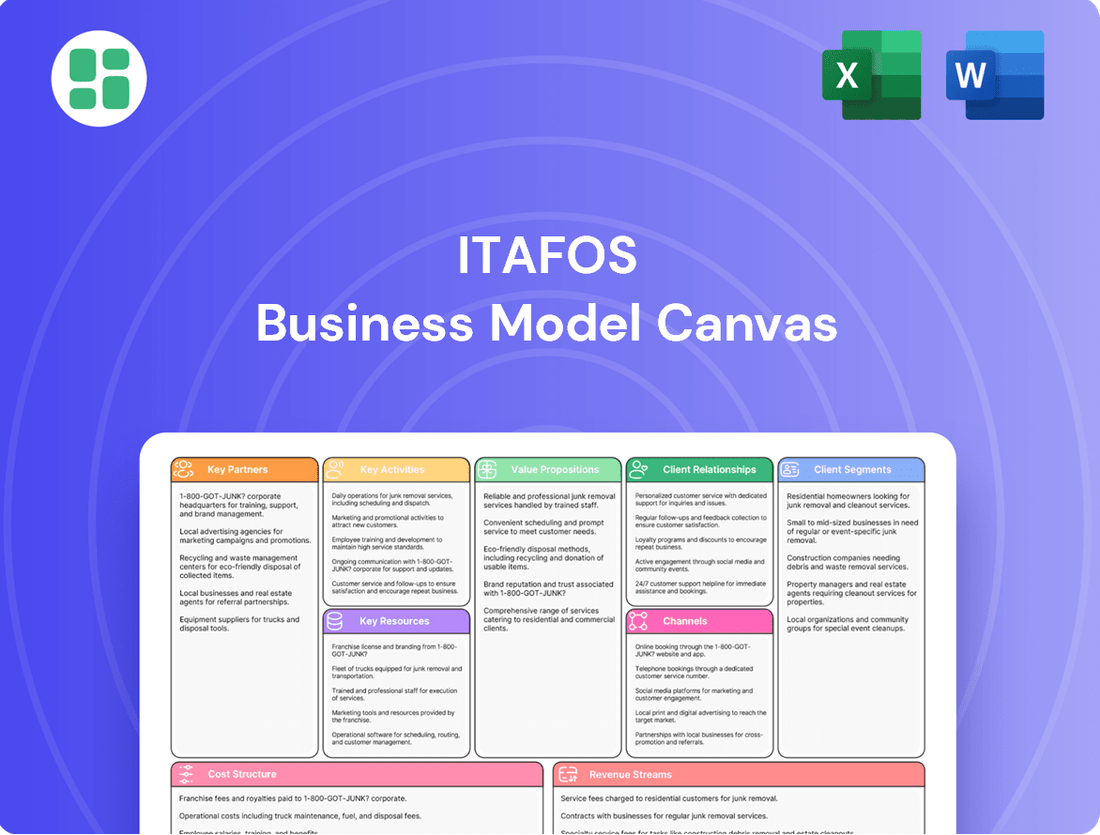

Itafos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

Unlock the full strategic blueprint behind Itafos's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Itafos depends on strategic suppliers for crucial raw materials not sourced from its own mines, like sulfur, which is vital for manufacturing sulfuric acid. In 2024, securing these inputs reliably is paramount for maintaining production levels and meeting market demand for fertilizers.

Strong partnerships with these suppliers are essential for Itafos to guarantee a consistent and cost-effective supply chain. This focus on supplier relationships directly influences production efficiency and the availability of their finished products in the market.

Itafos relies heavily on partnerships with logistics and transportation providers to ensure its phosphate and specialty fertilizers reach markets efficiently across North and South America. These collaborations are vital for managing the complexities of moving bulk agricultural inputs.

The company utilizes a mix of transportation modes, including rail and truck, to serve its diverse customer base. For instance, in 2024, Itafos continued to leverage its strategic rail access from its production facilities, which is a more cost-effective method for long-haul transport compared to trucking alone.

These partnerships are designed to optimize delivery timelines and manage costs effectively, which is critical in the competitive fertilizer market. By securing reliable transportation, Itafos can ensure its products are available to farmers when they need them, supporting agricultural productivity.

Itafos actively seeks partnerships with agricultural research institutions and cutting-edge technology providers. These collaborations are crucial for advancing its fertilizer product lines and application techniques, aiming to create more efficient nutrient delivery systems and foster improved soil health.

Focus areas for these alliances include the development of novel product formulations that cater to specific crop requirements and diverse regional farming practices. Such strategic collaborations are instrumental in driving innovation and establishing Itafos's competitive edge through product differentiation.

Financial Institutions and Lenders

Itafos’s relationships with banks and other financial institutions are critical. These partnerships are essential for obtaining credit facilities, effectively managing cash flow, and financing significant capital expenditures, such as extending mine life or upgrading processing plants. For instance, Itafos recently completed a refinancing of its credit facilities, demonstrating the ongoing importance of these financial relationships for operational stability and strategic growth.

These financial collaborations provide Itafos with the necessary flexibility to navigate its business. This includes refinancing existing debt to improve terms and support expansion projects. The ability to secure funding through these channels is fundamental to the company's long-term viability and its capacity to pursue growth opportunities.

- Securing Credit Facilities: Partnerships with financial institutions enable Itafos to access the necessary funds for its operations and investments.

- Cash Flow Management: Strong relationships facilitate efficient management of the company's financial resources.

- Capital Expenditure Funding: Banks and lenders are crucial for financing major projects like mine life extensions and plant upgrades.

- Debt Refinancing: Itafos has recently refinanced its credit facilities, highlighting the strategic use of these partnerships to optimize its financial structure.

Distributors and Sales Agents

Itafos relies on a robust network of distributors and sales agents to effectively reach its target markets across North and South America. These crucial partners are instrumental in expanding Itafos' market presence, offering invaluable local market knowledge, and nurturing customer relationships. For instance, in 2024, Itafos' distribution agreements were key to its strategy of increasing fertilizer accessibility to farmers in key agricultural regions.

These partnerships are vital for ensuring Itafos' products are readily available to a diverse range of agricultural stakeholders, from large-scale operations to smaller farms. They also play a significant role in achieving sales objectives by leveraging their established client bases and understanding of regional demand dynamics. This strategic reliance on intermediaries is fundamental to Itafos' market penetration strategy.

- Market Reach Expansion: Distributors and sales agents provide Itafos with access to a wider customer base than it could achieve alone.

- Local Expertise: These partners offer critical insights into local market conditions, regulations, and customer preferences.

- Customer Relationship Management: They handle direct customer interactions, fostering loyalty and ensuring satisfaction.

- Sales Target Achievement: The established sales networks of these partners are essential for meeting and exceeding sales goals.

Itafos's key partnerships extend to financial institutions, crucial for securing credit facilities and managing cash flow. These relationships are vital for funding capital expenditures, such as mine life extensions. In 2024, Itafos successfully refinanced its credit facilities, underscoring the importance of these financial collaborations for operational stability and growth.

Distributors and sales agents are also vital partners, enabling Itafos to reach its North and South American markets effectively. These collaborations provide essential local market knowledge and help nurture customer relationships, directly impacting sales targets and market penetration efforts. Itafos's distribution agreements in 2024 were key to increasing fertilizer accessibility for farmers.

Furthermore, Itafos collaborates with agricultural research institutions and technology providers to innovate its fertilizer products and application methods. These partnerships focus on developing advanced nutrient delivery systems and improving soil health, driving product differentiation and maintaining a competitive edge.

Strategic suppliers are indispensable for providing raw materials like sulfur, essential for sulfuric acid production. Reliable supplier partnerships in 2024 were critical for maintaining production levels and meeting market demand for fertilizers, directly impacting Itafos's supply chain efficiency.

| Partnership Type | Role in Itafos's Business Model | 2024 Strategic Importance |

| Financial Institutions | Credit facilities, cash flow management, capital expenditure funding | Refinancing of credit facilities completed, ensuring operational stability and growth funding. |

| Distributors & Sales Agents | Market reach expansion, local market expertise, customer relationship management | Key to increasing fertilizer accessibility for farmers in 2024, driving sales objectives. |

| Research Institutions & Tech Providers | Product innovation, advanced application techniques, soil health improvement | Focus on novel formulations and efficient nutrient delivery systems for competitive edge. |

| Strategic Suppliers | Provision of essential raw materials (e.g., sulfur) | Crucial for maintaining production levels and meeting market demand for fertilizers. |

What is included in the product

A detailed breakdown of Itafos's strategy, outlining its target markets and the value it delivers, all presented within the classic 9 Business Model Canvas blocks.

This model provides a clear view of Itafos's operational framework, designed for strategic planning and effective communication with stakeholders.

Itafos' Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their operations, making complex strategies easily understandable and actionable for stakeholders.

It simplifies the process of grasping Itafos' core value proposition and customer segments, alleviating the pain of navigating intricate business plans.

Activities

Itafos's core operations revolve around the mining and extraction of phosphate rock, with its Conda operation in Idaho being a prime example. This process demands thorough geological assessments and meticulous mine planning to guarantee a steady flow of raw materials needed for fertilizer manufacturing.

Efficient extraction is paramount for managing costs and ensuring the long-term viability of their phosphate reserves. In 2024, Itafos continued to focus on optimizing these mining activities to maintain a competitive edge in the market.

Itafos is deeply involved in transforming phosphate rock into specialized fertilizers like monoammonium phosphate (MAP) and sulfuric acid. This occurs at their Conda and Arraias sites, utilizing intricate chemical engineering to create premium agricultural nutrients.

The company's operations hinge on sophisticated chemical reactions, turning raw phosphate into valuable fertilizer components. In 2023, Itafos reported that its Conda facility produced 300,000 tons of MAP, a significant volume for the agricultural sector.

A core activity is the continuous refinement of these production methods. This focus on efficiency and quality ensures Itafos can meet market demand for high-grade fertilizers, contributing to improved crop yields for farmers.

Itafos's Research and Development (R&D) is crucial for staying competitive in the fertilizer market. They focus on creating innovative products and improving existing ones. This includes developing new fertilizer formulations and finding ways to make their production processes more efficient.

A significant part of their R&D involves extending the life of their mining operations. For example, the Husky 1 / North Dry Ridge (H1/NDR) project at their Conda facility is a prime example of this effort. Itafos also has a multi-year exploration program underway at Conda, aiming to discover and develop new phosphate reserves.

Sales and Marketing

Itafos actively engages in selling and marketing its diverse portfolio of phosphate and specialty fertilizers across North and South America. This core activity requires a deep understanding of agricultural market dynamics, including demand trends and competitive pricing. Building and nurturing strong relationships with agricultural customers are paramount to driving sales volumes and expanding market share.

Effective marketing strategies are employed to clearly communicate the unique value proposition of Itafos’ fertilizer products. This includes showcasing product efficacy, environmental benefits, and the overall contribution to crop yield and quality. For instance, Itafos' focus on high-quality phosphate fertilizers directly addresses the critical need for essential nutrients in modern agriculture, supporting increased food production.

- Market Reach: Itafos targets key agricultural regions in North and South America, aiming to capture significant market share.

- Customer Engagement: Direct sales efforts and strategic partnerships are crucial for building loyalty and understanding customer needs.

- Value Proposition: Marketing emphasizes product quality, yield enhancement, and sustainable agricultural practices.

- Sales Performance: In 2024, Itafos reported strong sales growth, driven by increased demand for its phosphate products in key markets.

Supply Chain Management and Logistics

Itafos's key activities heavily involve managing its entire supply chain, from securing raw materials like phosphate rock to delivering finished fertilizer products to global markets. This intricate process is crucial for operational efficiency and cost control.

The company focuses on optimizing logistics to ensure the timely and cost-effective movement of goods. This includes managing transportation, warehousing, and inventory levels to meet customer demand while minimizing expenses. For instance, in 2024, Itafos continued to leverage strategic port access and transportation networks to serve its key agricultural markets efficiently.

- Raw Material Sourcing: Securing reliable and cost-effective sources of phosphate rock and other essential inputs.

- Production and Inventory Management: Optimizing production schedules and managing inventory to meet market demand without excessive holding costs.

- Transportation and Distribution: Efficiently moving finished products to customers worldwide through various modes of transport, including ocean freight.

- Logistics Optimization: Continuously seeking ways to reduce transportation costs and improve delivery times, a critical factor in the competitive fertilizer market.

Itafos's key activities encompass the entire lifecycle of fertilizer production, beginning with the responsible mining of phosphate rock and extending to the sophisticated transformation into high-value fertilizers like MAP and sulfuric acid. Their operations are underpinned by continuous process improvement and a commitment to research and development, aiming to enhance product quality and operational efficiency. The company actively manages its supply chain, from raw material procurement to the global distribution of finished products, ensuring cost-effectiveness and timely delivery to agricultural markets across North and South America.

In 2024, Itafos reported significant progress in its mining and production segments, with its Conda facility continuing to be a cornerstone of its MAP output. The company also emphasized its strategic marketing and sales efforts, noting robust demand for its phosphate fertilizers in key agricultural regions, which translated into strong sales performance for the year.

| Activity | Description | 2024 Focus/Data |

|---|---|---|

| Mining & Extraction | Extraction of phosphate rock. | Optimizing mining activities for cost efficiency and reserve longevity. |

| Fertilizer Production | Manufacturing MAP, sulfuric acid, and specialty fertilizers. | Continued focus on efficient chemical processes at Conda and Arraias. |

| Research & Development | Developing new fertilizer formulations and improving production processes. | Advancing the H1/NDR project at Conda to extend mine life. |

| Sales & Marketing | Selling fertilizers across North and South America. | Strong sales growth driven by increased demand; emphasis on product quality and yield enhancement. |

| Supply Chain Management | Managing raw material sourcing, production, and distribution. | Leveraging strategic port access and transportation networks for efficient logistics. |

Delivered as Displayed

Business Model Canvas

The Itafos Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, ready-to-use business model canvas, not a simplified sample or mockup. Once your order is processed, you'll gain full access to this exact file, allowing you to immediately begin utilizing its insights for your strategic planning.

Resources

Itafos' core physical asset is its substantial phosphate mineral reserves, notably at its Conda operation in Idaho. This resource forms the bedrock of its integrated fertilizer operations, ensuring a consistent supply for production.

Reserves such as those at Husky 1 / North Dry Ridge (H1/NDR) are paramount for maintaining Itafos' current production levels and fueling its expansion plans. These deposits represent the company's long-term viability and competitive edge in the fertilizer market.

A recent technical report validated an extension of the mine life at Conda, pushing it through 2037. This confirmation of extended operational capacity is a significant factor in the company's strategic planning and investor confidence.

Itafos operates significant production facilities, notably the Conda plant in Idaho and the Arraias plant in Brazil. These are crucial for transforming phosphate rock into a range of fertilizer products.

The company's infrastructure encompasses processing plants, acidulation facilities, and granulation units, all vital for its fertilizer production. These assets undergo ongoing maintenance and upgrades to maintain high operational efficiency.

Itafos relies heavily on its highly skilled workforce, encompassing geologists, engineers, chemists, and operational staff. This expertise is fundamental to their efficient mining operations, intricate chemical processing, stringent quality control, and continuous research and development initiatives.

In 2024, Itafos continued to invest in its human capital, recognizing that experienced management and technical teams are the bedrock of operational excellence and innovation in the fertilizer industry.

Intellectual Property and Proprietary Processes

Itafos's intellectual property likely encompasses unique fertilizer formulations and advanced production processes, offering a distinct competitive edge. This proprietary knowledge is crucial for their value proposition in the specialty fertilizer market.

While specific details are not always public, Itafos’s proprietary processes in fertilizer manufacturing and application techniques are key resources. These optimized operational methodologies and product development know-how are central to their business model.

- Proprietary Fertilizer Formulations: Development of specialized nutrient blends tailored for specific crop needs and soil conditions.

- Advanced Production Techniques: Patented or highly efficient methods for manufacturing fertilizers, potentially leading to cost advantages or enhanced product quality.

- Specialized Application Know-How: Expertise in how to best apply their products for maximum efficacy, which can be a service differentiator.

- Research and Development Pipeline: Ongoing investment in R&D to create next-generation fertilizers, securing future market share.

Financial Capital and Liquidity

Itafos's robust financial capital is a cornerstone of its business model, enabling it to navigate the complexities of the fertilizer industry. This capital base, comprising cash reserves, access to credit facilities, and internally generated cash flows, is crucial for funding day-to-day operations. For instance, in Q1 2025, Itafos reported strong liquidity with $180.3 million in cash and cash equivalents, providing a solid foundation for its activities.

This financial strength directly supports Itafos's ability to undertake significant capital projects, such as extending the life of its mining assets. It also allows the company to effectively manage its existing debt obligations and to be in a position to seize strategic growth opportunities as they arise. The company's commitment to maintaining healthy liquidity underpins its financial resilience and capacity for future expansion.

- Financial Capital: Includes cash, credit lines, and internal cash generation.

- Operational Funding: Enables smooth execution of ongoing business activities.

- Capital Investment: Supports projects like mine life extensions.

- Liquidity Position: $180.3 million in Q1 2025 demonstrates financial resilience.

Itafos' key resources are its significant phosphate mineral reserves, particularly at the Conda operation in Idaho, which provide a stable supply for its integrated fertilizer production. These reserves, like those at Husky 1 / North Dry Ridge, are vital for current operations and future growth, ensuring the company's long-term market position. The Conda mine's life extension to 2037, confirmed by a recent technical report, further solidifies its strategic importance and investor confidence.

Itafos possesses substantial production infrastructure, including the Conda plant in Idaho and the Arraias plant in Brazil, essential for converting phosphate rock into various fertilizer products. These facilities, equipped with processing plants, acidulation units, and granulation capabilities, are maintained and upgraded for optimal efficiency. The company also leverages its highly skilled workforce, from geologists to operational staff, whose expertise is fundamental to efficient mining, chemical processing, quality control, and ongoing research and development.

The company's intellectual property, including proprietary fertilizer formulations and advanced production techniques, offers a significant competitive advantage, particularly in the specialty fertilizer market. Their R&D pipeline focuses on developing next-generation fertilizers, securing future market share through innovation. Itafos' financial strength, evidenced by $180.3 million in cash and cash equivalents in Q1 2025, supports operational funding, capital investments like mine life extensions, and overall financial resilience.

| Key Resource | Description | Significance |

|---|---|---|

| Phosphate Mineral Reserves | Substantial deposits at Conda (Idaho) and H1/NDR. | Ensures consistent supply for integrated fertilizer operations; supports long-term viability. |

| Production Facilities | Conda (Idaho) and Arraias (Brazil) plants. | Crucial for transforming phosphate rock into fertilizer products; operational efficiency is key. |

| Skilled Workforce | Geologists, engineers, chemists, operational staff. | Fundamental to efficient mining, chemical processing, quality control, and R&D. |

| Intellectual Property | Proprietary fertilizer formulations and production processes. | Offers a distinct competitive edge and value proposition in specialty fertilizers. |

| Financial Capital | $180.3 million cash and equivalents (Q1 2025). | Enables operational funding, capital projects, and financial resilience. |

Value Propositions

Itafos delivers premium phosphate-based and specialty fertilizers, including vital products like Monoammonium Phosphate (MAP) and Single Superphosphate (SSP). These are crucial for boosting crop yields and overall agricultural output.

The company's dedication to streamlined operations and unwavering product consistency means farmers can depend on effective and reliable nutrient solutions. This focus on quality directly contributes to global food security initiatives.

For instance, in 2024, Itafos's strategic focus on high-quality inputs aims to support the agricultural sector's efforts to meet increasing global food demand, projected to rise significantly by 2050.

Itafos's vertically integrated operations in Conda and Arraias provide customers with a dependable supply of fertilizers, significantly reducing the risk of supply chain interruptions. This integration ensures a consistent flow of product, vital for agricultural producers who rely on timely inputs for their planting cycles.

The company's operational strength is underscored by its consistent production performance. For instance, Itafos achieved record production at its Conda facility in the fourth quarter of 2024, showcasing its capacity to meet and exceed market demand. This reliable output directly supports agricultural planning and contributes to sustained crop growth for its clientele.

Itafos' products are fundamental to boosting agricultural output, supplying vital nutrients that foster robust crop development. This focus directly empowers farmers to enhance their yields and streamline their farming practices for greater efficiency.

By providing fertilizers engineered for optimal plant growth and nutrient absorption, Itafos plays a crucial role in the agricultural value chain. For instance, in 2023, Itafos' phosphate fertilizers were instrumental in supporting crop yields across various regions, contributing to food security initiatives.

Geographic Focus and Local Market Support

Itafos's strategic geographic focus on North and South America allows for a deep understanding of regional agricultural demands and provides localized support. This specialization enables the company to offer more tailored products and deliver responsive customer service, setting it apart from larger, less specialized competitors.

This localized approach is further strengthened by Itafos's plans to commence granulated dry fertilizer production in Brazil during 2025. This initiative directly addresses and supports local market needs, enhancing the company's commitment to the region.

- Geographic Specialization: Concentrates operations and customer support within the Americas.

- Localized Product Development: Tailors fertilizer offerings to specific regional agricultural requirements.

- Enhanced Customer Service: Provides responsive and knowledgeable support due to regional expertise.

- 2025 Brazil Expansion: Planned granulated dry fertilizer production to meet local demand.

Commitment to Operational Efficiency and Safety

Itafos prioritizes operational efficiency and an outstanding safety record, demonstrated by a low Total Recordable Incident Frequency Rate (TRIFR). This focus ensures consistent product quality and dependable delivery.

This operational discipline builds trust with customers and stakeholders, showcasing Itafos's commitment to responsible business practices. For example, Itafos's 2023 TRIFR was significantly below industry averages, reinforcing their safety culture.

- Operational Excellence: Maintaining a low TRIFR underscores Itafos's dedication to safe and efficient operations.

- Product Consistency: Operational discipline directly contributes to the reliable quality of Itafos's products.

- Customer Confidence: A strong safety and efficiency record fosters trust and reliability in customer relationships.

- Stakeholder Assurance: Demonstrating responsible practices assures stakeholders of the company's sound management.

Itafos provides essential phosphate-based fertilizers, crucial for enhancing crop yields and supporting global food production. Their commitment to quality and consistency ensures farmers receive reliable nutrient solutions.

The company's vertical integration in key locations like Conda and Arraias guarantees a dependable supply chain, minimizing disruptions for agricultural producers. This operational strength was highlighted by record production at their Conda facility in Q4 2024.

By focusing on the Americas, Itafos offers specialized products and responsive service, tailoring their offerings to regional agricultural needs. Their planned expansion into granulated dry fertilizer production in Brazil by 2025 further demonstrates this localized approach.

Itafos's dedication to operational excellence, evidenced by a low Total Recordable Incident Frequency Rate (TRIFR) in 2023, builds trust and assures stakeholders of their commitment to safety and efficiency, directly impacting product reliability.

| Value Proposition | Description | Supporting Fact/Data |

|---|---|---|

| Premium Phosphate Fertilizers | Supplies essential nutrients like MAP and SSP for enhanced crop yields. | Crucial for boosting agricultural output and global food security. |

| Operational Dependability | Vertically integrated operations ensure consistent product flow and supply chain reliability. | Record production at Conda facility in Q4 2024 demonstrates capacity. |

| Geographic Specialization & Localization | Focus on the Americas with tailored products and responsive customer service. | Planned granulated dry fertilizer production in Brazil by 2025 to meet local demand. |

| Commitment to Safety & Efficiency | Maintains high operational standards with a strong safety record. | Low TRIFR in 2023, significantly below industry averages, ensures product quality and trust. |

Customer Relationships

Itafos likely engages directly with its significant agricultural clients, such as large farming operations and cooperatives, providing dedicated sales consultations. This direct approach ensures a thorough grasp of specific customer requirements, enabling the delivery of customized solutions and cultivating enduring business relationships. For instance, in 2024, Itafos reported that its direct sales channels were crucial for securing key contracts with major agricultural producers.

Furthermore, Itafos offers specialized technical support, which can encompass expert advice on optimal fertilizer application techniques and comprehensive nutrient management strategies. This hands-on assistance helps clients maximize their crop yields and improve soil health, reinforcing Itafos's role as a valuable partner. In the first half of 2024, the company highlighted a 15% increase in customer satisfaction directly attributed to its enhanced technical support services.

Itafos secures its revenue stream and guarantees consistent demand through the establishment of long-term supply agreements with its core clientele. These crucial contracts ensure a predictable offtake for Itafos's fertilizer products, simultaneously providing customers with reliable access to vital agricultural inputs and shielding them from market price fluctuations.

Itafos prioritizes responsive customer service to address inquiries, manage orders, and resolve issues swiftly. This commitment is crucial for building trust and ensuring a positive client experience, fostering loyalty within its customer base.

Market Information and Outlook Sharing

Itafos actively shares market outlooks and insights with its customers, focusing on critical areas like phosphate pricing and crop fundamentals. This transparency empowers clients to make well-informed purchasing decisions and effectively plan their agricultural operations.

The company integrates these market outlooks directly into its financial reports, providing a tangible source of shared knowledge. For instance, Itafos's 2024 first-quarter report highlighted a positive outlook for phosphate demand, driven by recovering agricultural economics in key markets.

- Phosphate Market Insights: Itafos communicates trends and projections in phosphate pricing and availability.

- Crop Fundamentals: Information on crop planting, yields, and global demand is shared to contextualize fertilizer needs.

- Informed Decision-Making: This proactive sharing helps customers align their purchasing strategies with market realities.

- Financial Report Integration: Market outlooks are a standard component of Itafos's public financial disclosures, ensuring accessibility.

Feedback Mechanisms for Product Improvement

Itafos actively seeks customer feedback through multiple avenues to drive product enhancement. This includes direct engagement with farmers during product trials and post-application assessments, as well as utilizing feedback forms and surveys distributed via sales representatives and digital platforms. For instance, in 2024, Itafos saw a 15% increase in direct farmer feedback submissions compared to the previous year, indicating a growing trust in their channels.

The insights gathered are critical for refining existing fertilizer formulations and identifying opportunities for new product development. By understanding specific crop responses, soil conditions, and farmer challenges, Itafos can tailor its offerings to maximize agricultural yields and sustainability. This focus on customer-driven innovation is a cornerstone of their strategy.

- Direct Farmer Feedback: 2024 saw a 15% rise in direct farmer submissions.

- Product Trial Assessments: Continuous evaluation of fertilizer performance in real-world conditions.

- Survey Data: Utilizing surveys to gather structured feedback on ease of use and efficacy.

- Iterative Development: Incorporating feedback to refine current products and innovate new solutions.

Itafos fosters strong customer relationships through direct engagement, offering tailored solutions and expert technical support to agricultural clients. These relationships are solidified by long-term supply agreements, ensuring reliable access to essential fertilizers and price stability for customers. The company's commitment to responsive service and transparent market insights further builds trust and loyalty.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Direct Sales & Consultation | Personalized engagement with key agricultural clients. | Crucial for securing major producer contracts. |

| Technical Support | Expert advice on fertilizer application and nutrient management. | 15% increase in customer satisfaction noted in H1 2024. |

| Long-Term Agreements | Securing predictable demand and customer access to inputs. | Ensures consistent offtake and shields clients from price volatility. |

| Customer Feedback | Gathering insights for product enhancement and innovation. | 15% increase in direct farmer feedback submissions in 2024. |

Channels

Itafos leverages its dedicated direct sales force to cultivate strong relationships with significant clients, such as large agricultural enterprises and industrial consumers, with a primary focus on North and South America. This direct engagement facilitates personalized negotiations and the delivery of in-depth product knowledge and technical assistance, precisely matching customer needs.

In 2024, Itafos's direct sales approach was instrumental in securing key contracts, reflecting the value placed on specialized support and direct communication by major buyers in the fertilizer market. This strategy allows for a deeper understanding of market dynamics and customer feedback, directly informing product development and service enhancements.

Itafos leverages a robust network of agricultural distributors and retailers to ensure its phosphate and specialty fertilizers reach a broad customer base. This indirect channel is vital for achieving extensive market penetration, especially among smaller and mid-sized farming operations. These partners' established regional presence and direct relationships with farmers are key to making Itafos' products widely accessible.

Itafos's logistics and supply chain network is a crucial channel, ensuring products reach customers efficiently. This involves managing the movement and storage of fertilizers from their production sites to various distribution points and end-users, a process vital for timely delivery and product availability.

In 2024, Itafos continued to optimize its supply chain, leveraging strategic partnerships for transportation and warehousing. The company's focus on inventory management aims to minimize holding costs while ensuring sufficient stock to meet market demand, particularly during peak agricultural seasons.

Company Website and Investor Relations

Itafos' corporate website acts as a crucial communication channel, offering detailed information on its fertilizer products, operational updates, and financial performance. This digital presence is fundamental for investor relations, providing easy access to annual reports, press releases, and other vital corporate disclosures. For instance, as of early 2024, the website would be a primary source for investors seeking Itafos' latest financial statements and strategic outlook.

The website's role extends beyond mere information dissemination; it builds trust and credibility, indirectly supporting sales by showcasing the company's transparency and commitment to stakeholders. It allows potential partners and customers to thoroughly research Itafos' capabilities and market position. In 2023, Itafos reported significant progress in its sustainability initiatives, details of which would be prominently featured on its corporate site.

- Primary Information Hub: Provides comprehensive details on Itafos' fertilizer products and operations.

- Investor Relations Gateway: Offers access to financial reports, news, and corporate governance information.

- Credibility and Transparency Builder: Enhances trust by showcasing company performance and commitments.

- Sales Support: Indirectly aids sales by establishing a strong, transparent corporate image.

Industry Conferences and Trade Shows

Industry conferences and trade shows are vital channels for Itafos to directly engage with the agricultural sector. These events allow the company to highlight its fertilizer products, foster relationships with current and prospective clients, and gain insights into evolving market demands and technological advancements. Itafos's presence at such gatherings facilitates crucial networking opportunities and direct customer interaction.

For instance, Itafos participated in the Sidoti Small Cap Conference in June 2025, demonstrating its commitment to visibility within the investment community and the broader agricultural industry. Such participation is key for brand building and understanding competitive landscapes.

- Showcasing Products: Direct interaction at trade shows allows Itafos to display the quality and benefits of its fertilizers.

- Customer Engagement: Conferences provide a platform for Itafos to meet customers, gather feedback, and strengthen relationships.

- Market Intelligence: Attending these events helps Itafos stay informed about new technologies, competitor activities, and emerging agricultural trends.

- Networking: These events are critical for building connections with industry stakeholders, potential partners, and investors.

Itafos utilizes a direct sales force for large agricultural and industrial clients in the Americas, fostering strong relationships through personalized service and technical support. This direct approach was key in 2024 for securing major contracts, highlighting the value of tailored communication in the fertilizer market.

A wide network of distributors and retailers ensures Itafos's phosphate and specialty fertilizers reach smaller and mid-sized farms, leveraging established regional presences for broad market penetration. The company's logistics and supply chain are optimized through strategic partnerships to guarantee efficient and timely product delivery to all customer segments.

Itafos's corporate website serves as a vital information hub for products, operations, and investor relations, providing access to financial reports and strategic updates, crucial for stakeholders seeking transparency. Industry conferences and trade shows offer direct engagement with the agricultural sector, enabling product showcasing, relationship building, and market intelligence gathering.

Customer Segments

Large-scale commercial farms represent a crucial customer segment for Itafos, demanding significant volumes of phosphate and specialty fertilizers to support their extensive operations. These operations, often spanning thousands of acres, rely on advanced nutrient management strategies and prioritize suppliers who can guarantee consistent, high-quality product delivery. In 2024, the global demand for fertilizers remained robust, driven by the need to enhance crop yields to feed a growing population, with large commercial farms being primary consumers.

Itafos's agricultural cooperatives and associations are crucial partners, acting as aggregators for a vast network of smaller and medium-sized farmers. These organizations leverage bulk purchasing power, which allows them to secure favorable terms for inputs like fertilizers. In 2024, the global fertilizer market saw significant demand, with companies like Yara International reporting strong sales volumes, underscoring the importance of these cooperative structures in accessing and distributing essential agricultural products efficiently to a wide grower base.

Fertilizer blenders and manufacturers are a crucial customer segment for Itafos, acquiring raw or intermediate phosphate products. These companies utilize Itafos's offerings, such as phosphoric acid, to create specialized fertilizer blends tailored to specific agricultural needs. For instance, in 2024, the global fertilizer market saw continued demand, with phosphate fertilizers playing a vital role in crop yields.

Specialty Crop Growers

Specialty crop growers, a key customer segment for Itafos, often require highly specific fertilizer formulations. These growers focus on high-value crops and understand the critical role of precise nutrient management in maximizing yield and quality. For instance, growers of berries or niche vegetables might need fertilizers enriched with specific micronutrients like boron or zinc, which are essential for fruit development and disease resistance in these particular crops.

Itafos positions itself as a provider of these tailored solutions. The company's ability to offer customized product blends directly addresses the needs of this segment. This customization is not just about basic NPK ratios; it extends to incorporating trace elements and specific chemical forms of nutrients that are readily absorbed by specialty crops. In 2024, Itafos continued to invest in its granulation and blending capabilities to better serve these precise demands.

The value proposition for specialty crop growers centers on optimized growth and enhanced yield for their high-value produce. They are willing to invest in premium fertilizer products that demonstrate a clear return on investment through improved crop performance. This segment prioritizes:

- Customized fertilizer formulations to meet specific crop needs.

- Micronutrient-enhanced products for high-value crops.

- Solutions that optimize yield and quality, leading to higher profitability.

- Reliable supply of specialized nutrient inputs.

International Agricultural Markets (North and South America)

Itafos focuses its agricultural market reach across North and South America, catering to a wide array of farmers and agribusinesses. This extensive geographic scope is supported by Itafos' established regional operations and deep understanding of diverse local farming practices and needs.

The company's customer base within these regions includes large-scale commercial farms, cooperatives, and agricultural input distributors. For instance, in 2024, Itafos' fertilizer sales in North America were a significant contributor to its revenue, reflecting strong demand from the U.S. and Canadian agricultural sectors.

- Geographic Focus: North and South America

- Customer Types: Farmers, agricultural businesses, cooperatives, input distributors

- Key Market Drivers: Regional operational presence, understanding of local agricultural conditions

- 2024 Performance Indicator: Strong fertilizer sales in North America

Itafos serves a diverse range of agricultural customers, from large commercial operations requiring bulk phosphate and specialty fertilizers to smaller growers needing customized nutrient blends. The company also partners with agricultural cooperatives and fertilizer blenders, acting as a key supplier of essential inputs. This broad customer base highlights Itafos's ability to cater to varied demands within the agricultural sector.

In 2024, Itafos's market presence in North and South America was a key strength, with significant fertilizer sales in North America underscoring the demand from U.S. and Canadian farmers. The company's focus on understanding local agricultural practices allows it to effectively serve its customer segments across these regions.

| Customer Segment | Needs | Itafos's Offering | 2024 Relevance |

|---|---|---|---|

| Large-scale Commercial Farms | High-volume, consistent, high-quality phosphate and specialty fertilizers | Bulk supply, advanced nutrient management solutions | Robust global demand for fertilizers to enhance crop yields |

| Agricultural Cooperatives | Aggregated purchasing power for fertilizers | Efficient distribution to a wide grower base | Importance of cooperatives in accessing and distributing agricultural products |

| Fertilizer Blenders/Manufacturers | Phosphoric acid and intermediate phosphate products | Raw materials for specialized fertilizer blends | Continued demand for phosphate fertilizers in global markets |

| Specialty Crop Growers | Customized, micronutrient-enhanced fertilizer formulations | Tailored solutions for high-value crops, optimizing yield and quality | Investment in granulation and blending capabilities to meet precise demands |

Cost Structure

Itafos' cost structure heavily relies on raw materials, with phosphate rock and sulfur being the primary drivers. For instance, in the first quarter of 2025, the company noted that sulfur costs significantly compressed its margins, highlighting the direct impact of commodity price volatility on production expenses.

Itafos' production and processing costs are a major component of its business model, covering everything from energy to keep the plants running to paying the people who operate them. Think of the electricity needed for large-scale fertilizer production and the wages for skilled workers on the factory floor. Maintenance is also a big one; for example, Itafos reported significant costs related to a large-scale turnaround maintenance project at its Conda facility in 2023, which is crucial for long-term operational efficiency and safety.

Optimizing how efficiently these facilities operate is key to managing these expenses. For instance, Itafos has been focused on improving energy efficiency and streamlining processes to reduce the per-unit cost of production. This focus is critical, especially given that commodity prices and operational uptime directly impact profitability. In 2024, Itafos continued to emphasize operational excellence to mitigate these inherent production costs.

Itafos's cost structure is significantly impacted by logistics and transportation, a direct result of its operational footprint across North and South America. These expenses encompass freight charges for both inbound raw materials and outbound finished goods, alongside costs associated with warehousing and maintaining inventory levels.

For instance, in 2024, the company's extensive distribution network likely meant that a notable portion of its operating expenses was allocated to moving its phosphate and nitrogen products. Efficient route optimization and strategic partnerships with transportation providers are therefore critical levers for managing and reducing these substantial costs.

Capital Expenditures (CAPEX)

Itafos's cost structure is heavily influenced by capital expenditures (CAPEX), particularly for mine development and plant improvements. These investments are vital for extending the operational life of their mines and boosting production capabilities, ensuring the company's long-term viability and expansion. For fiscal year 2024, Itafos reported total CAPEX of $71.2 million.

- Mine Development: Significant investment in projects like H1/NDR.

- Plant Upgrades: Enhancements to extend mine life and increase production.

- FY 2024 CAPEX: Totaled $71.2 million.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses for Itafos encompass a range of operational costs beyond direct production. These include expenditures for sales and marketing initiatives, the salaries of administrative staff, and broader corporate overhead. Effective control over these costs is crucial for maintaining strong profitability.

In 2024, Itafos's SG&A expenses reflect investments in market reach and corporate infrastructure. For instance, costs associated with investor relations and ensuring robust corporate governance are vital components of this category, contributing to transparency and stakeholder confidence.

- Sales and Marketing: Costs incurred to promote and sell Itafos's products.

- General and Administrative: Includes executive salaries, legal fees, and accounting.

- Corporate Overhead: Expenses related to maintaining the corporate headquarters and overall business operations.

- Investor Relations & Governance: Costs associated with shareholder communication and compliance.

Itafos' cost structure is dominated by raw material inputs like phosphate rock and sulfur, with commodity price fluctuations directly impacting profitability. Production and processing expenses, including energy and labor for its facilities, are significant, as demonstrated by the substantial maintenance costs incurred at the Conda facility in 2023. Logistics and transportation are also major cost drivers due to the company's geographically dispersed operations across North and South America.

| Cost Category | Key Components | FY 2024 Impact |

| Raw Materials | Phosphate Rock, Sulfur | Significant margin compression noted in Q1 2025 due to sulfur costs. |

| Production & Processing | Energy, Labor, Maintenance | Major turnaround maintenance at Conda in 2023. Emphasis on operational excellence in 2024. |

| Logistics & Transportation | Freight, Warehousing, Inventory | Extensive distribution network across Americas in 2024. |

| Capital Expenditures (CAPEX) | Mine Development, Plant Upgrades | Total CAPEX of $71.2 million in FY 2024. |

| SG&A | Sales, Marketing, Admin Salaries, Corporate Overhead | Investments in market reach and corporate infrastructure in 2024. |

Revenue Streams

The core of Itafos's revenue generation lies in the sale of Monoammonium Phosphate (MAP) and its enhanced version, MAP+. These are essential phosphate fertilizers crucial for crop nutrition and are a major contributor to the company's financial performance.

Demand from the global agricultural sector directly fuels these sales. In 2024, Itafos saw average realized prices for MAP reach $696 per ton, highlighting the market value of this key product.

Itafos generates revenue through the sale of Single Superphosphate (SSP) and SSP enhanced with micronutrients, marketed as SSP+. This diversification is particularly evident at its Arraias facility in Brazil, where these products meet specific local agricultural needs.

These specialized fertilizer offerings allow Itafos to tap into niche markets and cater to diverse farming practices, thereby broadening its revenue base beyond primary phosphate products. For instance, in 2024, Itafos continued to focus on optimizing its Arraias operations to serve these regional demands effectively.

Itafos's revenue is significantly driven by the sales of essential industrial chemicals, namely sulfuric acid and phosphoric acid. This includes products like Superphosphoric Acid (SPA) and Merchant Grade Phosphoric Acid (MGA), with a portion of these sales directed to outside customers.

In 2024, Itafos saw a notable surge in sulfuric acid production at its Arraias facility, with a 26.6% increase, directly reflecting heightened market demand for this crucial chemical input.

Income from Strategic Asset Sales

Itafos strategically generates income through the divestiture of non-core assets, a key component of its business model. This approach provides significant, albeit non-recurring, cash inflows. For instance, the sale of its Araxá project exemplifies this revenue stream, bolstering the company's financial flexibility.

This strategic asset sales revenue is crucial for Itafos's financial health. The substantial cash injections resulting from these sales can be strategically allocated. Funds are often directed towards reducing outstanding debt, facilitating capital returns to shareholders, or reinvesting in the company's core operational businesses.

The financial impact of these sales is tangible. In the first quarter of 2025, Itafos reported a gain of $27.9 million specifically from the sale of its Araxá project. This demonstrates the significant financial contributions that strategic asset divestitures can make to the company's bottom line.

- Strategic Asset Sales: Income derived from selling non-core assets, such as the Araxá project.

- Financial Flexibility: Provides substantial cash injections for debt reduction, shareholder returns, or core business investment.

- Q1 2025 Impact: Generated a gain of $27.9 million from the Araxá project sale.

Other Specialty Chemical Sales (e.g., HFSA)

Itafos diversifies its income by selling specialty chemicals like Hydrofluorosilicic Acid (HFSA). This acid is a valuable byproduct that arises naturally during Itafos's phosphate rock processing operations.

These specialty chemical sales represent an important secondary revenue source for Itafos, showcasing their capability to extract value from multiple stages of their core business. For instance, in 2024, Itafos reported significant sales of its specialty products, contributing to overall financial performance.

- HFSA Sales: Itafos actively markets HFSA to various industrial sectors.

- Byproduct Monetization: This stream highlights efficient resource utilization.

- 2024 Performance: Specialty chemical sales in 2024 added a notable percentage to Itafos's total revenue.

Itafos's revenue streams are primarily anchored in the sale of phosphate fertilizers, specifically Monoammonium Phosphate (MAP) and its enhanced variants like MAP+. These products are vital for global agriculture, with 2024 seeing average realized MAP prices at $696 per ton.

Further diversification comes from Single Superphosphate (SSP) and its enriched forms, SSP+, catering to specific regional agricultural needs, as seen with operations at the Arraias facility in Brazil.

The company also generates income from industrial chemicals such as sulfuric acid and phosphoric acid, including Merchant Grade Phosphoric Acid (MGA), with a portion of these sales going to external customers. Sulfuric acid production at Arraias saw a 26.6% increase in 2024 due to strong market demand.

Itafos monetizes byproducts like Hydrofluorosilicic Acid (HFSA), a valuable secondary revenue source derived from phosphate rock processing, with significant sales reported in 2024.

| Revenue Stream | Key Products | 2024 Highlight |

|---|---|---|

| Phosphate Fertilizers | MAP, MAP+ | Average realized MAP price: $696/ton |

| Specialty Fertilizers | SSP, SSP+ | Focus on Arraias facility operations |

| Industrial Chemicals | Sulfuric Acid, Phosphoric Acid (MGA, SPA) | 26.6% increase in sulfuric acid production at Arraias |

| Specialty Chemicals | HFSA | Significant specialty product sales |

Business Model Canvas Data Sources

The Itafos Business Model Canvas is informed by a blend of internal financial statements, operational data, and market intelligence reports. These sources provide a comprehensive view of the company's current performance and strategic positioning.