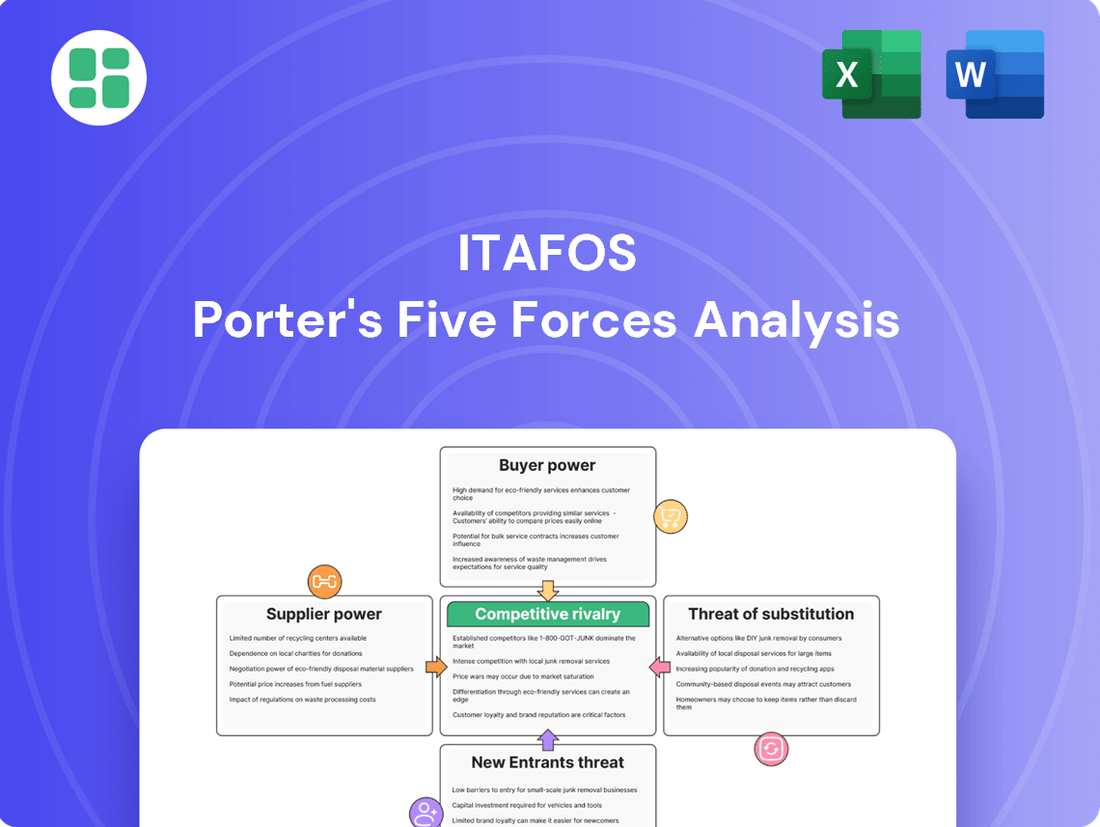

Itafos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

Itafos operates within a dynamic agricultural inputs market, where understanding the interplay of competitive forces is crucial for success. Our analysis reveals how buyer power, supplier leverage, and the threat of substitutes significantly shape Itafos's landscape.

The complete report reveals the real forces shaping Itafos’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Itafos's suppliers is shaped by the concentration of essential raw materials, especially phosphate rock. Although Itafos itself produces phosphate rock, the global market for premium grades remains dominated by a select few major companies, including Itafos, Nutrien, Mosaic, and OCP Group.

This limited supplier base can grant them substantial influence, particularly when Itafos requires specific types or qualities of phosphate rock crucial for its specialized fertilizer products. For instance, in 2024, the global phosphate rock market continued to see significant production concentrated among these leading entities, underscoring the potential leverage they hold.

High switching costs for essential inputs significantly bolster supplier bargaining power for Itafos. For instance, securing new phosphate rock suppliers requires extensive qualification processes, potentially impacting production timelines and quality. These hurdles, coupled with the need to adapt manufacturing to varied material specifications, mean Itafos faces considerable expense and operational disruption if it seeks to change providers, thereby empowering its current suppliers.

The threat of forward integration by suppliers significantly impacts Itafos's bargaining power. Major global phosphate rock miners, like The Mosaic Company and Nutrien Ltd., are already vertically integrated into fertilizer production. This means they possess the capability to bypass Itafos and enter the fertilizer market directly, using their own raw materials.

This potential for suppliers to become competitors increases their leverage. They can choose to consume their phosphate rock internally rather than selling it to Itafos, creating a supply constraint. For instance, in 2023, The Mosaic Company reported significant fertilizer sales, demonstrating their established presence in the downstream market.

Impact of Input Price Volatility

The prices of essential inputs such as sulfur and sulfuric acid, critical for Itafos's phosphate fertilizer manufacturing, can fluctuate significantly, directly affecting the company's operating margins. This price volatility grants suppliers of these commodities substantial leverage over Itafos's cost structure and overall profitability.

For example, Itafos disclosed in its Q2 2025 financial report that increased costs for sulfur and sulfuric acid negatively impacted its Adjusted EBITDA. This demonstrates how supplier pricing power can directly translate into reduced financial performance for Itafos.

- Input Price Volatility: Sulfur and sulfuric acid prices are subject to market forces, impacting Itafos's cost of goods sold.

- Supplier Leverage: Suppliers of these key raw materials can dictate terms due to their essential role in fertilizer production.

- Margin Compression: Rising input costs directly squeeze Itafos's profit margins, as seen in the Q2 2025 Adjusted EBITDA impact.

- Strategic Sourcing: Itafos's ability to mitigate this power hinges on effective sourcing strategies and potentially long-term supply agreements.

Limited Substitutes for Primary Raw Materials

For core phosphate-based fertilizers, the scarcity of direct substitutes for primary raw materials like phosphate rock significantly bolsters supplier bargaining power. While advancements in bio-based and organic fertilizers are noteworthy, they currently do not fully substitute the essential role of traditional phosphate sources in maintaining large-scale agricultural yields.

This limited availability of viable input alternatives grants considerable leverage to entities controlling the supply of these fundamental resources. For instance, in 2024, global phosphate rock reserves are concentrated, with Morocco and Western Sahara holding the largest share, estimated at over 70% of the world's total reserves, according to the U.S. Geological Survey.

- Limited Substitutes: The primary raw materials for phosphate fertilizers, such as phosphate rock, have few direct substitutes in large-scale agriculture.

- Emerging Alternatives: While bio-fertilizers and organic options are growing, they do not yet fully replace the need for traditional phosphate sources.

- Supplier Leverage: The scarcity of viable input substitutes increases the bargaining power of suppliers who control these essential resources.

- Geographic Concentration: A significant portion of global phosphate rock reserves are concentrated in a few regions, enhancing the power of those suppliers.

The bargaining power of Itafos's suppliers is considerable due to the concentrated nature of phosphate rock production and the lack of viable substitutes for this key input. Suppliers of essential materials like sulfur and sulfuric acid also wield significant influence due to price volatility, which directly impacts Itafos's profitability. Furthermore, the threat of forward integration by major phosphate rock miners, who are already active in fertilizer production, creates a dynamic where suppliers can become competitors, potentially limiting supply to Itafos.

| Factor | Impact on Itafos | Supporting Data/Example |

|---|---|---|

| Concentrated Supplier Base (Phosphate Rock) | High Bargaining Power | Major producers like Nutrien, Mosaic, and OCP Group dominate global supply. |

| Lack of Substitutes (Phosphate Rock) | High Bargaining Power | Morocco and Western Sahara hold over 70% of global reserves (USGS data, 2024). |

| Price Volatility (Sulfur/Sulfuric Acid) | Reduced Profitability | Itafos reported negative impact on Adjusted EBITDA due to increased sulfur/sulfuric acid costs (Q2 2025). |

| Threat of Forward Integration | Increased Supplier Leverage | Companies like Mosaic are already integrated into fertilizer sales (Mosaic's 2023 fertilizer sales). |

What is included in the product

This analysis meticulously examines the five competitive forces impacting Itafos, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the fertilizer industry.

Gain immediate insight into competitive pressures with a dynamic Porter's Five Forces analysis, allowing for swift strategic adjustments to alleviate market pain points.

Customers Bargaining Power

Customers in the agricultural sector, primarily farmers and distributors, are acutely sensitive to fertilizer prices. These costs represent a substantial portion of their operational expenses, making price a critical decision factor.

Even with Itafos's specialization in enhanced efficiency fertilizers, the overarching phosphate fertilizer market is subject to commodity price fluctuations. This environment compels customers to actively seek out the most economical options available.

This pronounced price sensitivity grants customers significant leverage, enabling them to apply downward pressure on Itafos's product pricing. For instance, in 2024, global phosphate fertilizer prices saw volatility, with some regions experiencing price increases of up to 15% year-over-year due to supply chain disruptions and increased demand, further amplifying customer bargaining power.

For standard phosphate fertilizer products, customers typically face minimal costs when switching between suppliers. This means if another company offers a similar product at a more attractive price or with more favorable conditions, buyers can readily move their business elsewhere. This flexibility significantly amplifies customer bargaining power, putting pressure on Itafos to maintain competitive pricing and service for its undifferentiated products.

Itafos's customer base is largely concentrated within North and South America, with sales often channeled through established distribution networks. This structure means that a few large agricultural cooperatives or major distributors can wield significant buying power.

These substantial customers, by virtue of their considerable purchasing volumes, are in a strong position to negotiate more favorable terms, including pricing and delivery schedules. This concentrated buying power directly translates into increased bargaining leverage for these customers when dealing with Itafos.

Access to Market Information

Agricultural customers and distributors possess a wealth of market information, including fertilizer prices, product availability, and details on competing suppliers. This transparency, bolstered by market reports and digital platforms, significantly levels the playing field.

Well-informed buyers can therefore negotiate more effectively, increasing their leverage over fertilizer producers such as Itafos. For instance, in 2024, the global fertilizer market saw increased price volatility, making readily available data crucial for purchasing decisions.

- Informed Procurement: Access to real-time pricing and supply data empowers buyers to secure more favorable terms.

- Supplier Comparison: Digital marketplaces and industry publications allow for easy comparison of offerings from various fertilizer manufacturers.

- Reduced Information Asymmetry: The widespread availability of market intelligence diminishes the advantage suppliers might have had in the past.

- Negotiating Strength: Knowledgeable customers are better equipped to challenge supplier pricing and contract conditions, directly impacting Itafos's pricing power.

Limited Threat of Backward Integration

The threat of customers, primarily farmers, integrating backward into phosphate and specialty fertilizer production is minimal. The significant capital outlay, specialized knowledge, and complex regulatory environment required for fertilizer manufacturing present substantial barriers. For instance, establishing a new phosphate fertilizer plant can cost hundreds of millions of dollars, a prohibitive investment for most individual agricultural operations.

This low likelihood of backward integration means customers cannot easily produce their own fertilizers to bypass Itafos. While this limits their ultimate bargaining power, their price sensitivity remains a crucial factor influencing Itafos's pricing strategies. In 2024, global fertilizer prices, while fluctuating, continued to be a major cost consideration for farmers, underscoring this sensitivity.

- Limited backward integration: Customers face high capital and expertise barriers to producing their own fertilizers.

- High investment costs: Building fertilizer production facilities requires hundreds of millions in capital.

- Regulatory hurdles: Navigating environmental and safety regulations adds complexity and cost to entry.

- Price sensitivity: Despite limited integration threats, customers' focus on fertilizer costs remains a key bargaining lever.

Customers, primarily farmers and distributors, hold significant bargaining power due to their acute price sensitivity. Fertilizer costs are a major operational expense, driving them to seek the most economical options, even for Itafos's specialized products.

The ease with which customers can switch suppliers for standard phosphate fertilizers amplifies their leverage. This flexibility compels Itafos to maintain competitive pricing and service to retain business, especially since in 2024, global phosphate fertilizer prices saw notable volatility, with some regions experiencing up to a 15% year-over-year increase, making cost a paramount concern for buyers.

A concentrated customer base, including large agricultural cooperatives and distributors in North and South America, further bolsters their negotiating strength. These major buyers, through substantial purchasing volumes, can secure more favorable terms, directly impacting Itafos's pricing power.

The widespread availability of market information, including real-time pricing and competitor data, empowers customers to negotiate more effectively. This transparency, evident in 2024's volatile fertilizer market, reduces information asymmetry and strengthens the customer's position.

| Factor | Impact on Itafos | 2024 Context |

|---|---|---|

| Price Sensitivity | High | Farmers' major cost consideration; prices up to 15% higher in some regions year-over-year. |

| Switching Costs (Standard Products) | Low | Buyers can easily shift to competitors offering better prices. |

| Customer Concentration | Moderate to High | Large distributors/cooperatives can negotiate bulk discounts. |

| Information Availability | High | Market data empowers buyers to secure favorable terms. |

Preview Before You Purchase

Itafos Porter's Five Forces Analysis

This preview showcases the complete Itafos Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the phosphate and nitrogen fertilizer industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights into Itafos's strategic positioning. You're looking at the actual document, ensuring no surprises and full readiness for your business analysis.

Rivalry Among Competitors

The phosphate and specialty fertilizer market is dominated by global giants like Nutrien Ltd. and The Mosaic Company, which reported revenues of approximately $13.5 billion and $7.4 billion respectively in 2023. These established players have significant advantages in terms of scale, R&D investment, and distribution networks, creating a highly competitive environment for Itafos.

Itafos, operating with a considerably smaller revenue base, faces intense pressure from these large competitors who possess diversified product offerings and extensive geographic reach. This disparity in resources means Itafos must strategically differentiate itself to capture and maintain market share against well-capitalized global rivals.

Moderate industry growth rates, with the global phosphate fertilizer market expected to expand at a compound annual growth rate of 5.2% between 2024 and 2025, can temper intense rivalry. Specialty fertilizers are even anticipated to grow slightly faster at 5.5% during this timeframe.

However, this growth doesn't eliminate competitive pressure. Geopolitical events and trade tariffs can still inject volatility into the market, forcing companies to compete vigorously for market share and new customer acquisition.

While the broader phosphate fertilizer market often sees intense price competition due to its commoditized nature, Itafos carves out a niche by emphasizing specialty products. Offerings like MAP+ and SSP+, enriched with essential micronutrients, and Ammonium Polyphosphate (APP) allow for significant product differentiation. This strategy focuses on delivering tailored nutrient solutions and superior efficacy, thereby reducing the pressure of direct price wars with competitors.

This product differentiation is crucial because other players in the fertilizer industry are also actively pursuing innovation. For instance, in 2024, several major fertilizer producers announced increased investment in research and development for enhanced efficiency fertilizers and bio-stimulants, signaling a growing trend towards specialized agricultural inputs. Itafos must therefore maintain a robust commitment to its own research and development pipeline to stay ahead and continue offering unique value propositions that justify premium pricing and foster customer loyalty.

High Fixed Costs and Exit Barriers

The fertilizer sector is inherently capital-intensive. Companies like Itafos must make massive investments in mining, advanced processing facilities, and extensive logistics networks. For instance, establishing a new phosphate mine and processing plant can easily cost billions of dollars.

These substantial upfront investments translate into significant exit barriers. Once a company has committed these resources, it becomes very difficult and costly to simply walk away, even if market conditions turn unfavorable. This forces companies to continue operating to at least cover their fixed costs.

- Capital Intensity: The fertilizer industry demands significant capital for mining, processing, and distribution.

- High Exit Barriers: Large investments make it difficult and expensive for companies to leave the market.

- Production Incentives: Companies are often compelled to continue production to cover fixed costs, even in weak markets.

- Price Competition: This can lead to oversupply and intensified price wars among existing players.

Strategic Importance of Market Share

Maintaining and expanding market share is crucial for fertilizer companies like Itafos to leverage economies of scale and ensure their long-term success. For instance, in 2024, the global fertilizer market was valued at approximately $250 billion, with significant consolidation and strategic moves being made by major players to capture a larger piece of this pie. This intense focus on market share directly fuels competitive rivalry.

Competitors are actively pursuing strategic partnerships, investing in new product development, and expanding their geographic reach to solidify their market positions. In 2024, we saw several major fertilizer producers announcing new joint ventures and acquisitions aimed at increasing their production capacity and market access, particularly in emerging economies. These actions highlight the high strategic stakes involved.

This elevated strategic importance intensifies the rivalry within the industry. Companies are aggressively defending their existing market leadership and simultaneously pursuing opportunities to gain an advantage over their rivals. This dynamic leads to price competition, increased marketing efforts, and a constant drive for operational efficiency to remain competitive.

- Strategic Importance: Market share is key for economies of scale and long-term viability in the fertilizer sector.

- Competitive Actions: Firms engage in partnerships, product innovation, and geographic expansion to gain market share.

- Market Dynamics: The pursuit of market leadership intensifies rivalry, leading to aggressive competition.

- Industry Value: The global fertilizer market's approximate $250 billion valuation in 2024 underscores the significance of market share.

The competitive rivalry in the phosphate and specialty fertilizer market is intense, largely due to the presence of global giants like Nutrien and Mosaic, which reported revenues of approximately $13.5 billion and $7.4 billion respectively in 2023. Itafos, with a smaller revenue base, faces significant pressure from these larger, well-resourced competitors who possess extensive distribution networks and R&D capabilities, forcing Itafos to focus on product differentiation in specialty fertilizers to avoid direct price wars.

| Competitor | 2023 Revenue (Approx.) | Key Strategy |

| Nutrien Ltd. | $13.5 billion | Scale, Diversification, Distribution |

| The Mosaic Company | $7.4 billion | Scale, Diversification, Distribution |

| Itafos | (Smaller Revenue Base) | Specialty Products, Differentiation |

SSubstitutes Threaten

The push towards sustainable agriculture is fueling the rise of biofertilizers and organic alternatives, directly challenging traditional phosphate products. These eco-friendly options, utilizing microorganisms and natural materials, offer a greener path to boosting soil fertility and plant yields, sidestepping the environmental drawbacks of synthetic fertilizers.

Precision agriculture, leveraging innovations like IoT sensors and AI, allows farmers to apply fertilizers with extreme accuracy. This means less overall fertilizer is used, making these advanced methods a substitute for traditional, broader application techniques. For instance, by 2024, the global precision agriculture market was valued at approximately $10.5 billion, signaling significant adoption.

This shift directly impacts Itafos by potentially reducing the demand for their conventional fertilizer products. As these technologies become more widespread, farmers can achieve similar or better crop yields with a reduced volume of synthetic fertilizers, forcing Itafos to consider strategies that align with this more efficient approach to nutrient management.

The threat of substitutes for Itafos's traditional phosphate fertilizers is intensifying due to advancements in enhanced-efficiency fertilizer technologies. Innovations like controlled-release and slow-release formulations are gaining traction, allowing for more precise nutrient delivery and reduced waste, directly impacting the demand for conventional products.

While Itafos is developing specialty fertilizers, the wider market adoption of these more efficient alternatives by competitors poses a significant threat. For instance, the global market for enhanced-efficiency fertilizers is projected to reach over $12 billion by 2027, indicating a growing preference for these substitutes that could diminish the need for larger volumes of traditional phosphate fertilizers.

Growing Environmental and Sustainability Concerns

Growing environmental and sustainability concerns are increasingly shaping agricultural practices, creating a potential substitution threat for synthetic fertilizers like those produced by Itafos. Farmers, consumers, and regulators are all pushing for more eco-friendly methods. This heightened awareness drives demand for alternatives that minimize chemical runoff and enhance soil health, directly impacting the market for traditional fertilizers.

The societal shift towards sustainability encourages the adoption of products perceived as more environmentally benign. This includes a rising interest in organic soil conditioners and compost, which offer a direct alternative to synthetic fertilizers. For instance, the global organic fertilizer market was valued at approximately USD 10.5 billion in 2023 and is projected to grow significantly, indicating a tangible market shift away from conventional options.

- Rising Demand for Organic Fertilizers: The market for organic fertilizers is expanding, driven by consumer preference for sustainably grown produce.

- Regulatory Pressures: Stricter environmental regulations in various regions may limit the use of synthetic fertilizers, further promoting alternatives.

- Technological Advancements in Biofertilizers: Innovations in biofertilizer technology are making these alternatives more effective and accessible to a wider range of farmers.

- Consumer Awareness: Consumers are increasingly willing to pay a premium for food produced using environmentally friendly methods, influencing farmer choices.

Crop Rotation and Soil Health Management

Beyond direct product substitutes, agricultural practices like diverse crop rotation and comprehensive soil health management can naturally improve nutrient availability and reduce reliance on external fertilizer inputs. As farmers increasingly prioritize long-term soil health and regenerative agriculture, the fundamental need for synthetic fertilizers could diminish, acting as an indirect but significant substitute for Itafos's products.

For instance, advancements in cover cropping and organic soil amendments are gaining traction. A 2024 report indicated a 15% year-over-year increase in farmer adoption of regenerative agriculture practices in North America, directly impacting the demand for synthetic fertilizers.

- Reduced Synthetic Fertilizer Demand: As soil health improves through practices like crop rotation, the need for synthetic nitrogen, phosphorus, and potassium fertilizers can decrease.

- Increased Organic Input Use: Farmers are exploring compost, manure, and bio-fertilizers as cost-effective and environmentally friendly alternatives.

- Focus on Soil Biology: Practices that enhance beneficial soil microbes can improve nutrient cycling, further lessening the dependence on manufactured fertilizers.

- Economic and Environmental Drivers: Rising fertilizer costs and increasing environmental regulations are accelerating the shift towards these substitute practices.

The threat of substitutes for Itafos's phosphate fertilizers is significant, driven by the growing adoption of biofertilizers and organic soil amendments. These alternatives offer environmentally friendly ways to improve soil fertility, with the global organic fertilizer market valued at approximately USD 10.5 billion in 2023. This trend is further bolstered by precision agriculture techniques, which optimize fertilizer application and reduce overall usage, with the precision agriculture market reaching about $10.5 billion in 2024.

| Substitute Type | Market Value (Approximate) | Growth Driver |

| Biofertilizers/Organic Fertilizers | USD 10.5 billion (2023) | Sustainability concerns, consumer preference for organic produce |

| Precision Agriculture | $10.5 billion (2024) | Efficiency, reduced waste, technological advancements |

| Enhanced-Efficiency Fertilizers | Projected >$12 billion (by 2027) | Precise nutrient delivery, reduced environmental impact |

Entrants Threaten

The phosphate and specialty fertilizer industry presents a formidable barrier to entry due to its exceptionally high capital investment requirements. Establishing mining operations, sophisticated processing plants, and intricate chemical production facilities demands enormous sums of money. For instance, constructing a new, vertically integrated phosphate fertilizer complex can easily exceed $1 billion in upfront costs.

This substantial financial hurdle significantly deters potential new entrants. The sheer scale of investment needed means that only a select few organizations possess the financial capacity to even consider entering this market, thereby limiting competitive pressures.

Existing players in the phosphate industry, including Itafos, benefit from significant economies of scale. This means they can produce at a lower cost per unit due to their large-scale operations in raw material sourcing, manufacturing processes, and efficient distribution networks.

For instance, Itafos's integrated operations, from mining to fertilizer production, allow it to spread fixed costs over a larger output. This cost advantage makes it exceedingly challenging for new entrants to match the per-unit pricing of established companies unless they can immediately achieve comparable production volumes.

In 2024, the global phosphate market saw continued consolidation, with major players leveraging their scale to maintain competitive pricing. For a new entrant to overcome this barrier, it would require substantial upfront capital investment to build facilities capable of achieving similar economies of scale, a daunting prospect in a mature industry.

Established distribution networks represent a significant hurdle for new fertilizer companies. Itafos, like other major players, has invested heavily in building and maintaining strong ties with agricultural distributors, cooperatives, and directly with farmers throughout North and South America. These relationships, often spanning decades, are built on trust and reliability, making it difficult for newcomers to gain access to these crucial channels.

The cost and time required to replicate these extensive networks are substantial deterrents. New entrants would need to invest heavily in logistics, warehousing, and sales infrastructure, all while trying to establish credibility in a market where loyalty to established brands is high. For instance, the global fertilizer market, valued at over $200 billion in 2023, is characterized by entrenched players with significant market share, further solidifying these barriers.

Complex Regulatory and Permitting Hurdles

The fertilizer industry faces significant regulatory complexities, especially for operations involving mining and chemical production. These stringent environmental and safety standards, coupled with intricate permitting processes, demand substantial expertise, time, and capital investment. For instance, obtaining the necessary permits for a new phosphate mine in jurisdictions like Florida can take several years and millions of dollars in environmental impact assessments and compliance planning.

These regulatory barriers effectively deter potential new entrants by increasing the cost and timeline for market entry. The need for specialized legal and environmental consulting, along with the capital required to meet compliance standards, creates a high barrier to entry. In 2024, the ongoing scrutiny of agricultural inputs and their environmental footprint means these hurdles are unlikely to diminish, reinforcing the position of established players.

- Environmental Regulations: Strict rules govern emissions, water usage, and waste disposal in fertilizer production.

- Safety Standards: Comprehensive safety protocols are mandatory for handling hazardous materials in manufacturing.

- Permitting Processes: Obtaining licenses for mining, chemical synthesis, and distribution can be lengthy and costly.

- Compliance Costs: Meeting these diverse regulatory requirements adds significant operational expenses for new market participants.

Proprietary Technology and Specialized Expertise

The production of specialty fertilizers, like Itafos's MAP+ and APP, relies on proprietary technologies and specialized chemical processes. This technical complexity, coupled with unique formulations, acts as a significant barrier for potential newcomers. Itafos's vertically integrated model further solidifies this advantage, requiring substantial investment in both advanced know-how and capital to replicate.

For instance, the development of enhanced efficiency fertilizers often involves intricate coating technologies or the incorporation of specific micronutrients, demanding a deep understanding of agronomy and chemical engineering. Without this specialized expertise, new entrants would struggle to compete on product performance and efficacy. Itafos's commitment to innovation, evidenced by its ongoing research and development efforts, continually raises this technological bar.

- Proprietary Technology: The creation of specialty fertilizers involves unique chemical processes and formulations.

- Specialized Expertise: Deep knowledge in agronomy and chemical engineering is crucial for product development and efficacy.

- Capital Investment: Significant financial resources are needed to acquire or develop advanced manufacturing capabilities and intellectual property.

The threat of new entrants in the phosphate and specialty fertilizer industry is considerably low, primarily due to the immense capital required to establish operations. Building a new, vertically integrated phosphate fertilizer facility can easily surpass $1 billion, a sum that deters most potential competitors.

Economies of scale enjoyed by established players like Itafos, stemming from their large-scale sourcing, manufacturing, and distribution, create a significant cost advantage. For example, in 2024, the global phosphate market continued to see consolidation, with major companies leveraging their scale to maintain competitive pricing, making it difficult for newcomers to match unit costs without comparable output volumes.

Furthermore, established distribution networks, built over decades and fostering trust with agricultural partners, present a substantial barrier. Replicating these extensive logistics, warehousing, and sales channels requires considerable investment and time. The global fertilizer market, valued at over $200 billion in 2023, is dominated by these entrenched players.

Regulatory hurdles, including stringent environmental and safety standards, lengthy permitting processes, and high compliance costs, also elevate the barrier to entry. Obtaining permits for a new phosphate mine, for instance, can take years and cost millions in assessments, a challenge that intensified in 2024 with ongoing environmental scrutiny.

| Barrier Type | Description | Example/Impact |

| Capital Requirements | Extremely high upfront investment for mining and processing facilities. | New facility costs often exceed $1 billion. |

| Economies of Scale | Lower per-unit costs for established, high-volume producers. | It's difficult for new entrants to match the cost-competitiveness of large players. |

| Distribution Networks | Established relationships with distributors and farmers built on trust and reliability. | Newcomers face challenges gaining access to crucial sales channels. |

| Regulatory Compliance | Strict environmental, safety, and permitting requirements. | Permitting for new mines can take years and cost millions, increasing entry costs significantly. |

| Proprietary Technology | Unique chemical processes and formulations for specialty fertilizers. | Requires specialized expertise and significant R&D investment to replicate. |

Porter's Five Forces Analysis Data Sources

Our Itafos Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Itafos's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and macroeconomic data to capture the full competitive landscape.