IRESS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRESS Bundle

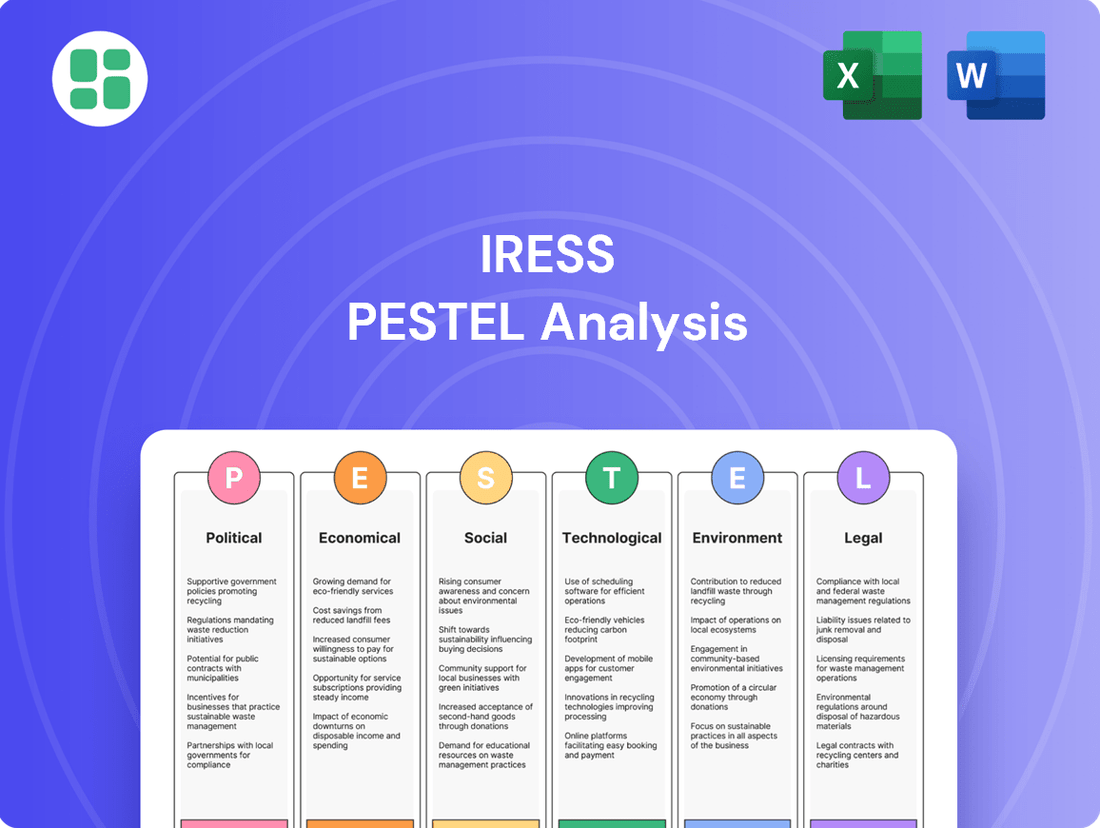

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping IRESS's trajectory. Our meticulously researched PESTLE analysis provides the crucial external intelligence you need to anticipate market shifts and identify strategic opportunities. Don't guess about the future – download the full, actionable report now and gain a decisive advantage.

Political factors

Government policy shifts significantly influence IRESS's operational landscape. For instance, the UK's Financial Conduct Authority (FCA) continues to emphasize consumer protection and market integrity, potentially leading to increased compliance burdens for financial technology providers like IRESS. Changes in data privacy regulations, such as GDPR or similar frameworks being adopted globally, directly impact how IRESS manages client data, requiring ongoing investment in robust security measures and system adaptations.

Political stability in IRESS's core markets, including Australia, the UK, and North America, is crucial for sustained business growth. Economic policies enacted by governments, such as tax reforms or incentives for technological innovation, can either bolster or hinder IRESS's investment in research and development. For example, government investment in digital infrastructure can create new opportunities for financial technology adoption.

IRESS's global operations mean it's directly affected by geopolitical shifts and evolving trade policies. For instance, the ongoing trade tensions between major economies in 2024 and 2025 could disrupt supply chains and create uncertainty in international markets, impacting IRESS's revenue streams from its trading platforms.

Rising protectionist policies, as seen in some sectors during 2024, could hinder IRESS's market expansion efforts and complicate service delivery to its international client base. This could lead to increased compliance costs and a slower adoption rate for its solutions in new territories.

Geopolitical stability is a key driver of investor sentiment, directly influencing the demand for financial market data and trading solutions. Periods of heightened global instability in 2024 and 2025 have historically correlated with increased market volatility, potentially boosting demand for real-time data services offered by IRESS, but also raising operational risks.

The evolving landscape of financial market regulation significantly shapes IRESS's business. For instance, the implementation of the EU's Markets in Financial Instruments Directive II (MiFID II) in 2018, which imposed stringent reporting and transparency requirements, boosted demand for compliance-enabling technologies like those offered by IRESS. As of early 2025, ongoing discussions around digital asset regulation and data privacy continue to present both challenges and opportunities, requiring IRESS to adapt its software solutions to meet emerging compliance needs.

Government Support for Fintech Innovation

Governments worldwide are actively fostering fintech innovation through various programs. For instance, the UK's Financial Conduct Authority (FCA) operates a regulatory sandbox, which has supported over 200 firms since its inception, allowing them to test innovative products and services in a controlled environment. This type of initiative can significantly de-risk new ventures, encouraging financial institutions to adopt cutting-edge solutions and potentially increasing demand for established players like IRESS.

These supportive policies, including grants and tax incentives, can accelerate the development and adoption of new technologies within the financial sector. In 2024, many nations are increasing investment in digital infrastructure and cybersecurity, which are crucial for fintech growth. Such government backing creates a more fertile ground for innovation, potentially leading to faster market penetration for companies like IRESS that offer advanced technological solutions.

- Regulatory Sandboxes: Initiatives like the UK's FCA sandbox have enabled numerous fintech firms to test new ideas, fostering a more dynamic market.

- Financial Incentives: Grants and tax credits offered by governments can reduce the cost of R&D for fintech companies, spurring innovation.

- Digital Infrastructure Investment: Government spending on digital and cybersecurity infrastructure in 2024-2025 underpins the secure and efficient operation of fintech services.

Data Sovereignty and Cross-Border Data Flows

Growing concerns about data sovereignty are creating significant hurdles for companies like IRESS operating globally. Many nations are implementing stricter rules on how data can move across borders, which can make it harder for IRESS to manage its operations worldwide. For instance, the European Union's General Data Protection Regulation (GDPR) has set a high bar for data protection and transfer.

To navigate these complexities, IRESS needs to ensure its data storage and processing methods align with the specific laws of every country it operates in. This might mean setting up local data centers in different regions or making significant changes to how its cloud-based services are architected. These adjustments inevitably increase both the complexity and the cost associated with delivering services on a global scale.

- GDPR Fines: In 2023, GDPR fines reached over €370 million, highlighting the financial risks of non-compliance.

- Data Localization Mandates: Countries like China and Russia have strict data localization laws requiring certain data to be stored within their borders.

- Cloud Provider Compliance: Major cloud providers are investing heavily in regional data centers to meet these localization demands, a trend IRESS must leverage or replicate.

- Increased Operational Costs: Managing multiple localized data solutions can add 10-20% to operational expenses compared to a single, centralized approach.

Government regulations continue to shape the financial technology landscape, impacting IRESS's operations significantly. As of early 2025, regulatory bodies like the UK's FCA are focusing on consumer protection and market integrity, potentially increasing compliance demands for fintech firms. Evolving data privacy laws globally, such as GDPR, necessitate ongoing investment in robust data security and system adaptations for IRESS.

Political stability across IRESS's key markets, including Australia and the UK, is vital for its growth. Government economic policies, such as tax incentives for technological innovation, can influence IRESS's R&D investments. For example, government initiatives promoting digital infrastructure development in 2024-2025 create new avenues for fintech adoption.

Geopolitical shifts and trade policies directly affect IRESS's international business. Trade tensions observed in 2024 and continuing into 2025 can disrupt supply chains and create market uncertainties, impacting revenue from IRESS's trading platforms. Conversely, periods of heightened global instability can boost demand for real-time financial data services, though they also introduce operational risks.

| Factor | Impact on IRESS | 2024-2025 Data/Trend |

| Regulatory Compliance | Increased operational costs and system adaptations | FCA sandbox supported over 200 firms; GDPR fines exceeded €370 million in 2023. |

| Data Sovereignty | Complexities in global data management and increased costs | Data localization mandates in China and Russia; potential 10-20% increase in operational costs for localized solutions. |

| Government Incentives | Opportunities for R&D investment and market expansion | Increased government investment in digital and cybersecurity infrastructure. |

| Geopolitical Stability | Market volatility affecting demand for financial data services | Trade tensions in 2024 impacting international markets; potential boost in demand for real-time data during instability. |

What is included in the product

This IRESS PESTLE analysis examines the impact of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the business landscape.

Provides a clear, actionable framework for understanding the external forces impacting IRESS, enabling proactive strategy development and risk mitigation.

Economic factors

Overall economic growth is a major driver for IRESS, as its clients in the financial services sector thrive when the economy is expanding. For instance, a robust global GDP growth forecast for 2024, projected around 3.2%, generally translates to increased investment activity and higher demand for IRESS's software and services.

Periods of strong economic expansion boost trading volumes and wealth management needs, directly benefiting IRESS's revenue streams. In 2024, many developed economies are expected to see moderate growth, which should support continued client spending on technology solutions.

Conversely, economic downturns and heightened market volatility can significantly impact IRESS. A slowdown in economic activity or sharp market corrections might cause financial institutions to cut back on discretionary spending, including investments in new technology, potentially affecting IRESS's sales pipeline.

Changes in interest rates and inflation directly influence the financial health of companies like IRESS, impacting their capacity to invest in technology. For instance, if the Bank of England raises its base rate, as it has done multiple times in 2023 and early 2024, borrowing becomes more expensive for IRESS and its clients. This could lead to a cautious approach to new software development or acquisitions, potentially slowing down IRESS's growth trajectory.

Inflation also plays a critical role. Rising inflation, which saw the UK Consumer Price Index (CPI) reach a peak of 11.1% in October 2022 and remained elevated through much of 2023, increases IRESS's operational expenses. This includes higher costs for employee salaries, data center power, and software licenses, all of which can squeeze profit margins if not passed on to customers, a move that itself could impact demand.

The global fintech market is experiencing robust growth, with projections indicating it could reach $1.5 trillion by 2030, a significant leap from its estimated $111.8 billion in 2023. This surge in investment fuels demand for advanced financial technology solutions like those offered by IRESS, particularly in wealth management and trading platforms.

Financial institutions are channeling substantial capital into digital transformation initiatives, aiming to streamline operations and enhance customer experiences. This trend directly benefits IRESS as it provides the critical infrastructure and software needed for these upgrades, evidenced by the increasing adoption rates of its cloud-based services.

The sustained economic focus on fintech innovation creates a dynamic environment for IRESS to expand its market share and develop new offerings. For instance, the company's recent investments in AI-driven analytics for its trading solutions reflect this broader economic push towards more sophisticated digital financial tools.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant risk for IRESS, a global entity. As of late 2024, major currency pairs like EUR/USD and GBP/USD have experienced volatility, impacting the translation of IRESS's international earnings back into its reporting currency, likely AUD. For instance, a stronger Australian dollar against the Euro could reduce the reported value of IRESS's European revenue.

These movements directly affect IRESS's top and bottom lines. For example, if IRESS generates a substantial portion of its revenue in the UK, a weakening GBP against the AUD would mean less revenue in AUD terms, potentially impacting profitability. This necessitates robust financial strategies, including currency hedging, to buffer against adverse movements and maintain predictable financial performance.

- Impact on Revenue: Fluctuations in exchange rates, such as the AUD/USD rate, can alter the reported revenue from IRESS's North American operations.

- Profitability Concerns: Adverse currency movements can erode profit margins on international sales when converted back to the parent company's reporting currency.

- Hedging Necessity: IRESS likely employs financial instruments like forward contracts or currency options to mitigate the risk associated with significant currency swings, aiming to stabilize its financial results.

- 2024/2025 Outlook: Analysts anticipate continued volatility in global currencies through 2025, driven by differing monetary policies and geopolitical events, underscoring the ongoing importance of currency risk management for IRESS.

Client Budgetary Constraints and Cost Efficiency Drive

Client budgetary constraints are a significant factor, pushing financial institutions to prioritize cost efficiency. This environment fuels demand for solutions like IRESS's that offer automation and streamlined operations, directly impacting operational expenses. For instance, the global financial technology market, valued at approximately $112.5 billion in 2023, is projected to grow, with a significant portion of this growth driven by the need for efficiency gains.

IRESS's success hinges on its capacity to deliver demonstrable return on investment (ROI) to clients. This means showcasing how their platforms, such as digital advice or automated compliance tools, reduce manual effort and associated labor costs. A recent survey indicated that over 60% of financial services firms are investing in automation technologies specifically to cut operational costs.

- Cost Reduction Focus: Financial firms are actively seeking technologies that reduce overheads, making solutions with clear cost-saving propositions more attractive.

- ROI Demonstration: IRESS must clearly articulate and prove the financial benefits of its offerings, such as reduced processing times or lower compliance expenditure, to win new business.

- Market Trends: The broader fintech market's growth, driven by efficiency demands, underscores the opportunity for IRESS to capitalize on this client need.

Economic stability and growth directly influence IRESS's client base, the financial services sector. Projections for 2024 anticipate moderate global economic expansion, generally supporting increased investment and demand for IRESS's software. However, economic downturns or significant market volatility can lead financial institutions to reduce discretionary spending, potentially impacting IRESS's sales pipeline and revenue.

Full Version Awaits

IRESS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of IRESS delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough strategic overview for informed decision-making.

Sociological factors

Demographic shifts are significantly reshaping the investment landscape. In developed nations, aging populations are increasingly looking for wealth preservation and retirement solutions, often favoring more conservative investment strategies. Conversely, younger, digitally savvy investors, often referred to as Gen Z and Millennials, are driving demand for accessible, user-friendly digital platforms and are showing a strong inclination towards sustainable and ESG (Environmental, Social, and Governance) investing. For instance, a 2024 survey indicated that over 60% of investors under 30 consider ESG factors when making investment decisions, a notable increase from previous years.

These evolving investor preferences necessitate a strategic adaptation of financial service offerings. IRESS must prioritize the development of digital-first experiences that are intuitive and engaging for a younger demographic, while also providing robust tools for wealth management and retirement planning for older investors. This includes offering personalized advice, potentially leveraging AI, and expanding options for sustainable investments, which are projected to see continued strong growth through 2025.

A growing number of people are becoming more financially savvy and comfortable using digital tools. This trend directly fuels the demand for online wealth management services and self-service financial platforms. For instance, in 2024, a significant portion of the global population, estimated to be over 65%, actively uses digital banking services, indicating a strong inclination towards digital financial management.

IRESS's digital advice and educational resources are well-positioned to capitalize on this shift. As more individuals look to take control of their finances, either by managing them entirely online or with efficient digital assistance, IRESS's solutions directly meet this evolving need, offering accessible pathways to financial planning and investment.

Consumers are increasingly seeking financial guidance that speaks directly to their individual needs and aspirations. This societal shift means financial advisors, and by extension, companies like IRESS, must invest in advanced technologies. These tools, often powered by data analytics and artificial intelligence, are crucial for delivering bespoke advice and fostering deeper client relationships, moving away from one-size-fits-all solutions.

The demand for personalized financial advice is a significant driver in the wealth management sector. For instance, a 2024 report indicated that 70% of surveyed investors expressed a preference for advisors who offer tailored investment strategies. This highlights the need for platforms like IRESS to enhance their capabilities in areas such as AI-driven client profiling and personalized financial planning tools to meet this growing expectation.

Public Trust in Financial Institutions

Public trust in financial institutions is a critical sociological factor that can significantly sway how readily people adopt new financial technologies. Following events like the 2008 financial crisis or more recent scandals, public confidence can erode, leading to greater caution regarding digital financial services. For instance, a 2023 survey indicated that only 45% of consumers globally felt very confident in the security of their financial data with online providers, a figure that can impact fintech adoption rates.

IRESS plays a vital role in this dynamic by offering solutions designed for robustness and regulatory compliance. By enabling their clients—financial institutions—to operate with greater transparency and security, IRESS helps foster the trust necessary for customer engagement. When individuals trust their banks and investment platforms, they are more likely to utilize the digital tools and services these institutions provide, which often integrate IRESS technology.

The impact of trust on IRESS's business is indirect but substantial. High levels of public trust in the financial sector generally translate to increased participation in financial markets and services. This broader engagement means more potential users for the platforms and software that IRESS develops and supports, ultimately driving demand for their solutions. For example, in markets where consumer trust in digital banking is high, the adoption of advanced wealth management platforms, often powered by IRESS, tends to be faster.

- Public Trust Fluctuations: Consumer confidence in financial firms can dip significantly after major economic downturns or data breaches, impacting willingness to engage with new digital financial tools.

- IRESS's Role in Trust Building: Providing secure, compliant, and transparent technology solutions allows financial institutions to demonstrate reliability to their customers, a key component of trust.

- Impact on Adoption: Greater public trust in financial services generally correlates with increased adoption of digital platforms and fintech innovations, indirectly benefiting technology providers like IRESS.

- Data Security Concerns: In 2024, data privacy and security remain paramount; institutions perceived as weak in these areas face higher customer attrition, highlighting the need for robust solutions.

Workforce Trends and Talent Acquisition

The shift towards remote and hybrid work models significantly influences IRESS's talent acquisition strategy. Companies like IRESS face intensified global competition for skilled technology professionals, particularly in specialized areas like AI and cybersecurity. For instance, a 2024 LinkedIn report indicated a 30% year-over-year increase in demand for AI specialists globally, putting upward pressure on salaries and benefits.

Meeting the demand for tech talent in the fintech sector necessitates competitive compensation packages and a strong employer brand. IRESS must not only offer attractive salaries but also cultivate an engaging and supportive work culture to retain its engineering and development teams. In 2025, Glassdoor data suggests that companies offering robust professional development opportunities and flexible work arrangements see a 20% higher retention rate for tech roles.

- Remote Work Adoption: A 2024 survey revealed that 75% of tech workers prefer hybrid or fully remote roles, impacting IRESS's recruitment reach and operational flexibility.

- Global Talent Competition: The demand for AI and cybersecurity engineers in fintech surged by an estimated 25% in 2024, intensifying competition for specialized skills.

- Compensation Expectations: To attract top talent, IRESS needs to align its remuneration with industry benchmarks, where average salaries for senior fintech engineers rose by 10-15% in 2024.

- Work Culture Importance: A positive work environment and opportunities for growth are critical, with 60% of tech professionals citing culture as a key factor in job satisfaction and retention.

Societal expectations around financial inclusion and ethical investing are growing. Consumers, particularly younger generations, increasingly demand that financial institutions align with their values, prioritizing ESG factors. This trend means companies like IRESS need to ensure their platforms support these evolving client needs, offering tools that facilitate socially responsible investment strategies.

The increasing digital literacy across populations means more individuals are comfortable managing their finances online. This societal shift drives demand for intuitive, user-friendly digital wealth management tools and self-service platforms. For instance, in 2024, over 70% of global internet users engaged in some form of online financial activity, underscoring this trend.

Public trust in financial institutions remains a critical factor influencing technology adoption. Following economic uncertainties, consumers are more discerning about data security and transparency. A 2024 survey indicated that 55% of individuals consider a firm's data protection policies as a primary factor when choosing a financial service provider.

The desire for personalized financial advice is a significant societal trend. Investors are moving away from generic recommendations towards bespoke strategies tailored to their unique circumstances. A 2024 report highlighted that 65% of investors prefer financial advice that is highly customized, pushing for greater use of data analytics and AI in wealth management.

Technological factors

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the financial services sector, and IRESS is at the forefront of this transformation. These technologies allow IRESS to offer enhanced predictive analytics, sophisticated automation, and deeply personalized insights to its clients.

The integration of AI and ML is crucial for IRESS to maintain a competitive edge. By leveraging these advancements, IRESS can significantly improve areas like portfolio management, client interaction, and risk assessment. For instance, AI-powered tools can analyze vast datasets to identify investment opportunities or potential risks far more efficiently than traditional methods, directly benefiting IRESS's user base.

The financial industry saw significant investment in AI in 2023, with global spending on AI in financial services projected to reach over $25 billion. This trend is expected to continue growing, underscoring the strategic importance for firms like IRESS to embed AI and ML capabilities into their platforms to drive operational efficiency and deliver superior value to their customers.

The pervasive adoption of cloud computing is a significant technological driver for IRESS. It enables the company to offer its financial software solutions as a service (SaaS), providing clients with enhanced scalability, greater flexibility, and importantly, lower infrastructure expenses. This shift is not just about efficiency; it’s about meeting the dynamic needs of a global clientele.

For IRESS, a strategic focus on migrating to and optimizing cloud-native platforms is paramount to staying ahead in the competitive financial technology landscape. This commitment ensures robust support for its expanding international client base, allowing for rapid deployment and adaptation of services. For instance, many SaaS providers saw significant revenue growth in 2024, with the global cloud computing market projected to reach over $1 trillion by 2025, underscoring the importance of cloud infrastructure for companies like IRESS.

The escalating complexity of cyber threats, including ransomware and sophisticated phishing attacks, demands ongoing, substantial investment in cybersecurity for IRESS. In 2024, financial services firms globally reported an average of 15 significant cyber incidents, highlighting the pervasive risk.

IRESS's commitment to safeguarding sensitive financial data is a critical differentiator, directly impacting client trust and its competitive standing. Failure to maintain robust data protection, such as adhering to GDPR or CCPA standards, can lead to severe penalties and reputational damage, making secure solutions a core operational necessity.

Open Banking and API Integration

The financial industry is undergoing a significant transformation due to open banking initiatives and the widespread adoption of APIs. This trend necessitates that IRESS prioritizes platform interoperability, enabling smooth connections with a diverse range of financial service providers and external applications. Such integration is crucial for unlocking new revenue opportunities and elevating the overall customer experience.

By embracing API-driven strategies, IRESS can tap into a growing market. For instance, in the UK, open banking has led to a substantial increase in consumer adoption, with millions of consumers and businesses now using open banking-enabled services. This highlights the potential for IRESS to leverage these technologies.

- Interoperability: IRESS platforms must be designed for seamless integration with other financial institutions and fintech solutions.

- API Economy: Developing and exposing robust APIs can create new business models and partnerships.

- Customer Experience: Enhanced data sharing through APIs allows for more personalized and efficient financial services.

- Revenue Streams: Open banking can unlock new revenue through data aggregation, payment initiation, and value-added services.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are continuing their evolution, promising significant shifts in financial services, particularly in trading, settlements, and enhancing data transparency. IRESS must actively investigate how these technologies can be integrated into its services to manage secure data exchange and streamline transaction processing, ensuring it meets future market needs.

The adoption of DLT in financial markets is gaining momentum. For instance, by early 2024, several major financial institutions were actively piloting DLT for various use cases, including cross-border payments and trade finance, aiming for faster settlement times and reduced operational costs. IRESS's strategic exploration of these technologies is crucial for maintaining a competitive edge.

- Market Growth: The global blockchain in financial services market was projected to reach over $10 billion by 2024, indicating significant investment and development.

- Efficiency Gains: Studies suggest DLT could reduce settlement times for securities from T+2 (trade date plus two days) to near real-time.

- Transparency: Blockchain's inherent immutability offers enhanced audit trails and data integrity, a key benefit for regulated financial environments.

The increasing reliance on cloud infrastructure is a defining technological factor for IRESS. This allows for scalable, flexible, and cost-effective delivery of financial software solutions. The global cloud computing market is anticipated to surpass $1 trillion by 2025, highlighting the strategic importance for IRESS to leverage these platforms for its expanding international client base and rapid service adaptation.

AI and machine learning are transforming financial services, enabling IRESS to offer advanced analytics and automation. Global spending on AI in financial services exceeded $25 billion in 2023, a figure expected to rise, underscoring the necessity for IRESS to integrate these capabilities for operational efficiency and enhanced customer value.

Cybersecurity remains a critical technological challenge, with financial firms reporting an average of 15 significant cyber incidents in 2024. IRESS's robust data protection measures are vital for maintaining client trust and avoiding severe penalties associated with data breaches.

Open banking and API adoption are driving interoperability in finance. The UK's open banking initiative has seen millions of consumers and businesses adopt these services, presenting opportunities for IRESS to create new partnerships and improve customer experiences through seamless data sharing.

| Technology Area | Key Trend | Impact on IRESS | Market Data/Projection |

|---|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhanced analytics, automation, personalization | Improved portfolio management, risk assessment, client interaction | Global AI in financial services spending projected to exceed $25 billion (2023) |

| Cloud Computing | SaaS delivery, scalability, flexibility | Lower infrastructure costs, support for global clients, rapid service deployment | Global cloud computing market projected to exceed $1 trillion (2025) |

| Cybersecurity | Increasing threat sophistication (ransomware, phishing) | Essential for data protection, client trust, regulatory compliance | Average of 15 significant cyber incidents reported by financial firms (2024) |

| Open Banking & APIs | Interoperability, data sharing | New revenue streams, enhanced customer experience, partnerships | Millions of users in UK open banking services |

| Blockchain & DLT | Secure data exchange, streamlined settlements | Potential for faster settlements, reduced costs, enhanced transparency | Global blockchain in financial services market projected to exceed $10 billion (2024) |

Legal factors

Global data privacy laws like GDPR, CCPA, and emerging US state regulations such as those in Texas, Oregon, and New Jersey, significantly shape how IRESS handles client information. These regulations mandate stringent protocols for data collection, storage, and processing.

Non-compliance with these evolving privacy frameworks, which are becoming increasingly complex, can result in substantial financial penalties. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risk.

Maintaining robust data protection measures is therefore paramount for IRESS, not only to avoid legal repercussions but also to preserve the trust and confidence of its clients in its data handling practices.

IRESS's software must constantly adapt to evolving financial services regulations. For instance, in Australia, the ASIC Regulatory Guide 271, which came into effect in October 2021, mandates enhanced standards for handling customer complaints, requiring financial firms to update their processes and, by extension, the software they use to manage these interactions.

Compliance with licensing and conduct obligations, such as those under the Corporations Act 2001 (Cth) in Australia, is paramount. Failure to meet these can result in significant penalties, impacting both IRESS's clients and its own reputation. The Australian Securities and Investments Commission (ASIC) actively enforces these rules, with financial services and products enforcement actions totaling $102.1 million in the 2023 financial year.

As financial advice reforms continue globally, like the ongoing discussions around the Quality of Advice review in Australia, IRESS must ensure its platforms facilitate adherence to new or modified conduct rules, such as those potentially impacting how financial product recommendations are made and documented.

The increasing global focus on financial crime necessitates that IRESS's software includes strong Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance tools. This means features like detailed customer verification, suspicious activity reporting, and transaction monitoring are vital, especially for their trading and wealth management systems.

Regulatory bodies worldwide are tightening rules, demanding more rigorous due diligence and real-time transaction analysis. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national legislation and impacting how financial technology providers like IRESS must build their solutions to ensure adherence. The expectation is for seamless integration of these compliance measures into the core functionality of their platforms.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for IRESS, particularly as financial services increasingly move online. These evolving regulations, especially concerning digital products, directly influence how IRESS designs and implements its software. For instance, the UK's Financial Conduct Authority (FCA) continues to emphasize consumer protection, with new rules on digital markets and data privacy impacting how financial technology firms operate and present information to end-users.

IRESS must ensure its platforms facilitate compliance with stringent transparency, disclosure, and fair treatment requirements. This means building features that enable IRESS's clients, such as financial advisors and wealth managers, to clearly communicate product details and risks to consumers. The growing focus on data security and consumer consent, driven by regulations like GDPR and similar frameworks globally, also necessitates robust security protocols within IRESS's offerings.

- Evolving Digital Regulations: Increased scrutiny on digital financial products demands adaptive software solutions from IRESS.

- Transparency and Disclosure Mandates: Legal requirements for clear information sharing directly shape IRESS's platform design.

- Data Privacy Compliance: Adherence to data protection laws like GDPR is crucial for IRESS's software architecture.

- Fair Treatment of Consumers: Regulations ensuring equitable customer practices necessitate features that support client compliance.

Intellectual Property Rights and Software Licensing

Intellectual property rights are paramount for IRESS, a technology solutions provider. The company's success hinges on safeguarding its proprietary software through patents, copyrights, and robust licensing agreements. For instance, IRESS likely invests significantly in R&D, with a portion of its operating expenses dedicated to innovation, which directly relates to IP protection.

Navigating the complexities of software patents and copyrights is essential for IRESS to maintain its competitive edge and prevent unauthorized use of its technology. In 2023, the global software market saw continued growth, underscoring the value of intellectual property in this sector.

Furthermore, adherence to open-source licensing terms is critical for IRESS, especially when integrating third-party components into its offerings. This ensures legal compliance and avoids potential disputes.

- Software Patents: IRESS must actively pursue and defend patents for its unique technological innovations to prevent competitors from replicating its solutions.

- Copyright Protection: Copyright law safeguards the literal expression of IRESS's software code, preventing unauthorized copying and distribution.

- Licensing Agreements: Clearly defined licensing terms are crucial for IRESS to monetize its software and manage usage rights with clients.

- Open-Source Compliance: Strict adherence to the licenses of any open-source software used by IRESS is necessary to avoid legal repercussions.

IRESS must navigate a complex web of financial services regulations globally, impacting everything from data handling to product disclosure. For instance, the Australian Securities and Investments Commission (ASIC) reported $102.1 million in enforcement actions in FY23, highlighting the significant penalties for non-compliance.

Evolving consumer protection laws, particularly concerning digital financial products, require IRESS to build transparency and fair treatment into its software design. Adherence to data privacy mandates like GDPR, with potential fines up to 4% of global annual turnover, necessitates robust security and consent management features within IRESS's platforms.

Furthermore, intellectual property rights are critical, with IRESS needing to protect its proprietary software through patents and copyrights, essential in a growing global software market. Compliance with open-source licensing terms is also vital to avoid legal disputes.

Environmental factors

The growing demand for Environmental, Social, and Governance (ESG) reporting significantly influences IRESS's client base, especially major financial organizations. This trend fuels the need for IRESS's offerings that assist clients in gathering, analyzing, and disclosing their environmental impact, social contributions, and governance structures.

For instance, the European Union’s Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, mandates extensive ESG disclosures, creating a clear market for IRESS's data management and reporting tools. IRESS can enhance its platforms by integrating advanced ESG data analytics to meet these evolving client needs.

Financial institutions are facing growing pressure to actively manage climate-related financial risks. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming a de facto standard for reporting, with many regulators globally mandating compliance. IRESS can empower its clients by creating sophisticated tools to model various climate risk scenarios, seamlessly integrate crucial climate data into investment analysis, and ensure adherence to evolving climate disclosure requirements.

This presents a significant opportunity for IRESS to innovate in software development and expand its service offerings. By providing solutions that address these critical environmental factors, IRESS can help its clients navigate the complexities of climate risk, potentially unlocking new revenue streams and strengthening its market position in the financial technology sector.

Investor demand for sustainable and ethical investments is surging, creating a strong market for financial products adhering to Environmental, Social, and Governance (ESG) principles. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2024, a significant increase from previous years, indicating a clear trend toward ESG integration.

IRESS can leverage this by upgrading its platforms to facilitate green investment screening, measure impact, and streamline reporting. This would empower financial professionals to effectively advise clients and manage portfolios focused on sustainability, meeting the growing client need for responsible investment options.

By offering robust tools for ESG analysis and portfolio management, IRESS can position itself as a key enabler of sustainable finance. This strategic enhancement allows financial advisors to demonstrate the tangible impact of their clients' investments, a crucial factor in attracting and retaining assets in the current market.

Operational Carbon Footprint and Energy Consumption

IRESS, as a technology provider, faces increasing pressure to manage its operational carbon footprint, especially concerning data centers and cloud infrastructure. The company's energy consumption directly impacts its environmental performance and, consequently, its brand image.

Adopting energy-efficient technologies and sourcing renewable energy are key strategies for IRESS. This not only reduces environmental impact but also resonates with clients and stakeholders who are increasingly prioritizing sustainability in their own operations and supply chains. For instance, many large financial institutions, IRESS's core clientele, have set ambitious net-zero targets for 2030 and beyond, making their technology partners' environmental credentials crucial.

Key areas of focus for IRESS's operational footprint include:

- Data Center Efficiency: Implementing advanced cooling systems and optimizing server utilization to reduce energy used per unit of computing power.

- Cloud Infrastructure: Partnering with cloud providers committed to renewable energy sources and efficient operations.

- Office Energy Use: Reducing consumption through smart building management, energy-efficient lighting, and promoting remote work where feasible.

Corporate Social Responsibility (CSR) Initiatives

Societal expectations for corporate social responsibility significantly shape IRESS's public image and its appeal to potential employees and business collaborators. Beyond direct environmental concerns, IRESS's commitment to community programs and ethical sourcing can enhance how stakeholders view the company, aiding in attracting top talent. For instance, in 2023, IRESS reported a 15% increase in employee participation in its volunteer programs, demonstrating a growing engagement with CSR activities.

These broader CSR efforts contribute to IRESS's overall brand value and can mitigate reputational risks. By investing in initiatives that align with social good, IRESS not only fulfills its ethical obligations but also strengthens its competitive position in the market. The company's 2024 sustainability report highlighted a 10% reduction in its supply chain's carbon footprint, a direct result of prioritizing ethical and sustainable partnerships.

Key CSR areas influencing IRESS include:

- Community Engagement: Supporting local initiatives and employee volunteering programs.

- Ethical Supply Chains: Ensuring fair labor practices and environmental responsibility among suppliers.

- Diversity and Inclusion: Promoting a workplace that reflects societal values.

- Philanthropic Contributions: Donating to charitable causes and supporting social impact projects.

The increasing regulatory focus on climate risk and sustainability reporting, exemplified by directives like the EU's CSRD and the widespread adoption of TCFD recommendations, creates a substantial market opportunity for IRESS. Financial institutions are actively seeking solutions to manage climate-related financial risks and comply with stringent disclosure requirements.

Investor demand for ESG-integrated investments reached an estimated $35.3 trillion globally in 2024, underscoring the trend towards sustainable finance. IRESS can capitalize on this by enhancing its platforms to support green investment screening and impact measurement, thereby empowering financial professionals to meet client needs for responsible investment options.

IRESS must also address its own operational carbon footprint, particularly concerning data centers and cloud infrastructure, as clients increasingly scrutinize their partners' sustainability credentials. Many large financial institutions have set ambitious net-zero targets, making IRESS's environmental performance a critical factor in maintaining strong business relationships.

The growing emphasis on corporate social responsibility (CSR) influences IRESS's brand image and talent acquisition, with initiatives like increased employee volunteerism (up 15% in 2023) and supply chain carbon footprint reduction (10% in 2024) demonstrating commitment.

| Environmental Factor | Impact on IRESS | Opportunity/Challenge | Data/Example |

|---|---|---|---|

| Climate Risk & Disclosure | Increased demand for reporting tools | Market for ESG data analytics and climate risk modeling software | EU CSRD applicable from 2024; TCFD recommendations widely adopted |

| Sustainable Investment Demand | Growth in ESG-focused financial products | Enhance platforms for green screening and impact measurement | Global sustainable investment market at $35.3 trillion in 2024 |

| Operational Carbon Footprint | Pressure to reduce energy consumption | Adopt energy-efficient tech and renewable energy sources | Clients setting net-zero targets (e.g., by 2030) |

| Corporate Social Responsibility (CSR) | Influences brand perception and talent attraction | Invest in community programs and ethical supply chains | 15% increase in employee volunteerism (2023); 10% supply chain carbon reduction (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide a comprehensive overview.