IRESS Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRESS Bundle

Uncover the strategic brilliance behind IRESS's marketing efforts by exploring its Product, Price, Place, and Promotion. This analysis reveals how they craft compelling offerings, set competitive prices, reach their target audience, and communicate their value proposition effectively. Dive deeper to understand the intricate interplay of these elements and gain actionable insights.

Ready to elevate your marketing strategy? Get instant access to the complete 4Ps Marketing Mix Analysis for IRESS, a professionally written, editable resource designed for business professionals and students. Discover the secrets to their market success and apply them to your own ventures.

Product

IRESS's Integrated Wealth Management Platform, exemplified by Xplan, acts as the Product in the 4Ps. It’s a unified solution that brings together financial planning, advice delivery, portfolio management, and client reporting into one cohesive system. This integration is designed to significantly reduce operational friction for financial advisors and institutions.

The platform’s core value proposition lies in its ability to offer a holistic view of client financial situations, enabling more informed decision-making and personalized advice. For instance, in 2024, the demand for such integrated solutions surged as firms looked to consolidate technology stacks and improve client experience amidst increasing regulatory scrutiny and market volatility.

By streamlining complex workflows, IRESS’s platform directly addresses the efficiency needs of wealth management professionals. This allows them to focus more on client relationships and strategic advice rather than administrative tasks. The platform’s comprehensive nature aims to capture a significant share of the market seeking end-to-end wealth management capabilities.

IRESS's Advanced Trading & Market Data Solutions are a cornerstone of their product offering, providing sophisticated platforms and real-time data. These tools are designed to equip financial professionals with the critical insights and execution capabilities needed in today's fast-paced markets. For instance, IRESS's platforms are utilized by a significant portion of financial institutions globally, facilitating millions of trades annually.

A key development in this area is IRESS's partnership with interop.io. This collaboration focuses on delivering modular and personalized trading experiences through their 'MyIress' workspace. This initiative aims to enhance user experience by allowing seamless integration of various third-party applications, thereby boosting efficiency and customization for traders.

IRESS's superannuation administration software is a core product designed to handle the intricate administrative and compliance demands of Australia's superannuation sector. This includes managing member data, contributions, payments, and regulatory reporting for various super funds. The software aims to streamline operations for providers, ensuring accuracy and efficiency in a highly regulated environment.

The product's value is enhanced by IRESS's commitment to innovation, as demonstrated by the 2024 launch of a new digital advice and education solution. This initiative directly addresses a critical need within the superannuation industry to better engage and serve members, particularly those lacking access to professional financial advice. This move positions IRESS as a partner in improving member outcomes and financial literacy.

By offering these integrated solutions, IRESS supports superannuation providers in navigating the evolving landscape of member engagement and digital service delivery. The focus on end-to-end digital capabilities underscores a strategy to provide comprehensive tools that not only manage administration but also foster member growth and financial well-being, a crucial aspect given the significant assets managed within Australian superannuation, which stood at over $3.5 trillion as of late 2024.

Compliance and Regulatory Tools

IRESS’s compliance and regulatory tools are a cornerstone of its product suite, directly addressing the critical need for financial firms to navigate complex legal frameworks. These offerings are engineered to help clients adhere to mandates like the Quality of Advice Review (QAR), ensuring they operate within the bounds of evolving financial legislation. This focus on compliance is essential for mitigating operational risks and maintaining market integrity.

The demand for robust regulatory solutions is escalating. For instance, in Australia, the financial services industry is continuously adapting to new compliance standards. IRESS's tools provide a technological advantage, enabling firms to automate reporting, monitor transactions for suspicious activity, and manage client data securely, thereby reducing the likelihood of penalties and reputational damage.

- Regulatory Adherence: Tools support compliance with frameworks like the QAR, crucial for financial advice businesses.

- Risk Mitigation: Features help reduce operational and regulatory risks through automated checks and alerts.

- Adaptability: The platform is designed to evolve with changing financial regulations, ensuring ongoing compliance.

- Market Demand: Strong client adoption reflects the industry's need for efficient and reliable compliance solutions.

AI-Enabled Capabilities and Data Intelligence

IRESS is heavily investing in AI and data intelligence to boost efficiency for financial advisors, particularly through its Xplan platform. A key development is a new data product designed to offer clear insights into retail advice capital flows, a critical metric for understanding market dynamics. This initiative aims to make essential data readily accessible and actionable for advisors.

The company's strategy involves embedding AI-driven intelligence and best practices directly into its offerings. This means features for health monitoring, recording, and visibility will become instantly usable, streamlining advisor workflows. By 2025, IRESS is exploring the use of AI agents as virtual team members to augment advice processes, potentially transforming how financial advice is delivered.

- Data-Driven Insights: IRESS's new data product offers real-time visibility into retail advice capital flows, a crucial indicator for market strategy.

- Enhanced Efficiency: AI integration into platforms like Xplan aims to automate tasks and provide instant access to critical information for financial advisors.

- Future of Advice: By 2025, IRESS plans to deploy AI agents to support and augment advisor workflows, acting as virtual team members.

- Focus on Usability: The company is committed to making AI-powered health monitoring, recording, and visibility features instantly usable and integrated.

IRESS's product strategy centers on delivering integrated, data-driven solutions that enhance efficiency and compliance for financial professionals. The Xplan platform, a prime example, unifies wealth management functions, while advanced trading and market data solutions provide critical insights. Furthermore, specialized software for superannuation administration and robust compliance tools cater to specific industry needs.

| Product Area | Key Features | 2024/2025 Focus/Data | Target Audience | Value Proposition |

|---|---|---|---|---|

| Integrated Wealth Management (Xplan) | Financial planning, advice delivery, portfolio management, client reporting | Surging demand for consolidated tech stacks; focus on client experience and regulatory adherence. | Financial advisors, wealth management firms | Streamlined operations, holistic client view, improved decision-making. |

| Trading & Market Data | Real-time data, execution capabilities, modular workspaces (MyIress) | Partnership with interop.io for personalized trading experiences; millions of trades facilitated annually. | Traders, institutional investors | Critical insights, efficient execution, enhanced user experience. |

| Superannuation Administration | Member data management, contributions, payments, regulatory reporting | Launch of digital advice & education solution to improve member engagement; Australian superannuation assets over $3.5 trillion (late 2024). | Superannuation fund administrators | Streamlined administration, compliance, enhanced member engagement. |

| Compliance & Regulatory Tools | Adherence to frameworks (e.g., QAR), automated reporting, risk mitigation | Escalating demand due to evolving financial regulations; automation of reporting and transaction monitoring. | Financial services firms | Reduced operational risk, ongoing compliance, mitigation of penalties. |

| AI & Data Intelligence | AI-driven insights, data products for capital flows, virtual team members (future) | Investment in AI to boost advisor efficiency; new data product for retail advice capital flows. AI agents planned for 2025. | Financial advisors | Actionable data insights, automated workflows, augmented advice processes. |

What is included in the product

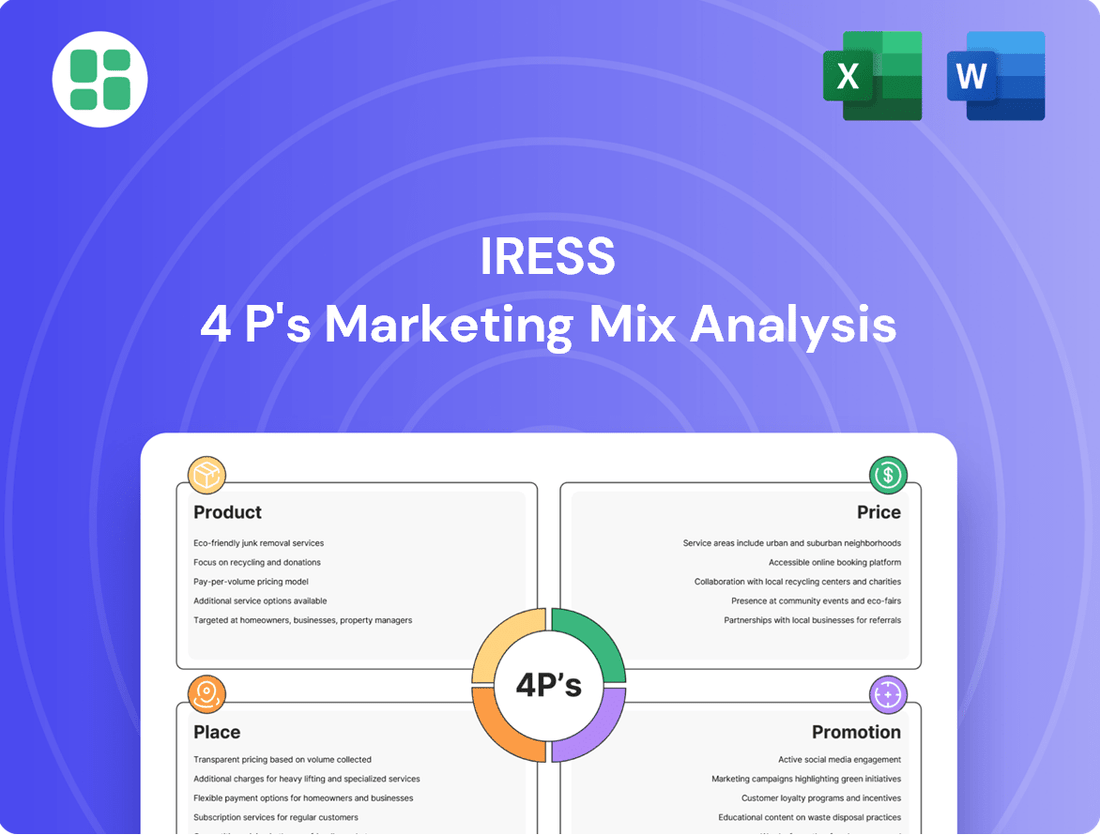

This analysis provides a comprehensive deep dive into IRESS's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and managers.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for informed decision-making.

Provides a clear, structured framework for analyzing IRESS's marketing efforts, easing the burden of identifying and addressing strategic gaps.

Place

IRESS's direct sales and account management strategy is central to its go-to-market approach, especially for its enterprise-level software solutions. This model focuses on building deep relationships with financial institutions, ensuring a nuanced understanding of complex client requirements. For instance, in 2024, IRESS continued to invest in its global sales teams, aiming to provide personalized support and tailored demonstrations of its platforms, which are crucial for securing and retaining large financial services contracts.

The direct engagement model allows IRESS to effectively communicate the value proposition of its comprehensive suite of products, from trading and market data to wealth management and mortgage origination. By having dedicated account managers, clients receive ongoing support, strategic advice, and proactive problem-solving, which is vital in the fast-evolving financial technology landscape. This client-centric focus is a key differentiator, particularly when competing for substantial enterprise deals where trust and expertise are paramount.

IRESS strategically operates a global network of regional offices, spanning key financial centers in Asia-Pacific, North America, Africa, the UK, and Europe. This extensive footprint allows IRESS to directly engage with its diverse international clientele, offering tailored support and localized implementation strategies. For instance, as of early 2024, IRESS reported serving clients in over 20 countries, underscoring its commitment to localized market understanding and service delivery.

IRESS leverages cloud technology to deliver its software via secure, scalable platforms, emphasizing no-outage upgrades for clients spanning global time zones. This approach ensures enhanced accessibility and faster deployment.

This cloud-based model aligns with modern enterprise software demands, facilitating continuous updates. For instance, in early 2024, IRESS reported significant growth in its cloud-based revenue streams, reflecting a strong market adoption of this delivery method.

Strategic Partnerships and Integrations

IRESS actively cultivates strategic partnerships to broaden its market presence and enrich its technological ecosystem. A prime example is the Iress Partnership within the UK Wealth business, which prioritizes deep integrations with carefully chosen third-party technology providers. These collaborations are designed for maximum impact, involving joint solution development and synchronized roadmap planning to deliver a more unified and fluid client experience.

These alliances are crucial for IRESS's growth strategy, enabling it to offer more comprehensive solutions. For instance, by integrating with specialized fintech firms, IRESS can provide clients with access to cutting-edge functionalities without needing to develop them in-house. This approach not only accelerates innovation but also ensures that IRESS's offerings remain competitive and meet evolving market demands. In 2024, IRESS continued to emphasize these integrations, aiming to solidify its position as a central hub for financial services technology.

- Expanded Market Reach: Partnerships allow IRESS to tap into new client segments and geographies by leveraging the established networks of its collaborators.

- Enhanced Product Offerings: Co-designed solutions and integrated roadmaps mean clients benefit from a more complete and seamless technology experience.

- Accelerated Innovation: Collaborating with third-party providers speeds up the introduction of new features and capabilities, keeping IRESS at the forefront of financial technology.

- Ecosystem Strengthening: These strategic alliances build a robust ecosystem around IRESS's core platforms, increasing their value proposition for all stakeholders.

Client Training and Support Channels

IRESS understands that successful adoption hinges on robust client training and accessible support. They offer a multi-channel approach, encompassing online knowledge bases, live chat, and dedicated account management teams, ensuring clients can access assistance when and how they need it. This commitment is underscored by their 'Loop' feedback program, which actively solicits and integrates client suggestions to refine their offerings.

In 2024, IRESS reported a 92% client satisfaction rate with their support services, a figure directly attributed to the effectiveness of these diverse training and support initiatives. Their professional services division also plays a crucial role, providing tailored onboarding and advanced training sessions. This focus on continuous improvement and client empowerment is key to maximizing the value derived from their financial technology solutions.

- Online Resources: Comprehensive documentation, video tutorials, and FAQs available 24/7.

- Dedicated Support Teams: Technical and functional support staffed by product experts.

- Professional Services: On-site training, custom implementation, and strategic consulting.

- Client Feedback Program ('Loop'): Structured mechanism for gathering and acting on client input for product enhancement.

IRESS's place strategy centers on its global presence and cloud-based delivery. By operating regional offices in key financial hubs, IRESS ensures localized engagement and support for its diverse clientele. This physical footprint, combined with its cloud infrastructure, facilitates accessibility and efficient deployment of its financial technology solutions across different markets.

Same Document Delivered

IRESS 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive IRESS 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. Gain valuable insights into IRESS's strategy without any hidden steps.

Promotion

IRESS leverages precision digital marketing to connect with financial institutions, utilizing content marketing, webinars, and expert insights. Their approach focuses on delivering value to key decision-makers by addressing industry-specific challenges.

By offering content such as quarterly product roadmap updates and insightful industry analysis, IRESS demonstrates its commitment to solving the unique problems and capitalizing on the opportunities within the financial sector. This targeted approach ensures their marketing efforts resonate deeply with their intended audience.

IRESS actively participates in key industry events like the annual Money20/20 Europe and various national financial services expos. In 2024, their presence at these forums is expected to reach over 10,000 attendees, providing direct engagement opportunities with prospective clients and partners.

These events serve as vital platforms for IRESS to demonstrate its cutting-edge solutions, such as advancements in AI-driven wealth management and open banking integrations. Their thought leadership is amplified through executive speaking slots, with IRESS executives scheduled to present on topics like the future of financial advice at major 2024 conferences.

IRESS strategically leverages public relations and media engagement to bolster its brand. This involves securing prominent coverage in key financial and technology outlets, such as The Wall Street Journal and TechCrunch, and issuing timely press releases for significant announcements like their 2024 acquisition of a new data analytics firm, which was widely reported. These efforts are crucial for building credibility and positive perception within the financial services sector, reinforcing IRESS's market standing.

Client Success Stories and Case Studies

IRESS effectively leverages client success stories as a key promotional element. By showcasing detailed case studies and testimonials, they highlight the tangible benefits and return on investment (ROI) that clients achieve with their solutions. This social proof is crucial for building trust with potential customers.

These real-world examples, often found on IRESS's website and industry platforms, demonstrate the practical application and positive outcomes of their software. For instance, a case study might detail how a wealth management firm improved operational efficiency by 25% after implementing IRESS's platform, leading to significant cost savings and enhanced client service.

- Demonstrates Tangible ROI: Case studies quantify the value clients receive, such as increased revenue or reduced operational costs.

- Builds Credibility and Trust: Real client experiences validate IRESS's claims and build confidence among prospects.

- Highlights Solution Versatility: Success stories across different financial sectors showcase the adaptability of IRESS's offerings.

- Provides Social Proof: Positive feedback and documented achievements from existing users act as powerful endorsements.

Direct Sales Presentations and Demos

Direct sales presentations and demonstrations are a cornerstone of IRESS's promotional strategy, offering a tangible way for prospective clients to engage with its sophisticated financial software. This direct interaction allows the sales team to highlight how IRESS's solutions can address specific industry challenges, such as streamlining compliance workflows or enhancing trading desk efficiency.

These personalized sessions are crucial for demonstrating the practical application and value proposition of IRESS's offerings. For instance, a demo might showcase how IRESS's wealth management platform can reduce client onboarding time by an estimated 20%, a significant improvement for financial advisory firms aiming to scale their operations. The ability to see the software in action, tailored to their needs, builds confidence and clarifies the return on investment.

- Personalized Engagement: Sales teams tailor presentations to address individual client pain points and business objectives.

- Live Demonstrations: Potential clients experience the software's features and benefits firsthand, fostering understanding and trust.

- Solution-Oriented Approach: Focus is placed on how IRESS's technology solves specific business challenges, such as improving data accuracy or automating reporting.

- ROI Clarity: Demonstrations often highlight efficiency gains and cost savings, such as a projected 15% reduction in manual data entry for investment banks using IRESS's trading solutions.

IRESS's promotional strategy is multi-faceted, combining digital reach with direct engagement. They utilize content marketing, industry event participation, public relations, and client success stories to showcase their solutions and build credibility. Direct sales demonstrations are also key, allowing potential clients to see the value firsthand.

In 2024, IRESS's presence at major financial expos is projected to connect them with over 10,000 attendees, facilitating direct engagement. Their digital efforts include webinars and expert insights, targeting financial decision-makers with solutions to industry challenges, as evidenced by their 2024 acquisition of a data analytics firm, widely covered by outlets like The Wall Street Journal.

Client success stories are crucial, often detailing ROI improvements like a 25% efficiency gain for wealth management firms using their platform. Direct sales demos further solidify this, with presentations showcasing how IRESS can reduce onboarding time by 20% or cut manual data entry by 15% for investment banks.

| Promotional Tactic | Key Activities | Target Audience Impact | 2024/2025 Data Point |

| Digital Marketing & Content | Webinars, industry analysis, product roadmap updates | Addresses specific industry challenges, delivers value | Focus on AI-driven wealth management advancements |

| Industry Events | Money20/20 Europe, national expos | Direct engagement, solution showcasing | Expected attendance over 10,000 in 2024 |

| Public Relations | Media coverage, press releases | Builds credibility, positive perception | Acquisition of data analytics firm widely reported in 2024 |

| Client Success Stories | Case studies, testimonials | Demonstrates tangible ROI, builds trust | Case study example: 25% operational efficiency increase |

| Direct Sales & Demos | Personalized presentations, software demonstrations | Highlights specific solutions, clarifies ROI | Demo example: 20% reduction in client onboarding time |

Price

IRESS likely utilizes value-based enterprise licensing for its software, a strategy that prices solutions based on the substantial benefits clients receive. This means the cost reflects the significant operational efficiencies, enhanced compliance, and strategic advantages IRESS solutions offer financial institutions, rather than just the software's features.

This approach directly ties the price to the client's long-term return on investment (ROI), ensuring the cost aligns with the tangible value and competitive edge IRESS delivers. For instance, a 2024 study indicated that financial firms adopting advanced workflow automation software, like those IRESS offers, saw an average 15% reduction in operational costs.

IRESS's subscription-based model is central to its pricing strategy, offering a predictable revenue stream for the company and a stable cost structure for its clients. This approach allows customers to budget effectively, knowing their expenses for software and services will remain consistent. For instance, many of IRESS's solutions, like their market data terminals or wealth management platforms, operate on a per-user or per-module subscription basis, with pricing tiers designed to accommodate different client needs and scales of operation.

IRESS likely employs tiered pricing to accommodate its broad client spectrum, from smaller advisory practices to large institutional investors. For instance, a basic tier might offer core portfolio management tools for a few hundred dollars per month, while a premium tier for enterprise clients could include advanced analytics, extensive data feeds, and dedicated support, potentially costing tens of thousands monthly. This structure ensures affordability for emerging firms while providing the robust capabilities needed by major financial players.

Custom Quotes and Negotiated Contracts

For significant projects or highly tailored solutions, IRESS likely engages in custom quoting and direct contract negotiations. This approach offers pricing flexibility to address specific client needs, intricate integrations, and enduring strategic alliances, especially for enterprise-level engagements.

This bespoke pricing strategy acknowledges the unique demands of large-scale deployments. For instance, a financial institution requiring extensive customization of IRESS's wealth management platform might negotiate terms that reflect the significant development resources allocated. Such contracts often include multi-year commitments, ensuring stability for both parties.

Key aspects of custom quotes and negotiated contracts typically include:

- Tiered pricing structures based on user volume or feature sets.

- Implementation and integration fees that vary with project complexity.

- Support and maintenance agreements tailored to service level requirements.

- Long-term partnership incentives such as volume discounts or dedicated account management.

Competitive Landscape and Market Conditions

IRESS's pricing strategy is deeply intertwined with the dynamic financial technology sector and current market conditions. The company's 2024 transformation program, for instance, featured a significant move towards standardized pricing. This initiative reflects a broader aim to establish a fairer and more equitable pricing structure across its diverse offerings.

By balancing market demand with the perceived value of its solutions, IRESS seeks to maintain a competitive edge. This approach is crucial in a sector where innovation and cost-effectiveness are paramount. The company's commitment to this balanced pricing model ensures they remain attractive to clients while reflecting the value delivered.

- Standardization: IRESS implemented standardized pricing as part of its 2024 transformation.

- Market Alignment: Pricing is adjusted to reflect prevailing market conditions and demand.

- Value Proposition: The strategy aims to align prices with the perceived value of IRESS's technology solutions.

- Competitiveness: Ensuring competitive pricing is a key objective in the fintech landscape.

IRESS's pricing strategy centers on value-based enterprise licensing and a subscription model, ensuring costs align with client ROI and operational benefits. For example, adopting automation software, similar to IRESS offerings, led to a 15% average reduction in operational costs for financial firms in 2024.

Tiered pricing caters to a wide client base, from small practices to large institutions, with custom quoting for bespoke enterprise solutions. This flexibility ensures affordability while delivering robust capabilities, reflecting IRESS's 2024 transformation towards more standardized, equitable pricing structures that remain competitive in the dynamic fintech market.

| Pricing Strategy Element | Description | Example/Data Point (2024/2025) |

|---|---|---|

| Value-Based Licensing | Pricing based on client benefits and ROI. | Clients saw a 15% average reduction in operational costs with similar automation software. |

| Subscription Model | Predictable revenue and costs via recurring payments. | Per-user or per-module subscriptions for market data and wealth management platforms. |

| Tiered Pricing | Segmented pricing for different client sizes and needs. | Basic tiers for small firms; premium enterprise tiers with advanced analytics and support. |

| Custom Quoting | Bespoke pricing for large-scale or highly customized projects. | Negotiated multi-year contracts for extensive wealth management platform customization. |

| Standardization Initiative | Move towards uniform pricing as part of 2024 transformation. | Aiming for fairer and more equitable pricing across diverse offerings. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is meticulously constructed using a blend of primary and secondary data sources. We leverage official company disclosures, including annual reports and investor presentations, alongside proprietary market intelligence and consumer behavior data to ensure comprehensive insights.