Isagro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isagro Bundle

Navigate the complex external forces impacting Isagro's agricultural solutions. Our PESTLE analysis delves into political stability, economic shifts, technological advancements, environmental regulations, and social trends that shape the industry. Arm yourself with this critical intelligence to refine your strategies and anticipate market movements.

Unlock a deeper understanding of Isagro's operational landscape with our comprehensive PESTLE analysis. Discover how evolving political landscapes, economic fluctuations, and emerging social factors present both challenges and opportunities for the company. Purchase the full analysis to gain actionable insights for your business planning.

Political factors

The EU's Common Agricultural Policy (CAP) for 2023-2027 places a strong emphasis on environmental and climate goals, influencing direct payments to farmers and encouraging greener farming methods. This shift can affect the market for certain agrochemicals as farmers adapt to new incentives. For instance, the CAP's focus on reducing pesticide use by 50% by 2030 under the Farm to Fork strategy directly impacts the demand for conventional crop protection solutions.

The European Union's Farm to Fork Strategy, a cornerstone of the European Green Deal, aims to drastically cut chemical pesticide use by 50% by 2030, alongside boosting organic farming. This ambitious goal, even after the withdrawal of the Sustainable Use of Plant Protection Products Regulation in February 2024 due to significant pushback, continues to shape agricultural policy and market demand for greener solutions.

This policy direction presents a dual impact for companies like Isagro: it poses challenges for conventional agrochemical producers but simultaneously opens substantial market avenues for biostimulants and biopesticides. For instance, the EU's commitment to reducing pesticide risk underscores a growing regulatory and consumer preference for products with lower environmental footprints.

National agricultural policies and subsidies, particularly within individual EU member states like Italy, significantly shape farming practices and the uptake of crop protection solutions. These national initiatives, while often complementing overarching EU goals, introduce country-specific elements that can alter local market dynamics for agrochemical firms.

For instance, Italy's national agricultural strategy may prioritize certain crops or farming methods, influencing demand for specific Isagro products. Support for sustainable farming and organic production at the national level, as seen in various EU countries, can accelerate the transition away from conventional chemical products, impacting Isagro's conventional product sales and driving demand for its biological or integrated pest management solutions.

Geopolitical Instability and Trade Relations

Global geopolitical events and evolving trade relations significantly impact Isagro's supply chain and the pricing of crucial agrochemical raw materials. For instance, the ongoing geopolitical tensions in Eastern Europe have led to supply chain disruptions and price volatility for key inputs, affecting operational costs. Market access for Isagro's finished products can also be hindered by trade disputes or protectionist policies implemented by various nations.

These disruptions directly translate to increased operational expenses and can erode the competitiveness of companies heavily reliant on international trade for both sourcing essential components and distributing their final products. The need to build more resilient food systems in the face of these global challenges is also increasingly shaping government policy decisions concerning agricultural inputs and their availability.

- Supply Chain Vulnerability: Geopolitical conflicts, such as those impacting energy and fertilizer production regions, can cause sudden spikes in raw material costs for agrochemicals.

- Trade Policy Impact: Tariffs or trade barriers imposed between major agricultural markets can restrict Isagro's ability to export its products efficiently, impacting revenue streams.

- Food Security Focus: Governments prioritizing food security may implement policies favoring domestic production or specific types of agricultural inputs, influencing market dynamics for companies like Isagro.

Food Security and Production Priorities

Governments worldwide are increasingly prioritizing food security, a complex balancing act between maximizing agricultural output and adhering to environmental sustainability mandates. This often leads to fluctuating political support, potentially favoring intensive farming for immediate yield gains or shifting towards eco-friendly practices to meet long-term ecological goals. For instance, in 2024, many nations continued to review and adapt their agricultural subsidies, with some directing funds towards precision agriculture technologies aimed at improving efficiency while others emphasized organic farming incentives.

This ongoing political dynamic directly influences the regulatory landscape for crop protection products, impacting companies like Isagro. Decisions made regarding pesticide approvals, residue limits, and environmental impact assessments are shaped by these competing priorities. For example, the European Union's Farm to Fork strategy, which aims for a more sustainable food system, continues to drive stricter regulations on agrochemicals, potentially affecting market access and product development strategies for companies operating within or exporting to the EU.

- Governmental focus on food security in 2024 led to policy reviews impacting agricultural input markets.

- The tension between high yields and environmental sustainability influences regulatory approaches to crop protection.

- Policies promoting sustainable agriculture, like those in the EU, can create both challenges and opportunities for agrochemical companies.

Political factors significantly shape the agrochemical landscape, with government policies on food security and environmental sustainability creating a delicate balance. For example, the EU's Farm to Fork strategy, targeting a 50% reduction in pesticide use by 2030, directly influences market demand for conventional products and drives innovation in biopesticides. This regulatory push, even with policy adjustments like the withdrawal of the Sustainable Use of Plant Protection Products Regulation in February 2024, continues to guide agricultural practices and market opportunities for companies like Isagro.

National agricultural policies and subsidies, often aligned with but distinct from EU directives, further segment the market. Italy's agricultural strategy, for instance, can steer farmer adoption of specific crop protection methods, impacting product demand. This creates a complex regulatory environment where adherence to both supranational and national mandates is crucial for market success.

Geopolitical instability and trade relations also play a critical role, as demonstrated by supply chain disruptions and price volatility for essential agrochemical inputs stemming from global conflicts. These events necessitate robust supply chain management and can influence market access due to trade disputes or protectionist measures.

The increasing global focus on food security in 2024 has led governments to re-evaluate agricultural support, often navigating between maximizing immediate yields and promoting long-term ecological goals. This dynamic influences subsidy allocation, with some nations favoring precision agriculture for efficiency and others incentivizing organic farming, directly impacting the market for crop protection solutions.

What is included in the product

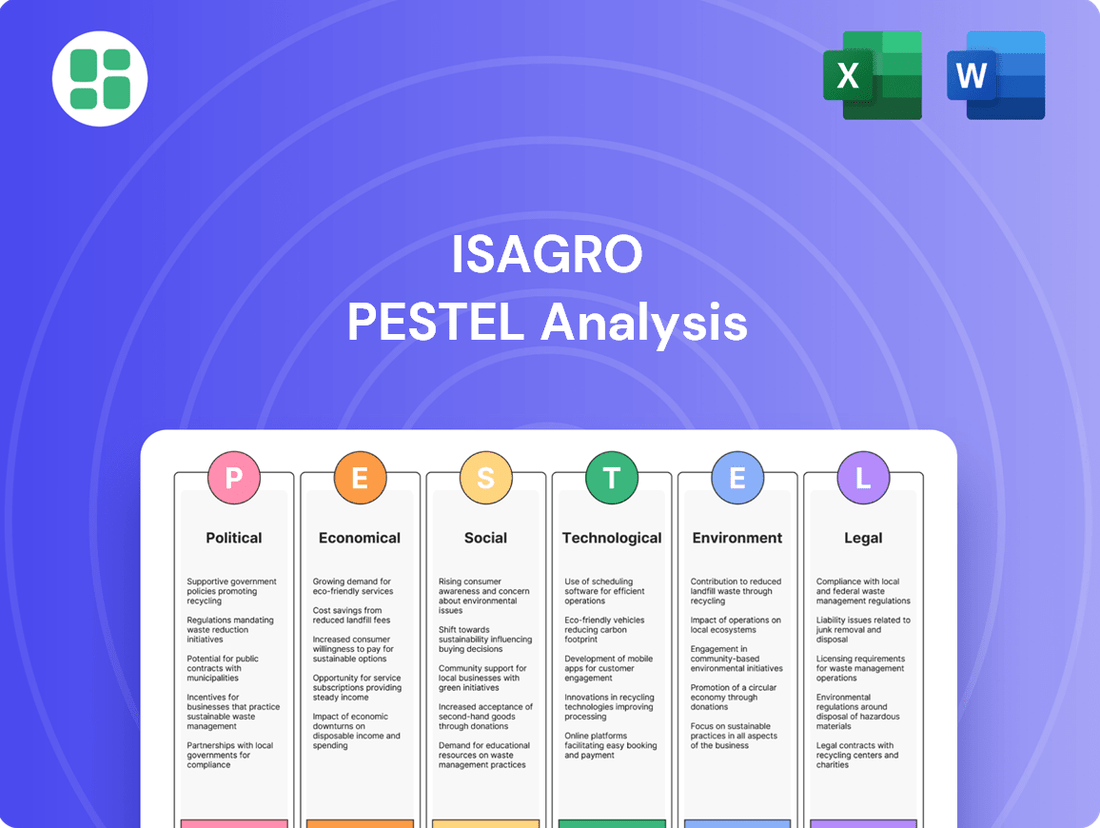

This Isagro PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic direction.

It provides actionable insights for stakeholders to navigate the external landscape and capitalize on emerging opportunities within the agrochemical sector.

The Isagro PESTLE analysis offers a streamlined, actionable framework, simplifying complex external factors into easily digestible insights for strategic decision-making.

By dissecting external influences into clear PESTLE categories, the analysis provides a structured approach to identifying and mitigating potential threats and opportunities for Isagro.

Economic factors

The global agrochemicals market is on a strong growth trajectory, with projections showing an increase from an estimated USD 242.49 billion in 2025 to over USD 300 billion by 2033. This expansion is fundamentally fueled by the escalating global demand for food, a direct consequence of a growing population, and the continuous push for technological innovations in agriculture.

This robust market expansion presents significant opportunities for companies like Isagro operating within the crop protection sector. The increasing need to enhance both crop yield and overall quality to feed a growing world population directly translates into higher demand for effective agrochemical solutions.

The market for biostimulants and biopesticides is surging, especially in Europe, as farmers seek sustainable solutions. This sector is projected to experience robust growth, with estimates suggesting it could reach tens of billions of dollars globally by 2030. This increasing demand for eco-friendly crop protection and enhancement methods creates a significant opportunity for companies like Isagro, which are already invested in these innovative agricultural inputs.

Fluctuations in the cost of raw materials and energy significantly impact agrochemical manufacturers like Isagro. Global supply chain disruptions, geopolitical events, and general commodity price volatility create an unpredictable cost environment. For instance, the price of key inputs such as phosphates and nitrogen, crucial for fertilizers and pesticides, saw considerable swings in 2024, with some commodities experiencing double-digit percentage increases year-over-year due to increased demand and supply constraints.

These cost pressures directly affect profit margins. Companies must implement highly efficient production processes and develop robust strategic sourcing plans to mitigate these risks. For example, Isagro’s operational efficiency in 2024 was partly measured by its ability to absorb a 7% increase in energy costs without a proportional rise in product prices, achieved through process optimization.

Effectively managing these input costs is paramount for maintaining competitiveness. Companies that can secure stable, cost-effective raw material supplies are better positioned to offer competitive pricing and protect their market share. The ability to forecast and hedge against raw material price volatility, a strategy Isagro actively pursued in late 2024, proved vital in navigating the market.

Agricultural Income and Farmer Affordability

Farmers' income is a critical driver for the agricultural sector, directly impacting their capacity to invest in essential inputs like crop protection products. In 2024, for instance, while crop prices saw some stability, the persistent rise in fertilizer and energy costs put significant pressure on farmer profitability across many regions. This economic squeeze means growers are increasingly scrutinizing every purchase, prioritizing solutions that offer a demonstrable return on investment.

The affordability of innovative agrochemicals is therefore paramount. When farmers face tighter margins, they tend to defer spending on premium or newer technologies, opting instead for more established, cost-effective options. This trend was evident in late 2024, with reports indicating a slight slowdown in adoption rates for certain advanced crop protection formulations in key markets due to budget constraints.

- Farmer income directly correlates with demand for crop protection products.

- Rising input costs in 2024 squeezed farmer profitability, impacting spending power.

- Economic pressures lead farmers to favor cost-effective solutions over premium innovations.

- Demonstrating clear economic benefits and ROI is crucial for market penetration.

Investment in Sustainable Agriculture

Investment in sustainable agriculture is rapidly growing, influencing the economic landscape for crop protection solutions. This trend favors bio-based and eco-friendly inputs over traditional chemical approaches, as seen in the increasing market share of organic farming products.

Public and private funding for green farming initiatives provides significant market incentives. For instance, the USDA's Organic Certification Cost Share Program helps offset expenses for farmers transitioning to organic practices, directly boosting demand for sustainable inputs. This financial support encourages innovation in environmentally sound agricultural products.

- Growing Market for Organic Produce: The global organic food market was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2028, indicating a strong economic driver for sustainable farming.

- Government Incentives for Green Farming: In 2024, various governments worldwide allocated billions towards agricultural sustainability programs, including subsidies for precision agriculture technology and organic input research.

- Increased R&D in Bio-based Solutions: Venture capital funding for agritech startups focused on biological crop protection solutions saw a 20% increase in 2023 compared to the previous year, signaling investor confidence in this sector.

- Precision Agriculture Adoption: By 2025, it's estimated that over 70% of large-scale farms in developed nations will be utilizing some form of precision agriculture technology, optimizing resource use and reducing reliance on broad-spectrum chemicals.

Economic factors significantly influence Isagro's operational landscape, particularly concerning raw material costs and farmer purchasing power. The agrochemical sector's growth, projected to exceed USD 300 billion by 2033, is tempered by the rising costs of essential inputs like nitrogen and phosphates, which saw double-digit increases in 2024, impacting manufacturers' margins.

Farmer profitability, a key demand driver, faced pressure in 2024 due to these increased input costs, leading to a more cautious approach to adopting premium agrochemical solutions and a preference for cost-effective alternatives that demonstrate clear ROI.

The burgeoning investment in sustainable agriculture, supported by government incentives and a growing organic produce market (valued at $250 billion in 2023), presents a significant economic opportunity for companies like Isagro that focus on bio-based and eco-friendly solutions.

| Economic Factor | 2024/2025 Trend | Impact on Isagro |

|---|---|---|

| Raw Material & Energy Costs | Rising (e.g., double-digit % increase in phosphates/nitrogen in 2024) | Increased production costs, pressure on profit margins |

| Farmer Profitability | Pressured (due to rising input costs) | Reduced spending power, preference for cost-effective solutions |

| Sustainable Agriculture Investment | Growing (e.g., $250B organic market in 2023) | Opportunity for bio-based products, demand for eco-friendly solutions |

Same Document Delivered

Isagro PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Isagro PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

Consumers across Europe, particularly in key markets like Germany and France, are demonstrating a pronounced preference for food produced with health and environmental consciousness. This has fueled a substantial rise in demand for organic and sustainably cultivated produce. For instance, the European organic food market was valued at approximately €52 billion in 2023 and is projected to continue its upward trajectory.

This evolving consumer mindset directly influences agricultural practices, compelling farmers to move away from heavy chemical reliance and explore more natural pest and disease management solutions. Consequently, agrochemical companies that provide environmentally friendly alternatives, such as biopesticides and biofertilizers, are seeing increased favor and market opportunities.

Public concern over the environmental and health impacts of chemical pesticides is a significant sociological factor influencing the agrochemical industry. This heightened awareness is driving demands for stricter regulations and safer alternatives.

Negative public perception directly impacts consumer purchasing habits, with a growing preference for organically grown produce and a reduced demand for conventional agrochemicals. For instance, a 2024 survey indicated that 65% of consumers are willing to pay a premium for pesticide-free food, a trend that is expected to accelerate.

Companies like Isagro must proactively address these concerns through transparent communication about product safety and by investing in research and development for bio-pesticides and integrated pest management solutions. This shift is crucial for maintaining market share and brand reputation in an increasingly environmentally conscious global market.

Farmer willingness to adopt new agricultural technologies, like integrated pest management (IPM) and digital farming, is vital for innovative product success. In 2024, a significant portion of farmers globally are looking for ways to boost efficiency and sustainability. For instance, adoption rates for precision agriculture tools are projected to grow, with the global market expected to reach over $15 billion by 2025, indicating a strong interest in tech-driven solutions.

Education and clear demonstrations of benefits, such as higher yields or lower input costs, are key drivers for this adoption. Farmers are increasingly motivated by the potential for improved profitability and easier compliance with environmental regulations. A recent survey indicated that over 60% of farmers consider yield increase as a primary factor when evaluating new technologies.

Understanding specific farmer needs and offering user-friendly, practical solutions is paramount. Products that simplify complex processes or offer tangible cost savings are more likely to gain traction. The success of digital farming platforms in 2024, with many reporting a 15-20% increase in user engagement, highlights the demand for accessible and beneficial tools.

Demographic Shifts in Rural Areas

Demographic shifts in rural areas present a significant challenge for the agricultural sector. An aging farmer population, with the average age of farmers in many developed nations creeping into the late 50s, means a shrinking and experienced workforce. This trend, coupled with difficulties in attracting younger generations to farming, directly impacts the available labor for tasks like crop protection application and the adoption of new technologies.

These demographic realities necessitate a strategic shift towards less labor-intensive solutions. For companies like Isagro, this means a greater focus on automated application systems and crop protection products that require fewer manual interventions. Policies designed to encourage generational renewal in agriculture, such as subsidies for young farmers or land transfer programs, are crucial for long-term sustainability and the successful integration of advanced farming practices.

- Aging Farmer Population: The average age of farmers in the US was 57.5 years in 2022, highlighting a generational gap.

- Labor Shortages: Rural areas often face labor shortages, impacting the capacity for traditional farming operations.

- Technology Adoption: A younger, tech-savvy generation is more likely to adopt advanced crop protection solutions.

- Policy Influence: Government initiatives supporting new farmers can mitigate demographic pressures.

Food Waste and Supply Chain Efficiency

Societal concerns regarding food waste are increasingly influencing agricultural practices, pushing for greater supply chain efficiency. Consumers and governments alike are demanding solutions that reduce losses from pests and diseases, thereby extending the shelf life and improving the quality of food products. This trend directly fuels the demand for advanced crop protection solutions that minimize spoilage throughout the value chain.

Innovations in agrochemicals that demonstrably contribute to reduced post-harvest losses are particularly sought after. For instance, advancements in fungicides and insecticides that prevent rot and insect damage can significantly cut down on the estimated 30-40% of food that is wasted globally. These solutions are crucial for ensuring that more produce reaches consumers in good condition.

The drive for a more efficient and less wasteful food supply chain translates into a clear market opportunity for companies like Isagro.

- Market Demand: Growing consumer awareness of food waste is creating a strong market for crop protection products that enhance food preservation.

- Economic Impact: Reducing food loss through effective pest and disease management can save billions of dollars annually across the agricultural sector. In 2024, the global economic cost of food waste was estimated to be over $1 trillion.

- Regulatory Push: Governments are implementing policies to reduce food waste, which indirectly supports the adoption of advanced agricultural technologies.

- Innovation Focus: Companies are investing in R&D for safer, more targeted agrochemical solutions that minimize waste and improve food safety standards.

Societal awareness regarding the environmental and health implications of conventional farming practices is a powerful driver for change. Consumers are increasingly prioritizing food safety and sustainability, leading to a greater demand for organic and reduced-chemical produce. This shift is directly impacting the agrochemical sector, with a notable rise in the market for biopesticides and integrated pest management solutions.

The willingness of farmers to adopt new technologies, particularly those enhancing efficiency and sustainability, is crucial. For instance, the projected growth of the precision agriculture market to over $15 billion by 2025 underscores this trend, as farmers seek solutions that offer tangible benefits like increased yields and reduced input costs.

Demographic shifts, such as an aging farmer population and rural labor shortages, present challenges that necessitate a move towards less labor-intensive agricultural solutions. Companies must focus on automated application systems and user-friendly products to address these evolving needs.

Concerns about food waste are also reshaping agricultural practices, creating a demand for crop protection products that minimize spoilage and extend shelf life. Innovations that reduce post-harvest losses are particularly valuable, as the global economic cost of food waste was estimated to exceed $1 trillion in 2024.

| Sociological Factor | Impact on Agrochemicals | Market Opportunity/Challenge | Supporting Data (2024/2025) |

|---|---|---|---|

| Consumer Health & Environmental Consciousness | Increased demand for organic and sustainable produce; reduced reliance on conventional pesticides. | Growth in biopesticides and IPM solutions. | European organic food market valued at ~€52 billion in 2023. 65% of consumers willing to pay a premium for pesticide-free food (2024 survey). |

| Farmer Technology Adoption | Need for efficient, sustainable, and user-friendly solutions. | Opportunities in precision agriculture and digital farming tools. | Precision agriculture market projected to exceed $15 billion by 2025. 15-20% user engagement increase for digital farming platforms (2024). |

| Demographic Shifts (Aging Farmers, Labor Shortages) | Necessity for less labor-intensive crop protection methods. | Focus on automated application systems and simplified product use. | Average age of US farmers was 57.5 years in 2022. |

| Food Waste Reduction | Demand for solutions that minimize spoilage and post-harvest losses. | Market for advanced crop protection that enhances food preservation. | Global economic cost of food waste estimated over $1 trillion (2024). ~30-40% of food wasted globally. |

Technological factors

Precision agriculture, powered by AI, IoT, and satellite imagery, is revolutionizing crop management. This shift facilitates data-driven decisions for optimizing input application, leading to more efficient and targeted use of agrochemicals. For instance, by 2024, the global precision agriculture market was projected to reach $12.9 billion, highlighting significant adoption.

This technological advancement allows for a substantial reduction in agrochemical waste and a minimized environmental footprint. Companies that successfully integrate their products with these digital farming platforms, such as John Deere's See & Spray Ultimate technology which demonstrated up to 77% reduction in herbicide use in trials, are poised for a competitive edge.

Ongoing research is yielding more potent biopesticide and biostimulant formulations, utilizing beneficial microbes, plant extracts, and natural compounds to boost efficacy and broaden usage. This innovation is critical for companies like Isagro, which specialized in novel molecules and biostimulants, to maintain their competitive edge.

The global biopesticides market is projected to reach $10.4 billion by 2025, growing at a compound annual growth rate of 13.7%, according to MarketsandMarkets. This expansion highlights the increasing demand for sustainable agricultural solutions and the significant opportunities for companies investing in advanced formulation technologies.

Artificial intelligence is revolutionizing agriculture, with applications in pest and disease detection, yield forecasting, and optimizing resource use. AI platforms offer farmers immediate insights, enhancing their ability to make informed decisions about crop protection strategies.

This technological evolution presents a significant avenue for companies like Isagro to innovate by developing AI-compatible or AI-enhanced agrochemical products. For instance, by mid-2024, the global AI in agriculture market was projected to reach over $3.7 billion, indicating substantial growth and adoption.

Development of Digital Twin Technology for Farms

Digital twin technology is poised to revolutionize agriculture by creating virtual replicas of physical farms. This allows for the simulation and testing of various agricultural inputs and environmental conditions without real-world risk. For instance, by simulating different soil compositions and predicted weather patterns for 2024-2025, companies can optimize product efficacy and application strategies.

The ability to conduct virtual testing significantly cuts down on the time and expense associated with traditional product development cycles. This accelerated validation process is crucial for bringing new, more effective agrochemical solutions to market faster. By 2025, it's projected that the global digital twin market, which includes agricultural applications, could reach tens of billions of dollars, underscoring its growing importance.

- Virtual Testing: Digital twins allow for risk-free simulation of new agrochemical products under diverse simulated conditions, reducing the need for costly field trials.

- Cost and Time Efficiency: By accelerating the validation process, digital twins can reduce R&D expenses and shorten the time to market for innovative agricultural solutions.

- Precision Agriculture: This technology supports more granular insights into farm management, leading to optimized resource allocation and improved crop yields in the coming years.

- Market Growth: The digital twin market is experiencing rapid expansion, with agriculture identified as a key growth sector, indicating significant investment and adoption potential through 2025.

Biotechnology and Genetic Engineering in Crop Resistance

Advances in biotechnology and genetic engineering are creating crop varieties with superior natural resistance to pests and diseases. This trend, projected to significantly impact the agrochemical sector, could lessen the need for traditional chemical crop protection methods. For instance, by 2024, genetically modified (GM) crops accounted for over 200 million hectares globally, with a substantial portion featuring pest resistance traits.

This evolution presents a dual challenge and opportunity for companies like Isagro. While it might reduce demand for certain chemical solutions, it also opens avenues for developing complementary products, such as biopesticides or specialized nutrients that support these advanced crop varieties. The global biopesticides market, valued at approximately $5.5 billion in 2023, is expected to reach over $12 billion by 2030, indicating a strong shift towards biological solutions.

- Reduced reliance on chemical pesticides: Biotechnology offers natural resistance, potentially lowering agrochemical usage.

- Market shift towards biologicals: Companies can capitalize on the growing demand for biopesticides and biofertilizers.

- Development of complementary products: Opportunities exist in creating solutions that enhance the performance of genetically engineered crops.

- Investment in R&D: Continued innovation in biotechnology is crucial for staying competitive in the evolving agricultural landscape.

Technological advancements in precision agriculture, leveraging AI and IoT, are driving more efficient agrochemical application, with the global precision agriculture market projected to reach $12.9 billion by 2024. This trend minimizes waste and environmental impact, as seen with technologies reducing herbicide use by up to 77%. Companies like Isagro can gain a competitive edge by integrating with these digital farming platforms.

The rise of biopesticides and biostimulants, fueled by ongoing research into beneficial microbes and natural compounds, is reshaping the market. The global biopesticides market is expected to reach $10.4 billion by 2025, growing at a CAGR of 13.7%, presenting significant opportunities for firms investing in advanced formulation technologies.

AI in agriculture is enhancing pest detection and yield forecasting, with the market projected to exceed $3.7 billion by mid-2024. Digital twin technology offers risk-free product simulation, reducing R&D costs and time-to-market, with the overall digital twin market anticipated to reach tens of billions by 2025.

Biotechnology is fostering crop resistance, potentially reducing reliance on chemical pesticides; GM crops already cover over 200 million hectares globally by 2024. This shift creates opportunities for complementary products like biopesticides, a market expected to surpass $12 billion by 2030.

Legal factors

The European Union's commitment to reducing chemical pesticide use is intensifying. In 2024 and into 2025, expect continued scrutiny and potential withdrawals of active substances deemed harmful to human health or the environment. For instance, the non-renewal of approvals for substances like dimethomorph and thiacloprid in recent years highlights this trend, forcing companies to innovate and develop safer alternatives. This regulatory landscape directly impacts product portfolios and R&D investment for agrochemical firms.

The EU Green Deal and its Farm to Fork Strategy establish ambitious legal targets for sustainable agriculture, profoundly impacting the agrochemical sector. These frameworks mandate significant reductions in pesticide and fertilizer use, aiming for a 50% cut in pesticide use by 2030, a goal that necessitates substantial innovation and adaptation within the industry.

While some specific legislative proposals, such as the Sustainable Use Regulation, have faced challenges and withdrawals, the core principles remain. These principles continue to drive the development of future regulations focused on promoting organic farming, enhancing biodiversity, and strengthening environmental protection measures across the EU.

Companies like Isagro must proactively integrate these long-term legal and policy directives into their strategic planning. This includes investing in research and development for more environmentally friendly crop protection solutions and adapting business models to align with the EU's evolving sustainability agenda.

The European Union is actively working to harmonize and simplify the regulatory landscape for biostimulants and biopesticides. This initiative aims to reduce the time and complexity involved in bringing these environmentally friendly agricultural inputs to market, with new regulations expected to be fully implemented by 2025.

Streamlined approval processes are projected to significantly accelerate market entry for companies like Isagro, which focus on biological solutions. For instance, the EU's Fertilising Products Regulation (FPR), which came into effect in July 2022, already provides a pathway for certain biostimulants to be marketed across member states, indicating a trend towards greater market access.

This evolving legal framework is vital for fostering growth in the biologicals sector, as clearer guidelines reduce uncertainty and encourage investment in research and development. The market for biopesticides and biostimulants in Europe was valued at approximately €2.5 billion in 2023 and is forecast to grow substantially in the coming years, partly due to this regulatory support.

Product Registration and Intellectual Property Rights

Isagro's business hinges on successfully navigating the intricate and expensive process of registering new agrochemical products. This involves submitting comprehensive data to regulatory bodies, demonstrating strict adherence to safety and efficacy standards. For instance, the European Food Safety Authority (EFSA) continuously updates its guidelines, impacting the data requirements and timelines for new active substance approvals, which can stretch for years.

Protecting intellectual property (IP) for proprietary molecules and formulations is paramount for R&D-driven companies like Isagro. This safeguards their significant investments in innovation and preserves their competitive edge in the market. The duration and scope of patent protection, such as the typical 20-year patent life for new chemical entities, directly influence a company's ability to recoup R&D costs and generate future revenue streams.

- Product Registration Costs: Developing and registering a new pesticide can cost upwards of $250 million globally, with significant portions allocated to safety and environmental studies.

- IP Protection Value: Strong patent portfolios allow companies to command premium pricing and prevent generic competition for a defined period, crucial for recouping R&D expenditure.

- Regulatory Timelines: Delays in regulatory approval processes, which can extend beyond the initial projected timelines, directly impact market entry and revenue generation for new products.

- IP Law Evolution: Changes in patentability criteria or enforcement mechanisms for agrochemical innovations can significantly alter a company's long-term strategic planning and investment decisions.

International Trade Agreements and Standards

International trade agreements and varying pesticide residue standards across different countries present significant hurdles for companies like Isagro. Navigating these differences is crucial for avoiding trade disruptions and maintaining access to key export markets.

Compliance with a patchwork of global regulations is non-negotiable. For instance, the European Union's Maximum Residue Levels (MRLs) are often stricter than those in other regions, requiring tailored product formulations and rigorous testing protocols. In 2024, the World Trade Organization (WTO) reported that over 70% of trade disputes involved technical barriers to trade, a category often encompassing differing product standards.

- Global Regulatory Intelligence: Companies must invest in robust systems to track and interpret evolving international trade pacts and pesticide regulations.

- Market-Specific Compliance: Adherence to diverse MRLs and registration requirements in each target market is paramount for successful market entry and sustained sales.

- Adaptable Product Development: R&D efforts need to focus on creating products that can meet a range of international standards, facilitating broader market acceptance.

- Trade Barrier Mitigation: Proactive engagement with regulatory bodies and industry associations can help anticipate and address potential trade barriers arising from standard discrepancies.

The legal landscape for agrochemicals is increasingly stringent, with a strong push towards reducing chemical pesticide use, especially within the European Union. This trend is evident in the ongoing review and potential withdrawal of active substances, impacting product portfolios and R&D investments for companies like Isagro. The EU's Farm to Fork Strategy, aiming for significant pesticide use reductions by 2030, underscores this regulatory direction.

Environmental factors

Climate change, characterized by increasingly frequent extreme weather events like droughts and floods, directly impacts agricultural yields. For instance, the UN estimates that climate change could reduce global crop yields by up to 30% by 2050. This escalating unpredictability heightens the demand for advanced crop protection solutions that bolster plant resilience and facilitate adaptation to shifting environmental conditions, making companies offering such innovations more relevant.

Growing concerns about biodiversity loss are significantly influencing agricultural practices, pushing companies like Isagro towards developing more environmentally friendly solutions. This shift is driven by the understanding that conventional agrochemicals can harm essential elements like pollinators, soil microbes, and aquatic ecosystems. For instance, the European Union’s Farm to Fork Strategy, a key policy framework through 2030, aims to reduce the overall use and risk of pesticides by 50% and the use of more hazardous pesticides by 65%, directly impacting the agrochemical sector.

Isagro is therefore incentivized to innovate in product development, focusing on solutions that actively support biodiversity and minimize their ecological footprint. This might involve creating biopesticides or crop protection agents that are less harmful to non-target organisms. The global market for biopesticides is projected to grow substantially, reaching an estimated $17.4 billion by 2028, indicating a strong market demand for such environmentally conscious products, a trend Isagro would need to align with to maintain competitiveness.

Maintaining healthy soil and safeguarding water resources from agricultural runoff is a critical environmental priority. This focus directly fuels demand for innovative solutions designed to significantly reduce nutrient losses and chemical contamination in farming operations.

Governments and agricultural bodies are increasingly promoting practices such as low-input farming and advanced, efficient nutrient management strategies to achieve these goals. For example, the European Union’s Farm to Fork Strategy aims to reduce nutrient losses by at least 50% by 2030, which directly impacts the market for soil and water management products.

Isagro's core business, centered on developing sustainable agricultural solutions, positions it favorably to meet this growing need. The company’s product portfolio, emphasizing bio-stimulants and biopesticides, directly addresses the demand for products that enhance soil health and improve water quality, aligning with global environmental directives and farmer needs for more sustainable practices.

Sustainable Resource Management

The agricultural sector faces increasing pressure to manage natural resources sustainably, with a particular focus on water conservation and energy efficiency in farming. This trend directly impacts agrochemical companies like Isagro, pushing them towards developing products and manufacturing methods that are resource-efficient and align with circular economy principles. For instance, the global water-use efficiency in agriculture is a critical concern, with reports in 2024 highlighting that inefficient irrigation practices can lead to significant water loss. Isagro's innovation in bio-based solutions and renewable inputs is crucial for meeting these evolving environmental demands.

Agrochemical companies are actively exploring ways to contribute to a circular economy by minimizing waste and maximizing resource utilization. This involves a shift towards bio-based and renewable inputs, reducing reliance on finite resources. By 2025, the market for bio-based pesticides is projected to see substantial growth, indicating a clear industry trend towards more sustainable alternatives. Isagro's investment in research and development for such solutions positions them to capitalize on this expanding market segment.

Key areas of focus for sustainable resource management include:

- Responsible water usage: Implementing technologies and practices that reduce water consumption in agricultural production.

- Energy efficiency: Optimizing energy use in the production of agrochemicals and encouraging energy-saving practices on farms.

- Circular economy integration: Developing products and processes that minimize waste and promote the reuse of materials.

- Bio-based and renewable inputs: Shifting towards inputs derived from renewable sources to reduce environmental impact.

Waste Management and Packaging Sustainability

Environmental concerns are increasingly focusing on the waste generated by agricultural inputs, particularly the packaging and disposal of agrochemical products. Isagro, like other companies in the sector, faces pressure to implement more sustainable packaging solutions. For instance, the European Union's Circular Economy Action Plan, updated in 2023, emphasizes reducing packaging waste and increasing recycling rates for materials used in agricultural products.

Companies are expected to actively participate in responsible waste management programs, reflecting a growing commitment to corporate social responsibility and environmental stewardship. This includes exploring biodegradable or recyclable packaging options and supporting take-back schemes for used products. In 2024, the global sustainable packaging market is projected to reach over $400 billion, indicating a significant shift towards eco-friendly alternatives across industries, including agriculture.

Isagro's approach to waste management and packaging sustainability is crucial for maintaining its social license to operate and meeting evolving regulatory and consumer demands. The company’s efforts in this area can also lead to cost efficiencies through reduced material usage and improved waste handling processes. By 2025, it is anticipated that a larger percentage of agrochemical packaging will be designed for reuse or efficient recycling, driven by stricter environmental regulations and market preferences.

- Packaging Waste Reduction: Growing regulatory pressure, such as the EU's updated Circular Economy Action Plan, mandates reduced packaging waste.

- Sustainable Materials: Increased adoption of biodegradable and recyclable packaging materials is becoming a market expectation.

- Corporate Responsibility: Participation in responsible waste management programs is now a key component of corporate social responsibility.

- Market Trends: The global sustainable packaging market's growth to over $400 billion by 2024 highlights a strong industry-wide shift.

The intensifying focus on climate change, with its attendant extreme weather events, directly impacts agricultural productivity and necessitates adaptive crop protection strategies. For instance, projections indicate potential crop yield reductions of up to 30% by 2050 due to climate change, amplifying the need for resilient agricultural solutions.

Biodiversity concerns are reshaping agricultural practices, driving demand for eco-friendly agrochemicals. Regulations like the EU's Farm to Fork Strategy aim to slash pesticide use by 50% by 2030, creating a market opening for biopesticides, which are expected to reach $17.4 billion by 2028.

The imperative to conserve water and soil resources is spurring innovation in nutrient management and runoff reduction. The EU's target to cut nutrient losses by 50% by 2030 underscores the market's shift towards sustainable agricultural inputs, a space where Isagro's bio-stimulant and biopesticide focus aligns well.

Resource efficiency, particularly water conservation and energy use in agriculture, is a growing priority. Reports in 2024 highlight significant water losses from inefficient irrigation, reinforcing the importance of Isagro's bio-based solutions and renewable inputs.

There's a clear trend towards circular economy principles within agriculture, emphasizing waste reduction and the use of bio-based inputs. The bio-pesticide market's projected growth by 2025 signals a strong industry move towards sustainable alternatives, a segment Isagro is well-positioned to leverage.

Packaging waste from agrochemicals is a significant environmental concern, with regulations like the EU's Circular Economy Action Plan pushing for reduced waste and increased recycling. The global sustainable packaging market, projected to exceed $400 billion by 2024, reflects this broader industry shift.

| Environmental Factor | Impact on Agriculture | Market Opportunity/Challenge for Isagro | Relevant Data/Target |

| Climate Change | Increased extreme weather, reduced crop yields | Demand for resilient crop protection solutions | Up to 30% crop yield reduction by 2050 |

| Biodiversity Loss | Need for reduced pesticide impact on non-target organisms | Growth in biopesticides market | EU: 50% pesticide use reduction by 2030; Biopesticide market to reach $17.4B by 2028 |

| Water & Soil Conservation | Pressure to reduce nutrient runoff and contamination | Demand for efficient nutrient management products | EU: 50% nutrient loss reduction by 2030 |

| Resource Efficiency | Focus on water conservation and energy use | Opportunity for bio-based and renewable inputs | 2024: Inefficient irrigation leads to significant water loss |

| Circular Economy | Emphasis on waste reduction and bio-based inputs | Shift towards sustainable packaging and materials | 2025: Growth in bio-based pesticides; Sustainable packaging market >$400B by 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Isagro is built on a comprehensive review of global agricultural market reports, regulatory updates from key farming regions, and economic forecasts from reputable financial institutions. This ensures a robust understanding of the external factors impacting the agrochemical sector.