IRESS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRESS Bundle

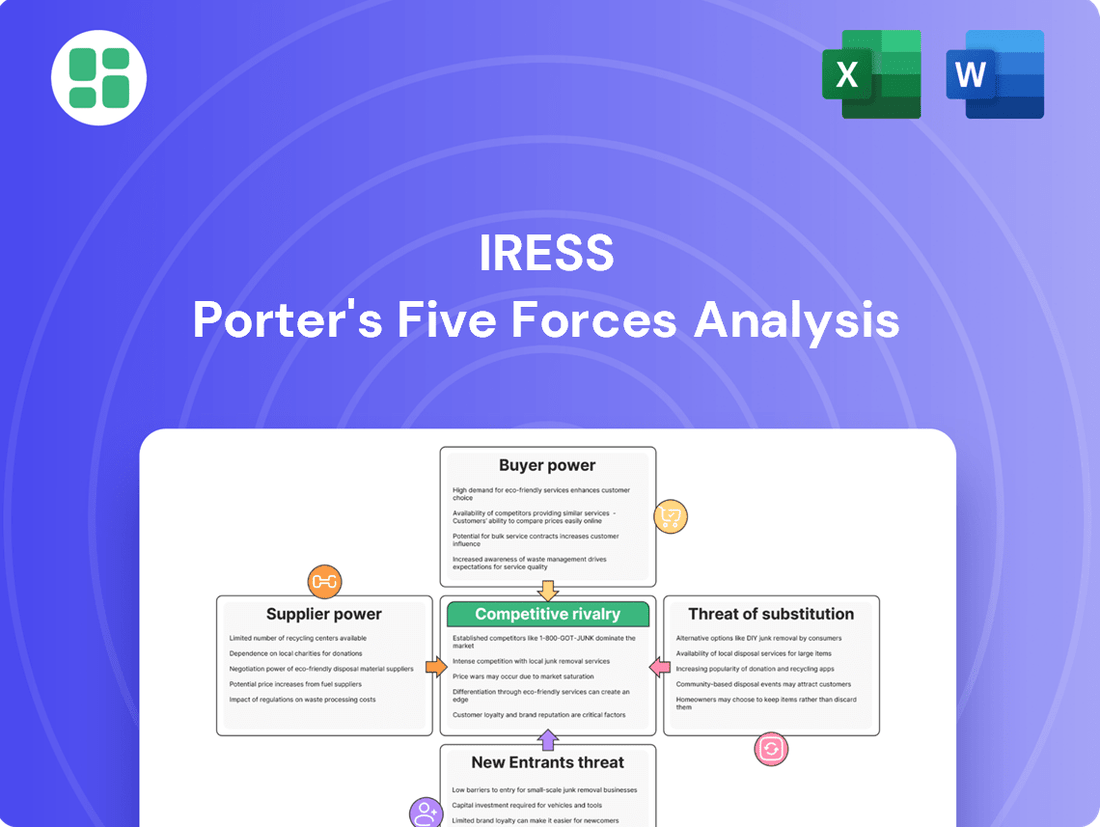

IRESS operates in a dynamic financial technology landscape, facing pressures from buyer power and the threat of substitutes. Understanding these forces is crucial for navigating its competitive environment.

The complete report reveals the real forces shaping IRESS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of IRESS's suppliers leans towards moderate to high, especially when it comes to specialized data feeds and crucial technology infrastructure. When only a limited number of suppliers can offer essential components or unique financial data vital for IRESS's operations, their negotiation leverage naturally grows.

This supplier concentration directly impacts IRESS by reducing its available alternatives and its capacity to secure more favorable pricing. For instance, in 2024, the cost of specialized financial data subscriptions for platforms like IRESS can represent a significant portion of operational expenses, with some niche data providers commanding substantial fees due to their exclusive content.

IRESS faces moderate to high switching costs when changing core technology suppliers, particularly for essential services like cloud hosting or foundational software. The complexity of migrating extensive financial data and integrated systems to a new provider is significant. This process is often lengthy, costly, and can disrupt ongoing operations, potentially impacting client service.

These substantial switching costs mean IRESS is less inclined to frequently change its primary technology partners. Consequently, existing suppliers hold a stronger bargaining position, as IRESS has a vested interest in maintaining continuity with established, integrated solutions rather than incurring the significant expense and risk of a transition.

Suppliers providing essential financial market data, compliance engines, and secure cloud infrastructure hold significant sway over IRESS. These inputs are not merely components; they are the very bedrock upon which IRESS builds its services for financial institutions. For instance, the accuracy and timeliness of market data directly impact the functionality of IRESS's trading and analysis platforms.

The integrity of IRESS's offerings, from trading execution to regulatory reporting, hinges on the quality and reliability of these supplier-provided elements. A disruption or deficiency in these critical areas, such as inaccurate data feeds or compromised cloud security, would directly impair IRESS's capacity to serve its clientele, underscoring the suppliers' leverage.

In 2024, the increasing complexity of financial regulations and the demand for real-time data further amplify the importance of these suppliers. For example, providers of specialized compliance software are vital as financial firms navigate evolving regulatory landscapes, giving these suppliers substantial bargaining power due to the critical nature of their specialized services.

Threat of Forward Integration by Suppliers

The threat of forward integration by IRESS's suppliers is generally low. Most technology and data providers operate in different market segments and lack the specialized expertise to enter the complex financial software solutions space that IRESS dominates.

However, a significant shift could occur if large, diversified technology conglomerates, with substantial resources and broad market reach, decide to develop their own competing financial services platforms. This would transform them from mere suppliers into direct rivals, thereby increasing their bargaining power by offering an alternative to IRESS's offerings.

For instance, in 2024, major cloud providers like Amazon Web Services (AWS) or Microsoft Azure are increasingly offering industry-specific solutions. While not directly competing with IRESS's core software yet, their expanding capabilities in data analytics and AI could pose a future threat if they choose to integrate these further into financial workflow management tools.

- Low Likelihood: Most IRESS suppliers are specialized technology or data firms unlikely to enter the financial software market.

- Potential Disruption: Large, diversified tech giants could integrate forward, becoming direct competitors.

- Example Trend: Cloud providers like AWS and Microsoft Azure are expanding into industry-specific solutions, potentially impacting the competitive landscape.

Availability of Substitute Inputs

The availability of substitute inputs for IRESS significantly influences supplier bargaining power. While generic IT hardware and some software components boast numerous suppliers, thereby limiting individual supplier leverage, the landscape shifts dramatically for specialized offerings.

Highly specialized financial data feeds, unique regulatory compliance modules, and advanced AI-driven data analytics tools often have a limited pool of viable alternatives. For instance, providers of real-time, niche market data or proprietary algorithmic trading components might face few direct competitors. This scarcity of substitutes directly translates into increased bargaining power for those suppliers, allowing them to command higher prices or more favorable terms from IRESS.

The less substitutable a supplier's offering is, the stronger their position becomes. Suppliers with unique intellectual property, established network effects, or specialized expertise that IRESS relies upon heavily can exert considerable influence. For example, if a particular data vendor possesses exclusive rights to a critical dataset that is fundamental to IRESS's product suite, that vendor's bargaining power is substantially amplified.

- Limited Substitutes for Specialized Data: Providers of niche financial data or proprietary analytics tools often face minimal competition, enhancing their bargaining power.

- Proprietary Technology Advantage: Suppliers offering unique, patented technologies or highly specialized software modules that are difficult to replicate gain significant leverage.

- Impact on IRESS's Costs: The lack of readily available substitutes for key inputs can force IRESS to accept higher prices, impacting its profitability and operational costs.

The bargaining power of IRESS's suppliers is generally moderate to high, primarily driven by the specialized nature of the inputs required for its financial software solutions. Suppliers of critical financial data feeds and essential technology infrastructure, especially those with unique offerings, hold significant leverage. This is compounded by the substantial switching costs IRESS incurs when changing core technology partners, making it less likely to seek alternatives frequently.

In 2024, the cost of specialized financial data subscriptions can represent a notable operational expense for companies like IRESS, with niche providers often charging premium rates for exclusive content. The threat of forward integration by suppliers is low for most, as they typically lack the expertise to enter IRESS's core market. However, large tech conglomerates expanding into industry-specific solutions, such as cloud providers offering enhanced data analytics, could potentially become future competitors, thereby increasing their bargaining power.

The availability of substitute inputs is limited for IRESS's specialized needs, particularly for proprietary financial data or unique compliance modules. Suppliers with exclusive intellectual property or specialized expertise that are difficult to replicate can command greater influence, directly impacting IRESS's costs and operational strategies.

| Factor | Assessment | Implication for IRESS |

|---|---|---|

| Supplier Concentration | Moderate to High (for specialized inputs) | Reduced negotiation leverage for IRESS, potentially higher input costs. |

| Switching Costs | High | Discourages frequent supplier changes, strengthening existing suppliers' positions. |

| Supplier Differentiation | High (for unique data/tech) | Suppliers with proprietary offerings hold significant power. |

| Forward Integration Threat | Low (generally) | Limited risk of suppliers becoming direct competitors, except for large tech firms. |

What is included in the product

This analysis meticulously examines the five competitive forces impacting IRESS, providing a strategic overview of its industry landscape.

Effortlessly identify and mitigate competitive threats with a visual, actionable breakdown of market forces.

Customers Bargaining Power

The bargaining power of IRESS's customers varies, with large financial institutions holding significant sway due to their substantial revenue contributions. These sophisticated clients can leverage their size to negotiate for tailored solutions, better pricing, and more rigorous service standards, potentially impacting IRESS's profitability.

However, IRESS mitigates this risk through a broad and geographically diverse customer base. A large number of smaller clients globally dilutes the impact of any single customer's demands, spreading revenue and reducing overall concentration risk.

Customers face substantial switching costs when considering a move away from IRESS's comprehensive technology platforms. These costs are not trivial; they encompass significant financial investments, the intricate process of data migration, the necessity of retraining staff on new systems, and the inherent risk of operational disruption during the transition. For instance, migrating a large financial institution's wealth management or trading infrastructure can easily run into millions of dollars and take many months, if not years, to complete.

The complexity involved in transferring vast amounts of sensitive financial data, ensuring its integrity, and integrating it with entirely new software architectures presents a formidable barrier. This technical hurdle, coupled with the need for extensive staff re-education on unfamiliar interfaces and workflows, further amplifies the switching costs.

Consequently, these high switching costs effectively anchor customers to IRESS's ecosystem. This lock-in effect significantly diminishes the bargaining power of customers, as the perceived benefits of switching often fail to outweigh the substantial costs and risks associated with leaving IRESS's established and integrated solutions.

Financial institutions, especially those operating in crowded or budget-focused markets, often exhibit a strong sensitivity to price. This can significantly amplify their leverage when negotiating with software providers like IRESS. For instance, in 2023, the financial services sector saw continued pressure on operational costs, with many firms actively seeking to optimize their technology spend.

While IRESS's offerings are designed to boost efficiency and ensure regulatory adherence, clients will always weigh the overall cost of implementing and maintaining these solutions against the tangible benefits and what competitors might offer. Understanding this total cost of ownership is crucial for customers making purchasing decisions.

IRESS itself has acknowledged this dynamic, as evidenced by their strategic transformation program, which included a dedicated effort to refine and enhance their pricing structures. This focus aims to better align their value proposition with the cost considerations of their diverse client base.

Availability of Substitute Products for Customers

While IRESS offers a robust, integrated platform, customers do have options for specific functionalities. For instance, a firm might use a separate CRM system alongside a specialized trading platform, rather than a single, all-encompassing IRESS solution. This fragmentation of needs means that the threat of substitution isn't always about a direct competitor offering an identical package, but rather about customers piecing together solutions from various vendors.

The viability of these alternative approaches directly impacts IRESS's pricing power. If customers can readily achieve similar outcomes by combining best-of-breed solutions from different providers, they are less likely to tolerate premium pricing for IRESS's integrated offering. This is particularly true as fintech innovation continues to churn out specialized tools.

Consider the rise of cloud-based, modular financial technology solutions. Many of these are designed for specific tasks, like portfolio management or regulatory reporting, and can be integrated with existing systems. This modularity offers flexibility and can be a cost-effective alternative for businesses that don't require the full breadth of IRESS's capabilities.

- Limited direct substitutes: While a fully integrated competitor offering the exact same breadth of services as IRESS might be scarce, customers can achieve similar functional outcomes by combining specialized solutions.

- Modular alternatives: The growth of cloud-based, modular fintech solutions allows customers to select best-of-breed tools for specific needs, potentially reducing reliance on a single, comprehensive provider.

- Cost-effectiveness pressure: The availability of these alternative, often more focused and potentially cheaper, solutions puts pressure on IRESS to maintain competitive pricing and demonstrate the value of its integrated platform.

- In-house development as a fallback: For larger institutions with significant IT resources, the option of developing certain functionalities in-house, though costly, remains a potential substitute that can influence market dynamics.

Customer Information and Industry Knowledge

IRESS's customer base comprises sophisticated financial professionals and institutions. These clients possess extensive industry knowledge and readily access information on a wide array of technology solutions available in the market. This deep understanding allows them to thoroughly evaluate offerings and negotiate terms effectively, thereby increasing their bargaining power.

The ability of IRESS's customers to access and process detailed information about competing products and pricing significantly influences their negotiation stance. For instance, in 2024, financial institutions continued to prioritize solutions offering demonstrable ROI and cost efficiencies, forcing vendors like IRESS to present compelling value propositions. This informed approach means customers can readily identify alternatives, putting pressure on IRESS to offer competitive pricing and superior service to retain business.

- Informed Decision-Making: Customers' deep industry knowledge enables them to make well-researched purchasing decisions, comparing IRESS's offerings against a broad spectrum of alternatives.

- Price Sensitivity: The availability of competitive pricing data empowers customers to negotiate favorable terms, directly impacting IRESS's pricing strategies and profit margins.

- Demand for Value: In 2024, the financial services sector saw a heightened focus on operational efficiency, leading customers to demand solutions that clearly demonstrate cost savings and productivity gains.

- Switching Costs Consideration: While switching costs can be a factor, informed customers are adept at calculating these costs against potential long-term benefits of alternative solutions, further bolstering their negotiation leverage.

The bargaining power of IRESS's customers is significantly influenced by the availability of substitutes and the ease with which they can switch providers. While IRESS offers a comprehensive suite, the rise of modular fintech solutions allows clients to assemble tailored technology stacks, potentially reducing their reliance on a single vendor.

| Factor | IRESS's Position | Customer Leverage |

|---|---|---|

| Switching Costs | High due to integration and data migration complexity. | Mitigated by the significant investment required to switch. |

| Availability of Substitutes | Modular fintech solutions for specific functions. | Allows customers to piece together best-of-breed alternatives. |

| Customer Information | Sophisticated clients with deep market knowledge. | Enables effective negotiation and comparison of offerings. |

| Price Sensitivity | Clients seek cost optimization and demonstrable ROI. | Puts pressure on IRESS to offer competitive pricing. |

Full Version Awaits

IRESS Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of IRESS through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

The financial technology sector where IRESS competes is bustling with activity. You'll find a wide array of companies, from massive tech giants offering broad solutions to smaller, specialized fintech firms focusing on areas like wealth management or trading platforms. This variety means IRESS faces competition from many different angles.

This diverse field includes significant players such as SS&C Technologies, which also provides a range of financial software and services. The presence of these established and emerging competitors, each with their own strengths, naturally cranks up the intensity of the rivalry across all the markets IRESS serves.

The fintech landscape is dynamic, with overall growth, but specific niches within financial services technology may be reaching maturity. This maturity often translates to heightened competition as established players and new entrants vie for market share. For instance, while the global fintech market was projected to reach over $1.1 trillion by 2024, segments like core banking software might exhibit slower growth compared to emerging areas.

IRESS distinguishes itself by offering comprehensive, integrated solutions that span wealth management, trading, market data, and superannuation administration. This holistic approach creates a sticky ecosystem for its users.

The high switching costs associated with IRESS's software are a significant factor. Because its platforms are deeply embedded in clients' operations, migrating to a competitor involves substantial time, expense, and operational disruption, effectively locking in existing customers and reducing direct competitive pressure among established players.

Strategic Stakes and Exit Barriers

The strategic stakes for IRESS and its rivals in the financial technology space are exceptionally high, given the sector's rapid evolution and critical role in global finance. This intense competition fuels a fierce rivalry as companies fight for market share and technological leadership.

Exit barriers are substantial, making it difficult for competitors to leave the market. These include significant investments in specialized, proprietary technology platforms and long-term, deeply integrated client contracts that create high switching costs. For instance, the cost to develop and maintain sophisticated trading and wealth management software can run into hundreds of millions of dollars, making abandonment financially prohibitive.

- High Investment in Proprietary Technology: Companies like IRESS invest heavily in R&D, creating unique software solutions that are difficult and costly to replicate or abandon.

- Long-Term Client Contracts: Many financial institutions are locked into multi-year service agreements, ensuring competitors remain engaged and committed to their existing infrastructure.

- Specialized Assets and Infrastructure: The financial tech sector relies on specialized hardware, data centers, and regulatory compliance frameworks that are not easily repurposed or sold.

- Brand Reputation and Trust: Building a trusted brand in financial services takes years, and exiting the market would mean forfeiting this valuable intangible asset.

Cost Structure and Capacity Utilization

IRESS is actively working to improve its cost structure through transformation programs and the divestment of non-strategic assets. This focus on efficiency aims to enhance operating leverage, a critical factor in the competitive software industry.

Software development companies, often characterized by high fixed costs, engage in intense rivalry. They compete fiercely on price and feature sets to achieve and maintain high capacity utilization, which in turn can drive further competition.

- Cost Optimization: IRESS's strategic initiatives, including divestments, underscore a commitment to streamlining operations and reducing its cost base.

- Operating Leverage: By improving cost efficiency, IRESS aims to benefit from increased operating leverage, where revenue growth translates into disproportionately higher profits.

- Industry Dynamics: The software sector's high fixed costs necessitate aggressive competition to maximize asset utilization, creating a challenging environment for all players.

- Capacity Utilization: Achieving high capacity utilization is a key competitive lever, allowing companies to spread fixed costs over a larger revenue base and potentially offer more competitive pricing.

The competitive rivalry within the fintech sector, where IRESS operates, is intense due to a crowded market with diverse players from large tech firms to niche specialists. This dynamic environment, projected for significant growth, means companies like IRESS face constant pressure to innovate and capture market share.

The stakes are high as firms battle for technological leadership and customer acquisition in a rapidly evolving industry. For instance, the global fintech market is expected to surpass $1.1 trillion by 2024, highlighting the lucrative but fiercely contested nature of this space.

| Competitor | Key Offerings | Market Focus |

|---|---|---|

| SS&C Technologies | Financial software, services | Broad financial services |

| Fiserv | Payment processing, financial tech solutions | Financial institutions, merchants |

| Temenos | Core banking software | Banking sector |

SSubstitutes Threaten

The threat of substitutes for IRESS's technology solutions is significant, stemming from alternative methods financial professionals use for investment management, regulatory compliance, and market data access. These substitutes range from direct competitor software to less integrated, manual workarounds or even in-house developed tools for niche functions.

For instance, while IRESS offers comprehensive platforms, a firm might opt for a combination of specialized, best-of-breed software for specific needs like portfolio analytics or trading execution, thereby substituting parts of IRESS's integrated offering. The rise of open-source financial tools and APIs also presents a substitution threat, allowing for more customizable, albeit potentially less supported, solutions.

In 2024, the increasing availability of cloud-based, modular financial technology solutions allows firms to pick and choose components, potentially reducing reliance on a single, all-encompassing provider like IRESS. This modularity means that if IRESS's pricing or feature set becomes less competitive for a particular function, a substitute can readily fill that gap.

While substitute solutions might appear cheaper upfront, they often fall short when it comes to seamless integration, the depth of features, or automated workflows that IRESS platforms provide. For instance, many smaller fintech solutions may offer basic charting at a lower cost, but lack the sophisticated analytics and regulatory adherence required by major financial institutions.

The perceived value of IRESS's comprehensive and specialized offerings, which streamline complex financial processes, frequently justifies the investment over the cost savings from less capable or fragmented alternatives. In 2024, financial firms are increasingly prioritizing efficiency and compliance, making the trade-offs of cheaper, less integrated substitutes a significant concern.

Customer propensity to switch from IRESS solutions hinges on operational complexity and regulatory demands. For instance, a large investment bank with intricate trading workflows and stringent compliance needs might find it challenging to migrate to a less specialized substitute, especially if it requires significant retraining of staff. In 2024, the financial services industry continued to grapple with evolving regulatory landscapes, making the cost and risk of switching platforms a significant deterrent for many established players.

Technological Advancements in Substitutes

Rapid technological advancements, especially in AI and data analytics, are creating more sophisticated and accessible substitute solutions that could challenge IRESS's market position. These innovations can lower the cost and complexity of financial technology, potentially drawing customers away from established providers.

IRESS is actively addressing this threat by investing heavily in AI-enabled capabilities, aiming to enhance its own product suite and remain competitive. For instance, in 2024, IRESS continued to roll out AI-powered features within its trading and wealth management platforms, seeking to offer superior functionality and user experience.

- AI-driven analytics: New entrants leveraging AI can offer highly personalized insights and automation at a lower price point.

- Open banking initiatives: These facilitate the integration of third-party fintech solutions, increasing the availability of substitutes.

- Cloud-native platforms: Modern, agile cloud solutions can be developed and deployed more quickly than legacy systems, presenting a faster-moving alternative.

- Increased investment in fintech: Venture capital funding for fintech startups reached $40 billion globally in 2024, fueling innovation in substitute offerings.

Regulatory Landscape Impact on Substitutes

The evolving regulatory landscape significantly impacts the threat of substitutes for financial technology providers like IRESS. Stricter compliance mandates, such as those related to data privacy (e.g., GDPR, CCPA) and financial reporting standards, can render non-compliant substitute solutions less viable and more costly to implement.

For instance, in 2024, financial institutions faced ongoing scrutiny regarding cybersecurity and data protection, increasing the operational risk associated with adopting solutions that fall short of these evolving standards. This heightened regulatory pressure naturally elevates the attractiveness of IRESS's offerings, which are designed with compliance at their core, thereby diminishing the competitive threat posed by less regulated or adaptable substitutes.

- Regulatory Compliance as a Differentiator

- Increased Risk for Non-Compliant Substitutes

- Market Advantage for Compliant Providers

The threat of substitutes for IRESS's technology solutions is substantial, driven by the growing availability of specialized fintech tools and modular platforms. These alternatives offer financial firms the flexibility to cherry-pick functionalities, potentially bypassing comprehensive solutions like IRESS. The increasing investment in fintech, with global venture capital funding reaching $40 billion in 2024, fuels the development of these competitive substitutes.

While cheaper, niche solutions exist, they often lack the seamless integration and deep feature sets that IRESS provides, making them less appealing for complex financial operations. The financial services industry's continued focus on efficiency and compliance in 2024 further underscores the value of integrated, robust platforms over fragmented alternatives.

The increasing adoption of AI-driven analytics and cloud-native platforms by new entrants presents a significant substitution threat, offering potentially lower-cost and more agile solutions. IRESS is actively countering this by enhancing its own AI capabilities, aiming to maintain its competitive edge in a rapidly evolving market.

| Substitute Type | Key Characteristics | Potential Impact on IRESS | 2024 Market Trend/Data |

| Specialized Fintech Apps | Niche functionality, lower upfront cost | Fragmented adoption, potential loss of specific business segments | Increased availability of best-of-breed solutions |

| Open-Source Tools & APIs | Customizable, lower direct cost | Reduced reliance on integrated platforms, potential for in-house development | Growth in API-driven financial ecosystems |

| Modular Cloud Platforms | Agile, scalable, pick-and-choose components | Competition on specific modules, pressure on bundled offerings | Significant VC investment in cloud-native fintech startups |

| AI-Powered Analytics Platforms | Advanced insights, automation | Direct challenge to IRESS's data analytics capabilities | Global fintech VC funding hit $40 billion in 2024 |

Entrants Threaten

The financial services technology sector presents a moderate threat from new entrants, primarily because establishing a presence demands significant capital. Companies need substantial funding to develop, deploy, and scale sophisticated, secure, and compliant software. For instance, building a trading platform or a comprehensive wealth management system can easily require tens of millions of dollars in research and development alone.

The financial services sector presents significant barriers to entry due to stringent regulatory frameworks. Newcomers must navigate a complex web of global and local compliance requirements, particularly in areas like wealth management and trading. For instance, in 2024, the cost of compliance for financial institutions globally continued to rise, with many reporting significant investments in technology and personnel to meet evolving data privacy and anti-money laundering (AML) regulations.

Developing sophisticated software solutions that adhere to these diverse regulations, such as those governing superannuation in Australia or MiFID II in Europe, requires specialized legal and technical expertise. This demand for specialized knowledge and the associated development costs act as a substantial deterrent for potential new entrants looking to compete with established players like IRESS.

Established players in the financial technology sector, such as IRESS, leverage significant economies of scale. This means they can spread their substantial development, sales, and customer support costs over a larger customer base, leading to lower per-unit costs. For instance, in 2023, major fintech providers often reported operating margins that reflected these efficiencies, with some larger firms achieving double-digit percentages while newer entrants might struggle to break even.

Furthermore, an accumulated experience curve allows incumbents to refine their processes, product offerings, and client relationships over many years. This deep understanding of complex financial workflows and regulatory environments is difficult for new entrants to replicate quickly. For example, a fintech company with a decade of experience might have a more robust and adaptable platform than a startup founded in 2022, even if the latter has innovative technology.

New entrants face a considerable hurdle in matching the operational efficiency and the depth of expertise that established firms possess. To compete effectively on price or feature set, they would need a substantial initial capital injection and a considerable amount of time to build a similar level of scale and experience. This barrier makes it challenging for them to gain market share rapidly against well-entrenched competitors.

Brand Loyalty and Switching Costs for Customers

Existing IRESS customers often face significant hurdles when considering a switch. These include the complex integration of IRESS's financial software into their daily workflows, the considerable effort and cost involved in migrating vast amounts of data, and the need for retraining staff on new platforms. For instance, a financial firm might have years of historical client data and trading records embedded within IRESS systems, making a seamless transition to a competitor a costly and time-consuming endeavor.

These high switching costs foster a strong sense of customer loyalty for IRESS. This loyalty acts as a substantial barrier for new entrants aiming to penetrate the market. To gain traction, new competitors must not only offer a comparable or superior product but also present a value proposition so compelling that it outweighs the inherent difficulties and expenses associated with switching. Without such a disruptive advantage, new players struggle to attract customers away from established, deeply integrated solutions like IRESS.

The challenge for new entrants is further amplified by the specialized nature of financial services technology.

- High Integration Costs: The deep embedding of IRESS solutions into client operations creates significant technical and operational barriers to switching.

- Data Migration Complexity: Migrating extensive financial data, often accumulated over many years, is a complex and resource-intensive process.

- Staff Training Requirements: New software necessitates retraining personnel, adding to the overall cost and disruption for a customer.

- Customer Retention: These factors contribute to strong customer loyalty, making it difficult for new entrants to acquire market share without a substantial incentive.

Access to Distribution Channels and Talent

New entrants into the financial technology sector, like IRESS, often struggle to gain traction due to established relationships and trust that existing players have cultivated with financial institutions. Building credible distribution channels requires a proven track record, which is difficult for newcomers to demonstrate. For instance, securing partnerships with major banks or investment firms for platform integration can take years and significant investment.

Furthermore, the competition for specialized talent presents a substantial hurdle. The financial technology landscape demands professionals with deep expertise in areas such as AI, blockchain, cybersecurity, and regulatory compliance. As of early 2024, the demand for these specialized skills continues to outstrip supply, driving up recruitment costs and making it challenging for new companies to attract and retain top talent compared to established firms with greater resources and brand recognition.

- Distribution Channel Barriers: Financial institutions prioritize stability and proven performance, making it difficult for new entrants to establish distribution partnerships.

- Talent Acquisition Costs: High demand for specialized fintech and compliance talent increases recruitment expenses for new companies.

- Reputation and Trust: New entrants must invest heavily in building credibility to overcome the inherent trust advantage of incumbent providers.

- Regulatory Hurdles: Navigating complex financial regulations requires specialized knowledge and resources that can be a significant barrier for newcomers.

The threat of new entrants in the financial technology sector, particularly for a company like IRESS, is generally moderate. This is largely due to the significant capital investment required to develop and scale sophisticated, secure, and compliant software solutions. For example, building a robust trading platform can easily cost tens of millions of dollars in research and development alone.

Stringent regulatory frameworks also present a substantial barrier. New companies must navigate complex global and local compliance requirements, with compliance costs for financial institutions continuing to rise in 2024, demanding significant investment in technology and personnel to meet evolving data privacy and anti-money laundering (AML) regulations.

Established players benefit from economies of scale, spreading costs over a larger customer base, and an accumulated experience curve that fosters deep understanding of complex financial workflows and regulatory environments, making it difficult for newcomers to replicate their efficiency and expertise.

High switching costs for existing customers, including complex integration, data migration challenges, and staff retraining needs, foster strong customer loyalty. This makes it difficult for new entrants to acquire market share without a compelling value proposition to overcome these inherent difficulties and expenses.

| Barrier Type | Description | Example Impact (2024 Data) |

|---|---|---|

| Capital Requirements | High R&D and infrastructure costs for sophisticated software. | Building a trading platform can exceed $50 million in initial investment. |

| Regulatory Compliance | Navigating complex financial laws and data privacy standards. | Increased spending by financial firms on compliance technology, estimated to grow by 8-10% annually. |

| Economies of Scale | Lower per-unit costs for established players due to larger customer base. | Larger fintech firms achieving operating margins of 15-20% vs. startups struggling for profitability. |

| Switching Costs | Customer inertia due to integration, data migration, and training. | Financial institutions may spend months and significant budgets to migrate critical data and systems. |

| Brand Loyalty & Trust | Established relationships and proven track records are highly valued. | New entrants need substantial investment in marketing and sales to build credibility. |

Porter's Five Forces Analysis Data Sources

Our IRESS Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, financial statements, and industry-specific market research from reputable firms.