Isagro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isagro Bundle

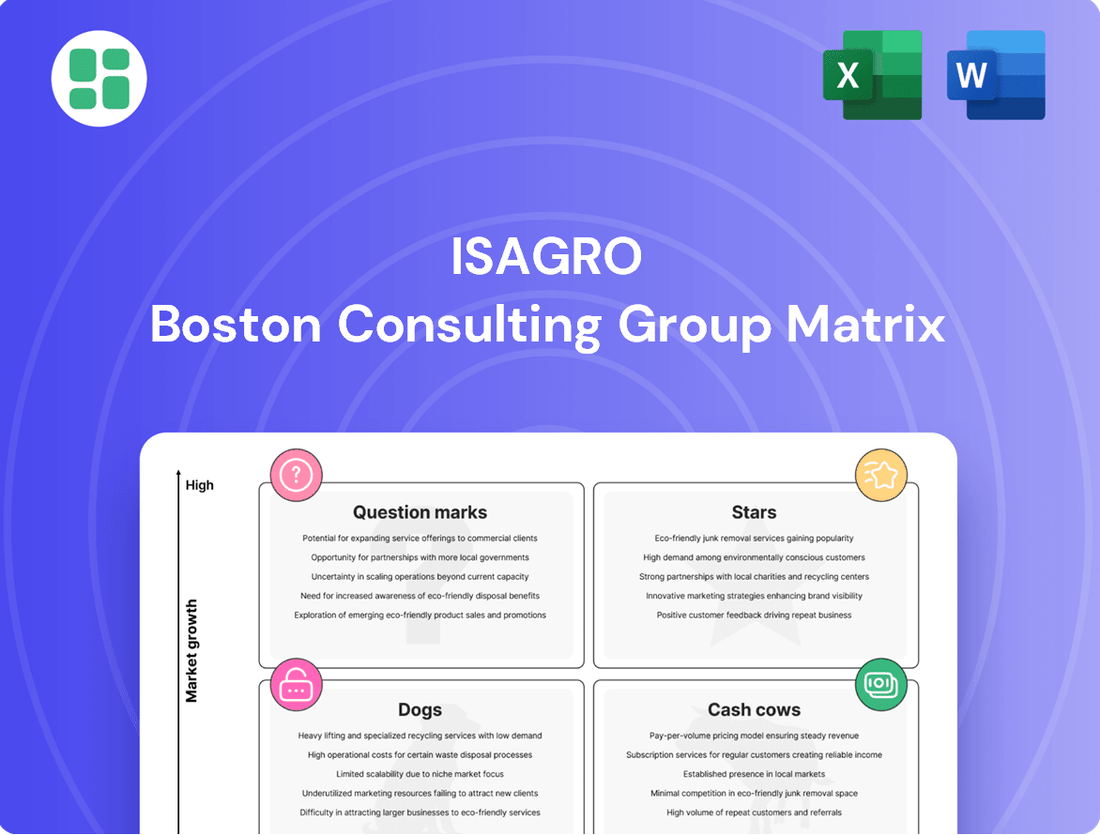

Uncover Isagro's strategic product portfolio with this BCG Matrix overview, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their innovations are positioned for growth and where resources might be better allocated. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize Isagro's market performance.

Stars

Novel biostimulant formulations represent Isagro's stars, tapping into advancements in microbial and plant-extract-based solutions. These products are poised to capture a significant share of the burgeoning biostimulants market, which is projected to reach USD 3.18 billion by 2025 and continue its robust growth trajectory through 2035.

Advanced Sustainable Agrochemicals represent Isagro's innovative, eco-conscious solutions designed for the burgeoning sustainable agriculture sector. These products are engineered for high performance, directly addressing the increasing global preference for environmentally sound farming practices.

The market for sustainable agriculture was valued at an impressive USD 15.36 billion in 2024. Projections indicate robust growth, with an estimated reach of USD 28.36 billion by 2030, highlighting a substantial opportunity for Isagro's offerings.

With their reduced environmental footprint and proven efficacy, these advanced agrochemicals are poised to secure significant market share. They are expected to emerge as leaders within their specialized niche, capitalizing on the strong demand for greener agricultural inputs.

Isagro's next-generation fungicides, particularly those featuring novel modes of action to combat growing resistance, are positioned as Stars in the BCG Matrix. The global fungicides market is anticipated to expand significantly, reaching an estimated USD 33.41 billion by 2029 from USD 24.64 billion in 2025, with a compound annual growth rate of 7.9%.

These advanced formulations are designed to tackle critical crop disease challenges effectively, offering superior protection and thus aiming to capture a substantial market share. Their innovative nature and efficacy in a growing market segment strongly suggest a Star classification, indicating high growth and high relative market share potential for Isagro.

Proprietary Insecticides with Low Environmental Impact

Isagro's proprietary insecticides represent a significant advancement, offering high efficacy against target pests while minimizing harm to the environment. These products are designed to meet the escalating demands from both regulators and consumers for agricultural solutions that are safer and more sustainable. The global insecticides market is projected for robust growth, anticipated to expand from USD 22.38 billion in 2025 to USD 36.43 billion by 2034, reflecting a compound annual growth rate of 5.56%.

The combination of superior performance and an eco-friendly profile positions these Isagro offerings to capture a substantial share of this expanding market. Their ability to effectively control pests without adverse environmental consequences aligns perfectly with evolving industry standards and consumer preferences for greener agricultural practices.

- Product Efficacy: High kill rates against key agricultural pests.

- Environmental Profile: Low toxicity to non-target organisms and reduced persistence in soil and water.

- Market Growth: Capitalizing on the insecticides market's projected growth to USD 36.43 billion by 2034.

- Competitive Advantage: Dominant market share potential due to a favorable environmental and performance combination.

High-Performance Herbicides for Key Crops

Isagro's high-performance herbicides are crucial for major crops like cereals and oilseeds, offering superior weed control and tackling herbicide resistance. The global herbicides market is expected to reach USD 44.29 billion by 2025, with a compound annual growth rate of 6.7%, underscoring the demand for effective weed management solutions.

- Effective Weed Control: Isagro's leading herbicide portfolio provides robust solutions for critical crops.

- Addressing Resistance: Products are designed to combat the growing challenge of herbicide-resistant weeds.

- Market Growth: The herbicides market is expanding, driven by the need for efficient agricultural practices.

- High Market Share: Proven efficacy and wide applicability ensure these herbicides maintain a strong market position.

Isagro's novel biostimulant formulations are classified as Stars due to their innovative nature and strong market potential. These advanced solutions leverage microbial and plant-extract technologies to enhance crop performance and resilience.

The biostimulant market is experiencing significant growth, projected to reach USD 3.18 billion by 2025 and continue its upward trend. This expansion signifies a substantial opportunity for Isagro's biostimulant offerings to capture a leading market share.

Isagro's next-generation fungicides, designed to combat resistance and offer novel modes of action, are also identified as Stars. The global fungicides market is expected to grow to USD 33.41 billion by 2029, indicating a favorable environment for these advanced products.

These fungicides provide superior crop protection, positioning them to secure a significant portion of this expanding market. Their innovative efficacy against critical crop diseases strongly supports their Star classification, reflecting high growth and market share potential.

| Product Category | Market Status | Key Drivers | Projected Market Growth |

|---|---|---|---|

| Biostimulants | Star | Advancements in microbial/plant-extract tech, increasing demand for sustainable inputs | USD 3.18 billion by 2025 |

| Next-Gen Fungicides | Star | Combating fungicide resistance, novel modes of action, crop disease management | USD 33.41 billion by 2029 |

What is included in the product

The Isagro BCG Matrix categorizes its product portfolio into Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

The Isagro BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis and alleviating the pain of strategic confusion.

Cash Cows

Isagro's established copper-based fungicides are classic Cash Cows. These products have a long history of broad-spectrum disease control and are staples in agriculture. Their market is mature, meaning growth is steady but not explosive, and competition is significant.

These fungicides generate substantial and consistent cash flow for Isagro. This is because they are widely recognized and relied upon by farmers, requiring less marketing spend to maintain their market share. In 2024, the global fungicide market, which includes copper-based products, was valued at approximately USD 15.5 billion, with copper fungicides holding a significant, albeit stable, portion due to their proven efficacy and cost-effectiveness.

Mature Broad-Spectrum Herbicides represent Isagro's established cash cows within the BCG framework. These are the reliable workhorses, holding a solid market share in regions where agriculture is well-developed and demand for these general-purpose solutions is consistent.

The global herbicides market itself is mature, yet it maintains a steady trajectory. Projections indicate it will reach an estimated USD 44.29 billion by 2025, highlighting the sustained demand for such products. Isagro's mature herbicides benefit from this stable market, requiring minimal new investment to maintain their position.

Their widespread adoption and strong brand recognition mean these herbicides generate significant profits with relatively low marketing expenditure. This allows Isagro to leverage these products as consistent cash generators, funding other areas of their business.

Isagro's legacy insecticide brands, characterized by a loyal customer base and consistent sales in stable agricultural segments, represent its Cash Cows. These established products, like those with a history of proven efficacy, continue to generate substantial profits with minimal need for reinvestment, even as the broader insecticide market evolves. For instance, in 2023, Isagro reported that its mature product lines continued to be a significant contributor to overall revenue, demonstrating their enduring market position.

Widely Adopted Conventional Crop Protection

Isagro's established portfolio of conventional crop protection products, such as fungicides and insecticides that have achieved market maturity, represent its cash cows. These products hold a significant and stable market share within the broader agrochemicals sector.

The global agrochemicals market is substantial, with projections for 2024 ranging between USD 247.3 billion and USD 297.7 billion, indicating a mature yet steadily growing industry. These mature products are highly efficient in generating cash due to their entrenched market position and robust competitive advantages.

- Market Maturity: Products have achieved their peak sales and are experiencing stable demand.

- Stable Market Share: These offerings command a significant portion of their respective market segments.

- Strong Cash Generation: Established market presence and competitive advantages translate to consistent cash flow.

- Mature Industry Growth: The overall agrochemicals market is projected for steady growth in 2024.

Proprietary Formulations in Niche, Stable Markets

Proprietary formulations that hold dominant positions in stable, niche crop protection markets exemplify cash cows. These products typically cater to specific crop types or pest challenges, insulating them from the volatility often seen in broader agricultural markets. Their consistent market share and predictable revenue streams require minimal new investment, making them reliable profit generators.

Consider Isagro's historical portfolio, where certain established fungicides or insecticides, developed with unique active ingredients and application methods, have maintained high market penetration in regions with specific agricultural needs. For instance, a product targeting a particular soil-borne disease in a high-value crop could represent such a cash cow. These offerings provide a bedrock of stable income, allowing the company to fund research and development in more dynamic areas.

- Dominant Niche Market Share: These products often command a significant percentage of their specific, limited market.

- Stable, Predictable Revenue: They generate consistent sales with low year-over-year fluctuation.

- Low Reinvestment Needs: Minimal capital is required for marketing or product development due to established market presence.

- Profitability Focus: Their primary role is to generate substantial profits that can be deployed elsewhere in the business.

Isagro's established copper-based fungicides and mature broad-spectrum herbicides are prime examples of Cash Cows. These products benefit from a stable market, commanding significant share with consistent sales. Their long-standing efficacy and farmer reliance mean they generate substantial, predictable profits with minimal marketing investment.

These Cash Cows are vital for Isagro, providing a reliable income stream that supports innovation in other business areas. The global agrochemicals market, valued at an estimated USD 247.3 billion in 2024, underscores the scale of these mature product lines' contributions. For instance, Isagro's legacy insecticide brands continue to be significant revenue drivers, demonstrating their enduring market position.

| Product Category | Market Status | Cash Flow Generation | Key Characteristics |

| Copper-based Fungicides | Mature, Stable | High, Consistent | Broad-spectrum efficacy, Farmer reliance, Low marketing needs |

| Mature Herbicides | Mature, Steady | Substantial, Predictable | Established market share, Strong brand recognition, Minimal reinvestment |

| Legacy Insecticides | Stable Segments | Significant | Loyal customer base, Proven efficacy, Enduring market position |

Full Transparency, Always

Isagro BCG Matrix

The Isagro BCG Matrix preview you are currently viewing is the definitive, unwatermarked document you will receive immediately after your purchase. This comprehensive analysis, detailing Isagro's product portfolio within the Boston Consulting Group framework, is ready for immediate integration into your strategic planning processes. You can confidently expect the same high-quality, professionally formatted report that will empower your decision-making. This is the exact file you will download, offering actionable insights without any hidden surprises or demo limitations.

Dogs

Obsolete or High-Resistance Agrochemicals represent Isagro's older products facing declining relevance. These might include compounds where pests or weeds have developed significant resistance, diminishing their efficacy and market demand. For instance, the global agrochemical market has seen increased focus on integrated pest management strategies, which can reduce reliance on older, single-mode-of-action products.

Products in this category typically generate very low cash flow, and in some cases, may even incur losses due to ongoing maintenance and regulatory costs. The challenge of resistance is a persistent issue in crop protection; by 2024, the industry continues to invest heavily in R&D for novel solutions to combat evolving resistance patterns.

These low-performing assets are prime candidates for divestiture or strategic withdrawal from the market. Isagro, like other players in the sector, would likely evaluate these products for their potential to be phased out to redirect resources towards more promising areas of its portfolio.

Isagro's products facing stringent regulatory bans are those impacted by evolving environmental standards or outright prohibitions in crucial markets. This regulatory pressure significantly challenges their market position, leading to reduced sales and diminishing relevance.

These products, characterized by their limited usability due to strict regulations, exhibit low market share and minimal growth potential. For instance, the European Union's persistent review and potential phase-out of certain active ingredients in crop protection, as seen with ongoing discussions around neonicotinoids, exemplifies the type of regulatory headwinds these Isagro products would encounter.

Generic Formulations in Highly Competitive Segments represent Isagro's offerings in crowded crop protection markets where differentiation is minimal. These products face intense price pressure from numerous competitors, making it difficult to achieve substantial market share or healthy profit margins.

In 2024, the agrochemical industry continued to see consolidation and intense competition, particularly in generic segments. Companies with highly commoditized portfolios often struggle to achieve above-average growth, with many generic products operating on single-digit margins. For Isagro, these formulations would likely contribute minimally to revenue and could even represent a drain on resources if not managed carefully, potentially breaking even or incurring losses.

Underperforming Legacy Insecticides/Herbicides

Underperforming legacy insecticides and herbicides would fall into the Dogs category of the Isagro BCG Matrix. These are products that have seen declining sales and market share, often due to intense competition or a lack of new development. For instance, if a particular older herbicide, which once held a significant market position, now only contributes a small fraction of revenue and faces pressure from newer, more effective alternatives, it would be classified here. In 2024, many established agrochemical companies are reviewing their portfolios, with products exhibiting less than 3% annual market growth and a market share below 10% often being candidates for divestment or discontinuation.

These products typically operate in mature markets with limited growth prospects. Their low market share suggests they are not leaders, and the overall market stagnation means significant future growth is unlikely. This situation means they generate minimal profits and can even drain resources that could be better allocated to more promising areas of the business. For example, a legacy insecticide that saw its peak sales a decade ago, and in 2024 accounts for less than 5% of a company's total sales with no clear path to increased market penetration, exemplifies a Dog.

- Low Market Share: Products with a low relative market share compared to their main competitors.

- Low Market Growth: Operating in markets that are stagnant or declining.

- Limited Strategic Value: Offer little potential for future growth or profitability.

- Resource Drain: May require ongoing investment for maintenance or regulatory compliance without commensurate returns.

Products with Limited Geographical Reach

Products with limited geographical reach, often referred to as Dogs in the BCG Matrix, represent a challenge for companies like Isagro. These are offerings that, for various reasons, haven't managed to expand their market presence beyond a few select regions or have struggled against entrenched local competitors. Despite potentially good performance in those niche areas, their inability to achieve wider adoption means they contribute little to overall market share and growth.

These "Dog" products typically represent a drain on company resources. They require ongoing investment in research, development, marketing, and distribution, yet the return on these investments is minimal due to their restricted market penetration. In 2024, companies are increasingly scrutinizing such product lines to optimize resource allocation. For instance, a hypothetical Isagro product that saw limited success in a specific European market but failed to gain traction in North America or Asia would be a prime example.

- Limited Market Penetration: These products struggle to expand beyond their initial, often small, geographical footprint.

- Low Market Share and Growth: Their inability to capture a significant portion of the broader market leads to stagnant or declining sales.

- Resource Drain: Investments in R&D, marketing, and distribution for these products yield little return, impacting overall profitability.

- Competitive Disadvantage: Strong local competitors or regulatory hurdles can prevent wider market access.

Dogs in Isagro's BCG Matrix are products with low market share in low-growth markets. These often include older agrochemicals facing resistance or strict regulations, generic formulations in crowded segments, and products with limited geographical reach. By 2024, companies are actively divesting or phasing out such underperforming assets to reallocate resources more effectively.

These products generate minimal profits and can even consume resources without significant returns. For example, a legacy insecticide with less than 3% annual market growth and a market share below 10% is a typical candidate for discontinuation. The focus for Isagro would be to streamline its portfolio by exiting these low-potential offerings.

| BCG Category | Isagro Product Examples (Hypothetical) | Market Characteristics | Financial Implications | Strategic Recommendation |

|---|---|---|---|---|

| Dogs | Obsolete Agrochemicals, Generic Herbicides with Low Differentiation, Legacy Insecticides with Limited Efficacy | Low market growth (<3% annually), low market share (<10%), high competition, evolving resistance, regulatory pressures | Low or negative cash flow, minimal profit contribution, potential resource drain | Divestiture, discontinuation, or minimal investment for maintenance only |

Question Marks

Isagro's emerging biostimulants for specialized crops represent a classic Stars in the making, poised for significant growth within niche markets. These innovative products target high-value, low-volume crop segments, a strategy that, while promising, means they currently hold a small market share. The broader biostimulant market itself is experiencing robust expansion, with projections indicating continued double-digit growth through 2024 and beyond, driven by increasing demand for sustainable agriculture and enhanced crop yields.

The initial low market penetration for these specialized biostimulants is a direct consequence of their targeted application and the need for market education and farmer adoption. For instance, the global biostimulant market was valued at approximately $3.2 billion in 2023 and is forecast to reach over $7.5 billion by 2028, demonstrating the immense potential for new entrants. Isagro's investment in research and development for these products, estimated to be substantial for scaling, is crucial for capturing a larger portion of this burgeoning market.

Innovative Sustainable Solutions in Early Adoption represents Isagro's cutting-edge, yet nascent, sustainable agricultural technologies. These are products with high potential but currently in the early stages of market entry, requiring significant investment in marketing and farmer education to gain traction.

The sustainable agriculture market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 12% through 2028, reaching an estimated value of $30 billion. For Isagro's early-stage innovations, success hinges on effectively communicating their benefits and demonstrating their value proposition to farmers to overcome adoption barriers.

Newly developed molecules with unproven market acceptance, like Isagro's recent proprietary innovations, would fall into the "Question Marks" category of the BCG Matrix. These represent significant investments in research and development, with the potential for high future returns but also considerable uncertainty regarding their commercial success. For instance, if Isagro invested €20 million in R&D for a new molecule in 2023, and its initial market share in 2024 was only 0.5% of a €100 million potential market, it would clearly fit this profile.

Biopesticides for Niche Pest Control

Biopesticides for niche pest control represent a promising area for Isagro, fitting into the Question Mark quadrant of the BCG Matrix. These are new solutions designed to tackle specific, hard-to-manage pests. While the market for these specialized biopesticides is growing, Isagro's current market share is relatively small.

The broader biopesticides market is experiencing significant expansion within the crop protection sector. For instance, the global biopesticides market was valued at approximately $5.2 billion in 2023 and is projected to reach over $15 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 16%. This indicates a strong upward trend for biopesticide adoption.

These niche biopesticide products demonstrate high growth potential due to increasing demand for targeted and environmentally friendly pest management solutions. However, they necessitate strategic investment to build market presence and transition into the Star category. Key considerations for Isagro include:

- Market Penetration: Focusing on gaining a larger share in these emerging niche markets.

- Product Development: Continuing innovation to address unmet needs in specific pest control.

- Strategic Partnerships: Collaborating with research institutions or distributors to enhance market reach.

- Investment Allocation: Directing resources towards marketing and sales efforts to capitalize on growth opportunities.

Digital Agriculture Integration Offerings

If Isagro had ventured into offering digital tools and data analytics integrated with their crop protection products for precision agriculture, these would likely be categorized as Stars or Question Marks in the BCG matrix, depending on their market penetration and growth trajectory. The global digital agriculture market is booming, projected to reach over $40 billion by 2025, indicating significant growth potential.

These integrated digital offerings would have represented a strategic move into a high-growth sector. While Isagro's current market share in this specific niche might have been low, the potential for rapid expansion is substantial. Success would hinge on farmer adoption and clearly demonstrating the value proposition of these digital solutions in enhancing yields and optimizing resource use.

- Market Growth: The digital agriculture sector is expanding rapidly, with forecasts suggesting continued strong growth through 2025 and beyond.

- Potential for Adoption: Farmer uptake of precision agriculture technologies is increasing as the benefits become more evident.

- Value Proposition: Integrated digital solutions offer enhanced efficiency and data-driven decision-making for farmers.

- Competitive Landscape: While competitive, the market still offers significant opportunities for innovative players.

Isagro's new proprietary molecules with unproven market acceptance are classic Question Marks. These represent significant R&D investments with high future return potential but also considerable commercial uncertainty. For example, a €20 million R&D investment in 2023 for a new molecule, with only a 0.5% market share in a €100 million potential market in 2024, clearly fits this profile.

These products require substantial strategic investment to build market presence and transition into the Star category. Key considerations include focusing on gaining a larger share in emerging niche markets, continuing innovation, and potentially forming strategic partnerships to enhance market reach.

The company must direct resources towards marketing and sales efforts to capitalize on growth opportunities for these high-potential, but currently low-share, products.

The global biopesticides market, a relevant sector for Isagro's Question Marks, was valued at approximately $5.2 billion in 2023 and is projected to reach over $15 billion by 2030, showing a strong CAGR of around 16%.

BCG Matrix Data Sources

Our Isagro BCG Matrix leverages comprehensive data, including Isagro's financial reports, market share data, and industry growth projections, to accurately position its business units.