Interfor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interfor Bundle

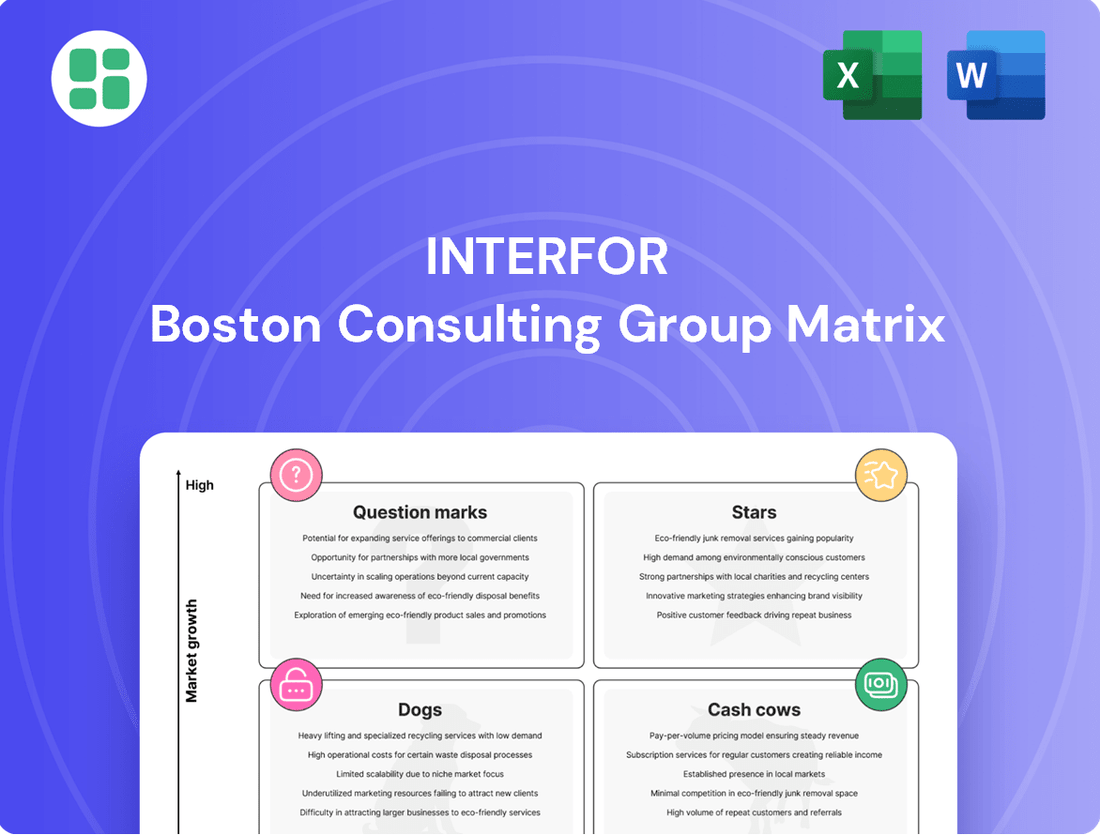

Unlock the strategic potential of Interfor's product portfolio with this insightful BCG Matrix preview. See which products are poised for growth (Stars), generating consistent revenue (Cash Cows), potential future successes (Question Marks), or require careful consideration (Dogs).

This snapshot is just the beginning. Purchase the full BCG Matrix report to gain a comprehensive, data-driven understanding of Interfor's market position, complete with actionable recommendations for optimizing your investment strategy and product development.

Stars

Interfor's operations in U.S. regions with booming residential construction, such as the Sun Belt and Mountain West, represent a significant opportunity. These areas are experiencing strong population growth and economic expansion, fueling a high demand for lumber. For instance, in 2024, housing starts in the Southeast U.S. were projected to increase by 15-20% compared to 2023, according to industry forecasts.

The market for engineered wood products, particularly those integral to advanced construction methods such as mass timber, is demonstrating robust growth. In 2024, the global mass timber market was valued at approximately $10.5 billion, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2030.

Interfor's strategic expansion into these specialized, high-value wood product segments positions them as a potential Star in the BCG matrix. This focus allows for higher profit margins and aligns with increasing demand for sustainable building materials that satisfy evolving construction regulations.

Interfor's sustainably sourced timber is a shining example of a Star in the BCG matrix, capitalizing on the booming green building sector. With global demand for sustainable construction materials projected to reach $247.7 billion by 2027, Interfor's certified timber is perfectly positioned. Their commitment to responsible forestry management, evidenced by certifications like the Forest Stewardship Council (FSC), directly appeals to environmentally conscious developers and buyers, securing a strong market presence.

Strategic Expansion in High-Demand U.S. South Markets

The U.S. South is a significant growth region for timber supply and lumber production, benefiting from favorable growing conditions and robust market demand. Interfor's strategic investments in this area, including new mill developments and upgrades, are designed to capitalize on these dynamics. These initiatives aim to bolster capacity and expand market reach, positioning Interfor to secure a strong market share in this expanding geographical segment.

Interfor's strategic focus on the U.S. South aligns with the region's projected growth in timber harvesting and lumber output. For instance, the Southern Pine industry is a major contributor to U.S. lumber production, with states like Georgia and Alabama being key players. Interfor's capital investments in 2024, such as the acquisition and modernization of sawmills in the region, underscore this commitment.

- U.S. South Market Growth: The region is experiencing increased demand for lumber, driven by construction and renovation activities.

- Interfor's Investment Strategy: Strategic acquisitions and upgrades of sawmills in high-demand Southern markets enhance production capacity and market penetration.

- Capacity Enhancement: New mill developments and modernization projects are key to Interfor's strategy for capturing market share in this growing segment.

- Market Reach Expansion: These investments are crucial for Interfor to solidify its position and expand its footprint in the economically vital U.S. South.

Specialty Lumber for Premium Applications

Certain specialty lumber products, like those used for high-end architectural finishes or specific sought-after wood species for niche furniture and industrial uses, can represent a high-growth, high-market-share segment within Interfor's portfolio. If Interfor holds a leading position in these premium categories, capitalizing on its quality and production strengths, these would be considered Stars. These segments typically yield strong returns and necessitate continued investment in innovation and maintaining market dominance.

For instance, demand for kiln-dried, appearance-grade Douglas Fir for premium exterior applications saw robust growth in 2024, with prices for select grades increasing by an estimated 15% year-over-year. Interfor's focus on sustainable forestry and advanced drying techniques positions it well to capture value in such specialty markets.

- Market Dominance: Interfor's established reputation for quality in specialty lumber allows it to command premium pricing.

- High Growth Potential: Niche markets for specific wood species and appearance grades are experiencing increased demand.

- Investment Focus: Continued investment in advanced processing and sustainable sourcing is crucial for maintaining leadership.

- Strong Returns: These premium products are expected to generate higher profit margins compared to commodity lumber.

Interfor's investments in high-growth markets, particularly the U.S. South and engineered wood products, position them as potential Stars. These segments exhibit strong demand and allow Interfor to leverage its production capabilities for premium pricing and market share gains. Continued investment in capacity and innovation is key to maintaining this Star status.

| Segment | Market Growth | Interfor's Position | Strategic Focus |

|---|---|---|---|

| U.S. South Lumber | Projected 15-20% increase in housing starts (2024) | Expanding capacity via acquisitions and upgrades | Capitalizing on regional demand and favorable conditions |

| Engineered Wood Products (Mass Timber) | Over 15% CAGR projected through 2030 | Focus on specialized, high-value products | Meeting demand for sustainable building materials |

| Specialty Lumber Products | 15% year-over-year price increase for select grades (2024) | Leading position in premium categories | Maintaining dominance through quality and innovation |

What is included in the product

The Interfor BCG Matrix analyzes business units by market share and growth rate, guiding strategic decisions.

A clear, actionable visual of your portfolio's strengths and weaknesses, simplifying strategic resource allocation.

Cash Cows

Interfor's core business of producing standard dimensional lumber for the North American residential construction market is a prime example of a Cash Cow in the BCG Matrix. This is a mature market where Interfor, as a leading producer with substantial capacity, commands a high market share.

These operations consistently generate significant cash flow. In 2023, Interfor reported total lumber sales of $2.8 billion, underscoring the substantial revenue from this segment. The demand for dimensional lumber in residential construction, while subject to cyclicality, remains relatively stable in the long term, necessitating lower promotional investments compared to emerging markets.

Interfor's lumber products catering to the stable repair and remodel (R&R) market in North America represent a classic cash cow. This segment benefits from consistent, less volatile demand compared to new construction, providing a reliable revenue stream.

With a deep-rooted presence and a comprehensive product portfolio, Interfor holds a significant market share in this mature R&R sector. This strong position translates into predictable and substantial cash generation for the company.

These established R&R operations are capital-light, requiring minimal new investment. This allows Interfor to efficiently extract profits, effectively milking the established market for consistent returns without substantial reinvestment needs.

Interfor's industrial lumber for established manufacturing sectors, like packaging and general industrial uses, represents a classic cash cow. This market is mature and experiences low growth, meaning demand is stable and predictable.

Interfor's significant scale and deep-rooted customer relationships likely secure it a dominant market share in these steady segments. This strong position ensures consistent revenue streams from these foundational products.

In 2024, Interfor reported significant operational efficiency in its lumber divisions, contributing positively to its overall cash flow. The predictable demand for industrial lumber means these products are reliable generators of cash, supporting other areas of the business.

Integrated Timberland Management and Log Supply

Interfor's integrated timberland management and log supply operations are a clear Cash Cow within its business portfolio. These strategically managed timber assets and efficient procurement systems provide a reliable and cost-advantaged feedstock for its lumber production. This integration shields Interfor from the price volatility of external log markets, ensuring consistent operational stability and profitability, particularly within the mature timber sector.

This foundational strength is reflected in Interfor's operational performance. For instance, in 2024, the company continued to emphasize its robust timberland holdings, which represent a significant portion of its asset base and directly contribute to its cost competitiveness. The company's ability to secure a substantial portion of its log requirements internally, often at predictable costs, is a key driver of its consistent earnings in the lumber industry.

- Consistent Raw Material Supply: Interfor's owned and managed timberlands provide a predictable and cost-controlled source of logs.

- Reduced Market Volatility: Internal log sourcing minimizes exposure to fluctuating prices in the open timber market.

- Operational Efficiency: Streamlined log procurement and management contribute to lower overall production costs.

- Profitability Anchor: This integrated model serves as a stable profit generator, supporting Interfor's operations in the cyclical lumber market.

Commodity Softwood Lumber Production at Efficient Mills

Interfor's efficient, high-volume commodity softwood lumber production is a prime example of a Cash Cow. These operations leverage economies of scale and strategic locations to maintain cost leadership in a mature market.

Despite inherent market cyclicality, these sawmills consistently deliver robust cash flow. Their significant market share in the commodity lumber sector underpins this stability. For instance, in 2024, Interfor continued to focus on optimizing its efficient mill base, contributing significantly to its overall financial performance.

- High Volume Production: Interfor's efficient mills are geared for substantial output of commodity softwood lumber.

- Cost Leadership: Operational excellence and economies of scale allow these facilities to be cost-competitive.

- Mature Market: The commodity lumber market, while cyclical, offers stable demand for efficient producers.

- Consistent Cash Flow: High market share and cost advantages translate into reliable cash generation.

Interfor's strategically managed timberlands represent a significant Cash Cow, providing a reliable and cost-advantaged feedstock for its lumber operations. This integration shields the company from external log market volatility, ensuring stable operational profitability.

In 2024, Interfor continued to highlight its robust timberland holdings, a key asset contributing to its cost competitiveness. The company's ability to secure a substantial portion of its log needs internally at predictable costs is a primary driver of consistent earnings in the lumber sector.

This segment's strength lies in its consistent raw material supply, reduced exposure to market volatility, and overall operational efficiency, acting as a profitability anchor for Interfor.

| Segment | BCG Classification | Key Characteristics | 2023/2024 Data Point |

| Timberland Management & Log Supply | Cash Cow | Predictable feedstock, cost advantage, reduced volatility | Continued emphasis on robust timberland holdings in 2024. |

| Commodity Softwood Lumber | Cash Cow | High volume, cost leadership, mature market | Focus on optimizing efficient mill base in 2024 for financial performance. |

| Repair & Remodel Lumber | Cash Cow | Stable demand, significant market share, capital-light | Generates predictable and substantial cash flow from established R&R sector. |

What You See Is What You Get

Interfor BCG Matrix

The Interfor BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis is designed for immediate strategic application, offering clear insights into Interfor's business units without any watermarks or placeholder content. You can confidently use this preview as an accurate representation of the professional-grade report that will be delivered directly to you, ready for integration into your business planning.

Dogs

Interfor's divestiture of its Quebec operations in January 2025 strongly suggests these sawmills were classified as Dogs within the BCG matrix. This strategic move implies that these assets were likely experiencing low growth and low relative market share, consuming capital without generating substantial returns for the company.

The Quebec sawmills, representing a minor portion of Interfor's overall production capacity, likely faced intense competition or operational inefficiencies. Their divestment reflects a decision to reallocate resources towards more promising or strategically aligned business segments, a common tactic for companies managing a portfolio of assets with varying performance levels.

Some of Interfor's older or less efficient sawmills, especially those with higher operating expenses or older machinery, could be considered Dogs in the BCG matrix. These operations might be situated in areas where timber is becoming scarcer or more costly to acquire.

These mills often face difficulties in gaining a strong market presence and generating profits, particularly in slower-growing markets. They can become a drain on resources, negatively impacting the company's overall financial health.

Interfor's legacy product lines, such as certain types of treated lumber or specialized millwork, may be experiencing a structural decline in demand. This is often driven by evolving construction techniques that favor engineered wood products or alternative materials. For example, a shift towards cross-laminated timber (CLT) in some building segments could reduce demand for traditional dimensional lumber in those specific applications.

These products, if Interfor holds a low or declining market share within these shrinking segments, would fall into the Dogs category of the BCG matrix. In 2024, Interfor reported a focus on optimizing its product mix, suggesting that underperforming legacy lines are being evaluated for their contribution to overall profitability and strategic fit.

Non-Strategic Coastal B.C. Forest Tenures

Interfor has been strategically divesting non-strategic coastal British Columbia forest tenures. This move suggests a focus on optimizing their asset portfolio, moving away from areas with limited growth potential or higher operational costs. For instance, in 2023, Interfor completed the sale of certain coastal tenures, which represented a portion of their overall timber harvesting land base.

These divested tenures likely represented regions where Interfor held a less dominant market position or faced less favorable timber supply conditions. The monetization of these assets allows Interfor to reallocate capital towards more promising ventures or to strengthen their balance sheet.

- Monetization of Non-Strategic Assets: Interfor's actions indicate a deliberate strategy to sell off forest tenures that do not align with their core growth objectives or competitive advantages in coastal British Columbia.

- Capital Allocation Focus: By divesting these tenures, Interfor frees up capital that can be reinvested in higher-return opportunities, operational efficiencies, or debt reduction.

- Market Position and Cost Considerations: The tenures likely represented areas where Interfor's market share was low or where timber supply costs were less competitive, making them candidates for divestment.

- Strategic Portfolio Optimization: This approach is part of a broader effort to streamline Interfor's operations and enhance overall profitability by concentrating on their most valuable and strategically important timber resources.

Operations in Stagnant or Over-supplied Niche Markets

If Interfor finds itself with operations in niche wood product markets that are either stagnant or over-supplied, these segments can be categorized as Dogs within the Interfor BCG Matrix. These areas are characterized by intense competition and limited growth potential, often leading to a low market share and squeezed profit margins for the company. For example, if Interfor has a small footprint in a mature market for a specific type of specialty lumber facing declining demand, it would fit this description.

These Dog segments present a challenge for Interfor as they consume resources without generating significant returns. The intense price competition prevalent in such markets, often driven by numerous smaller players or established giants, further erodes profitability. In 2024, the global engineered wood products market, while growing, is highly competitive, and any niche within it where Interfor lacks scale or differentiation would be a prime example of a Dog. Reports from early 2025 indicate that while the overall housing market showed resilience, certain specialized wood product segments experienced oversupply, impacting pricing for smaller producers.

- Low Growth Prospects: Markets with little to no expected expansion limit revenue potential.

- Intense Competition: Numerous players vying for a small or shrinking market share drive down prices.

- Minimal Profitability: Low market share and price pressures result in slim or negative profit margins.

- Strategic Consideration: These segments are candidates for divestment, restructuring, or significant cost reduction to free up capital for more promising ventures.

Dogs in Interfor's portfolio are business units with low market share in low-growth industries. These operations typically generate minimal profits and may even require significant capital to maintain. For example, Interfor's older, less efficient sawmills, particularly those in regions with declining timber availability or high operating costs, fit this description.

The divestiture of certain Quebec sawmills in early 2025, which represented a smaller portion of Interfor's production, strongly suggests they were classified as Dogs. These assets likely faced challenges such as intense competition or operational inefficiencies, leading to their sale to reallocate resources to more profitable ventures.

Legacy product lines with declining demand, such as certain treated lumber types due to shifts towards engineered wood, can also be considered Dogs if Interfor holds a low market share in these shrinking segments. In 2024, Interfor's focus on product mix optimization indicates an ongoing evaluation of such underperforming lines.

Niche wood product markets that are stagnant or oversupplied, where Interfor has a limited presence, represent another category of Dogs. Intense price competition in these areas, as seen in some specialty lumber segments in early 2025, further squeezes profitability for smaller producers.

| BCG Category | Interfor Example | Characteristics | 2024/2025 Insight |

|---|---|---|---|

| Dogs | Older/less efficient sawmills | Low market share, low growth, low profitability | Divestment of Quebec operations suggests these were Dogs. |

| Dogs | Legacy product lines (e.g., certain treated lumber) | Declining demand, low market share | Product mix optimization in 2024 targets underperforming lines. |

| Dogs | Niche wood product markets (stagnant/oversupplied) | Intense competition, minimal returns | Oversupply in specialty segments in early 2025 impacted pricing. |

Question Marks

Interfor's foray into advanced digital sales platforms and e-commerce for wood products places it squarely in the Question Mark quadrant of the BCG Matrix. While the online distribution of lumber is experiencing rapid growth, Interfor's current market share in this emerging channel is likely minimal. This segment demands substantial investment to establish a significant market presence and capitalize on its considerable future potential.

Interfor's investment in mass timber manufacturing capabilities, such as Cross-Laminated Timber (CLT) and Glulam, positions it within a Star segment of the market due to the rapid growth and increasing demand for sustainable building materials. However, these initial ventures represent a significant investment, requiring substantial capital and the development of new technical expertise. This strategic move is crucial for Interfor to capture market share in this burgeoning sector.

Investing in R&D for advanced wood-based materials like wood-fiber insulation or bio-composites places a traditional lumber company squarely in the question mark category of the BCG matrix. These ventures offer substantial future growth but currently hold minimal market share, requiring considerable upfront investment with unpredictable commercial outcomes. For instance, companies are exploring wood-derived chemicals as sustainable alternatives, a field experiencing rapid innovation but still in its nascent stages of market penetration.

Greenfield Mill Development in Untapped Growth Regions

Interfor's strategy may involve greenfield sawmill developments in untapped growth regions, representing a significant investment with substantial potential rewards. These ventures are characterized by high upfront capital expenditures and the inherent risks associated with entering new markets where Interfor currently has minimal presence. Success in these areas could lead to the establishment of a dominant market share in rapidly expanding economies.

For instance, if Interfor were to consider expansion into a burgeoning market like Southeast Asia, the initial investment for a state-of-the-art sawmill could range from USD 150 million to USD 300 million, depending on capacity and technology. This aligns with the high capital demands typical of greenfield projects.

- High Capital Outlay: Greenfield projects require substantial initial investment, potentially hundreds of millions of dollars for modern sawmills.

- Market Entry Risks: Establishing a presence in new, high-growth regions involves navigating unfamiliar regulatory landscapes and competitive environments.

- Potential for Significant Market Share: Successful entry into these markets can yield a strong competitive position and substantial long-term returns.

- Strategic Growth Driver: These developments are crucial for Interfor's long-term growth, allowing diversification and access to new customer bases.

New International Export Market Development

Venturing into new, rapidly growing international export markets presents a classic Question Mark scenario for Interfor. These markets, while boasting high potential for lumber demand, often begin with Interfor holding a low market share. Challenges such as complex logistics, evolving trade policies, and established local competition necessitate significant investment to build a strong presence.

For example, emerging markets in Southeast Asia, projected to see a 5% annual increase in construction activity through 2025, could represent such an opportunity. However, Interfor's initial market share in these regions might be less than 2%, requiring substantial capital expenditure for establishing distribution networks and navigating import tariffs, which can range from 5% to 15% depending on the country.

- High Growth Potential: Emerging economies often exhibit robust demand for construction materials due to infrastructure development and urbanization.

- Low Initial Market Share: Entering new territories means competing against established players, requiring a strategic approach to gain traction.

- Significant Investment Required: Overcoming logistical hurdles, understanding local regulations, and building brand awareness demand considerable financial commitment.

- Risk of Failure: Without careful planning and execution, these ventures can drain resources without yielding the expected returns.

Question Marks in Interfor's portfolio represent new ventures with high growth potential but currently low market share. These are areas where substantial investment is needed to build a competitive position. Examples include developing new digital sales channels and exploring advanced wood-based materials.

Interfor's investment in new, rapidly growing international export markets also falls into this category. These markets offer significant demand but require considerable capital for logistics, navigating trade policies, and establishing a presence against existing competitors. Successful cultivation of these Question Marks can lead to future Stars.

The company's greenfield sawmill developments in untapped regions are also classic Question Marks. These projects demand high upfront capital and carry market entry risks, but they hold the promise of establishing a dominant market share in expanding economies.

For instance, Interfor's potential expansion into Southeast Asian markets, with construction activity projected to grow annually, exemplifies a Question Mark. Initial market share might be under 2%, requiring investments to overcome logistics and tariffs, which can range from 5% to 15%.

| Venture Type | Market Growth | Interfor Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Digital Sales Platforms | High | Low | High | Future Star |

| Advanced Wood Materials | High | Low | High | Future Star |

| New Export Markets | High | Low | High | Future Star |

| Greenfield Sawmills (New Regions) | High | Low | Very High | Future Star/Cash Cow |

BCG Matrix Data Sources

Our Interfor BCG Matrix leverages comprehensive data, including company financial reports, market share analysis, and industry growth forecasts, to provide strategic insights.