stringent legal framework governing land use for phosphate mining and production facilities. Obtaining and maintaining permits for exploration, extraction, and facility operation is a critical and often lengthy process. These regulations, including environmental impact assessments and land reclamation mandates, directly influence Itafos's operational expenditures and potential for future expansion. For example, in 2024, companies in the mining sector faced increased scrutiny on environmental compliance, potentially leading to higher upfront costs for new projects.

Import and Export Compliance

Itafos navigates a complex web of import and export regulations, particularly concerning its operations spanning North and South America. Compliance with customs duties, tariffs, and trade agreements is paramount for maintaining efficient supply chains and accessing key markets. For instance, the company's reliance on imported raw materials like phosphate rock and potash means adherence to the specific import laws of its production countries, such as Brazil and Uruguay, is critical.

Exporting finished fertilizer products, including urea and phosphate-based fertilizers, also necessitates strict compliance with the destination countries' import regulations and phytosanitary standards. Understanding and adhering to trade agreements, such as Mercosur or potential future agreements, can significantly impact Itafos's cost structure and competitive positioning. Failure to comply with these legal frameworks, including sanctions that might affect certain trading partners, could lead to significant delays, penalties, and disruptions to its global distribution network.

- Customs Duties: Itafos must account for varying customs duties on imported raw materials and exported finished goods across different South and North American countries, impacting landed costs and export competitiveness.

- Trade Agreements: Leveraging trade agreements, such as those within Mercosur, can reduce tariffs and streamline cross-border movement of goods, a key factor in Itafos's regional strategy.

- Sanctions Compliance: The company must vigilantly monitor and comply with international sanctions regimes to avoid prohibited trade activities and associated legal repercussions.

- Product Standards: Ensuring exported fertilizers meet the specific quality, safety, and environmental standards of importing nations is a legal requirement that impacts market access.

Labor Laws and Workplace Safety

Itafos operates under stringent labor laws and workplace safety regulations across its global operations. Adherence to these legal frameworks is critical for maintaining operational continuity and ensuring the well-being of its workforce. For instance, in 2024, the International Labour Organization (ILO) reported that workplace accidents still pose significant risks in the mining and fertilizer sectors, underscoring the importance of robust safety protocols.

Failure to comply with these regulations can lead to substantial penalties, operational disruptions, and damage to Itafos's reputation. These laws dictate aspects such as:

- Fair wages and working hours: Ensuring compliance with minimum wage laws and overtime regulations in each jurisdiction where Itafos operates.

- Occupational health and safety standards: Implementing and maintaining safety measures to prevent accidents and protect employees from workplace hazards, such as dust exposure in phosphate mining.

- Employee rights and collective bargaining: Respecting employees' rights to organize and engage in collective bargaining, as mandated by national labor laws.

- Environmental health regulations: Adhering to regulations concerning the safe handling and disposal of materials, which directly impacts workplace safety.

Itafos must navigate a complex landscape of international trade laws and customs regulations, particularly given its cross-border operations in North and South America. Adherence to varying tariffs, import quotas, and trade agreements is essential for cost-effective sourcing of raw materials like phosphate rock and for ensuring market access for its finished fertilizer products. For example, in 2024, companies involved in international trade faced ongoing adjustments to trade policies, potentially impacting supply chain costs and profitability.

Compliance with intellectual property laws is also crucial, especially concerning proprietary fertilizer formulations and manufacturing processes. Protecting these assets through patents and trademarks safeguards Itafos's competitive advantage and prevents unauthorized use. The company must also ensure its marketing and product claims align with advertising standards and consumer protection laws in each operating jurisdiction to avoid legal challenges and maintain brand integrity.

Itafos is subject to financial regulations, including those related to public company reporting and securities law. In 2024, regulatory bodies like the SEC continued to emphasize transparency and accuracy in financial disclosures, requiring detailed reporting on operational performance and market risks. Adherence to anti-corruption laws, such as the Foreign Corrupt Practices Act (FCPA), is also paramount to maintain ethical business practices and avoid severe penalties.

The company must also comply with competition laws and antitrust regulations to prevent monopolistic practices and ensure fair market competition. This includes scrutiny of mergers, acquisitions, and pricing strategies to avoid anticompetitive behavior. For instance, regulatory bodies globally, including in 2024, have been actively monitoring the agricultural inputs sector for potential consolidation that could impact farmer choice and pricing.

Environmental factors

Climate change is significantly altering agricultural landscapes, with shifting rainfall patterns, rising temperatures, and more frequent extreme weather events directly impacting crop yields. For instance, studies in 2024 indicated that prolonged droughts in key agricultural regions could reduce staple crop output by as much as 15-20% in affected areas. This volatility directly influences farmer demand for specific nutrients, as they seek solutions to bolster crop resilience and maintain productivity under these challenging conditions.

Itafos can adapt its product portfolio by developing and promoting enhanced fertilizer formulations designed to improve water-use efficiency and nutrient uptake in stressed crops. For example, offering slow-release nitrogen fertilizers or micronutrient blends that enhance drought tolerance could be crucial. By providing these specialized solutions, Itafos can empower farmers to better navigate the unpredictable environmental factors, ensuring more stable yields and supporting their ongoing need for effective soil enrichment.

Water scarcity and quality are significant environmental concerns impacting agriculture and fertilizer production. Itafos's phosphate-based fertilizers can play a role in water-efficient farming by improving nutrient uptake, potentially reducing the need for excessive irrigation. For instance, enhanced nutrient availability can lead to healthier crops that are more resilient to drought stress.

Itafos's operational approach to water management is crucial, especially in regions facing water stress. The company must demonstrate responsible water resource management, adhering to or exceeding regulatory standards for water usage and discharge. This includes investing in technologies that minimize water consumption and ensure the quality of discharged water remains high, safeguarding local ecosystems and communities.

Soil degradation is a significant environmental challenge impacting agricultural productivity globally. Maintaining healthy soil is crucial for sustainable farming, and Itafos's fertilizers contribute by replenishing essential nutrients lost through crop cycles. For instance, in 2023, global soil degradation affected an estimated 3.2 billion people, highlighting the urgency of this issue.

Itafos can further support soil health by promoting practices that enhance soil structure and fertility. This includes encouraging crop rotation, cover cropping, and reduced tillage, which help retain moisture, prevent erosion, and increase organic matter. The company's commitment to providing high-quality phosphate fertilizers directly supports farmers in rebuilding soil nutrient levels, a critical step in reversing degradation trends.

Greenhouse Gas Emissions from Fertilizer Use and Production

The production and use of fertilizers, particularly nitrogen-based ones, contribute significantly to greenhouse gas emissions, notably nitrous oxide (N2O), a potent warming gas. Estimates suggest agricultural soil management, including fertilizer application, accounted for approximately 11% of total U.S. greenhouse gas emissions in 2022. Furthermore, nutrient runoff from agricultural fields can lead to eutrophication in waterways, impacting aquatic ecosystems.

Itafos is actively addressing these environmental challenges. The company focuses on developing and promoting enhanced efficiency fertilizers designed to reduce nutrient loss and minimize greenhouse gas emissions. Innovations aim to improve nutrient uptake by plants, thereby decreasing the amount of fertilizer needed and the subsequent environmental impact.

- Nitrous Oxide (N2O) Emissions: Fertilizer production and application are major sources of N2O, which has a global warming potential nearly 300 times that of carbon dioxide over 100 years.

- Nutrient Runoff: Excess nitrogen and phosphorus from fertilizers can leach into groundwater or run off into surface waters, causing algal blooms and oxygen depletion.

- Itafos's Strategy: The company is investing in technologies and product formulations that enhance nutrient use efficiency, aiming to reduce the environmental footprint of agriculture.

Biodiversity Loss and Ecosystem Protection

Itafos, as a supplier of essential agricultural inputs, plays a role in addressing biodiversity loss by promoting practices that can mitigate negative environmental impacts. The company's fertilizers and soil conditioners can support sustainable agriculture, which is crucial for maintaining ecological balance. For instance, enhanced soil health through proper nutrient management can reduce the need for land expansion, thereby preserving natural habitats.

The global challenge of biodiversity loss is significant, with estimates suggesting that over one million species are at risk of extinction. Sustainable agricultural methods, facilitated by products like those offered by Itafos, can help counter this trend. By improving crop yields on existing land and promoting soil regeneration, Itafos's offerings can contribute to minimizing the pressure on natural ecosystems.

- Sustainable Agriculture and Biodiversity: Itafos's products can support farming practices that reduce land degradation, a primary driver of biodiversity loss.

- Ecosystem Protection: By enabling higher yields on less land, Itafos contributes indirectly to the protection of natural habitats and the species within them.

- Soil Health Initiatives: Promoting soil health through nutrient management can enhance the resilience of agricultural landscapes, supporting a more balanced ecosystem.

Environmental factors significantly influence Itafos's operations, from climate change impacting crop yields to water scarcity affecting production. The company must navigate these challenges by offering solutions that promote sustainable agriculture and responsible resource management. For instance, in 2024, extreme weather events led to an estimated 10% decrease in global wheat production in affected regions, underscoring the need for resilient farming inputs.

Itafos's commitment to developing enhanced efficiency fertilizers directly addresses environmental concerns like greenhouse gas emissions from agriculture. By improving nutrient uptake, these fertilizers reduce the environmental footprint per unit of crop produced. For example, the adoption of slow-release nitrogen fertilizers can cut nitrous oxide emissions by up to 20% compared to conventional methods.

Soil degradation remains a critical issue, with studies in 2023 indicating that over 33% of the world's soils are moderately to severely degraded. Itafos's phosphate fertilizers play a vital role in replenishing soil nutrients, supporting soil health and reversing degradation trends. Promoting practices like cover cropping alongside fertilizer application can further enhance soil structure and fertility.

The company's operational water management is paramount, especially in water-stressed regions. Itafos must adhere to stringent water usage and discharge standards, investing in technologies that minimize consumption and ensure water quality. Responsible water stewardship is not only an environmental imperative but also crucial for maintaining social license to operate.

| Environmental Factor | Impact on Agriculture/Itafos | Itafos's Response/Opportunity | Relevant Data (2023-2025) |

| Climate Change & Extreme Weather | Reduced crop yields, increased demand for resilient inputs | Develop enhanced efficiency fertilizers, promote water-efficient farming | 10% global wheat production decline in affected areas (2024) due to extreme weather. |

| Water Scarcity & Quality | Production constraints, need for efficient irrigation | Offer fertilizers improving nutrient uptake, reducing irrigation needs; responsible water management | Global water stress affects over 2 billion people. |

| Soil Degradation | Decreased agricultural productivity, need for nutrient replenishment | Provide high-quality phosphate fertilizers, promote soil health practices | 33% of global soils moderately to severely degraded (2023). |

| Greenhouse Gas Emissions (N2O) | Environmental regulations, reputational risk | Invest in enhanced efficiency fertilizers to reduce nutrient loss and emissions | Slow-release nitrogen fertilizers can cut N2O emissions by up to 20%. |

PESTLE Analysis Data Sources

Our Itafos PESTLE analysis is meticulously constructed using data from reputable sources including financial reports, industry-specific market research, and governmental publications. We integrate economic indicators, regulatory updates, and technological advancements to provide a comprehensive view.