Itafos Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

Discover how Itafos leverages its product portfolio, pricing strategies, distribution channels, and promotional efforts to capture market share in the fertilizer industry. This analysis goes beyond surface-level observations to reveal the strategic thinking behind their success.

Unlock the complete Itafos 4Ps Marketing Mix Analysis to gain actionable insights into their competitive positioning, pricing architecture, channel strategy, and communication mix. This ready-to-use, editable report is perfect for business professionals, students, and consultants seeking strategic depth.

Product

Itafos's core product offering centers on essential phosphate-based fertilizers, vital for modern agriculture. These include Monoammonium Phosphate (MAP) and Superphosphoric Acid (SPA), produced at their Conda facility in the United States. These products are fundamental building blocks for effective crop nutrition, supporting global food production.

Itafos's specialty fertilizer solutions, like Direct Application Phosphate Rock (DAPR) and Partially Acidulated Phosphate Rock (PAPR) from its Arraias operation in Brazil, are key differentiators. These products are designed for advanced agricultural techniques such as precision agriculture, offering farmers more targeted nutrient delivery.

This focus on specialty products allows Itafos to capture higher margins compared to commodity fertilizers. For instance, the global specialty fertilizer market was projected to reach approximately $25.7 billion in 2024, with a compound annual growth rate (CAGR) of around 6.5% expected through 2030, highlighting the demand for these value-added solutions.

Sulfuric acid is a critical input for Itafos's fertilizer production at both its Conda and Arraias facilities, underpinning its integrated operational model. This internal production capability not only guarantees a consistent supply of a vital raw material but also opens avenues for external sales, thereby boosting revenue streams.

In 2024, Itafos's sulfuric acid segment is projected to be a significant contributor to its financial performance, with internal consumption for fertilizer production being a primary driver. The company's strategic advantage lies in its control over this essential component, mitigating supply chain risks and optimizing production costs.

New Granulated s Development

Itafos is strategically expanding its product offerings with new granulated fertilizer developments, exemplified by the planned 2025 launch of SuperForte Gran from its Arraias facility in Brazil. This move diversifies Itafos's portfolio, directly addressing specific needs within local markets.

The introduction of SuperForte Gran is designed to capitalize on market demand for granulated dry fertilizers, a segment showing consistent growth. For instance, the global fertilizer market was valued at approximately $250 billion in 2023 and is projected to reach over $300 billion by 2028, with granulated products representing a significant portion of this growth.

- Product Innovation: Launch of SuperForte Gran in 2025 from the Arraias facility.

- Market Focus: Tailored to meet specific local market demands in Brazil.

- Profitability: Potential for increased profit margins through specialized product offerings.

- Portfolio Expansion: Diversifies Itafos's product range in the growing fertilizer sector.

Mine Life Extension and Resource Development

Itafos' Mine Life Extension and Resource Development is a crucial element of its marketing mix, ensuring the long-term viability of its fertilizer production. The Husky 1 / North Dry Ridge (H1/NDR) project, a prime example, is designed to extend the operational life of the Conda plant. This initiative focuses on accessing previously undeveloped ore bodies, thereby securing a consistent and reliable source of raw materials for the foreseeable future.

This strategic investment directly supports product availability and sustainability. By unlocking new reserves, Itafos mitigates the risk of supply disruptions and reinforces its commitment to meeting future market demand for fertilizers. The H1/NDR project, in particular, is a significant undertaking aimed at bolstering the Conda facility's resource base.

- Project Focus: Husky 1 / North Dry Ridge (H1/NDR) to support the Conda plant.

- Objective: Unlock untapped reserves and ensure stable raw material supply.

- Strategic Importance: Guarantees long-term product availability and sustainability for fertilizer production.

Itafos's product strategy is built on a foundation of essential phosphate fertilizers like MAP and SPA, complemented by higher-margin specialty products such as DAPR and PAPR. The company is also innovating with granulated fertilizers, with SuperForte Gran set for a 2025 launch in Brazil, targeting specific market needs and enhancing its portfolio's profitability.

The company's commitment to long-term product availability is underscored by its mine life extension projects, like H1/NDR for the Conda plant, ensuring access to critical raw materials. This strategic focus on securing resources supports consistent supply and reinforces Itafos's position in the market.

| Product Category | Key Products | Production Facility | Market Focus | 2025 Outlook/Initiative |

|---|---|---|---|---|

| Essential Fertilizers | MAP, SPA | Conda, USA | Global Agriculture | Continued core production |

| Specialty Fertilizers | DAPR, PAPR | Arraias, Brazil | Precision Agriculture | Higher margin contribution |

| Granulated Fertilizers | SuperForte Gran (New) | Arraias, Brazil | Brazilian Market | Planned 2025 Launch |

| Input Material | Sulfuric Acid | Conda, Arraias | Internal Consumption & External Sales | Key revenue driver |

What is included in the product

This analysis provides a comprehensive examination of Itafos's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and operational tactics.

Simplifies complex marketing strategies into actionable insights for Itafos, alleviating the pain of strategic uncertainty.

Provides a clear, concise framework for Itafos' marketing efforts, reducing confusion and streamlining execution.

Place

Itafos's marketing strategy heavily emphasizes the North American market, a crucial area for its business. This focus is directly supported by its operational base at the Conda facility in Idaho, USA.

This strategic positioning allows Itafos to efficiently supply essential agricultural nutrients directly to a significant farming region. In 2024, the North American phosphate market was valued at approximately $15 billion, highlighting the importance of this region for companies like Itafos.

Itafos's South American strategy is anchored by its Arraias facility in Tocantins, Brazil, a key operational hub. This strategic location allows Itafos to effectively serve the burgeoning agricultural sector in Brazil, a continent with substantial demand for enhanced crop nutrition. The company's dual-continental approach, encompassing both North and South America, is designed to maximize market penetration and adapt to varied regional agricultural practices and demands.

Itafos's vertically integrated model is a key strength, encompassing everything from phosphate rock extraction to the final fertilizer product. This end-to-end control significantly optimizes their supply chain, ensuring greater efficiency and reliability in delivering products to customers. For instance, in Q1 2024, Itafos reported that its integrated operations contributed to a 10% reduction in logistics costs compared to the previous year.

This deep integration allows Itafos to maintain stringent quality control throughout the production process, from the mine to the market. It also provides them with a competitive edge by enabling better cost management and responsiveness to market demands. By managing the entire value chain, Itafos can more effectively navigate potential disruptions and ensure consistent product availability for its key agricultural markets.

Direct Sales and Offtake Agreements

Itafos's distribution strategy heavily leans on direct sales to major agricultural clients and securing offtake agreements. This approach streamlines product delivery and guarantees a steady supply chain for crucial purchasers.

A significant example is the monoammonium phosphate (MAP) offtake agreement, which underscores Itafos's commitment to predictable sales and buyer relationships. These direct channels are vital for market penetration.

- Direct Sales: Targeting large agricultural enterprises for bulk purchases.

- Offtake Agreements: Securing long-term contracts for consistent revenue.

- MAP Offtake: A key example of strategic supply chain commitment.

- Efficiency: Direct channels reduce logistical complexities and costs.

Strategic Logistics and Inventory Management

Itafos's distribution strategy hinges on meticulous inventory management to align with market demand. For instance, during 2024, low inventory levels in North America were noted as a significant factor influencing market dynamics, highlighting the direct impact of stock availability on sales potential.

Effective logistics are crucial for ensuring Itafos's products reach their destinations efficiently. This operational strength allows the company to capitalize on sales opportunities by having products available precisely when and where customers need them, thereby maximizing market penetration.

- Inventory Optimization: Itafos actively manages stock levels to prevent shortages and overstocking.

- North American Market Impact: Low inventory in North America during 2024 demonstrably affected market dynamics and sales.

- Demand Fulfillment: Efficient logistics ensure timely product availability, directly supporting sales targets.

- Supply Chain Agility: The ability to respond to demand fluctuations through smart inventory and logistics is a key competitive advantage.

Place, as a core element of Itafos's marketing mix, is defined by its strategic operational locations and efficient distribution channels. The company's presence in both North and South America, specifically at the Conda facility in Idaho, USA, and the Arraias facility in Brazil, allows for targeted market access. These strategically chosen sites facilitate direct supply to key agricultural regions, capitalizing on the substantial demand in these markets.

Itafos's distribution strategy is built on direct sales and offtake agreements, minimizing intermediaries and ensuring product availability. This approach is crucial for reaching major agricultural clients efficiently. The company's focus on inventory management and logistics further strengthens its ability to meet market demand, as demonstrated by the impact of low inventory levels in North America during 2024.

The North American phosphate market, valued at approximately $15 billion in 2024, represents a significant area of focus for Itafos. Its operations in Idaho are well-positioned to serve this lucrative market. Similarly, Brazil's growing agricultural sector presents a substantial opportunity, with Itafos's Arraias facility enabling effective penetration.

Itafos's vertically integrated model enhances its place strategy by ensuring supply chain control and cost efficiency. This end-to-end integration, from mining to product delivery, provides a competitive advantage in product availability and market responsiveness. In Q1 2024, this integration led to a 10% reduction in logistics costs.

| Operational Hub | Primary Market Focus | Key Advantage | 2024 Market Context |

|---|---|---|---|

| Conda, Idaho, USA | North America | Proximity to major agricultural regions, efficient supply | North American phosphate market valued at ~$15 billion |

| Arraias, Tocantins, Brazil | South America (Brazil) | Access to burgeoning agricultural sector, high demand for crop nutrition | Brazil's significant agricultural output and demand |

| Vertical Integration | Global Supply Chain | Optimized logistics, cost reduction, enhanced reliability | Q1 2024 logistics cost reduction of 10% |

| Direct Sales & Offtake Agreements | Key Agricultural Clients | Streamlined delivery, guaranteed supply chain, predictable revenue | MAP offtake agreements crucial for sales commitment |

Same Document Delivered

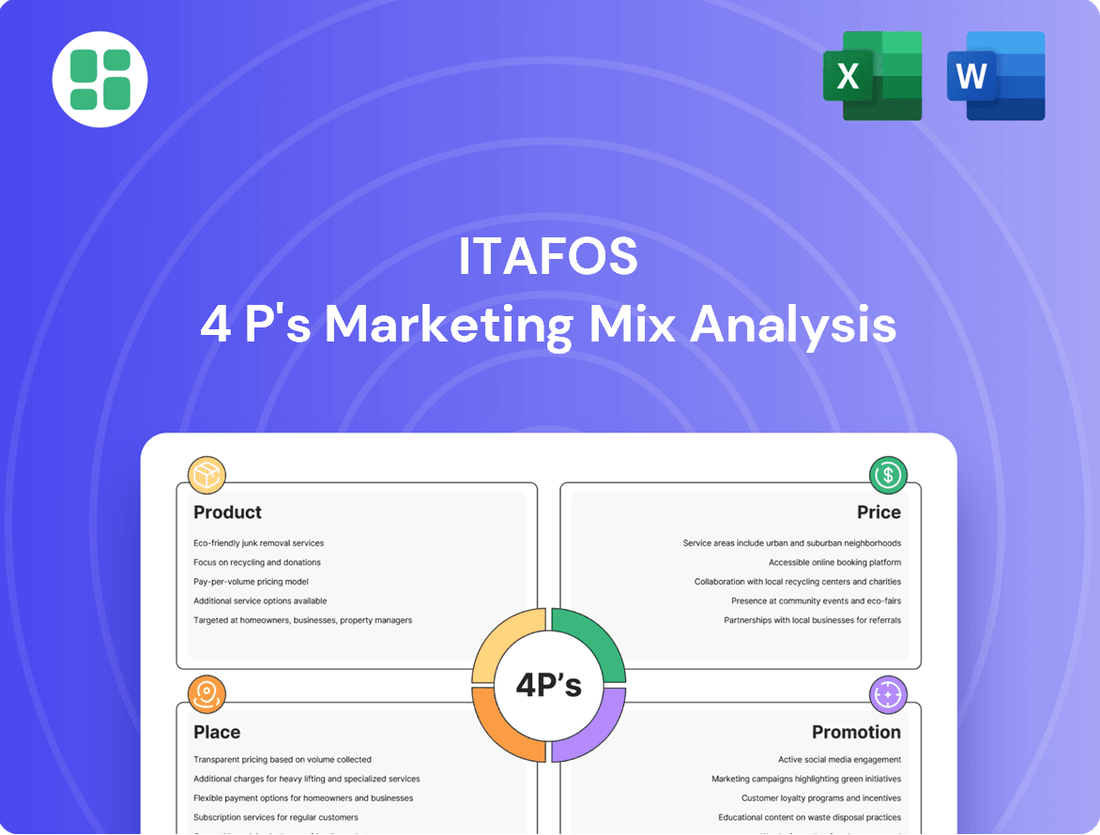

Itafos 4P's Marketing Mix Analysis

The preview shown here is the actual Itafos 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown of Itafos's marketing strategy is ready for your immediate use.

Promotion

Itafos prioritizes robust investor relations and transparent financial reporting to effectively communicate its operational performance and strategic vision. This includes timely dissemination of quarterly and annual financial results, often accompanied by investor presentations that offer deeper insights into the company's progress and future plans.

For instance, Itafos's financial reporting in 2024 and early 2025 would detail key performance indicators such as production volumes, cost of goods sold, and EBITDA, providing the financial community with the data needed for valuation and investment decisions.

These efforts aim to foster trust and maintain strong engagement with shareholders and the broader investment community, ensuring they are well-informed about Itafos's trajectory and value proposition.

Itafos's corporate website, itafos.com, is a crucial element of its digital communication strategy, acting as a central repository for all official company information. This platform provides stakeholders with easy access to investor presentations, critical corporate news, and in-depth details regarding its various business segments and ongoing projects.

The website ensures broad accessibility, allowing individual investors, financial professionals, and business strategists to quickly obtain the latest updates. For instance, as of the first quarter of 2024, Itafos reported a significant increase in website traffic, indicating heightened stakeholder interest in their phosphate and fertilizer operations.

Itafos leverages industry conferences, like the Sidoti Small-Cap Conference, as a crucial element of its promotional strategy. These events are vital for directly connecting with institutional investors and financial analysts, offering a prime opportunity to communicate the company's strategic direction and operational progress.

By presenting at these gatherings, Itafos aims to bolster its market visibility and articulate its core investment narrative. This direct engagement allows for the transparent sharing of key operational updates and financial performance metrics, fostering investor confidence.

In 2024, participation in such conferences is particularly important as Itafos continues to advance its projects, providing a platform to showcase tangible achievements and future growth potential to a targeted audience of capital allocators.

ESG Reporting and Sustainability Messaging

Itafos utilizes its Environmental, Social, and Governance (ESG) reporting as a core element of its marketing mix, specifically within the promotion strategy. This approach underscores the company's dedication to sustainable operations and maintaining high standards of safety. By transparently communicating its ESG performance, Itafos aims to resonate with a growing segment of investors prioritizing sustainability in their portfolios.

This strategic messaging serves a dual purpose: it fulfills the company's commitment to corporate responsibility while simultaneously attracting capital from ESG-conscious investors. For instance, Itafos's 2023 ESG report detailed a 15% reduction in water intensity compared to 2022, a key metric for environmental stewardship. This focus on tangible environmental improvements is crucial for building trust and demonstrating a forward-thinking business model.

- ESG Reporting as a Promotional Tool: Itafos leverages its ESG reports to communicate its commitment to sustainability and operational safety, directly appealing to environmentally and socially conscious investors.

- Attracting ESG-Focused Investors: The company's transparent communication of ESG initiatives and performance data aims to capture the interest of a rapidly expanding investor base prioritizing sustainable investments.

- Tangible Sustainability Metrics: Itafos highlights specific achievements, such as a reported 15% reduction in water intensity in 2023, to provide concrete evidence of its sustainability efforts and operational excellence.

News Releases and Media Outreach

Itafos leverages news releases, often distributed via wire services like GlobeNewswire, as a cornerstone of its communication strategy. This approach ensures timely dissemination of crucial information such as operational advancements and financial performance to a wide array of stakeholders, including the media and the general public.

These releases are vital for maintaining transparency and building investor confidence. For instance, Itafos's Q1 2024 financial results, released in May 2024, detailed significant progress in their mining operations, providing concrete data points for market analysis.

- Operational Updates: Regular announcements on production levels and project milestones.

- Financial Reporting: Dissemination of quarterly and annual financial results, such as the reported revenue of USD 112.5 million for Q1 2024.

- Corporate Developments: Information on strategic partnerships or significant business events.

- Market Reach: Utilizing wire services to ensure broad distribution to financial media and investors.

Itafos actively engages with the financial community through participation in industry conferences and direct investor outreach. This proactive approach ensures key stakeholders are consistently informed about the company's strategic initiatives and operational achievements. For example, Itafos's presentation at the 2024 BMO Global Mining & Critical Materials Conference highlighted their progress in expanding production capacity.

The company's promotional efforts are further amplified by its commitment to transparent ESG reporting, which resonates with an increasing number of investors prioritizing sustainability. By showcasing tangible improvements, such as their 2023 report detailing a 15% reduction in water intensity, Itafos builds trust and attracts capital from this growing investor segment.

Furthermore, Itafos utilizes its corporate website as a central hub for information, ensuring easy access to financial reports, investor presentations, and news releases for all stakeholders. This digital presence, combined with timely announcements via wire services like GlobeNewswire, reinforces their commitment to open communication and market awareness.

| Communication Channel | Key Information Disseminated | Impact/Purpose | Example (2024/2025) |

|---|---|---|---|

| Investor Relations & Financial Reporting | Quarterly/Annual Results, KPIs (Production, Costs, EBITDA) | Valuation, Investment Decisions, Transparency | Q1 2024 results detailing production volumes and revenue of USD 112.5 million. |

| Corporate Website (itafos.com) | Investor Presentations, News, Segment Details | Accessibility, Stakeholder Information | Increased website traffic noted in Q1 2024, indicating heightened interest. |

| Industry Conferences (e.g., Sidoti, BMO) | Strategic Direction, Operational Progress, Growth Potential | Market Visibility, Direct Investor Engagement | Presentation at 2024 BMO Global Mining & Critical Materials Conference on capacity expansion. |

| ESG Reporting | Sustainability Efforts, Safety Standards, Environmental Metrics | Attracting ESG-Conscious Investors, Corporate Responsibility | 2023 ESG report showing a 15% reduction in water intensity from 2022. |

| News Releases (e.g., GlobeNewswire) | Operational Advancements, Financial Performance, Corporate Developments | Timely Dissemination, Market Awareness, Investor Confidence | May 2024 release of Q1 2024 financial results with operational progress updates. |

Price

Itafos's phosphate fertilizer pricing is intrinsically linked to the ebb and flow of global and regional market forces, particularly the interplay of supply and demand for key products such as monoammonium phosphate (MAP) and diammonium phosphate (DAP). These external market conditions directly shape the prices Itafos can realize for its offerings.

The company's realized prices have demonstrated a clear sensitivity to these market dynamics, directly impacting its revenue streams. For instance, during periods of robust agricultural demand and tighter supply, Itafos has seen upward price pressure, while oversupply or weaker demand can lead to price erosion.

As of the latest available data, global phosphate prices have experienced volatility. For example, benchmark prices for DAP in late 2024 have hovered around $500-$550 per metric ton, reflecting a complex mix of input costs, geopolitical factors, and seasonal demand patterns, which Itafos navigates in its pricing strategy.

Global supply constraints, particularly export restrictions from China, are a significant tailwind for Itafos' pricing strategy. These limitations on global fertilizer supply, coupled with historically low inventory levels in crucial markets such as North America, naturally drive up prices. This environment directly benefits producers like Itafos, allowing them to capitalize on the upward price pressure.

The affordability of fertilizers is directly linked to the prices farmers receive for their grain and oilseed harvests. When crop prices are high, farmers have more disposable income, which can support higher fertilizer prices. For instance, in late 2024 and early 2025, robust global demand for corn and soybeans, driven by factors like increased biofuel production and favorable weather in key growing regions, has led to stronger farm gate prices, potentially improving farmers' capacity to invest in crucial inputs like Itafos's fertilizers.

Pricing from Offtake Contracts

The pricing strategy for Itafos is significantly shaped by its offtake contracts. These agreements, like the one with MAP, dictate the terms of sales and can influence how quickly the company benefits from rising market prices. This means even if spot prices for fertilizers surge, the actual revenue impact for Itafos might be staggered due to the contractual terms.

Contractual structures can create a lag between market price movements and their reflection in Itafos's financial performance. For instance, if a contract is based on a trailing average price, a recent spike in the spot market might not be fully captured in Itafos's revenue for several months. This delayed realization is a key consideration in understanding the company's revenue stream.

- Contractual Lag: Offtake agreements can delay the pass-through of market price increases to Itafos's revenue.

- MAP Contract Influence: Specific contracts, such as the one with MAP, are crucial in determining the timing of revenue recognition from price hikes.

- Spot vs. Contracted Pricing: While spot prices might show immediate gains, contracted prices often lead to a more predictable but potentially slower revenue adjustment.

- Revenue Predictability: Contractual pricing offers a degree of revenue predictability, but it can mute the immediate upside from favorable market conditions.

Cost Management and Margin Enhancement

Itafos's pricing strategy is deeply intertwined with its cost management and margin enhancement initiatives. The company actively seeks to boost operational efficiency, which directly impacts its cost of goods sold. For instance, in 2024, Itafos has been focusing on optimizing its production processes to reduce energy consumption and improve raw material utilization, aiming to lower per-unit production costs.

A key element of Itafos's approach is the strategic introduction of higher-margin specialty fertilizer products. This diversification allows the company to capture greater profitability by catering to specific agricultural needs and commanding premium prices. By aligning pricing with the perceived value of these specialized offerings, Itafos aims to maximize its overall profit margins.

The company's commitment to managing input costs is also crucial. Fluctuations in the prices of natural gas, a primary feedstock for fertilizer production, are closely monitored and hedged where possible. This proactive cost management helps Itafos maintain competitive pricing while safeguarding its profitability, especially in a volatile commodity market.

Key aspects of Itafos's cost management and margin enhancement include:

- Operational Efficiency Improvements: Initiatives in 2024 targeting reduced energy and material waste in production.

- Specialty Product Development: Launching higher-margin fertilizers to capture premium pricing opportunities.

- Input Cost Management: Strategies to mitigate the impact of fluctuating raw material prices, such as natural gas.

- Value-Based Pricing: Aligning product prices with the perceived benefits and performance for the end-user.

Itafos's pricing is a dynamic interplay of global market conditions and contractual obligations. While benchmark DAP prices were around $500-$550 per metric ton in late 2024, Itafos's realized prices are influenced by offtake agreements that can create a lag in reflecting spot market surges.

The company leverages global supply constraints, like Chinese export limitations, to its advantage, pushing prices upward. Furthermore, strong farm gate prices for crops like corn and soybeans in late 2024 and early 2025 bolster farmer purchasing power, supporting Itafos's pricing strategy.

Cost management, including optimizing production for energy efficiency and managing natural gas input costs, is central to maintaining competitive pricing and profitability. Itafos also strategically prices its higher-margin specialty fertilizers to capture premium value.

| Metric | Value (Late 2024/Early 2025) | Impact on Itafos Pricing |

|---|---|---|

| Global DAP Benchmark Price | $500 - $550 / metric ton | Sets a general market price level |

| Chinese Phosphate Exports | Limited | Creates supply tightness, supporting higher prices |

| North American Fertilizer Inventories | Historically Low | Increases demand for available supply |

| Corn/Soybean Farm Gate Prices | Strong | Enhances farmer affordability for fertilizers |

| Natural Gas Prices | Volatile | Key input cost influencing production cost and pricing |

4P's Marketing Mix Analysis Data Sources

Our Itafos 4P's analysis leverages a comprehensive blend of primary and secondary data. We meticulously review official company disclosures, investor relations materials, and product literature to understand Itafos's product offerings and strategic direction.