Interfor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interfor Bundle

Interfor's market position is shaped by its strong operational efficiencies and diverse product portfolio, but understanding the full scope of its competitive landscape requires a deeper dive. Our comprehensive SWOT analysis reveals key vulnerabilities and untapped opportunities that could significantly impact its future growth.

Want the full story behind Interfor's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Interfor stands as a dominant force in the North American softwood lumber market, ranking among the top three producers. This strong market position is underpinned by its extensive operational footprint, featuring 28 strategically situated facilities across the continent.

The company’s impressive annual production capacity of approximately 4.7 billion board feet allows for significant economies of scale and a robust market presence. This substantial output capacity is a key strength, enabling Interfor to efficiently meet demand and maintain a competitive edge in the industry.

Interfor's extensive geographic diversification is a significant strength, with operations spread across key timber-producing regions in North America. This includes the US South, Eastern Canada, British Columbia Interior, and the US Northwest.

This broad footprint, notably with 50% of its capacity located in the US South, allows Interfor to effectively mitigate regional risks and capitalize on varying market cycles. For instance, in 2023, the US South segment contributed a substantial portion to its lumber production, demonstrating its importance in balancing the portfolio.

This strategic distribution not only enhances supply chain reliability but also provides broader market access, a crucial advantage in the often-volatile lumber industry.

Interfor's revenue streams benefit from a broad exposure across various product types and end-use markets. While softwood lumber is the primary revenue driver, the company's portfolio is diversified by species, with Southern Yellow Pine, Spruce-Pine-Fir, and Douglas Fir/Larch representing significant segments.

This product diversity translates into a wide customer base, serving critical sectors such as residential and commercial construction, the repair and remodel market, industrial applications, and the furniture industry. For instance, in the first quarter of 2024, Interfor reported that its U.S. South segment, heavily reliant on Southern Yellow Pine, contributed a substantial portion of its lumber production.

This multi-faceted market engagement significantly mitigates the risk associated with over-reliance on any single product or industry. Such diversification enhances Interfor's ability to weather economic downturns or shifts in demand within specific sectors, showcasing a robust business model.

Strong Commitment to Sustainable Practices

Interfor's dedication to sustainable forest management and strong ESG initiatives is a significant strength. The company has actively invested in projects focused on improving energy efficiency, reducing water usage, and minimizing waste generation across its operations.

This commitment is further underscored by Interfor's ambitious target to decrease its Scope 1 and 2 greenhouse gas emissions by 40% by the close of 2030. This aligns directly with the growing market preference for environmentally responsible products and practices.

Key sustainability achievements and targets include:

- 40% reduction target for Scope 1 and 2 GHG emissions by end of 2030.

- Ongoing investments in energy efficiency projects.

- Initiatives to reduce water consumption.

- Programs aimed at waste minimization.

Solid Financial Position and Liquidity

Interfor demonstrates a robust financial standing, underscored by its strong liquidity. As of June 30, 2025, the company reported available liquidity amounting to $330.0 million. This healthy cash position, coupled with consistent positive operating cash flow generation, provides significant financial flexibility.

The company’s prudent financial management is further evidenced by its manageable net debt to invested capital ratio, which remains a key strength. This financial discipline allows Interfor to navigate market fluctuations effectively and pursue strategic growth opportunities without undue financial strain.

- Strong Liquidity: $330.0 million in available liquidity as of June 30, 2025.

- Positive Cash Flow: Consistent generation of positive operating cash flow.

- Manageable Debt: A well-controlled net debt to invested capital ratio.

- Financial Flexibility: Capacity for strategic investments and resilience in volatile markets.

Interfor's leading position in the North American softwood lumber market is a cornerstone strength, supported by its substantial production capacity of approximately 4.7 billion board feet annually. This scale allows for significant cost efficiencies and a powerful market presence.

The company's extensive geographic diversification across the US South, Eastern Canada, and the US Northwest, with 50% of capacity in the US South, provides resilience against regional downturns and broad market access. This strategic distribution ensures supply chain reliability and market penetration.

Interfor benefits from diversified revenue streams across various lumber species and end-use markets, including construction and repair/remodel sectors. This broad market engagement mitigates risks associated with over-reliance on any single product or industry, enhancing overall business stability.

Interfor's commitment to sustainability, including a target to reduce Scope 1 and 2 GHG emissions by 40% by the end of 2030, resonates with market demand for environmentally conscious products. This focus on ESG initiatives strengthens its brand reputation and long-term viability.

The company's robust financial health is a key strength, highlighted by $330.0 million in available liquidity as of June 30, 2025, and consistent positive operating cash flow. This financial flexibility allows Interfor to pursue strategic growth and manage market volatility effectively.

What is included in the product

Delivers a strategic overview of Interfor’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Interfor's key challenges and leverage its competitive advantages.

Weaknesses

Interfor faces significant challenges due to the lumber market's inherent price volatility, which directly impacts its average selling prices. While prices have recovered from recent lows, they remain prone to sharp swings influenced by supply-demand dynamics and broader economic trends.

This instability directly affects Interfor's profitability and revenue streams, making financial forecasting more complex. For instance, lumber prices experienced a notable decline in early 2023, with futures trading around $350 per thousand board feet, a stark contrast to the record highs seen in 2021.

Interfor's significant exposure to trade duties and tariffs presents a considerable weakness. The company has paid a substantial US$621.5 million in cumulative duties on Canadian lumber exports to the United States as of June 30, 2025. These duties are primarily expensed, directly impacting profitability.

These tariffs increase the cost of Canadian-sourced lumber, putting Interfor at a competitive disadvantage in the vital U.S. market. This financial burden can hinder the company's ability to compete effectively on price with domestic U.S. producers.

Interfor has faced significant financial headwinds, reporting a $35.1 million net loss in the first quarter of 2025 and a $49.9 million net loss in the fourth quarter of 2024. These periods were also marked by revenue shortfalls compared to analyst expectations.

Although the company managed to achieve net earnings in the second quarter of 2025, the preceding losses underscore the considerable impact of adverse market conditions on its bottom line. Such a pattern of negative profitability can erode investor trust and hinder the company's ability to fund future growth initiatives.

Impact of Production Curtailments and Mill Closures

Interfor's decision to implement temporary production cuts in 2024, amounting to roughly 175 million board feet, highlights a strategic response to challenging market dynamics. This move, coupled with the indefinite curtailment of operations at its Philomath, Oregon sawmill, underscores the company's effort to align production with current demand and manage oversupply.

These capacity adjustments, while necessary for navigating weak market conditions, present inherent weaknesses. The underutilization of assets during these curtailments can translate into missed revenue opportunities, particularly as market demand is expected to recover. This situation necessitates careful management to ensure the company is positioned to capitalize on future upturns.

- Production Reduction: Approximately 175 million board feet cut in 2024.

- Mill Closure: Indefinite curtailment of the Philomath, Oregon sawmill.

- Market Response: Actions taken due to weak market conditions and oversupply.

- Potential Impact: Risk of underutilized assets and missed revenue during demand rebound.

Challenges with Labor Shortages and Rising Costs

Interfor, like many in the broader lumber sector, faces ongoing challenges with labor shortages, particularly for skilled trades and commercial drivers. This scarcity directly contributes to increased operational costs, impacting expenses for labor, essential parts, and fuel throughout 2024 and into 2025. These rising expenses can impede efforts to enhance production efficiency and maintain a competitive cost structure.

The persistent difficulty in securing a sufficient workforce and the escalating costs associated with it present significant headwinds. For instance, the average hourly wage for manufacturing production workers in Canada, where Interfor has substantial operations, saw a notable increase. These upward pressures on input costs can directly affect Interfor's bottom line and its ability to control its overall cost of production.

- Labor Scarcity: Difficulty in finding and retaining skilled trades and CDL drivers across operations.

- Rising Operational Costs: Increased expenses for labor, replacement parts, and fuel impacting profitability.

- Efficiency Hindrance: Labor shortages and cost pressures can limit the implementation of efficiency improvements.

- Cost Competitiveness: Upward pressure on production expenses may challenge Interfor's position relative to competitors.

Interfor's profitability is significantly hampered by the cyclical nature of lumber prices, which experienced a sharp decline in early 2023, with futures trading around $350 per thousand board feet, a considerable drop from previous highs. The company's financial performance in late 2024 and early 2025 reflected this volatility, with net losses reported in Q4 2024 ($49.9 million) and Q1 2025 ($35.1 million), despite a return to profitability in Q2 2025.

The company's reliance on Canadian lumber exports to the U.S. exposes it to substantial trade duties; as of June 30, 2025, Interfor had paid US$621.5 million in cumulative duties, directly impacting its profit margins and competitive standing against domestic U.S. producers.

Interfor has had to implement production adjustments, including a 175 million board feet reduction in 2024 and the indefinite curtailment of its Philomath, Oregon sawmill, signaling challenges in aligning output with weak market demand and potentially leading to underutilized assets.

Labor shortages, particularly for skilled trades and commercial drivers, are escalating operational costs across the board, affecting expenses for labor, parts, and fuel throughout 2024 and into 2025, thereby hindering efficiency and cost competitiveness.

Preview Before You Purchase

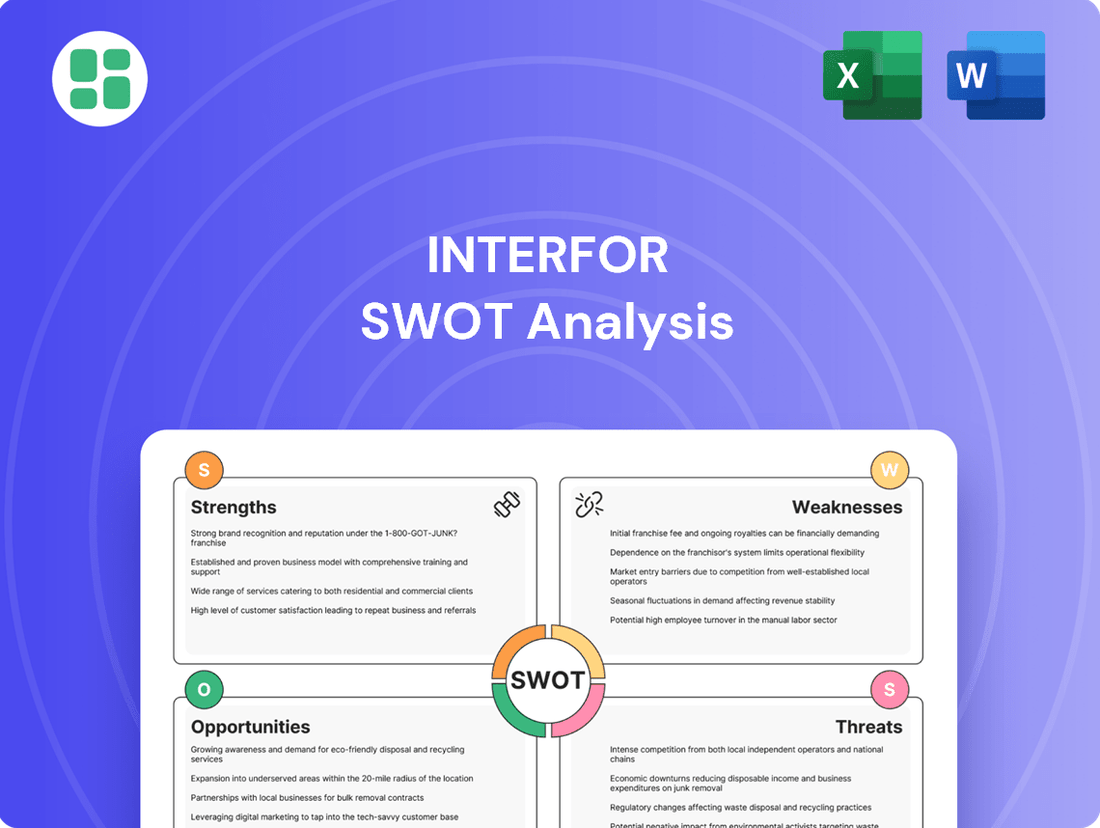

Interfor SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Interfor's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Interfor's strengths, weaknesses, opportunities, and threats.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This ensures you have all the necessary information for strategic planning.

Opportunities

The North American housing market is showing signs of a gradual rebound expected into 2025. This improvement is largely attributed to anticipated interest rate decreases and a continuing scarcity of homes for sale. This scenario is a positive indicator for lumber demand.

The rebuilding efforts following recent natural disasters are also contributing to a heightened need for construction materials, including lumber. Interfor is strategically positioned to benefit from this increased demand in its primary operating regions.

The repair and remodel sector is poised for a rebound, presenting a substantial growth avenue for Interfor. As economic sentiment potentially strengthens and borrowing costs find a more predictable footing, both residential and commercial property owners are anticipated to increase spending on renovation initiatives.

This trend offers Interfor a steady demand stream for its wide array of wood products, moving beyond the cyclical nature of new construction.

Growing environmental consciousness and supportive regulations are fueling a rise in demand for certified wood products and innovative mass timber solutions like Cross-Laminated Timber (CLT). This trend is particularly strong in the construction sector, where wood is increasingly seen as a superior, climate-friendly alternative to traditional materials. The global CLT market, for instance, is anticipated to see significant annual growth through 2030, reflecting this shift.

Interfor's established dedication to sustainable forestry practices and robust Environmental, Social, and Governance (ESG) initiatives places it in a strong position to capitalize on this burgeoning market. By aligning with these evolving consumer and regulatory preferences, the company can effectively meet the increasing demand for responsibly sourced and environmentally sound wood-based building materials.

Leveraging Technological Advancements for Efficiency

Interfor has a significant opportunity to boost its operational efficiency and product quality by further investing in and adopting advanced manufacturing technologies. Think automation, artificial intelligence (AI), and Building Information Modeling (BIM). These aren't just buzzwords; they are tools that can streamline Interfor's wood processing. For instance, automation can speed up production lines and reduce manual labor costs, while AI can optimize inventory management and predict maintenance needs, preventing costly downtime. BIM, commonly used in construction, can also be adapted for timber manufacturing to improve design accuracy and reduce material waste.

Embracing these technological innovations can translate directly into tangible benefits for Interfor. Enhanced operational efficiency means faster production cycles and lower energy consumption. Reducing waste not only cuts costs but also aligns with growing environmental sustainability demands. Improved precision in wood processing leads to higher quality end products, which can command premium pricing and increase customer satisfaction. Ultimately, these advancements can significantly strengthen Interfor's competitive position in the market.

Consider these specific areas for technological investment:

- Automated Sawmill Operations: Implementing robotic arms for log handling and automated grading systems can increase throughput by an estimated 15-20% while improving worker safety.

- AI-Powered Predictive Maintenance: Utilizing AI to monitor equipment performance can reduce unplanned downtime by up to 30%, ensuring consistent production schedules.

- BIM for Timber Design and Fabrication: Integrating BIM into the design and manufacturing process can minimize material waste by up to 10% through precise cutting patterns and optimized material utilization.

- Digital Twin Technology: Creating virtual replicas of manufacturing processes can allow for real-time performance monitoring and simulation of changes, leading to further efficiency gains.

Strategic Acquisitions and Optimized Portfolio

Interfor's history demonstrates a consistent and successful strategy of expanding through acquisitions. Since 2021, the company has significantly boosted its production capacity by roughly 57%. This track record suggests a continued opportunity to acquire strategically located assets, particularly in growth markets like the US South, to further enhance its operational scale and market presence.

The company can leverage its acquisition expertise to target complementary businesses or facilities in regions with favorable market dynamics and cost structures. This approach allows for incremental capacity growth and market share gains, reinforcing its competitive position.

Furthermore, Interfor's strategic portfolio optimization, exemplified by the divestiture of its Quebec operations, presents an ongoing opportunity. This allows the company to reallocate capital and management focus towards its highest-potential assets and markets, thereby improving overall profitability and return on investment.

- Strategic Acquisitions: Interfor has increased production capacity by approximately 57% since 2021 through acquisitions.

- US South Expansion: The company can target further acquisitions in attractive regions like the US South to expand capacity and market reach.

- Portfolio Optimization: Divesting underperforming or non-core assets, like the Quebec operations, allows for greater focus on high-potential areas.

- Capacity Enhancement: Continued strategic acquisitions offer a clear path to further increase production capacity and market share.

Interfor is well-positioned to capitalize on the growing demand for sustainable building materials and innovative wood products like Cross-Laminated Timber (CLT). The company's commitment to ESG principles and responsible forestry practices aligns with increasing consumer and regulatory preferences for environmentally friendly construction solutions.

Investing in advanced manufacturing technologies, such as AI and automation, presents a significant opportunity for Interfor to enhance operational efficiency, reduce waste, and improve product quality. These technological advancements can lead to cost savings and a stronger competitive edge in the market.

The company's proven track record of strategic acquisitions, which has boosted production capacity by approximately 57% since 2021, offers a clear path for continued growth. Targeting complementary assets in favorable markets, particularly the US South, can further expand Interfor's scale and market presence.

Portfolio optimization, including the divestiture of non-core assets like the Quebec operations, allows Interfor to strategically reallocate resources to its most promising ventures, thereby improving overall profitability and shareholder value.

Threats

Interfor faces a significant threat from persistent market volatility and economic uncertainty, with the lumber market projected to remain unpredictable through 2025. This volatility is fueled by evolving monetary policies, ongoing inflation concerns, and broader geopolitical instability. For example, the U.S. Federal Reserve's interest rate decisions directly impact housing starts, a key driver of lumber demand.

This unpredictable economic landscape creates substantial challenges for Interfor in forecasting demand and managing its operational costs. Sudden price swings can erode profit margins and complicate inventory management. The International Monetary Fund (IMF) revised its global growth forecast downwards for 2024, highlighting the pervasive economic headwinds that could further dampen construction activity.

Such instability directly hinders Interfor's ability to engage in effective long-term strategic planning and capital investment. Uncertainty about future demand and pricing makes committing to large-scale projects riskier, potentially slowing down growth initiatives and impacting the company's competitive positioning.

The ongoing softwood lumber dispute between the U.S. and Canada remains a significant threat to Interfor. This long-standing issue, which has seen duties imposed on Canadian lumber imports, directly impacts Interfor's cost structure. As of early 2024, these duties have fluctuated, with the U.S. Department of Commerce continuing to review and adjust them, creating uncertainty for Canadian producers like Interfor.

The potential for increased tariffs on Canadian lumber imports, particularly into the crucial U.S. market, poses a continuous risk. These duties directly increase Interfor's cost of goods sold, diminishing its price competitiveness. For instance, past duty rates have significantly impacted profitability, and any escalation could further squeeze margins.

Any new trade restrictions or the continuation of existing ones could exacerbate existing supply chain challenges and further inflate operational expenses for Interfor. This creates a less predictable operating environment, making strategic planning more difficult and potentially hindering market access.

Interfor, like others in the wood products sector, faces growing pressure from non-wood alternatives. Materials such as engineered plastics, composites, and metals are increasingly being adopted in construction and design, often promoted for their durability, lower maintenance, or cost-effectiveness. This trend directly impacts demand for traditional wood products.

The flooring market, for instance, has seen a significant shift towards luxury vinyl plank (LVP) and laminate flooring, which can mimic wood aesthetics at a lower price point and with greater resilience to moisture. This erosion of market share in key segments requires Interfor to continually highlight the inherent advantages of wood, such as its sustainability, unique aesthetic, and structural integrity.

For example, while LVP can be cost-effective, it lacks the natural beauty and renewability of sustainably harvested timber. Interfor's strategy must therefore emphasize the long-term value and environmental benefits of wood products to counter the immediate cost appeal of alternatives, especially as consumer preferences evolve.

Impact of Environmental Factors and Natural Disasters

Natural disasters like wildfires and hurricanes, along with widespread pest infestations, pose a significant threat to Interfor's timber supply and can severely disrupt its operations. These events directly impact the availability of raw materials and can cause substantial delays and increased costs in the supply chain.

Climate change introduces long-term risks to forest health and the sustainability of harvesting practices. This could lead to localized shortages of timber and increased price volatility, impacting Interfor's cost structure and revenue predictability.

- Increased operational disruptions: Extreme weather events can halt logging operations and damage infrastructure, leading to downtime and lost production.

- Supply chain volatility: Natural disasters can impact transportation routes and processing facilities, creating unpredictable delays and cost fluctuations.

- Long-term resource availability: Climate change effects, such as increased drought or pest outbreaks, could reduce the long-term yield and health of timber stands in key regions.

- Financial impact: The costs associated with disaster recovery, increased insurance premiums, and lost revenue can significantly affect Interfor's financial performance.

Supply Chain Constraints and Industry Capacity Reductions

North American lumber production capacity has been impacted by mill closures, raising concerns about the industry's ability to respond to a sudden increase in demand without significant delays. For Interfor, this means potential challenges in scaling up production to meet market needs, potentially leading to extended lead times for customers.

Supply chain disruptions, including transportation bottlenecks and logistical hurdles, continue to pose a threat. These issues can impede the timely delivery of raw materials and finished products, affecting Interfor's operational efficiency and its ability to fulfill orders promptly.

These constraints can directly translate into increased operating costs for Interfor due to higher freight charges and the need for more robust inventory management. Furthermore, the inability to meet demand quickly can result in lost sales opportunities, impacting revenue and market share.

- Mill Closures: Several North American sawmills have ceased operations in recent years, reducing overall production capacity.

- Logistical Challenges: Interfor, like other industry players, faces ongoing issues with trucking availability and railcar capacity, impacting material flow.

- Demand Volatility: A sharp increase in housing starts or renovation activity could outstrip current production capabilities, leading to significant price volatility and lead times.

Interfor's profitability is threatened by fluctuating lumber prices, with market analysts predicting continued volatility through 2025 due to global economic uncertainties and shifting interest rate policies. For instance, the U.S. housing market, a major demand driver, is sensitive to Federal Reserve rate hikes, which can dampen construction activity and subsequently lumber demand.

The persistent softwood lumber dispute between Canada and the U.S. remains a significant risk, as U.S. duties on Canadian lumber imports directly inflate Interfor's costs. These duties, subject to ongoing review by the U.S. Department of Commerce, create an unpredictable cost structure for Canadian producers like Interfor, impacting their competitiveness.

Increasing adoption of non-wood alternatives in construction, such as composites and plastics, poses a threat by eroding demand for traditional lumber products. For example, the flooring sector has seen a rise in luxury vinyl plank (LVP) due to its perceived durability and cost-effectiveness, necessitating Interfor to emphasize wood's unique benefits.

Natural disasters and climate change present substantial threats to Interfor's timber supply and operational continuity. Wildfires, pest infestations, and extreme weather can disrupt harvesting, damage infrastructure, and impact long-term forest health, leading to supply chain volatility and increased costs.

Reduced North American lumber production capacity due to mill closures, coupled with ongoing logistical challenges like trucking and railcar shortages, creates a risk of supply chain bottlenecks. This can hinder Interfor's ability to meet demand surges, potentially leading to extended lead times and lost sales opportunities.

| Threat Category | Specific Threat | Impact on Interfor | Data/Fact (2024-2025 Projection) |

|---|---|---|---|

| Market Volatility | Lumber Price Fluctuations | Erodes profit margins, complicates inventory management. | Lumber futures trading indicates continued price volatility through 2025, influenced by global economic outlook and interest rate policies. |

| Trade Policy | Softwood Lumber Dispute (U.S.-Canada) | Increases cost of goods sold, reduces price competitiveness. | U.S. duties on Canadian lumber imports remain a factor, with potential adjustments by the U.S. Department of Commerce in 2024-2025. |

| Competition | Non-Wood Alternatives | Erodes market share in construction segments. | Growth in engineered plastics and composites in construction continues, impacting demand for traditional wood products. |

| Environmental/Operational | Natural Disasters & Climate Change | Disrupts timber supply, increases operational costs. | Increased frequency of wildfires and pest outbreaks in North America poses ongoing risks to timber availability and forest health. |

| Supply Chain | Mill Closures & Logistical Bottlenecks | Limits production capacity, creates delivery delays. | Several North American sawmills have closed, reducing industry capacity, while trucking and rail shortages persist. |

SWOT Analysis Data Sources

This analysis is built on a foundation of Interfor's official financial statements, comprehensive industry reports, and current market intelligence to provide a robust understanding of its strategic position.