Isagro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isagro Bundle

Isagro's competitive landscape is shaped by potent forces, from the intense rivalry among existing players to the looming threat of substitute products. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Isagro’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The agrochemical sector's dependence on specific raw materials, like active ingredients and various chemical compounds, means that the concentration of suppliers for these fundamental inputs significantly influences bargaining power. Generally, the availability of numerous chemical substances keeps supplier power low to moderate, especially as the industry often produces its own intermediates.

However, this dynamic shifts notably when active ingredients are highly specialized or protected by patents. For instance, in 2024, the market for patented crop protection chemicals saw key suppliers holding substantial sway, as evidenced by the pricing power demonstrated by companies with exclusive rights to novel active ingredients, impacting the cost structure for agrochemical manufacturers.

For a company like Isagro, specializing in proprietary agrochemicals, the uniqueness of its active ingredients directly impacts supplier bargaining power. If Isagro relied on a select few suppliers for crucial, hard-to-replicate specialized components, those suppliers would hold significant leverage.

Switching suppliers for key raw materials or active ingredients in the agrochemical sector can be a costly endeavor. For a company like Isagro, these costs can encompass extensive reformulation of existing products, rigorous re-testing to ensure efficacy and safety, and the often lengthy and expensive process of re-registration with regulatory bodies. These substantial switching costs effectively bolster the bargaining power of Isagro's current suppliers, limiting the company's flexibility in sourcing its essential inputs.

Supplier Industry Concentration

When the agrochemical industry relies on a few dominant suppliers for essential raw materials or specialized compounds, those suppliers wield significant bargaining power. This concentration means a limited number of companies control the supply chain for critical inputs, potentially dictating terms and prices to agrochemical firms like Isagro.

For instance, if the market for a key patented intermediate used in Isagro's fungicides is dominated by just two or three global chemical manufacturers, these producers can leverage their market position. This contrasts with commodity chemicals, where a broader base of suppliers typically dilutes individual supplier power.

- Supplier Concentration: If the supplier industry has fewer players than the agrochemical sector, their ability to influence prices and terms increases.

- Critical Input Control: Suppliers controlling specialized or patented ingredients essential for agrochemical production hold a stronger bargaining position.

- Market Dominance: A few large chemical producers dominating the supply of key intermediates can exert considerable pressure on agrochemical companies.

Potential for Forward Integration by Suppliers

Suppliers might become a significant threat if they can realistically move into manufacturing or distributing agrochemicals themselves. While less frequent for basic material providers in a sophisticated sector like agrochemicals, this possibility grants them substantial power over companies such as Isagro.

This potential for forward integration means suppliers could bypass Isagro, directly serving the end market. This would not only cut off Isagro's supply chain but also turn a supplier into a direct competitor, potentially capturing market share and dictating terms.

- Supplier Integration Threat: Suppliers with the capability and intent to move into Isagro's manufacturing or distribution channels represent a direct competitive threat.

- Leverage and Competition: Such forward integration would grant suppliers increased bargaining power and transform them into direct rivals, impacting Isagro's market position.

- Industry Example: While specific instances of raw material suppliers integrating forward into complex agrochemical manufacturing are rare, the potential remains a strategic consideration for companies like Isagro.

The bargaining power of suppliers for Isagro hinges on supplier concentration and control over critical, often patented, inputs. In 2024, the agrochemical sector continued to see suppliers of specialized active ingredients and intermediates exert significant influence due to market exclusivity and high switching costs for manufacturers like Isagro. These costs include reformulation and regulatory re-approval, which can run into millions of dollars, effectively locking in existing supplier relationships and amplifying supplier leverage.

| Factor | Impact on Isagro | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration of suppliers for key intermediates increases their power. | Limited global producers for certain patented intermediates in 2024 meant higher supplier leverage. |

| Critical Input Control | Suppliers of unique, patented active ingredients have substantial pricing power. | Companies holding patents on novel crop protection chemicals in 2024 dictated terms due to lack of alternatives. |

| Switching Costs | High costs for Isagro to change suppliers (reformulation, re-registration) strengthen existing suppliers. | Estimated re-registration costs for a new active ingredient can exceed $250 million, making supplier shifts prohibitive. |

What is included in the product

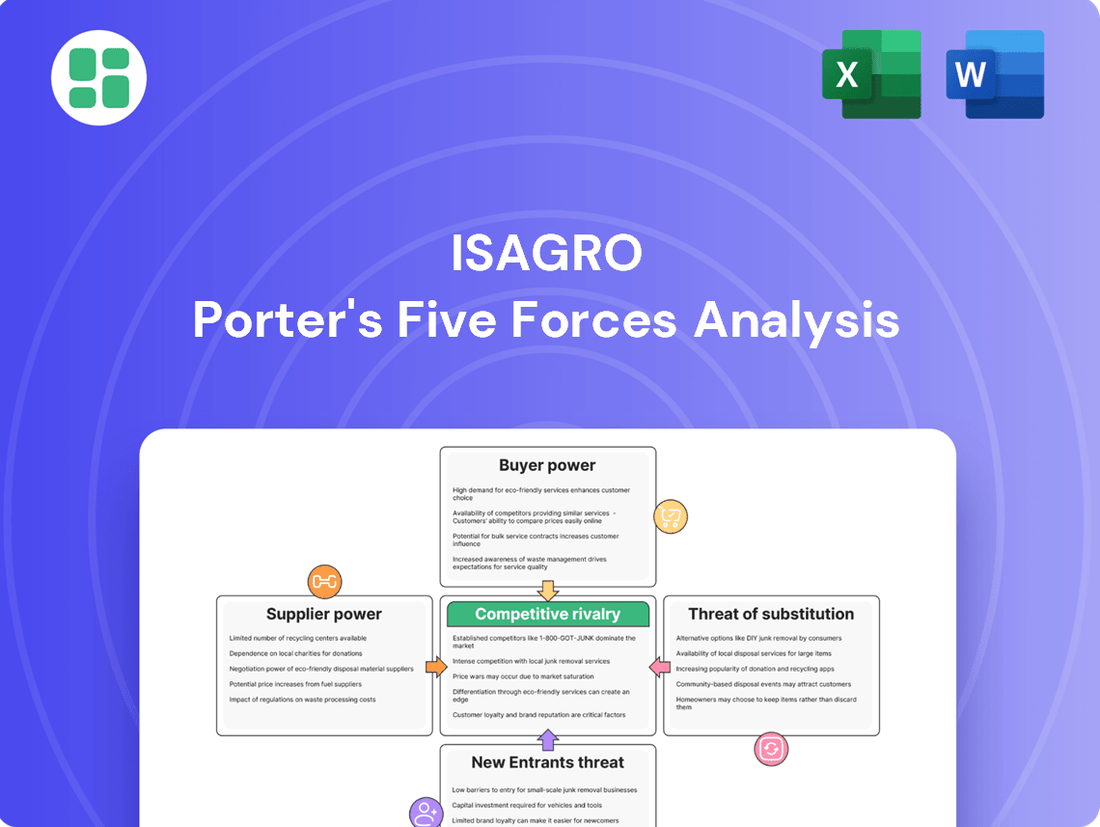

This analysis dissects the competitive forces impacting Isagro, evaluating the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the agrochemical industry.

Isagro Porter's Five Forces Analysis provides a visual, easy-to-understand breakdown of competitive pressures, simplifying complex market dynamics for informed strategic choices.

Customers Bargaining Power

Farmers and distributors, the direct customers for agrochemical products, frequently exhibit a high degree of price sensitivity, especially when dealing with more commoditized offerings. This sensitivity translates into significant leverage for buyers to negotiate lower prices, particularly for widely available and undifferentiated products in the market.

The agrochemical market in 2024 underscored this dynamic, with reports indicating that lower agrochemical prices negatively affected overall market performance. This trend suggests that buyers were able to exert downward pressure on pricing, a clear signal of their bargaining power, especially for products that are not unique or specialized.

The bargaining power of customers in the agrochemical sector is significantly influenced by the availability of alternative crop protection solutions. This includes readily accessible generic versions of well-known agrochemicals, which often come at lower price points, as well as a growing array of biological alternatives that appeal to environmentally conscious buyers.

In 2024, the market for biopesticides, a key alternative, continued its robust growth. Projections indicated the global biopesticides market could reach approximately $10.5 billion by 2025, up from an estimated $5.5 billion in 2020, demonstrating a substantial increase in viable alternatives for farmers. This expanding choice empowers customers to negotiate better terms or switch suppliers if they find existing offerings unsatisfactory in terms of price, efficacy, or environmental impact.

While individual farmers are numerous, Isagro's direct clientele often comprises large agricultural distributors and trading companies. These key intermediaries, due to their consolidated purchasing power and control over market access, can significantly influence pricing and contract terms, thereby increasing the bargaining power of customers.

Differentiation of Isagro's Product Portfolio

Isagro's focus on developing proprietary agrochemicals and sustainable solutions, like biostimulants, aims to differentiate its offerings. This differentiation can potentially lessen customer bargaining power by providing unique benefits or superior performance that are not easily replicated by competitors. For instance, if Isagro's biostimulants demonstrably increase crop yields by a significant margin, customers may be less inclined to switch based solely on price.

When products are distinct, it becomes more challenging for buyers to conduct direct price comparisons. This makes it harder for customers to exert significant downward pressure on pricing, thereby granting Isagro some degree of pricing power. The market for sustainable agriculture solutions is growing, with global spending projected to reach billions, indicating a demand for innovative products.

- Proprietary Products: Isagro's investment in research and development for unique agrochemical formulations.

- Sustainable Solutions: The growing market for biostimulants and environmentally friendly agricultural inputs.

- Reduced Price Sensitivity: Differentiation can lead to customers prioritizing performance over cost.

- Market Trends: Increasing consumer and regulatory demand for sustainable agricultural practices.

Low Switching Costs for Customers

For many agrochemical products, especially those considered standard or generic, the cost and effort for farmers or distributors to switch to a different supplier are often minimal. This ease of switching significantly enhances the bargaining power of customers.

When an agrochemical product lacks strong brand differentiation and is perceived as a commodity, customers can readily shift their allegiance to a competitor that offers more favorable pricing or more attractive payment terms. This dynamic puts pressure on Isagro to remain competitive on price and service.

- Low Switching Costs: Farmers can easily switch between suppliers of generic agrochemicals, impacting Isagro's customer retention.

- Commoditization: Many agrochemical products are viewed as commodities, reducing brand loyalty and increasing price sensitivity.

- Price Sensitivity: In 2024, global agricultural commodity prices experienced volatility, making farmers more attuned to input costs, including agrochemicals.

The bargaining power of customers in the agrochemical sector is substantial, driven by price sensitivity and the availability of alternatives. In 2024, lower agrochemical prices impacted market performance, indicating buyers' ability to exert downward pricing pressure, especially for undifferentiated products. The growing market for biopesticides, projected to reach approximately $10.5 billion by 2025, further empowers farmers with more choices and negotiation leverage.

Large distributors, as key intermediaries, consolidate purchasing power, influencing pricing and contract terms. While Isagro aims to mitigate this through proprietary and sustainable solutions, low switching costs for generic products remain a significant factor. This means customers can easily shift suppliers, demanding competitive pricing and service from Isagro.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance/Data |

| Price Sensitivity | High for commoditized products | Lower agrochemical prices negatively affected market performance. |

| Availability of Alternatives | Increases power | Biopesticides market projected to reach $10.5 billion by 2025. |

| Switching Costs | Low for generic products | Farmers readily switch suppliers for cost savings. |

| Consolidated Buyers | Significant leverage | Large distributors wield substantial purchasing power. |

Full Version Awaits

Isagro Porter's Five Forces Analysis

This preview showcases the complete Isagro Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the agrochemical industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently proceed with your purchase, knowing you'll gain instant access to this valuable strategic tool.

Rivalry Among Competitors

The global agrochemical market exhibits moderate concentration, with the top five suppliers – Syngenta, Bayer CropScience, BASF, Corteva Agriscience, and Nutrien – holding a substantial market share in 2024. This means that a few large, established companies are vying intensely for dominance.

Competitive rivalry in the agrochemical sector is significantly fueled by massive investments in research and development. Companies are pouring resources into discovering novel active ingredients, advanced formulations, and eco-friendly solutions, such as biologicals and precision agriculture technologies. For instance, in 2023, the global R&D spending in the crop protection market was estimated to be around $6 billion, highlighting the intensity of innovation efforts.

This relentless pursuit of innovation creates a high barrier to entry and intensifies competition among established players. Companies like Isagro, which specialized in proprietary molecules, felt this pressure acutely, needing continuous breakthroughs to stay ahead. The race to develop more effective and sustainable products means companies must constantly reinvest to maintain their market position and avoid obsolescence.

Competitive rivalry in the agrochemical sector, including for companies like Isagro, is intense, driven by a constant stream of new products. This innovation includes herbicides, insecticides, and fungicides featuring novel modes of action, better effectiveness, and more environmentally friendly characteristics. For instance, the global biopesticides market, a key area for innovation, was valued at approximately USD 5.2 billion in 2023 and is projected to reach USD 13.7 billion by 2030, indicating a CAGR of 15.1%.

Successfully differentiating products through superior performance, particularly in high-growth areas like biostimulants, is paramount for gaining and maintaining a competitive edge. The biostimulant market alone was estimated at USD 3.7 billion in 2023 and is expected to grow significantly, highlighting the importance of these advanced solutions in a crowded marketplace.

Global Market Dynamics and Regional Pressures

The agrochemical sector is inherently global, and this characteristic fuels intense competition. Companies from established markets like Europe and North America face increasing rivalry from emerging players, particularly from China and India, which are expanding their production capabilities and market reach. This global dynamic means that strategies must account for a worldwide competitive landscape.

Regional market conditions significantly amplify competitive rivalry. For instance, in 2024, North America experienced pressure from declining commodity prices, forcing agricultural producers to seek cost-effective solutions, thereby increasing demand for competitive agrochemical offerings. Simultaneously, unfavorable weather patterns in Asia and Europe during the same year created volatile market conditions, prompting companies to aggressively pursue market share in the regions that remained more stable or offered growth opportunities.

- Global Agrochemical Market Growth: The global agrochemical market was projected to reach approximately $250 billion by 2024, indicating a substantial and competitive arena.

- Emerging Market Competition: Chinese and Indian agrochemical exports have seen significant growth, with India's agrochemical exports alone reaching over $5 billion annually in recent years, directly challenging established players.

- Impact of Weather on Rivalry: Adverse weather events in 2024, such as droughts in parts of Europe and floods in Asia, led to reduced crop yields and increased price volatility, intensifying the fight for market share among agrochemical suppliers.

- Price Sensitivity: Declining commodity prices in North America in 2024 put pressure on farmers, making them more sensitive to agrochemical prices and thus heightening competition based on cost-effectiveness.

Strategic Alliances and Mergers & Acquisitions

The agrochemical industry is characterized by significant consolidation, with major companies frequently engaging in strategic alliances and mergers and acquisitions (M&A). These moves are driven by the desire to broaden product offerings, acquire cutting-edge technologies, and solidify market dominance. For instance, in 2023, Syngenta Group announced its acquisition of Valagro, a leader in biostimulants, for an undisclosed sum, aiming to bolster its biologicals portfolio. This trend intensifies the competitive landscape, particularly for smaller and medium-sized enterprises.

The ongoing M&A activity creates a dynamic environment where larger entities leverage acquired scale and technology to outcompete smaller players. This consolidation means that companies like Isagro, prior to its acquisition, faced increased pressure to innovate and differentiate or risk being marginalized. The global agrochemical market size was estimated to be around $250 billion in 2024, with a significant portion of this revenue concentrated among the top few players, underscoring the impact of these strategic maneuvers.

- Strategic Alliances: Companies form partnerships to share R&D costs, access new markets, and co-develop products.

- Mergers & Acquisitions (M&A): Major players acquire competitors or complementary businesses to gain market share, technology, and product lines.

- Industry Consolidation: This trend leads to fewer, larger competitors, increasing competitive intensity for remaining independent firms.

- Impact on Smaller Players: Mid-sized and smaller companies face greater challenges in competing against consolidated giants with expanded resources and portfolios.

The competitive rivalry within the agrochemical sector is fierce, driven by a few dominant global players and an increasing number of specialized innovators. Companies are locked in a continuous battle for market share, fueled by substantial R&D investments and a constant stream of new product introductions, particularly in high-growth areas like biopesticides and biostimulants. This intense competition is further amplified by global market dynamics and regional economic pressures, forcing companies to differentiate through performance and cost-effectiveness.

Consolidation through mergers and acquisitions is a significant factor, creating larger, more powerful entities that can outmaneuver smaller competitors. This trend, exemplified by Syngenta's acquisition of Valagro in 2023, intensifies the pressure on remaining independent firms to innovate or risk being marginalized in a market estimated to be around $250 billion in 2024.

| Key Competitor | 2024 Market Share (Est.) | Key Innovation Focus |

|---|---|---|

| Syngenta | 10-12% | Biologicals, Seedcare |

| Bayer CropScience | 12-14% | Digital Farming, Crop Protection |

| BASF | 8-10% | Sustainable Solutions, Fungicides |

| Corteva Agriscience | 7-9% | Seed Technologies, Herbicides |

| Nutrien | 5-7% | Fertilizers, Crop Inputs |

SSubstitutes Threaten

The growing emphasis on sustainable agriculture and minimizing environmental footprints is fueling a surge in biological crop protection. Solutions like biopesticides, biostimulants, and biofertilizers are gaining traction as eco-friendly replacements for conventional synthetic chemicals. This trend presents a direct substitution threat to Isagro's established product portfolio.

The increasing adoption of organic farming practices presents a significant threat of substitutes for conventional agrochemical products. This global shift, fueled by consumer demand for healthier food options and evolving regulatory landscapes, directly promotes the use of natural pest and disease management solutions over synthetic chemicals. For instance, the global organic food market was valued at approximately $200 billion in 2023 and is projected to reach over $400 billion by 2028, indicating a substantial expansion of the market for biological and natural alternatives.

Precision agriculture, with tools like drones and AI, allows for highly targeted application of agrochemicals. This means farmers can use less product overall, directly impacting the demand for traditional, broad-spectrum chemical treatments. For instance, by 2024, the global precision agriculture market was valued at over $10 billion, showcasing significant investment and adoption of these technologies.

Development of Genetically Modified (GM) and Gene-Edited Crops

The emergence of genetically modified (GM) and gene-edited crops presents a significant threat of substitutes for traditional agricultural inputs like chemical pesticides. These advanced crop varieties, engineered for inherent resistance to pests, diseases, and environmental stressors, directly reduce the demand for external chemical treatments. For instance, by 2024, a substantial portion of the global soybean and corn acreage is planted with GM varieties, diminishing the market for certain herbicides and insecticides.

This shift towards bio-engineered solutions can erode the market share of companies heavily reliant on conventional agrochemical sales. As gene editing technologies like CRISPR become more accessible and refined, the development of crops with enhanced resilience will accelerate. This creates a substitute for specific crop protection products, potentially leading to a decline in their sales volume and profitability.

- Reduced reliance on chemical inputs: Gene-edited crops with built-in pest resistance lessen the need for insecticides.

- Lower demand for herbicides: Crops engineered for weed tolerance can decrease the application of specific herbicides.

- Market impact: The increasing adoption of GM and gene-edited crops by 2024 has already begun to reshape the agrochemical market.

- Future implications: Continued innovation in crop genetics poses an ongoing threat to the demand for traditional chemical crop protection solutions.

Integrated Pest Management (IPM) Strategies

The rise of Integrated Pest Management (IPM) presents a significant threat of substitutes for traditional, purely chemical-based pest control solutions. IPM strategies, which blend biological controls, crop rotation, and cultural practices with judicious chemical application, reduce the overall demand for single-solution agrochemicals. For instance, by 2024, many agricultural regions saw increased adoption of IPM, driven by regulatory pressures and consumer demand for sustainably grown produce.

These alternative approaches offer a way to manage pests effectively while minimizing environmental impact and the risk of resistance development. This diversification of pest control methods means that companies solely reliant on broad-spectrum chemical pesticides face competition from these more integrated and often more sustainable alternatives. The market for biological pest control agents, a key component of IPM, has seen robust growth, with projections indicating continued expansion through 2025 and beyond.

- Reduced reliance on single chemical solutions: IPM fosters a multi-pronged approach to pest control.

- Environmental and sustainability benefits: IPM practices often lead to lower chemical runoff and improved biodiversity.

- Growing market for biologicals: The biological pest control market is expanding, offering direct substitutes for synthetic chemicals.

- Consumer and regulatory drivers: Demand for sustainably produced food and stricter regulations encourage IPM adoption.

The increasing demand for organic and sustainably produced food directly fuels the market for biological pest control agents and natural alternatives, presenting a significant substitution threat. For example, the global biopesticides market was projected to reach over $10 billion by 2024, demonstrating a substantial shift away from conventional chemical inputs.

Precision agriculture technologies, including drones and AI-driven analytics, enable more targeted and reduced application of agrochemicals. This efficiency means farmers can achieve effective pest management with less product overall, diminishing the demand for broad-spectrum chemical treatments. By 2024, the precision agriculture market was valued at over $10 billion, highlighting the growing adoption of these resource-saving methods.

The development of genetically modified (GM) and gene-edited crops, engineered for inherent pest and disease resistance, directly substitutes for traditional chemical pesticides. By 2024, a significant portion of global corn and soybean acreage utilized GM varieties, directly impacting the market for certain herbicides and insecticides.

| Substitution Trend | Description | Market Data (Approximate) | Impact on Traditional Agrochemicals |

|---|---|---|---|

| Biologicals & Organic Farming | Rise of biopesticides, biostimulants, and organic practices | Global organic food market valued at ~$200 billion in 2023 | Reduces reliance on synthetic chemicals |

| Precision Agriculture | Targeted application of inputs via technology | Precision agriculture market valued at >$10 billion in 2024 | Decreases overall agrochemical volume needed |

| GM & Gene-Edited Crops | Crops with built-in resistance | Significant GM crop acreage by 2024 | Directly replaces need for specific pesticides/herbicides |

| Integrated Pest Management (IPM) | Multi-faceted pest control strategies | Growing adoption in key agricultural regions by 2024 | Diversifies pest control, lessening single-chemical reliance |

Entrants Threaten

The agrochemical sector demands enormous upfront capital for research, development, and building manufacturing plants. For instance, bringing a new pesticide to market can cost hundreds of millions of dollars, with significant portions allocated to R&D and navigating stringent regulatory hurdles.

Isagro's strategy, focused on developing innovative crop protection solutions, inherently involves substantial R&D investments. This high barrier makes it difficult for smaller players or new companies to enter the market and compete effectively with established giants.

The agrochemical industry presents formidable barriers to entry, particularly due to stringent regulatory hurdles and lengthy approval processes. Companies must invest heavily in research and development to meet rigorous standards for environmental impact, human health, and safety. For instance, obtaining registration for a new pesticide in the European Union can take over 10 years and cost upwards of $250 million, a significant deterrent for potential new entrants.

Established brand loyalty is a significant barrier for new entrants. Companies like Isagro have cultivated strong relationships with farmers over decades, fostering trust in their products and services. For instance, in 2024, the agrochemical market continued to see high customer retention rates for established brands, with many farmers prioritizing proven efficacy and reliable supply chains over novel offerings.

Furthermore, extensive distribution networks are crucial in the agricultural sector. New companies struggle to replicate the reach and logistical capabilities of incumbents, which ensure timely delivery and technical support to farmers. In 2024, the cost and complexity of building out such networks remained a formidable hurdle, often requiring substantial upfront investment that deters potential new entrants.

Economies of Scale for Incumbent Firms

The threat of new entrants in the agrochemical sector is significantly mitigated by the substantial economies of scale enjoyed by incumbent firms like Isagro. Major players leverage their size to achieve lower per-unit costs in production, raw material sourcing, and research and development. For instance, in 2024, leading agrochemical companies reported R&D investments in the billions of dollars, a figure virtually insurmountable for a startup.

This cost advantage creates a formidable barrier. New companies entering the market without comparable scale would inherently face higher production expenses, making it exceedingly challenging to compete on price with established giants. This disparity in cost structure is a critical factor for any potential new competitor to consider.

Key aspects of this barrier include:

- Manufacturing Efficiency: Large-scale production facilities allow for optimized processes and reduced overhead per unit.

- Procurement Power: Bulk purchasing of raw materials grants significant negotiation leverage and lower input costs.

- R&D Investment Capacity: Established firms can fund extensive, long-term research projects, leading to proprietary products and patents.

- Distribution Networks: Existing, extensive distribution channels reduce the cost and complexity of reaching customers for established players.

Intellectual Property and Patent Protection

Intellectual property, particularly patents, acts as a significant barrier to entry in the agrochemical sector. Companies like Isagro, which invest heavily in research and development to create proprietary molecules and formulations, benefit from this protection. For example, in 2024, the global agrochemical market was valued at approximately $240 billion, with innovation being a key driver of market share.

New competitors face a substantial hurdle: they must either undertake the expensive and time-consuming process of discovering and patenting novel active ingredients or wait for existing patents to expire. This waiting period can extend for many years, effectively limiting immediate market access for potential entrants and reinforcing the position of established players.

- Patent Protection: Proprietary agrochemical compounds are typically shielded by patents, creating a significant entry barrier.

- R&D Investment: Developing new, patentable molecules requires substantial financial and time investment.

- Market Access: New entrants often must wait for patent expirations, delaying their ability to compete with established products.

- Competitive Advantage: Patent-protected innovations grant incumbent firms like Isagro a distinct advantage in the market.

The threat of new entrants in the agrochemical industry, including for companies like Isagro, is generally low. This is primarily due to the immense capital required for research, development, and regulatory compliance. For instance, bringing a new pesticide to market can cost hundreds of millions of dollars, a significant hurdle for any newcomer.

The lengthy and complex regulatory approval processes, which can take over a decade and cost hundreds of millions of dollars, further deter new entrants. Established players also benefit from strong brand loyalty and extensive distribution networks, making it difficult for new companies to gain market traction.

Economies of scale and intellectual property protection, such as patents, also create substantial barriers. In 2024, the global agrochemical market, valued at approximately $240 billion, saw innovation as a key differentiator, reinforcing the advantage of established firms with significant R&D capacities.

New entrants must either invest heavily in discovering novel compounds or wait for existing patents to expire, which can be many years. This temporal and financial barrier significantly limits immediate competition.

| Barrier Type | Description | Estimated Cost/Timeframe (Illustrative) |

|---|---|---|

| Capital Requirements | R&D, manufacturing facilities, regulatory filings | Hundreds of millions of USD |

| Regulatory Hurdles | Product approval, environmental and safety testing | 10+ years, >$250 million USD |

| Economies of Scale | Lower per-unit costs in production and sourcing | Billions of USD in annual R&D for major players |

| Intellectual Property | Patents on active ingredients and formulations | Years of patent protection, significant R&D investment |

Porter's Five Forces Analysis Data Sources

Our Isagro Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Isagro's official annual reports and financial statements, alongside industry-specific market research from reputable firms like IHS Markit and Agrow. We also incorporate data from relevant regulatory bodies and agricultural economic databases to provide a comprehensive view.