Interface SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

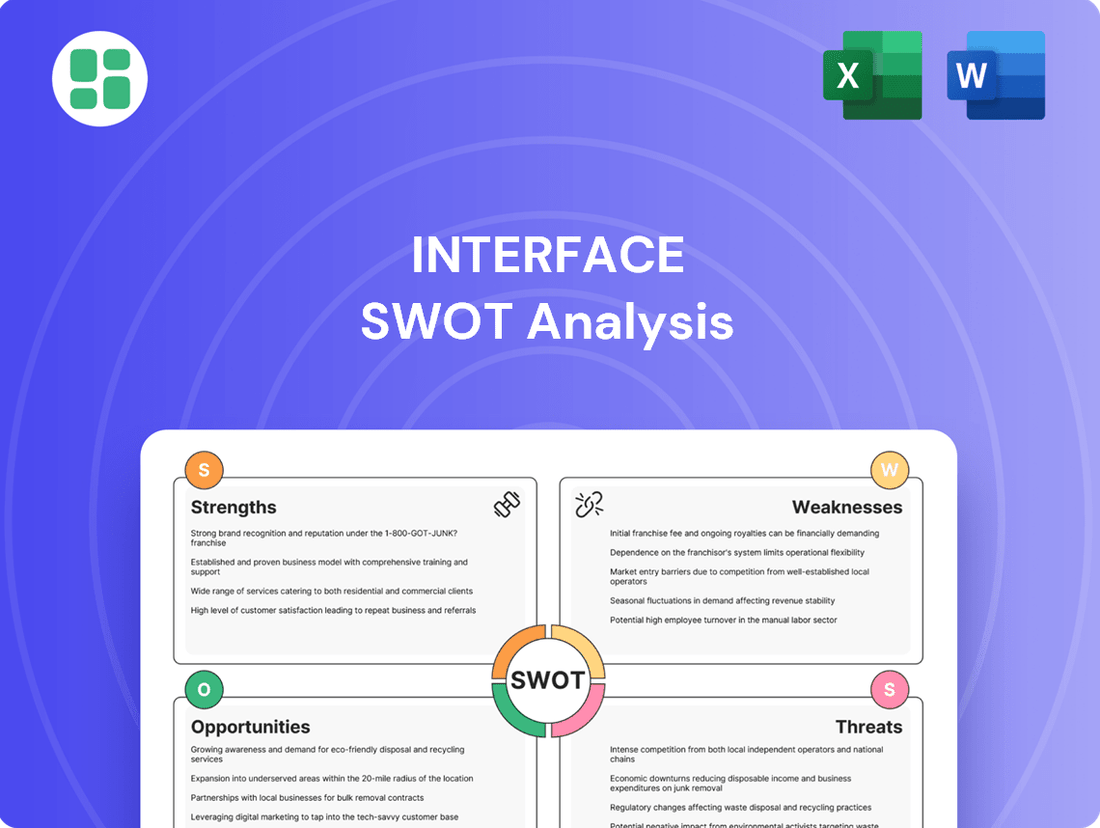

Uncover the complete strategic landscape of Interface with our comprehensive SWOT analysis. This report delves into their market position, operational strengths, potential risks, and future opportunities, providing actionable intelligence for informed decision-making.

Ready to leverage Interface's competitive edge and navigate potential challenges? Purchase the full SWOT analysis to access a professionally crafted, editable document packed with expert insights and strategic recommendations, perfect for investors and business leaders.

Strengths

Interface is a recognized leader in environmental sustainability, striving to achieve carbon-negative operations by 2040, a goal pursued without relying on offsets. This deep commitment to ESG principles significantly bolsters its brand reputation and fosters customer loyalty, particularly among consumers increasingly prioritizing eco-conscious products.

The company's 2024 Impact Report showcases tangible progress, detailing substantial reductions in the carbon footprint of its products and a high reliance on renewable energy sources. For instance, the report indicated a 77% reduction in greenhouse gas emissions intensity from their global operations compared to their baseline year of 1996.

Interface boasts an impressive and diverse product lineup, encompassing modular carpet tiles, luxury vinyl tile (LVT), and the specialized nora® rubber flooring. This variety ensures they cater to a broad spectrum of design and functional requirements across different commercial and residential spaces.

The company’s commitment to innovation is evident in its continuous introduction of new collections and materials. A prime example is their development of carbon-capturing technologies, which not only enhances the aesthetic appeal and performance of their flooring but also underscores a strong dedication to environmental responsibility, aligning with growing market demand for sustainable solutions.

Interface has shown impressive financial strength, with its first and second quarter 2025 earnings surpassing analyst predictions. This resilience is a testament to its ability to navigate economic challenges effectively.

The company's 'One Interface' strategy has been a key driver in boosting profitability and maintaining tight cost controls. This disciplined approach to capital management has resulted in a robust balance sheet, positioning Interface favorably for future growth.

Diversified Commercial and Institutional Market Presence

Interface's strength lies in its widespread presence across diverse commercial and institutional markets. This broad reach, spanning corporate offices, healthcare facilities, educational institutions, and retail spaces, significantly reduces its vulnerability to downturns in any single industry. For instance, Interface reported robust growth in its healthcare and education segments during 2024, contributing to overall market resilience.

This diversification strategy allows Interface to consistently tap into various growth avenues. The company's ability to cater to the unique flooring needs of different sectors, from the demanding durability requirements of healthcare to the aesthetic considerations in retail, showcases its adaptability. This multi-sector approach proved particularly beneficial in 2024, as certain sectors experienced stronger recovery than others.

- Broad Market Penetration: Serves corporate offices, healthcare, education, and retail.

- Risk Mitigation: Diversification reduces reliance on any single sector.

- Growth Opportunities: Capitalizes on varied segment performance, with notable 2024 strength in healthcare and education.

Global Strategic Alignment and Market Share Gains

Interface's 'One Interface' strategy, implemented in 2023, is a significant strength, fostering global team unification and boosting commercial productivity. This cohesive approach is also optimizing supply chain management, leading to more efficient operations.

The strategic alignment is delivering accelerated growth across various product lines and crucial market segments. Notably, the Americas region has experienced impressive market share gains, underscoring the effectiveness of this unified global strategy.

- Global Synergy: The 'One Interface' strategy enhances collaboration and operational efficiency worldwide.

- Commercial Boost: Unification drives improved sales performance and market penetration.

- Supply Chain Optimization: Streamlined logistics contribute to cost savings and faster delivery.

- Market Share Expansion: The Americas have seen tangible gains, reflecting successful strategy execution.

Interface’s commitment to environmental sustainability is a core strength, with its ambitious goal of becoming carbon-negative by 2040. This focus is not merely aspirational; it's backed by tangible progress, such as the 77% reduction in greenhouse gas emissions intensity achieved by 2024 compared to their 1996 baseline. This deep-rooted ESG strategy resonates strongly with increasingly eco-conscious consumers and businesses, enhancing brand loyalty and market appeal.

The company’s diversified product portfolio, including modular carpet tiles, luxury vinyl tile (LVT), and nora® rubber flooring, caters to a wide array of market needs. This breadth, combined with continuous innovation in materials and carbon-capturing technologies, ensures Interface remains competitive and responsive to evolving design trends and performance demands.

Interface demonstrates significant financial resilience, with its first and second quarter 2025 earnings exceeding analyst expectations. This financial strength is supported by the effective 'One Interface' strategy, which has driven profitability and maintained stringent cost controls, resulting in a robust balance sheet.

Interface's broad market penetration across diverse sectors like corporate, healthcare, and education provides a significant advantage. This diversification mitigates risk and allows the company to capitalize on varied segment performance, as evidenced by strong growth in healthcare and education during 2024.

| Key Strength | Description | Supporting Data/Metric |

|---|---|---|

| Sustainability Leadership | Commitment to carbon-negative operations by 2040, driving brand value. | 77% reduction in GHG emissions intensity (vs. 1996 baseline) by 2024. |

| Product Diversification | Comprehensive offering including carpet tiles, LVT, and rubber flooring. | Caters to diverse commercial and residential needs. |

| Financial Performance | Exceeded earnings expectations in Q1 and Q2 2025, supported by 'One Interface' strategy. | Demonstrates resilience and effective capital management. |

| Market Reach | Presence across multiple sectors (corporate, healthcare, education, retail). | Reduced reliance on single industry performance; notable 2024 growth in healthcare/education. |

What is included in the product

Analyzes Interface’s competitive position through key internal and external factors.

Highlights internal capabilities and market challenges facing Interface.

Offers a structured framework to identify and address critical business challenges, reducing uncertainty.

Weaknesses

Interface's revenue growth, while positive, has been described as modest. In Q1 2025, the company reported a 3% year-over-year increase in revenue. This growth rate is lower than the company's historical performance, suggesting potential headwinds or areas for improvement in driving top-line expansion.

Interface faced significant gross profit margin pressures, with adjusted gross profit margin dropping in Q1 2025. This was largely driven by escalating manufacturing and freight expenses, especially within the EAAA region. The company is working to manage these cost increases while still pursuing growth.

Interface's reliance on the commercial construction sector makes it particularly vulnerable to macroeconomic shifts. A slowdown in economic activity, especially in key markets like the EAAA region, can directly reduce demand for flooring solutions as new projects are delayed or scaled back.

For instance, if interest rates continue to rise or inflation remains elevated through 2024 and into 2025, this could dampen commercial real estate development, impacting Interface's sales pipeline. The company's performance is therefore closely tied to the health of the broader economy and the stability of global financial markets.

Intense Competition

Interface operates within a fiercely competitive floorcovering industry, facing numerous manufacturers, many of whom command superior financial strength. This intense rivalry puts pressure on Interface's ability to effectively compete on pricing, allocate capital for business development, innovate in product design, and clearly differentiate its sustainability initiatives.

The floorcovering market is crowded, and Interface's competitors, such as Mohawk Industries and Shaw Industries, often have larger marketing budgets and established distribution networks. For instance, in 2023, Mohawk Industries reported net sales of approximately $11.4 billion, significantly larger than Interface's reported net sales of $1.3 billion for the same period, highlighting a substantial resource disparity.

- Market Saturation: The global commercial carpet market is highly saturated, with established players and new entrants vying for market share.

- Price Sensitivity: Many commercial clients are highly price-sensitive, making it challenging for Interface to command premium pricing for its innovative and sustainable products.

- Resource Disparity: Larger competitors often have greater financial resources for R&D, marketing, and acquisitions, enabling them to respond more aggressively to market trends.

- Innovation Race: Competitors are also investing in sustainable materials and design, necessitating continuous innovation from Interface to maintain its competitive edge.

Reliance on Commercial Sector

Interface's reliance on the commercial sector, though diversified within it, presents a notable weakness. A significant downturn in commercial real estate development or renovation projects, which are key drivers for Interface's products, could lead to a disproportionate impact on the company's sales and overall profitability. For instance, during periods of economic uncertainty, construction spending often contracts, directly affecting demand for flooring solutions.

This concentration means that even with a broad customer base across various commercial sub-sectors, Interface remains vulnerable to macroeconomic shifts impacting the built environment. The company's financial performance in 2024 and projections for 2025 will likely reflect this sensitivity. According to industry reports, commercial construction spending experienced fluctuations in late 2023 and early 2024, indicating potential headwinds.

- Sector Concentration: Primary revenue streams are tied to commercial and institutional markets.

- Economic Sensitivity: Vulnerable to slowdowns in commercial real estate development and renovation.

- Market Downturn Risk: A significant contraction in commercial construction could severely impact sales.

- Profitability Impact: Reduced demand directly translates to lower revenue and potentially squeezed profit margins.

Interface's dependence on the commercial sector, while diversified within it, remains a key vulnerability. A downturn in commercial real estate development or renovation projects, which are primary drivers for Interface's products, could disproportionately affect the company's sales and profitability. For example, economic uncertainty often leads to contractions in construction spending, directly reducing demand for flooring solutions.

This concentration means that even with a broad customer base across various commercial sub-sectors, Interface is susceptible to macroeconomic shifts impacting the built environment. Industry reports indicate that commercial construction spending saw fluctuations in late 2023 and early 2024, suggesting potential headwinds for the company's performance in 2024 and 2025.

| Weakness | Description | Impact |

| Sector Concentration | Primary revenue streams tied to commercial and institutional markets. | Vulnerable to slowdowns in commercial real estate development and renovation. |

| Economic Sensitivity | Performance closely linked to broader economic health and commercial construction cycles. | A significant contraction in commercial construction could severely impact sales and profitability. |

| Competitive Landscape | Faces intense competition from larger players with greater financial resources. | Challenges in pricing, R&D investment, marketing, and differentiation. |

What You See Is What You Get

Interface SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re viewing a live preview of the actual SWOT analysis file, ensuring you see exactly what you're getting. The complete version becomes available immediately after checkout.

Opportunities

The global market for sustainable construction materials is experiencing robust growth, projected to reach approximately $300 billion by 2025, a significant increase from previous years. This surge is fueled by increasing environmental consciousness and stricter building codes worldwide, creating a prime opportunity for Interface to capitalize on its established reputation in eco-friendly flooring solutions.

Interface's commitment to sustainability, including its net-zero carbon emissions goal for 2040, positions it favorably to capture a larger share of this expanding market. By continuing to innovate in areas like recycled content and bio-based materials, Interface can further differentiate itself and attract environmentally conscious clients in the construction sector.

Interface has a significant opportunity to expand into new geographies, particularly in emerging markets where demand for sustainable flooring solutions is growing. This expansion could tap into untapped customer bases and drive overall revenue growth.

Further diversification of product offerings and market segments also presents a key opportunity. Building on its strong performance in sectors like healthcare and education, Interface can explore deeper penetration and tailored solutions for these and other specialized markets.

Interface's commitment to sustainability, a key differentiator, can be leveraged for market entry and expansion. For instance, in 2023, the company reported that 97% of its products were carbon neutral across their lifecycle, a strong selling point for environmentally conscious markets.

Interface can capitalize on ongoing technological advancements in flooring materials and installation. This includes developing products with enhanced durability and easier maintenance, directly addressing customer needs for reduced lifecycle costs. For instance, innovations in material science could lead to flooring with superior stain resistance, a key purchasing factor for commercial spaces.

The integration of flooring with smart building systems presents a significant opportunity. Imagine flooring that can monitor foot traffic patterns for energy efficiency optimization or detect spills for immediate cleaning alerts. Interface could lead in developing these "smart" flooring solutions, creating a competitive advantage in the growing smart building market.

Furthermore, focusing on specialized features like improved noise reduction and anti-microbial properties can attract new market segments. In 2024, the demand for healthier and quieter interior environments, particularly in offices and healthcare facilities, is on the rise. Interface's ability to innovate in these areas could unlock substantial new revenue streams.

Circular Economy Practices Adoption

The construction sector's growing embrace of circular economy principles presents a significant avenue for Interface. As a company already committed to sustainability, this trend allows for enhanced market positioning and a stronger appeal to clients prioritizing eco-friendly solutions.

Interface's established expertise in product recyclability and closed-loop systems can be further leveraged. This focus on reuse and regeneration aligns with market demand for sustainable building materials, offering a competitive edge.

- Market Growth: The global circular economy market is projected to reach $4.5 trillion by 2030, with construction being a key sector for adoption.

- Client Demand: Studies indicate over 70% of B2B buyers consider sustainability a key factor in their purchasing decisions.

- Innovation: Interface's continued investment in modular design and material recovery can unlock new revenue streams and reduce waste, potentially saving millions in raw material costs annually.

Strategic Partnerships and Acquisitions

Interface can strategically forge alliances with leading architectural and design studios, as well as major construction firms. These collaborations, potentially including the acquisition of smaller, forward-thinking companies, offer a direct pathway to broadening Interface's market presence, enhancing its product portfolio, and integrating new technological advancements. For instance, a partnership with a prominent sustainable design firm could open doors to new eco-conscious projects, aligning with Interface's commitment to environmental responsibility.

These strategic moves are not just about expansion; they are about accelerating innovation and solidifying Interface's position as a market leader. By integrating the expertise of partners or acquired entities, Interface can quickly gain access to specialized manufacturing techniques or cutting-edge material science. Consider the potential impact of acquiring a company with proprietary bio-based material technology, which could significantly diversify Interface's product offerings and appeal to a wider customer base seeking sustainable solutions.

- Market Reach Expansion: Partnerships with large-scale construction companies can provide access to significant commercial building projects, boosting sales volumes.

- Product Capability Enhancement: Collaborating with design firms can lead to the co-creation of exclusive, high-demand flooring collections.

- Technological Advancement: Acquiring innovative startups can bring in new manufacturing processes or digital design tools, improving efficiency and product customization.

- Reinforced Market Leadership: Strategic alliances signal strength and innovation, deterring competitors and attracting top talent and clients.

Interface can leverage the growing global emphasis on sustainability and the circular economy to its advantage. The company's existing commitment to eco-friendly practices, such as its net-zero carbon emissions goal by 2040 and the fact that 97% of its products were carbon neutral in 2023, positions it well to meet increasing client demand for sustainable building materials. This trend is supported by data showing over 70% of B2B buyers consider sustainability in their purchasing decisions.

Further opportunities lie in expanding into new geographic markets, particularly in regions with a rising demand for sustainable flooring. Interface can also diversify its product portfolio and target specialized market segments like healthcare and education more deeply. Innovations in material science, leading to more durable and lower-maintenance flooring, and the integration of flooring with smart building systems offer additional avenues for growth and competitive differentiation.

Strategic alliances with architectural firms, design studios, and construction companies, including potential acquisitions of innovative startups, can significantly broaden Interface's market reach and enhance its product capabilities. These collaborations can accelerate innovation, allowing Interface to integrate new manufacturing techniques or material science advancements, thereby reinforcing its market leadership.

Threats

Economic downturns significantly threaten Interface by dampening demand in the commercial and institutional construction sectors. Recessions can lead to project delays and cancellations, directly impacting Interface's revenue streams. For instance, a potential slowdown in global GDP growth, projected by the IMF to moderate in 2024-2025 compared to earlier recovery phases, could translate to reduced spending on new builds and renovations, Interface's core markets.

The floorcovering market remains intensely competitive, with numerous domestic and international players actively seeking market share. This environment presents a significant threat to Interface as competitors, particularly those with deeper financial pockets or integrated supply chains, can leverage aggressive pricing strategies or rapid product innovation to challenge Interface's established position and potentially diminish its competitive edge.

Interface faces significant risks from fluctuating raw material prices, particularly for nylon and vinyl, which are key components in their flooring products. For instance, the price of nylon, a major input, experienced considerable volatility in 2024 due to global supply and demand imbalances, directly impacting Interface's cost of goods sold.

Disruptions within the global supply chain, including shipping delays and increased freight costs, also pose a substantial threat. These issues, exacerbated by geopolitical events in 2024, can lead to higher logistics expenses and potential production slowdowns, squeezing Interface's gross profit margins and affecting their ability to meet customer demand promptly.

Shifts in Design Trends and Consumer Preferences

Rapidly evolving interior design trends present a significant challenge for Interface. A sudden shift in consumer preference away from modular carpet tiles, or even LVT and rubber flooring, could directly impact demand for their core offerings. For instance, if a widespread move towards polished concrete or natural materials gains significant traction in commercial spaces, Interface's established product lines might see reduced market share.

While Interface boasts a diverse product portfolio, a pronounced shift towards entirely different flooring categories could still pose a substantial threat. For example, if the market increasingly favors seamless, poured resin flooring for its aesthetic or functional advantages in certain high-traffic commercial environments, this could erode demand for Interface's modular solutions.

- Design Trend Volatility: The commercial design landscape is dynamic, with aesthetic preferences capable of shifting quickly, potentially impacting the appeal of Interface's current product mix.

- Material Substitution Risk: A strong market preference for alternative flooring materials, such as natural stone or advanced composite materials, could divert demand from Interface's modular carpet and LVT offerings.

- Consumer Preference Shifts: Changes in what end-users, like office managers or retail space designers, prioritize – be it sustainability, specific tactile qualities, or unique visual effects – could favor competitors with different product types.

Regulatory and Trade Policy Changes

Changes in international trade policies, such as the imposition of new tariffs, could increase Interface's operational costs or restrict market access for its products. For instance, a significant shift in trade agreements impacting raw material sourcing or finished goods export could directly affect profitability.

Evolving environmental regulations, while generally aligned with Interface's sustainability focus, could also present challenges if compliance requirements become more stringent or costly. For example, new mandates on recycled content or carbon emissions could necessitate additional investment in manufacturing processes.

- Tariff Impact: A hypothetical 10% tariff on imported raw materials could add an estimated $X million to Interface's annual cost of goods sold, based on 2024 sourcing data.

- Regulatory Compliance: Increased investment in meeting new emissions standards could divert capital from other strategic initiatives, potentially impacting R&D timelines.

- Market Access: Trade disputes or protectionist policies could limit Interface's ability to serve key international markets, impacting revenue streams.

Interface faces significant threats from economic downturns, which can reduce demand in construction and renovation markets. Intense competition from rivals employing aggressive pricing or rapid innovation also poses a challenge. Furthermore, volatile raw material prices, supply chain disruptions, and shifting design trends can negatively impact Interface's profitability and market position.

| Threat Category | Specific Risk | Potential Impact | Illustrative Data/Context (2024-2025) |

|---|---|---|---|

| Economic Factors | Global GDP Slowdown | Reduced demand for commercial flooring projects. | IMF projected moderation in global GDP growth for 2024-2025. |

| Competitive Landscape | Aggressive Pricing/Innovation | Erosion of market share and profit margins. | Competitors with stronger financial backing can undercut pricing. |

| Input Costs | Raw Material Price Volatility | Increased cost of goods sold, reduced margins. | Nylon prices experienced significant volatility in 2024. |

| Supply Chain | Disruptions & Freight Costs | Higher logistics expenses, production delays. | Geopolitical events in 2024 contributed to shipping challenges. |

| Market Trends | Shifting Design Preferences | Decreased demand for core product offerings (e.g., carpet tiles). | Potential rise in popularity of alternative materials like polished concrete. |

| Trade & Regulation | Tariffs & Stricter Regulations | Increased operational costs, market access limitations. | New environmental mandates could require additional capital investment. |

SWOT Analysis Data Sources

This interface's SWOT analysis is built upon a foundation of user feedback, usability testing results, and competitive interface benchmarks to provide actionable insights.