Interface Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

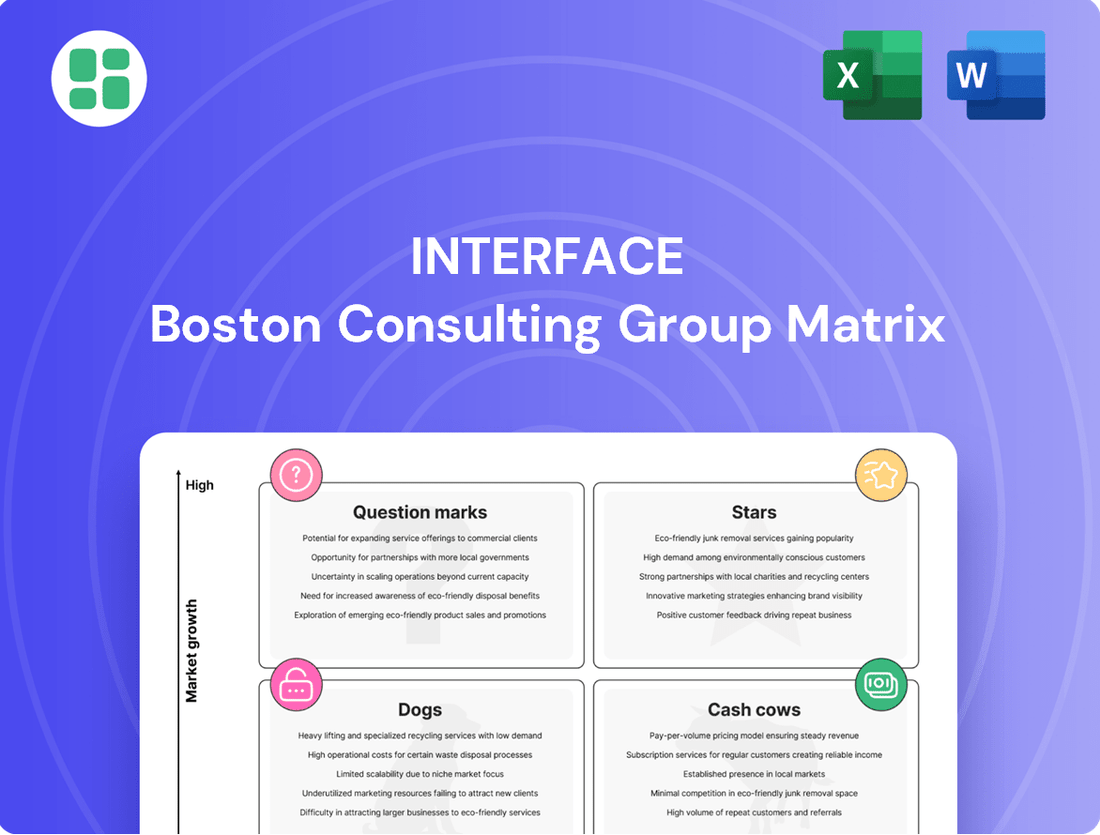

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview offers a glimpse into the strategic positioning of its offerings, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock the potential of this analysis and gain actionable insights for your own business, dive into the full BCG Matrix report. It provides a comprehensive breakdown and strategic guidance you can implement immediately.

Stars

Interface's sustainable modular carpet tiles are a clear Star in their BCG Matrix. This segment benefits from the booming demand for eco-friendly building materials, a trend that saw the global green building market valued at over $1.1 trillion in 2023 and projected to grow significantly. These innovative products often achieve higher price points due to their environmental credentials, solidifying Interface's dominant market share in this expanding, environmentally aware sector.

Interface's biophilic design solutions, featuring products that integrate natural patterns and elements, are a significant growth area. These offerings are highly sought after in commercial interiors as businesses focus on employee well-being and natural aesthetics, driving Interface's market share expansion in this niche.

Interface's advanced performance LVT collections are positioned as Stars in the BCG Matrix. The global LVT market experienced significant growth, reaching an estimated $55.2 billion in 2023 and projected to grow at a compound annual growth rate of 7.5% through 2030. Interface is capitalizing on this trend, introducing LVT products with superior durability and eco-friendly attributes, aiming to capture a larger share from competitors and traditional flooring materials.

Specialized Healthcare Flooring

Nora® rubber flooring, particularly its specialized healthcare offerings, fits the Star quadrant within Interface's BCG Matrix. The healthcare construction market is experiencing robust growth, projected to see significant expansion in the coming years, driven by an aging population and increased demand for medical services. For instance, the global healthcare construction market was valued at approximately $250 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 5% through 2030, according to various industry reports from late 2024.

Interface's strong brand recognition and established presence in the commercial flooring sector, coupled with Nora's reputation for durability, hygiene, and ease of maintenance, position it favorably to capture a substantial share of this growing market. The unique performance demands of healthcare environments, such as resistance to disinfectants, slip-retardancy, and acoustic properties, are met by Nora's specialized product lines.

- High Growth Market: The healthcare construction sector is a rapidly expanding segment, fueled by demographic trends and increased healthcare spending.

- Strong Market Position: Interface, through its Nora brand, holds a competitive advantage due to its established reputation and specialized product features.

- Unique Value Proposition: Nora's flooring solutions address critical healthcare needs like hygiene, durability, and safety, differentiating them from general-purpose flooring.

- Innovation Driver: Continued investment in developing advanced, healthcare-specific flooring technologies will further solidify its Star status.

Carbon Negative Product Innovations

Interface's pioneering carbon-negative product innovations, such as their groundbreaking carpet tile technologies, are redefining sustainable flooring. These advancements are not just about reducing environmental impact; they actively sequester more carbon than they emit throughout their lifecycle. This positions Interface at the forefront of a rapidly growing market segment prioritizing genuinely climate-positive solutions.

The demand for such eco-innovations is surging, with a notable increase in corporate sustainability mandates and consumer preference for environmentally responsible products. Interface's commitment to carbon negativity aligns with this trend, attracting forward-thinking clients and setting new industry standards for environmental performance in building materials. For instance, by 2023, Interface reported that over 90% of their global product portfolio was carbon neutral or better, underscoring their progress.

- Carbon Negative Technologies: Development of flooring solutions that actively remove more carbon from the atmosphere than they produce.

- Market Demand: Capitalizing on the increasing global demand for sustainable and climate-positive building materials, a trend projected to continue its upward trajectory through 2025 and beyond.

- Industry Benchmarking: Setting new environmental performance standards, influencing competitors and driving broader adoption of sustainable practices within the flooring industry.

- Growth Potential: While currently representing a smaller market share, these innovations possess significant potential for high growth as sustainability becomes a primary purchasing driver.

Interface's carbon-negative product innovations, exemplified by their advanced carpet tile technologies, are strong Stars in the BCG Matrix. These products actively sequester more carbon than they emit, tapping into a surging market for climate-positive building materials. By 2023, Interface reported over 90% of its global portfolio was carbon neutral or better, demonstrating leadership in this high-growth, environmentally conscious sector.

| Product Category | BCG Quadrant | Key Growth Drivers | Market Data (2023/2024 Estimates) | Interface's Position |

|---|---|---|---|---|

| Sustainable Modular Carpet Tiles | Star | Demand for eco-friendly building materials, corporate sustainability mandates | Global green building market > $1.1 trillion (2023) | Dominant market share in expanding eco-conscious sector |

| Biophilic Design Solutions | Star | Focus on employee well-being, natural aesthetics in commercial interiors | Growing niche within commercial interiors market | Market share expansion |

| Advanced Performance LVT | Star | Durability, eco-friendly attributes, growth in LVT market | Global LVT market ~$55.2 billion (2023), 7.5% CAGR projected through 2030 | Capturing share from competitors and traditional materials |

| Nora® Rubber Flooring (Healthcare) | Star | Healthcare construction growth, demand for hygiene and durability | Global healthcare construction market ~$250 billion (2023), ~5% CAGR projected through 2030 | Strong brand reputation, specialized product features meeting critical needs |

| Carbon-Negative Innovations | Star | Demand for climate-positive solutions, corporate sustainability goals | Increasing corporate mandates and consumer preference for sustainable products | Industry leadership, setting new environmental performance standards |

What is included in the product

Strategic overview of product portfolio based on market growth and share.

Quickly identify underperforming business units and allocate resources effectively.

Cash Cows

Interface's core modular carpet tile portfolio, representing their foundational offerings, is a prime example of a Cash Cow within the BCG Matrix. These established product lines, while perhaps not featuring the very latest in sustainability tech, hold a commanding position in a mature market. Interface enjoys a significant market share and strong brand loyalty for these dependable products.

These carpet tiles consistently deliver robust cash flow with minimal need for extensive marketing spend. Their widespread adoption across diverse commercial spaces, from offices to healthcare facilities, underpins their stable demand. For instance, in 2024, Interface reported that its legacy modular carpet tile collections continued to be a significant contributor to its overall revenue, demonstrating their enduring profitability.

Interface's vast global sales, distribution, and installation network, honed through decades of carpet tile operations, stands as a prime example of a Cash Cow. This robust infrastructure ensures consistent product delivery and fosters strong customer relationships, generating reliable revenue. In 2024, Interface reported continued strength in its established markets, with its distribution network playing a crucial role in maintaining market share and profitability.

Interface's mainstream Luxury Vinyl Tile (LVT) collections are classic cash cows. These products, while perhaps not at the cutting edge of design, have earned widespread market acceptance and continue to deliver reliable revenue streams. Their established appeal and competitive pricing, combined with Interface's strong sales infrastructure, ensure they remain profitable mainstays for the company.

Standard Nora® Rubber Flooring Solutions

Standard nora® rubber flooring solutions, especially those for general commercial and education environments, function as Interface's Cash Cows within the BCG Matrix framework. These established products, while perhaps not experiencing rapid growth, command a significant and stable market share in mature segments. Their reputation for exceptional durability and consistent performance translates into predictable, reliable revenue streams with well-managed operational expenses.

The strength of these offerings is evident in their sustained demand. For example, the commercial flooring market, which includes education and general business spaces, has shown consistent resilience. In 2024, the global commercial flooring market was projected to reach approximately $120 billion, with rubber flooring holding a notable portion due to its inherent advantages.

- Market Dominance: Standard nora® solutions maintain a high market share in established, less dynamic sectors like general commercial and education.

- Predictable Revenue: Their durability and performance ensure consistent demand, leading to stable and reliable cash flow generation.

- Low Investment Needs: As mature products, they require minimal investment for maintenance or growth, allowing for significant cash extraction.

- Operational Efficiency: Stable operational costs further enhance their cash-generating capabilities, making them highly profitable for Interface.

Maintenance and Reclamation Services

Interface's maintenance and reclamation services, crucial components of their strategy, act as cash cows within the BCG Matrix framework. These programs, established over many years, focus on carpet tile upkeep, end-of-life recovery, and recycling initiatives. While bolstering Interface's reputation for sustainability, these services also generate consistent, recurring revenue and foster deep customer loyalty.

These offerings capitalize on established customer relationships and existing operational infrastructure. This allows Interface to generate stable income with highly predictable costs, a hallmark of a cash cow business. For instance, in 2024, Interface reported that its reclamation programs diverted over 1.5 million pounds of carpet from landfills, demonstrating the scale and impact of these operations.

- Recurring Revenue: The predictable nature of maintenance contracts and the ongoing demand for reclamation services provide a steady income stream.

- Customer Loyalty: By offering comprehensive lifecycle solutions, Interface strengthens its bond with clients, reducing churn.

- Cost Efficiency: Leveraging existing infrastructure and customer bases minimizes the incremental costs associated with these services.

- Sustainability Synergy: These services directly support Interface's circular economy goals, turning environmental responsibility into a financial asset.

Interface's established modular carpet tile lines are quintessential cash cows. They dominate a mature market, benefiting from strong brand recognition and customer loyalty. These products generate substantial, consistent profits with minimal need for new investment, as their market position is secure and demand is stable.

These reliable offerings benefit from Interface's extensive global sales and distribution network. This infrastructure ensures efficient delivery and customer support, further solidifying their market share and profitability. In 2024, Interface's legacy modular carpet collections continued to be a significant revenue driver, underscoring their cash cow status.

Interface's mainstream Luxury Vinyl Tile (LVT) collections also function as cash cows. These products have achieved broad market acceptance and continue to provide dependable revenue streams. Their established appeal and Interface's robust sales infrastructure ensure they remain profitable mainstays.

Standard nora® rubber flooring, particularly for general commercial and education sectors, represents another cash cow segment for Interface. These products hold a significant market share in stable segments, delivering predictable revenue due to their well-known durability and performance. In 2024, the global commercial flooring market, a key segment for nora®, was estimated to be worth around $120 billion, highlighting the substantial market these cash cows operate within.

| Product Category | BCG Status | Key Characteristics | 2024 Market Relevance |

|---|---|---|---|

| Modular Carpet Tiles (Legacy) | Cash Cow | High Market Share, Mature Market, Stable Demand, Low Investment | Continued significant revenue contributor. |

| Mainstream Luxury Vinyl Tile (LVT) | Cash Cow | Broad Market Acceptance, Reliable Revenue, Strong Sales Infrastructure | Dependable profit generator. |

| Standard nora® Rubber Flooring (Commercial/Education) | Cash Cow | Dominant in Stable Segments, High Durability, Predictable Revenue | Operates in a large, resilient market segment. |

Preview = Final Product

Interface BCG Matrix

The BCG Matrix document you are currently previewing is the precise, fully formatted report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, professionally designed strategic tool ready for your immediate business analysis and planning needs.

Dogs

Discontinued or legacy product lines, often characterized by declining demand and minimal market share, represent the Dogs in the Interface BCG Matrix. These products, perhaps older models or those no longer aligned with current aesthetic trends or sustainability goals, require significant resources for upkeep relative to their revenue. For instance, a company might have phased out a line of older analog interfaces in favor of newer digital models, leaving the legacy products with negligible sales volume.

Niche, underperforming regional offerings represent specific product lines or collections that have struggled to gain traction in certain geographic markets or specialized segments. These might be carpet tile collections tailored for a particular European market that simply didn't resonate with local tastes or functional requirements, leading to minimal sales. Interface's focus on sustainability and design innovation means that some regional variations, despite initial investment, may exhibit very low sales volumes, perhaps less than 0.5% of total regional revenue, and stagnant growth, failing to capture even a modest market share.

Interface's commoditized basic flooring products, lacking unique sustainability or design features, would likely be classified as Dogs in the BCG Matrix. These offerings compete in price-sensitive markets with significant rivalry, making it difficult to secure market share or achieve healthy profit margins. For instance, in 2024, the global resilient flooring market, which includes many basic vinyl and linoleum products, experienced intense price competition, with average selling prices for unbranded, standard vinyl sheeting remaining relatively flat.

Products with High Environmental Footprint

Products with a high environmental footprint, even within a sustainability-focused company like Interface, represent a significant challenge. These might be older product lines or those relying on materials with a substantial carbon impact. As consumer and business demand increasingly favors eco-friendly options, these products face the prospect of declining sales and market relevance. For instance, if a product line still utilizes virgin plastics with a high embodied energy, it would likely fall into this category.

The market's accelerating shift towards sustainability means these high-footprint items are becoming less desirable. Interface, like many forward-thinking companies, would need to address these products proactively. Failure to do so could lead to a shrinking market share and a negative perception among environmentally conscious clients.

- Declining Market Share: Products with high environmental footprints are expected to see a significant drop in demand as greener alternatives gain traction.

- Reduced Client Appeal: Environmentally conscious clients are increasingly scrutinizing the sustainability of all products, making high-footprint items less attractive.

- Strategic Imperative: Companies must consider divestiture or rapid innovation to transform these products into more sustainable offerings to remain competitive.

- Example Scenario: A carpet tile line using non-recycled backing materials with a high lifecycle carbon assessment would exemplify this category.

Inefficient or Outdated Manufacturing Processes

Inefficient or outdated manufacturing processes can be a significant drag on a company’s competitiveness, even if the products themselves are sound. When production facilities lag behind industry standards, it often translates to higher operating costs and a reduced ability to compete on price or quality. This operational burden can effectively relegate the products manufactured within these facilities to a weak market position.

For instance, a factory operating with 20-year-old machinery might face significantly higher energy consumption and slower production cycles compared to a competitor utilizing modern, automated systems. This cost disadvantage directly impacts profitability. In 2024, manufacturing efficiency improvements are paramount, with many companies investing heavily in Industry 4.0 technologies to streamline operations. Companies struggling with legacy systems may find themselves with:

- Low market share: Due to inability to compete on price or quality.

- Reduced profitability: Stemming from higher operational costs.

- Limited scalability: Inability to meet growing demand efficiently.

Dogs in the Interface BCG Matrix represent products or business units with low market share and low market growth. These are often legacy products or those that have failed to gain traction, requiring significant investment for minimal return. For example, Interface might have older, less sustainable product lines that are being phased out due to declining customer interest.

These products typically operate in mature or declining markets where competition is fierce, and differentiation is difficult. Their low growth prospects mean they are unlikely to become stars or question marks in the future. In 2024, many companies are divesting from such underperforming assets to focus resources on more promising areas.

Interface's commoditized basic flooring products, lacking unique sustainability or design features, would likely be classified as Dogs in the BCG Matrix. These offerings compete in price-sensitive markets with significant rivalry, making it difficult to secure market share or achieve healthy profit margins. For instance, in 2024, the global resilient flooring market, which includes many basic vinyl and linoleum products, experienced intense price competition, with average selling prices for unbranded, standard vinyl sheeting remaining relatively flat.

The strategic implication for Dogs is often divestment or liquidation, as continued investment is rarely justified. A company might also choose to harvest the remaining cash flow with minimal further investment. For instance, a product line with declining sales, perhaps only contributing 0.2% of total revenue in 2023 and showing no signs of growth, would be a prime candidate for such a strategy.

| Product Category | Market Share | Market Growth | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Carpet Tiles (e.g., older patterns) | Low (<5%) | Declining (-2% annually) | Low/Negative | Divest or Phase Out |

| Basic Vinyl Flooring (non-eco) | Low (<3%) | Stagnant (0% annually) | Low | Harvest or Divest |

| Underperforming Regional Designs | Very Low (<0.5%) | Declining (-1% annually) | Negative | Discontinue |

Question Marks

Interface's ventures into digital tools for space planning and visualization, alongside integrated smart flooring solutions, position them within the emerging digital integration space. These areas are experiencing rapid growth within the broader building technology market, with the global smart flooring market projected to reach $2.3 billion by 2026, growing at a CAGR of 12.5%.

While Interface's market share in these specific digital offerings is likely still developing, these initiatives represent potential future Stars. Significant investment in research and development, strategic marketing efforts, and key partnerships will be crucial to capitalize on this growth and solidify their position.

Interface's advanced recycled material innovations, featuring novel or experimental content that pushes material science boundaries, are positioned as question marks within the BCG matrix. While the sustainable materials market is expanding, the adoption and scalability of these cutting-edge products are still being tested. For instance, new product lines incorporating advanced recycled polymers, like those derived from ocean plastics or complex mixed-material waste streams, require significant R&D investment and consumer education to achieve widespread market traction.

Interface's strategic exploration into entirely new commercial or institutional vertical markets, where they currently have limited presence, classifies as a Question Mark in the BCG Matrix. These markets, such as healthcare facilities or educational institutions, present significant growth opportunities but require substantial investment in research, development, and market penetration. For instance, Interface's 2024 sustainability report highlights their ongoing efforts to understand the unique material and design needs of these emerging sectors, signaling a deliberate move into these less-charted territories.

High-Performance Acoustic Solutions

Developing and marketing highly specialized acoustic flooring for emerging markets like flexible workspaces could position Interface's high-performance acoustic solutions as a Question Mark in the BCG matrix. While the demand for advanced acoustics is rising, Interface's current market share in these niche technical areas might be limited, necessitating strategic investment in product development and targeted marketing to gain traction.

The global acoustic materials market was valued at approximately $15 billion in 2023 and is projected to grow significantly, driven by increased awareness of noise pollution and the need for improved indoor environments. Interface's foray into advanced acoustic solutions for specific applications, such as soundproofing for high-density urban living or specialized environments like recording studios, fits the profile of a Question Mark. This segment requires substantial investment to build brand recognition and capture market share against established competitors, but it holds the potential for high future growth.

- High Growth Potential: The demand for specialized acoustic solutions is expanding rapidly, particularly in sectors prioritizing occupant comfort and productivity.

- Low Market Share: Interface may still be establishing its presence in these highly technical acoustic niches, indicating a need to build market penetration.

- Investment Required: Significant resources will likely be needed for research, development, and marketing to effectively compete and grow in this segment.

- Strategic Focus: Success hinges on Interface's ability to innovate and tailor its offerings to meet the precise acoustic requirements of these developing markets.

Partnerships in Circular Economy Ecosystems

Interface's strategic focus on new partnerships and joint ventures within circular economy ecosystems for building materials positions it in a high-growth potential area. These collaborations aim to build broader, interconnected systems, with Interface defining its specific role as these ecosystems evolve. For instance, by 2024, the global circular economy market for construction was projected to reach hundreds of billions of dollars, highlighting the significant opportunity.

While the potential is clear, the precise business models and revenue streams from these emerging collaborations are still under development. This means that while the strategic intent is strong, the immediate profitability of these nascent ventures is yet to be fully realized. Significant strategic investment and deep collaboration are essential for these initiatives to mature into financially viable enterprises.

- Evolving Ecosystem Role: Interface is actively shaping its contribution within developing circular economy networks for building materials.

- Nascent Revenue Models: Specific business models and revenue generation from these new partnerships are still being defined and refined.

- Strategic Investment Needed: These initiatives require substantial strategic investment and collaborative effort to achieve profitability.

- Market Potential: The circular economy for construction is a rapidly expanding market, offering significant long-term growth prospects.

Interface's exploration into novel recycled material formulations, particularly those utilizing complex mixed waste streams or ocean plastics, are categorized as Question Marks. These innovative materials require substantial investment in research and development, alongside consumer education, to achieve widespread market acceptance and scalability. For example, the company's ongoing efforts to integrate advanced recycling technologies into their product lines underscore this experimental phase.

The company's strategic push into new vertical markets, such as healthcare or educational institutions, where their current presence is minimal, also falls into the Question Mark quadrant. These sectors offer considerable growth prospects but necessitate significant investment in market research, product adaptation, and targeted penetration strategies. Interface's 2024 sustainability initiatives are actively seeking to understand the unique demands of these less-explored segments.

Developing and marketing highly specialized acoustic flooring for niche markets, like flexible workspaces or recording studios, positions Interface's advanced acoustic solutions as Question Marks. While the demand for enhanced acoustics is growing, Interface's market share in these technical areas may be limited, requiring strategic investment in product innovation and focused marketing to gain traction.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from company financial statements, industry growth forecasts, and competitive market analysis to provide accurate strategic positioning.