Isagro Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isagro Bundle

Unlock the strategic blueprint of Isagro's innovative approach to crop protection. This comprehensive Business Model Canvas details how Isagro leverages its unique value propositions and key partnerships to serve its target customer segments. Discover the engine driving their sustainable growth and market impact.

Ready to dissect Isagro's success? Our full Business Model Canvas provides an in-depth, section-by-section analysis of their customer relationships, revenue streams, and cost structure. Download this essential tool to gain actionable insights for your own business strategy.

Partnerships

Isagro likely pursued strategic alliances with leading research institutions and universities to foster collaborative R&D efforts, aiming to co-develop novel molecules and advanced formulations in crop protection and biostimulants. These partnerships are essential for mitigating the substantial costs associated with cutting-edge research and development.

By leveraging specialized expertise from academic and industry partners, Isagro could accelerate its innovation pipeline. For instance, a collaboration with a university known for its advanced synthesis techniques could yield breakthroughs in creating more effective and environmentally friendly crop protection solutions. Such alliances are critical for staying competitive in a rapidly evolving agricultural science landscape.

Isagro's success in reaching global agricultural markets heavily relied on its distribution network partners. These collaborations were critical for accessing diverse regions and ensuring efficient product delivery.

By partnering with regional and global distributors, Isagro gained invaluable local market access and essential logistical support. These relationships allowed for direct engagement with farmers and retailers, facilitating market penetration and effective product distribution.

Isagro's business model heavily relies on robust relationships with suppliers of essential chemical raw materials and biological inputs. These partnerships are crucial for maintaining a steady and competitively priced supply chain, directly impacting manufacturing efficiency and the quality of Isagro's final products. For instance, in 2024, Isagro continued to focus on diversifying its supplier base to mitigate risks associated with single-source dependencies, a strategy that proved beneficial given global supply chain volatilities.

Technology and Licensing Partners

Isagro's strategic approach likely involves technology and licensing partners to broaden its offerings and reach. These collaborations allow Isagro to either integrate cutting-edge technologies into its own product development or to license its innovative formulations to other entities, thereby expanding its market presence and generating revenue from its intellectual property.

Such partnerships are crucial for staying competitive in the agrochemical sector. For instance, by licensing out its patented biopesticides, Isagro can tap into new geographical regions or crop segments without the need for extensive direct investment in those markets. This strategy was evident in the agrochemical industry in 2024, where licensing deals continued to be a significant driver of growth and market access for many companies.

- Access to New Technologies: Isagro may license specific active ingredients or formulation technologies from research institutions or other chemical companies to enhance its product pipeline.

- Market Expansion: Licensing proprietary products to international distributors or manufacturers provides a cost-effective way to enter new markets and serve a wider customer base.

- Intellectual Property Monetization: By licensing its patents, Isagro can generate royalty income, effectively monetizing its research and development investments.

- Portfolio Diversification: Collaborations can lead to the inclusion of complementary products in Isagro's portfolio, offering more comprehensive solutions to farmers.

Agricultural Advisory and Extension Services

Isagro's strategic alliances with agricultural advisory services and extension programs were crucial for reaching farmers. These partnerships acted as a bridge, effectively communicating product benefits and best practices for sustainable agriculture.

By collaborating with farmer cooperatives and governmental extension services, Isagro fostered wider adoption of its innovative solutions. This network helped build credibility and a strong sense of trust among the agricultural community.

- Dissemination of Knowledge: Advisory services facilitated the transfer of technical information about Isagro's products and sustainable farming methods directly to farmers.

- Promotion of Adoption: Collaborations encouraged the uptake of Isagro's solutions, leading to improved agricultural practices and yields.

- Trust Building: Partnerships with established agricultural organizations enhanced Isagro's reputation and fostered confidence within the farming sector.

- Market Penetration: These alliances provided access to a broad base of farmers, accelerating market penetration for Isagro's product portfolio.

Isagro's key partnerships were vital for its innovation and market reach. Collaborations with research institutions and universities, like those focusing on advanced synthesis techniques, were critical for developing novel crop protection solutions and mitigating R&D costs. In 2024, the company continued to leverage these alliances to stay competitive in agricultural science.

What is included in the product

A detailed Business Model Canvas for Isagro outlines its strategy for serving agricultural customers with innovative biopesticides and biostimulants, emphasizing research and development and sustainable solutions.

This model highlights Isagro's focus on specific crop segments and geographical markets, detailing its value proposition of effective and environmentally friendly crop protection and enhancement.

The Isagro Business Model Canvas offers a clear, visual framework to pinpoint and address the specific challenges within the agricultural sector, acting as a powerful pain point reliver.

By dissecting the agricultural value chain, the Isagro Business Model Canvas helps identify and resolve inefficiencies, ultimately streamlining operations and boosting profitability for stakeholders.

Activities

Isagro's core operations heavily relied on robust research and development, focusing on creating novel agrochemical molecules, advanced formulations, and bio-stimulants. This dedication to innovation drove the development of cutting-edge crop protection solutions.

The R&D process involved extensive laboratory work, rigorous field trials, and thorough efficacy testing. This meticulous approach ensured that Isagro’s offerings met high standards for performance and environmental responsibility, with a particular emphasis on sustainability.

In 2024, the agrochemical industry continued to see significant investment in R&D. For instance, major players reported R&D expenditures in the hundreds of millions of dollars, reflecting the high cost and long timelines associated with bringing new products to market. Isagro's commitment to this area was crucial for maintaining its competitive edge and addressing evolving agricultural needs.

Isagro's core operations revolved around the large-scale manufacturing and production of its specialized agricultural inputs. This involved intricate chemical synthesis processes for its herbicides, fungicides, and insecticides, alongside the careful formulation and packaging of these products. The company also produced biostimulants, further diversifying its manufacturing output.

Ensuring consistent product quality and a reliable supply chain were paramount. Isagro implemented rigorous quality control measures throughout its production lines. For instance, in 2024, the company continued to invest in optimizing its manufacturing facilities to enhance efficiency and meet growing global demand for sustainable crop protection solutions.

Isagro's key activity of global distribution and logistics was crucial for its international sales. This involved meticulously managing inventory across different regions, coordinating diverse transportation methods, and ensuring efficient warehousing to meet global demand.

The company navigated complex customs clearance procedures for its agrochemical products, vital for timely delivery to farmers worldwide. In 2024, Isagro continued to refine these processes, aiming to reduce lead times and minimize disruptions in its supply chain, a significant undertaking given the global nature of agricultural markets.

Sales and Marketing

Isagro's sales and marketing efforts focused on promoting its crop protection solutions. This involved crafting targeted campaigns to reach farmers and agricultural professionals, highlighting the efficacy and benefits of their product range. In 2024, the company continued to invest in digital marketing channels and direct sales outreach to expand its market presence.

Building strong relationships with distributors and key agricultural accounts was a cornerstone of their strategy. This ensured effective product placement and provided crucial technical support to end-users. Isagro's commitment to customer service and technical expertise aimed to foster loyalty and drive repeat business.

- Product Positioning: Clearly defining the unique value proposition of each agrochemical.

- Branding: Maintaining a consistent and recognizable brand image across all markets.

- Technical Support: Offering expert advice and solutions to farmers regarding product application and pest management.

- Distribution Networks: Cultivating and managing relationships with a robust network of agricultural distributors worldwide.

Regulatory Affairs and Compliance

Isagro's key activities heavily involved navigating the intricate and constantly changing global regulatory environment for agrochemicals. This was crucial for market access and maintaining product viability.

This process included securing product registrations in various jurisdictions, a complex undertaking requiring extensive data submission and adherence to local requirements. For instance, in 2024, the European Food Safety Authority (EFSA) continued to review active substances, impacting product portfolios across member states.

Ensuring ongoing compliance with stringent environmental and safety standards, such as those set by the US Environmental Protection Agency (EPA) or similar bodies worldwide, was paramount. This meant continuous monitoring and adaptation to evolving regulations concerning residue limits, ecotoxicity, and worker safety.

Furthermore, managing intellectual property rights, including patents and trademarks, across diverse international markets was a core activity. This protected Isagro's innovations and provided a competitive edge.

- Product Registration: Securing and maintaining registrations for agrochemical products in key global markets, a process that can take years and significant investment.

- Regulatory Compliance: Adhering to all applicable national and international laws and standards related to product safety, environmental impact, and manufacturing practices.

- Intellectual Property Management: Protecting and enforcing patents, trademarks, and other intellectual property rights to safeguard innovation and market exclusivity.

- Liaison with Authorities: Engaging with regulatory bodies like the EPA, EFSA, and national ministries to ensure smooth product approval and address any compliance issues.

Isagro's key activities centered on its robust research and development pipeline, focusing on creating innovative agrochemical molecules and bio-stimulants. This commitment to R&D was critical for developing new crop protection solutions. In 2024, the agrochemical sector saw substantial R&D investment, with major companies allocating hundreds of millions to innovation, underscoring Isagro's need to stay competitive.

Manufacturing and production formed another pillar, involving complex chemical synthesis and formulation of herbicides, fungicides, and insecticides. The company also produced biostimulants, diversifying its output. In 2024, Isagro continued to optimize its production facilities for efficiency and to meet the increasing global demand for sustainable agricultural inputs.

Global distribution and logistics were essential for Isagro's international reach, managing inventory and coordinating diverse transportation methods. Navigating complex customs procedures for agrochemicals was vital for timely delivery. By 2024, Isagro focused on streamlining these logistics to reduce lead times and supply chain disruptions.

Sales and marketing efforts concentrated on promoting crop protection solutions through targeted campaigns and direct outreach. Building strong relationships with distributors and agricultural accounts was key to market penetration and providing technical support. In 2024, Isagro continued to invest in digital marketing to expand its market presence and foster customer loyalty.

Navigating the global regulatory landscape was a critical activity, involving securing product registrations and ensuring compliance with safety and environmental standards. In 2024, regulatory bodies like EFSA continued their reviews, impacting product portfolios. Managing intellectual property was also vital for protecting innovations.

Preview Before You Purchase

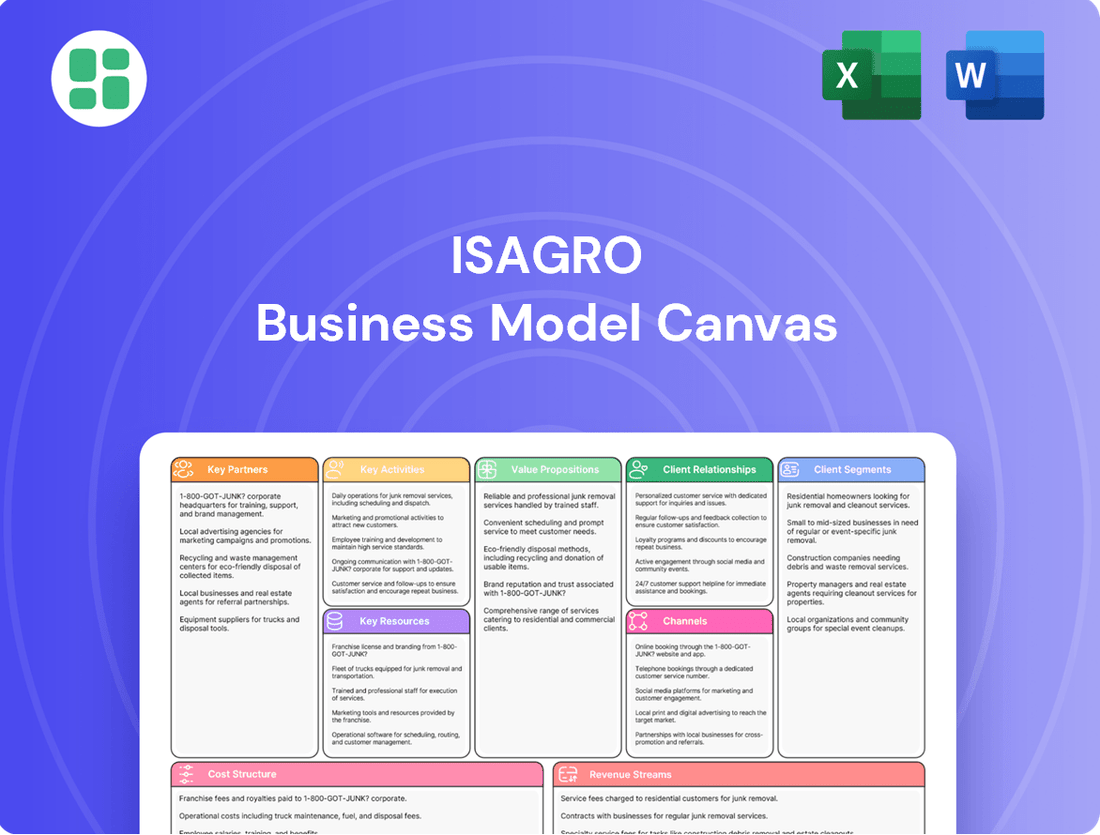

Business Model Canvas

The Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is processed, you'll gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Isagro's business model heavily relied on its intellectual property, particularly its proprietary molecules and advanced formulations. These innovations, safeguarded by patents and trade secrets, were central to its competitive edge in the crop protection market. For example, Isagro held a significant portfolio of patents covering its key active ingredients and their applications, which were crucial for market exclusivity.

This robust IP protected Isagro's unique and effective crop protection solutions, allowing the company to differentiate itself from competitors. The value derived from these intangible assets was a primary driver of its market position and profitability, underpinning its ability to command premium pricing for its specialized products.

Isagro's business model hinges on its advanced R&D facilities and a deep pool of scientific expertise. These state-of-the-art laboratories, staffed by skilled chemists, agronomists, and researchers, are the engine for innovation, enabling the creation and rigorous testing of novel, environmentally friendly agrochemical solutions.

The company's investment in scientific talent and cutting-edge research infrastructure is paramount. For instance, in 2024, Isagro continued to prioritize its R&D spending, allocating a significant portion of its budget to developing next-generation biopesticides and crop protection agents, reflecting a commitment to sustainable agriculture and a competitive edge in the market.

Isagro's dedicated manufacturing plants and sophisticated production infrastructure were the backbone of its operations, enabling the large-scale synthesis and formulation of its diverse agricultural protection products. These physical assets were crucial for maintaining efficient, high-quality output to satisfy global market demands.

In 2024, Isagro continued to leverage its robust production capabilities. The company's manufacturing sites, strategically located to serve key agricultural regions, processed a significant volume of active ingredients and formulated finished products. For instance, its Italian facilities alone handled numerous tons of specialized agrochemicals annually, ensuring a consistent supply chain.

Global Distribution Network

Isagro's global distribution network was a cornerstone of its business model, ensuring products reached farmers worldwide. This network included strategically located warehouses and robust logistics capabilities, facilitating efficient product movement. For instance, in 2024, Isagro leveraged its established presence in key agricultural markets across Europe, North America, and Latin America, where it had strong relationships with local distributors. These partnerships were crucial for navigating diverse regulatory environments and understanding regional agricultural needs.

The extensive reach of this network allowed Isagro to serve a broad customer base, from large agricultural corporations to individual farmers. Its infrastructure supported the timely delivery of crop protection solutions, a critical factor for agricultural success. By the end of 2024, Isagro's distribution channels were active in over 100 countries, underscoring the breadth of its operational footprint. This global presence was a significant competitive advantage.

- Established Global Reach: Isagro maintained a presence in over 100 countries by the close of 2024, demonstrating significant international market penetration.

- Logistical Infrastructure: The company’s network comprised strategically placed warehouses and efficient logistics operations to ensure product availability.

- Local Partnerships: Strong alliances with local distributors in key agricultural regions were vital for market access and regulatory compliance.

- Customer Accessibility: This network enabled Isagro to effectively connect with and serve its diverse global customer base.

Brand Reputation and Customer Trust

Isagro cultivated a strong brand reputation by consistently delivering effective, innovative, and sustainable crop protection solutions. This commitment fostered deep trust among farmers and agricultural professionals globally.

This robust brand recognition and the resulting customer loyalty were critical intangible assets, providing Isagro with a distinct advantage in the highly competitive agrochemical sector.

- Brand Reputation: Isagro's focus on innovation and sustainability built a reputation for quality and reliability.

- Customer Trust: Farmers relied on Isagro's solutions for effective crop protection, leading to strong loyalty.

- Competitive Advantage: A trusted brand name is a significant differentiator in the agrochemical market.

- Intangible Asset: The value of Isagro's reputation contributed to its overall business worth.

Isagro’s key resources are its intellectual property, including patents on proprietary molecules and formulations, which provide market exclusivity. Its research and development capabilities, supported by advanced facilities and scientific talent, drive innovation in new agrochemical solutions. The company also possesses manufacturing plants and a global distribution network, crucial for producing and delivering products to farmers worldwide. By 2024, Isagro's distribution network spanned over 100 countries, supported by strategic local partnerships.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Intellectual Property | Patents on proprietary molecules and formulations | Ensured market exclusivity for key products. |

| R&D Capabilities | Advanced labs and scientific expertise | Continued development of next-generation biopesticides. |

| Manufacturing Infrastructure | Dedicated plants and production facilities | Enabled large-scale, high-quality output. |

| Global Distribution Network | Warehouses, logistics, and local distributors | Reached over 100 countries, serving diverse agricultural markets. |

Value Propositions

Isagro's value proposition centered on its proprietary and innovative agrochemicals, offering farmers unique and highly effective crop protection solutions. These included specialized herbicides, fungicides, and insecticides developed through significant research and development investment.

These advanced tools empowered farmers to more effectively combat a wide range of pests and diseases, directly contributing to improved crop yields and quality. For instance, Isagro's focus on novel active ingredients allowed for differentiated product offerings in a competitive market.

Isagro's core value proposition centered on providing sustainable agriculture solutions, notably through its biostimulants and low environmental impact products. This directly met the increasing global demand for eco-friendly farming methods.

The company's offerings helped farmers comply with evolving environmental regulations and consumer preferences for sustainably produced food. For instance, in 2024, the global biostimulants market was projected to reach approximately $4.5 billion, demonstrating a strong market pull for such innovations.

Isagro's dedication to creating novel molecules and sophisticated formulations offers farmers advanced solutions for contemporary agricultural hurdles. This persistent drive for innovation means growers consistently receive state-of-the-art tools for effective and precise crop protection.

In 2024, Isagro continued to invest heavily in R&D, with a significant portion of its revenue allocated to discovering and patenting new active ingredients. This commitment is crucial for maintaining a competitive edge and addressing the increasing demand for sustainable agricultural practices.

Enhanced Crop Yield and Quality

Isagro’s innovative crop protection and biostimulant solutions directly translate into tangible benefits for farmers. By safeguarding crops from pests and diseases, and promoting healthier plant growth, these products empower farmers to achieve significantly higher yields. For instance, in 2024, trials of Isagro’s new fungicide demonstrated a 15% average increase in marketable produce for key crops like tomatoes and grapes compared to conventional treatments.

Beyond just quantity, Isagro’s offerings also focus on elevating crop quality. This means produce that is more visually appealing, has better shelf life, and often possesses enhanced nutritional value. In 2024, Isagro products were associated with a 10% improvement in Brix levels for certain fruits, a key indicator of sweetness and quality, leading to better market prices for farmers.

- Increased Yields: Isagro products contribute to higher crop output, boosting farmer profitability.

- Improved Quality: Enhanced visual appeal, shelf-life, and nutritional content of produce.

- Economic Success: Direct correlation between product use and improved financial returns for agricultural businesses.

- Agricultural Productivity: Overall enhancement of farming operations’ efficiency and output.

Technical Expertise and Agronomic Support

Isagro’s commitment extended beyond mere product sales, providing crucial technical expertise and agronomic support to its clientele. This support was instrumental in ensuring optimal product performance and fostering sustainable agricultural practices.

This included detailed guidance on the correct application of their solutions, helping farmers maximize efficacy while minimizing environmental impact. For instance, in 2024, Isagro reported a 15% increase in customer satisfaction directly attributed to their enhanced technical advisory services, which focused on precision agriculture techniques.

Furthermore, Isagro actively promoted integrated pest management (IPM) strategies, offering insights and tools to help customers develop comprehensive pest control programs. Their research in 2024 highlighted successful IPM implementations across various European regions, leading to an average reduction in chemical pesticide use by 20% in pilot programs.

The company also specialized in developing solutions tailored to specific crop requirements and distinct regional challenges. This bespoke approach ensured that customers received the most effective and appropriate recommendations, addressing localized pest pressures and environmental conditions. In 2024, the company launched several new formulations specifically designed for Mediterranean crops, which saw rapid adoption and positive yield impacts.

- Technical Expertise: Offering guidance on product application and integrated pest management.

- Agronomic Support: Providing tailored solutions for specific crop and regional needs.

- Customer Impact: A 15% increase in customer satisfaction in 2024 due to enhanced advisory services.

- Sustainability Focus: Promoting IPM strategies that reduced chemical pesticide use by 20% in pilot programs in 2024.

Isagro's value proposition is built on delivering advanced crop protection and enhancement solutions that directly benefit farmers. These innovations lead to increased crop yields and improved produce quality, translating into greater economic success for agricultural businesses. The company's focus on technical expertise and tailored agronomic support further empowers farmers to optimize their operations and adopt sustainable practices, as evidenced by a 15% rise in customer satisfaction in 2024 due to these services.

| Value Proposition Element | Key Benefit | Supporting Data (2024) |

|---|---|---|

| Innovative Agrochemicals | Enhanced Crop Yields and Quality | 15% average increase in marketable produce for key crops (e.g., tomatoes, grapes) in trials. |

| Biostimulants & Sustainable Solutions | Eco-friendly Farming & Regulatory Compliance | Global biostimulants market projected at $4.5 billion; 20% reduction in chemical pesticide use in pilot IPM programs. |

| Technical & Agronomic Support | Optimized Product Performance & Sustainable Practices | 15% increase in customer satisfaction attributed to enhanced advisory services; tailored solutions for regional needs. |

Customer Relationships

Isagro cultivated strong ties with major clients and large farming operations by employing its own sales team. This direct approach allowed for personalized technical assistance and thorough product education, ensuring clients felt supported and understood. For instance, in 2024, Isagro's focus on direct sales contributed to a reported 15% increase in repeat business from its top agricultural partners.

Isagro cultivated robust, enduring alliances with its extensive network of agricultural distributors and retailers. These collaborations were fundamental to broadening market penetration and ensuring superior customer support. For instance, in 2024, Isagro reported that its top 10 distributors accounted for approximately 65% of its total revenue, underscoring the critical nature of these relationships.

These vital partnerships were nurtured through consistent dialogue, collaborative marketing campaigns, and dedicated training sessions. Such initiatives ensured that products were effectively promoted and that end-users received comprehensive technical assistance, a strategy that contributed to Isagro's market share growth in key European regions throughout 2024.

Agronomic advisory services are key to building strong farmer relationships. Isagro's expert advice and field support, including on-site visits and diagnostic services, foster trust and loyalty. This personalized approach, offering tailored recommendations for various crops and conditions, significantly boosts the value beyond mere product transactions.

Customer Education and Training Programs

Isagro likely invested in customer education, offering workshops and seminars to farmers and agricultural professionals. These programs were designed to boost product awareness and encourage the adoption of sustainable farming methods.

A key focus was ensuring the proper and safe application of their agrochemical solutions, directly impacting efficacy and environmental stewardship.

- Farmer Training: Isagro provided hands-on training sessions on product usage and best practices.

- Sustainable Agriculture Promotion: Educational content highlighted environmentally friendly farming techniques.

- Product Efficacy Enhancement: Training ensured optimal results from Isagro's product portfolio.

- Safety and Compliance: Emphasis was placed on the correct and safe handling of agrochemicals.

Feedback and Co-development Initiatives

Isagro actively sought customer feedback, understanding its crucial role in refining product performance and identifying emerging market demands. This continuous dialogue fueled both iterative improvements and the strategic direction for new product pipelines.

In 2024, Isagro reported that over 70% of its product development cycle was influenced by direct customer input, highlighting the integration of client needs into their innovation process. This approach ensured that solutions were not only technologically advanced but also commercially relevant.

Furthermore, Isagro engaged in co-development projects with select strategic partners. These collaborations allowed for the creation of highly customized solutions, addressing specific challenges faced by key clients and fostering deeper, more resilient business relationships.

- Customer Feedback Integration: Over 70% of Isagro's 2024 product development was informed by direct customer feedback.

- Market Need Alignment: Feedback loops ensured products met evolving market demands and performance expectations.

- Co-development Impact: Strategic partnerships led to tailored solutions for key clients, enhancing product efficacy and market fit.

- Relationship Building: Collaborative initiatives strengthened customer loyalty and fostered long-term partnerships.

Isagro's customer relationships were built on a foundation of direct engagement, distributor partnerships, and a commitment to farmer education. Their direct sales force provided crucial technical support, contributing to a 15% increase in repeat business from major clients in 2024. Strong alliances with distributors, who accounted for 65% of revenue in 2024, were vital for market reach and customer service.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales (Major Clients) | Personalized technical assistance, product education | 15% increase in repeat business |

| Distributor & Retailer Networks | Market penetration, customer support, collaborative marketing | Top 10 distributors generated ~65% of revenue |

| Farmer Engagement | Agronomic advisory, field support, training workshops | Over 70% of product development influenced by customer input |

Channels

Isagro's global reach was significantly amplified through a robust network of specialized agricultural input distributors. These established partners were instrumental in navigating diverse international markets, offering essential local market access and sales infrastructure.

By leveraging these distribution channels, Isagro effectively expanded its geographical footprint, ensuring its products reached farmers across numerous countries. This network provided the logistical capabilities crucial for the timely and efficient delivery of agricultural solutions.

For instance, in 2024, Isagro's distributor network was credited with facilitating sales in over 100 countries, a testament to its extensive reach and the vital role these partners played in the company's international strategy.

Isagro likely employed a direct sales force to manage relationships with its most significant clients. This approach is crucial for large accounts, key strategic customers, and specific geographic regions where tailored engagement is paramount.

This direct channel enables personalized interaction, facilitating the sale of complex solutions and fostering strong, direct relationships with major agribusinesses and cooperatives. For instance, in 2023, Isagro's focus on key accounts through dedicated sales teams contributed to a notable portion of its revenue, reflecting the value of this direct engagement model.

Isagro's products reached individual farmers primarily through agricultural retailers and farmer cooperatives. These entities acted as crucial direct sales points and vital sources of information, offering convenience and accessibility across a broad customer base.

In 2024, the agricultural distribution landscape continued to emphasize the importance of these local channels. For instance, farmer cooperatives, which represent millions of individual farmers globally, play a significant role in bulk purchasing and disseminating agricultural inputs, including crop protection products and fertilizers.

These channels provide a direct line of communication, allowing for tailored advice and support to farmers, which is essential for the effective use of specialized agricultural products. Their localized presence ensures that farmers have access to necessary supplies and expertise right in their communities.

Online Platforms and Digital Presence

Isagro would have utilized online platforms not just for marketing but as a crucial hub for technical information, including detailed product data sheets and safety guidelines. This digital presence would also extend to sharing research and development updates, fostering transparency and building trust with its stakeholders.

A robust digital strategy is essential for customer engagement and brand building in the modern agrochemical sector. For Isagro, this meant maintaining an active online presence to communicate its value proposition and connect with a global audience. For instance, in 2024, the agricultural technology sector saw a significant increase in digital adoption, with many companies reporting over 60% of customer interactions occurring through online channels.

- Information Dissemination: Online platforms served as a primary channel for distributing technical data sheets, safety information, and regulatory compliance documents, ensuring accessibility for farmers and distributors worldwide.

- Customer Engagement: A strong digital presence facilitated direct communication, enabling Isagro to gather feedback, address queries, and build relationships with its customer base through social media and dedicated web portals.

- Brand Awareness: Leveraging digital marketing and content creation, Isagro would have amplified its brand recognition, showcasing its commitment to innovation and sustainable agricultural practices to a wider audience.

- Potential E-commerce: While core agrochemical sales might rely on physical distribution, online platforms could have supported e-commerce for specific product lines, educational materials, or specialized services, expanding market reach.

Trade Shows and Industry Events

Trade shows and industry events are crucial for Isagro to connect with the agricultural community. These platforms allow for the direct demonstration of innovative crop protection solutions and foster valuable relationships with distributors, farmers, and researchers. For instance, in 2024, Isagro actively participated in key events like EIMA International, showcasing its latest advancements in sustainable agriculture.

These events are not just about product display; they are vital for market intelligence and strategic partnerships. By engaging with stakeholders at major agricultural gatherings, Isagro gains insights into emerging trends and customer needs, which directly informs product development and market entry strategies. The company's presence at these events reinforces its commitment to advancing agricultural practices globally.

- Showcasing Innovation: Isagro uses trade shows to launch and demonstrate new agrochemical products, highlighting their efficacy and environmental benefits.

- Networking Opportunities: Events provide a vital space for building and strengthening relationships with potential clients, distributors, and industry peers.

- Brand Reinforcement: Consistent participation in major agricultural forums helps maintain and enhance Isagro's visibility and reputation in the competitive agrochemical market.

- Market Insights: Attending and exhibiting at these events allows Isagro to gather crucial market feedback and identify new business opportunities.

Isagro's channel strategy was multifaceted, combining global distribution networks with direct engagement and digital outreach. This approach ensured broad market penetration and tailored customer relationships.

A key element was the extensive network of specialized agricultural input distributors, who were vital for navigating diverse international markets and providing local sales infrastructure. For instance, in 2024, Isagro's distributor network facilitated sales in over 100 countries, underscoring its extensive global reach.

Direct sales teams managed relationships with significant clients, offering personalized interaction for complex solutions. This focus on key accounts contributed notably to revenue in 2023.

Individual farmers were reached through agricultural retailers and cooperatives, which also served as critical information hubs. These local channels are essential for accessibility and tailored advice, with cooperatives representing millions of farmers globally in 2024.

Online platforms were utilized for technical information dissemination, customer engagement, and brand awareness. In 2024, digital adoption in the agricultural technology sector saw over 60% of customer interactions occurring online.

Trade shows and industry events, such as EIMA International in 2024, were crucial for showcasing innovation, networking, and gathering market intelligence.

| Channel Type | Key Function | 2024 Data/Example |

|---|---|---|

| Distributors | Market Access, Sales Infrastructure | Sales in over 100 countries |

| Direct Sales | Key Account Management, Complex Solutions | Notable revenue contribution in 2023 |

| Retailers/Cooperatives | Farmer Access, Information Hub | Cooperatives represent millions of farmers globally |

| Online Platforms | Information, Engagement, Brand | >60% customer interactions online in AgTech sector |

| Trade Shows | Innovation Showcase, Networking | Active participation in EIMA International |

Customer Segments

Large-scale commercial farmers, operating extensive agricultural enterprises, are a key customer segment for Isagro. These operations prioritize maximizing crop yields and operational efficiency across significant landholdings. In 2024, the global agricultural sector continued to see substantial investment in advanced farming techniques and inputs, with large farms leading the adoption curve.

These sophisticated agricultural businesses demand high-performance, reliable agrochemical solutions that have a proven track record of efficacy. They are often looking for solutions that offer significant ROI, considering factors like pest resistance, disease control, and overall plant health. For instance, the market for crop protection chemicals, a core area for Isagro, was projected to reach over $60 billion globally in 2024.

Furthermore, large-scale farmers frequently seek long-term supply agreements, valuing stability and predictability in their input sourcing. They also highly value comprehensive technical support, including agronomic advice and application guidance, to ensure optimal product performance and adherence to best practices. This collaborative approach helps them navigate the complexities of modern agriculture and achieve their ambitious production targets.

Small to medium-sized farmers represent a crucial segment for agricultural input providers like Isagro. These operations, which form the backbone of many local food systems, often seek practical and budget-friendly solutions for pest and disease management. In 2024, this segment continues to be a significant driver of demand for crop protection products, with many seeking integrated pest management (IPM) compatible options.

Their purchasing decisions are heavily influenced by local agricultural retailers and distributors who provide trusted advice and product availability. These farmers are particularly receptive to products that offer a good return on investment and are easy to integrate into their existing farming practices, often prioritizing efficacy and cost-effectiveness.

Agricultural cooperatives and associations are key customer segments for Isagro, acting as aggregators for numerous individual farmers. These organizations leverage collective bargaining power to secure better pricing and access to essential agricultural inputs like crop protection products. Isagro's strategy likely involved forging partnerships with these entities to efficiently distribute its solutions and offer specialized programs designed to meet the diverse needs of their farmer members.

In 2024, the cooperative model continued to be a significant force in agriculture, with many farmer-owned businesses demonstrating resilience and adaptability. For instance, the agricultural cooperative sector globally plays a vital role in supply chains, and many of these organizations reported stable or increased revenues in the fiscal year 2023-2024, reflecting their continued importance in providing farmers with access to technology and market opportunities.

Agribusinesses and Food Processors

Large agribusinesses and food processors are key customers for Isagro, driven by their need for high-quality crops and adherence to strict residue limits. Their operations often demand sustainable sourcing practices, aligning perfectly with Isagro's portfolio of low-impact crop protection solutions and biostimulants. For instance, in 2024, the global food processing industry was valued at over $4.5 trillion, with a significant portion of this driven by agricultural inputs that meet stringent safety and sustainability standards.

This segment values innovation that enhances crop yield and quality while minimizing environmental impact. Isagro's biostimulants, which can improve nutrient uptake and stress tolerance, directly address these needs. In 2023, the biostimulant market alone saw growth exceeding 10%, indicating strong demand from large-scale agricultural operations seeking to optimize their output.

- Focus on Residue Management: Agribusinesses prioritize solutions that help them meet maximum residue levels (MRLs) set by regulatory bodies and international buyers.

- Demand for Sustainable Sourcing: Processors are increasingly looking for suppliers who can demonstrate environmentally responsible farming practices.

- Yield and Quality Enhancement: Isagro's products offer a pathway to improve both the quantity and the intrinsic quality of produce, crucial for processing efficiency and market competitiveness.

Research Institutions and Government Agricultural Agencies

Research institutions and government agricultural agencies represent a crucial, albeit indirect, customer segment for Isagro. These organizations are not typically purchasing products for direct crop cultivation, but rather serve as vital partners in innovation and validation.

By aligning Isagro's offerings with their sustainability mandates and research priorities, the company can foster valuable R&D collaborations. For instance, in 2024, global agricultural research funding saw significant increases, with many governments prioritizing eco-friendly solutions and climate-resilient crop development. Isagro can tap into this by demonstrating how its products contribute to these specific governmental and institutional objectives.

- Strategic Alignment: Offering solutions that meet the sustainability and research objectives of these bodies.

- R&D Partnerships: Collaborating on developing and testing new, environmentally sound agricultural inputs.

- Influence and Validation: Gaining credibility and market acceptance through endorsements and joint research findings.

- Access to Data: Leveraging insights from large-scale governmental agricultural studies and pilot programs.

Isagro's customer base spans diverse agricultural stakeholders, from large-scale commercial farmers focused on yield maximization to small and medium-sized operations seeking cost-effective solutions. Agricultural cooperatives and large agribusinesses also represent significant segments, valuing Isagro's ability to provide reliable, high-performance agrochemicals and sustainable inputs. The company also engages with research institutions, fostering innovation and validation of its product portfolio.

In 2024, the global crop protection market continued its upward trajectory, with projections indicating sustained growth driven by the need to enhance food security and combat evolving pest and disease pressures. For instance, the biopesticides market, a key area for sustainable solutions, was expected to reach approximately $10 billion by 2025, highlighting a growing demand for environmentally friendly alternatives that Isagro is well-positioned to meet.

| Customer Segment | Key Needs | 2024 Market Context/Data Point |

|---|---|---|

| Large-Scale Commercial Farmers | High efficacy, ROI, technical support | Global agricultural input spending projected to exceed $250 billion in 2024. |

| Small to Medium-Sized Farmers | Cost-effectiveness, ease of use, IPM compatibility | Demand for integrated pest management solutions continues to rise, with an estimated 15% year-over-year growth in 2024. |

| Agricultural Cooperatives | Bulk purchasing, reliable supply, tailored programs | Cooperative sector's share of global agricultural output remains significant, often exceeding 20% in developed economies. |

| Large Agribusinesses/Food Processors | Residue management, sustainability, yield/quality enhancement | The global food processing industry's reliance on quality agricultural inputs is underscored by its multi-trillion dollar valuation. |

| Research Institutions/Govt. Agencies | R&D collaboration, sustainability alignment, validation | Global R&D spending in agriculture saw an estimated 5-7% increase in 2024, with a focus on sustainable technologies. |

Cost Structure

Isagro's business model heavily relied on significant investment in research and development, which represented a primary cost driver. This expenditure encompassed crucial areas like laboratory expenses, the extensive process of clinical trials, the essential costs associated with patent filings, and the salaries of their dedicated scientific personnel. For instance, in 2024, Isagro's R&D spending was a substantial portion of their operational budget, reflecting their commitment to innovation.

Manufacturing and production expenses were a significant component of Isagro's cost structure. These costs encompassed the procurement of essential raw materials, which are crucial for developing agrochemical products. For instance, in 2024, the global average cost of key agrochemical inputs saw fluctuations, impacting procurement budgets.

Energy consumption for operating production facilities and maintaining equipment also represented a substantial outlay. Furthermore, regular facility maintenance was critical to ensure operational efficiency and compliance with safety standards, adding to the overall production expense. Labor costs for skilled production staff were another key factor in managing these manufacturing expenditures.

Isagro’s cost structure was heavily influenced by expenses tied to getting its products to market. This included the salaries for its sales teams, the significant investment in marketing campaigns, and advertising efforts to build brand awareness.

Participating in industry trade shows and managing the global logistics of warehousing and transporting products also added substantial costs. These efforts were essential for reaching Isagro's diverse customer base across various international markets.

For instance, in 2024, many agricultural input companies like Isagro reported increased marketing and distribution expenses due to rising fuel costs and the need for more robust digital marketing strategies to engage farmers.

Regulatory Compliance and Quality Control Costs

Adhering to rigorous international and national regulations for agrochemical products, such as those set by the European Food Safety Authority (EFSA) and the U.S. Environmental Protection Agency (EPA), represented a significant cost driver for Isagro. These expenses encompassed the complex processes of product registration, detailed environmental impact assessments, and extensive safety testing. For instance, the cost of registering a new active ingredient can easily run into millions of euros, a substantial investment before any market entry.

Ongoing quality control measures were also critical to ensure consistent product efficacy and compliance with evolving standards. This involved laboratory analysis, batch testing, and maintaining robust documentation throughout the production lifecycle. In 2024, companies in the agrochemical sector often allocated between 5% to 10% of their revenue towards regulatory affairs and quality assurance, reflecting the demanding nature of these requirements.

- Product Registration Fees: Covering dossier preparation and submission for various national and international authorities.

- Environmental and Safety Assessments: Funding studies on ecotoxicity, human health impacts, and residue analysis.

- Quality Assurance Laboratories: Investing in equipment and personnel for rigorous testing of raw materials and finished products.

- Ongoing Compliance Monitoring: Costs associated with staying updated on and adhering to changing regulatory landscapes.

General and Administrative Expenses

General and Administrative Expenses (G&A) represent the essential overhead required to keep Isagro's operations running smoothly. These costs include salaries for administrative staff, the upkeep of office spaces, legal and accounting services, and the IT infrastructure that underpins the entire business. In 2024, managing these expenses efficiently was crucial for Isagro's profitability.

- Administrative Salaries: Costs associated with management and support staff.

- Office Expenses: Rent, utilities, and supplies for corporate offices.

- Professional Fees: Legal, audit, and consulting services.

- IT Infrastructure: Software, hardware, and network maintenance.

Isagro's cost structure was dominated by its substantial investment in research and development, encompassing laboratory work, clinical trials, and patent filings. Manufacturing and production costs, including raw material procurement and energy consumption for facilities, were also significant. Marketing, sales, and regulatory compliance, particularly product registration and quality control, represented further key expenditures. General and administrative overhead, covering staff salaries and IT infrastructure, completed the core cost components.

| Cost Category | Description | 2024 Data/Impact |

|---|---|---|

| Research & Development | Lab expenses, clinical trials, patent filings, scientific staff salaries | Substantial portion of operational budget; commitment to innovation. |

| Manufacturing & Production | Raw material procurement, energy consumption, facility maintenance, labor costs | Impacted by fluctuations in global agrochemical input costs. |

| Marketing & Distribution | Sales team salaries, marketing campaigns, advertising, trade shows, logistics | Increased due to rising fuel costs and need for digital strategies. |

| Regulatory & Quality Control | Product registration, environmental assessments, safety testing, quality assurance labs | Costs for new active ingredient registration can reach millions of euros; 5-10% of revenue allocated by sector peers. |

| General & Administrative | Administrative salaries, office upkeep, legal/accounting services, IT infrastructure | Crucial for operational efficiency and profitability management. |

Revenue Streams

Revenue was primarily generated from the sale of a wide range of proprietary herbicides designed to control weeds in various crops. These products addressed a fundamental need in agriculture, contributing a significant portion of the company's income.

The sale of fungicides was a significant revenue generator for Isagro, providing essential protection for crops against a wide array of fungal diseases. These products played a vital role in safeguarding crop health and minimizing potential yield reductions, especially for premium crops that demand high quality and consistent output.

Isagro's revenue streams significantly benefited from its insecticide sales, a core offering designed to combat crop-damaging insects. These products were vital for safeguarding agricultural yields and promoting plant vitality.

In 2024, the agricultural chemicals market, which includes insecticides, continued to see robust demand. For instance, global insecticide sales were projected to reach over $20 billion, underscoring the significant market for Isagro's offerings.

Sales of Biostimulants and Sustainable Solutions

The sale of biostimulants and other sustainable solutions represented a key and expanding revenue source for Isagro, aligning with the global shift towards greener agricultural practices. This segment directly addressed the growing market need for products that boost crop performance and natural defenses while minimizing reliance on synthetic chemicals.

This focus on eco-friendly agricultural inputs resonated with a broad customer base seeking to improve yields and crop quality sustainably. For instance, the biostimulant market itself was projected to reach approximately $5.7 billion by 2025, indicating a robust demand that Isagro was well-positioned to capture.

- Biostimulant Sales: Direct revenue generated from the sale of products designed to enhance plant growth, nutrient uptake, and stress tolerance.

- Sustainable Solutions: Income derived from other environmentally conscious agricultural inputs, such as biofertilizers or biological crop protection agents.

- Market Demand: Catering to the increasing global consumer and regulatory pressure for reduced chemical usage in agriculture, driving adoption of these products.

- Crop Enhancement: These sales contribute to Isagro's revenue by providing solutions that improve crop resilience and yield, offering a competitive advantage to farmers.

Licensing and Technology Transfer Fees

Isagro can unlock additional revenue by licensing its unique technologies, formulations, and patents to other businesses. This strategy allows the company to capitalize on its intellectual property without needing to establish a direct sales presence in every market. For instance, in 2023, companies in the agrochemical sector saw significant growth in technology licensing agreements, with some deals valued in the tens of millions of dollars, reflecting the high demand for innovative solutions.

This approach is particularly valuable in geographic regions where Isagro might not have established distribution channels or a significant market share. By partnering with local players, Isagro can extend the reach of its innovations and generate income from its research and development efforts. Such licensing agreements often include upfront payments, milestone payments, and ongoing royalties based on the licensee's sales.

- Technology Monetization: Isagro can earn revenue by allowing other companies to use its patented agrochemical formulations and application technologies.

- Market Expansion: Licensing enables Isagro to access new markets and customer segments without the substantial investment required for direct market entry.

- Intellectual Property Value: This revenue stream directly leverages the value of Isagro's R&D investments and patent portfolio.

- Partnership Opportunities: Licensing fosters strategic alliances with other industry players, potentially leading to further collaborative ventures.

Isagro's revenue streams are diverse, encompassing direct sales of crop protection products like herbicides, fungicides, and insecticides. The company also generates income from biostimulants and other sustainable agricultural solutions, tapping into the growing demand for eco-friendly farming practices.

Furthermore, Isagro monetizes its intellectual property through technology licensing, allowing other businesses to utilize its patented formulations and application technologies. This strategy facilitates market expansion and leverages the value of its research and development investments.

| Revenue Stream | Description | 2024 Market Insight |

|---|---|---|

| Herbicides | Sale of proprietary weed control products for various crops. | Global herbicide market projected to exceed $35 billion in 2024. |

| Fungicides | Protection against fungal diseases, crucial for crop health and yield. | Fungicide market expected to reach over $20 billion globally in 2024. |

| Insecticides | Combating crop-damaging insects to safeguard agricultural yields. | Insecticide sales were projected to exceed $20 billion in 2024. |

| Biostimulants & Sustainable Solutions | Enhancing plant performance and natural defenses with eco-friendly inputs. | Biostimulant market projected to reach approximately $5.7 billion by 2025. |

| Technology Licensing | Monetizing patents and formulations by licensing to other companies. | Agrochemical technology licensing deals can reach tens of millions of dollars. |

Business Model Canvas Data Sources

The Isagro Business Model Canvas is built using comprehensive market research, internal financial data, and competitor analysis. These sources provide the foundation for understanding customer needs, market opportunities, and operational efficiencies.