Interfor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interfor Bundle

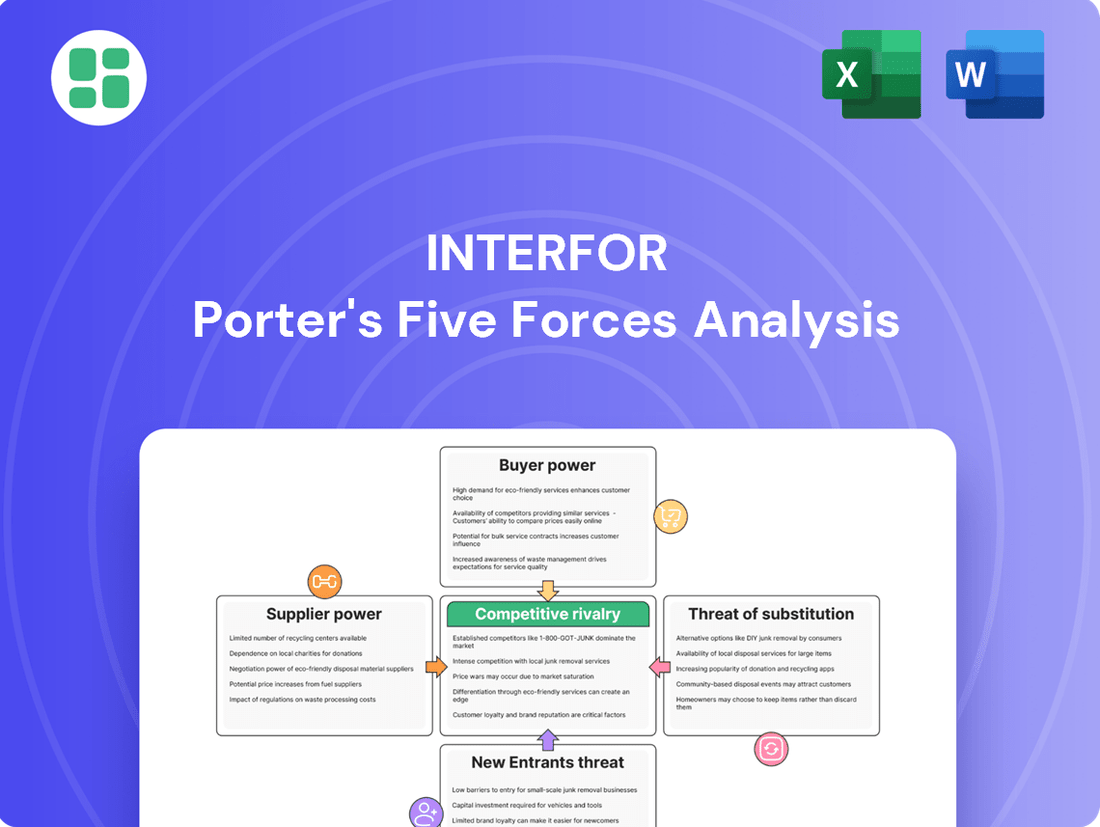

Understanding Interfor's competitive landscape is crucial, and Porter's Five Forces provides the framework. We've analyzed the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Interfor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of timberland ownership significantly influences the bargaining power of suppliers. If a few large entities, like government bodies or major private landowners, control a substantial portion of timber resources, they can exert considerable leverage over pricing and supply agreements for raw logs. This concentration can lead to less favorable terms for timber purchasers.

However, the landscape of timberland ownership in North America, as detailed in the 2025 North American Timberland Owner & Manager List, appears to be more diverse. This suggests a less concentrated supply base, which could potentially dilute the bargaining power of individual suppliers. A fragmented ownership structure generally offers timber companies more options and greater flexibility in sourcing their raw materials.

The availability and uniqueness of raw timber significantly influence the bargaining power of suppliers for companies like Interfor. If specific timber species or qualities are scarce or possess unique characteristics, suppliers who control these resources gain leverage. For instance, fiber supply constraints, particularly noted in regions like British Columbia and the Western U.S., can amplify this supplier power. In 2023, lumber prices experienced volatility, with some specialty wood products seeing higher demand and thus stronger supplier pricing power.

Interfor faces significant switching costs if it were to change its primary timber suppliers. These costs encompass not only the financial implications of negotiating new contracts and potentially reconfiguring logistics but also the operational adjustments needed for its milling processes to accommodate different timber characteristics. For instance, a shift in wood species or quality could necessitate recalibrating machinery, impacting production efficiency and output quality.

The regional nature of timber markets further amplifies these switching costs. Transportation expenses for lumber are substantial, meaning a change in supplier location could drastically alter inbound freight costs. In 2024, Interfor's reliance on established supplier relationships, often built over years, means that breaking these ties would involve more than just finding a new source; it would require rebuilding trust and operational alignment, thereby strengthening the bargaining power of its current suppliers.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers for Interfor is influenced by their ability to forward integrate. This means timber suppliers could potentially move into lumber manufacturing themselves, effectively becoming competitors to Interfor. If these suppliers can readily acquire or build sawmills, their threat to do so strengthens their negotiating position.

While the concept of suppliers forward integrating is a factor in supplier bargaining power, it's less common for pure timberland owners to directly enter the complex lumber manufacturing business. Their primary role remains the provision of raw materials, making direct competition through integration less of a prevalent threat in this specific industry segment. However, the potential remains a consideration in the broader supplier landscape.

For instance, in 2024, the lumber industry saw significant consolidation, with some larger timber companies exploring value-added processing. While specific data on timberland owners integrating into Interfor's direct competition isn't readily available, the general trend of vertical integration within the broader forest products sector suggests this is a dynamic area. Interfor's own operations, which include both timber sourcing and manufacturing, position it to manage such potential shifts.

- Potential for Competition: Suppliers could become direct competitors by entering lumber manufacturing.

- Increased Leverage: Suppliers gain bargaining power if they can easily forward integrate.

- Industry Trend: Vertical integration is a consideration in the broader forest products sector.

Importance of Interfor to Supplier Revenue

The bargaining power of suppliers is a key factor in Interfor's operational landscape. Understanding how crucial Interfor's business is to its timber suppliers directly impacts the leverage these suppliers hold.

If Interfor constitutes a substantial percentage of a particular timber supplier's annual sales, that supplier’s dependence on Interfor for consistent demand can diminish their bargaining power. This is because the supplier has more to lose if that business relationship is jeopardized.

For instance, if a supplier's revenue is heavily reliant on Interfor, they may be less inclined to push for significantly higher prices or more favorable terms, knowing that Interfor has other sourcing options. This dynamic is a critical consideration in Interfor's procurement strategy.

- Supplier Dependence: The degree to which timber suppliers depend on Interfor for a significant portion of their revenue directly influences their bargaining power.

- Market Concentration: In regions where Interfor is a dominant buyer, suppliers with fewer alternative customers may find their negotiating leverage reduced.

- Interfor's Procurement Scale: Interfor's large-scale purchasing operations can sometimes create situations where individual suppliers are more reliant on them than vice-versa, thereby limiting supplier power.

The bargaining power of Interfor's timber suppliers is influenced by the concentration of timberland ownership. While some regions show more concentrated ownership, a general trend towards fragmentation in North America, as indicated by data like the 2025 North American Timberland Owner & Manager List, suggests a less powerful supplier base. However, specific fiber supply constraints in key areas like British Columbia and the Western U.S. can still grant significant leverage to suppliers controlling scarce or unique timber resources, especially for specialty wood products where demand was strong in 2023.

Switching costs for Interfor are substantial, encompassing logistics, operational adjustments, and regional transportation expenses. The established nature of supplier relationships, built on trust and operational alignment, further strengthens the position of current suppliers. The potential for timber suppliers to forward integrate into lumber manufacturing is a consideration, though less prevalent for pure timberland owners, it remains a dynamic factor in the broader forest products sector, with some larger companies exploring value-added processing in 2024.

A critical factor is the degree to which timber suppliers depend on Interfor for their revenue. If Interfor represents a significant portion of a supplier's sales, that supplier's bargaining power is diminished due to their reliance on Interfor's consistent demand. Conversely, Interfor's large-scale procurement can sometimes create situations where individual suppliers are more dependent on Interfor, thereby limiting their negotiating leverage.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Observation |

| Timberland Ownership Concentration | Potentially Lowered (more fragmented ownership) | 2025 North American Timberland Owner & Manager List suggests diverse ownership. |

| Availability & Uniqueness of Timber | Potentially Increased (for scarce/unique species) | Fiber supply constraints in BC/Western US; specialty wood demand in 2023. |

| Switching Costs | Increased (logistics, operational, regional factors) | High transportation costs; established relationships require rebuilding trust. |

| Supplier Forward Integration Potential | Potential Increase (though less common for pure timberland owners) | Trend of vertical integration in forest products; some exploration of value-added processing in 2024. |

| Supplier Dependence on Interfor | Lowered (if supplier relies heavily on Interfor) | Interfor's scale can create supplier reliance, reducing their leverage. |

What is included in the product

This analysis breaks down the competitive landscape for Interfor by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the lumber industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force on a dynamic dashboard.

Customers Bargaining Power

Interfor's customer base reveals a significant degree of concentration, particularly within the U.S. market, which represents a substantial 84% of its lumber sales. This concentration means that a smaller number of large buyers, such as major home builders and large retailers, can wield considerable influence.

These large customers, by virtue of their substantial purchase volumes, possess significant bargaining power. Their ability to commit to large orders allows them to negotiate more favorable terms, potentially impacting Interfor's pricing and profitability.

The standardization of lumber products significantly influences the bargaining power of customers. When lumber is largely a commodity, meaning it's difficult to distinguish one supplier's product from another's, buyers can readily switch between providers. This ease of switching, driven by price as the primary differentiator, directly amplifies customer bargaining power.

In 2024, the lumber market largely operates on this commodity principle. While there are grading systems and species variations, the core product is often perceived as interchangeable. This means customers, from large construction firms to smaller builders, can shop around for the best price, putting pressure on lumber producers like Interfor to remain competitive on cost.

Customer price sensitivity is a key factor, amplified by readily available pricing information across multiple suppliers. This transparency empowers buyers to negotiate harder, especially given the anticipated continued volatility in lumber prices through 2025.

For instance, in the first quarter of 2024, lumber prices experienced significant fluctuations, with Western Spruce-Pine-Fir (SPF) 2x4s trading in a range that allowed informed customers to seek competitive bids, directly impacting Interfor's pricing power.

Customer's Ability to Backward Integrate

The threat of customers backward integrating, meaning they start producing lumber themselves, is a key factor in Interfor's bargaining power of customers. For instance, a major construction firm could theoretically acquire its own sawmill.

However, this is generally a limited threat for most of Interfor's customer base. The substantial capital outlay and specialized knowledge needed to run a sawmill effectively create significant barriers to entry.

- Limited Feasibility: While large construction companies could potentially invest in sawmills, the operational complexity and upfront costs are substantial deterrents.

- Capital Investment: Establishing a modern sawmill requires hundreds of millions of dollars in investment, making it impractical for many potential integrators.

- Expertise Required: Running a sawmill involves specialized knowledge in timber sourcing, milling processes, and quality control, which most end-users lack.

- Focus on Core Business: Most customers, like home builders or furniture manufacturers, prefer to focus on their core competencies rather than venturing into lumber production.

Availability of Alternative Lumber Suppliers

The availability of alternative lumber suppliers significantly impacts customer bargaining power. When numerous other lumber producers exist with comparable capacity, customers can readily switch, forcing Interfor to offer more competitive pricing and terms. This is a key factor in the North American lumber market, which features several large, established players.

Interfor faces competition from major North American lumber producers like Canfor, West Fraser, and Resolute Forest Products. These companies, along with many smaller regional suppliers, provide customers with a wide array of choices. For instance, in 2024, the North American softwood lumber market remained robust, with production volumes from these key players creating a competitive landscape where customers have considerable leverage.

- High Number of Competitors: The presence of multiple large and small lumber producers means customers are not reliant on a single source.

- Capacity of Alternatives: The substantial production capacity of competing firms ensures that customers can find sufficient supply elsewhere if Interfor's terms are unfavorable.

- Customer Leverage: This abundance of choice empowers customers to negotiate better prices, payment terms, and delivery schedules.

- Market Dynamics: In 2024, the ongoing demand for lumber in construction and renovation, coupled with the output from various suppliers, maintained this competitive pressure on Interfor.

Interfor's customers, particularly large buyers in the U.S. market which accounts for 84% of its lumber sales, possess significant bargaining power. This power stems from their ability to purchase in high volumes, negotiate favorable terms, and readily switch suppliers due to the commoditized nature of lumber products. The transparency in pricing and the presence of numerous competitors further amplify this leverage, making it challenging for Interfor to dictate terms.

| Factor | Impact on Interfor's Bargaining Power | 2024 Market Context |

|---|---|---|

| Customer Concentration | High (U.S. market 84% of sales) | Large home builders and retailers can exert significant pressure. |

| Product Standardization | High | Lumber is largely a commodity, making price the primary differentiator. |

| Availability of Alternatives | High | Competition from Canfor, West Fraser, etc., provides customers with many choices. |

| Threat of Backward Integration | Low | High capital and expertise requirements deter most customers. |

Preview the Actual Deliverable

Interfor Porter's Five Forces Analysis

This preview showcases the complete Interfor Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The North American lumber industry is characterized by a concentrated competitive landscape, with Interfor vying for position among the top three softwood lumber producers. Major players like West Fraser, Canfor, and Weyerhaeuser command significant market share and operational scale, creating intense rivalry.

As of early 2024, Interfor operates 21 sawmills across Canada and the United States, with a significant portion of its production capacity located in the U.S. South. This places it in direct competition with larger entities that also have substantial footprints in these key lumber-producing regions, highlighting the concentrated nature of the market.

The North American lumber industry experienced slow consumption growth in 2024. This sluggish demand, combined with ongoing production curtailments by major players, creates an environment ripe for intensified competitive rivalry. As capacity utilization tightens due to these cutbacks, companies may be more aggressive in vying for market share.

Interfor faces significant competitive rivalry, particularly as a large portion of its lumber products, like basic dimensional lumber, are considered commodities. This means differentiation is often challenging, pushing competition towards price. For instance, in 2023, Interfor's revenue was approximately CAD 3.1 billion, reflecting the scale of operations in a market where price is a key driver.

While Interfor does offer specialty wood products, the overall market for many lumber types is characterized by low switching costs for customers. Buyers can readily shift to alternative suppliers if pricing or availability is more favorable, intensifying the pressure on Interfor to maintain competitive pricing and efficient operations.

High Fixed Costs and Exit Barriers

Interfor, like many in the lumber industry, faces intense competitive rivalry partly due to high fixed costs associated with its sawmills. These substantial capital investments necessitate high operating rates to spread costs, pushing companies to produce even when market demand is low. This dynamic fuels aggressive competition as firms strive to cover their fixed expenses.

Exit barriers are also a significant factor. The specialized nature of sawmill equipment and the need for skilled labor make it difficult and costly for companies to leave the industry. This immobility means that even underperforming firms tend to remain, adding to the competitive pressure. For instance, in 2024, the industry saw production curtailments as companies adjusted to market conditions, a direct consequence of these high fixed costs and exit barriers.

- High Capital Investment: Sawmill operations require significant upfront investment in machinery and infrastructure, creating a substantial barrier to entry and a commitment for existing players.

- Difficulty Exiting: Specialized assets and labor requirements make it challenging and expensive for companies to divest or cease operations in the lumber industry.

- Production Curtailments: The industry experienced production adjustments in 2024, highlighting how high fixed costs compel firms to manage output rather than exit during weaker market periods.

- Intensified Rivalry: The combination of high fixed costs and exit barriers forces companies to compete fiercely for market share to maintain profitability and operational efficiency.

Strategic Stakes and Geographic Overlap

Interfor's strategic stakes are high, as market leadership in key timber-producing regions directly impacts its profitability and growth. The company's presence across the US South, Eastern Canada, British Columbia Interior, and the US Northwest creates significant geographic overlap with major competitors like West Fraser Timber Co. Ltd. and Canfor Corporation.

This overlap intensifies rivalry, particularly in areas where multiple large producers vie for timber supply and market share. For instance, in the US South, Interfor competes fiercely with companies that have established long-term relationships with landowners and a strong regional presence.

- Geographic Overlap: Interfor's operations in the US South, Eastern Canada, BC Interior, and US Northwest directly pit it against competitors with similar regional footprints.

- Market Leadership Importance: Dominance in these key timber-producing areas is crucial for securing timber resources and achieving favorable pricing.

- Intensified Rivalry: The shared operational territories mean direct competition for raw materials and end-user markets, driving up costs and pressure on margins.

Interfor operates in a highly competitive North American lumber market, facing intense rivalry from major players like West Fraser and Canfor. This rivalry is amplified by the commodity nature of many lumber products, leading to price-based competition and low customer switching costs.

The industry's high fixed costs and significant exit barriers compel companies to maintain production even during downturns, further intensifying competition for market share. For example, Interfor's 2023 revenue of approximately CAD 3.1 billion underscores the scale of operations where efficiency and pricing are paramount.

Geographic overlap in key timber-producing regions like the US South and Eastern Canada means direct competition for timber supply and end markets, putting pressure on margins and operational strategies.

The North American lumber market in 2024 saw slow consumption growth, with companies implementing production curtailments. This environment necessitates aggressive strategies to secure market share and manage costs effectively.

| Competitor | Approximate 2023 Revenue (CAD billions) | Key Operational Regions |

|---|---|---|

| Interfor | 3.1 | Canada, USA |

| West Fraser | 10.5 | Canada, USA |

| Canfor | 6.1 | Canada, USA |

SSubstitutes Threaten

The threat of substitutes for Interfor's lumber products is significant, primarily driven by the availability and price-performance of alternative materials like steel, concrete, and engineered wood. These materials can often serve similar structural and aesthetic purposes in construction. For example, in 2024, the price of structural steel framing remained a key consideration for builders, with fluctuations impacting its competitiveness against lumber.

Customers weigh the cost-effectiveness and performance of these substitutes. Engineered wood products such as cross-laminated timber (CLT) and glulam are increasingly viable alternatives, offering comparable strength and sustainability benefits. Reclaimed lumber also presents an option, particularly for projects prioritizing recycled content and unique aesthetics, further diversifying the competitive landscape.

Interfor's customers, especially in the construction and furniture sectors, face a growing array of substitute materials that could sway their purchasing decisions. Factors like evolving building codes, shifts in design aesthetics, and a heightened awareness of environmental impact are key drivers. For instance, the increasing demand for sustainable building solutions means that materials like engineered wood products, recycled plastics, or even advanced composites could become more appealing alternatives to traditional lumber.

The threat of substitutes for lumber is significantly influenced by the regulatory environment and evolving building codes. For instance, stricter fire safety regulations in many jurisdictions in 2024 might favor non-combustible materials like steel or concrete over traditional wood framing in certain applications, thereby increasing the threat of substitution.

Furthermore, escalating energy efficiency mandates, such as those being implemented across North America and Europe by 2025, could either boost or hinder lumber's position. While engineered wood products offer excellent insulation properties, stringent performance requirements might push developers towards alternative materials that are perceived to meet these benchmarks more reliably or cost-effectively.

Changes in building codes that promote or require the use of recycled content or low-embodied carbon materials also present a dynamic for substitutes. While the forestry industry is increasingly focusing on sustainable practices, the perceived or actual environmental advantages of certain manufactured substitutes could sway construction choices, impacting lumber demand.

Technological Advancements in Substitute Materials

Technological advancements are continuously improving substitute materials, making them more competitive against traditional lumber. Innovations in engineered plastics and advanced concrete formulations are enhancing their cost-effectiveness and durability. For instance, by 2024, the global market for engineered wood products, which are themselves an advancement on traditional lumber, was projected to reach over $130 billion, demonstrating the growing appeal of material innovation within the broader wood products sector.

These developments directly impact the threat of substitutes for companies like Interfor. As these alternative materials become more accessible and perform better, they present a stronger challenge to wood-based products across various applications, from construction to furniture manufacturing. This dynamic necessitates ongoing evaluation of material science trends and their potential to disrupt established markets.

- Growing Material Innovation: Engineered plastics and advanced concrete formulations are seeing significant R&D investment, leading to improved performance characteristics.

- Cost-Effectiveness Improvements: Manufacturers are finding ways to produce these substitutes at lower costs, closing the price gap with lumber.

- Enhanced Durability and Functionality: New materials offer superior resistance to moisture, pests, and fire, appealing to construction and manufacturing sectors.

- Market Penetration: As performance and cost align, these substitutes are gaining traction in markets traditionally dominated by wood products.

Perceived Value and Sustainability of Substitutes vs. Lumber

The perceived value and sustainability of substitutes significantly influence the threat they pose to lumber. While Interfor highlights its commitment to sustainable forestry practices, which are increasingly important to consumers and businesses, competing materials like steel, concrete, and engineered wood products often tout their own environmental credentials or offer distinct aesthetic qualities. For example, the construction industry's growing focus on embodied carbon means that materials with lower carbon footprints, whether real or perceived, can gain an advantage. In 2024, the demand for green building materials continued to rise, with consumers and developers actively seeking options that align with environmental goals.

Customers assess substitutes based on a range of factors beyond just environmental impact. Aesthetic appeal is a key differentiator; some designers and homeowners prefer the natural look and feel of wood, while others might opt for the sleekness of steel or the uniformity of concrete. Long-term value is also a consideration, encompassing durability, maintenance requirements, and resistance to elements like fire and pests. These perceptions directly shape purchasing decisions and can shift market share away from traditional lumber if substitutes are seen as offering superior or more desirable attributes.

The long-term value proposition of lumber is often tied to its renewability and its established role in construction, but substitutes are actively challenging this. For instance, engineered wood products, while still wood-based, offer enhanced performance characteristics like dimensional stability and strength-to-weight ratios that can be perceived as superior for certain applications. This creates a dynamic where Interfor must not only compete on price and traditional quality but also on the evolving perceptions of value and sustainability across its entire product portfolio and its competitors.

- Environmental Impact: Consumers increasingly favor materials with lower embodied carbon and verifiable sustainability claims.

- Aesthetic Appeal: The visual characteristics of substitutes, such as the modern look of steel or the clean lines of concrete, can attract specific market segments.

- Long-Term Value: Durability, maintenance needs, and resistance to damage are critical factors in how customers perceive the overall worth of lumber versus alternatives.

- Market Trends: The growing demand for green building materials in 2024 highlights the importance of perceived sustainability in competitive positioning.

The threat of substitutes for Interfor's lumber products is substantial, driven by the increasing viability and competitive pricing of materials like steel, concrete, and engineered wood in construction and furniture. These alternatives often offer comparable structural integrity and aesthetic qualities, directly challenging lumber's market share.

In 2024, the cost-competitiveness of steel framing remained a critical factor for builders, with price fluctuations influencing its appeal against lumber. Engineered wood products, such as cross-laminated timber (CLT), are also gaining traction due to their strength and sustainability, further diversifying the substitute landscape.

| Substitute Material | Key Advantages | 2024 Market Considerations |

|---|---|---|

| Steel Framing | High strength-to-weight ratio, non-combustible | Price volatility, potential for higher initial cost |

| Concrete | Durability, fire resistance, thermal mass | Higher embodied energy, slower construction times |

| Engineered Wood (e.g., CLT) | Strength, dimensional stability, sustainability potential | Growing availability, increasing acceptance in building codes |

| Recycled Plastics | Moisture resistance, low maintenance | Aesthetics, structural limitations in some applications |

Entrants Threaten

The threat of new entrants into the lumber industry, particularly for Interfor, is significantly mitigated by the substantial capital investment required to establish a modern sawmill. This includes considerable outlays for land, advanced machinery, and essential infrastructure, creating a high barrier to entry.

For instance, building a new, large-scale sawmill in North America can easily cost hundreds of millions of dollars. This massive upfront financial commitment naturally deters many potential new competitors from entering the market, as they may lack the necessary funding or access to capital.

Consequently, new capacity additions in the North American lumber market, including those relevant to Interfor's operations, are predominantly driven by existing, established firms that can leverage their financial strength and existing infrastructure to expand. This trend reinforces the protective effect of high capital requirements.

Newcomers face significant hurdles in securing consistent and affordable timber, the primary raw material for Interfor. Established companies often possess long-term supply contracts or own timberlands, giving them a distinct advantage. For instance, in 2024, regions like the Pacific Northwest continued to experience fiber supply constraints, making it even more challenging for new entrants to establish reliable sourcing channels.

The timber industry, including companies like Interfor, faces significant regulatory hurdles. Obtaining environmental permits for logging operations can be a complex and lengthy process, often requiring extensive studies and public consultations. For instance, in 2024, the average time to secure a new environmental permit for industrial projects in many jurisdictions remained substantial, acting as a barrier to entry.

Compliance with forestry regulations, sustainable harvesting practices, and land reclamation requirements also adds to the cost and complexity for new entrants. These stringent rules, while promoting responsible resource management, can deter smaller or less capitalized companies from entering the market. Despite these challenges, government initiatives in 2024 continued to support the timber industry through various programs, aiming to stimulate growth and innovation, which could potentially ease some entry barriers over time.

Economies of Scale and Cost Advantages of Incumbents

Interfor, as a significant player in the lumber industry, benefits from substantial economies of scale. Its large production volumes allow for significant cost efficiencies across its operations, from raw material sourcing to finished product distribution. This established scale provides a formidable barrier to entry for potential new competitors.

New entrants would find it challenging to replicate Interfor's cost advantages, which are built upon years of optimized supply chains and considerable purchasing power. The lumber market has also experienced capacity reductions from existing players, further intensifying the difficulty for newcomers to achieve comparable cost structures from the outset.

- Economies of Scale: Interfor's extensive production capacity, reaching approximately 3.1 billion board feet annually as of early 2024, allows for lower per-unit production costs compared to smaller operations.

- Supply Chain Optimization: Decades of experience have enabled Interfor to build highly efficient and cost-effective supply chains, securing favorable terms for raw materials and logistics.

- Purchasing Power: As a major buyer of timber and other inputs, Interfor wields significant purchasing power, negotiating better prices than smaller, less established firms.

Established Distribution Channels and Brand Loyalty

Established distribution channels present a significant hurdle for new entrants in the forest products industry. Companies like Interfor have cultivated long-standing relationships with retailers, sawmills, and industrial buyers, making it challenging for newcomers to secure shelf space or consistent orders.

Brand loyalty further solidifies this barrier. Customers often prefer to stick with suppliers they trust, especially for critical materials like lumber and wood products. This loyalty, built over years of reliable service and quality, means new entrants must offer a compelling reason for customers to switch, which is difficult when established players already have strong market penetration.

- Distribution Network Strength: Interfor's extensive network of distribution centers and direct sales channels across North America and Asia provides a significant advantage, limiting access for new competitors.

- Customer Relationships: Decades of supplying to major construction firms and manufacturers have fostered deep loyalty, making it difficult for new entrants to displace existing suppliers.

- Brand Recognition: Interfor's established brand name in the market signifies quality and reliability, a perception that new entrants must work hard to replicate.

The threat of new entrants into the lumber market, impacting companies like Interfor, is generally low due to significant barriers. These include the massive capital required for new sawmills, estimated in the hundreds of millions of dollars, as well as the difficulty in securing consistent timber supply, often requiring long-term contracts or owned timberlands.

Regulatory compliance and the need for established distribution channels and brand recognition further deter newcomers. While government initiatives in 2024 aimed to support the timber industry, the inherent complexities and costs remain substantial deterrents.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building a modern sawmill costs hundreds of millions of dollars. | High; deters many potential competitors. |

| Timber Supply Access | Securing consistent, affordable fiber is challenging without long-term contracts or owned land. | Significant; new entrants struggle to establish reliable sourcing. |

| Regulatory Hurdles | Complex environmental permits and compliance with forestry regulations add cost and time. | Substantial; lengthy processes and stringent rules increase entry difficulty. |

| Economies of Scale | Established players like Interfor benefit from lower per-unit costs due to large production volumes. | Formidable; difficult for new entrants to match cost efficiencies. |

| Distribution & Brand Loyalty | Existing relationships and customer trust are hard for newcomers to overcome. | Challenging; requires significant effort to gain market penetration. |

Porter's Five Forces Analysis Data Sources

Our Interfor Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Interfor's annual reports, investor presentations, and SEC filings, alongside industry-specific market research reports and publications from reputable sources like IBISWorld and Statista.