IRESS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRESS Bundle

IRESS, a leader in financial services technology, boasts significant strengths in its comprehensive platform and strong client relationships, but also faces challenges like evolving market demands and competitive pressures. Understanding these internal capabilities and external forces is crucial for strategic planning.

Want the full story behind IRESS’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IRESS has demonstrated a robust financial turnaround, reporting a statutory net profit after tax of $88.7 million for 2024. This represents a significant achievement, bolstered by a 25% surge in adjusted EBITDA, which surpassed earlier projections.

This impressive financial uplift is a direct consequence of the company's comprehensive 18-month transformation program. The initiative has successfully reshaped IRESS into a more agile and focused entity, leading to improved profit margins and a streamlined operational cost structure.

IRESS boasts a comprehensive suite of technology solutions specifically designed for the financial services sector. These offerings span critical areas such as wealth management, trading, market data provision, and superannuation administration, catering to a wide range of industry needs.

The company's global reach is a significant strength, enabling it to serve a diverse international client base. This broad geographical presence allows IRESS to support financial institutions in streamlining operations, optimizing investment management, and navigating complex regulatory landscapes across multiple jurisdictions.

IRESS has made significant strides in its strategic focus by divesting non-core assets. In 2024, the company successfully offloaded businesses like Platform, Pulse, and Mortgages. This move is designed to sharpen IRESS's attention on its core strengths, particularly in global wealth management and essential trading infrastructure.

Further streamlining is planned for 2025 with the divestment of its superannuation and QuantHouse businesses. These strategic decisions are not just about focus; they've demonstrably strengthened IRESS's balance sheet and reduced its debt burden. This financial health allows for increased investment in key growth areas.

Commitment to Product Innovation and AI Integration

IRESS demonstrates a strong commitment to product innovation, with a significant focus on integrating artificial intelligence (AI) to elevate its financial solutions. This forward-thinking approach is evident in their recent investments and strategic initiatives aimed at staying ahead in a rapidly evolving market.

Key developments include the introduction of a new digital advice and education platform tailored for the superannuation sector, alongside the launch of the IRESS FIX Hub. Furthermore, IRESS is actively prototyping AI-driven functionalities within its flagship Xplan software, designed to boost adviser productivity and streamline workflows.

- AI-Powered Efficiency: Prototyping AI capabilities in Xplan to enhance adviser efficiency.

- Digital Advice Expansion: Launch of a new digital advice and education solution for superannuation.

- Market Connectivity: Introduction of the IRESS FIX Hub to improve market access and trading.

Improved Customer Sentiment and Operational Efficiency

IRESS has seen a significant boost in how customers feel about them, with their Net Promoter Score (NPS) jumping by 25 points in 2024. This kind of improvement shows that their efforts to better serve clients are paying off.

This positive customer sentiment is a direct result of their focus on operational efficiency. By managing costs wisely and increasing revenue generated per employee, IRESS is demonstrating a more streamlined and effective business model. This renewed efficiency means they can deliver more value to their customers.

- Improved Customer Sentiment: NPS increased by 25 points in 2024.

- Enhanced Operational Efficiency: Demonstrated through disciplined cost management.

- Increased Revenue per Employee: Reflects better resource utilization.

- Client Value Focus: Post-transformation, a clear emphasis on delivering tangible benefits.

IRESS's strategic divestments in 2024, including Platform, Pulse, and Mortgages, have sharpened its focus on core wealth management and trading infrastructure. Further planned divestments of superannuation and QuantHouse in 2025 are expected to strengthen the balance sheet and reduce debt, enabling greater investment in key growth areas. The company's commitment to product innovation is highlighted by its AI integration efforts, including prototyping AI functionalities in Xplan to boost adviser productivity.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Financial Turnaround | Strong profit recovery and improved financial health. | Statutory net profit after tax of $88.7 million for 2024; 25% surge in adjusted EBITDA. |

| Comprehensive Technology Suite | Broad range of solutions for the financial services sector. | Offerings span wealth management, trading, market data, and superannuation administration. |

| Global Reach | Ability to serve a diverse international client base. | Supports financial institutions across multiple jurisdictions in streamlining operations and navigating regulations. |

| Strategic Focus & Divestments | Streamlining operations by divesting non-core assets. | Divested Platform, Pulse, Mortgages in 2024; planned divestments of superannuation and QuantHouse in 2025. |

| Product Innovation (AI) | Forward-thinking approach with AI integration. | Prototyping AI in Xplan for adviser productivity; launching new digital advice and education platform. |

| Improved Customer Sentiment | Significant increase in customer satisfaction. | Net Promoter Score (NPS) jumped by 25 points in 2024. |

What is included in the product

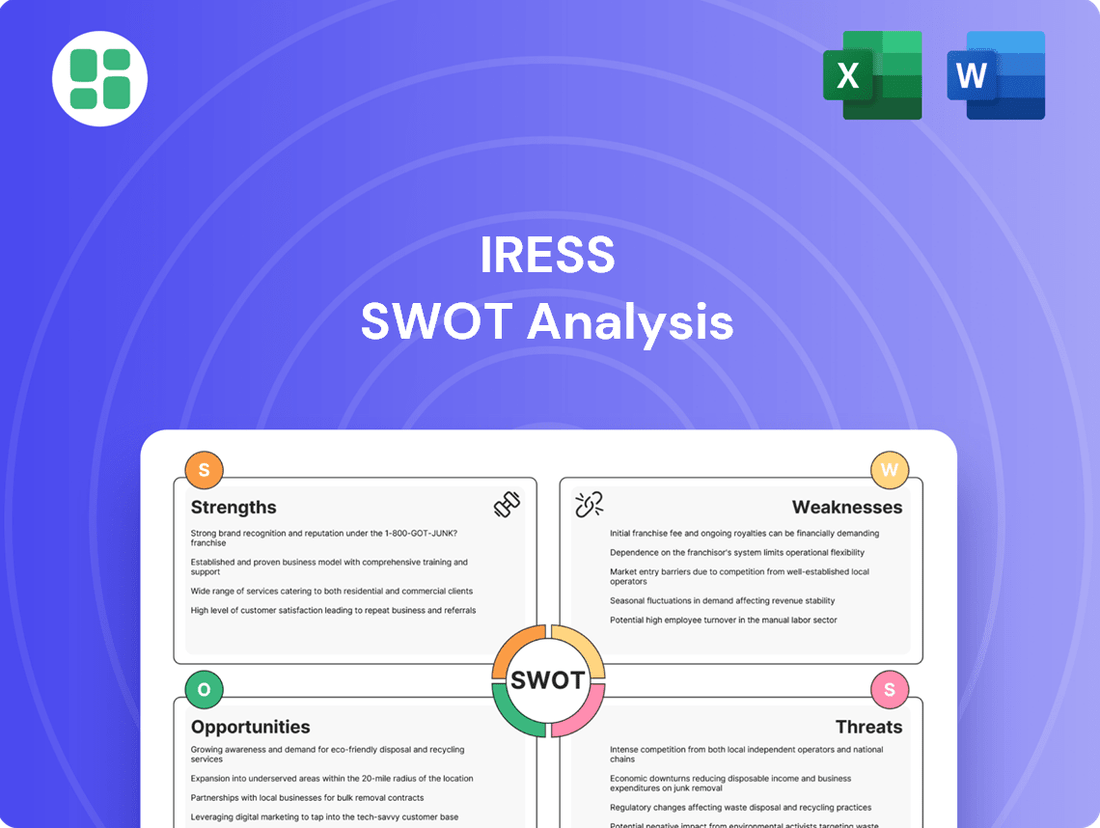

Analyzes IRESS’s competitive position through key internal and external factors, identifying its strengths in technology and market presence alongside weaknesses in integration and opportunities in global expansion, while also considering threats from competitors and regulatory changes.

Simplifies complex market dynamics by clearly outlining IRESS's competitive advantages and areas for improvement.

Weaknesses

IRESS experienced a 3% contraction in operating revenue for 2024, a direct consequence of divesting non-core assets. While this move sharpens strategic focus, it necessitates the cultivation of new revenue streams to compensate for the lost income.

IRESS's financial makeup highlights a significant reliance on intangible assets and human capital, leading to negative net tangible assets. This situation, while typical for many tech-focused companies, could be perceived as a weakness by investors who prioritize a more robust tangible asset foundation. For instance, as of the first half of 2024, the company's net tangible assets remained in negative territory, underscoring this characteristic.

IRESS's reliance on specific market segments makes it susceptible to the fallout from financial industry consolidation. For instance, the company's APAC Wealth Management division saw flat revenue in 2024, a situation partly attributed to the ongoing mergers and acquisitions within the financial sector. This trend highlights how client consolidation can directly affect IRESS's revenue streams, particularly in regions where such activity is prevalent.

Potential for Legacy System Challenges and Integration Complexity

IRESS faces potential hurdles with its extensive software offerings, as integrating diverse legacy systems across various financial sectors can be complex. This inherent challenge might slow down the rollout of new functionalities or require significant ongoing investment to maintain system compatibility. For instance, as of their 2023 annual report, IRESS continued to invest in platform modernization, indicating the ongoing effort to address these integration complexities.

The complexity of managing and integrating these varied systems can also present a weakness. This could manifest in slower adoption rates for new modules or a need for substantial resources dedicated to ensuring smooth data flow and interoperability.

- Legacy System Integration: IRESS's broad product suite necessitates ongoing efforts to ensure seamless integration between its various software solutions and client-specific legacy systems.

- Deployment Delays: System complexity can potentially lead to slower deployment timelines for new features or updates, impacting the speed of innovation.

- Investment in Compatibility: Maintaining compatibility across a wide range of existing technologies requires substantial and continuous investment in IT infrastructure and development resources.

- Data Exchange Challenges: Ensuring efficient and secure data exchange between disparate systems remains a critical operational challenge, potentially impacting user experience and operational efficiency.

Past Cybersecurity Incidents Impacting Trust

IRESS faced a significant cybersecurity challenge in May 2024 when it experienced unauthorized access to its GitHub user space and a segment of its OneVue production environment. While the company stated that no core production systems or broader client data were compromised, such events can erode client trust.

These incidents highlight the persistent risks in the digital landscape and the critical need for ongoing, substantial investment in advanced cybersecurity defenses. Maintaining client confidence in data protection is paramount, especially following a breach, even if limited in scope.

- May 2024 Incident: Unauthorized access to GitHub user space and part of OneVue production environment.

- Data Compromise: No evidence found of compromise to core production or wider client data.

- Trust Impact: Incidents can raise concerns about data security and affect client confidence.

- Mitigation: Requires continuous investment in robust cybersecurity measures.

IRESS's reliance on intangible assets, resulting in negative net tangible assets as seen in H1 2024, could deter investors prioritizing tangible asset backing. Furthermore, the company's exposure to financial industry consolidation, evidenced by flat revenue in its APAC Wealth Management division in 2024, poses a risk to its revenue streams due to client mergers.

The complexity of integrating IRESS's diverse software with client legacy systems presents ongoing challenges, as indicated by continued investment in platform modernization in 2023. This complexity can lead to deployment delays and requires substantial investment in IT infrastructure to ensure compatibility and efficient data exchange.

A significant weakness stems from cybersecurity vulnerabilities, highlighted by the May 2024 incident involving unauthorized access to its GitHub and OneVue production environments. While core systems were reportedly unaffected, such events can erode client trust, necessitating continuous, substantial investment in advanced cybersecurity defenses to maintain confidence in data protection.

Full Version Awaits

IRESS SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You'll gain access to all sections of this comprehensive document, providing a complete picture of IRESS's strategic position.

Opportunities

The financial services sector is heavily investing in digital transformation and AI, with global spending on AI in financial services projected to reach $25.5 billion by 2026, up from $10.6 billion in 2021. This surge reflects a clear demand for enhanced efficiency and data-driven insights.

IRESS is strategically positioned to leverage this trend. By further embedding AI and advanced analytics into its core offerings, such as wealth management and trading platforms, IRESS can provide clients with superior decision-making tools and operational improvements.

This integration allows IRESS to meet the evolving needs of financial institutions seeking to automate processes, personalize client experiences, and gain a competitive edge through intelligent automation and predictive capabilities.

The Australian financial advice market, particularly within superannuation, shows a significant unmet demand. IRESS's new digital advice and education tools are well-positioned to capture this, offering a scalable solution for retirement income planning and data services. For instance, in 2023, only 20% of Australians reported receiving formal financial advice, highlighting a substantial opportunity for digital platforms to bridge this gap.

IRESS can significantly boost its market presence and capabilities through strategic alliances. For instance, its existing partnerships demonstrate a successful model for expanding service reach and streamlining operations. By collaborating with fintech innovators, IRESS can integrate cutting-edge solutions, potentially enhancing its wealth management platforms or trading technology offerings.

Targeted acquisitions represent another key avenue for growth. Acquiring companies with complementary technologies, such as advanced AI-driven analytics or specialized data visualization tools, would allow IRESS to deepen its existing product suite. This strategic move could accelerate market penetration in areas like digital advice or regulatory compliance solutions, building on its strong foundation in financial markets software.

Leveraging Cloud-Native Technologies and Enhanced Interoperability

IRESS's strategic investment in cloud-native, SaaS-hosted models for its backend infrastructure is a significant opportunity. This modernization effort, including enhancements to interoperability like the IRESS FIX Hub, directly addresses the growing demand for agile and connected financial technology solutions.

This technological pivot allows for faster delivery of new products and services, directly impacting revenue streams by enabling quicker adaptation to market needs. For instance, a more robust and scalable cloud architecture can support a larger client base and more complex trading environments, potentially increasing market share in key segments.

The improved interoperability fostered by these investments is crucial for attracting and retaining clients in an increasingly interconnected financial ecosystem. By facilitating seamless data exchange and integration with other platforms, IRESS can offer a more compelling value proposition, differentiating itself from competitors and driving client acquisition.

- Faster Solution Deployment: Cloud-native architecture enables IRESS to roll out new features and updates more rapidly, a critical advantage in the fast-paced fintech sector.

- Enhanced User Experience: A modernized backend translates to a smoother, more intuitive experience for users, improving client satisfaction and reducing churn.

- Expanded Global Reach: Improved interoperability, particularly through hubs like the FIX Hub, opens doors to new markets and strengthens IRESS's global connectivity.

- Attracting New Clients: The technological advancements position IRESS as a forward-thinking provider, appealing to financial institutions seeking cutting-edge solutions.

Capitalizing on Evolving Regulatory Frameworks

Changes in financial regulations are a constant, and for IRESS, these shifts often present significant opportunities. For instance, the ongoing implementation of MiFID II in Europe, which came into full effect in 2018 but continues to evolve, significantly increased the demand for enhanced transaction reporting and best execution analysis tools. IRESS's established presence and expertise in providing compliance and reporting solutions position it well to adapt and innovate in response to such evolving regulatory landscapes.

By developing new products or enhancing existing features to meet these emerging needs, IRESS can effectively turn regulatory changes into revenue streams. For example, as data privacy regulations like GDPR (General Data Protection Regulation) continue to be refined and enforced globally, there's a growing need for robust data management and security solutions within financial services. IRESS can leverage its technology platform to offer specialized services that help financial institutions navigate these complex data governance requirements.

- Increased Demand for Compliance Solutions: Regulatory changes, such as those stemming from the UK's Financial Services and Markets Act 2023, drive demand for sophisticated reporting and compliance software.

- Development of New Products: IRESS can create specialized tools for areas like ESG (Environmental, Social, and Governance) reporting, which is becoming increasingly mandated across various jurisdictions.

- Market Share Expansion: By proactively addressing new regulatory demands, IRESS can attract new clients seeking compliant solutions and strengthen its position with existing customers.

The ongoing digital transformation in financial services, coupled with the increasing adoption of AI, presents a substantial opportunity for IRESS. Global spending on AI in financial services is expected to grow significantly, creating a strong demand for advanced analytics and automation. IRESS can capitalize on this by further integrating AI into its platforms, offering clients enhanced decision-making capabilities and operational efficiencies.

Threats

The fintech sector is a battlefield, with established financial institutions and nimble startups vying for market share. This fierce competition means IRESS faces constant pressure to innovate and offer competitive pricing, potentially impacting profit margins. For instance, by the end of 2024, the global fintech market was projected to reach over $300 billion, highlighting the sheer scale of players involved.

This intense rivalry also creates a challenge in keeping existing clients engaged. As new solutions emerge rapidly, clients may be tempted by more advanced or cost-effective alternatives, requiring IRESS to invest heavily in client retention strategies and continuous product development to stay ahead.

The financial technology sector is in constant flux, with rapid advancements in AI, machine learning, and blockchain presenting a significant threat to established players like IRESS. Failing to keep pace with these innovations means existing software and platforms risk becoming outdated and uncompetitive. For instance, the global AI market is projected to reach $1.81 trillion by 2030, highlighting the sheer scale of investment and development in this area.

If IRESS does not proactively invest in and integrate these emerging technologies, its current offerings could quickly lose their edge. This technological obsolescence could lead to a decline in market share as competitors leverage newer, more efficient solutions. The company's ability to adapt its product roadmap and R&D spending will be crucial in navigating this disruptive landscape.

IRESS, operating in the financial technology sector, faces persistent cybersecurity risks. Despite investments in security, the company, which manages sensitive client data, remains a prime target for advanced cyber threats. A breach could expose client information, potentially leading to significant reputational damage and financial penalties.

The financial services industry, in general, saw a 72% increase in ransomware attacks between 2022 and 2023, highlighting the escalating threat landscape. For IRESS, a successful cyberattack could result in the loss of client trust, impacting its business relationships and future revenue streams, especially given the critical nature of the data it handles.

Economic Downturns Affecting Financial Services Spending

Economic downturns pose a significant threat to IRESS, as the financial services sector is closely tied to broader economic health. During recessions, financial institutions often cut back on discretionary spending, which can include investments in new technology and software solutions like those offered by IRESS. This reduced spending directly impacts IRESS's revenue streams and profitability.

For instance, a potential global economic slowdown in late 2024 or 2025 could see financial firms delay or cancel technology upgrades. Historically, periods of economic contraction have led to decreased IT budgets within financial services. A report from Gartner in late 2023 projected a slowdown in IT spending growth for the financial sector in 2024 compared to previous years, indicating a cautious approach from institutions.

- Reduced Client Spending: Financial institutions facing revenue pressures may reduce their expenditure on software licenses and maintenance.

- Delayed Projects: Capital expenditure on new technology implementations, a key revenue driver for IRESS, is likely to be postponed during economic uncertainty.

- Increased Competition for Budget: With tighter budgets, IRESS will face intensified competition from other vendors and internal IT projects for limited financial resources.

Challenges in Talent Acquisition and Retention

IRESS operates in a highly specialized technology segment within financial services, making the acquisition and retention of skilled professionals a significant hurdle. The intense competition for talent in areas like artificial intelligence, cloud infrastructure, and cybersecurity directly impacts operational expenses. For instance, salary benchmarks for AI engineers in Australia, a key market for IRESS, saw an average increase of 15-20% in 2024, according to industry reports.

This talent scarcity can translate into project delays and slower innovation cycles. Companies like IRESS must contend with the reality that attracting top AI and cloud talent often requires compensation packages exceeding industry averages. In 2024, the average salary for a senior cloud architect in major financial hubs where IRESS operates could range from AUD $180,000 to $250,000 annually, a substantial cost factor.

The challenge extends to retaining these critical employees, as they are frequently courted by other tech firms and even different sectors. High turnover in specialized roles can disrupt product roadmaps and client service delivery. For example, a 2025 survey indicated that the average tenure for cybersecurity specialists in the financial sector had dropped to under 2.5 years, highlighting the retention difficulty.

- High demand for AI, cloud, and cybersecurity expertise.

- Increased operational costs due to competitive salaries.

- Risk of product development delays and talent attrition.

- Average senior cloud architect salaries in Australia reaching $180k-$250k (2024).

The rapid evolution of technology presents a constant threat of obsolescence for IRESS's existing platforms. Competitors are actively integrating AI, machine learning, and blockchain, demanding significant R&D investment from IRESS to remain competitive. Failure to adapt could lead to a loss of market share as clients seek more advanced solutions.

Cybersecurity risks are a persistent danger, given the sensitive data IRESS handles. A successful breach could result in severe financial penalties and irreparable damage to client trust. The financial services sector experienced a notable increase in cyberattacks in recent years, underscoring the critical need for robust security measures.

Economic downturns directly impact IRESS's revenue as financial institutions often reduce discretionary spending on technology. This can lead to delayed projects and increased competition for limited IT budgets. Projections for 2024 indicated a slowdown in IT spending growth for the financial sector, signaling potential headwinds.

The intense competition within the fintech sector forces IRESS to maintain competitive pricing, potentially squeezing profit margins. Furthermore, the rapid pace of innovation requires continuous investment in product development and client retention to prevent clients from migrating to newer, more cost-effective alternatives.

SWOT Analysis Data Sources

This IRESS SWOT analysis is built upon a robust foundation of data, drawing from IRESS's official financial reports, comprehensive market intelligence, and insights from industry experts. These sources provide a well-rounded perspective on the company's internal capabilities and external market position.