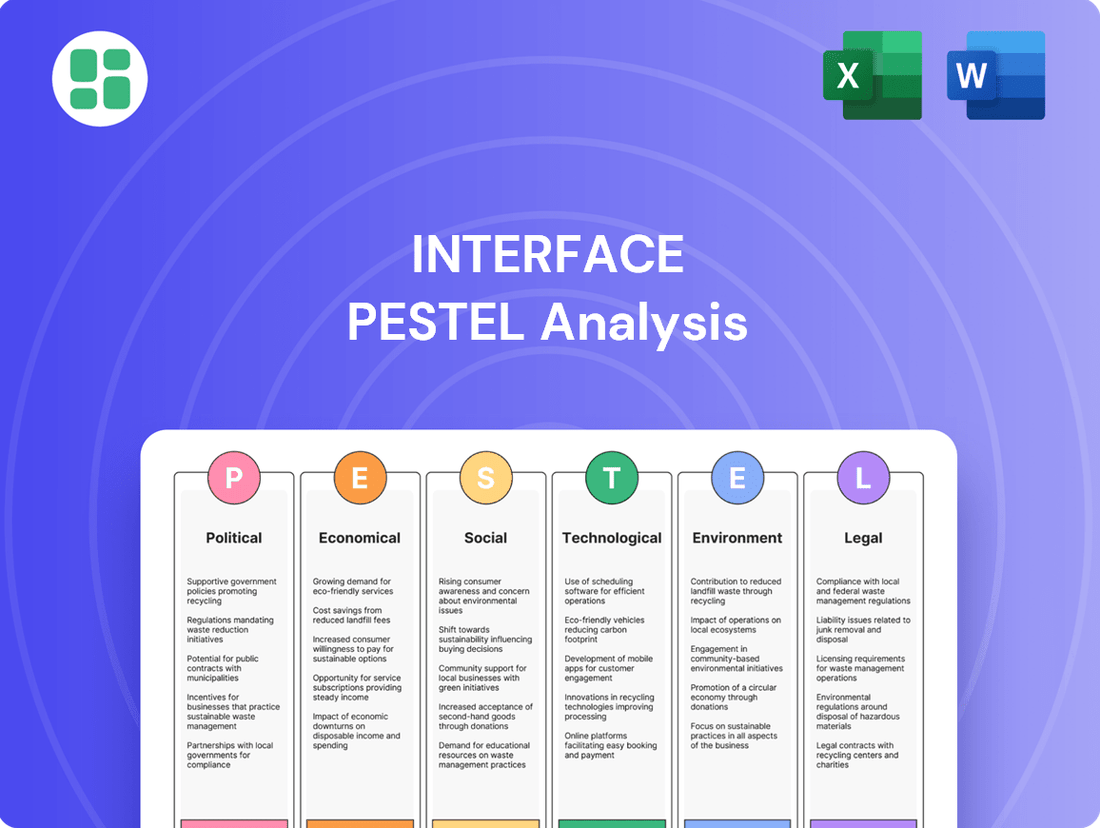

Interface PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

Interface operates within a dynamic global landscape, influenced by a complex interplay of Political, Economic, Social, Technological, Legal, and Environmental factors. Understanding these external forces is crucial for strategic planning and staying ahead of the curve. Our comprehensive PESTLE analysis delves deep into these trends, offering actionable intelligence tailored for Interface. Don't miss out on critical insights that could redefine your market approach – download the full report now!

Political factors

Government policies and incentives promoting green building standards directly influence demand for Interface's sustainable flooring. For instance, the U.S. Environmental Protection Agency's (EPA) new label program for low embodied carbon construction materials, launched in 2024, prioritizes American-made, lower-carbon materials for federal projects, potentially creating substantial market opportunities for Interface.

Interface's strong commitment to sustainability, including its Mission Zero and Climate Take Back initiatives, positions it favorably to capitalize on these evolving regulatory landscapes and certifications. The company's focus on recycled content and reduced environmental impact aligns with increasing governmental emphasis on eco-friendly construction practices.

Global trade policies, including tariffs and import/export regulations, directly influence Interface's supply chain costs and market access. For instance, changes in trade agreements or new tariffs can alter the price of key raw materials like nylon or polypropylene, impacting production expenses. In 2024, the ongoing re-evaluation of trade relationships by major economies could introduce volatility, requiring Interface to adapt its sourcing and pricing strategies to maintain competitiveness in diverse international markets.

Interface's performance is significantly tied to the political stability and regulatory landscapes in its core markets, particularly within the commercial, healthcare, and education sectors. Uncertainty or instability in these areas can dampen investment and slow down project pipelines, directly impacting demand for Interface's flooring solutions.

Geopolitical events and evolving government priorities can also play a crucial role. For instance, shifts in government spending on infrastructure or public sector initiatives, like new hospital constructions or school modernizations, can create substantial opportunities for commercial flooring providers like Interface. A stable political environment generally fosters greater confidence for businesses and institutions to undertake these capital expenditures.

Looking at 2024 and projections into 2025, many developed economies are experiencing a degree of political flux, which could introduce headwinds. However, in regions prioritizing sustainable development and public infrastructure upgrades, like parts of Europe and North America, there's potential for increased demand. For example, government stimulus packages aimed at green building initiatives in 2024 could benefit companies like Interface that focus on sustainable materials.

Building Codes and Standards

Evolving building codes and performance standards, particularly those emphasizing energy efficiency, indoor air quality, and sustainable materials, directly influence product development and specifications. For example, the upcoming 2025 U.S. Building Performance Standards are expected to elevate benchmarks for energy efficiency, further promoting green building certifications such as LEED, which Interface's product portfolio is well-positioned to support.

Compliance with these increasingly stringent regulations is paramount for ensuring market acceptance and maintaining a competitive edge in the flooring industry. Interface's commitment to innovation in sustainable materials and design directly addresses these evolving requirements.

- Energy Efficiency Mandates: New codes are pushing for lower energy consumption in buildings, impacting material choices.

- Green Building Certifications: Standards like LEED v5, anticipated for release in late 2024 or early 2025, will likely increase requirements for recycled content and low-VOC materials.

- Indoor Air Quality (IAQ) Standards: Stricter IAQ regulations are driving demand for products with verified low emissions.

Government Procurement Policies

Government procurement policies can significantly impact Interface. Agencies and publicly funded institutions are substantial customers, and policies favoring sustainable or locally sourced goods offer a distinct advantage. For instance, the US federal government's 'Buy Clean' initiative, established to encourage the use of low-carbon building materials, directly benefits Interface's eco-friendly product offerings.

These policies can translate into tangible opportunities:

- Increased demand for Interface's low-carbon flooring solutions due to government mandates.

- Potential for Interface to secure larger contracts with public sector entities prioritizing sustainability.

- A competitive edge over manufacturers not aligned with these green procurement standards.

Government policies and incentives directly shape Interface's market. For example, the U.S. federal government's 'Buy Clean' initiative, promoting low-carbon building materials, favors Interface's sustainable flooring. Furthermore, upcoming building codes, like the anticipated 2025 U.S. Building Performance Standards, are expected to tighten energy efficiency and indoor air quality requirements, areas where Interface excels.

Trade policies and geopolitical stability also play a critical role. Changes in tariffs or trade agreements can impact raw material costs for Interface, as seen with ongoing re-evaluations of trade relationships by major economies in 2024. Political stability in key markets fosters confidence for capital expenditures, directly influencing demand for Interface's commercial flooring solutions.

The company's proactive stance on sustainability, including its Mission Zero and Climate Take Back initiatives, aligns with increasing global regulatory emphasis on eco-friendly construction. This positions Interface to benefit from green building certifications and government procurement policies favoring sustainable products.

Interface's strategic alignment with evolving building codes and government procurement policies is crucial for its growth. The company's focus on recycled content and low-carbon materials directly addresses new standards like LEED v5, anticipated in late 2024 or early 2025, which will likely increase demand for such products.

| Policy/Regulation Area | Impact on Interface | Key Data/Trend (2024-2025) |

|---|---|---|

| Green Building Standards | Increased demand for sustainable products | LEED v5 anticipated late 2024/early 2025, likely raising recycled content requirements. |

| Government Procurement | Preferential treatment for eco-friendly materials | US 'Buy Clean' initiative benefits Interface's low-carbon offerings. |

| Trade Policies | Potential impact on raw material costs | Ongoing re-evaluation of trade relationships in 2024 could introduce volatility. |

| Building Performance Standards | Drive for energy efficiency and IAQ | 2025 US Building Performance Standards expected to elevate benchmarks. |

What is included in the product

Interface PESTLE Analysis examines the influence of external macro-environmental factors on Interface's operations and strategy across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable overview of external factors, enabling teams to proactively identify and address potential challenges before they become significant problems.

Economic factors

Global economic health is a critical driver for Interface, as its sales are directly tied to the performance of the commercial and institutional construction sectors. A robust economy generally translates to increased investment in new buildings and renovations, boosting demand for Interface's flooring solutions.

Looking ahead to 2025, the U.S. construction industry is projected for growth, though perhaps at a more measured pace. This expansion is expected to be particularly noticeable in non-residential segments, including manufacturing facilities, warehouses, data centers, hospitality, healthcare, and educational institutions. These growing sectors represent a fundamental demand base for Interface's product offerings.

Inflationary pressures and the fluctuating costs of raw materials like nylon, polyester, and natural fibers directly impact Interface's manufacturing expenses and overall profitability. These material costs are a significant component of their cost of goods sold.

Interface experienced gross profit margin expansion in the second quarter of 2025, a positive sign attributed to increased pricing strategies and a more favorable product mix. However, persistent upward trends in raw material prices could present ongoing challenges to maintaining these margins.

Interest rates are a significant factor for Interface, as they heavily influence the financing of commercial real estate projects. Lower interest rates generally make it more affordable for developers to secure loans for new construction and renovations, which directly impacts demand for Interface's flooring products.

Looking ahead to 2025, many economists are anticipating a potential decline in interest rates. For instance, the Federal Reserve has signaled a possible shift towards easing monetary policy if inflation continues to moderate. This easing could translate into lower borrowing costs, making commercial real estate development more attractive.

An environment of declining interest rates in 2025 is expected to stimulate investment across various commercial sectors, including offices, healthcare, and education. This increased construction activity would likely translate into higher demand for flooring solutions as these projects move forward, benefiting companies like Interface.

Commercial Client Spending Trends

Interface's commercial client spending is a key indicator of its market performance. The company's Q2 2025 earnings report highlighted significant increases in billings across several critical sectors.

Specifically, the healthcare sector demonstrated exceptional resilience and growth, with global billings up by a substantial 28%. This surge reflects increased investment in healthcare facilities and a demand for updated, hygienic, and aesthetically pleasing interior environments.

The education sector also showed positive momentum, with an 11% rise in global billings. This growth suggests that educational institutions are prioritizing facility upgrades and renovations to enhance learning spaces.

Furthermore, the corporate office segment experienced a 3% increase in global billings. While more modest, this growth indicates a continued, albeit slower, trend of companies investing in their workspaces, potentially driven by hybrid work models and a focus on employee well-being.

- Healthcare Sector Growth: Q2 2025 global billings increased by 28%.

- Education Sector Growth: Q2 2025 global billings increased by 11%.

- Corporate Office Sector Growth: Q2 2025 global billings increased by 3%.

Currency Exchange Rates

Currency exchange rates are a critical economic factor for Interface, a global manufacturer. Fluctuations can significantly impact its reported revenues and the overall cost of its international operations. For instance, if the US dollar strengthens against other major currencies, Interface's overseas earnings, when translated back into dollars, would appear lower.

In the second quarter of 2025, Interface reported currency-neutral net sales growth, indicating that its underlying business performance was positive even before accounting for currency impacts. However, this doesn't negate the potential for unfavorable currency movements to negatively affect financial results in specific regions or across the company as a whole in future reporting periods.

- Impact on Revenue: A stronger US dollar can decrease the reported value of international sales.

- Cost of Operations: Conversely, a weaker US dollar can increase the cost of imported raw materials or components.

- Q2 2025 Performance: Interface achieved currency-neutral net sales growth in Q2 2025, showing resilience in its core business.

- Future Risk: Ongoing volatility in exchange rates remains a key risk that could impact profitability in different markets.

Economic growth directly fuels demand for Interface's flooring products, as commercial construction projects are highly sensitive to the overall health of the economy. Projections for 2025 indicate continued expansion in key non-residential sectors like manufacturing and healthcare, providing a solid foundation for Interface's sales.

Inflationary pressures and raw material costs remain a concern, impacting Interface's cost of goods sold. However, the company demonstrated an ability to offset some of these pressures through pricing strategies, as evidenced by gross profit margin expansion in Q2 2025.

Anticipated interest rate decreases in 2025 could significantly boost commercial real estate development, leading to increased demand for Interface's offerings. This trend is supported by positive billings growth in sectors like healthcare and education during Q2 2025.

Currency fluctuations present an ongoing risk for Interface's global operations, potentially affecting reported revenues. Despite this, the company achieved currency-neutral net sales growth in Q2 2025, highlighting the underlying strength of its business.

| Economic Factor | 2025 Outlook/Trend | Impact on Interface | Supporting Data (Q2 2025) |

|---|---|---|---|

| Economic Growth | Moderate expansion in non-residential construction | Increased demand for flooring | Healthcare billings +28%, Education billings +11% |

| Inflation/Material Costs | Persistent upward pressure | Increased manufacturing expenses, potential margin pressure | Gross profit margin expansion achieved via pricing |

| Interest Rates | Potential decline signaling easing monetary policy | Stimulates commercial real estate investment, higher demand | Corporate office billings +3% |

| Currency Exchange Rates | Volatility expected | Impacts reported international revenues and costs | Currency-neutral net sales growth |

Full Version Awaits

Interface PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Interface PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a complete Interface PESTLE Analysis.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive Interface PESTLE Analysis.

Sociological factors

Societal shifts are increasingly prioritizing healthy and sustainable indoor spaces. This is evident in the growing demand for biophilic design elements and materials that promote well-being. For instance, a 2024 survey indicated that 78% of commercial real estate tenants consider indoor air quality a key factor in their leasing decisions.

Interface's product offerings directly address this trend, with a focus on low-VOC (volatile organic compound) materials and designs that bring nature indoors. This commitment resonates with clients seeking to enhance occupant comfort and productivity, as studies from 2024 showed a 15% increase in reported employee satisfaction in offices with improved indoor environmental quality.

The ongoing evolution of work, with hybrid and remote arrangements becoming standard, significantly impacts office spaces. By 2025, companies are prioritizing adaptable environments that encourage teamwork and a sense of belonging, often integrating residential comfort cues. This trend directly fuels demand for flooring that can easily be reconfigured, such as modular carpet tiles or luxury vinyl tile (LVT), which facilitate dynamic space planning.

Clients, investors, and employees are increasingly scrutinizing companies for their commitment to corporate social responsibility (CSR) and ethical operations. Interface's proactive stance, particularly its ambitious carbon-negative goals, resonates strongly with this growing demand for responsible business practices.

Interface's dedication to sustainability, evidenced by its transparent impact reporting, directly bolsters its brand image. This commitment is particularly attractive to a market segment that prioritizes ethical business conduct, a trend that has seen significant growth in consumer and investor preferences throughout 2024 and into 2025.

Demographic Shifts and Sector Needs

Demographic shifts significantly shape the demand for products and services across various sectors, directly impacting companies like Interface. For example, the growing global population, projected to reach 8.5 billion by 2030, will increase the need for infrastructure, including schools and healthcare facilities.

An aging population is a key driver for the healthcare sector. In the US, the number of individuals aged 65 and over is expected to reach 73 million by 2030. This demographic trend translates into a greater demand for healthcare spaces, requiring flooring solutions that are not only durable and easy to maintain but also prioritize hygiene and safety, such as anti-microbial properties and slip resistance.

Simultaneously, evolving educational models are transforming learning environments, from K-12 institutions to higher education. Interface's flooring solutions need to cater to these changing needs, offering adaptability and acoustic performance to support diverse teaching methods and student well-being. For instance, flexible learning spaces that can be easily reconfigured demand modular flooring systems.

- Healthcare Demand: The increasing number of elderly individuals worldwide, with over 20% of the population in developed countries expected to be 65+ by 2050, fuels expansion in healthcare facilities.

- Educational Adaptability: The global education market is projected to grow, with a rising emphasis on technology integration and flexible classroom designs, requiring versatile flooring.

- Performance Requirements: Specific demographic needs dictate flooring attributes like enhanced durability for high-traffic areas in hospitals and superior acoustic properties for quieter learning environments.

Aesthetic and Design Trends in Commercial Spaces

Current commercial design trends are leaning heavily towards natural textures, warmer color palettes, and biophilic elements, aiming to create spaces that feel more connected to the outdoors. This shift is driven by a growing awareness of well-being and a desire for more inviting environments.

Interface's product offerings, such as their luxury vinyl tile (LVT) that mimics wood grain and carpet designs featuring organic patterns, directly address these evolving aesthetic preferences. This alignment is vital for maintaining market relevance and appealing to clients who prioritize sophisticated and nature-inspired interiors.

- Biophilic Design Growth: The global biophilic design market was valued at approximately $16.5 billion in 2023 and is projected to grow significantly, indicating a strong demand for nature-integrated spaces.

- Natural Material Preference: A 2024 survey by the American Society of Interior Designers (ASID) found that 70% of designers reported an increased client demand for natural materials and textures in commercial projects.

- Color Psychology in Design: Warmer, earthy tones are increasingly favored to promote comfort and reduce stress, with studies showing a positive impact on occupant mood and productivity in commercial settings.

Societal values are increasingly emphasizing health and sustainability, driving demand for indoor environments that promote well-being. Interface's focus on low-VOC materials and biophilic design directly aligns with this, as evidenced by a 2024 survey showing 78% of commercial tenants prioritizing indoor air quality.

The evolving nature of work, with hybrid models becoming prevalent by 2025, necessitates adaptable office spaces that foster collaboration and belonging. This trend boosts demand for modular flooring solutions that allow for easy reconfiguration, supporting dynamic space planning and a sense of community.

Corporate social responsibility and ethical operations are under heightened scrutiny. Interface's commitment to ambitious carbon-negative goals, backed by transparent impact reporting, strongly appeals to clients and investors prioritizing responsible business practices, a sentiment that gained significant traction throughout 2024.

Demographic shifts, such as an aging global population, are reshaping sector demands. By 2030, the number of individuals aged 65+ in the US is projected to reach 73 million, increasing the need for healthcare facilities requiring durable, hygienic, and safe flooring solutions.

| Societal Factor | Trend Description | Interface Alignment | Supporting Data (2024/2025) |

|---|---|---|---|

| Health & Well-being | Prioritization of healthy indoor spaces and air quality. | Low-VOC materials, biophilic design elements. | 78% of commercial tenants consider indoor air quality key (2024 survey). |

| Future of Work | Rise of hybrid/remote work, need for adaptable spaces. | Modular carpet tiles, LVT for easy reconfiguration. | Companies prioritizing adaptable environments by 2025. |

| Corporate Social Responsibility | Increased demand for ethical operations and sustainability. | Carbon-negative goals, transparent impact reporting. | Growing market segment prioritizing ethical conduct (2024-2025). |

| Demographic Shifts | Aging population driving healthcare demand. | Durable, hygienic, safe flooring for healthcare. | US population 65+ to reach 73 million by 2030. |

Technological factors

Technological progress is significantly influencing the flooring sector, particularly in creating more eco-friendly materials and production methods. Interface is leveraging these advancements, incorporating recycled and bio-based components into its product lines.

Innovations in carbon-neutral manufacturing are crucial. For instance, Interface's commitment to reducing its carbon footprint extends to its carpet tiles, luxury vinyl tile (LVT), and rubber flooring, with ongoing efforts to minimize environmental impact throughout the product lifecycle.

Technological leaps are significantly boosting the resilience and functionality of commercial flooring. Innovations like hybrid flooring, waterproof laminates, and advanced vinyl compounds, alongside improved carpet tile backing, are creating surfaces far more capable of withstanding the rigors of high-traffic areas, moisture, and spills.

These advancements are particularly crucial for sectors like healthcare and education, where hygiene and durability are paramount. For instance, the global commercial flooring market, valued at approximately $100 billion in 2023, is seeing a growing demand for materials that offer superior performance and longevity, directly impacting product development and material science within companies like Interface.

The integration of digital tools like Building Information Modeling (BIM) and artificial intelligence (AI) is fundamentally reshaping how products are specified and incorporated into building projects. For instance, by 2024, the global BIM market was projected to reach over $11 billion, indicating its widespread adoption and influence on design decisions.

Advanced technologies enabling complex patterns and 3D printing, driven by digital design software, are expanding manufacturing precision and aesthetic possibilities. This allows for a greater variety of product offerings that cater to contemporary architectural demands, directly impacting the interface between design and material production.

Recycling Technologies for Flooring Materials

Interface's commitment to a circular economy, exemplified by its ReEntry® program, hinges on advancements in recycling and reclamation technologies. These innovations are key to processing post-consumer carpet tiles and other flooring materials, facilitating closed-loop systems. This reduces waste significantly and lessens the dependence on new raw materials.

Technological progress allows for the efficient separation of carpet components, such as nylon face fiber and backing materials. For instance, in 2023, Interface reported that its ReEntry program diverted over 1.2 million pounds of carpet from landfills in North America alone. This highlights the tangible impact of improved recycling processes.

- Nylon Reclamation: Technologies are evolving to recover and recycle nylon face fiber from used carpet tiles, turning it into new yarn.

- Backing Material Recycling: Innovations are enabling the recycling of carpet backing, often containing PVC or bitumen, into new backing products.

- Closed-Loop Systems: The goal is to create systems where old Interface products are recycled back into new Interface products, minimizing virgin resource use.

- Waste Diversion Rates: Continued investment in technology aims to increase the percentage of materials diverted from landfills, pushing towards zero waste.

Smart Building Technologies Integration

The increasing integration of smart building technologies, including sensors for space utilization, intelligent heating systems, and indoor air quality monitors, opens new avenues for flooring innovation. Interface can leverage these advancements to develop flooring solutions that actively contribute to building efficiency and occupant well-being.

Smart flooring systems can offer enhanced functionalities, such as occupancy detection for optimized HVAC usage or integrated pressure sensors for data collection. This aligns with the growing demand for smart offices and homes, where technology seamlessly enhances user experience and operational efficiency.

- Smart flooring can contribute to energy savings by enabling dynamic adjustments to lighting and climate control based on real-time occupancy data.

- The global smart building market was valued at approximately $80.2 billion in 2023 and is projected to reach $246.7 billion by 2030, demonstrating significant growth potential.

- Advancements in sensor technology embedded within flooring can provide valuable insights into space utilization patterns, aiding in facility management and resource allocation.

Technological advancements are driving the development of more sustainable and resilient flooring materials, a key focus for Interface. Innovations in recycling and bio-based materials are central to this, with Interface actively incorporating these into its product lines to reduce environmental impact.

The company is leveraging technologies for carbon-neutral manufacturing, aiming to minimize the footprint of its carpet tiles, LVT, and rubber flooring. Furthermore, digital tools like BIM are transforming how flooring is specified, with the BIM market expected to exceed $11 billion by 2024, showcasing the growing influence of digital integration in construction projects.

Interface's circular economy initiatives, such as its ReEntry program, rely heavily on advanced recycling technologies. These innovations allow for the efficient separation and reuse of materials like nylon face fiber and backing, diverting significant waste from landfills; for example, over 1.2 million pounds of carpet were diverted in North America in 2023 through this program alone.

The integration of smart building technologies, including sensors, presents opportunities for Interface to develop flooring that enhances building efficiency and occupant well-being. The smart building market, projected to reach $246.7 billion by 2030, highlights the demand for such integrated solutions.

| Technology Area | Impact on Interface | Market Data/Trend |

|---|---|---|

| Sustainable Materials | Incorporation of recycled and bio-based components | Growing demand for eco-friendly building materials |

| Carbon-Neutral Manufacturing | Reducing emissions in production processes | Industry-wide push for net-zero operations |

| Digital Design & BIM | Enhanced product specification and integration | Global BIM market projected to exceed $11 billion by 2024 |

| Recycling & Reclamation | Enabling circular economy through ReEntry program | Over 1.2 million pounds of carpet diverted from landfills in North America (2023) |

| Smart Building Integration | Development of functional, sensor-enabled flooring | Smart building market projected to reach $246.7 billion by 2030 |

Legal factors

Interface faces stringent environmental regulations, particularly concerning carbon emissions and waste management, which directly influence its manufacturing operations and product development. For instance, the company's commitment to reducing its carbon footprint is highlighted by its goal to be carbon negative by 2040, a target that necessitates significant investment in sustainable practices and materials.

Compliance with standards such as those for low-Volatile Organic Compound (VOC) emissions and responsible material sourcing is critical for Interface to maintain market access and avoid substantial fines. In 2023, the company reported a 94% reduction in its global manufacturing carbon footprint compared to its 1996 baseline, demonstrating the financial and operational impact of adhering to evolving environmental mandates.

Interface must navigate a complex web of product safety and labeling laws. Regulations concerning volatile organic compound (VOC) content, fire resistance, and slip resistance are paramount for flooring manufacturers. For instance, in the US, the Consumer Product Safety Commission (CPSC) sets standards, while in Europe, REACH regulations influence chemical content. Failure to comply can lead to significant fines and reputational damage.

Meeting these stringent legal requirements is not just about avoiding penalties; it's a cornerstone of consumer trust and market access. Interface's commitment to certifications like Environmental Product Declarations (EPDs) and Health Product Declarations (HPDs) demonstrates adherence to these standards. As of early 2024, the emphasis on transparency in material sourcing and health impacts continues to grow, pushing manufacturers to provide more detailed product information.

Interface's global operations mean navigating a complex web of labor laws, impacting everything from manufacturing costs to hiring practices. For instance, in 2024, varying minimum wage laws across its key markets, such as the US and Europe, directly influence labor expenses. Compliance with these regulations, alongside worker safety standards like OSHA in the US, is not just a legal necessity but also crucial for maintaining a positive social responsibility image.

Intellectual Property Rights

Interface's ability to protect its intellectual property is a key legal factor. This includes patents for innovative flooring materials, proprietary manufacturing techniques, and distinctive product designs. These legal safeguards allow Interface to maintain its competitive edge and encourage continued investment in research and development, knowing its innovations are protected.

The strength of intellectual property laws directly impacts Interface's ability to innovate and profit from its creations. For instance, in 2023, the global intellectual property market saw significant activity, with companies filing millions of patents, underscoring the importance of robust legal protection for technological advancements in the flooring industry.

- Patent Protection: Securing patents for new materials and manufacturing processes is vital for Interface's market differentiation.

- Design Rights: Safeguarding unique product aesthetics through design registrations prevents competitors from easily replicating successful styles.

- Enforcement: The legal ability to enforce these rights against infringement is critical for maintaining market exclusivity and recouping R&D costs.

Anti-Trust and Competition Laws

Interface must navigate a complex web of anti-trust and competition laws across its global markets. These regulations are designed to prevent monopolistic behavior and ensure a level playing field for all businesses. For Interface, this means careful consideration of pricing strategies, potential market share concentrations, and the terms of any strategic partnerships or acquisitions. Failure to comply can result in significant fines and reputational damage, impacting market expansion plans.

Key areas of focus for Interface regarding competition law include:

- Pricing Practices: Ensuring pricing strategies do not engage in price fixing or predatory pricing, which are illegal under many jurisdictions.

- Market Share Limitations: Monitoring market share to avoid exceeding thresholds that could trigger regulatory scrutiny, particularly in concentrated markets.

- Mergers and Acquisitions: Adhering to notification and approval processes for any M&A activity that could substantially lessen competition.

- Distribution Agreements: Structuring reseller and distributor agreements to avoid anti-competitive clauses, such as exclusive dealing arrangements that could stifle market entry for competitors.

Interface must continuously adapt to evolving legal frameworks governing product safety and chemical content, such as the EU's REACH regulations and US EPA standards. Adherence to these mandates, including those for low VOC emissions, is crucial for market access and avoiding penalties, with companies increasingly seeking certifications like Health Product Declarations (HPDs) to demonstrate compliance and build consumer trust.

Environmental factors

Mounting global anxiety over climate change is fueling a surge in consumer and business demand for products that emit less carbon or even remove it from the atmosphere. This shift presents a significant opportunity for companies that can innovate in this space.

Interface, a leader in flooring solutions, has set an ambitious target to achieve carbon negativity by 2040. This proactive stance involves a comprehensive strategy to reduce its carbon footprint across its entire product range, driven by advancements in materials science and manufacturing processes.

By 2023, Interface had already achieved carbon neutrality for all its products globally, a milestone that underscores its commitment to sustainability and its ability to translate environmental goals into tangible business practices. This achievement positions them favorably as regulations and market preferences increasingly favor eco-conscious solutions.

The growing scarcity of raw materials globally is a significant environmental factor driving businesses toward more sustainable practices. Interface is actively addressing this by embedding circular economy principles into its product development, focusing on longevity, ease of reuse, and efficient recycling. This commitment is evident in their use of recycled, bio-based, and even carbon-captured materials in their manufacturing processes.

Interface's ReEntry program exemplifies their dedication to a circular economy by facilitating the collection and recycling of old carpet tiles, effectively closing the product lifecycle loop. In 2023, Interface reported that 94% of their total product offering contained recycled or bio-based content, showcasing tangible progress in reducing reliance on virgin resources.

The effectiveness of waste management and recycling systems is a critical environmental factor for Interface, directly impacting its circular economy initiatives. Improved infrastructure allows Interface to more efficiently reclaim and reuse materials in its manufacturing processes.

Interface's commitment to a circular economy hinges on robust recycling capabilities, particularly for post-consumer carpet tiles. For instance, in 2023, Interface reported that 88% of its global manufacturing sites were zero waste to landfill, demonstrating progress in waste diversion.

Water Usage and Pollution Control

Environmental scrutiny on industrial water usage and pollution control significantly impacts manufacturing operations, compelling companies like Interface to actively manage their water footprint. Interface's commitment to sustainability includes stringent measures for water consumption reduction and responsible discharge practices, directly addressing these environmental concerns.

Interface has made notable progress in water stewardship. For instance, by 2020, the company achieved its goal of using zero process water in its manufacturing facilities, a testament to its innovative approaches in water management.

- Water Conservation: Interface aims to minimize water consumption across its global operations.

- Pollution Prevention: The company implements advanced wastewater treatment technologies to ensure discharges meet or exceed regulatory standards.

- Circular Economy Integration: Water management is increasingly viewed through a circular economy lens, seeking to reuse and recycle water where feasible.

- Reporting Transparency: Interface publicly reports on its water usage and pollution control performance, providing data for stakeholders.

Sustainable Certification Standards and Transparency

Interface's commitment to sustainable certification standards like LEED and Cradle to Cradle is a significant environmental factor. These certifications, along with Environmental Product Declarations (EPDs) and Health Product Declarations (HPDs), provide tangible proof of their environmental responsibility. For example, Interface has achieved Cradle to Cradle Certified™ for many of its flooring products, a rigorous standard for material health, material reutilization, renewable energy, water stewardship, and social fairness.

This transparency is highly valued by Interface's eco-conscious clientele, who increasingly demand products that meet stringent environmental and health criteria. The company actively uses these tools to communicate its sustainability efforts, which directly impacts its market positioning and appeal to environmentally aware customers. Interface's 2024 sustainability report highlighted continued progress in reducing its environmental footprint, with specific metrics on recycled content and carbon emissions tied to their product lifecycle assessments.

- LEED (Leadership in Energy and Environmental Design): Interface products contribute to LEED points, a key driver for green building projects.

- Cradle to Cradle Certified™: Many Interface products hold this certification, signifying adherence to strict material health and circular economy principles.

- EPDs and HPDs: These provide detailed environmental and health impact data, fostering transparency for specifiers and end-users.

- Client Demand: Eco-conscious clients are a growing segment, making sustainable certifications a competitive advantage for Interface.

Growing awareness of climate change is driving demand for eco-friendly products, benefiting companies like Interface that prioritize sustainability. Interface's commitment to carbon negativity by 2040 and achieving carbon neutrality for all products by 2023 positions them well in this evolving market.

Interface actively embraces circular economy principles to combat raw material scarcity, evident in their use of recycled and bio-based materials. Their ReEntry program and the fact that 94% of their product offering contained recycled or bio-based content in 2023 highlight this dedication.

Effective waste management is crucial for Interface's circularity goals, with 88% of their global manufacturing sites achieving zero waste to landfill in 2023. This focus extends to water stewardship, where they achieved zero process water usage in manufacturing by 2020.

Interface's adherence to certifications like Cradle to Cradle Certified™ and its provision of EPDs and HPDs demonstrate a strong commitment to environmental responsibility, meeting the increasing demands of eco-conscious clients.

| Environmental Factor | Interface's Action/Status (as of 2023/2024) | Impact |

|---|---|---|

| Climate Change & Carbon Emissions | Target: Carbon Negative by 2040; Achieved Carbon Neutrality for all products by 2023. | Meets growing market demand for low-carbon solutions, enhances brand reputation. |

| Raw Material Scarcity & Circular Economy | 94% of products contained recycled/bio-based content; ReEntry program for tile recycling. | Reduces reliance on virgin resources, mitigates supply chain risks. |

| Waste Management | 88% of global manufacturing sites were zero waste to landfill (2023). | Minimizes landfill impact, supports circularity goals, reduces disposal costs. |

| Water Usage & Pollution | Achieved zero process water usage in manufacturing by 2020. | Conserves water resources, reduces operational costs, ensures regulatory compliance. |

| Sustainable Certifications & Transparency | Multiple products Cradle to Cradle Certified™; Provides EPDs and HPDs. | Builds trust with clients, provides competitive advantage, supports green building initiatives. |

PESTLE Analysis Data Sources

Our Interface PESTLE Analysis is grounded in a comprehensive blend of data from leading market research firms, government statistical agencies, and reputable academic institutions. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to ensure a robust and accurate assessment.