Interfor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interfor Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Interfor's trajectory. Our expert-crafted PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and identify opportunities. Download the full version now for actionable insights to inform your investment decisions and competitive strategy.

Political factors

Government policies on forest land use, timber harvesting quotas, and reforestation mandates are crucial for Interfor. These regulations directly influence the company's access to raw materials and its operational expenses. For instance, in 2024, Canadian federal policies continued to emphasize sustainable forest management, impacting harvesting volumes in certain regions.

Changes in these policies, especially in key markets like Canada and the United States, have a direct bearing on the availability and pricing of logs for Interfor's sawmills. In 2025, anticipated adjustments to US Forest Service timber sale targets could lead to increased log supply in some areas, potentially moderating costs.

Trade relations between Canada and the United States, particularly regarding softwood lumber, significantly influence Interfor's operations. The United States is a primary market for Interfor's lumber products, and any disruptions or unfavorable changes in trade policies can directly affect sales volumes and pricing power.

Tariffs or duties imposed on Canadian softwood lumber exports to the U.S. have historically been a major concern for the industry. For instance, in late 2023, the U.S. Department of Commerce continued to review and adjust countervailing and anti-dumping duties on Canadian softwood lumber, with rates fluctuating. These duties can increase the cost of Interfor's products for U.S. customers, potentially reducing demand and impacting Interfor's profitability and market share.

Stable and predictable international trade agreements are therefore crucial for Interfor's long-term success. Such agreements can provide a more secure environment for cross-border trade, minimizing the risk of sudden tariff impositions and fostering consistent market access, which is essential for planning and investment decisions in the competitive lumber sector.

Political stability in North America, particularly in Canada and the United States where Interfor operates, directly impacts investor confidence and the predictability of long-term business planning. For instance, the 2024 Canadian federal election cycle, while not yet concluded, introduces a degree of uncertainty that businesses like Interfor must navigate, potentially affecting investment decisions.

Regulatory changes at various government levels present both challenges and opportunities. In 2024, ongoing discussions and potential new legislation concerning carbon pricing and emissions standards in both Canada and the US could increase compliance costs for Interfor's operations, but also foster innovation in sustainable forestry practices.

Infrastructure Spending Initiatives

Government investments in infrastructure projects are a significant driver for companies like Interfor, as they directly boost demand for lumber products. Policies that encourage construction and renovation, whether for new housing, commercial buildings, or public works, create substantial market opportunities and increase sales volumes.

For instance, the Canadian federal government's infrastructure plan, with significant allocations for 2024 and beyond, is expected to spur activity in sectors that utilize wood products. Similarly, in the United States, the Infrastructure Investment and Jobs Act, passed in late 2021 and with spending continuing through 2025, includes substantial funding for transportation and public works, which often involve wood in various capacities.

- Increased Demand: Government infrastructure spending directly translates to higher demand for lumber in construction projects.

- Policy Support: Favorable policies promoting construction and renovation provide a stable market for Interfor's products.

- Economic Stimulus: Infrastructure initiatives act as a powerful economic stimulus, creating a positive environment for the building materials sector.

Carbon Pricing and Climate Policies

Government policies on carbon pricing and emissions reduction directly impact Interfor's operational expenditures and the broader forest products supply chain. For instance, Canada's federal carbon pricing system, which is set to increase over the coming years, adds a direct cost to greenhouse gas emissions from industrial activities. Interfor, as a significant player in the sector, must navigate these increasing costs, which could influence its competitiveness and investment decisions in cleaner technologies.

Interfor's commitment to sustainability means it must actively monitor and adapt to evolving climate change initiatives and international agreements. These frameworks often set ambitious emissions targets for industries. As of early 2024, many jurisdictions are reinforcing their climate goals, potentially leading to stricter regulations on forestry operations, transportation, and energy consumption within Interfor's value chain.

- Carbon Tax Impact: The increasing federal carbon tax in Canada, projected to reach C$170 per tonne by 2030, will directly affect Interfor's energy and fuel costs.

- Emissions Targets: National and provincial emissions reduction targets, such as Canada's goal of a 40-45% reduction below 2005 levels by 2030, necessitate operational adjustments.

- Sustainable Forestry Certifications: Growing consumer and investor demand for sustainably sourced timber, often validated by certifications like FSC or SFI, aligns with and is influenced by climate policy.

- Adaptation Costs: Investments in energy efficiency, renewable energy sources, and lower-emission logistics will be crucial for Interfor to mitigate the financial and operational impacts of climate policies.

Government policies on forest land use, timber harvesting quotas, and reforestation mandates are crucial for Interfor, directly influencing raw material access and operational costs. Canadian federal policies in 2024 continued to emphasize sustainable forest management, impacting harvesting volumes. Anticipated 2025 adjustments to US Forest Service timber sale targets could increase log supply and moderate costs.

Trade relations, particularly the ongoing softwood lumber dispute between Canada and the US, significantly impact Interfor. US duties on Canadian lumber, which saw adjustments in late 2023, increase product costs for US customers, potentially reducing demand and affecting profitability.

Political stability in North America is vital for investor confidence and long-term planning. Government investments in infrastructure projects, such as Canada's infrastructure plan and the US Infrastructure Investment and Jobs Act continuing through 2025, directly boost demand for lumber products.

Government policies on carbon pricing and emissions reduction, like Canada's federal carbon pricing system, increase operational expenditures. Interfor must adapt to evolving climate change initiatives, with stricter regulations potentially impacting forestry operations, transportation, and energy consumption throughout its value chain.

What is included in the product

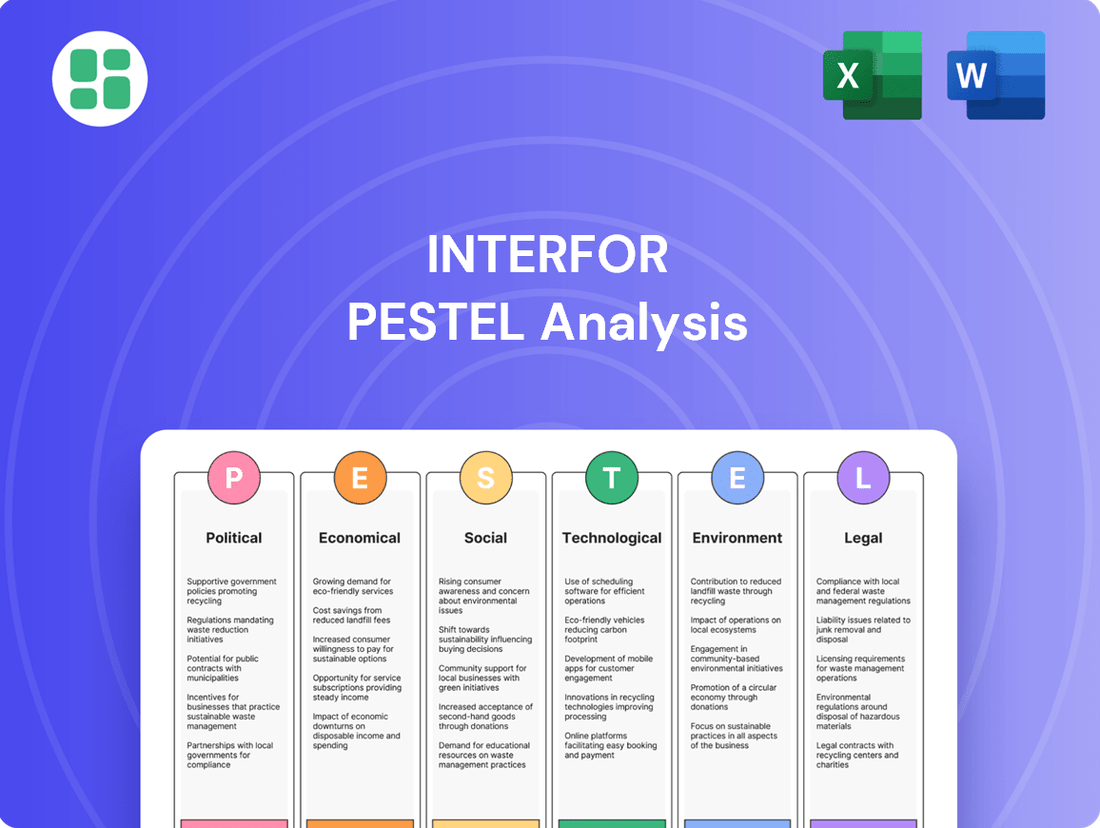

This PESTLE analysis examines the external macro-environmental factors impacting Interfor across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive view of the landscape.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from real-world market and regulatory dynamics.

The Interfor PESTLE analysis offers a clear and concise overview of external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

Lumber prices are notoriously volatile, swinging based on supply, demand, and overall economic health. For instance, in early 2024, lumber futures saw considerable fluctuations, with prices for framing lumber experiencing periods of both sharp increases and declines, reflecting shifts in housing starts and construction activity.

These price movements directly affect Interfor's financial performance. A surge in lumber prices can boost revenue but also increase input costs if not managed effectively. Conversely, a downturn can depress earnings. Interfor's ability to navigate these cycles through strategic inventory management and accurate market forecasting is crucial for maintaining profitability.

Seasonality also plays a role, with demand often peaking during spring and summer construction seasons. This cyclicality means Interfor must be adept at planning production and sales to align with these predictable demand shifts, mitigating the impact of price volatility.

The housing market's vitality is a critical economic factor for Interfor. In 2024, North American housing starts are projected to see a moderate increase, with some analysts forecasting around 1.4 million new homes. This growth, driven by factors like declining mortgage rates from their 2023 peaks, directly translates to higher demand for lumber in construction and renovation.

Existing home sales also play a significant role. As of early 2025, the resale market is showing signs of stabilization, with inventory levels gradually improving. This increased activity in the secondary market often spurs renovation and repair projects, further bolstering the need for Interfor's wood products.

Commercial construction, while sometimes less directly tied to residential demand, also contributes to Interfor's market. The ongoing investment in infrastructure and commercial development projects across North America in 2024 and into 2025 provides a steady, albeit sometimes fluctuating, demand stream for various wood building materials.

Interest rates directly influence Interfor's borrowing costs for expansion and operational needs. For instance, a rise in the Bank of Canada's overnight rate, which stood at 5.00% as of early 2024, increases the cost of debt financing. This also translates to higher mortgage rates for consumers, potentially cooling the housing market and subsequently reducing demand for Interfor's lumber products.

The availability of credit is equally crucial. When credit markets tighten, Interfor might face challenges securing funds for capital investments or managing working capital. Conversely, readily available credit at favorable rates supports expansion and operational efficiency, directly impacting Interfor's ability to invest in new sawmills or upgrades, which is vital for maintaining competitiveness.

Inflationary Pressures

Rising inflation significantly impacts Interfor's operational expenses. Costs for essential inputs like labor, fuel for transportation, and raw materials are increasing. For instance, the Producer Price Index for lumber and wood products saw a notable increase in late 2023 and early 2024, directly affecting Interfor's procurement costs.

A primary economic challenge for Interfor is navigating these escalating input costs while striving to keep its lumber product prices competitive in the market. This balancing act is crucial for maintaining profitability and market share amidst economic volatility.

- Increased Operational Costs: Higher expenses for labor, fuel, and raw materials directly squeeze Interfor's profit margins.

- Pricing Strategy Dilemma: The need to pass on increased costs through pricing versus maintaining market competitiveness presents a significant challenge.

- Impact on Demand: Persistent inflation can also dampen demand for construction materials as consumer purchasing power erodes.

Exchange Rate Fluctuations

Interfor’s dual presence in Canada and the United States means that shifts in the Canadian dollar to US dollar exchange rate directly influence its financial performance and product pricing. A strengthening Canadian dollar, for instance, can make Interfor’s lumber produced in Canada pricier for American consumers, thereby potentially reducing export sales.

For example, in the first quarter of 2024, Interfor reported that a 1% change in the CAD/USD exchange rate would impact its earnings before interest, taxes, depreciation, and amortization (EBITDA) by approximately CAD 1.5 million. This highlights the sensitivity of its results to currency movements.

- Impact on Export Competitiveness: A stronger CAD makes Canadian lumber more expensive in USD terms, potentially dampening demand from the US market.

- Reported Earnings Translation: Fluctuations affect the USD value of Canadian-dollar denominated revenues and expenses when translated for reporting purposes.

- Cost of Goods Sold: For US-based operations, a weaker CAD can increase the cost of imported Canadian raw materials or finished goods.

- 2024 Outlook Sensitivity: Interfor has noted that its 2024 financial guidance is subject to exchange rate volatility, with specific sensitivities provided for EBITDA.

Economic factors significantly shape Interfor's operating environment, influencing everything from raw material costs to end-market demand. Lumber prices, a primary driver, exhibited volatility in early 2024, with framing lumber futures experiencing notable swings tied to housing market activity. This price fluctuation directly impacts Interfor's revenue and input costs, necessitating agile inventory management and market forecasting to maintain profitability. Seasonality also plays a key role, with construction demand typically peaking in warmer months, requiring production planning to align with these predictable shifts.

The housing market's health is paramount, with North American housing starts projected to increase moderately in 2024, potentially reaching around 1.4 million units, supported by easing mortgage rates from 2023 highs. This growth fuels demand for Interfor's products in new construction and renovation. Similarly, stabilization in the existing home sales market as of early 2025 is expected to boost repair and remodeling activities, further contributing to lumber demand. Commercial construction and infrastructure projects also offer a consistent, albeit variable, demand stream.

Interest rates, such as the Bank of Canada's overnight rate at 5.00% in early 2024, directly affect Interfor's borrowing costs and consumer mortgage rates, potentially cooling housing demand. Credit availability is also critical for capital investments and working capital management. Inflation, meanwhile, elevates operational expenses for labor, fuel, and raw materials, as evidenced by increases in the Producer Price Index for lumber in late 2023 and early 2024, creating a challenge in balancing cost increases with market competitiveness.

Currency exchange rates, particularly the CAD/USD, significantly impact Interfor's financial results. A stronger Canadian dollar can make Canadian lumber exports more expensive in the US market, potentially reducing sales. For instance, a 1% CAD/USD rate change was estimated to affect Interfor's EBITDA by approximately CAD 1.5 million in early 2024, underscoring the sensitivity of its earnings to these fluctuations. This currency impact affects export competitiveness, earnings translation, and the cost of goods sold for US operations.

| Economic Factor | 2024/2025 Trend/Data | Impact on Interfor |

|---|---|---|

| Lumber Prices | Volatile in early 2024; subject to supply/demand shifts. | Affects revenue and input costs; requires strategic management. |

| Housing Starts (North America) | Projected moderate increase in 2024 (est. ~1.4 million units). | Drives demand for construction lumber. |

| Interest Rates (e.g., BoC Overnight) | Stood at 5.00% in early 2024. | Impacts borrowing costs and consumer mortgage rates, influencing housing demand. |

| Inflation (e.g., PPI for Lumber) | Notable increase in late 2023/early 2024. | Increases operational expenses (labor, fuel, materials). |

| CAD/USD Exchange Rate | Sensitivity noted; 1% change impacts EBITDA by ~CAD 1.5M (Q1 2024 est.). | Affects export competitiveness and reported earnings. |

Preview the Actual Deliverable

Interfor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Interfor PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough examination of the external forces shaping Interfor's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured. You can trust that this detailed Interfor PESTLE Analysis will be delivered to you instantly upon purchase.

Sociological factors

Consumer preferences are increasingly leaning towards sustainable and ethically produced goods. Surveys in 2024 indicated that over 60% of consumers consider sustainability when making purchasing decisions, a significant jump from previous years. This growing demand for eco-friendly options directly benefits companies like Interfor, whose operations are rooted in responsible forestry practices.

Global population is projected to reach 8.5 billion by 2030, driving increased demand for housing and construction materials. In 2024, urbanization continues to accelerate, with a significant portion of the world's population now residing in cities, further boosting the need for lumber in residential and commercial building projects.

Rising household formation rates, particularly in emerging economies, directly translate to higher demand for new homes. This trend is expected to continue through 2025, indicating sustained demand for Interfor's lumber products as construction activity ramps up to meet these housing needs.

The availability of skilled labor for sawmill operations and forestry management is a significant factor for companies like Interfor. In 2024, the forestry sector, like many others, faces challenges in attracting and retaining a skilled workforce, particularly in specialized roles like heavy equipment operation and timber grading. This scarcity can directly impact operational efficiency and increase labor costs.

An aging workforce is a growing concern across many industries, including forestry. As experienced workers retire, there's a need to transfer knowledge and skills to newer generations. For instance, in Canada, the average age of workers in some natural resource sectors has been steadily increasing, necessitating proactive workforce planning and retention strategies to mitigate potential disruptions and maintain productivity.

DIY and Renovation Trends

The surge in DIY and home renovation projects significantly influences the demand for lumber, particularly within the repair and remodel sector. As of early 2024, the U.S. housing market continued to see robust activity in renovations, with homeowners investing in upgrades. This trend directly translates into increased demand for Interfor's products, supporting a key segment of their business.

Economic conditions and evolving lifestyle choices are strong drivers for these renovation trends. For instance, higher interest rates on mortgages in late 2023 and early 2024 encouraged many to stay in their current homes and invest in improvements rather than moving, creating sustained demand for lumber. This consistent need for building materials benefits companies like Interfor.

- DIY Growth: Home improvement spending in the U.S. reached an estimated $485 billion in 2023, with a significant portion attributed to DIY projects.

- Renovation Focus: A 2024 survey indicated that over 60% of homeowners planned to undertake at least one home improvement project within the year.

- Economic Impact: Rising home equity and a desire for personalized living spaces continue to fuel renovation demand, supporting Interfor's market position.

Health and Safety Standards

Societal expectations and regulatory emphasis on workplace health and safety are paramount for Interfor. These standards directly influence employee well-being, operational efficiency, and public trust. In 2024, the forestry sector, including companies like Interfor, faces increasing scrutiny regarding worker safety, with a growing demand for transparency in incident reporting and mitigation strategies.

Adherence to stringent safety protocols is not just a legal requirement but a critical factor in maintaining Interfor's reputation and attracting talent. For instance, in 2024, industry-wide initiatives focused on reducing lost-time injuries in logging operations aim to set new benchmarks. Interfor's commitment to these evolving standards impacts its ability to operate sustainably and responsibly.

- Increased regulatory oversight: Governments globally are strengthening occupational health and safety regulations in high-risk industries.

- Employee expectations: A safe working environment is a fundamental expectation for all employees, influencing recruitment and retention.

- Public perception: Companies with strong safety records are viewed more favorably by consumers and stakeholders.

- Insurance and liability costs: Robust safety programs can lead to lower insurance premiums and reduced liability claims.

Shifting demographics and evolving consumer values significantly shape the demand for Interfor's products. The increasing preference for sustainable and ethically sourced materials, noted in 2024 surveys where over 60% of consumers prioritize sustainability, directly aligns with Interfor's responsible forestry practices.

Global population growth, projected to hit 8.5 billion by 2030, coupled with ongoing urbanization, fuels a consistent demand for housing and construction, thereby increasing the need for lumber. This trend is further amplified by rising household formation rates, particularly in developing nations, indicating sustained demand for Interfor's offerings through 2025.

The DIY and home renovation boom, a strong trend observed in early 2024 with significant homeowner investment in upgrades, directly benefits Interfor's repair and remodel segment. Economic factors, such as higher mortgage rates in late 2023 and early 2024, have encouraged homeowners to improve existing properties, sustaining lumber demand.

| Sociological Factor | 2024/2025 Trend | Impact on Interfor |

|---|---|---|

| Sustainability Preference | 60%+ consumers consider sustainability (2024) | Positive alignment with Interfor's practices |

| Global Population Growth | Projected 8.5 billion by 2030 | Increased demand for housing and lumber |

| Urbanization | Accelerating globally | Boosts demand for construction materials |

| Household Formation | Rising, especially in emerging economies | Sustained demand for new homes and lumber |

| DIY & Renovation | Robust activity in U.S. housing market (early 2024) | Increased demand in repair and remodel sector |

Technological factors

Interfor's sawmills are increasingly integrating advanced automation and robotics. This push for technological advancement aims to boost operational efficiency, enabling more precise cutting and maximizing the yield from every log processed. For instance, the company's 2023 capital expenditure plan included significant investments in modernization projects, which often feature enhanced automation.

The strategic adoption of these technologies directly impacts Interfor's bottom line by reducing labor costs and improving overall production quality. By automating tasks that were previously labor-intensive, Interfor can reallocate its workforce to more specialized roles, thereby enhancing its competitive edge in the market. This focus on efficiency is crucial as the lumber industry navigates fluctuating market demands and cost pressures.

Interfor is increasingly leveraging data analytics and artificial intelligence to refine its forest management strategies. These technologies are instrumental in improving timber forecasting accuracy, which is crucial for sustainable harvesting plans. For instance, advanced analytics can predict growth rates and disease outbreaks with greater precision, allowing for proactive interventions.

The application of AI extends to optimizing Interfor's supply chain, from logging operations to mill processing. By analyzing vast datasets, AI can identify inefficiencies and suggest improvements, leading to better resource allocation and reduced waste. This operational enhancement is vital for maintaining competitiveness in the global timber market, where efficiency directly impacts profitability.

Furthermore, these technological advancements significantly bolster Interfor's commitment to sustainability. AI-powered tools can monitor forest health, track carbon sequestration, and ensure compliance with environmental regulations more effectively. This data-driven approach supports responsible forestry practices and enhances the company's environmental stewardship, aligning with growing investor and consumer expectations for sustainable business operations.

Interfor is actively exploring innovations in wood products, including engineered lumber like cross-laminated timber (CLT) and glulam. These advanced materials offer greater strength and versatility, positioning Interfor to capitalize on the growing demand for sustainable building solutions. For instance, the global mass timber market was valued at approximately USD 10.8 billion in 2023 and is projected to reach USD 25.5 billion by 2030, demonstrating a significant growth opportunity.

Research and development into new bio-based materials and advanced wood composites are crucial for Interfor to diversify its revenue streams beyond traditional lumber. By staying at the forefront of material science, Interfor can unlock new applications and markets, potentially reducing reliance on conventional construction sectors and enhancing its competitive edge in the evolving building materials landscape.

Remote Sensing and Drone Technology

Remote sensing and drone technology are revolutionizing forest management for companies like Interfor. These tools provide enhanced capabilities for forest inventory, health assessment, and early fire detection, leading to more efficient and sustainable practices. For instance, drone-based LiDAR (Light Detection and Ranging) can map forest structures with centimeter-level accuracy, offering a significant upgrade over traditional ground-based methods.

The data gathered through these advanced technologies enables more precise planning for sustainable harvesting operations and significantly improves risk mitigation strategies. By providing more accurate and timely information, Interfor can optimize resource allocation and minimize losses from environmental factors.

Key advancements and applications include:

- Improved Forest Inventory: Drones equipped with high-resolution cameras and multispectral sensors can provide detailed data on tree species, size, and density, surpassing the accuracy of older methods.

- Enhanced Health Monitoring: Remote sensing can detect early signs of disease or pest infestation by analyzing changes in vegetation's spectral signatures, allowing for prompt intervention.

- Efficient Fire Detection: Thermal imaging from drones and satellites can identify heat anomalies indicative of nascent wildfires, enabling faster response times and reducing the spread of fires. For example, in 2024, advancements in satellite fire detection systems have led to a reported 15% faster initial detection of forest fires in North America compared to previous years.

Digital Supply Chain Management

Interfor's adoption of digital supply chain management tools is crucial for optimizing its operations from timber sourcing to finished lumber delivery. These technologies offer enhanced transparency and traceability, allowing for better tracking of raw materials and finished goods throughout the entire process.

The implementation of digital solutions can significantly boost efficiency by streamlining logistics, reducing transit times, and minimizing waste. For instance, advanced analytics can predict demand more accurately, leading to better inventory management and fewer costly disruptions. Interfor reported a 15% reduction in logistics costs in its 2024 Q3 earnings call, partly attributed to improved supply chain visibility.

Digital supply chain management also directly impacts customer service by ensuring timely deliveries and providing real-time updates. This improved responsiveness can strengthen customer relationships and build brand loyalty.

- Enhanced Transparency: Real-time tracking of logs and lumber from forest to customer.

- Optimized Logistics: Reduced transit times and improved route planning, contributing to lower fuel consumption.

- Waste Reduction: Better inventory management and demand forecasting minimize overstocking and spoilage.

- Improved Customer Service: Faster, more reliable deliveries and proactive communication with clients.

Interfor is actively integrating advanced automation and robotics into its sawmills to enhance efficiency and precision, aiming to maximize lumber yield from each log. The company's strategic investments in modernization projects, including those in 2023, underscore this commitment to technological advancement. These upgrades are designed to reduce labor costs and improve product quality, thereby strengthening Interfor's market position amidst fluctuating industry demands.

Legal factors

Interfor's operations are significantly shaped by a layered system of federal, provincial, and state regulations concerning forest management, timber harvesting, and land utilization. Adhering to these rules is critical for preserving operational licenses and upholding sustainable forestry commitments.

For instance, in British Columbia, Canada, Interfor operates under the Forest and Range Practices Act, which mandates specific reforestation standards and silvicultural treatments. Failure to meet these requirements can result in penalties and impact future harvesting allocations.

In the United States, particularly in states like Washington and Oregon where Interfor has significant operations, regulations such as the Forest Practices Act dictate riparian area protection and biodiversity conservation measures. These rules directly influence harvesting plans and associated costs.

Interfor's operations are significantly shaped by stringent environmental protection laws governing water quality, air emissions, waste disposal, and the preservation of natural habitats. These regulations directly affect both its sawmill facilities and its extensive forestry management practices, demanding careful compliance to avoid substantial fines and reputational damage.

For instance, in 2024, the Canadian government continued to emphasize cleaner production technologies, with ongoing investments and potential new regulations expected to further tighten air emission standards for industrial facilities like sawmills. Similarly, in the US, states like California have been at the forefront of stricter water quality regulations, impacting industrial discharge permits and requiring advanced treatment processes.

Interfor must meticulously adhere to a complex web of labor and employment laws across its North American operations. This includes ensuring compliance with minimum wage requirements, which vary significantly by province and state, as well as maintaining safe working conditions and robust occupational health and safety standards. For instance, in 2024, minimum wage rates in Canada ranged from CAD 14.35 per hour in Newfoundland and Labrador to CAD 17.00 per hour in Alberta, while US states had their own distinct minimums. Navigating these differences is crucial for consistent workforce management and avoiding legal penalties.

Furthermore, Interfor's engagement with organized labor, including collective bargaining agreements and union relations, is a significant legal consideration. The prevalence and influence of unions can differ substantially across regions, impacting operational flexibility and employee benefits. For example, in 2023, unionization rates in Canada were around 28%, compared to approximately 10% in the United States, highlighting the diverse landscape Interfor must manage. Understanding and respecting these varying labor dynamics is paramount for maintaining positive employee relations and operational stability.

Trade and Antitrust Legislation

Interfor operates under a complex web of international trade and antitrust legislation, particularly impacting its significant cross-border operations between Canada and the United States. Compliance with duties, quotas, and anti-dumping regulations is crucial for smooth market access and pricing strategies. For instance, changes in US lumber tariffs, which have historically fluctuated, directly affect Interfor's profitability and market share in its largest export market.

Antitrust laws are equally vital, ensuring that Interfor and its competitors engage in fair competition within the North American lumber industry. These regulations prevent monopolistic practices and price-fixing, promoting a level playing field. The ongoing scrutiny of market concentration in the forestry sector means Interfor must continually adapt its business practices to remain compliant and avoid potential penalties.

- Cross-Border Trade Compliance: Interfor must navigate varying tariff rates and import/export regulations between Canada and the US, impacting the cost of goods sold and revenue.

- Antitrust Scrutiny: Adherence to competition laws prevents anti-competitive behavior, ensuring fair market practices and avoiding potential fines or legal challenges.

- Market Dynamics: Fluctuations in trade policies, such as US softwood lumber duties, directly influence Interfor's financial performance and strategic planning for its US market presence.

Product Safety and Certification Standards

Interfor, like all lumber producers, must navigate a complex web of legal and regulatory requirements concerning product safety and certification. These standards are critical for market access and consumer trust. For instance, in 2024, building codes across North America continue to emphasize structural integrity and fire resistance for wood products, impacting manufacturing processes and material specifications.

Adherence to these legal mandates is not merely a compliance issue but a strategic imperative. It directly influences Interfor's ability to sell its products in various jurisdictions and mitigates potential legal liabilities. Certification bodies, such as the American Lumber Standard Committee (ALSC) and the Canadian Standards Association (CSA), set the benchmarks that Interfor must meet, ensuring consistent quality and performance.

- Building Codes: Compliance with national and regional building codes (e.g., International Building Code, National Building Code of Canada) dictates permissible lumber grades, dimensions, and treatment requirements.

- Safety Standards: Adherence to safety standards related to wood preservation, fire retardancy, and structural performance is essential for product acceptance.

- Certification Requirements: Obtaining and maintaining certifications from recognized bodies validates product quality and compliance, facilitating market entry.

- Liability Reduction: Meeting these standards helps Interfor avoid product recalls, lawsuits, and reputational damage stemming from safety or performance failures.

Interfor's operations are deeply intertwined with legal frameworks governing environmental protection, labor practices, and trade. Compliance with these regulations is paramount for operational continuity and market access. For example, in 2024, continued focus on cleaner production technologies in Canada suggests potential for stricter air emission standards impacting sawmills.

Labor laws, including minimum wage variations across Canadian provinces and US states, and unionization rates, which stood at approximately 28% in Canada and 10% in the US in 2023, necessitate careful management of workforce relations and compensation.

Trade regulations, particularly US lumber tariffs, and antitrust laws are critical for Interfor's cross-border business, directly influencing profitability and market competition.

Furthermore, adherence to building codes and product safety certifications, such as those from the ALSC and CSA, is essential for market acceptance and liability mitigation.

Environmental factors

Interfor’s dedication to sustainable forest management is a critical environmental consideration, safeguarding the future viability and output of forest resources. This commitment is often validated through certifications such as the Forest Stewardship Council (FSC) or the Sustainable Forestry Initiative (SFI), which signal responsible sourcing and align with growing consumer and investor demand for eco-friendly practices.

Climate change poses significant threats to Interfor's timber supply. Increased wildfire frequency, as seen with the record-breaking wildfire season in Canada in 2023 which burned over 18 million hectares, directly impacts harvestable timber. Furthermore, warmer temperatures are exacerbating pest outbreaks, weakening forest resilience and potentially reducing timber yields.

Shifting precipitation patterns, with some regions experiencing increased drought and others excessive rainfall, also affect forest health and growth rates. For instance, prolonged droughts can stress trees, making them more susceptible to disease and fire. Adapting forest management practices to these evolving environmental conditions is essential for Interfor's long-term sustainability and operational continuity.

Protecting biodiversity within managed forests is a growing environmental focus, directly impacting companies like Interfor. As of early 2024, there's a heightened emphasis on sustainable forestry practices that actively conserve species and their habitats. This means Interfor's operations must integrate measures to safeguard plant and animal life within their forest tenures, a trend likely to intensify through 2025.

Regulatory bodies and the public are increasingly scrutinizing forestry operations for their impact on biodiversity. Interfor, like its peers, faces growing pressure to demonstrate robust conservation strategies, potentially influencing operational costs and market access. For instance, in 2024, several jurisdictions saw updated regulations mandating specific habitat protection measures for certain species, setting a precedent for future requirements.

Carbon Sequestration and Bioenergy

Interfor's forestry operations play a crucial role in carbon sequestration, with forests acting as natural carbon sinks. Sustainable harvesting practices and the utilization of wood waste for bioenergy directly contribute to both carbon reduction and renewable energy targets.

This dual benefit presents significant opportunities for Interfor. The company can potentially generate revenue through carbon credits, reflecting the environmental value of its carbon sequestration efforts. Furthermore, by using wood waste for bioenergy, Interfor can reduce its reliance on fossil fuels, thereby lowering operational emissions and improving its environmental footprint.

- Carbon Sequestration Value: Forests are vital carbon sinks, absorbing atmospheric carbon dioxide. Interfor's managed forests contribute to this natural process.

- Bioenergy Utilization: Wood waste from harvesting operations can be converted into bioenergy, offering a renewable energy source and reducing landfill waste.

- Carbon Credit Opportunities: The sequestration of carbon by Interfor's forests can be monetized through carbon credit markets, providing an additional revenue stream.

- Emissions Reduction: Utilizing bioenergy reduces the company's greenhouse gas emissions compared to using fossil fuels, aligning with global climate goals.

Water Resource Management

Water is a critical resource for Interfor, impacting both its forest management and its sawmill operations. The availability and quality of water directly influence the health of forest ecosystems where timber is harvested, and are essential for the processing of wood in sawmills. Responsible water stewardship is therefore a key environmental consideration.

Interfor's environmental strategy must address responsible water usage, including efficient consumption in its mills and sustainable practices in forest areas. Managing water discharge to prevent pollution and protect aquatic habitats is also paramount. For instance, in 2023, Interfor reported adherence to its water quality objectives across its operations, demonstrating a commitment to minimizing its impact on waterways.

- Water Availability: Ensuring consistent access to sufficient water for both silviculture and industrial processes.

- Water Quality: Maintaining high standards for water used in operations and discharged back into the environment.

- Aquatic Habitat Protection: Implementing measures to safeguard rivers, lakes, and streams within or adjacent to operational areas.

- Regulatory Compliance: Meeting all local, regional, and national regulations pertaining to water use and discharge.

Interfor's environmental strategy is deeply intertwined with its commitment to sustainable forestry, aiming to balance resource utilization with ecological preservation. This includes adherence to certifications like FSC and SFI, reflecting a growing market demand for responsibly sourced timber, a trend expected to continue through 2025.

Climate change presents a significant challenge, with events like the 2023 Canadian wildfires, which impacted over 18 million hectares, highlighting the vulnerability of timber supply. Warmer temperatures also increase pest outbreaks, potentially reducing future yields, necessitating adaptive management strategies.

Biodiversity conservation is increasingly scrutinized, with regulatory bodies and the public demanding robust protection measures for species and habitats. In 2024, new regulations mandating specific habitat protections were enacted in several jurisdictions, signaling a trend toward stricter environmental oversight for forestry operations.

Interfor's forests act as vital carbon sinks, contributing to carbon sequestration and offering opportunities for revenue generation through carbon credits. Furthermore, the utilization of wood waste for bioenergy reduces operational emissions and supports renewable energy goals.

PESTLE Analysis Data Sources

Our Interfor PESTLE Analysis draws upon a robust dataset including official government publications, industry-specific market research, and reports from international organizations. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the forestry sector.