Itafos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

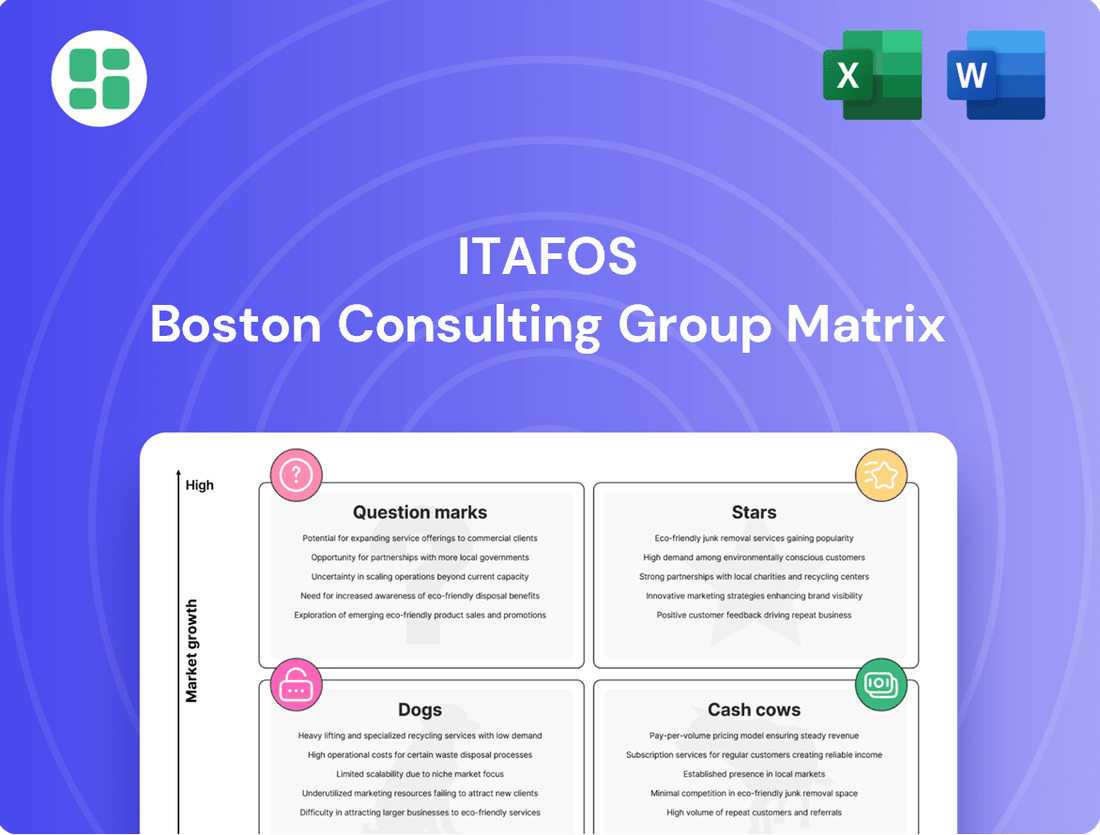

The Itafos BCG Matrix provides a crucial snapshot of its product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions is vital for strategic resource allocation and future growth. Purchase the full BCG Matrix for an in-depth analysis and actionable insights to optimize Itafos's market strategy.

Stars

Itafos's specialty phosphate products, like Superphosphoric Acid (SPA) and Monoammonium Phosphate with micronutrients (MAP+), are positioned in a booming specialty fertilizer market. This sector is expected to see robust growth, with projected compound annual growth rates (CAGRs) between 5.5% and 7.5% from 2029 to 2033, fueled by the demand for advanced, efficient crop nutrition.

The company has experienced positive market shifts and better pricing for SPA, demonstrating its strength in this high-growth area. These specialized fertilizers are vital for enhancing crop productivity and supporting sustainable farming methods, suggesting continued expansion of Itafos's market presence.

Itafos is making a strong push into promising agricultural areas, notably Brazil, by introducing new dry fertilizer options. The company's Arraias plant has successfully brought back its granulation capabilities and launched SuperForte Gran, a new granulated fertilizer. This strategic expansion is designed to boost profitability and meet the increasing demand in a market eager for better nutrient products.

In 2024, Itafos' Conda facility saw significant success with turnaround maintenance, boosting production recoveries and minimizing downtime. This operational enhancement allowed the company to extract more P2O5 from existing throughput, directly translating to higher sales volumes and revenue.

These technological improvements at Conda are crucial for Itafos to maintain its competitive edge and expand market share within the phosphate industry. The increased efficiency means more value from the same operational input, a key indicator of strong performance.

Ammonium Polyphosphate (APP) Offerings

Itafos's Ammonium Polyphosphate (APP) is a specialty fertilizer produced at its Conda facility. Its concentrated liquid form and efficient nutrient delivery make it a standout product in the evolving specialty fertilizer market, which is driven by innovation and the need for customized nutrient solutions.

The demand for precision farming is accelerating the growth of products like APP. If Itafos can scale its APP production effectively, its advanced characteristics position it to capture a significant market share. For instance, the global specialty fertilizers market was valued at approximately USD 20.1 billion in 2023 and is projected to reach USD 35.6 billion by 2030, growing at a CAGR of 8.4% during this period, according to industry reports from 2024.

- Specialty Product: APP's liquid form and efficient nutrient delivery distinguish it.

- Market Trend: Precision farming fuels demand for tailored nutrient solutions.

- Growth Potential: APP is a high-growth product in a expanding market.

- Market Value: The global specialty fertilizer market is expected to reach USD 35.6 billion by 2030.

Vertically Integrated Value Chain in Key Markets

Itafos's vertically integrated value chain, especially evident at its Conda facility in Idaho, USA, grants the company significant control over its phosphate fertilizer production. This end-to-end management, from raw material mining to the delivery of finished goods, is a cornerstone of its competitive strategy in North America.

This integration translates into tangible benefits, particularly in cost management and ensuring a dependable supply chain. In the North American specialty fertilizer market, where reliability and cost-efficiency are paramount, Itafos's model positions it strongly. For example, in 2024, the company continued to leverage its Conda operations to meet the growing demand for high-quality phosphate fertilizers.

- Cost Control: Vertical integration allows Itafos to manage costs more effectively by controlling each stage of production, from mining to processing.

- Supply Chain Reliability: Direct control over operations minimizes disruptions and ensures a consistent supply of phosphate fertilizers to the market.

- Market Share: This robust structure supports a strong market position by guaranteeing product quality and availability, crucial for capturing market share in a growing demand environment.

Stars in the BCG matrix represent products with high market share in high-growth industries. Itafos's specialty phosphate products, like APP and MAP+, fit this description due to the booming specialty fertilizer market. This sector is experiencing strong growth, with projected CAGRs between 5.5% and 7.5% from 2029 to 2033, driven by the need for advanced crop nutrition.

Itafos's focus on products like Ammonium Polyphosphate (APP), which offers efficient nutrient delivery, aligns with the growing demand for precision farming solutions. The global specialty fertilizers market, valued at approximately USD 20.1 billion in 2023, is projected to reach USD 35.6 billion by 2030, with a CAGR of 8.4% as reported in 2024, underscoring the significant growth potential for Itafos's Star products.

The company's strategic investments, such as the successful turnaround maintenance at its Conda facility in 2024 which boosted production recoveries, and the introduction of new granulated fertilizers like SuperForte Gran in Brazil, further solidify its position in these high-growth segments. These initiatives enhance operational efficiency and expand market reach, capitalizing on favorable market trends.

| Product Category | Market Growth Rate (CAGR) | Itafos's Market Position | Strategic Focus |

| Specialty Fertilizers | 5.5% - 7.5% (2029-2033) | High (with products like APP, MAP+) | Innovation, Precision Farming |

| Superphosphoric Acid (SPA) | Strong Market Demand | Positive Market Shifts, Better Pricing | Leveraging existing strengths |

| Granulated Fertilizers | Increasing Demand in Brazil | Expanding Market Presence | New product launches (SuperForte Gran) |

What is included in the product

The Itafos BCG Matrix categorizes its business units by market share and growth, guiding strategic decisions.

Itafos BCG Matrix: A clear visual guide to strategically allocate resources, relieving the pain of uncertain investment decisions.

Cash Cows

Itafos's Conda facility, a cornerstone of its operations, continues to excel in monoammonium phosphate (MAP) production, achieving record output levels. This consistent performance translates into significant revenue and adjusted EBITDA generation, underscoring its dominant position in the mature phosphate fertilizer market.

While the phosphate market is experiencing a moderate compound annual growth rate, estimated between 5.2% and 5.68% as of recent reports, Conda's MAP stands out as a dependable cash cow. Its operational efficiency and steady production mean it requires minimal investment for aggressive market expansion, solidifying its role as a low-maintenance profit engine for Itafos.

In 2024, Itafos's Conda facility set new records for sulfuric acid production, achieving its best-ever monthly and quarterly output. This robust performance underscores the facility's critical role in supporting the company's phosphate fertilizer operations, a core business segment.

The consistent, high-volume sulfuric acid output from Conda generates a stable and predictable cash flow for Itafos. As a vital input and often a co-product in fertilizer manufacturing, sulfuric acid operates within a mature market where Itafos maintains a strong, entrenched market position.

This established strength in the sulfuric acid market means that the Conda operation requires minimal incremental capital investment for ongoing maintenance and operational efficiency. This low reinvestment need further solidifies its status as a cash cow within Itafos's portfolio.

Arraias' sulfuric acid production is a strong cash cow for Itafos. In 2024, this facility boosted its output by a significant 26.6% over 2023 levels, fueled by robust demand from both external clients and Itafos's internal operations.

This consistent growth in a mature market indicates a dominant market share for Arraias' sulfuric acid. The facility reliably generates substantial cash flow, providing Itafos with the financial flexibility to invest in other ventures without needing extensive marketing efforts.

Merchant Grade Phosphoric Acid (MGA) Production

Itafos's Merchant Grade Phosphoric Acid (MGA) production at its Conda facility represents a core component of its operations, supplying a vital input for the fertilizer sector. This segment likely benefits from a mature, stable industrial market where Itafos capitalizes on its existing production capabilities and established customer base to secure a significant market share.

The MGA business is characterized by its ability to generate consistent cash flow with minimal need for substantial growth investments, thereby contributing to the company's overall profitability. For instance, in 2024, Itafos continued to optimize its MGA production, aiming for operational efficiencies that support its cash generation targets.

- Stable Market Share: Itafos leverages its established production capacity and relationships in the MGA market.

- Consistent Cash Flow: The MGA segment provides steady profitability with low investment needs.

- Operational Focus: In 2024, Itafos concentrated on optimizing MGA production for efficiency.

- Industry Staple: MGA is a fundamental chemical crucial to the fertilizer industry.

Established Distribution Channels in North America

Itafos's established distribution channels in North America are a prime example of a Cash Cow within the BCG Matrix. These channels are deeply entrenched, serving a mature market where Itafos holds a significant share of its core phosphate products. In 2024, the company reported record production and sales volumes from its Conda operations, underscoring the strength and efficiency of these established networks.

The company's focus on North America, particularly its Conda operations, has allowed it to build and refine these distribution systems over time. This maturity means that while growth may be limited, the channels consistently generate substantial cash flow. This cash generation is critical, as it requires ongoing management and optimization rather than substantial new investment to maintain its strong position.

- North American Focus: Itafos primarily serves customers in North America, leveraging its Conda operations.

- Record Performance: In 2024, Itafos achieved record production and sales volumes in this region.

- Mature Market Share: Well-developed distribution networks for phosphate products indicate a high market share in a mature geographic market.

- Consistent Cash Flow: The efficiency of these channels generates reliable cash flow, requiring management over significant growth investment.

Itafos's sulfuric acid production, particularly from its Arraias facility, exemplifies a strong cash cow. In 2024, Arraias saw a significant 26.6% output increase over 2023, driven by both internal needs and external demand, showcasing its dominance in a mature market. This consistent performance generates substantial, reliable cash flow for Itafos, requiring minimal new capital for expansion.

The Conda facility's monoammonium phosphate (MAP) production is another key cash cow, achieving record output in 2024. This segment benefits from a mature market with moderate growth, where Conda's operational efficiency allows for steady revenue and adjusted EBITDA generation with low reinvestment needs. Itafos's established North American distribution channels for phosphate products also function as cash cows, generating consistent cash flow from high sales volumes at its Conda operations.

| Facility/Operation | Product | 2024 Performance Highlight | BCG Category | Key Financial Trait |

| Arraias | Sulfuric Acid | 26.6% output increase vs. 2023 | Cash Cow | Strong, consistent cash flow |

| Conda | MAP | Record output levels | Cash Cow | Steady revenue and EBITDA |

| North American Distribution | Phosphate Products | Record production & sales volumes | Cash Cow | Reliable cash generation |

Delivered as Shown

Itafos BCG Matrix

The Itafos BCG Matrix preview you're seeing is the identical, fully formatted report you'll receive immediately after purchase. This comprehensive document, meticulously crafted for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis for your business planning. You can confidently rely on this preview as the exact representation of the valuable strategic tool that will be yours to download and implement without delay.

Dogs

Itafos officially divested its entire stake in the Araxá project in Brazil in February 2025. This move strongly suggests the project was categorized as a 'Dog' within the BCG matrix, likely due to its limited growth potential, small market share, or substantial capital needs with questionable profitability.

The sale of Araxá points to it being a cash drain, absorbing capital without generating substantial strategic benefits or profits for Itafos. This divestiture aligns with the typical strategy for 'Dog' assets, which is to exit them to free up resources for more promising ventures.

Underperforming legacy product lines at Itafos, characterized by older technology or a lack of differentiation, would fall into the Dogs category of the BCG Matrix. These products likely face intense price competition in mature markets, leading to low market share and profitability. For instance, if a legacy fertilizer product line saw a 5% year-over-year revenue decline in 2024 due to increased competition from newer, more efficient alternatives, it would exemplify a Dog.

Within Itafos's existing operations, certain production units might be considered Dogs. These are typically older facilities or specific lines that demand excessive maintenance, costing more than their output justifies. For instance, if a particular mining equipment in 2024 required 20% more maintenance hours than newer models, yet produced only 80% of the output, it would be a prime candidate for this category.

These inefficient units struggle to compete, effectively holding a small market share due to their uncompetitive cost structure. They tie up capital that could be better invested in more productive, high-growth areas of the business. For example, if a plant's operating cost per ton in 2024 was $150, while the company's best-in-class facilities operated at $100 per ton, this unit would be underperforming significantly.

Niche Products with Limited Market Adoption and Growth

If Itafos were to have niche products that struggled to gain traction in the market, these would be classified as Dogs in the BCG Matrix. These offerings would likely operate in segments with limited growth prospects and generate very little revenue. For instance, imagine a specialized fertilizer additive Itafos launched in 2023 that only captured 0.5% of a niche agricultural market, which itself is projected to grow at a mere 1% annually through 2028.

Products in this category typically consume resources without providing a substantial return. The ongoing costs for marketing, distribution, or even minimal production for these 'Dog' products would likely outweigh the revenue they bring in. This situation would represent a drain on Itafos’s overall financial health, demanding a strategic decision on whether to divest or attempt a turnaround, though the latter is often unfeasible for true 'Dogs'.

- Limited Market Share: Products with minimal adoption, such as a specialized phosphate blend that only serves 100 specific farms in a region.

- Low Growth Potential: Operating in markets with stagnant or declining demand, for example, a legacy fertilizer product for an outdated farming technique.

- Negative or Low Profitability: These products would likely incur costs exceeding their revenue generation, potentially leading to a net loss for Itafos.

- Resource Drain: Continued investment in research, development, or marketing for these underperforming products diverts capital from more promising areas.

Unprofitable Niche Geographic Markets

If Itafos maintains a presence in certain minor geographic markets where competition is intense, market growth is low, and its market share remains marginal, these operations could be classified as Dogs.

Such ventures would struggle to achieve profitability or scale, tying up capital and management attention without contributing meaningfully to the company's strategic objectives.

For instance, in 2024, Itafos might find its operations in a small, saturated European fertilizer market fitting this description, where low demand growth and aggressive pricing from established players limit any potential for significant returns.

- Low Market Share: Itafos's market share in these niche regions might be below 5%.

- Intense Competition: The presence of 3-4 dominant local competitors.

- Stagnant Growth: Annual market growth rates in these specific areas could be less than 1%.

- Negative Profitability: Operations in these markets may consistently report operating losses.

Dogs within Itafos's portfolio represent ventures with low market share and low growth potential, often consuming more resources than they generate. The divestment of the Araxá project in February 2025 exemplifies this, signaling its classification as a Dog due to limited growth prospects and questionable profitability.

Underperforming legacy products or inefficient production units also fit this category. These assets face intense competition, demand high maintenance, and operate with uncompetitive cost structures, such as a plant with a 2024 operating cost per ton of $150 compared to a company best of $100.

Niche products with minimal market traction or operations in saturated, low-growth geographic markets also fall into the Dog category. These ventures, like a specialized fertilizer additive capturing only 0.5% of a 1% annual growth market, tie up capital without contributing meaningfully.

These 'Dog' assets are characterized by their minimal adoption, operating in stagnant markets, and often incurring costs exceeding revenue, representing a drain on financial health.

| Itafos Asset Category (Dogs) | Key Characteristics | Illustrative 2024 Data Point |

| Divested Projects (e.g., Araxá) | Low growth, low profitability, capital drain | Divested February 2025 |

| Legacy Product Lines | Low market share, high competition, declining revenue | 5% year-over-year revenue decline in 2024 |

| Inefficient Production Units | High maintenance costs, low output, uncompetitive costs | 20% higher maintenance hours than newer models |

| Niche Market Offerings | Minimal market traction, low growth segments | 0.5% market share in a 1% annual growth niche |

| Minor Geographic Markets | Marginal market share, intense competition, stagnant growth | <1% market share in saturated European market |

Question Marks

Itafos's SuperForte Gran, launched in Brazil in Q2 2025 from its Arraias facility, represents a new entrant in a growing granulated fertilizer market. Initial volumes have reached the local market, but its market share is currently low.

This new product requires substantial investment to build brand awareness and distribution, aiming to capture a significant portion of the expanding Brazilian fertilizer market. The strategy is to position SuperForte Gran as a high-growth potential product, a classic 'Question Mark' in the BCG matrix, needing careful nurturing to become a 'Star'.

The Husky 1 / North Dry Ridge (H1/NDR) mine development by Itafos represents a significant investment aimed at securing phosphate rock supply for its Conda operations through 2037. This project is currently in a high capital expenditure phase, with first ore shipments anticipated in the latter half of 2025.

As a strategic initiative, H1/NDR is positioned as a potential future cash cow, but its current status is that of a question mark within the BCG matrix. It demands substantial growth capital, and its long-term profitability and market impact are still under development, making its future trajectory uncertain but promising for resource security.

The Farim project in Guinea-Bissau is a significant phosphate mine development. Itafos secured a 25-year mining contract extension for this project in 2024, highlighting its long-term potential.

As a large-scale venture not yet generating revenue, Farim is a prime example of a Question Mark in the BCG matrix. It requires substantial future capital for development and faces market entry risks, positioning it for high growth but with considerable uncertainty.

Santana Project (Brazil) Development

The Santana Project in Brazil is characterized as a vertically integrated, high-grade phosphate development, mirroring the profile of the Farim project. This strategic positioning within a burgeoning agricultural nutrient market underscores its significant future potential.

As a development stage asset, Santana is categorized as a Question Mark in the BCG Matrix. This classification stems from its current low market share, despite its high growth potential.

- High Growth Potential: The project targets the expanding agricultural nutrient market.

- Low Market Share: Currently, it holds a negligible position in the market.

- Substantial Investment Required: Significant capital is needed for exploration, development, and eventual production.

- Strategic Importance: It represents a key growth opportunity for Itafos.

Capital Project for Magnesium Reduction at Conda

The capital project approved in Q2 2025 for magnesium reduction at Conda, targeting ore from the Husky 1/North Dry Ridge mines, is positioned as a 'Question Mark' within Itafos' BCG Matrix. This initiative focuses on process improvement to maintain P2O5 production capacity, supporting a core asset.

While crucial for preserving future production quality and efficiency, the direct return on investment for this magnesium reduction project is not yet fully quantified. Its impact on market share is also under evaluation, making its strategic resource allocation a point of consideration.

- Project Focus: Magnesium reduction in ore to preserve P2O5 production capacity.

- Strategic Alignment: Supports a core 'Cash Cow' asset by optimizing raw materials.

- Investment Rationale: High-demand initiative for future production quality and efficiency.

- BCG Classification: 'Question Mark' due to unquantified ROI and market share impact.

Question Marks represent Itafos's ventures with high growth potential but currently low market share, demanding significant investment. These projects, like SuperForte Gran in Brazil and the Farim and Santana projects in Guinea-Bissau and Brazil respectively, are in development stages. Their success hinges on capturing market share and achieving profitability, making them critical strategic bets for future growth.

| Project | Status | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| SuperForte Gran (Brazil) | New entrant, low market share | Growing | Low | High (brand awareness, distribution) |

| Husky 1 / North Dry Ridge (H1/NDR) Mine | Development, securing supply | N/A (resource security) | N/A | High (capital expenditure) |

| Farim Project (Guinea-Bissau) | Development, 25-year contract extension (2024) | High potential | Low (pre-revenue) | Substantial (future development) |

| Santana Project (Brazil) | Development stage | High (agricultural nutrients) | Low | Substantial (exploration, development) |

| Magnesium Reduction (Conda) | Capital project (Q2 2025 approved) | N/A (process improvement) | Under evaluation | High (process optimization) |

BCG Matrix Data Sources

Our Itafos BCG Matrix is built on a foundation of robust financial disclosures, detailed operational reports, and comprehensive market research to provide a clear strategic overview.