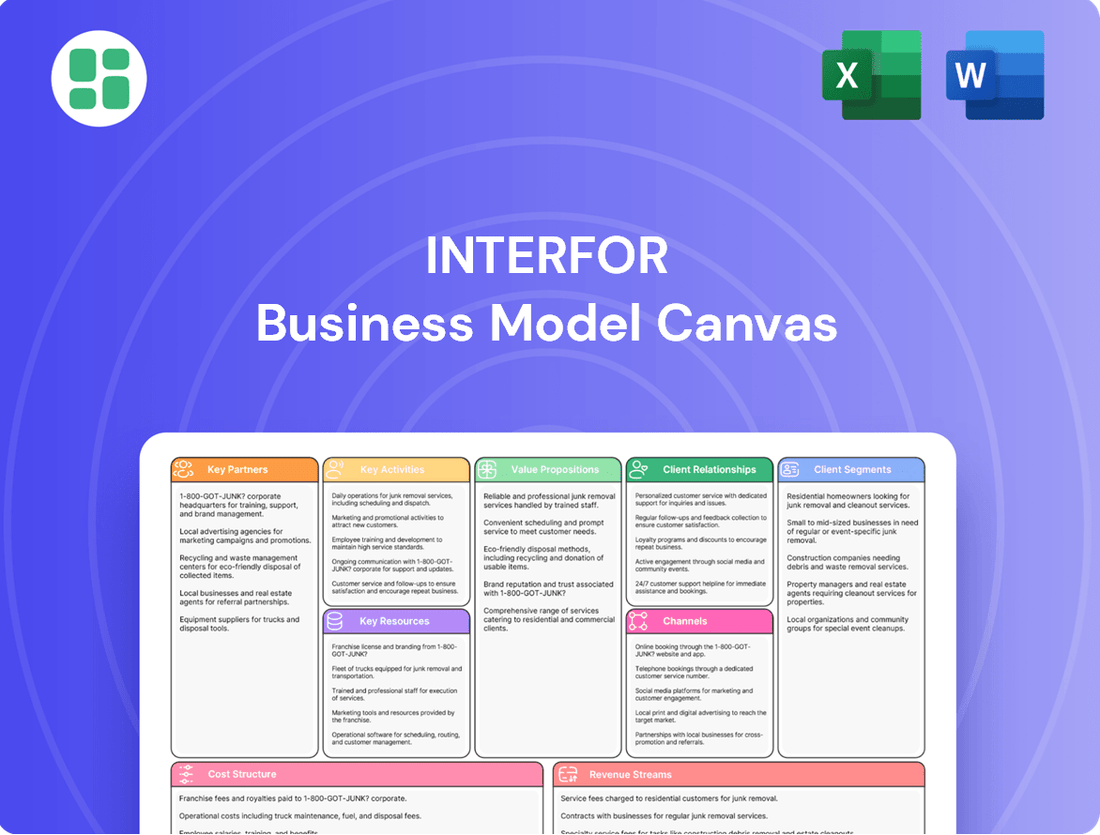

Interfor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interfor Bundle

Unlock the core strategies that drive Interfor's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their competitive edge.

Ready to dive deeper? Download the full Interfor Business Model Canvas and gain a complete, actionable blueprint of their operations, perfect for strategic analysis or business inspiration.

Partnerships

Interfor secures a steady flow of logs, its core input, by collaborating with a diverse group of timberland owners and forestry firms. These relationships are vital for efficient operations and controlling timber expenses, especially when facing localized supply limitations and market fluctuations.

In 2024, Interfor's strategic timberland partnerships are fundamental to its integrated business model. The company's extensive sawmill network across North America depends on a balanced mix of company-owned timber assets and fiber acquired through these crucial external supply agreements.

Interfor's success hinges on strong partnerships with logistics and transportation providers, including rail, trucking, and ocean freight carriers. These collaborations are critical for moving raw logs to sawmills and delivering finished lumber products to a wide customer base across North America and international markets.

Efficiently managing these transportation networks is key to controlling significant costs, which in 2023 represented a substantial portion of Interfor's operational expenses. By utilizing a mix of transport modes, Interfor optimizes its supply chain, ensuring timely deliveries and expanding its market reach, which is crucial for maintaining competitive pricing and customer satisfaction.

Interfor relies on key partnerships with specialized equipment and technology vendors to equip its sawmills. These relationships are crucial for sourcing advanced machinery, sophisticated software, and integrated systems that power their complex production lines.

These collaborations ensure Interfor gains access to state-of-the-art technology, driving improvements in operational efficiency and product quality. For instance, in 2024, Interfor continued its strategic investments in mill modernization, which directly benefits from these vendor relationships to integrate new capabilities.

The ongoing investment in modern infrastructure, facilitated by these vendor partnerships, is fundamental for Interfor to maintain and enhance its competitive edge in the lumber market.

Industry Associations and Regulatory Bodies

Interfor actively engages with industry associations like the Forest Products Association of Canada (FPAC) and the American Wood Council (AWC). These collaborations are vital for staying informed on evolving best practices in sustainable forestry and for advocating on behalf of the sector. For example, in 2024, FPAC continued its focus on advocating for policies that support Canada's forest sector's competitiveness and sustainability initiatives.

Partnerships with regulatory bodies are fundamental to Interfor's operations, ensuring adherence to environmental regulations and trade agreements. This includes working with agencies such as Environment and Climate Change Canada and the U.S. Environmental Protection Agency (EPA). In 2024, regulatory landscapes continued to emphasize sustainability and emissions reporting, requiring robust compliance from companies like Interfor.

- Industry Association Engagement: Collaborations with groups like FPAC and AWC facilitate knowledge sharing on best practices in sustainable forestry and wood product innovation.

- Regulatory Compliance: Partnerships with bodies such as Environment and Climate Change Canada and the EPA are crucial for meeting environmental standards and trade regulations across operating regions.

- Advocacy and Policy Influence: These relationships allow Interfor to contribute to policy discussions that impact the forest products industry, promoting a favorable operating environment.

- Sustainability Standards: Working with associations and regulators helps Interfor maintain and improve its commitment to environmentally responsible forestry and production.

Research and Development Institutions

Interfor collaborates with research and development institutions to drive innovation in wood products and sustainable forestry. These alliances are crucial for developing advanced manufacturing processes and exploring new product applications, ensuring Interfor remains at the forefront of the industry. For instance, in 2024, the company continued its focus on enhancing wood product performance through advanced material science, a field often advanced by university research.

These partnerships directly contribute to Interfor's value proposition by fostering the creation of higher-value wood products and improving the efficiency of their operations. By engaging with academic experts, Interfor can also proactively address significant long-term challenges, such as climate change adaptation and ensuring the sustainable availability of timber resources. This commitment to continuous improvement is a cornerstone of their business strategy.

Key benefits of these R&D collaborations include:

- Development of innovative wood-based materials and solutions.

- Enhancement of sustainable forest management practices.

- Optimization of manufacturing processes for greater efficiency.

- Addressing industry challenges through scientific research.

Interfor's key partnerships are foundational to its operational success and market position. These include vital collaborations with timberland owners and forestry firms for a consistent log supply, as well as relationships with logistics providers to ensure efficient product distribution. Furthermore, strategic alliances with technology vendors are critical for maintaining advanced sawmill operations and driving innovation in wood product development.

In 2024, Interfor's commitment to these partnerships underscores its integrated approach to the forest products industry. The company's reliance on a diverse supply chain, from raw materials to finished goods delivery, highlights the critical nature of these external relationships. For example, Interfor's 2023 annual report indicated that transportation costs represented a significant portion of their operating expenses, emphasizing the importance of optimizing these logistics partnerships.

These collaborations extend to industry associations like the Forest Products Association of Canada (FPAC) and research institutions, fostering best practices and technological advancements. By engaging with regulatory bodies, Interfor ensures compliance and navigates complex environmental and trade landscapes, a key aspect of its 2024 operational strategy.

| Partnership Type | Key Collaborators | 2024 Strategic Importance | Impact on Operations |

|---|---|---|---|

| Timber Supply | Timberland Owners, Forestry Firms | Ensuring consistent, cost-effective log sourcing. | Supports stable sawmill operations, mitigates supply chain volatility. |

| Logistics & Transportation | Rail, Trucking, Ocean Freight Carriers | Efficient movement of raw materials and finished products. | Controls significant operational costs, expands market reach. |

| Technology & Equipment | Specialized Vendors | Access to advanced machinery and software. | Drives operational efficiency, product quality, and mill modernization investments. |

| Industry & Research | FPAC, AWC, Universities | Knowledge sharing, innovation, advocacy. | Promotes sustainable practices, develops new wood products, influences policy. |

What is included in the product

A comprehensive, pre-written business model tailored to Interfor's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Interfor, organized into 9 classic BMC blocks with full narrative and insights.

The Interfor Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of the company's strategy, enabling quick identification of core components and facilitating efficient team alignment.

Activities

Interfor's core operations revolve around the active management and procurement of timber from sustainably managed forests. This involves adhering to stringent certifications and employing responsible harvesting practices to guarantee a continuous and ethical supply of raw materials.

This commitment to sustainability is not just an ethical stance but a crucial business strategy. It ensures minimal environmental impact, actively supports biodiversity, and serves as a significant value driver for the company. For instance, in 2023, Interfor reported that 99% of its timber sourced in Canada was from certified sustainable forests, underscoring their dedication to responsible fiber procurement.

Interfor's core activity revolves around operating a robust network of sawmills strategically located across North America. These facilities are the engine for transforming raw logs into a wide array of high-quality lumber products, essential for construction and manufacturing sectors.

The process involves precise cutting, meticulous drying to ensure stability, expert grading to meet industry standards, and finishing touches that prepare lumber for diverse applications. This comprehensive approach ensures the quality and usability of their output.

In 2024, Interfor's operational efficiency and investment in advanced manufacturing technologies are paramount. These factors directly influence their production volume and their ability to maintain cost control in a competitive market, ensuring they can meet demand effectively.

Interfor actively markets and sells its broad portfolio of wood products, including lumber, to a global customer base. This involves understanding market needs, optimizing distribution channels, and setting competitive prices, all while highlighting the company's commitment to quality and sustainability.

In 2024, Interfor's strategic sales and marketing efforts are crucial for driving revenue and expanding its market presence. The company focuses on promoting the specific benefits of its high-quality, sustainably sourced lumber to various industries, from construction to manufacturing.

Logistics and Supply Chain Optimization

Interfor's logistics and supply chain optimization is central to its operations, focusing on the efficient movement of lumber. This includes managing the inbound flow of raw timber to its sawmills and the outbound distribution of finished wood products to a diverse customer base.

Key activities involve meticulous coordination with trucking, rail, and marine transportation partners to ensure reliable and cost-effective delivery. In 2024, Interfor continued to refine its logistics network, aiming to reduce transit times and freight expenses, which are critical for maintaining competitive pricing and customer loyalty in the global lumber market. Supply chain resilience and efficiency directly impact Interfor's ability to meet market demand and manage inventory effectively.

- Transportation Coordination: Managing relationships and contracts with various carriers to secure capacity and favorable rates for moving logs and finished lumber.

- Route Optimization: Utilizing advanced planning tools to determine the most efficient and cost-effective transportation routes, minimizing fuel consumption and delivery times.

- Inventory Management: Ensuring optimal stock levels at mills and distribution points to meet customer orders promptly while avoiding excess carrying costs.

- Supply Chain Visibility: Implementing technologies to track shipments in real-time, providing transparency and enabling proactive management of potential disruptions.

Capital Management and Strategic Investments

Interfor meticulously manages its financial capital, encompassing debt, liquidity, and capital expenditures, to fuel operations, strategic expansion, and deliver shareholder value. This financial stewardship involves careful allocation to both essential maintenance and growth-oriented capital projects.

The company actively assesses opportunities for acquisitions and divestitures, aiming to refine its asset base for optimal performance. For instance, in response to evolving market dynamics, Interfor undertook asset sales and production adjustments during 2024.

- Financial Capital Oversight: Interfor prioritizes robust management of its debt, liquidity, and capital expenditures to sustain operations and pursue growth.

- Strategic Capital Allocation: The company directs capital towards critical maintenance and strategic discretionary projects to enhance its operational capabilities and market position.

- Portfolio Optimization: Through the evaluation of potential acquisitions and divestitures, Interfor seeks to continually improve its asset portfolio.

- Market Responsiveness: In 2024, Interfor demonstrated adaptability by executing asset sales and production curtailments in reaction to prevailing market conditions.

Interfor's key activities include the strategic sourcing of timber from certified forests, the efficient operation of sawmills to produce high-quality lumber, and the robust marketing and sales of its diverse product portfolio globally. These are supported by meticulous logistics and supply chain management, ensuring timely and cost-effective delivery, alongside prudent financial capital oversight and strategic portfolio optimization, including market-responsive asset adjustments.

In 2024, Interfor continued to emphasize operational excellence and market responsiveness. For example, the company reported strong performance in its lumber segment, with production volumes reflecting ongoing investments in efficiency. Their commitment to sustainability, with a significant portion of timber sourced from certified forests, remained a cornerstone of their strategy, influencing both operations and market perception.

| Key Activity | Description | 2024 Relevance/Fact |

|---|---|---|

| Timber Sourcing & Forest Management | Procuring timber from sustainably managed, certified forests. | In 2023, 99% of Canadian timber was certified sustainable. This focus continues to be critical for supply chain integrity and market access in 2024. |

| Sawmill Operations | Transforming logs into lumber through cutting, drying, grading, and finishing. | Interfor's investment in advanced manufacturing in 2024 directly impacts production efficiency and cost competitiveness. |

| Sales & Marketing | Selling lumber products globally, focusing on quality and sustainability. | Strategic marketing efforts in 2024 aim to leverage the company's high-quality, sustainable lumber for revenue growth and market expansion. |

| Logistics & Supply Chain | Efficiently moving timber to mills and finished products to customers. | In 2024, Interfor refined its logistics network to reduce transit times and freight costs, enhancing competitiveness. |

| Financial & Portfolio Management | Managing capital, debt, and strategically optimizing the asset base. | Interfor executed asset sales and production adjustments in 2024 to adapt to market conditions and improve portfolio performance. |

Delivered as Displayed

Business Model Canvas

The Interfor Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive business model, ready for immediate use and customization.

Resources

Interfor's core physical resource is its access to timberlands, secured through ownership and supply agreements, forming the bedrock of its lumber production. This fiber supply chain is critical for sustainability and meeting environmental goals.

The company manages substantial volumes of allowable annual cut, a key metric for resource availability. For instance, in 2023, Interfor's timberland holdings and tenures supported a significant, consistent fiber supply essential for its operations.

Interfor's sawmills and manufacturing facilities are the backbone of its operations, forming a critical part of its key resources. The company boasts a significant network of modern sawmills strategically positioned throughout North America, ensuring efficient lumber processing and access to vital timber resources and consumer markets.

These facilities are equipped with advanced technology, enabling high levels of production efficiency and supporting Interfor's diverse product offerings. As of the first quarter of 2024, Interfor operated 17 sawmills across Canada and the United States, highlighting its substantial operational scale and capacity.

Interfor's skilled workforce and management expertise form a cornerstone of its business model, encompassing a seasoned leadership team, proficient sawmill operators, dedicated foresters, and adept sales professionals. This human capital is instrumental in driving the company's operational excellence and fostering innovation across its value chain.

The collective expertise of Interfor's employees in sustainable forestry practices, advanced manufacturing techniques, and strategic market engagement directly translates into competitive advantages. For instance, in 2023, Interfor reported capital expenditures of $313 million, a significant portion of which supports technology upgrades aimed at enhancing operational efficiency and leveraging the skills of its workforce.

Prioritizing employee development and maintaining a strong safety culture are critical elements for Interfor in retaining its valuable talent. This focus on human capital is essential for navigating the complexities of the timber industry and ensuring long-term success.

Financial Capital and Liquidity

Interfor's robust financial capital and liquidity are foundational to its business model. This strength allows for consistent funding of operations, significant capital expenditures, and the pursuit of strategic growth opportunities, ensuring the company can adapt to market shifts. In 2023, Interfor reported a strong balance sheet, with cash and cash equivalents totaling $413 million, underscoring its healthy liquidity position.

The company’s manageable debt levels and established access to capital markets are key resources. This financial flexibility is critical for Interfor to undertake large-scale projects and weather economic downturns. Interfor maintained compliance with all its financial covenants throughout 2023, demonstrating sound financial management.

- Financial Strength: Interfor's access to capital and liquidity enables it to fund ongoing operations, capital investments, and strategic growth initiatives.

- Liquidity Position: As of December 31, 2023, Interfor held $413 million in cash and cash equivalents, providing significant operational flexibility.

- Debt Management: The company’s strategy focuses on maintaining manageable debt levels, supported by consistent compliance with financial covenants.

- Market Navigation: This financial stability empowers Interfor to effectively navigate market fluctuations and invest strategically for future expansion.

Proprietary Processes and Operational Know-How

Interfor's proprietary processes and operational know-how are central to its business model, enabling efficient and high-quality lumber production. This intellectual capital includes optimized manufacturing techniques, stringent quality control measures, and sophisticated supply chain management. For instance, in 2024, Interfor continued to invest in technology to enhance its operational efficiency, aiming to reduce waste and improve product consistency across its diverse lumber offerings.

This deep understanding of operations allows Interfor to maintain a competitive edge by producing a wide array of lumber products cost-effectively. Their commitment to continuous improvement is evident in their ongoing efforts to integrate new technologies and refine existing workflows. This focus on operational excellence is a key driver of their ability to meet market demands reliably.

The company's operational know-how translates directly into tangible benefits:

- Optimized Manufacturing: Streamlined production lines and advanced machinery contribute to higher output and lower costs.

- Quality Assurance: Robust quality control systems ensure product integrity and customer satisfaction.

- Supply Chain Efficiency: Effective logistics and inventory management minimize delays and optimize resource allocation.

Interfor's key resources are its substantial timberland base, efficient sawmills, skilled workforce, strong financial position, and proprietary operational expertise. These elements collectively enable the company to produce and deliver high-quality lumber products reliably and cost-effectively. The company's strategic investments in technology and talent further enhance its competitive advantage in the market.

| Key Resource | Description | 2023/2024 Data Point |

| Timberlands | Access to fiber through ownership and agreements. | Significant allowable annual cut supported by holdings. |

| Sawmills | Network of modern, efficient manufacturing facilities. | Operated 17 sawmills as of Q1 2024. |

| Workforce | Skilled employees and experienced management. | Capital expenditures of $313 million in 2023 included technology upgrades leveraging workforce skills. |

| Financial Capital | Strong liquidity and access to capital markets. | $413 million in cash and cash equivalents as of December 31, 2023. |

| Operational Know-how | Proprietary processes for efficient, high-quality production. | Ongoing investment in technology to enhance efficiency and reduce waste in 2024. |

Value Propositions

Interfor offers a wide array of high-quality softwood lumber, from standard dimensional lumber crucial for building structures to specialized items like decking and siding. This extensive product selection, available in various dimensions, species, and grades, is designed to meet the diverse requirements of customers across numerous industries.

By providing this broad product portfolio, Interfor effectively serves multiple segments within the construction and industrial sectors. For instance, in 2024, the demand for residential construction, a key market for dimensional lumber, remained robust, supported by ongoing infrastructure projects and a healthy housing market in North America.

Interfor's commitment to sustainable sourcing means its lumber comes from forests managed with environmental responsibility, a key value for eco-conscious consumers and investors.

This focus on responsible practices, detailed in their sustainability reports, appeals to stakeholders who demand transparency in the supply chain and prioritize green building materials.

In 2023, Interfor reported that 99% of its timber acquisitions were from certified sustainable sources, underscoring their dedication to environmental stewardship.

Interfor's extensive network of sawmills strategically located throughout Canada and the United States underpins its value proposition of reliable supply and North American production scale. This broad operational footprint, encompassing numerous facilities, ensures consistent lumber availability for a diverse customer base.

The company's geographic diversification across North America acts as a crucial risk mitigation strategy. By operating in multiple regions, Interfor can buffer against localized supply disruptions, such as adverse weather or operational issues, and navigate market volatility more effectively. This resilience is a key differentiator in the lumber industry.

In 2024, Interfor's significant production capacity, bolstered by its numerous mills, allows it to meet the demands of various markets, from construction to manufacturing. This scale not only guarantees product availability but also provides customers with the assurance of a dependable partner capable of fulfilling large-volume orders consistently.

Solutions for Diverse End Markets

Interfor's value proposition centers on providing tailored wood products to a broad spectrum of end markets. This includes crucial sectors like residential and commercial construction, where their lumber is a foundational material. They also cater to the repair and remodel segment, offering solutions for ongoing maintenance and upgrades. Furthermore, Interfor serves industrial applications and the furniture manufacturing industry, demonstrating the versatility of their offerings.

This strategic diversification allows Interfor to effectively navigate fluctuating market demands. By serving multiple sectors, the company mitigates risks associated with over-reliance on any single market. They focus on developing specialized solutions that meet the unique requirements of each customer segment, ensuring product relevance and customer satisfaction.

For instance, in 2024, Interfor's commitment to diverse end markets was evident in their operational focus. The company continued to supply high-quality lumber for new home construction, a sector that saw steady demand throughout the year. Simultaneously, their products were integral to numerous renovation projects, reflecting the robust repair and remodel market. This balanced approach underscores their strategy of aligning production capabilities with varied customer needs across the industry.

- Residential Construction: Supplying essential lumber for new home builds.

- Commercial Construction: Providing materials for various commercial building projects.

- Repair and Remodel: Offering solutions for home and building upgrades and maintenance.

- Industrial Applications: Catering to specialized needs within industrial sectors.

- Furniture Manufacturing: Providing wood components for the furniture industry.

Customer-Centric Service and Support

Interfor prioritizes building strong customer relationships through dedicated service, ensuring needs are met with product availability and timely delivery. This commitment to customer satisfaction fosters loyalty and solidifies their image as a reliable partner, especially crucial when navigating market fluctuations.

Meeting customer needs effectively is central to Interfor's strategy, particularly during periods of market change. For instance, in 2023, Interfor reported that its focus on customer service contributed to maintaining strong relationships even as lumber prices experienced volatility.

- Customer Relationship Management: Investing in systems and personnel to track and respond to customer interactions.

- Product Availability and Delivery: Maintaining robust inventory levels and efficient logistics to ensure on-time delivery.

- Responsive Support: Providing accessible and knowledgeable customer support to address inquiries and resolve issues promptly.

- Market Adaptability: Adjusting service models to meet evolving customer demands during economic shifts.

Interfor's value proposition is built on delivering a diverse range of high-quality softwood lumber products, from essential dimensional lumber to specialized items like decking and siding. This extensive selection caters to the varied needs of customers across residential construction, commercial projects, repair and remodel markets, industrial applications, and furniture manufacturing. Their commitment to sustainable sourcing, with 99% of timber acquisitions from certified sustainable sources in 2023, further enhances their appeal to environmentally conscious stakeholders.

The company's strategic network of sawmills across North America ensures reliable supply and significant production scale, providing customers with consistent availability and the assurance of a dependable partner. This geographic diversification also serves as a risk mitigation strategy, allowing Interfor to navigate market volatility and potential localized disruptions effectively. Their focus on customer relationships, supported by product availability and responsive service, fosters loyalty and strengthens their position as a trusted supplier.

| Value Proposition Element | Description | Supporting Fact/Data (2024/2023) |

|---|---|---|

| Product Breadth and Quality | Wide array of softwood lumber, including dimensional, decking, and siding, in various dimensions, species, and grades. | Serves key markets like residential construction, which saw robust demand in 2024. |

| Sustainability Focus | Lumber sourced from responsibly managed forests. | 99% of timber acquisitions were from certified sustainable sources in 2023. |

| Reliable Supply and Scale | Extensive network of strategically located sawmills across North America. | Significant production capacity in 2024 to meet diverse market demands. |

| Customer Centricity | Building strong relationships through dedicated service, product availability, and timely delivery. | Focus on customer service contributed to maintaining strong relationships amidst lumber price volatility in 2023. |

Customer Relationships

Interfor's dedicated sales and account management teams are central to its customer relationships, acting as direct conduits for understanding client needs and delivering tailored solutions. These teams are vital for fostering trust and ensuring consistent, high-quality service, particularly for those making substantial purchases or entering into long-term agreements.

In 2024, Interfor's focus on these dedicated teams likely contributed to its ability to secure and maintain strong relationships with key customers in the construction and manufacturing sectors. This approach ensures that clients receive personalized attention, which is critical for navigating the complexities of lumber procurement and supply chain management.

Interfor prioritizes long-term supply agreements with key customers, fostering stability and predictable demand. These contracts ensure a consistent lumber supply for clients, underpinning their operations. In 2023, Interfor reported that approximately 70% of its lumber sales were secured through such agreements, reflecting strong customer reliance on their supply chain.

Interfor provides robust technical support, guiding customers through product selection and application to ensure optimal performance. This assistance is crucial for complex projects, helping clients utilize Interfor's lumber effectively.

The company also offers customized lumber specifications when feasible, a key differentiator that directly addresses unique project needs. This flexibility builds stronger customer relationships by demonstrating a commitment to tailored solutions.

In 2023, Interfor reported net sales of $3.1 billion, underscoring the scale of their operations and the importance of these customer-centric services in maintaining market share and fostering loyalty. Such support is vital for delivering on promises and solidifying partnerships.

Industry Engagement and Market Communication

Interfor actively participates in industry events and conferences, fostering direct engagement with customers and stakeholders. This approach allows for real-time understanding of market shifts and customer needs, crucial for a company that reported approximately $3.2 billion in revenue for 2023.

Through consistent market communications, Interfor shares its outlook on lumber supply and demand dynamics. This transparency aids customers in their procurement planning, a vital aspect for businesses relying on consistent material flow. For instance, in 2024, Interfor has emphasized its commitment to reliable supply chains amidst fluctuating global economic conditions.

- Industry Events: Interfor's presence at key lumber and building material trade shows reinforces its brand and facilitates direct customer interaction.

- Market Outlooks: Providing clear, data-backed market forecasts helps customers make informed purchasing decisions, enhancing their own operational efficiency.

- Customer Feedback: Engagement at these events serves as a critical channel for gathering feedback, enabling Interfor to adapt its offerings and services.

- Brand Reinforcement: Consistent communication and visible industry participation solidify Interfor's reputation as a dependable and leading supplier in the North American lumber market.

Emphasis on Health and Safety for Shared Success

Interfor's unwavering commitment to health and safety, encompassing both its employees and contractors, directly strengthens customer relationships. By ensuring a secure and reliable operating environment, the company guarantees consistent production, which translates into a dependable supply chain for its clients. This dedication to safety underscores Interfor's overall operational integrity, fostering trust and reinforcing its reputation as a responsible partner.

Safety is indeed a paramount priority for Interfor, integrated into the core of its operations. This focus not only protects its workforce but also assures customers that their orders will be fulfilled without disruption caused by preventable incidents. For instance, in 2023, Interfor reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.70, demonstrating a robust safety culture that minimizes operational risks and enhances customer confidence.

- Safety as a Cornerstone: Interfor prioritizes the well-being of its employees and contractors, fostering a culture where safety is paramount.

- Reliable Production: A strong safety record ensures consistent and uninterrupted operations, leading to dependable product availability for customers.

- Supply Chain Integrity: The company's dedication to safe practices extends to its entire supply chain, assuring customers of responsible sourcing and delivery.

- Operational Excellence: A safe operating environment reflects positively on Interfor's overall operational efficiency and reliability, building customer trust.

Interfor cultivates strong customer relationships through dedicated account management and a focus on long-term supply agreements, ensuring consistent lumber availability for clients. The company's commitment to providing robust technical support and customized specifications further solidifies these partnerships, addressing unique project needs and enhancing client satisfaction.

In 2024, Interfor's emphasis on these customer-centric approaches is crucial for navigating market dynamics and maintaining its position as a reliable supplier. This strategy, underscored by significant sales figures like the $3.1 billion in net sales reported for 2023, highlights the value placed on customer loyalty and dependable service.

Channels

Interfor leverages a dedicated direct sales force to cultivate relationships with substantial clients, such as major construction firms, industrial enterprises, and furniture makers. This approach ensures tailored support and a nuanced grasp of their clientele's specific needs.

This direct engagement is crucial for Interfor, enabling them to effectively serve their varied customer base by providing personalized service and negotiating significant contracts directly. In 2024, Interfor's sales force played a key role in securing large-volume orders, contributing to their robust market presence.

Interfor leverages a robust network of wholesalers and distributors to expand its market reach, especially for smaller orders and in specific regional areas. These partners are essential for efficient inventory management and local delivery, enhancing product accessibility for a wider customer base.

This channel strategy is critical for Interfor's market penetration and overall logistical efficiency. For instance, in 2023, Interfor's sales through its distribution partners contributed significantly to its ability to serve diverse customer needs across North America.

Interfor supplies lumber to major retail chains that cater to the substantial repair and remodel (R&R) market. This allows individual contractors and homeowners to purchase Interfor's products, directly accessing consumer-driven demand for home improvement.

The R&R segment is a crucial channel for Interfor, especially given its significant growth during recent market shifts. For instance, in 2024, the home improvement market continued to show resilience, with spending on renovations and repairs remaining robust, driven by an aging housing stock and a desire for personalized living spaces.

International Export Marketing Groups

Interfor's International Export Marketing Groups are crucial for its global presence, focusing on sales and distribution, particularly in Asian markets. These groups navigate the intricacies of international trade, ensuring smooth shipping and compliance, thereby broadening Interfor's reach beyond North America.

This channel is vital for expanding Interfor's customer base internationally. In 2024, Interfor reported that approximately 25% of its total lumber production is exported globally, highlighting the significant contribution of these export marketing efforts to the company's overall sales volume and market diversification.

- Global Market Access: Facilitates sales and distribution in key international regions, with a strong emphasis on Asia.

- Trade Expertise: Manages complex international trade logistics, including shipping, customs, and regulatory compliance.

- Revenue Diversification: Contributes significantly to Interfor's revenue streams by accessing markets outside of North America.

- Export Volume: Approximately 25% of Interfor's total lumber output is destined for export markets worldwide.

Online Presence and Investor Relations Platforms

Interfor leverages its corporate website and dedicated investor relations platforms as crucial communication channels. These digital spaces are not for direct lumber sales but are vital for disseminating company news, financial reports, and updates on sustainability efforts, fostering transparency and engagement with stakeholders.

In 2024, Interfor continued to emphasize its online presence to keep investors and the public informed. The company's investor relations section typically provides access to quarterly earnings calls, annual reports, and presentations, offering a comprehensive overview of its financial performance and strategic direction.

- Corporate Website: Serves as a central hub for all company information, including news releases, operational updates, and corporate governance details.

- Investor Relations Portal: Offers dedicated resources for investors, such as financial statements, SEC filings, and webcast archives, ensuring easy access to crucial data.

- Sustainability Reporting: Interfor utilizes these platforms to showcase its commitment to environmental, social, and governance (ESG) initiatives, a key factor for many modern investors.

- Stakeholder Engagement: These channels facilitate two-way communication, allowing stakeholders to ask questions and receive timely responses, thereby building trust and accountability.

Interfor utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for large clients, a network of wholesalers and distributors for broader market access, and relationships with major retail chains to tap into the repair and remodel segment.

International export marketing groups are vital for global reach, particularly in Asia, managing complex trade logistics. Additionally, corporate websites and investor relations platforms serve as key communication channels for stakeholders, not direct sales.

| Channel | Target Market | Key Function | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Large construction, industrial, furniture | Tailored support, contract negotiation | Secured large-volume orders |

| Wholesalers & Distributors | Smaller orders, regional markets | Market reach, inventory management | Enhanced product accessibility |

| Retail Chains | Repair & Remodel (R&R) market | Consumer access, home improvement demand | Robust demand in R&R segment |

| International Export | Global markets (esp. Asia) | Global sales, trade logistics | ~25% of total production exported |

| Corporate Website/IR | Investors, public | Information dissemination, transparency | Key for stakeholder engagement |

Customer Segments

Residential construction companies, including home builders and developers, represent a cornerstone customer segment for Interfor. These businesses rely heavily on dimensional lumber for crucial structural elements like framing and flooring in new home builds. This segment's performance is closely tied to broader economic indicators, particularly housing starts and prevailing interest rates.

In 2024, the residential construction segment demonstrated its significance by holding the largest revenue market share for Interfor. This underscores the vital role these companies play in Interfor's overall business strategy and financial performance, reflecting robust demand within the new home construction sector.

Interfor's commercial construction segment caters to builders constructing a range of non-residential projects. This includes everything from light commercial buildings to multi-family housing complexes, showcasing the diverse applications of their lumber products.

These customers, particularly those in the mid-rise and multi-family housing sectors, increasingly favor timber construction due to its sustainability and aesthetic appeal. This trend directly impacts Interfor by driving demand for specific lumber dimensions and consistent quality, essential for these specialized builds.

In 2024, the demand for engineered wood products, often used in commercial construction, continued to grow. For instance, the U.S. Census Bureau reported a steady increase in residential construction starts, with a notable uptick in multi-family units, directly benefiting suppliers like Interfor.

Repair and remodel contractors, along with DIY enthusiasts, represent a crucial customer base for lumber suppliers. This segment is characterized by its consistent demand, often fueled by the aging U.S. housing stock, which requires ongoing maintenance and upgrades. For instance, in 2023, the U.S. housing stock averaged 40 years old, driving significant demand for repair and remodel materials.

This market segment showed remarkable resilience, even when new residential construction faced headwinds. In 2024, the repair and remodeling market is projected to continue its growth trajectory, with spending expected to increase year-over-year, demonstrating the enduring need for lumber in these projects.

Industrial Manufacturers

Interfor's industrial manufacturing customers, like those producing pallets and crates, depend on specific lumber grades and dimensions. These businesses need a reliable flow of high-quality materials to keep their production lines running smoothly. This segment is a crucial outlet for Interfor's broad range of wood products.

For instance, in 2024, the demand for wood pallets remained robust, driven by e-commerce growth and supply chain activity. Interfor's ability to supply consistent, precisely dimensioned lumber directly supports these manufacturers' operational efficiency and product integrity.

- Key Customers: Pallet manufacturers, crate producers, and other wood component fabricators.

- Needs: Specific lumber grades, precise dimensions, and consistent quality for mass production.

- Interfor's Role: Providing a stable supply chain for essential raw materials.

- Market Relevance: This segment is vital for industries reliant on wood packaging and components.

Furniture Manufacturers

Furniture manufacturers represent a key customer segment for Interfor, relying on appearance-grade lumber and specific wood species. These producers often require higher aesthetic quality and precise specifications for their products, driving demand for Interfor's diverse offerings.

Interfor caters to this segment by providing specialty products tailored for furniture applications. For instance, in 2024, Interfor continued to emphasize its value-added products, which are crucial for manufacturers prioritizing visual appeal and consistent quality in their furniture lines.

- High Aesthetic Standards: Furniture makers demand lumber with superior visual characteristics, such as consistent grain patterns and minimal defects.

- Specific Wood Species: This segment often specifies particular wood species like pine, fir, or cedar, depending on the desired look and durability of the final furniture piece.

- Precise Specifications: Manufacturers require lumber cut to exact dimensions and tolerances to ensure efficient production and high-quality assembly.

- Value-Added Products: Interfor's specialty products, often processed beyond basic milling, meet these stringent requirements, enhancing the value proposition for furniture producers.

Interfor serves a diverse range of customers, with residential construction companies forming a significant base. These builders require dimensional lumber for framing and flooring, with their demand closely linked to housing starts and interest rates.

In 2024, residential construction held the largest revenue share for Interfor, highlighting its importance. Commercial construction clients, including multi-family housing developers, also represent a key segment, increasingly favoring timber for its sustainability and look.

The repair and remodel market provides consistent demand, driven by the aging housing stock. Industrial manufacturers, such as pallet producers, rely on Interfor for specific lumber grades and dimensions to maintain their production. Furniture manufacturers seek appearance-grade lumber with precise specifications, a need Interfor addresses with its value-added products.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Residential Construction | Dimensional lumber for framing, flooring | Largest revenue market share |

| Commercial Construction | Timber for light commercial, multi-family housing | Growing demand for sustainable materials |

| Repair & Remodel | Lumber for maintenance and upgrades | Consistent demand due to aging housing stock |

| Industrial Manufacturing | Specific grades/dimensions for pallets, crates | Robust demand driven by e-commerce |

| Furniture Manufacturing | Appearance-grade lumber, precise specifications | Emphasis on value-added products for aesthetic appeal |

Cost Structure

The cost of securing logs and timber is a major part of Interfor's expenses. This cost is shaped by how much timber is available, what's happening in local markets, and the company's commitment to sustainable forestry. For instance, in 2023, Interfor noted that higher log costs in certain areas, like the US South, contributed to operational challenges and even temporary shutdowns of some facilities.

Interfor's manufacturing and operating expenses are a significant part of its cost structure. These costs encompass labor wages for its sawmill operations, the energy needed to power these facilities, and the ongoing maintenance required for its machinery. In 2023, Interfor reported total operating expenses of $2.1 billion, with a substantial portion dedicated to these manufacturing-related costs.

Managing these expenses effectively is key to Interfor's competitiveness. The company actively seeks efficiencies in its mill operations and implements cost controls. For instance, in response to market conditions, Interfor utilized temporary curtailments at certain facilities during 2023, a strategy aimed at managing production levels and associated operating costs.

Transportation and logistics represent a significant expense for Interfor, encompassing the movement of raw logs to sawmills and the delivery of finished lumber products to diverse markets across North America and globally. These costs are directly impacted by fluctuating fuel prices, freight rates, and the ever-present threat of supply chain disruptions.

For instance, in 2024, Interfor's transportation and logistics expenses were a material component of their overall cost structure, with fuel surcharges and trucking rates playing a crucial role. Effective management of these operations, including route optimization and carrier negotiations, is paramount to controlling these expenditures and maintaining profitability.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are a critical component of Interfor's cost structure, encompassing all costs not directly tied to production. This includes significant outlays for sales and marketing efforts to drive demand for their lumber products, as well as the salaries and benefits for corporate leadership, administrative staff, and support functions. Efficient management of these overheads is paramount for maintaining profitability and enhancing operational leverage.

In 2024, Interfor's SG&A expenses reflected the company's commitment to market presence and operational efficiency. These costs are vital for supporting the company's extensive distribution network and its corporate infrastructure. Effectively controlling these expenditures allows Interfor to maintain competitive pricing and improve its bottom line.

- Sales and Marketing: Costs associated with advertising, promotional activities, and sales team commissions.

- Corporate Administration: Expenses for executive salaries, legal, finance, and human resources departments.

- General Overhead: Includes rent for non-production facilities, utilities, and office supplies.

- Research and Development: Investments in improving wood products and manufacturing processes.

Duties and Tariffs on Cross-Border Shipments

Interfor faces considerable expenses from duties and tariffs on its softwood lumber moving from Canada to the United States. These trade-related costs significantly affect the final price of lumber, impacting both pricing strategies and overall profitability for the company.

The financial burden of these duties is substantial, with Interfor having paid hundreds of millions of dollars cumulatively. For example, in 2023, the company reported paying approximately $132 million in U.S. duties on its Canadian lumber exports.

- U.S. Duties Paid (2023): $132 million

- Impact on Landed Cost: Directly increases the cost of Canadian lumber in the U.S. market.

- Profitability Influence: Substantial trade-related expenses can reduce profit margins.

Interfor's cost structure is heavily influenced by raw material acquisition, with log and timber costs being a primary expense. These costs fluctuate based on timber availability, regional market dynamics, and sustainable forestry practices, as seen when higher log costs in the US South impacted operations in 2023.

Manufacturing and operating expenses, including labor, energy, and maintenance for sawmills, represent another significant cost. In 2023, Interfor's total operating expenses reached $2.1 billion, with a considerable portion allocated to these production-related activities. The company actively pursues operational efficiencies and cost controls, such as temporary curtailments in 2023, to manage these expenditures.

Transportation and logistics are crucial cost drivers, covering the movement of logs to mills and finished products to markets. Fuel prices, freight rates, and supply chain stability directly affect these costs, with 2024 seeing transportation expenses as a material component influenced by fuel surcharges and trucking rates.

Sales, General, and Administrative (SG&A) expenses, encompassing marketing, corporate salaries, and administrative functions, are vital for supporting Interfor's market presence and infrastructure. Effective management of these overheads, as observed in 2024's SG&A expenses, is key to competitive pricing and profitability.

Trade-related costs, particularly U.S. duties on Canadian lumber, represent a substantial financial burden. Interfor paid approximately $132 million in U.S. duties in 2023, directly increasing the landed cost of Canadian lumber and impacting profit margins.

| Cost Category | 2023 (Approximate) | Key Drivers | Impact |

| Log and Timber Costs | Significant | Availability, Market Prices, Sustainability | Operational Challenges, Facility Shutdowns |

| Manufacturing & Operating Expenses | $2.1 Billion (Total Operating Expenses) | Labor, Energy, Maintenance | Competitiveness, Profitability |

| Transportation & Logistics | Material Component | Fuel Prices, Freight Rates, Supply Chain | Landed Cost, Profitability |

| SG&A Expenses | Reflected Market Presence & Efficiency (2024) | Marketing, Administration, Support Functions | Competitive Pricing, Bottom Line |

| U.S. Duties on Canadian Lumber | $132 Million (2023) | Trade Policy, Import Tariffs | Increased Landed Cost, Reduced Margins |

Revenue Streams

Interfor's primary revenue source is the sale of dimensional lumber products, crucial for construction projects. These commodity structural lumber sales, predominantly softwood, accounted for about 80% of their total revenue in 2024, highlighting their central role in the company's financial performance.

Interfor's revenue streams include the sale of specialized wood products like exterior decking, siding, and appearance-grade lumber. These higher-value items, including machine stress rated (MSR) lumber and industrial timber, cater to specific market demands and often achieve premium pricing. This strategic focus on specialty products enhances Interfor's overall market resilience and profitability.

Interfor generates revenue from selling by-products like wood chips and sawdust, which are residuals from lumber production. These are typically sold to pulp and paper companies or biomass energy facilities, creating an extra income stream and improving resource efficiency.

Monetization of Forest Tenures and Assets

Interfor strategically monetizes its forest tenures and assets, generating revenue through the sale of non-core holdings. This process, part of ongoing portfolio optimization, allows the company to unlock capital and concentrate on more promising ventures. For instance, in 2023, Interfor completed the sale of its Coastal British Columbia forest tenures and certain Quebec operations, realizing significant cash proceeds.

- Strategic Divestitures: Periodic sales of forest tenures and non-core sawmill assets.

- Cash Generation: Divestitures provide substantial cash proceeds for reinvestment or debt reduction.

- Portfolio Focus: Enables Interfor to concentrate on higher-potential operational areas.

- 2023 Transactions: Included the sale of Coastal B.C. forest tenures and Quebec operations.

International Lumber Sales

Interfor generates revenue through international lumber sales, notably to Asian markets. This diversification strengthens its customer base and lessens dependence on North American market fluctuations. In 2023, approximately 25% of Interfor's total lumber production was exported globally.

These export sales are strategically handled by specialized marketing teams, enhancing the company's international presence. This global reach allows Interfor to capitalize on demand beyond its domestic borders.

- Diversified Customer Base: International sales, especially to Asia, reduce reliance on any single market.

- Global Reach: Dedicated marketing groups manage export sales, expanding Interfor's worldwide footprint.

- Export Volume: Around 25% of Interfor's lumber output is exported annually.

Interfor's revenue streams are primarily built on the sale of lumber products, with dimensional lumber being the largest contributor. The company also generates income from specialty wood products, by-products, strategic asset sales, and international exports.

| Revenue Stream | Description | 2024 Estimated Contribution |

|---|---|---|

| Dimensional Lumber Sales | Core business; sales of construction-grade lumber. | ~80% |

| Specialty Wood Products | Higher-value items like decking, siding, MSR lumber. | ~15% |

| By-products | Sales of wood chips and sawdust to other industries. | ~3% |

| International Sales | Exports to markets like Asia. | ~25% of total production |

| Strategic Divestitures | Sales of non-core assets and forest tenures. | Variable, significant cash proceeds |

Business Model Canvas Data Sources

The Interfor Business Model Canvas is built upon a foundation of comprehensive financial reports, detailed market research, and internal operational data. These sources ensure each component of the canvas is grounded in verified information and strategic insights.