Isagro SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isagro Bundle

Isagro's innovative product pipeline and strong R&D capabilities present significant strengths, but the company also faces challenges in market penetration and regulatory hurdles. Understanding these dynamics is crucial for any investor or strategist looking to navigate the agricultural sector.

Want the full story behind Isagro's market position, potential risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning.

Strengths

Isagro, now integrated with Gowan Company, leverages a deep-rooted history in creating and owning intellectual property for specialized agrochemicals. This strength is particularly evident in their ongoing commitment to discovering and refining new molecules and advanced formulations, vital for staying ahead in the dynamic crop protection sector.

The synergy with Gowan has significantly amplified Isagro's scientific prowess, fostering a continuous pipeline of innovation. This enhanced R&D capability positions them to address emerging agricultural challenges and market demands effectively.

Isagro boasts a diverse product portfolio encompassing herbicides, fungicides, insecticides, and biostimulants, offering a comprehensive suite of solutions for the agricultural sector. This breadth of offerings mitigates the risk associated with over-reliance on any single product category, enabling the company to provide integrated crop protection strategies.

Gowan’s strategic acquisitions of key active ingredients in recent years have further bolstered Isagro's product range, enhancing its competitive position. For instance, the acquisition of certain active ingredients for fungicides and insecticides in late 2023 and early 2024 directly contributes to this strengthened portfolio.

Isagro's historical emphasis on sustainable agriculture and biorational products is a significant strength, particularly as global demand for eco-friendly farming intensifies. This strategic focus positions the business, now part of Gowan, to effectively leverage market trends driven by heightened environmental awareness and stricter regulations favoring greener agricultural inputs.

Established Manufacturing and Distribution Network

Isagro's established manufacturing and distribution network, particularly its integration within the Gowan group, provides a significant competitive advantage. With four manufacturing sites strategically located in Italy, the company ensures robust production capabilities. This Italian manufacturing base is complemented by Gowan's extensive global sales presence, reaching over 70 countries. This broad market access allows for efficient and widespread distribution of Isagro's agrochemical solutions, a critical factor in the agricultural sector.

The strength of this network is evident in its operational efficiency and market penetration. By leveraging Gowan's established infrastructure, Isagro can effectively manage its supply chain from production to end-user delivery. This integrated approach minimizes logistical complexities and enhances the speed at which products reach global markets. As of late 2024, Gowan's portfolio, which includes Isagro's offerings, continues to expand its footprint in key agricultural regions, underscoring the network's ongoing vitality and reach.

- Four manufacturing sites in Italy provide a solid production foundation.

- Sales in over 70 countries through the Gowan distribution network ensure broad market access.

- Robust supply chain management facilitates efficient global delivery of agrochemical products.

- Synergies within the Gowan group enhance operational efficiency and market reach for Isagro's portfolio.

Integration with a Global Agricultural Solutions Business

The integration of Isagro's former operations into Gowan Company, a significant global player in agricultural solutions, offers a substantial uplift in commercial reach. This strategic move, finalized with Gowan's acquisition, allows the combined entity to tap into a broader international market, significantly expanding sales potential beyond Isagro's previous boundaries.

This synergy translates into tangible benefits, particularly in research and development and market access. Gowan's established global network and resources can accelerate the commercialization of Isagro's innovative product pipeline, potentially leading to faster market penetration and increased revenue streams. For instance, Gowan's presence in key agricultural regions like North America and Europe can provide immediate access for Isagro's technologies.

- Expanded Global Footprint: Gowan Company operates in over 30 countries, providing Isagro's former portfolio with immediate access to new markets.

- Enhanced Commercial Opportunities: The acquisition unlocks cross-selling potential and broader distribution channels for Isagro's specialized crop protection products.

- Synergistic R&D: Integration allows for the pooling of research capabilities, potentially leading to the faster development and launch of new agricultural solutions.

Isagro's core strength lies in its robust intellectual property portfolio for specialized agrochemicals, a testament to its sustained investment in discovering and developing new molecules and advanced formulations. This deep scientific expertise, now amplified by its integration with Gowan Company, ensures a continuous pipeline of innovative solutions crucial for addressing evolving agricultural needs and regulatory landscapes.

The company's diverse product range, spanning herbicides, fungicides, insecticides, and biostimulants, offers comprehensive crop protection strategies and mitigates reliance on single product categories. Strategic acquisitions of key active ingredients by Gowan in late 2023 and early 2024 have further enriched this portfolio, bolstering Isagro's competitive edge.

Isagro's commitment to sustainable and biorational products aligns perfectly with increasing global demand for eco-friendly farming practices. This focus positions the company, under Gowan's umbrella, to capitalize on market trends driven by environmental consciousness and stricter regulations favoring greener agricultural inputs.

The combined manufacturing and distribution network, with Isagro's four Italian production sites and Gowan's sales presence in over 70 countries, provides significant operational efficiency and broad market access. This integrated infrastructure ensures effective supply chain management and rapid product delivery to key agricultural regions worldwide.

What is included in the product

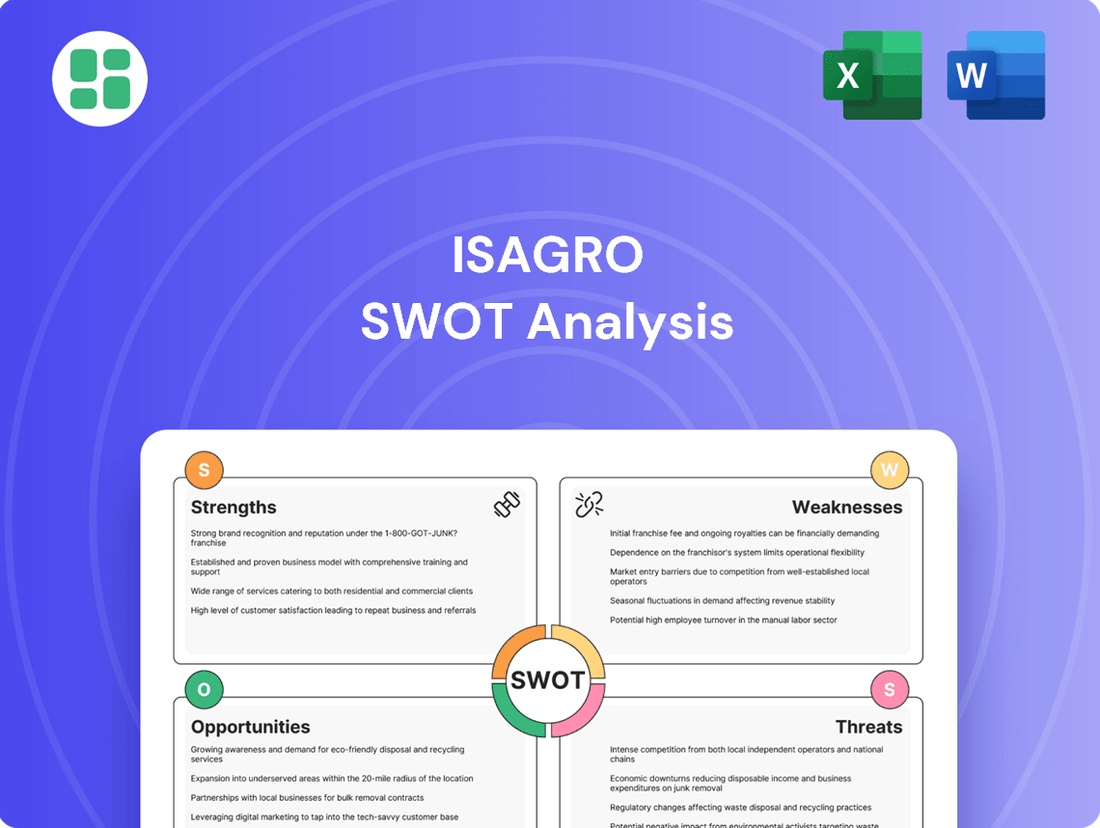

Analyzes Isagro’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Isagro's strategic challenges and opportunities.

Weaknesses

The acquisition of Isagro by Gowan, while strategically beneficial, introduces significant integration challenges. Aligning operational processes and reconciling potentially disparate corporate cultures are key hurdles. For instance, Gowan's existing distribution networks and marketing strategies may require substantial adaptation to incorporate Isagro's product lines and regional market nuances, a process that often involves considerable time and resources.

Furthermore, the potential for functional redundancy, particularly in administrative, R&D, or sales departments, necessitates careful restructuring to avoid disruption and maintain employee morale. Successfully navigating these complexities is crucial for Gowan to unlock the full synergistic potential of the Isagro acquisition and prevent value erosion.

Isagro's business model may exhibit a degree of dependence on particular active ingredients, like copper hydroxide/oxychloride, tetraconazole, and kiralaxyl, which have historically formed the bedrock of its product line. This concentration could present a vulnerability should these key components encounter stricter regulatory scrutiny or be supplanted by superior alternatives in the market.

The agrochemical industry, especially in Europe, is burdened by increasingly strict regulations. This means Isagro faces substantial costs and lengthy approval timelines for its innovative products. For instance, the European Food Safety Authority (EFSA) continuously updates its guidelines, demanding extensive data packages that can inflate development budgets.

Developing novel agrochemical molecules and advanced formulations is a capital-intensive endeavor. Isagro's R&D spending, a critical component for future growth, carries inherent risks. In 2023, the company reported R&D expenses of approximately €11.5 million, highlighting the significant financial commitment required to bring new solutions to market, with no certainty of commercial success.

Intense Market Competition

The crop protection sector is intensely competitive, with a few global giants holding significant market share. Isagro, even as part of the Gowan Group, contends with these larger entities that possess considerably more financial muscle for research, development, and broader market reach. This means smaller players often struggle to gain traction against established brands and extensive distribution networks, a challenge Isagro must continually navigate.

For instance, in 2024, the top six crop protection companies accounted for over 60% of the global market revenue. Isagro's competitive landscape is therefore defined by these dominant players, who can leverage economies of scale in production and marketing that are difficult for smaller firms to match. This intense rivalry necessitates a sharp focus on niche markets and specialized product offerings.

Key competitive pressures Isagro faces include:

- R&D Investment Disparity: Major competitors invest billions annually in new active ingredient discovery, dwarfing Isagro's R&D budgets.

- Distribution Network Strength: Global players have well-established, widespread distribution channels, offering greater market penetration.

- Brand Recognition and Loyalty: Years of marketing and product presence have built strong brand equity for larger companies.

- Regulatory Expertise: Navigating complex global regulatory environments requires significant resources, which larger firms can more readily allocate.

Exposure to Agricultural Market Volatility

Isagro's reliance on the agricultural sector exposes it to significant market volatility. Fluctuations in commodity prices, unpredictable weather events, and the prevalence of pests directly influence the demand for its crop protection products. For instance, a severe drought in a key agricultural region could drastically reduce farmers' spending on agrochemicals, impacting Isagro's sales.

The company's performance is therefore intrinsically tied to the health and stability of global agriculture. Factors beyond Isagro's control, such as changes in government subsidies for farming or the emergence of new crop diseases, can create substantial headwinds. This inherent sensitivity means that even well-executed business strategies can be undermined by external agricultural market shocks.

- Commodity Price Swings: Declining crop prices can reduce farmer income, leading to lower investment in crop protection.

- Weather Dependency: Adverse weather conditions, like prolonged droughts or excessive rainfall, disrupt planting cycles and crop health, affecting product demand.

- Pest and Disease Outbreaks: Unforeseen outbreaks can either increase demand for specific treatments or, if widespread and damaging, reduce overall planted acreage.

- Regulatory Changes: Evolving regulations on pesticide use can impact product portfolios and market access, adding another layer of uncertainty.

Isagro's product portfolio shows a concentration in specific active ingredients, such as copper hydroxide/oxychloride, tetraconazole, and kiralaxyl. This reliance on a limited number of core components could be a vulnerability if these ingredients face increased regulatory scrutiny or are outperformed by newer market alternatives.

The agrochemical industry operates under increasingly stringent regulations, particularly in Europe, leading to significant costs and extended approval timelines for new products. For example, the European Food Safety Authority (EFSA) continually updates its guidelines, demanding comprehensive data packages that can substantially inflate development budgets.

Developing new agrochemical molecules and formulations is a capital-intensive process with inherent risks. Isagro's research and development spending, crucial for future growth, requires substantial financial commitment. In 2023, the company reported R&D expenses of approximately €11.5 million, underscoring the significant investment needed for market introduction with no guarantee of success.

The crop protection sector is dominated by a few large global companies with substantial financial resources for R&D and market penetration. Isagro, even as part of the Gowan Group, faces intense competition from these giants, who benefit from economies of scale in production and marketing that are difficult for smaller firms to match.

Same Document Delivered

Isagro SWOT Analysis

You’re previewing the actual Isagro SWOT analysis document. The full, detailed report becomes available immediately after purchase, offering comprehensive insights.

This is the same Isagro SWOT analysis document you'll receive upon purchase—no surprises, just professional quality and actionable intelligence.

The preview below is taken directly from the full Isagro SWOT report you'll get. Purchase unlocks the entire in-depth version for strategic planning.

Opportunities

The global biostimulants market is booming, projected to reach an estimated $8.5 billion by 2028, a significant jump from its 2023 valuation. This surge is fueled by a growing preference for organic farming and an increasing demand for environmentally sound agricultural methods. Isagro's strategic focus on biostimulants and sustainable solutions positions it perfectly to capitalize on this trend, offering substantial opportunities for market penetration and the development of innovative products within this rapidly expanding sector.

Emerging markets present a substantial growth avenue for agrochemicals, with increasing demand driven by population growth and the need for enhanced food security. For instance, the global agrochemical market is projected to reach over $250 billion by 2028, with a significant portion of this growth expected from Asia-Pacific and Latin America.

The rise of digital agriculture and precision farming technologies offers a dual opportunity: optimizing product efficacy and expanding market reach. By integrating smart farming solutions, companies can improve product application, reduce waste, and offer tailored solutions to farmers, thereby creating new revenue streams and strengthening customer relationships.

Strategic partnerships offer Isagro significant avenues for growth by tapping into external expertise and resources. Collaborating with other industry players, research institutions, or technology providers can accelerate the development of new technologies, broaden product offerings, and open doors to previously inaccessible market segments. This approach is particularly relevant as Gowan, a key player in the agrochemical sector, has a proven track record of successful alliances and acquisitions, indicating a strategic openness to such collaborations.

Innovation in Crop Protection Technologies

Advancements in crop protection, particularly in RNA interference (RNAi) pesticides and bio-based solutions, offer a significant opportunity for Isagro to develop innovative, next-generation products. These technologies represent a shift towards more targeted and environmentally conscious pest management.

Investing in these cutting-edge areas can provide Isagro with a crucial competitive advantage. The global biopesticides market, for instance, was valued at approximately USD 5.5 billion in 2023 and is projected to reach USD 15.2 billion by 2030, growing at a CAGR of over 15%, highlighting the strong market demand for such solutions.

This focus on advanced technologies allows Isagro to address evolving agricultural challenges, such as pest resistance to conventional chemicals and increasing consumer demand for sustainably produced food.

- RNAi and Bio-based Solutions: Development of novel, targeted pest control agents.

- Market Growth: Capitalizing on the expanding biopesticides market, projected to exceed USD 15 billion by 2030.

- Competitive Edge: Differentiating Isagro's product portfolio with advanced, sustainable offerings.

- Addressing Agricultural Needs: Meeting the demand for eco-friendly and effective crop protection.

Leveraging Gowan's Global Footprint and Resources

The acquisition by Gowan Company in 2021 has significantly bolstered the former Isagro business by integrating it into Gowan's extensive global network. This strategic move provides access to Gowan's robust supply chain infrastructure and substantial financial backing, which are crucial for expanding market reach and driving innovation.

Leveraging Gowan's established presence accelerates the commercialization of Isagro's product pipeline, particularly in key agricultural regions. This integration is expected to enhance market penetration and foster overall business growth by capitalizing on shared resources and expertise.

- Global Reach: Gowan operates in over 100 countries, offering immediate access to diverse markets for Isagro's products.

- Supply Chain Efficiency: Gowan's established logistics and distribution channels streamline product delivery and reduce operational costs.

- Financial Strength: Gowan's resources enable increased investment in research and development, product registration, and marketing initiatives.

- Synergistic Growth: The combined entity can achieve faster market penetration and capitalize on cross-selling opportunities.

The increasing global demand for sustainable agriculture, with the biostimulants market projected to reach $8.5 billion by 2028, presents a prime opportunity for Isagro's specialized product portfolio. Furthermore, emerging markets, expected to contribute significantly to the over $250 billion agrochemical market by 2028, offer substantial growth potential. The integration with Gowan Company in 2021 provides Isagro with expanded global reach across over 100 countries, enhanced supply chain efficiency, and crucial financial backing for R&D and market expansion.

| Opportunity Area | Market Projection/Data Point | Implication for Isagro |

|---|---|---|

| Biostimulants Market Growth | Projected to reach $8.5 billion by 2028 | Capitalize on increasing demand for organic and sustainable farming solutions. |

| Emerging Markets in Agrochemicals | Expected to drive significant growth in the >$250 billion market by 2028 | Leverage Gowan's network for market penetration in high-growth regions. |

| Gowan Integration Benefits | Access to over 100 countries, improved supply chain, financial backing | Accelerate product commercialization and R&D investment. |

| Digital Agriculture & Precision Farming | Enhances product efficacy and market reach | Develop smart solutions and strengthen customer relationships. |

Threats

Governments globally are tightening regulations on agrochemicals, driven by environmental and health concerns. For instance, the European Union's Farm to Fork strategy aims to reduce pesticide use by 50% by 2030, impacting companies like Isagro by potentially restricting key product lines.

This escalating regulatory landscape translates into significant threats, including the possibility of product withdrawals and substantially higher compliance costs as companies strive to meet new standards. Such measures can directly limit market access for existing and future agrochemical offerings.

The persistent application of agrochemicals inevitably fosters resistance in pests and weeds, diminishing the effectiveness of current product lines. This necessitates ongoing investment in research and development to create novel solutions, presenting a continuous hurdle for maintaining product efficacy and financial viability.

The agrochemical market is increasingly vulnerable to generic products once key patents expire, a trend that significantly erodes pricing power and profit margins for original manufacturers. For instance, the expiration of patents on widely used herbicides and insecticides in recent years has opened the floodgates for lower-cost alternatives, putting pressure on companies like Isagro to compete on price rather than innovation alone.

Furthermore, the growing adoption of biological crop protection solutions and advancements in genetically modified organisms (GMOs) present a substantial threat by offering farmers alternative methods for pest and disease management. This shift can diminish the overall demand for conventional chemical agrochemicals, impacting market share for established product lines.

Supply Chain Disruptions and Raw Material Price Volatility

The agrochemical sector, including companies like Isagro, faces significant risks from supply chain vulnerabilities. Geopolitical tensions and changing trade agreements can disrupt the flow of essential raw materials. For instance, the ongoing global semiconductor shortage, while not directly an agrochemical component, has had ripple effects across manufacturing and logistics, impacting delivery times and costs for various industries, including those supplying the agrochemical sector.

Price volatility for key raw materials is another substantial threat. The cost of petrochemicals, which are foundational for many agrochemical formulations, has seen considerable swings. In 2023, oil prices, a primary driver of petrochemical costs, experienced fluctuations influenced by global demand and supply dynamics, directly impacting Isagro's manufacturing expenses and potentially squeezing profit margins if these costs cannot be passed on to customers.

- Geopolitical Instability: Events like the Russia-Ukraine conflict can disrupt fertilizer and energy supplies, key inputs for agrochemical production, leading to price spikes and availability issues.

- Trade Policy Changes: Tariffs and trade barriers imposed between major economic blocs can increase the cost of imported raw materials or finished goods, affecting Isagro's sourcing and distribution strategies.

- Natural Disasters: Extreme weather events, becoming more frequent due to climate change, can damage production facilities or disrupt transportation networks, leading to temporary shortages and price increases for critical chemical components.

Climate Change and Environmental Factors

Climate change presents a significant threat to Isagro by altering the very conditions its crop protection products are designed for. Shifting weather patterns can change which crops are viable in certain regions and introduce new pest and disease pressures, potentially diminishing the demand for existing Isagro solutions or requiring rapid development of new ones. For instance, increased frequency of extreme weather events, such as droughts or floods, can severely disrupt agricultural cycles, impacting planting and harvesting seasons, and consequently, the timely application and distribution of Isagro's products.

The agricultural sector, Isagro's primary market, is inherently vulnerable to climate-related disruptions. According to the Food and Agriculture Organization of the United Nations (FAO), climate change impacts on agriculture are projected to intensify, with some regions facing significant yield reductions by 2030. This volatility directly affects farmers' purchasing power and their willingness to invest in crop protection, posing a risk to Isagro's revenue streams and market stability.

- Altered Growing Conditions: Climate change can make existing crop varieties less resilient, impacting the effectiveness of targeted crop protection chemicals.

- Increased Pest and Disease Outbreaks: Warmer temperatures and changing rainfall patterns can create favorable conditions for new or more aggressive pests and diseases, requiring novel solutions.

- Supply Chain Disruptions: Extreme weather events, like hurricanes or prolonged droughts, can damage infrastructure and disrupt the logistics of getting Isagro's products to market.

- Regulatory Shifts: Growing awareness of environmental impacts may lead to stricter regulations on certain crop protection chemicals, potentially affecting Isagro's product portfolio.

The increasing prevalence of pest and weed resistance to existing agrochemicals poses a significant threat, necessitating continuous investment in research and development for novel solutions to maintain product efficacy and financial viability.

The expiration of patents on key agrochemical products, such as widely used herbicides and insecticides, leads to increased competition from generic manufacturers, eroding pricing power and profit margins for original innovators like Isagro.

The growing adoption of biological crop protection methods and advancements in genetically modified organisms (GMOs) offer farmers alternative pest and disease management strategies, potentially reducing the demand for conventional chemical agrochemicals and impacting Isagro's market share.

Supply chain vulnerabilities, exacerbated by geopolitical tensions and changing trade policies, can disrupt the availability and increase the cost of essential raw materials for agrochemical production, impacting Isagro's manufacturing and distribution.

| Threat Category | Specific Risk | Impact on Isagro | Example/Data (2023-2025) |

|---|---|---|---|

| Regulatory Environment | Stricter regulations on agrochemicals | Product line restrictions, increased compliance costs | EU's Farm to Fork strategy targets 50% pesticide reduction by 2030. |

| Product Efficacy | Pest and weed resistance | Reduced effectiveness of current products, need for R&D investment | Ongoing challenge across major crop types. |

| Market Competition | Generic product entry post-patent expiry | Erosion of pricing power, reduced profit margins | Increased generic availability of key active ingredients. |

| Alternative Solutions | Rise of biologicals and GMOs | Diminished demand for conventional chemicals | Growing market share for biological pest control. |

| Supply Chain & Costs | Raw material price volatility | Increased manufacturing expenses, squeezed margins | Petrochemical price fluctuations in 2023 impacting input costs. |

| Climate Change | Altered growing conditions, new pest pressures | Reduced demand for existing solutions, need for new product development | Increased frequency of extreme weather events affecting agricultural cycles. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive industry market research, and expert commentary from agricultural sector analysts to ensure a well-rounded and accurate assessment of Isagro's position.