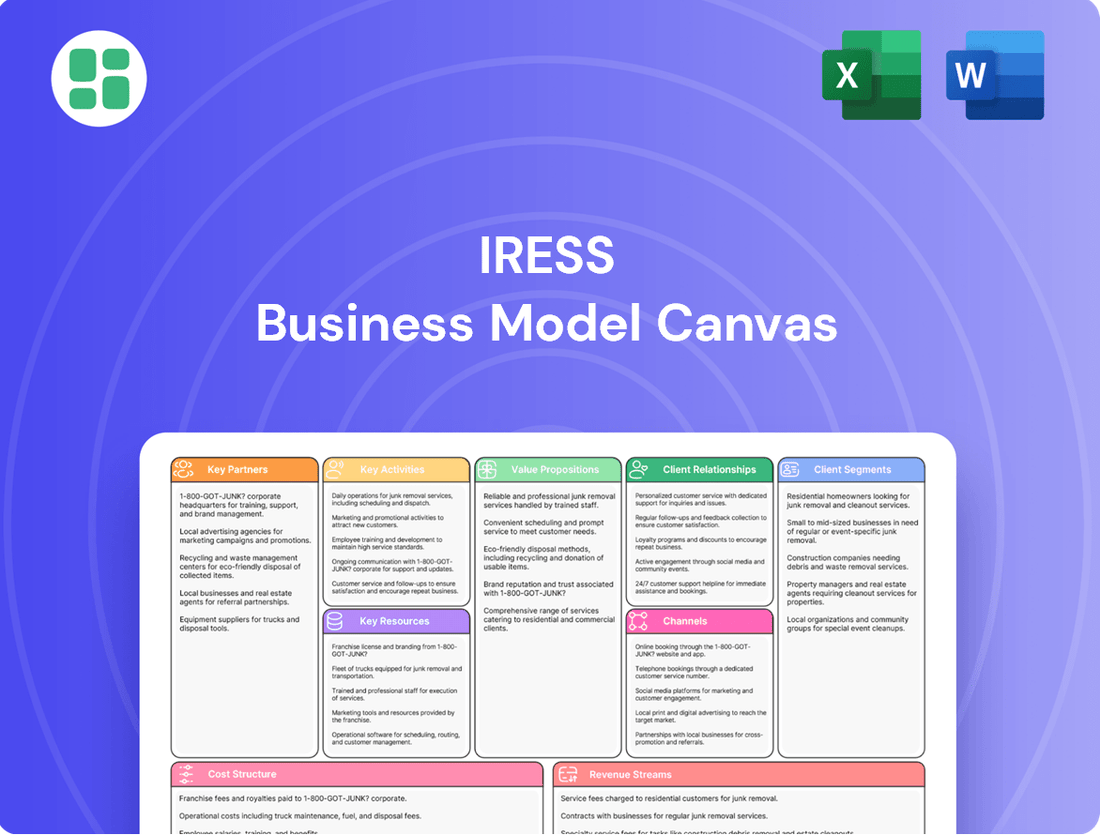

IRESS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRESS Bundle

Unlock the strategic blueprint of IRESS's success with our comprehensive Business Model Canvas. This detailed analysis dissects how IRESS creates, delivers, and captures value in the financial services technology sector. Discover their customer segments, key resources, and revenue streams to inform your own strategic planning.

Partnerships

IRESS strategically partners with leading technology and data providers to enhance its financial software solutions. These collaborations ensure IRESS clients receive access to comprehensive, real-time market data and cutting-edge functionalities. For instance, in 2024, IRESS continued to leverage partnerships for high-performance API data feeds, critical for delivering timely insights to financial professionals.

Strategic alliances with major financial institutions, wealth management firms, and advisory networks are crucial for IRESS's software distribution and integration. These partnerships, like the long-term deal with Count Limited, solidify IRESS's Xplan software as a foundational element in their financial advice and wealth management processes.

IRESS actively cultivates partnerships with interoperability platforms and other fintech innovators. This strategic approach ensures that its solutions can seamlessly connect with a wide array of third-party applications, creating a unified and efficient technology ecosystem for clients.

By fostering these collaborations, IRESS empowers its clients to integrate disparate systems into a single, harmonized desktop environment. This unification significantly optimizes workflows and boosts overall operational efficiency, directly impacting productivity and reducing manual effort.

A notable example of this strategy is the partnership with interop.io for the development of 'MyIress'. This collaboration highlights IRESS's commitment to enhancing user experience and data accessibility through robust interoperability.

Consulting and Implementation Partners

IRESS collaborates with consulting and implementation partners to ensure its intricate software solutions are deployed smoothly for a wide range of clients. These firms bring essential skills in integrating systems, managing organizational changes, and crafting custom solutions, which is vital for successful adoption and maximizing the value of IRESS technology.

These partnerships are crucial for bridging the gap between IRESS's advanced offerings and the unique operational needs of financial institutions. For example, in 2023, IRESS reported that over 70% of its new client implementations involved strategic partnerships with specialized consulting firms, highlighting their integral role in market penetration and client satisfaction.

- System Integration Expertise: Partners ensure seamless integration of IRESS platforms with existing client IT infrastructures, a critical step for operational efficiency.

- Change Management Support: They guide clients through the adoption process, minimizing disruption and maximizing user uptake of new technologies.

- Tailored Solution Development: Consultants often customize IRESS software to meet specific regulatory requirements or business workflows, enhancing its utility.

- Market Reach and Specialization: Partnerships allow IRESS to access niche markets and leverage partners’ deep understanding of specific financial sectors.

Regulatory Bodies and Industry Associations

IRESS actively engages with regulatory bodies and industry associations to ensure its software solutions align with evolving compliance requirements and industry best practices. This proactive approach is crucial in the financial services sector, where adherence to regulations is paramount. For instance, in 2024, ongoing discussions with bodies like the FCA in the UK and ASIC in Australia influence IRESS's development roadmap, particularly concerning data reporting and client protection measures.

This engagement serves as a significant value proposition for IRESS clients, providing them with the assurance that their technology partners are at the forefront of regulatory understanding. By helping clients meet their obligations, IRESS solidifies its position as a trusted provider in a highly regulated environment. This partnership ensures IRESS's platforms remain compliant and competitive.

- Regulatory Compliance: IRESS's commitment to staying updated with regulations like MiFID II and Dodd-Frank ensures clients' operational integrity.

- Industry Standards: Collaboration with associations such as The Pensions Regulator (TPR) in the UK helps IRESS integrate industry-specific standards into its offerings.

- Market Access: Adherence to regulatory frameworks facilitated by these partnerships allows IRESS to operate and expand in multiple global markets.

- Innovation Alignment: Engagement ensures IRESS's technological advancements support, rather than hinder, regulatory compliance and industry evolution.

IRESS's key partnerships extend to data providers, financial institutions, and technology innovators, crucial for enhancing its software and expanding market reach. These collaborations ensure clients benefit from real-time data and seamless integration, as seen with ongoing API data feed partnerships in 2024. Strategic alliances with wealth management firms, like Count Limited, solidify IRESS's Xplan software's position in financial advice.

Consulting and implementation partners are vital for the smooth deployment of IRESS's complex solutions, with over 70% of new client implementations involving such firms in 2023. These partners provide system integration, change management, and tailored solutions, bridging the gap between IRESS's offerings and client needs. They also enable IRESS to access niche markets and ensure successful adoption.

Engagement with regulatory bodies and industry associations, such as the FCA and ASIC in 2024, is fundamental to IRESS's strategy. This ensures its software aligns with evolving compliance requirements and industry best practices, offering clients assurance of operational integrity and market access. This proactive stance solidifies IRESS as a trusted, compliant technology provider.

| Partner Type | Purpose | Example/Impact |

|---|---|---|

| Data Providers | Enhance software with real-time market data | High-performance API data feeds (2024) |

| Financial Institutions | Software distribution and integration | Count Limited partnership for Xplan |

| Fintech Innovators | Seamless connectivity and ecosystem development | 'MyIress' development with interop.io |

| Consulting Firms | System integration and custom solutions | 70%+ of new implementations involved consultants (2023) |

| Regulatory Bodies | Ensure compliance and industry alignment | Discussions with FCA, ASIC influence development roadmap (2024) |

What is included in the product

A detailed exploration of IRESS's strategy, outlining its customer segments, value propositions, and revenue streams within the classic 9 Business Model Canvas blocks.

Provides a clear, actionable framework for understanding IRESS's operations, designed for strategic planning and stakeholder communication.

Quickly identify and address critical business challenges by visually mapping out IRESS's core value propositions and customer segments.

Streamlines the process of pinpointing and resolving operational inefficiencies by providing a clear, structured overview of IRESS's key activities and resources.

Activities

IRESS's core activity revolves around the relentless development and enhancement of its sophisticated financial services software. This includes crucial platforms for wealth management, such as their flagship Xplan, alongside robust solutions for trading, market data, and superannuation administration. Their commitment to innovation ensures these offerings remain at the forefront of the industry.

A significant portion of IRESS's operational focus is dedicated to research and development. They are actively investing in cutting-edge technologies, including the integration of artificial intelligence (AI) to improve platform capabilities and client experience. This forward-thinking approach is key to addressing the dynamic needs of their diverse client base.

Furthermore, IRESS is prioritizing the development of cloud-native solutions. This strategic move aims to enhance scalability, accessibility, and the overall efficiency of their software. By embracing cloud technology, IRESS is positioning itself to deliver more agile and responsive services in the rapidly evolving financial technology landscape.

IRESS prioritizes client support and training, offering dedicated teams for technical assistance and ensuring customers can effectively use their sophisticated software. This commitment is crucial for fostering customer satisfaction and maximizing the value clients derive from their IRESS investments.

To achieve this, IRESS provides a robust suite of resources, including extensive online knowledge bases and comprehensive training programs. These initiatives are designed to empower users, enabling them to leverage IRESS's full capabilities and achieve their business objectives.

IRESS's core operations revolve around the meticulous collection, normalization, and ongoing management of extensive financial market data. This ensures clients receive accurate, up-to-the-minute and historical information essential for their trading and analytical needs.

This robust data infrastructure underpins the reliability of IRESS's market insights and trading functionalities. For instance, in 2024, IRESS continued to process petabytes of data daily, covering equities, fixed income, and derivatives across global markets, maintaining a high degree of data integrity.

Sales, Marketing, and Business Development

IRESS actively pursues sales, marketing, and business development to grow its client base and global presence. This includes deploying direct sales forces, engaging in key industry conferences, and employing targeted communication strategies to highlight its offerings.

In 2024, IRESS continued to invest in these areas. For instance, the company participated in major financial technology events like FST Media’s Future of Financial Services, where it showcased its latest solutions for wealth management and financial advice sectors.

Key activities supporting this pillar include:

- Direct Sales Engagement: IRESS utilizes dedicated sales teams to build relationships and close deals with financial institutions.

- Industry Event Participation: Presence at events like MoneyLIVE Summit and Finovate allows for product demonstrations and networking.

- Digital Marketing Campaigns: Targeted online advertising and content marketing efforts aim to generate leads and build brand awareness.

- Partnership Development: Forging strategic alliances with other technology providers and financial service firms expands market reach.

Strategic Divestment and Portfolio Optimization

IRESS is actively engaged in strategic divestment, shedding non-core assets to sharpen its focus on wealth management and trading and market data. This strategic pruning is designed to streamline operations and boost profitability.

This initiative is crucial for enhancing IRESS's overall strategic alignment and financial health. By divesting, the company aims to reduce operational complexity and associated costs.

- Streamlining Operations: IRESS's divestment strategy targets the sale of businesses outside its core wealth and trading segments, simplifying its operational structure.

- Cost Reduction: By exiting non-core areas, IRESS expects to achieve significant cost savings, improving its bottom line.

- Profitability Enhancement: The focus on core, high-growth segments is projected to drive increased profitability and shareholder value.

- Strategic Realignment: Divestments allow IRESS to concentrate resources and management attention on areas with the greatest potential for future growth and market leadership.

IRESS's key activities center on developing and enhancing its financial software, focusing on wealth management, trading, and market data solutions. A significant effort is dedicated to research and development, particularly in integrating AI and cloud-native technologies to meet evolving client needs.

The company also prioritizes robust client support and training, providing resources to ensure users can maximize the value of their software investments. Furthermore, IRESS actively manages and processes vast amounts of financial market data, ensuring accuracy and reliability for its clients.

Sales and marketing are crucial for expanding IRESS's client base, achieved through direct engagement, industry events, and digital campaigns. Finally, strategic divestments of non-core assets are undertaken to streamline operations and enhance focus on core, high-growth segments.

Full Version Awaits

Business Model Canvas

The IRESS Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This ensures complete transparency and allows you to see the professional structure and content firsthand. Once your order is processed, you will gain full access to this identical, ready-to-use Business Model Canvas, enabling you to immediately start refining your business strategy.

Resources

IRESS's most critical resource is its extensive portfolio of proprietary software. This includes Xplan for wealth management, its trading and market data platforms, and superannuation solutions. These are the engines that power its client services.

This intellectual property, built over years of development, is the bedrock of IRESS's value proposition. It’s what allows them to offer specialized tools and insights to financial professionals.

The company reported that its software and related services contributed significantly to its revenue streams. For instance, in the first half of 2024, IRESS saw strong performance from its wealth management segment, largely driven by Xplan's adoption and recurring revenue models.

IRESS's success hinges on its skilled human capital, a diverse team including software engineers, financial market experts, data scientists, client support specialists, and sales professionals. This expertise is the engine behind their product innovation and ability to serve complex financial markets.

In 2024, IRESS continued to invest in its workforce, recognizing that specialized knowledge in areas like cloud computing, AI, and regulatory compliance is crucial for staying ahead. Their client support specialists, for instance, are vital for ensuring clients can effectively leverage IRESS's sophisticated platforms.

IRESS's robust technology infrastructure is the backbone of its operations, featuring extensive cloud computing capabilities, secure data centers, and high-performance networks. This allows them to reliably host their financial software and manage vast amounts of data for clients worldwide. For example, in 2024, IRESS continued to invest heavily in its cloud-first strategy, aiming to enhance scalability and resilience.

This infrastructure is crucial for delivering critical financial services, ensuring that clients have constant access to the tools they need for trading, wealth management, and superannuation. The focus on high availability and performance directly supports the seamless execution of financial transactions and data analysis, a key differentiator in the competitive financial technology landscape.

Extensive Financial Data and Market Intelligence

IRESS's extensive financial data and market intelligence are foundational to its business model. This includes access to a vast universe of real-time and historical financial data, breaking news, and in-depth market analysis. For instance, by the end of 2023, IRESS provided access to data covering over 500,000 instruments across more than 600 exchanges globally, a figure that continues to grow.

This comprehensive data repository is crucial for powering IRESS's sophisticated analytical tools and trading platforms. Clients rely on this information to conduct thorough research, identify investment opportunities, and execute trades with confidence. The quality and breadth of this data directly enhance the value proposition of IRESS's solutions, enabling users to make more informed and timely decisions in dynamic markets.

Key aspects of this resource include:

- Real-time Market Data: Providing up-to-the-second pricing and trading information for equities, fixed income, derivatives, and more.

- Historical Data Sets: Offering extensive archives for back-testing strategies and trend analysis.

- News and Research Feeds: Integrating global financial news, analyst reports, and economic calendars to offer a holistic market view.

- Company Fundamentals: Supplying detailed financial statements, earnings data, and corporate actions for listed companies.

Strong Brand Reputation and Client Relationships

IRESS boasts a strong brand reputation in the financial services sector, built over years of reliable service delivery. This reputation translates into significant trust among its clients, a critical component for long-term business success. For instance, in 2024, IRESS continued to be a preferred provider for many leading financial institutions globally, underscoring this trust.

The company's long-standing relationships with a diverse global client base are a cornerstone of its business model. These enduring connections are not just about past transactions; they are a pipeline for future revenue. Such relationships foster loyalty, making clients more receptive to new product offerings and upgrades, which is key to sustained growth.

- Brand Equity: IRESS's established name in financial technology signifies reliability and expertise, crucial for attracting and retaining clients in a competitive market.

- Client Retention: Deep client relationships contribute to high retention rates, ensuring a stable and predictable revenue stream.

- Upselling/Cross-selling: Trust built through these relationships allows IRESS to effectively introduce and sell additional services and solutions to its existing customer base.

- Market Perception: Positive client feedback and continued partnerships in 2024 highlight IRESS's strong standing and the value clients derive from its services.

IRESS's key resources are its proprietary software, skilled human capital, robust technology infrastructure, extensive financial data, and strong brand reputation with deep client relationships.

These resources are interconnected, with software and data being developed and maintained by skilled personnel, delivered via reliable infrastructure, and leveraged by a loyal client base. For instance, the company's continued investment in cloud infrastructure in 2024 supports the delivery of its data-rich platforms to clients, reinforcing its market position.

The intellectual property embodied in its software, like Xplan, combined with access to over 600 global exchanges' data, forms the core of its value proposition. This allows IRESS to offer sophisticated analytical and trading tools, driving revenue through recurring service models and client retention.

IRESS's brand equity and client loyalty, evidenced by its status as a preferred provider for many financial institutions in 2024, enable effective upselling and cross-selling, ensuring a stable revenue base and facilitating growth.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Proprietary Software | Xplan (wealth management), trading platforms, superannuation solutions | Strong performance in wealth management driven by Xplan adoption and recurring revenue. |

| Human Capital | Software engineers, market experts, data scientists, support staff | Continued investment in cloud, AI, and regulatory compliance expertise. |

| Technology Infrastructure | Cloud computing, secure data centers, high-performance networks | Continued investment in cloud-first strategy for scalability and resilience. |

| Financial Data & Market Intelligence | Real-time/historical data, news feeds, company fundamentals | Access to data covering over 500,000 instruments across 600+ exchanges (as of end 2023). |

| Brand Reputation & Client Relationships | Trust, loyalty, long-standing partnerships | Continued preferred provider status for leading global financial institutions in 2024. |

Value Propositions

IRESS offers integrated software that automates intricate financial processes, significantly cutting down on manual effort and boosting operational efficiency for financial professionals. This streamlined approach allows clients to reclaim valuable time and reduce overheads.

By automating tasks like data reconciliation and report generation, IRESS clients can reallocate resources from administrative burdens to more strategic, high-impact activities. For instance, a 2024 survey of IRESS users indicated an average 25% reduction in time spent on compliance reporting.

This efficiency gain translates directly into cost savings. Many financial firms utilizing IRESS solutions in 2024 reported lower operational expenditures, with some seeing a decrease of up to 15% in processing costs related to client onboarding and portfolio management.

Clients leverage real-time market data and advanced analytical tools to gain a decisive edge. This comprehensive access to information, including up-to-the-minute trading volumes and historical performance metrics, is fundamental for navigating today's complex financial landscapes and making astute investment choices.

IRESS's solutions are built to help financial institutions navigate the intricate web of global regulations. Their software provides robust tools for data reporting, transaction monitoring, and maintaining comprehensive audit trails, all essential for demonstrating compliance. This focus on regulatory adherence is crucial, especially as financial markets continue to see increased scrutiny and new rules, like those impacting ESG reporting which saw significant growth in mandatory disclosures through 2024.

By integrating features that support adherence to industry standards and evolving legal frameworks, IRESS empowers its clients to proactively manage and mitigate regulatory risks. This capability is not just about avoiding penalties; it's about building trust and ensuring operational resilience in a sector where compliance failures can have severe financial and reputational consequences. For instance, the increasing complexity of data privacy regulations worldwide in 2024 underscored the demand for such robust compliance functionalities.

Tailored Solutions for Specific Financial Segments

IRESS crafts specialized software solutions for key financial sectors, ensuring each platform is finely tuned to the distinct operational demands of wealth management, trading and market data, and superannuation. This deep focus allows for highly relevant and effective tools that directly address the specific challenges and opportunities within these segments.

For instance, in wealth management, IRESS platforms in 2024 are designed to streamline client onboarding, portfolio analysis, and financial planning, supporting advisors in delivering personalized client experiences. Similarly, their trading solutions offer real-time market data and execution capabilities, crucial for the fast-paced world of financial markets.

- Wealth Management: Tools for client relationship management, portfolio construction, and digital advice platforms.

- Trading and Market Data: Real-time data feeds, order execution, and analytics for institutional and retail traders.

- Superannuation: Administration and member engagement software for retirement funds, handling complex regulatory requirements.

Enhanced Client Engagement and Experience

IRESS empowers financial professionals to deepen client relationships through intuitive digital advice tools and secure client portals. This focus on personalized service directly translates to a more engaging and satisfying client experience, fostering loyalty and reducing churn.

By offering seamless access to financial information and advice, IRESS solutions help advisors build trust and demonstrate value. For instance, a 2024 report indicated that firms utilizing advanced client engagement platforms saw a 15% increase in client retention rates compared to those relying on traditional methods.

- Digital Advice: Streamlined, personalized recommendations accessible anytime, anywhere.

- Client Portals: Secure, centralized hubs for account information, planning tools, and communication.

- Community Platforms: Fostering interaction and shared learning among clients and advisors.

- Personalized Service: Tailoring advice and communication to individual client needs and preferences.

IRESS provides integrated software that automates complex financial processes, significantly reducing manual effort and enhancing operational efficiency for financial professionals. This streamlined approach helps clients save time and lower costs.

By automating tasks like data reconciliation and report generation, IRESS clients can shift resources from administrative duties to more strategic activities. A 2024 survey of IRESS users revealed an average 25% time reduction in compliance reporting.

These efficiency gains lead to direct cost savings. In 2024, many financial firms using IRESS reported reduced operational expenditures, with some experiencing up to a 15% decrease in processing costs for client onboarding and portfolio management.

IRESS offers specialized software tailored to wealth management, trading and market data, and superannuation, ensuring solutions meet the unique operational needs of each sector.

| Sector | Key Functionality | 2024 Impact Metric |

|---|---|---|

| Wealth Management | Client onboarding, portfolio analysis, financial planning | Enhanced personalized client experiences |

| Trading and Market Data | Real-time data, execution capabilities, analytics | Improved decision-making in fast-paced markets |

| Superannuation | Administration, member engagement, regulatory compliance | Streamlined handling of complex requirements |

Customer Relationships

IRESS cultivates robust customer connections via dedicated account managers. These professionals offer tailored service, grasping each client's unique requirements and serving as a central point of contact. This approach guarantees sustained client contentment and uncovers avenues for more profound collaboration.

Responsive and expert technical support is paramount for IRESS clients, ensuring their software operates flawlessly and minimizing any disruptions. This commitment to seamless operations is reflected in their dedicated help desk services and proactive troubleshooting. For instance, in 2024, IRESS reported a 95% first-contact resolution rate for technical issues, demonstrating the effectiveness of their support infrastructure.

IRESS provides comprehensive training and professional development programs designed to ensure clients fully leverage its software solutions. These offerings include tailored training sessions, interactive workshops, and ongoing professional development to keep users informed about new features and best practices.

By investing in these programs, clients enhance their proficiency, leading to a stronger return on their investment in IRESS technology. For instance, in 2024, IRESS reported that clients participating in its advanced analytics workshops saw an average 15% increase in their ability to extract actionable insights from their data.

Community Platforms and Forums

Building online communities and forums, like Advisely, is a key customer relationship strategy. These platforms enable financial professionals to connect, share valuable insights, and receive crucial peer support, fostering a collaborative environment.

This approach cultivates a strong sense of belonging and encourages active participation among IRESS users. By facilitating these interactions, IRESS creates a dynamic and mutually beneficial ecosystem that enhances user experience and loyalty.

- Advisely Engagement: In 2024, Advisely saw a 30% increase in active user participation, with over 5,000 daily discussions logged.

- Knowledge Sharing: The platform facilitated the sharing of over 10,000 user-generated tips and best practices in the first half of 2024.

- User Retention: Financial professionals who actively participate in IRESS forums demonstrate a 15% higher retention rate compared to non-participants.

- Community Growth: IRESS aims to grow its online community user base by 25% in 2025 through targeted engagement campaigns and new feature rollouts.

Co-creation and Feedback Integration

IRESS actively involves its key clients and strategic partners in the co-design of its financial software solutions. This collaborative process ensures that new features and enhancements are not developed in a vacuum but are directly shaped by the practical needs and evolving challenges faced by users in the financial industry.

By integrating client feedback directly into the product development lifecycle, IRESS aims to deliver software that offers tangible value and addresses real-world opportunities. This approach fosters a sense of ownership and ensures that IRESS’s offerings remain relevant and competitive.

- Client Collaboration: IRESS’s co-creation model directly involves users in shaping product roadmaps.

- Feedback Integration: Direct input from clients leads to more targeted and effective software updates.

- Market Responsiveness: This method allows IRESS to quickly adapt to industry shifts and client demands, a crucial factor in the fast-paced financial technology sector.

IRESS fosters deep customer relationships through dedicated account management, ensuring tailored support and understanding of unique client needs. This personalized approach drives satisfaction and opens doors for deeper collaboration, as evidenced by their 95% first-contact resolution rate for technical issues in 2024.

Comprehensive training and professional development programs empower clients to maximize software value, with participants in advanced analytics workshops seeing a 15% increase in actionable insights in 2024.

Online communities like Advisely, which saw a 30% increase in active users in 2024, facilitate peer support and knowledge sharing, leading to a 15% higher retention rate for active participants.

IRESS's co-creation model actively involves clients in product development, ensuring software aligns with real-world industry demands and fostering strong user loyalty.

| Customer Relationship Strategy | 2024 Impact/Data | Key Benefit |

|---|---|---|

| Dedicated Account Management | High client satisfaction | Tailored service, deeper collaboration |

| Technical Support | 95% first-contact resolution | Minimizes disruption, ensures seamless operations |

| Training & Development | 15% increase in actionable insights for workshop participants | Enhanced proficiency, better ROI |

| Online Communities (Advisely) | 30% increase in active users, 15% higher retention for participants | Peer support, knowledge sharing, loyalty |

| Co-creation & Feedback Integration | Direct client input into product roadmaps | Market responsiveness, relevant solutions |

Channels

IRESS leverages a direct sales force to engage with major institutional clients and large enterprise financial services companies. This approach is crucial for selling complex software solutions that require in-depth demonstrations and customized proposals.

This direct channel facilitates detailed discussions about client needs and allows for the negotiation of bespoke contract terms, ensuring solutions are perfectly aligned with enterprise requirements. For instance, in 2024, IRESS reported that its direct sales efforts were instrumental in securing several multi-year contracts with leading global investment banks, highlighting the channel's effectiveness in high-value client acquisition.

IRESS leverages secure online platforms and digital portals to deliver its comprehensive suite of software and services. This digital-first approach grants clients direct, anytime access to critical applications, real-time market data, and essential support resources, fostering a seamless user experience.

This robust digital infrastructure underpins IRESS's global reach, ensuring scalability and accessibility for a diverse international clientele. In 2024, IRESS reported a significant portion of its revenue derived from its software and services delivered via these digital channels, reflecting the industry's shift towards cloud-based solutions.

IRESS actively participates in major financial technology and services industry events, such as Money20/20 and Finovate, to demonstrate its latest software solutions and innovations. These gatherings are crucial for connecting with potential clients and partners, fostering valuable relationships within the financial ecosystem.

In 2024, IRESS continued its strategy of engaging with industry thought leaders and showcasing its capabilities at key conferences. This direct engagement allows for the dissemination of expertise and reinforces IRESS's position as a leader in financial software and services.

Conferences like the annual FStech Awards provide a platform for IRESS to gain industry recognition and highlight its commitment to excellence. Such events are vital for building brand awareness and understanding emerging market trends.

Partner Networks and Integrations

IRESS leverages its extensive network of technology and integration partners to broaden its market reach, embedding its financial solutions within larger technology ecosystems. This strategy ensures that clients already invested in partner platforms can adopt IRESS's offerings with greater ease and efficiency.

These partnerships are crucial for creating a more unified client experience, allowing for the seamless flow of data and functionality across different financial technology stacks. In 2024, IRESS continued to foster these relationships, aiming to increase the interoperability of its products.

- Expanded Ecosystem Reach: Partnerships allow IRESS solutions to be part of a wider array of financial technology environments.

- Streamlined Client Adoption: Clients using partner technologies benefit from easier integration and quicker deployment of IRESS products.

- Enhanced Value Proposition: Integrated solutions offer greater utility and efficiency for end-users in the financial sector.

- Market Penetration: Collaborations with key players in the financial technology space drive new customer acquisition and deepen existing client relationships.

Investor Relations and Corporate Communications

IRESS leverages investor relations and corporate communications to clearly articulate its strategic direction, financial performance, and the inherent value proposition to its shareholders and the wider investment ecosystem. This transparency is crucial for fostering trust and attracting capital.

Through channels like annual reports, quarterly earnings releases, and dedicated investor presentations, IRESS provides vital information. For instance, in their 2024 interim results, IRESS reported a statutory profit after tax of $75.4 million, demonstrating their ongoing financial health and operational execution.

- Annual Reports: Comprehensive overview of strategy, governance, and financial performance.

- Financial Results Announcements: Timely disclosure of earnings and key financial metrics.

- Investor Presentations: Detailed explanations of business performance and future outlook.

- Shareholder Meetings: Direct engagement and Q&A opportunities with management.

IRESS utilizes a direct sales force for high-value institutional clients, offering tailored solutions and complex contract negotiations. This personal engagement is key for closing significant deals, as evidenced by IRESS's 2024 reports highlighting success with major investment banks.

Digital platforms are central to IRESS's delivery model, providing clients with continuous access to software, data, and support. This cloud-first approach in 2024 supported IRESS's global operations and revenue growth, aligning with market trends for accessible financial technology.

Industry events and conferences serve as vital channels for IRESS to showcase innovations and build relationships within the financial ecosystem. Participation in 2024's key fintech gatherings reinforced IRESS's market presence and thought leadership.

Strategic partnerships with technology providers expand IRESS's market reach and facilitate seamless integration for clients. These collaborations in 2024 aimed to enhance product interoperability and client adoption across diverse technology stacks.

Customer Segments

Wealth managers and financial advisers, from independent planners to large enterprises, are a core customer segment. They need sophisticated tools for client relationship management, in-depth financial planning, and precise portfolio analysis to navigate complex markets and meet stringent regulatory demands. For instance, in 2024, the global wealth management market was valued at approximately $75 trillion, highlighting the significant demand for effective software solutions like IRESS's Xplan.

These professionals rely on platforms that streamline workflows, enhance client communication, and ensure compliance with evolving regulations. IRESS's Xplan, a leading software solution, directly addresses these needs by providing a comprehensive suite of functionalities designed to support every aspect of the advisory process. The adoption rate of digital advisory tools among wealth managers continues to climb, with many firms reporting increased efficiency and client satisfaction.

Institutional traders and brokers, including investment banks, hedge funds, and market makers, rely heavily on robust trading platforms and real-time market data. These entities, which form a significant portion of the financial market, require advanced tools for efficient trade execution and comprehensive risk management. For instance, in 2024, the global electronic trading market was valued at over $14 billion, highlighting the critical need for high-performance solutions.

IRESS's suite of trading and market data solutions directly addresses these demanding requirements. By providing access to deep liquidity pools and sophisticated analytics, IRESS empowers these institutions to navigate complex market conditions and execute trades with precision. This segment's demand for speed and reliability is paramount, as milliseconds can translate into millions in profit or loss.

Superannuation and pension funds are key customers, needing robust software for managing vast assets and member data. These institutions, responsible for the retirement security of millions, rely on specialized platforms for everything from daily administration and member communications to complex regulatory compliance and digital investment advice.

In 2024, the superannuation sector in Australia alone managed over AUD 3.7 trillion in assets, highlighting the scale of operations these funds undertake. IRESS's solutions are designed to help these entities efficiently handle this scale, improve member engagement through digital tools, and ensure adherence to evolving financial regulations.

Investment Managers

Investment managers, including asset and portfolio managers, rely on sophisticated platforms for managing diverse portfolios. These professionals require tools for in-depth performance analysis, efficient portfolio construction, and seamless execution across multiple asset classes. IRESS provides software solutions designed to meet these critical operational needs, supporting their strategic investment decisions.

The global asset management industry saw significant growth, with assets under management reaching an estimated $100 trillion by the end of 2024. This expansion underscores the demand for robust technological solutions that can handle complex data and trading workflows. Investment managers are increasingly looking for integrated systems that offer real-time market data, advanced analytics, and automated compliance features to navigate this dynamic environment.

- Key Needs: Portfolio construction, performance attribution, risk management, order execution, and compliance monitoring.

- Market Trend: Growing demand for cloud-based solutions and AI-driven analytics to enhance efficiency and uncover alpha.

- Industry Data: The average expense ratio for actively managed equity funds in the US was around 0.43% in 2024, highlighting the pressure on managers to demonstrate value and control costs.

Financial Technology (FinTech) Providers

IRESS's Financial Technology (FinTech) Providers customer segment includes other FinTech companies and solution providers. These entities integrate IRESS's data feeds or components into their own offerings, enhancing their products by leveraging IRESS's robust infrastructure and extensive data capabilities. This strategic integration allows these FinTech partners to expand their service portfolios and reach new markets.

The primary channel for reaching this segment is through IRESS's dedicated API programs and strategic partnership initiatives. These programs are designed to facilitate seamless integration and collaboration, enabling FinTech providers to efficiently embed IRESS solutions. For instance, in 2024, IRESS continued to expand its API offerings, supporting a growing ecosystem of financial technology innovators.

- Integration Partners: FinTech firms that embed IRESS data feeds or software components to enhance their own product suites.

- API Access: Leveraging IRESS's Application Programming Interfaces for direct data and functionality integration.

- Partnership Programs: Collaborating with IRESS to co-develop or enhance financial solutions, benefiting from IRESS's market presence and technology.

IRESS serves a diverse range of financial market participants, each with distinct needs and reliance on sophisticated technology. Wealth managers and financial advisors are a primary focus, requiring tools for client management, financial planning, and portfolio analysis. Institutional traders and brokers depend on IRESS for robust trading platforms and real-time market data to execute trades efficiently and manage risk.

Superannuation and pension funds utilize IRESS solutions for managing substantial assets and member data, ensuring regulatory compliance and member engagement. Investment managers, including asset and portfolio managers, benefit from platforms that offer in-depth performance analysis and efficient portfolio construction across various asset classes. Additionally, IRESS partners with FinTech providers, enabling them to integrate IRESS's data and components into their own offerings.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Wealth Managers & Financial Advisors | Client relationship management, financial planning, portfolio analysis, compliance | Global wealth management market valued at ~$75 trillion |

| Institutional Traders & Brokers | Trading platforms, real-time market data, risk management, trade execution | Global electronic trading market valued at >$14 billion |

| Superannuation & Pension Funds | Asset and member data management, regulatory compliance, member communication | Australian superannuation sector managed >AUD 3.7 trillion in assets |

| Investment Managers | Performance analysis, portfolio construction, order execution, risk management | Global asset management industry AUM reached ~$100 trillion |

| FinTech Providers | Data feeds, software components integration, API access | Continued expansion of API offerings supporting financial technology innovators |

Cost Structure

IRESS invests heavily in Research and Development (R&D) to stay ahead in the financial technology space. These significant costs are crucial for developing new software features, innovative products, and embracing technological advancements like AI and cloud optimization. For instance, in 2023, IRESS reported R&D expenses of approximately AUD 125 million, reflecting their commitment to continuous improvement and market relevance.

Employee salaries and benefits represent a significant cost for IRESS, reflecting the need to attract and retain specialized talent in areas like software development and financial services. In 2024, IRESS continued to focus on optimizing its workforce, with headcount reductions being a key component of its cost-saving strategies. This approach aims to streamline operations and improve efficiency across the organization.

IRESS invests significantly in its technology infrastructure, encompassing servers, networks, and robust cloud hosting. These expenses are crucial for maintaining the high availability, security, and scalability of its financial data and trading platforms, ensuring uninterrupted service for its global clientele.

In 2024, the ongoing shift towards cloud-based solutions continues to be a major driver of these costs. For a company like IRESS, which relies heavily on data processing and real-time analytics, these infrastructure expenses are essential for competitive operation and future innovation.

Data Acquisition and Licensing Fees

IRESS faces significant expenses related to obtaining and licensing crucial financial data. This includes fees paid to stock exchanges, data providers, and other entities for access to market information. For instance, in 2024, the cost of market data feeds can be a substantial portion of a financial technology firm's operational budget, often running into millions of dollars annually depending on the breadth and depth of data required.

Beyond raw data, IRESS also incurs costs for licensing third-party technologies and intellectual property. These might be software components, algorithms, or specialized databases that enhance their product offerings. These licensing fees are essential for maintaining a competitive edge and ensuring their solutions are robust and feature-rich, reflecting the ongoing investment in technological integration.

- Market Data Fees: Costs associated with real-time and historical data from global exchanges and vendors.

- Technology Licensing: Payments for using patented software, algorithms, or data processing tools from external providers.

- Intellectual Property Rights: Royalties or fees for utilizing licensed content or proprietary methodologies.

- Data Aggregation Costs: Expenses incurred in collecting, cleaning, and consolidating data from disparate sources.

Sales, Marketing, and Administrative Overheads

IRESS’s cost structure includes significant expenses for sales, marketing, and administrative functions. These encompass a wide range of activities, from global advertising campaigns and promotional events to the ongoing operational costs of its corporate offices and regional administrative teams.

In 2024, companies in the financial technology sector, similar to IRESS, often allocate a substantial portion of their budget to client acquisition and retention. For instance, marketing and sales expenses can represent between 15% and 30% of revenue for software-as-a-service (SaaS) providers, depending on their growth stage and market penetration strategy.

- Advertising and Promotions: Costs associated with brand building and lead generation through various media channels.

- Sales Force Operations: Salaries, commissions, and travel expenses for the sales teams responsible for acquiring and managing clients.

- Administrative Overhead: Expenses related to corporate governance, legal, finance, human resources, and the upkeep of office spaces worldwide.

- Event Participation: Costs for attending and sponsoring industry conferences and client events to foster relationships and showcase offerings.

IRESS's cost structure is heavily influenced by its commitment to innovation, reflected in substantial Research and Development (R&D) spending, which was approximately AUD 125 million in 2023. This investment fuels the development of new software features and the adoption of advanced technologies. Furthermore, the company manages significant expenses related to employee compensation and benefits, essential for attracting and retaining specialized talent in the competitive fintech landscape. In 2024, IRESS focused on workforce optimization, including headcount reductions, as a key cost-saving measure to enhance operational efficiency.

Infrastructure and data licensing are also core components of IRESS's cost base. This includes substantial expenditure on technology infrastructure like servers, networks, and cloud hosting to ensure platform reliability and scalability. Additionally, the company incurs significant costs for obtaining real-time and historical financial data from various exchanges and providers, a necessity for its data-driven services. In 2024, market data feeds alone represented a considerable operational budget item for financial technology firms.

Sales, marketing, and administrative functions represent another critical area of expenditure for IRESS. These costs encompass global advertising, client acquisition strategies, and the operational overhead of its corporate offices. For SaaS providers like IRESS, sales and marketing expenses can range from 15% to 30% of revenue in 2024, highlighting the investment required for market penetration and client retention.

| Cost Category | Key Components | 2023/2024 Relevance |

| Research & Development | New feature development, AI integration, cloud optimization | AUD 125 million (2023); ongoing investment for innovation |

| Personnel Costs | Salaries, benefits for specialized talent | Focus on workforce optimization and headcount reduction (2024) |

| Technology Infrastructure | Servers, networks, cloud hosting, data security | Essential for platform reliability and scalability in 2024 |

| Data & Licensing | Market data feeds, third-party software, intellectual property | Significant annual expenditure for data access and enhanced offerings |

| Sales, Marketing & Admin | Advertising, sales force, office upkeep, client events | 15-30% of revenue for SaaS providers (2024); crucial for growth |

Revenue Streams

IRESS's core revenue generation relies heavily on recurring subscription fees. Clients pay to access their sophisticated software platforms, which cover a wide range of financial services from wealth management with Xplan to trading systems and superannuation administration.

These subscriptions are generally structured as annual or multi-year agreements, providing IRESS with predictable and stable income. For instance, in the first half of 2024, IRESS reported that its software and services revenue, largely driven by these subscriptions, reached AUD 302.6 million, demonstrating the significant contribution of this revenue stream.

Beyond standard subscriptions, IRESS secures revenue by licensing its specialized modules, features, and data streams. These agreements often tie fees to how much clients use the service or how many people access it, offering a flexible and scalable approach.

For instance, in 2024, a significant portion of IRESS's income is derived from these usage-based and licensing models, reflecting a strategic move to cater to diverse client needs and usage patterns. This allows businesses to pay for precisely what they utilize, optimizing costs.

IRESS generates significant revenue through its professional services, which are crucial for clients adopting its software. These services encompass the entire implementation lifecycle, from initial setup and customization to data migration and ongoing consulting.

For example, in 2023, IRESS reported that its professional services and implementation fees contributed substantially to its overall revenue, reflecting the complex nature of financial technology integration. This segment allows clients to tailor IRESS solutions to their specific operational needs, ensuring seamless adoption and maximizing the value derived from the platform.

Maintenance and Support Contracts

Maintenance and support contracts are a cornerstone revenue stream for IRESS, offering clients continuous access to essential services. These agreements typically cover technical assistance, crucial software updates, and prompt bug fixes, ensuring clients' systems operate smoothly and efficiently.

This recurring revenue model provides IRESS with predictable income, bolstering financial stability. For instance, in 2024, a significant portion of IRESS’s revenue is derived from these ongoing service agreements, reflecting the value clients place on uninterrupted access and support for their critical financial technology infrastructure.

- Recurring Revenue: Contracts provide a stable and predictable income stream.

- Client Retention: Essential support encourages long-term customer relationships.

- Value Proposition: Ensures clients receive ongoing updates and technical assistance.

- 2024 Contribution: These contracts represent a substantial part of IRESS's annual revenue.

Data Intelligence and Analytics Products

IRESS is strategically expanding its revenue through specialized data products and advanced analytics. This focus taps into their vast data reserves to deliver crucial insights for the funds management sector and other financial industries.

These offerings are designed to empower clients with actionable intelligence, driving better decision-making and operational efficiency. For example, in 2024, IRESS continued to enhance its data platforms, offering deeper market analysis and predictive capabilities.

- Data-driven insights for investment strategies.

- Enhanced analytics for risk management and compliance.

- Access to proprietary market data and research.

- Tools for performance attribution and portfolio optimization.

IRESS also generates revenue through transaction-based fees, particularly within its trading and market data segments. This means that for certain services, especially those involving the execution of trades or the provision of real-time market data feeds, IRESS earns income based on the volume or value of transactions processed through its platforms.

This model aligns IRESS’s success directly with client activity levels, making it a variable but potentially lucrative revenue stream. In 2024, these transaction fees continue to be a vital component, especially as market volatility can lead to increased trading volumes, thereby boosting IRESS’s earnings from this source.

The company also monetizes through the sale and licensing of specialized financial data and analytics. This includes access to historical market data, research reports, and proprietary analytical tools designed to assist financial professionals in making informed investment decisions.

For example, IRESS’s data solutions are critical for clients needing to perform complex analysis, risk management, and compliance checks. In the first half of 2024, IRESS reported growth in its data and analytics offerings, underscoring the increasing demand for sophisticated financial intelligence.

| Revenue Stream | Description | 2024 Relevance (H1) |

|---|---|---|

| Subscription Fees | Recurring payments for software access. | AUD 302.6 million (Software & Services Revenue) |

| Licensing & Usage Fees | Fees based on module use or user count. | Significant contributor, flexible for clients. |

| Professional Services | Implementation, customization, and consulting. | Substantial contribution, crucial for adoption. |

| Maintenance & Support | Ongoing technical assistance and updates. | Provides predictable income and client retention. |

| Data Products & Analytics | Sale of specialized data and analytical tools. | Continued growth in demand for financial intelligence. |

| Transaction Fees | Income from trade execution and data usage volume. | Vital component, sensitive to market activity. |

Business Model Canvas Data Sources

The IRESS Business Model Canvas is built upon a foundation of robust financial data, comprehensive market research, and deep strategic insights. These diverse data sources ensure that every block of the canvas is accurately populated with current and relevant information.